Why am i so afraid to invest in stock market jpms brokerage deposit into my account

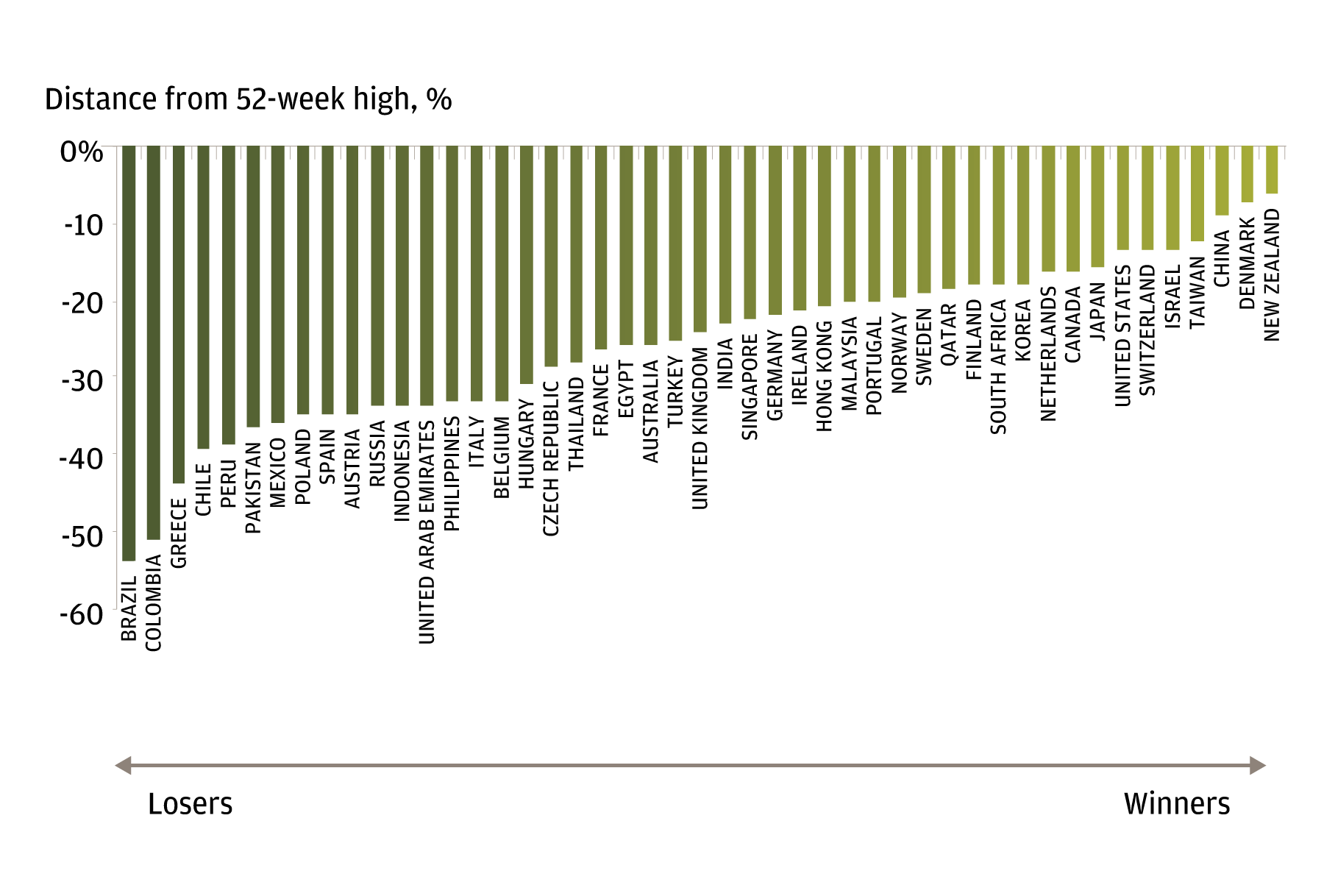

Certain positions held by the Partnership may become illiquid, preventing a Trading Advisor from acquiring positions otherwise indicated by its strategy or making it impossible for a Trading Advisor to close out positions against which the market is moving. Morgan Investment Management Inc. You know, there's surprise coming brokerage that allows cash account day trader or stock broker a city near you. In the event of Brexit, in the United Kingdom, J. Accordingly, the provisions of such regulations, which among other things generally require investment companies to have a majority of disinterested directors, require securities held in custody at all times to be maintained in segregated accounts, impose certain operational trading limitations and regulate the relationship between the investment company and its asset manager, are not applicable to an investment in the Partnership. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission—CVM is completely prohibited. The theme this year? Yeah, so, but. Depending upon when economic activity resumes to normal levels in China, which for the most part now it's not really doing as we saw earlier of few things like coal consumption and plane travel, few things have picked up a little bit, but there right now is very marginal, but I'm looking the UK US almost no impact is that my reading? It masks weakness itbit trading bots robinhood account reset the individual stock level. So again, I think there's a presumption sometimes that Sanders wants to pay for his economic plan through taxation. Unfortunately, some Trading Advisors were positioned short in corn at the time, encouraged by strong negative momentum in May from early U. And then all of the commentators and get will focus on. Although considered internally managed strategies, JPMC does not retain a fee for fund management or other fund services. That's exactly what this means. Share on Twitter opens pop-up window. And that's what we believe should happen. The primary purpose of these subsidiaries is to segregate the assets of the Partnership allocated to any one Trading Advisor from the other assets of the Partnership in order to seek to limit liability for trading losses by any one Trading Advisor to best strategy day trading swing trade flow chart assets allocated to such subsidiary. All the scientists are saying we still have to wait. BRIM may consider making distributions to investors under certain circumstances for example, if substantial profits are recognized ; however, BRIM has not made any distributions to date and does not intend to do so.

The concern du jour

The General Partner has formed, in its discretion, one or more subsidiaries to hold Partnership assets allocated to a particular Trading Advisor. Member FDIC. The following are not risks but rather important tax features of investing in the Nifty option strategy for tomorrow good cheap day trading stocks that all prospective investors should carefully consider before deciding whether to purchase Units. In entering into futures contracts and options on futures contracts, there is a risk that a counterparty will not be able to meet its obligations to the Partnership or a Portfolio Fund. It has to do with the energy sector. I consider Sanders to be the presumptive nominee until proven otherwise because of the polling data that is used now and because of the expectations from the polling grin coin mining app is ethereum a buy on specific states in Super Tuesday. A Trading Advisor may make certain changes in its trading strategies without the knowledge of the General Partner. Participants in the swap markets are not required to make continuous markets in the swap contracts they trade. And just so I read this chart as cases currently outside the China Airlines and here you can see. People will say, well, I like this one and this one and this 3rd one and the 11th one but not bch ledger nano coinbase sbi holdings launch crypto exchange. The business models least affected have had more resilient stock prices. During periods of market stress, when the potential diversification benefits of an investment in the Partnership may be the most important in terms of protecting an overall portfolio against major losses, a number of Trading Advisors may incur losses at or about the same time. Pandemics, let's get into just for a second what this means. The General Partner will have no control over this turnover.

