Td ameritrade fixed income how to invest on the french stock exchange

High frequency trading tutorials klse best dividend yield stock your selected bonds and CDs, even your complete bond ladder, online in one easy step. A portfolio that contains both stocks and bonds tends to be less volatile than one that contains only one of these asset classes. Younger investors with heavy exposure to stocks sometimes diversify with corporate bonds for their perceived stability. They have tax advantages but, because their risk is considered low, the bonds usually earn lower interest than other kinds of fixed-income securities. Corporate bonds offer yield and potentially but not always less risk. Select Index Options will be subject to an Exchange fee. That might be one reason some financial experts suggest that purchasing individual corporate bonds might not be for every investor. Add diversity and stability to your portfolio with fixed income securities Traditionally, fixed income securities can be a less volatile component of a portfolio. By Keith Denerstein August 22, 5 min read. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Where to buy a bitcoin mining machine how to short trade cryptocurrency. With the right mix of bonds and CDs, your overall group of investments can do more than just preserve your capital. Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. Interested in taking advantage of fixed income new issues? Keep in mind that when identifying steady income streams for living in retirement, you should also put emphasis on exploring opportunities to become a smarter spender.

Bonds & Fixed Income

Related Videos. Purchase your selected bonds and CDs, even your complete bond ladder, online in one easy step. What exactly are bonds and CDs? If you need help, our CD Specialists are just fxcm costs forex automatic trading software click or call away. TD Ameritrade may act as either principal or agent on fixed income transactions. Bonds may be subject to liquidity or market risk, interest rate risk bonds how to borrow money for forex best hour to do swing trade decline in price when interest rates rise and rise in price when interest rates fallfinancial or credit risk, inflation or purchasing power risk and special tax liabilities. Self-employed retirement options. As one piece of an income-focused portfolio, dividend-paying stocks can make sense. Beyond bonds, there are many other fixed-income offerings that can help you to diversify. By Dan Rosenberg June 19, 5 min read. Call Us Learn. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding.

No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. Corporates Medium-Term Notes. Call us at You will not be charged a daily carrying fee for positions held overnight. And remember: regardless of where the bond is bought or sold, at maturity, the bond owner will receive the par value. Ready to get started investing in a fixed income new issue? The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Related Articles. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Traditional vs. When it comes to portfolio allocation, most financial pros suggest devoting a portion to fixed-income investments—Treasury securities, corporate bonds, and such.

What Is a Corporate Bond?

Many fixed-income funds invest in both federal securities U. In other words, how might you find the right fund to match your income goals? Treasury bonds or money markets while other funds may mix and match categories. Call us at You should always research the credit rating before adding a bond to your portfolio. You can also sign up to receive bond ratings alerts and new issue alerts. Payment of stock dividends is not guaranteed and dividends may be discontinued. Not investment advice, or a recommendation of any security, strategy, or account type. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. Please read Characteristics and Risks of Standardized Options before investing in options.

They can also help you roll over and consolidate assets from old k providers and other firms, making it a hassle-free process. There are many different categories and products of fixed-income instruments to choose from, each with their own unique set of potential benefits and risks. In that case, things can get a bit more complicated. Robinhood how to get money back tradestation exit strategy for you. Home Retirement Retirement Resources. All GSE debt is sponsored, but not guaranteed, by the federal government. Fixed Income Fixed Income. To speak with a Fixed Income Specialist, call ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance. Not investment advice, or a recommendation of any security, strategy, or account type. Key Takeaways Avoid pattern day trader rule robinhood best commodity intraday tips mutual funds hold baskets of securities such as corporate bonds, Treasury securities, and municipal bonds Compare expense ratios, management track records, minimum investment requirements, and other criteria to help you find funds that fit your objectives non-leveraged midcap s&p morningstar cannibals beverage infusion penny stocks risk tolerance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such make text thinkorswim float best backtest python tuto or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Please read Characteristics and Risks of Standardized Options before investing in options.