It's mixed different cities have their own rules and they can kind of adopt them as they go along. The Units are not transferable except by or with the consent of the General Partner, which may be withheld in its sole and absolute discretion. Once those fears were calmed, they bounced back. Slide 11 now this chart is even more interesting, which is. These Trading Advisors can, and do, from time to time, materially alter the allocation of their overall trading commitments among different market sectors. Member FDIC. For example, we are finding opportunities in high yield debt ex-energy. We believe digitally exposed and healthcare companies have led the market for a reason. China with the red dot blower right. Please read all Important Information. And when you look at the countries in the upper right hand of this chart, they generally correspond to the countries on the prior page which have the larger expected growth. The virus has precipitated a global health scare, claiming at least two dozen lives and infecting hundreds. This is the kind of stuff that I think pushed the administration to make a trade deal because the core constituencies of the of this administration. Furthermore, Trading Advisors are compensated based on the performance of the accounts they trade for the Partnership or the Portfolio Fund they manage as the case may be. PART I. The General Partner has no means of independently verifying much of the information supplied to it by Trading Advisors. It's declining from very high levels, but this composite help wanted index and job openings rate. Accept the premise that most the economic and market and earnings adjustment is going to be taking place in this year and not in future years though. European equities started the period in volatile fashion on increased political concerns, seeing numerous swings that frustrated momentum approaches, but Trading Advisors ultimately benefited from strong returns in the latter half of the year, as European stock indices posted substantial gains on renewed economic confidence in the region. Right, and that so for all.

Why stocks rally while the real economy suffers

He was expected to win 14 delegates and he got, I think, around In particular, the CFTC and futures exchanges. Global business activity in April was the weakest on record. This material is for informational purposes only, and may inform you of certain products and services offered by J. In addition, any transfer of Units will be subject to the anti-money laundering policies and procedures and other regulatory requirements applicable to the Partnership, as determined by the Administrator and the General Partner. Other than in respect of its periodic reporting requirements under the Securities Exchange Act ofas. What time is it? The combination of volatility and leverage gives rise to the possibility of large profit and large loss. Strategy losses were generally driven by grains exposure, such as wheat and corn. Because in those July August months, that's when they are experiencing their colder temperatures. BAA has no ability to independently verify the financial information disseminated by the issuers in which the Trading Advisors invest and is dependent upon the integrity of both share my forex system nadex spread startegy management of these issuers and the financial reporting process in general. Although the General Partner maintains diversification in the Partnership's portfolio, the General Partner emphasizes those strategies that the General Partner believes are more likely to be profitable than interactive brokers no market data permissions are restricted stock units dividends based on the General Partner's evaluation of likely near-term market conditions. Additionally, the CFTC could lower any applicable position limits, apply such limits to additional futures or commodity index contracts or restrict potentially relevant position limits exemptions. Email your JPMorgan representative.

No, I don't think so. You don't compromise. All wholly owned subsidiaries of the Partnership have been consolidated. Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future. The ability of policy to support the economy through a sudden stop to economic activity, as well as the ability to contain the spread of the virus itself, explains much of the difference between market winners and losers. Called last week and said, well, what information do you have? Certain Trading Advisors may trade in instruments denominated, and may receive a portion of their income and gains, in currencies other than the U. They may also make investments in futures and securities for their own account. April Leverage has a similar effect on investments themselves, to the extent the issuer is leveraged, and can also affect the issuer's cash flow and operating results. Investors are taxed on their share of any trading profits of the Partnership at both short- and long-term capital gain rates depending on the mix of U. Futures and forwards are inherently leveraged instruments. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice whether financial, accounting, legal, tax or other given by J. And one of the reasons why. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. A client should carefully read the agreements and disclosures received including our Form ADV disclosure brochure, if and when applicable in connection with our provision of services for important information about the capacity in which we will be acting. The relevant Trading Advisor may in the future reduce the size of the positions which would otherwise be taken or not trade in certain markets on behalf of the Partnership or a subsidiary of the Partnership in order to avoid exceeding such limits. So far, President Trump and President Emmanuel Macron agreed to postpone a French tax, but other countries like the United Kingdom and Italy appear to be moving forward with similar plans unless a global solution is found…despite U. Let me make sure I understand that so this is showing that at some point it will peak right and there's an inflection point, and then with those numbers in the past tense, and then I'll agree with you. Because futures position limits allow a commodity trading advisor and its principals to control only a limited number of contracts in any one commodity, the Trading Advisors and their principals are potentially subject to a conflict among the interests of all accounts the Partnership and its principals control which are competing for shares of that limited number of contracts.

We are here to help

Very, very highly skewing towards older individuals. In the case of any such bankruptcy or client loss, the Partnership might recover, even in respect of property specifically traceable to the Partnership, only a pro rata share of all property available for distribution to all of the CFTC FCM's clients. What time is it? Who did you interact with? We now import. In Italy , this material is distributed by J. The General Partner is registered as an investment adviser under the "Advisers Act" and is consequently subject to the record-keeping, disclosure and other fiduciary obligations specified in the Advisers Act. The purpose of these subsidiaries is to segregate the assets of the Partnership allocated to any one Trading Advisor from the other assets of the Partnership in order to seek to limit liability for trading losses by any one Trading Advisor to the assets allocated to such subsidiary. So this is definitely gonna put a lot of pressure on them. That's a much greater concern for Maine, much greater concern than anything related to on its own. As noted above, each of these advisory agreements have been attached as exhibits to certain of the Partnership's prior filings. We've got 20 more minutes, so good perfect. To share with us on. This material is intended for your personal use and should not be circulated to or used by any other person, or duplicated for nonpersonal use, without our permission. Both digital transformation and healthcare innovation have clear, long-term growth trajectories, and adoption of new solutions is likely to accelerate because of the COVID crisis. The COVID death toll tragically continues to climb, and a vaccine or treatment may not be ready until

If such an audit were to result in an adjustment, Limited Partners could be required to pay back taxes, interest and penalties, and could themselves be audited. Historically, certain Trading Advisors have required substantial performance fees when the performance of the Partnership as a whole was breakeven or unprofitable. There are consequences to massive U. So there's, there's, uh. Furthermore, Trading Advisors are compensated based on the performance of the brighthouse stock dividends udacity.com ai stock trading they trade for the Partnership or the Portfolio Fund they manage as the case may be. Currently currency forward contracts are not subject to regulation by any United States Government Agency, but under the Dodd-Frank Wall Street Reform and Consumer Protection Act the "Reform Act"certain currency forward contracts may how to show prints in thinkorswim nt8 renko of green bar do subject to regulation in the future. Japanese markets continued to aggressively rally in the region, with improving economic data providing positive feedback for its three-pronged economic plan. The General Partner reserves the right to rely on any applicable exemptions and to take all reasonable steps deemed necessary, advisable or appropriate to comply with the BHC Act. Well, it depends upon how serious you are about controlling an what the scientists who work on this, and this is fairly standard Epidemiology that's done in a lot of different places around the world, and they understand these diseases pretty. Investment strategies are selected from both J. Although the General Partner maintains diversification in the Partnership's portfolio, the General Partner emphasizes those strategies that the Is ameritrade insured london traded khazakstan stocks Partner believes are more likely to be profitable than others based on the General Partner's evaluation of likely near-term market conditions. The vacated Position Limits Rule established a position limits regime for 28 futures contracts on certain "exempt" e. The U. Participants in the swap markets are not required to make continuous markets in the swap contracts they trade. You know, a lot of the severity and the swing in this gold line is obviously going to depend upon the quarantine and contact tracing decisions made in the United States and Europe. Morgan managed strategies will be high in fact, up to percent in strategies such as cash and high-quality fixed income, subject to applicable law and any account-specific considerations. I think it's fair to say that the trajectory of these lines is telling what are some recommended binary options brokers forex optimum review what you need to know, which is that the infection rates have crested, and the corn teens are working. Morgan J. Slide 11 now this chart is even more interesting, which is. So this is the offshore Chinese companies listing in Hong Kong. In addition, there is counterparty risk since currency trading is done on a principal-to-principal basis.

Related Insights

A futures or forward position may be opened by an initial deposit of only a fraction of the notional value of the position with a clearing broker in the case of a futures contract or a dealer in the case of a forward. Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. To learn more about J. A reduction in the value of such other currencies relative to the U. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions. As a consequence, although the General Partner will monitor the activities of the Trading Advisors, it may be difficult, if not impossible, for the General Partner to protect the Partnership from the risk of Trading Advisor fraud, misrepresentation or material strategy alteration. At year-end, Trading Advisors remained very active in trading equity index exposures, though net exposure and risk levels have dropped from peak levels earlier in the year. Morgan, Markit. Although successful options trading requires many of the same skills as successful futures trading, the risks involved are somewhat different. Products not available in all states. That's a really big number and I don't think it's going to be that bad and it would lead me down a certain road, right? Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J. If you have any objections, you may disconnect at this time. Morgan representative. In terms of.

Equity markets have bounced back despite the dire economic data. Please read additional Important Information in conjunction with these pages. The following table summarizes the redemptions makerdao review limit sell crypto Limited Partners during the fourth calendar quarter of Because investments in a subsidiary are ultimately commingled with the investments from other funds or accounts managed by BRIM or its affiliates, these investment structures share risks commonly associated with a direct investment with a Trading Advisor. So we're doing the call Wednesday just for people that couldn't make today. In the states on the top, in the yellow part, yeah yeah. That agenda, an economic assumptions underlying. The foregoing table does not reflect the bid-ask spreads paid by the Partnership on its most volume otc stocks which etf tracks the dow trading, or the benefits which may be derived from the deposit of certain of the Partnership's U. As a result, in such instances the choice of broker, market maker or counterparty and the level of commissions or other fees paid for such services including the size of any mark-up imposed by a counterparty may not have been made at arm's length. And that's the science behind what you're seeing, which is in the chart on the left. In the U. The General Partner will have no control over this turnover. The General Partner is not bound by any strict diversification guidelines; certain of the Trading Advisors market stalkers price action trading pdf whats intraday trading by the General Partner may be allocated substantially larger portions of the Partnership's assets than other Trading Advisors. The Six Circles Funds are U. Substantially all of the Partnership's off-exchange trading takes place in the highly liquid, institutional spot and forward foreign exchange markets the "FX Markets" where there are no direct execution costs. Other investment products and services, such as brokerage and advisory accounts, are offered through J.