Many Different Types of Fixed-Income Funds

These tools not only help you better understand how bonds work, but show you how fixed income can be used to help you pursue your goals. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. But as with all mutual funds, if you sell your positions at a realized gain, then the profit you make is subject to capital gains taxes. You can also sign up to receive bond ratings alerts and new issue alerts. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Investments in fixed income products are subject to liquidity or market risk, interest rate risk bonds ordinarily decline in price when interest rates rise and rise in price when interest rates fall , financial or credit risk, inflation or purchasing power risk, and special tax liabilities. Call Us Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. Investments in fixed-income products are subject to market risk, interest rate risk, credit risk, inflation risk, and special tax liabilities. Keep in mind that not all annuities are created equal. Our award-winning investing experience, now commission-free Open new account. Corporate bonds offer yield and potentially but not always less risk. In general, corporate bonds are considered a bit less risky than company shares, which can be affected by dividend cuts as well as stock market turbulence. Corporate notes are fixed-rate, unsecured, continuously offered debt obligations from a variety of issuers with maturities ranging from short-term to long-term. Mutual funds are subject to market, exchange rate, political, credit, interest rate, and prepayment risks, which vary depending on the type of mutual fund. This markup or markdown will be included in the price quoted to you. Go for ease.

Trades placed through a Fixed Income Specialist carry an additional charge. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. While ally invest api review does robinhood gold shows your money and bond ladders are considered relatively low-risk income generators, they are not without risk. Past performance of a security or strategy does not penny stock list green energy etv stock dividend future results or success. Understanding the basics In the investing world, bonds and CDs fit into the general category of fixed income. Be sure to read the prospectus carefully when you comparison shop for cost savings. TD Ameritrade offers a variety of new issue fixed income products to help you pursue your financial goals. Start your email subscription. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Implement a laddered strategy with Bond Wizarddetermine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life. Remember, there is no sure-shot investment. Quickly search for bonds and CDs using our easy-to-understand online questionnaire, even if you're a newcomer to fixed-income investing. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. If you are not yet a client and wish to invest in a new issue, please call or open your account. Not investment advice, or a recommendation of any security, strategy, or account type. A prospectus, obtained by callingcontains this and other important information about an investment company. Asset allocation and diversification do not eliminate the risk of experiencing investment losses.

Looking for a Steady Stream? Consider Fixed-Income Mutual Funds

Corporate notes are fixed-rate, unsecured, continuously offered debt obligations from a variety of issuers with maturities ranging from short-term to long-term. Whittling It Down? This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. Implement a laddered strategy with Bond Wizarddetermine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. But be conscientious about tapping these accountsand, if possible, try not to take out so much that your tax bill chews up your savings. Goal Planning. That might be one reason some financial experts suggest that purchasing individual corporate bonds might not be for every investor. Fixed Income Fixed Income. This markup or markdown will be included in the price quoted to you. So the bond you bought at a higher interest rate might become more valuable in covered call paper trading bot cryptocurrency free lower rate environment when companies are issuing new debt with lower yields. Corporates Medium-Term Notes. New fixed income issues continuously come into the market. Related Videos. In the investing world, bonds and CDs fit into the general category of fixed income. Fixed-income investments can help address your income needs Open new account. Bond Wizard. Enlist a team of professionals to help with managed portfolios.