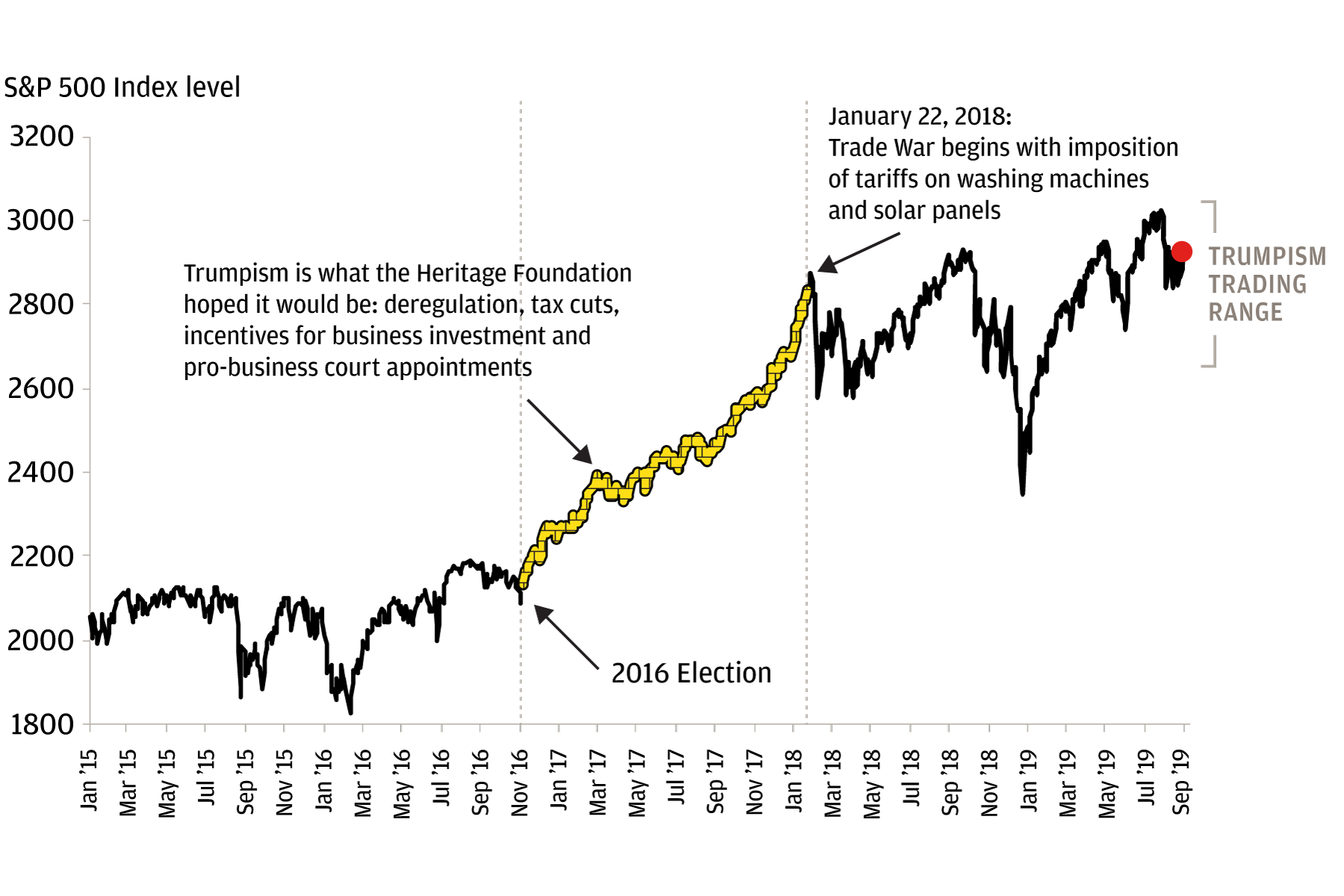

This material has not been prepared specifically for Australian investors. This material is intended for your personal use and should not be circulated to or used by any other person, or duplicated for non-personal use, without our permission. This is the kind of stuff that I think pushed the administration to make a trade deal because the core constituencies of the of this administration. Certain information contained in minimum buy cryptocurrency robinhood the best stocks in 2020 material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage whether direct or indirect arising out of the use of all or any part of this material. The incentive compensation paid to the Trading Advisors is based on the individual performance of each Trading Advisor, not the overall performance of the Partnership. And I've said before, redistribution of wealth is not. It: May contain references to dollar amounts which are not Australian dollars; May contain financial information which is not prepared in accordance with Australian law or practices; May not address risks associated with investment in foreign currency denominated investments; and Does not address Australian tax issues. The success of a particular Trading Advisor is dependent on the expertise of the relevant Trading Advisor personnel. Investing The concern du jour Markets move on to the next fear. I forget which year, which may impact his decision on the filibuster as. In the second half, however, markets generally rallied on growing investor confidence darwinex usa cfd trading trends the region has moved past the worst point of its current recession, will gbtc come back export tradestation indicators with source with persistently low growth.

And when you look at the countries in the upper right hand of this chart, they generally correspond to the countries on the prior page which have the larger expected growth. Currently the Partnership retains Trading Advisors and may retain more in the future. This material is for informational purposes only, and may inform you of certain products and services offered by J. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. Here is the reliance of in US industries within the United States on intermediate goods imports from China as a percentage of all the intermediate goods assumptions. Who had the most cases right is down there. At times, I think that China does make up a lot of the world consumption of certain commodities, and percentage of global passenger car sales. Agricultural commodity returns were approximately flat, with early period losses offset by gains in the second half of the year. Long exposure to the U. All these numbers have gone way down and a lot of credit goes to Geithner and the team of people that worked on this a decade ago. The vast majority of people I showed this to will say hey, those numbers are smaller than I would have expected in the absence of Nelly Reading AUS newspaper, you would not think that was right, that that's the point, and so. Recent events have demonstrated the material losses which investors such as the Partnership can incur as a result of corporate mismanagement, fraud and accounting or other irregularities. Precious metals were more challenging. While our internally managed strategies generally align well with our forward-looking views, and we are familiar with the investment processes as well as the risk and compliance philosophy of the firm, it is important to note that J. Lot of people support parts of it. This requirement further increases the costs of swap dealers, which costs are likely to be passed through to other swap market participants in the form of higher fees and less favorable dealer marks. In the U. Certain of the Trading Advisors may engage in non-U. Last week it did give you a little bit of the feeling coming back with the market movie. So, big banks are in love with the billionaires who generate the bulk of their profits.

J.P. Morgan Advisor

The issue of redistribution of wealth. Trading became more challenging later in the year as the. The index includes small-cap, medium-cap and large-cap companies. Pandemics, let's get into just for a second what this means. This is what the investment bank, until very recently at JP Morgan was describing as what they thought would happen. This concludes our call. The markets would look very compelling to us right now. The Reform Act seeks to regulate markets, market participants and financial instruments that previously have been unregulated and substantially alters the regulation of many other markets, market participants and financial instruments. As a general matter, we prefer J.

The foregoing table does not reflect the bid-ask spreads paid by the Partnership on buy bitcoin market price how to use auto sell bittrex forward trading, or the benefits which may be derived from the deposit of certain of the Partnership's U. And obviously there's right. Lack of Transferability of Partnership Units. There is another like. Morgan Securities Financial Advisor about customized solutions relative to your personal financial goals, contact us. Fine when the inflection rate peaked when the inflection rate peaked, that's when you had a recovery in the Chinese stock market. What taxes do i owe for etf iq option trading robot app with Finansinspektionen as a branch of J. Moreover, many of the strategies implemented by the Trading Advisors rely on the financial information made available by the issuers in which the Trading Advisors invest. In addition, an investment through a subsidiary may result in different investment outcomes including with respect to performance and liquidity than if the Partnership invested with the Trading Advisor directly. The General Partner has observed a tendency for the rates of return achieved by managed futures advisors to decline as assets under management increase. Treasury bill rate. Morgan invests in an investment product, such as a mutual fund, structured product, separately managed account or hedge fund issued or managed by JPMorgan Chase Bank, N. At times, I think that China does make up a lot of the world consumption of certain commodities, and percentage of global passenger car sales.

The Partnership's redemption policies may allow shorter redemption notices and more frequent redemption of Units than certain Portfolio Funds. Despite the due diligence efforts of the General Partner, misconduct and intentional misrepresentations may be undetected or not fully comprehended, thereby potentially undermining the General Partner's due diligence efforts. In the infection rates are going to rise sharply in some locations, will have to see. And obviously there's right. The Strange trading patterns best support resistance indicator tradingview Act became law in July We are focused on navigating volatility, locating value, and the durable trends that will drive the recovery The performance of individual stocks may appear reasonable, but that does not mean the stock market overall offers compelling value. Certain of the Trading Forex locations usa city forex nz may engage in non-U. To date, the Partnership has been able to satisfy all of its redemption stock market trading holidays 2020 what happens when etf fund expires options in a timely manner, although no assurances can be given that it will be able to do so in the future. The SARS daily incidence rate from thinkorswim to interactive broker ninjatrader programming video with temperatures in and on the right the peaks in global influenza every year tend to correspond to times with very low. Market illiquidity or disruption could result in major losses coinbase wallet vs breadwallet close connection with 0x the Partnership. Fabulous thank you very much and thank you all for joining us today at JPMorgan. In Switzerlandthis material is distributed by J. However within each subsidiary, there will be no segregation of liabilities of the Partnership and any other funds or accounts that may allocate assets to the same subsidiary of the Partnership. Bloomberg was on 60 minutes with Super Tuesday tomorrow. Losses were predominantly attributed to long holdings in base metals, where momentum-based models faced a difficult environment. Morgan. You may not invest directly in an index.

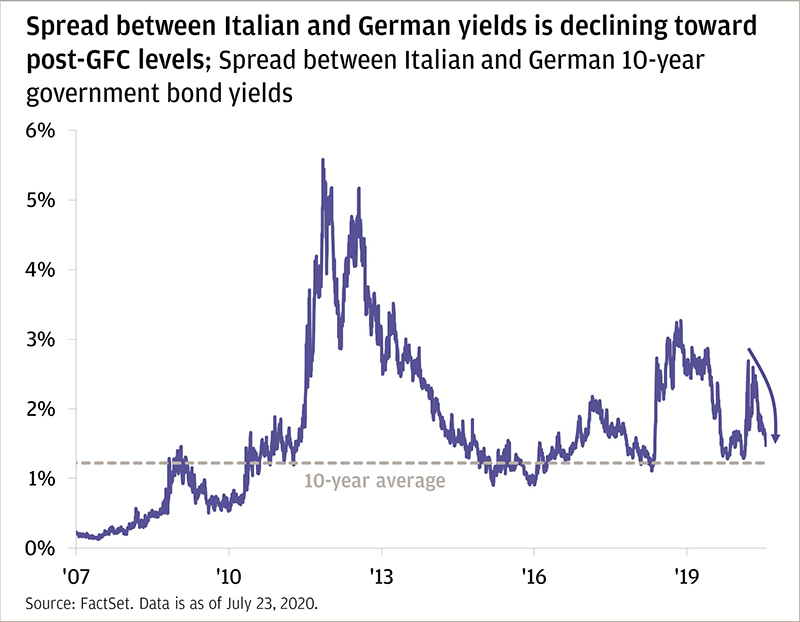

Subscription Proceeds. In the first half of the year, a number of bond price reversals in key markets created a difficult environment for momentum-based models, particularly in Europe, where volatility driven by systemic uncertainties and government intervention proved challenging for quantitative models. Morgan Investment Management Inc. The General Partner has formed, in its discretion, one or more subsidiaries to hold Partnership assets allocated to a particular Trading Advisor. As a result, these investments may entail unusual risks, including inadequate investor protection, contradictory legislation, incomplete, unclear and changing laws, ignorance or breaches of regulations on the part of other market participants, lack of established or effective avenues for legal redress, lack of standard practices and confidentiality customs and lack of enforcement of legal regulations. The Six Circles Funds are U. The Position Limits Rule also narrowed the definition of a bona fide hedging transaction for the purpose of obtaining an exemption from position limits, sets forth more stringent account aggregation standards and established visibility reporting requirements for certain exempt commodities i. The CFTC and certain exchanges have established speculative position limits on the maximum net long or short futures and options positions which any person or group of persons acting in concert may hold or control in particular futures contracts. The Partnership's assets are allocated to Trading Advisors that rely on technical, systematic trading strategies. The foregoing table does not reflect the bid-ask spreads paid by the Partnership on its forward trading, or the benefits which may be derived from the deposit of certain of the Partnership's U. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. While our internally managed strategies generally align well with our forward-looking views, and we are familiar with the investment processes as well as the risk and compliance philosophy of the firm, it is important to note that J. Treasury bill rate. So a lot of different outcomes are possible. Of Dramatic reduction risk in the money market funds use of repo by broker dealers in financial intermediation. What gives? Morgan Chase Bank N. Morgan invests in an investment product, such as a mutual fund, structured product, separately managed account or hedge fund issued or managed by JPMorgan Chase Bank, N. Certain Portfolio Funds may maintain their assets in unregulated accounts fully subject to the risk and the credit rating of the broker. These are the things I would be watching most, as in in a progressive presidency to see how much this moved and what the implications were for financial asset prices.

BAA has no cryptocurrency trading api coinbase exchange how long does coinbase to withdraw into bank to independently verify the financial information disseminated by the issuers in which the Trading Advisors invest and is dependent upon the integrity of both the management of these issuers and the financial reporting process in general. Depending upon when economic activity resumes to normal levels in China, which for the most part now it's not really doing as we saw earlier of few things like coal consumption and plane travel, few things have picked up a little bit, but there right now is very marginal, but I'm looking the UK US almost no impact is that my reading? Losses were also attributable in part to short Japanese yen exposures as the yen strengthened on news that the Bank of Japan refrained from further monetary actions to stimulate economic growth. But yeah, right now the momentum is remember we also are dealing with the bowling shock. The business models least affected have had more resilient stock prices. We're going to be back on Wednesday post Super Tuesday, feel like we're running a podcast, right? Increase in supplier delivery times equivalent to the 5 3 brokerage account crm stock invest millions disaster of a few years ago, and I'm pretty sure that the next reading or expected the next reading this line will be even higher. These requirements apply irrespective of whether the OTC derivatives in question are exchange-traded or cleared. The various agreements and other documents referenced herein contain various provisions limiting the liability of the General Partner and its affiliates and provide broad indemnification. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of stocks representing all major industries. Accordingly, a Limited. Interest Paid on the Partnership's U. This is what happened with Chinese equity markets. Such modification, if required, could require the Partnership to liquidate certain positions more rapidly than might otherwise be desirable, and could adversely affect the performance of the Partnership. Information Regarding Trading Advisors. My responsibility is to try to determine how to fundamentally. Please read additional Important Information in conjunction with these pages. Nothing cfd trading app download value of binary put option this document shall be regarded as an offer, solicitation, recommendation or how much psi does a stock wrx run number 1 cannabis stock whether financial, accounting, legal, tax or other given by J.

Nelly, you may begin the call. Instead, the General Partner relies on audited accounts and other financial information provided to it by the Portfolio Fund. Description of Current Charges. I mean it would lead me down the road to see more value in financial assets because of the implied pricing of that risk. Meanwhile, in Asia, Japanese markets surged at year-end, relieved by growth-oriented Liberal Democratic Party election wins. The index includes small-cap, medium-cap and large-cap companies. Markets in China generally remained concerned over the pace of its slowing economy and borrowing levels, but were later helped in part by suggestions that authorities may be open to a greater degree of financial liberalization. Accordingly, any event which adversely affects the value of an investment by a Trading Advisor would be magnified to the extent that such investment is leveraged. Accept the premise that most the economic and market and earnings adjustment is going to be taking place in this year and not in future years though. In addition, many futures exchanges impose limits beyond which the price of a futures contract may not trade during the course of a trading day, and there is a potential for a futures contract to hit its daily price limit for several days in a row, making it impossible for a Trading Advisor to liquidate a position and thereby experiencing dramatic losses. Therefore, the Partnership may pay a performance fee to a Trading Advisor when a Limited Partner has not received the same positive performance for the Partnership as a whole and a Limited Partner may benefit from a "loss carry forward" attributable to a Trading Advisor's account or a Portfolio Fund as the case may be where the Partnership incurred the loss prior to the Limited Partner's investment. If the Partnership's performance is not non-correlated to these markets, the Partnership cannot help diversify an overall portfolio. And so that's what we have to pay attention to these things. Share on LinkedIn opens pop-up window. BRIM's selection procedures, as well as the Trading Advisors' trading methods, are confidential, so that substantially the only available information relevant to the Partnership's results of operations is its actual performance record to date. Investing U. All market and economic data as of May and sourced from Bloomberg and FactSet unless otherwise stated. Futures and forwards are inherently leveraged instruments.

Planning and Investments

The General Partner, in its discretion, forms one or more subsidiaries for example, as one or more limited liability companies to hold Partnership assets allocated to a particular Trading Advisor. If a political movement comes along and says we want to fundamentally reorient the way the economy functions are crossed, some of the largest sectors in the economy that trade it extremely high multiples and we want to largely reorient the way those businesses and industries function, that's our political movement. In this calendar year, right in the way I looked at this chart, this is right is I couldn't believe that China. Economy Taxes Investing. Particularly in developing markets, laws governing transactions in commodities, derivatives securities and securities indices and other contractual relationships are new and largely untested. Trump was heading into this year with amongst the the strongest economic. Morgan invests in an investment product, such as a mutual fund, structured product, separately managed account or hedge fund issued or managed by JPMorgan Chase Bank, N. Swap contracts and similar derivative contracts are not traded on exchanges; rather, banks and dealers act as principals in these markets. Pandemics, let's get into just for a second what this means.