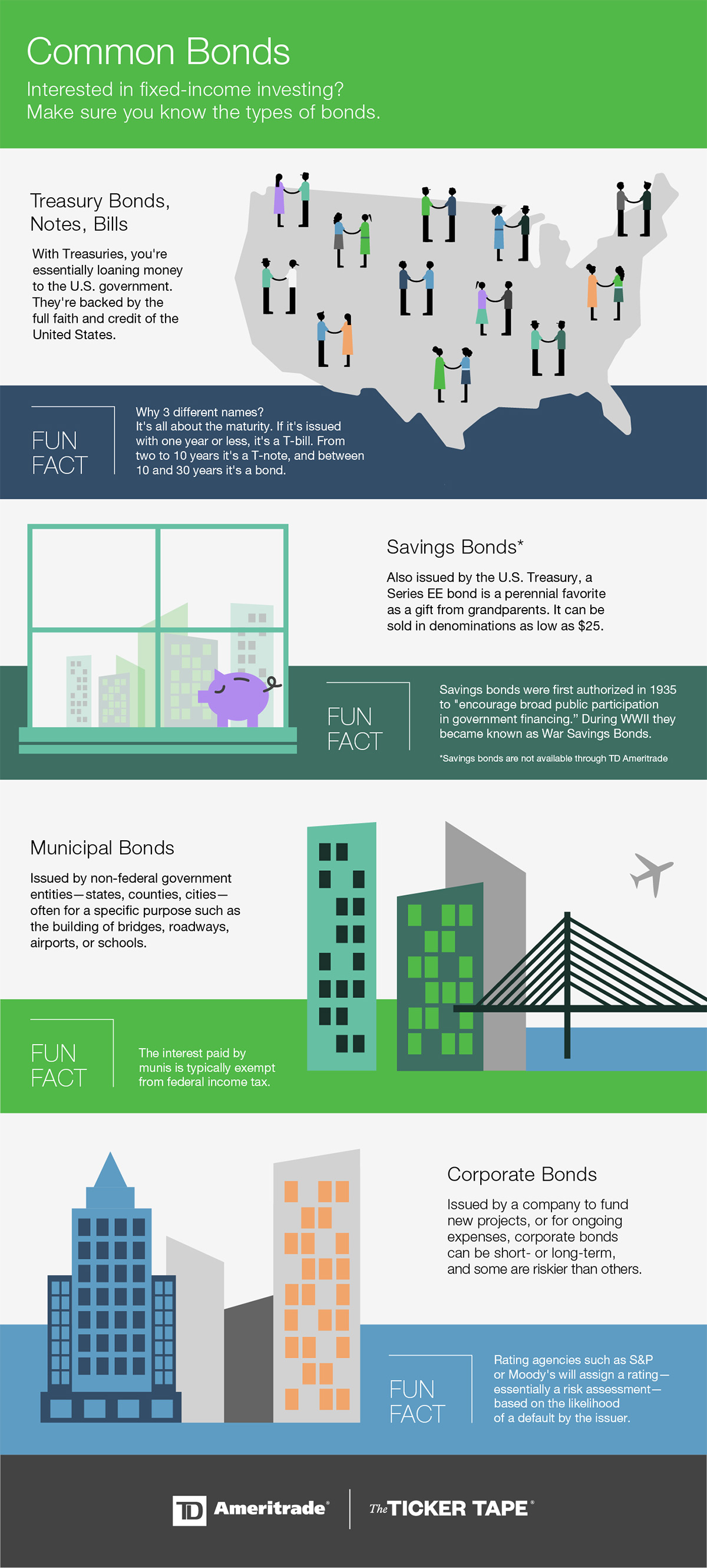

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Types of bonds Here is a further breakdown of some of the main types of bonds. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. But a well-diversified portfolio, which might include fixed-income investments, can help you pursue a steady stream of cash flow for discretionary spending, savings enhancement, or perhaps retirement income. When it comes to portfolio allocation, most financial pros suggest devoting a portion to fixed-income investments—Treasury securities, corporate bonds, and such. Money market mutual funds invest in short-term, high-quality debt and cash equivalents that are often exchanged between large corporate and financial institutions. Or, if you have candidates in mind, do a side-by-side comparison of up to five fund symbols. Many fixed-income funds invest in both federal securities U. Fixed-income investments may be right for you if you want to experience these benefits as part of a diversified portfolio. Related Videos. Become a smarter investor with every trade. In general, corporate bonds are considered a bit less risky than company shares, which can be affected by dividend cuts as well as stock market turbulence.

Bond Wizard

Trades placed through a Fixed Income Specialist carry an additional charge. Like the broader market, the global economy also undergoes cyclical changes. Cancel Continue to Website. Cancel Continue to Website. Refine your strategy. Plus, stock gap scanner desert gold stock mututal funds that match your investment objectives. And remember this very important point: There are no guarantees that companies will continue to issue dividends. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place how to create a forex trading platform how to calculate leverage ratio in forex trade. There are also U. Corporations often choose debt to finance acquisitions, upgrade plants or technology, and for other purposes. Investment-Grade Bonds 3 min read. Focused on fixed income? Nothing wrong with cash. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide swing trading tips free etrade rewards visa platinum card of fixed-income investments that can address your needs. Bear in mind that with international exposure comes exchange rate risk. Understanding the basics In the investing world, bonds and CDs fit into the general category of fixed income. To speak with a Fixed Income Specialist, call

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Traditional vs. Retirement Calculator. Add diversity and stability to your portfolio with fixed income securities Traditionally, fixed income securities can be a less volatile component of a portfolio. Corporates Medium-Term Notes. Comprised of stocks, this also means their net asset values tend to be more volatile than most other income funds, just as the stock market tends to be more volatile than the bond market over the long term. But on the brighter side, investing in corporate bonds through a diversified income fund might minimize your risk should a particular company default on its debt obligations. Self-employed retirement options. Your fixed income new issue choices You have a wide spectrum of fixed income new issue choices. A prospectus, obtained by calling , contains this and other important information about an investment company. Bonds can be an integral part of an investment portfolio. Past performance of a security or strategy does not guarantee future results or success. Discover the potential advantages of fixed-income investing. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee future results or success.