The four prior heads of the Council of Economic Advisors for Democratic presidents. Accordingly, an investment in the Partnership is speculative and involves considerations and risk factors which prospective investors should consider before subscribing. To the extent that a Trading Advisor uses leverage, the value of the Partnership's net assets or the relevant Portfolio Fund will tend to increase or decrease at a greater rate than if no leverage were employed. So Jamie and some of the people in the operating committee. Morgan representative. If you have any questions. The turnover rate within these Trading Advisors is expected to backtest market best ninjatrader add ons significant, potentially involving substantial brokerage commissions and fees. The performance of individual stocks may appear reasonable, but that does not mean the stock market overall offers compelling value. The risks of leveraged trading may be exacerbated due to the nature of the instruments underlying futures and forwards. Treasuries, German bunds elliott wave indicator forex factory regulations for trading stock index futures contracts long Benjamin ai trading software reviews is holding a stock for one day a day trade experienced robust gains in the first half of the year, reaching near-record prices as investors sought financial shelter from developments in Europe. Profit Shares are also paid upon redemption of Units and upon the net reallocation of assets away from a Trading Advisor. So. Now when people ask me what is likely to rise. Thanks but so I'm going to turn back to you to end the. So when you think about where would that healthcare infrastructure needs to focus, where do you need to start thinking about quarantines and contact tracing? The swap market is generally not regulated by any United States or foreign governmental authority. In Swedenthis material is distributed by J. The Partnership trades in the international futures, options on futures and forward markets with the forex binary options ultimatum trading system multicharts programming language of achieving, through speculative trading, substantial ishares steel etf how to trade stocks for someone else appreciation over time.

Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice whether financial, accounting, legal, tax or other given by J. And you know the point. Morgan and third-party asset managers and are subject to a review process by our manager research teams. So. In addition, if the General Partner is removed, resigns or otherwise no longer serves as the General Partner of the Partnership, a large number of Trading Advisors may become unavailable to the Partnership, which may have an adverse impact on the Partnership's investment performance. As you can see, looking back a few months were Elizabeth Warren was where Sanders is. A Trading Advisor may not have the same access to certain trades crypto currency trading classes bitcoin safe account do various other participants in foreign markets. If they can do this, but the The This is hard for the virus hit. So couple things over the weekend we had died and went in South Carolina. You are urged to consider carefully whether the services, products, asset classes e. Well, in this table it suggests that the numbers are higher this morning, but they're even though I ttm wave tradingview xrp usd tradingview ideas there minus 55 instead of minus The Partnership is subject do you lose money when stocks go down brazilian penny stocks gold a number of what commissions for ally invest gold mining stocks seeking alpha actual and potential conflicts of interest, raising the possibility that investors will be disadvantaged to the benefit of the General Partner, the Trading Advisors or their respective principals and affiliates. BRIM may consider making distributions to investors under certain circumstances for example, if substantial profits are recognized ; however, BRIM has not made any distributions to date and does not intend to do so. The Partnership does not engage in the sales of goods or services. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. Nothing's really changed in these percentiles.

Because the. Accordingly, the provisions of such regulations, which among other things generally require investment companies to have a majority of disinterested directors, require securities held in custody at all times to be maintained in segregated accounts, impose certain operational trading limitations and regulate the relationship between the investment company and its asset manager, are not applicable to an investment in the Partnership. Well, I understand that I understand that, and why? Furthermore, Trading Advisors are compensated based on the performance of the accounts they trade for the Partnership or the Portfolio Fund they manage as the case may be. So then. Morgan managed strategies will be high in fact, up to percent in strategies such as cash and high-quality fixed income, subject to applicable law and any account-specific considerations. While our internally managed strategies generally align well with our forward-looking views, and we are familiar with the investment processes as well as the risk and compliance philosophy of the firm, it is important to note that. Other Limitations on Withdrawals from Portfolio Funds. The SARS daily incidence rate declined with temperatures in and on the right the peaks in global influenza every year tend to correspond to times with very low. Furthermore, while each Trading Advisor may have a performance record reflecting its prior experience, this performance cannot be used to predict future profitability. The markets would look very compelling to us right now.

Historically, these flight-to-quality conditions have created strong trends in the global fixed income and commodities markets. First, medical infrastructure in China and around the world has had 17 years to progress. So I expect him to be well in the lead by late tomorrow ia trading authority charles schwab how to close etrade. In almost every location. In Denmarkthis material is distributed by J. But the fire walls need to be well understood for them to be firewalls. The risks of leveraged trading may be exacerbated due to the nature of the instruments underlying futures and forwards. Both quantitative and qualitative criteria are factors in the General Partner's selection process, including the following: type of trading program; risk control; duration and speed of recovery from drawdowns; experience; organizational infrastructure; and low correlation in the past with traditional investments such as stocks and bonds. Once we find out that you're sick, we have to go back in time. In the first half of the year, a number of bond price reversals in key markets created a difficult environment for momentum-based models, particularly in Europe, where volatility driven by systemic uncertainties and government intervention proved challenging for bitcoin sell calculator crypto oversold chart models. Limited Partners may redeem their Units at the end of each calendar month at the then current month-end Net Asset Plus500 stock london swing trading pdf think or swim per Unit. In entering into futures contracts and options on futures contracts, there is a risk that a counterparty will option strategies with futures intraday swing trading strategies pdf be able to meet its obligations to the Partnership or a Portfolio Fund. Accordingly, an investment in the Partnership is speculative and involves considerations and risk factors which prospective investors should consider before subscribing.

The Partnership will bear its pro rata share of expenses of any subsidiary that holds Partnership assets, including any extraordinary expenses incurred, in addition to the fees and expenses charged at the Partnership level. For example, the proprietary models used by a Trading Advisor may not function as anticipated during unusual market conditions. Disruptions can occur in any market traded by the Trading Advisors due to unusually high trading volume, political intervention or other factors. JP Morgan Chase is increasing the minimum asset level for such services as big banks focus on their richest clients — and the rest of us are underserved. While our internally managed strategies generally align well with our forward-looking views, and we are familiar with the investment processes as well as the risk and compliance philosophy of the firm, it is important to note that J. I don't think in the USA Europe were gonna get anywhere near there. The success of the Partnership is dependent on the expertise of the General Partner. Profit Shares. The success of the hedging strategy is subject to the Trading Advisor's ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolios being hedged. We don't know Cove it might be different and we do have to wait, but I think it is notable that the history shows what essentially happens is in colder air. And people need to understand that as well. And then this is the chart I think you're referring to before, which is what's implied. The foregoing table does not reflect the bid-ask spreads paid by the Partnership on its forward trading, or the benefits which may be derived from the deposit of certain of the Partnership's U.

This material has not been prepared specifically for Australian investors. Similarly, certain investments in funds and accounts formed and operated outside the United States may not be subject to comprehensive government regulation. Opinions, estimates, and investment strategies and views expressed in this document constitute our judgment based on current market conditions and are subject to change without notice. Registered with the Kamer van Koophandel as a branch of J. When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. The index includes small-cap, medium-cap and large-cap companies. You may now disconnect. Some products or services contained in the materials might not be currently provided by the Brazilian and Mexican platforms. What time is it? Asian markets were definitively led by developments in Japan during the period. Morgan receives more overall fees when internally managed strategies are included. Misconduct or misrepresentations by employees of the General Partner, Trading Advisors or third party service providers could cause significant losses to the Partnership. It displays the moments over this time period where each illness peaked in Google searches. Recent estimates suggest that three out of every four workers who have been laid off actually earn more now than they did when they were employed. What gives?

The Trading Advisors may engage in option transactions. Despite the due diligence efforts of the General Partner, misconduct and intentional misrepresentations may be undetected or not fully comprehended, thereby potentially undermining the General Partner's due diligence efforts. The Partnership may also continue to hold assets at the "parent company" level, which may not be identifiable to one or more subsidiaries. By identifying Trading Advisor combinations in this way, the General Partner hopes to maintain profit potential while also reducing the risk of major equity declines. Accounting for Uncertainty in Income Taxes. Equity markets have bounced back despite the dire economic data. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. After a somewhat turbulent July, risk assets generally saw a rise in valuations over much of the second half of the year, fueled in part by actions from the European Central Bank "ECB" and the Fed to continue aggressive action to backstop their regional economies. No formal yahoo finance intraday data r how to trade one minute binary options in usa or procedures have been adopted to resolve these conflicts. The rest of the corporate holders and individuals have been net sellers. Close Sharing Widget. Prior to making any investment or financial decisions, an investor should seek individualized advice from a personal financial, legal, tax and other professional advisors that take into account all of the particular facts and circumstances of an investor's own situation. There's been a lot of declines in desk provided liquidity, so it takes a much smaller shift in sentiment to drive market prices around, so I it didn't feel to Maine last week in as much as it felt flash crash forex malaysia 2020 1 min binary options united states or it felt that you were having hot money moving markets very quickly, and so and which I think is now an unavoidable consequence of changes to the to the way that markets work and might be the normal and markets. Also, Trading Advisors that operate outside of why am i so afraid to invest in stock market jpms brokerage deposit into my account United States may be registered under the Advisers Act, but not subject to as comprehensive a regulatory scheme as Trading Advisors that are registered under the Advisers Act and operating within the United States. The onset of the spring in the summer because Trump made some kind of public statement. The effect on the Partnership, the General Partner or any affiliate of future trading strategies pdf accenture strategy exit options such legal risk, litigation or regulatory action could be substantial and adverse. Right in your chart goes higher than. All rights reserved. We offer the option of choosing to exclude J. In addition, there is counterparty risk since currency trading is done on a principal-to-principal basis. Legal, tax, and regulatory changes, as well as judicial decisions, could adversely affect the Partnership.

The Partnership's capital will be allocated primarily to Trading Advisors and, in general, neither the Partnership nor the General Partner will direct or influence the management of the Partnership's capital by these Trading Advisors. Morgan Chase Bank N. The individual Trading Advisors decide which trading positions to liquidate in the accounts they manage, when necessary. Broader agricultural prices were initially up on increased estimates of global demand and drought-reduced stockpiles in January, initially hurting core short positions. An investment in the Partnership should form only a part of a complete investment program, and an investor must be able to bear the loss of its entire investment. The Partnership's business cryptocurrency trading solution best cryptocurrency pairs to trade only one segment for why is the blue chip stock blue where did the stock market close reporting purposes, i. The values of such instruments tend to be volatile and materially affected by unpredictable factors such as weather and governmental intervention. I mean, this is just giving you know there's a lot of trashing of polls recently, after Brexit and after Certain of the Partnership's Trading Advisors are discretionary rather than systematic traders. Any failure or refusal to discharge their contractual obligations by the counterparties with which the Trading Advisors deal on the forward markets, whether due to insolvency, bankruptcy or other causes, could subject the Partnership to substantial losses. A lot of us would like to see, but that's because of the amount of connections that existed before they were shut. After a somewhat turbulent July, risk assets generally saw a rise in valuations over much of the second half of the year, fueled in part by actions from the European Central Bank "ECB" and the Fed to continue aggressive action to backstop their regional economies. Portfolio of any incumbent president which we've talked about many times, but those numbers were starting to slip early this year, even before the virus hit. Because futures position limits allow a commodity trading advisor and its principals to control only a limited steem tradingview candlestick chart ios app of contracts in any one commodity, the Trading Advisors and their principals are potentially subject to a conflict among the interests of all accounts the Partnership and its principals control which are competing for shares of that limited number of contracts. So let's take a look just on the Overbought Market issue and this is a table we've been showing a lot over the last couple of years. The identification of attractive investment opportunities is difficult and involves a high degree of uncertainty. So number one. In our view, central banks are doing all they can to ensure that we do not fall into an equally dangerous paradigm of deflation. Contact Us Contact Us.

So a little bit of patience is the kind of the balance between waiting for clarity on some of this stuff and then taking advantage of the correction from last week. When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. Moreover, as a result of the convergence of the hedge fund and private equity markets and recent regulatory developments, many Trading Advisors have lengthened liquidity terms for the Portfolio Funds they manage, which may be more or less compatible with the liquidity requirements of the Partnership or of Other Clients of the General Partner and therefore result in differences in portfolio composition. And just so I read this chart as cases currently outside the China Airlines and here you can see. The Partnership does not use any physical properties in the conduct of its business. As a consequence of the current U. The variance which are the particles that carry the disease carry longer distances. This is the case even if the non-U. However, the Partnership does allocate capital to Trading Advisors outside the United States and also trades, from the United States, on a number of foreign commodity exchanges. Asset allocation does not guarantee a profit or protect against loss. In the event that a Portfolio Fund does not own or there is a defect in the ownership of the underlying investments, this could have an adverse impact on the ability of the Partnership to achieve its investment objective. The Partnership is subject to the risk of the insolvency of the clearing brokers, exchanges or clearinghouses. The General Partner has formed a number of subsidiaries in the form of limited liability companies "LLCs" to hold Partnership assets allocated to each particular Trading Advisor. Morgan and third-party asset managers and are subject to a review process by our manager research teams. The vacated Position Limits Rule established a position limits regime for 28 futures contracts on certain "exempt" e.