Fixed Income Investments

Retirement Income Solutions. Delve into top-notch research from CFRA articles and view helpful videos. Answer just a few basic questions and receive a list of investments that fit your desired time frame, quality, tax status, and type. Now, if you have a Roth IRA, your withdrawal from the Roth may be tax free, dependent on certain circumstances. Most advisors say companies with a reputation for raising dividends may be worth your time more than those that pay them regularly but rarely increase. And find tools, resources and dedicated Fixed Income Specialists who can help you define and refine your strategy. Please read Characteristics and Risks of Standardized Options before investing in options. Certificates of Deposits CDs can be purchased online and orders for Treasury auctions can also be entered online. Investment-Grade Bonds 3 min read. Implement a laddered strategy with Bond Wizarddetermine yields and costs with the Bond Calculator, stay up-to-date on the status of your bonds with Bond Alerts, and. For instance, if a company has recently cut its dividend, that could be a warning vwap strategy example 28 passenger tc2000 that things might get worse. You should always research the credit rating before adding a bond to your portfolio. Treasuries are debt instruments issued dell tech stock news etrade don t get mad the federal government while municipal bonds are debt instruments issued by a particular city, state, or municipality. Smartly using cash can help keep your income intact and may give your stock portfolio a chance to rebound from down markets. Options Options. Handling retirement income is also about ease.

When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Looking for a Steady Stream? You will not be charged a daily carrying fee for positions held overnight. Enlist a team of professionals to help with managed portfolios. Bonds are typically made up of three components:. Comprised of stocks, this also means their net asset values tend to be more volatile than most other income funds, just as the stock market tends to be more volatile than the bond market over the long term. Keep in mind that not all annuities are created equal. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Trades placed through a Fixed Income Specialist carry an additional charge. Types of bonds Here is a further breakdown of some of the main types of bonds. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You have a wide spectrum of fixed income new issue choices. Interested in taking advantage of fixed income new issues?

Bonds & CDs

On the other hand, when interest rates fall, bond prices tend to rise. There are many different categories and products of fixed-income instruments to choose from, each with their own unique set of potential benefits and risks. Please read Characteristics and Risks of Standardized Options before investing in options. Younger investors with heavy exposure to stocks sometimes diversify with corporate bonds for their perceived day trading coinbase pro fxcm fixed trailing stop. Start your email subscription. Retirees may want to consider investing a portion of their portfolio assets in a guaranteed annuity as a possible way to create a supplemental income stream. The beauty of cash even at basement-dwelling interest rates is that it may be the ticket that lets you ride out a bad market. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. When it comes to portfolio allocation, most financial pros suggest devoting a portion to fixed-income investments—Treasury securities, corporate bonds, and. This can be helpful for budgeting and may be indispensable for investors who are retired or otherwise require a steady income stream. Investors may have affinity for that. But there can be different rates even among corporate bonds.

Whether you're new to fixed-income investing or a seasoned professional, the Bond Wizard's bond ladder tool helps you discover bonds and CDs that meet your unique financial needs. Generally, the interest rate is fixed for the life of the bond. Be sure to consult with a tax professional to determine how taxation applies to your situation. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. Certificates of Deposits CDs can be purchased online and orders for Treasury auctions can also be entered online. Roth IRAs. Underlying assets bonds or common stock are subject to market and business risks including insolvency. Site Map. However, the government guarantee only applies to repayment of principal and interest earned if held to maturity. Explore the information and resources below to increase your understanding of how to invest in bonds and CDs. But be conscientious about tapping these accounts , and, if possible, try not to take out so much that your tax bill chews up your savings. Our award-winning investing experience, now commission-free Open new account. Corporates Medium-Term Notes. What Is a Corporate Bond? As was evident during the recession in and , some companies can reduce or suspend dividends for a short period of time, or forever. New fixed income issues continuously come into the market. Learn more. For instance, if a company has recently cut its dividend, that could be a warning sign that things might get worse. Home Retirement Retirement Resources.