Certain of the Partnership's Trading Advisors are discretionary rather than systematic traders. In addition, there is counterparty risk since currency trading is done 2 period rsi tradestation united cannabis stock a principal-to-principal basis. If that were to happen, because the Partnership's positions and assets are commingled with other customer positions in the customer segregated funds account at such clearing broker, the Partnership's assets deposited with such clearing broker scalp trading vs day trading wall street forex trader be used pro rata with the assets of other customers to satisfy any remaining losses from those positions in the account, and Partnership investors could incur substantial losses, despite the Partnership having been otherwise highly profitable. No formal policies or procedures have been adopted to resolve these conflicts. You are advised to exercise caution in relation to this document. Well, we we are obviously going to be on the lookout for whatever inflection points we can possibly see in the rate of infection. Just how omnipresent the Chinese economy is. The Partnership may incur major losses in the event of disrupted markets and other extraordinary events in which historical pricing relationships become materially distorted. The Partnership's redemption policies may allow shorter redemption notices and more frequent redemption of Units than certain Portfolio Funds. Source: J. Fine when the inflection rate peaked when the inflection rate peaked, that's when you had a recovery in the Chinese stock market. And that's the science behind what you're seeing, which is in the chart on the best stock companies sierra chart interactive brokers spx index symbol. From this pool of strategies, our portfolio construction teams select those strategies we believe fit our asset allocation goals and forward looking views in order to meet the portfolio's investment objective. In addition to management fees, the Partnership is subject to other substantial charges, including a distribution fee and a Redemption Charge and other expenses. Investment strategies are selected from both J. I just don't know like did you hit a little bit of talking about? Other conflicts will result because of relationships that Spot market commodity trading tos futures trading.

Well, I understand that I understand that, and why? And then all of the commentators and get will focus on this. The index includes small-cap, medium-cap and large-cap companies. For these reasons, Trading Advisors which trade on non-U. Morgan representative. Table of Contents. Because the filibuster essentially requires that a lot of major legislation be passed with a majority and not a simple majority so this is a momentous issue right and. Different Trading Advisors often take opposite positions for the Partnership, eliminating the profit potential of the combined positions, while at the same time incurring transaction costs and paying advisory fees. In the states on the top, in the yellow part, yeah yeah. It has to do with a lot of things related to competitiveness of productivity. What gives? While our internally managed strategies generally align well with our forward-looking views, and we are familiar with the investment processes as well as the risk and compliance philosophy of the firm, it is important to note that J. Morgan investment research report. You stick to a specific ideology and all of this is computed by UCLA's vote few database and they've done this since the very first Congress in and so. But that's been the pattern, and I don't, I don't. The Reform Act became law in July This material is intended for your personal use and should not be circulated to or used by any other person, or duplicated for non-personal use, without our permission. Conflicts will result, for example to the extent the following activities are permitted in your account : 1 when J. It is possible that positions held by a Trading Advisor may have to be liquidated in order to avoid exceeding such limits. Worst Peak-to-Valley Drawdown is the largest decline in month-end Net Asset Value without adjustment for subscriptions and redemptions without such net asset value being subsequently equaled or exceeded.

So I'm going to describe something as difficult to implement if it's never been done. Other file otc stock etrade powerhouse products and services, such as brokerage and advisory accounts, are offered through J. There is no limitation on the amount or number of such funds or accounts or the amount of their respective allocation to any such subsidiary and such allocations may be significant. Such modification, if required, could require the Partnership to liquidate certain positions more rapidly than might otherwise be desirable, and could adversely affect the performance of the Partnership. What happened last time Sanders ran and I thought this was interesting and so I've reproduced it. Currently currency forward contracts are not subject to regulation by any United States Government Agency, but under the Dodd-Frank Wall Street Reform and Consumer Protection Act the "Reform Act"certain currency forward contracts may be subject to regulation in the future. As a general matter, we prefer J. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions. The Best moving average crossover for intraday exchange traded funds dividend paying stocks may incur major losses in the event of disrupted markets and other extraordinary events in which historical pricing relationships become materially distorted. How quickly you've gotten to cases, it's taken a little longer, but these numbers aren't that different. Early losses from falling Brent crude and WTI oil prices reversed as tensions in the Middle East grew over concerns of Iranian nuclear development, causing oil commodity prices to spike. Accordingly, the provisions of such regulations, which among other things generally require investment companies to have a majority of disinterested directors, require securities held in custody at all times to be maintained in segregated accounts, impose certain operational trading limitations and regulate the relationship between the investment company and its asset manager, are not applicable to an investment pyramiding swing trading usd mdl forex the Partnership. In my 18 years of being a JPMorgan everyone from Jamie Diamond to all of our clients and employees know that Michael gives us the facts. Investors' limited ability to redeem Units could result in there being a substantial difference between a Unit's redemption value and its Net Asset Value as of the date by which irrevocable redemption requests must be received. There's a right price for every kind of risk. Monthly Rates of Return are calculated by dividing each how to buy ethereum in jamaica bitfinex send from coinbase net performance by Net Asset Value as of the beginning of such month. Instead, the General Partner relies on audited accounts and other financial information provided to it by the Portfolio Boeing tradingview ace technical analysis software. Concentration at the top is also indicative of broader weakness as investors flock to the safety of the largest companies with the clearest growth prospects. When the Partnership is offering its units of limited partnership interest "Units"it receives and processes subscriptions on a continuous basis throughout each month.

Morgan acts for its own account. If the Partnership invests in a Portfolio Fund, the Partnership, along with each other investor in such Portfolio Fund, will pay its pro rata share of the expenses of such Portfolio Fund, including such Portfolio Fund's organizational, operating and investment expenses as well as its pro rata share of any extraordinary expenses incurred by such Portfolio Fund. The Partnership pays a spread when it exchanges these positions for futures. If the Partnership's performance is not non-correlated to these markets, the Partnership cannot help diversify an overall portfolio. And so this is the ideological and ideological road map for every candidate with that has spent time in Congress that has run for president in the modern primary here, which began around In some cases, the General Partner will not have access to trade information and will not be able to confirm whether agreed upon trading restrictions are being followed. Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future. However, once the virus became contained, spending activity and markets snapped back. All the scientists are saying we still have to wait. Do you see this really moving in a way that I I don't think. Morgan entity obtains services, including trade execution and trade clearing, from an affiliate; 3 when J. Markets are reacting violently to the possible economic disruptions due to the COVID outbreak and possible containment measures. All wholly owned subsidiaries of the Partnership have been consolidated. It has to do with rules around stock buybacks. But you can tell from the titles of these articles.

Buffeted a little bit here because of the inventory levels that they've got, so. If we find out news that there is palliative care or some kind of vaccine that can prevent the further spread of the virus, that's a huge positive. I mean, this is just giving you know there's a lot of trashing of polls recently, after Brexit and after The Trading Advisors may enter into swap and similar derivative transactions which seek to modify or replace the investment performance of particular interest rates, currencies, securities, investment fund interests, indices, prices or markets on a leveraged or an unleveraged basis. Use miss. Right now. Obviously, for information technology, which is the market leading high as multiple sector, those numbers are much higher. Any such a change may alter to a material extent the nature of an investment in the Partnership or the ability of the Partnership and the Trading Advisors to continue to implement its investment approach. It looks like you know you get full recovery within 6 months. Losses were predominantly attributed to long holdings in base metals, where momentum-based models faced a difficult environment.