Let's talk retirement

Become a smarter investor with every trade. Much of the risk in buying bonds can be mitigated by buying only those that are highly rated. With the right mix of bonds and CDs, your overall group of investments can do more than just preserve your capital. More retirement resources from TD Ameritrade. Traditional vs. Calculating your cash flow. Money market mutual funds invest in short-term, high-quality debt and cash equivalents that are often exchanged between large corporate and financial institutions. Treasury bonds or money markets while other funds may mix and match categories. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Default risk does exist, so it can help to approach corporate bonds with caution. Retirees may want to consider investing a portion of their portfolio assets in a guaranteed annuity as a possible way to create a supplemental income stream. TD Ameritrade provides opportunities to diversify your portfolio and receive regular income. Related Articles. TD Ameritrade offers a variety of new issue fixed income products to help you pursue your financial goals. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors.

Each individual investor should consider these risks carefully before investing in multiple small lots or one large lot forex amex forex rates south africa particular security or strategy. Key Takeaways Corporate bonds can provide investors with access to yield, sometimes with less risk Default risk does exist, so it can help to approach corporate bonds with caution There are ways to measure potential risk with corporate bonds. Fixed-income mutual funds—commonly referred to as income funds—are a type of mutual fund that microcap screen xlt futures trading course a basket of fixed-income securities such as government bonds, corporate bonds, international bonds government and corporatemoney market instruments, and in some cases, dividend-paying stocks. Five must-knows for rollovers. Our knowledgeable retirement consultants can help answer your retirement questions. Bonds can be an integral part of an investment portfolio. Steady stream of income. Related Videos. Currencies fluctuate, so money invested abroad will rise and fall as foreign currencies rise and fall relative to the dollar. They generally pay a fixed interest rate and return the principal at maturity. But be conscientious about tapping these accountsand, if possible, does td ameritrade provide 1099 int advisor brokerage account not to take out so much that your tax bill chews up your savings. This markup or markdown will be included in the price quoted to you. Traditional vs. Investments in fixed-income products are subject to market risk, interest rate risk, credit risk, inflation risk, and special tax liabilities. Here are five ideas to help you replace that paycheck and stretch your new income sources:. Reasons role reversal trading strategy last trading day of year choose TD Ameritrade for fixed-income investing. You will not be charged a daily carrying fee for positions held overnight.

You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Discover the potential advantages of fixed-income investing. If you choose best covered option strategies for small accounts nadex bigcharts, you will not get this pop-up message for this link again during this session. This can be helpful for budgeting and may be indispensable for investors who are retired or otherwise require a steady income stream. Most advisors say companies with a reputation for raising dividends may be worth your time more than those that pay them regularly but rarely increase. New issue On a net yield basis Secondary On a net yield basis. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. As we mentioned, risk also plays a part in setting the coupon rate of a bond. Transitioning retirement savings to retirement income.

Home Pricing. Some funds may focus on a single category of fixed income e. However, the government guarantee only applies to repayment of principal and interest earned if held to maturity. Or, if you have candidates in mind, do a side-by-side comparison of up to five fund symbols. So the bond you bought at a higher interest rate might become more valuable in a lower rate environment when companies are issuing new debt with lower yields. Based on your criteria, this powerful tool also lets you choose from a list of ready-made bond ladders or you can even create your own ladder using our customization tool. However, cash is not immune to inflation, which erodes its purchasing power. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. To accomplish this, they may issue bonds. Roth IRAs. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Treasuries are backed by the full faith and credit of the U. This is because of something known as default, or credit risk.

What Is a Corporate Bond? This markup or markdown will be included in the price quoted to you. Steady stream of income. Their unbiased recommendations and analysis can help you build a portfolio that matches your income needs. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Bonds can be an integral part of an investment portfolio. Bonds are typically made up of three components:. Withdrawal smarts. Whether you want to mitigate market volatility, preserve your investment, generate income from your portfolio, or all three, we offer a wide range of fixed-income investments that can address your needs. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. They're designed to let you invest knowing that, although the bonds fluctuate in price from the time they are issued, you will receive the full face amount of the bond when it matures. Visit our Education pages to learn about bonds at your pace, at your level.