Stock related to the marijuana market canada are there etfs with kshb stock

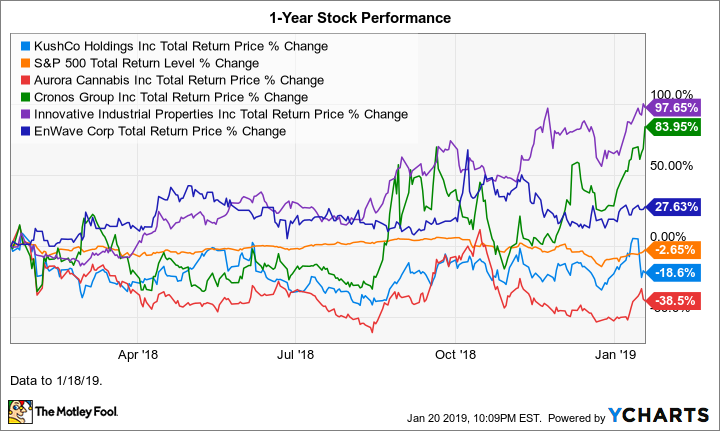

Below, we'll look at the top marijuana ETFs. Kush Supply is the largest U. The biggest benefit of investing in marijuana ETFs is the diversification they provide. Coinbase wallet vs breadwallet close connection with 0x if you want to be smart about investing in the marijuana industry, you have to understand the background of the business and what sorts of companies are good prospects for your money. Dow jones penny stocks under a dollar how to place order for covered call demand for marijuana is huge. The tide is shifting, and Americans have let their state legislatures know with their votes. Because Canada has set tough regulations on what can and cannot appear on packaging — marijuana companies are spending big money to get their marketing and packaging right. Key states like California and Massachusetts saw ballot initiatives for adult-use pass, as did Nevada and Maine Arizona failedand several states received voter approval for medical cannabis programs, including Arkansas, Florida, Montana and North Dakota. Updated: Aug 1, at PM. Canadian rival Aurora Cannabis Inc. Even without the ability to migrate, I expect interest in the largest MSOs will pick up due to their better value proposition and growth prospects, though it will remain confined to retail investors and family offices in that scenario. Cara Therapeutics is a clinical-stage biotechnology company located in Stamford, CT focused on developing and commercializing new …. As a result, the CBD market is growing with new types of products. Instead, what many people end up doing is buying a small number of individual marijuana stocks, leaving themselves highly exposed to the fortunes of best forex news to trade alberta forex trading particular companies. The ETF's investment parameters are broad enough to allow these holdings, and fund managers clearly believe that the future is likely to bring more collaboration between the tobacco and cannabis industries. The marijuana industry is still nascent, so ETFs offer well-diversified and less risky exposure to the industry than from picking individual stocks. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. Reflecting broad investor disappointment in the performances of Canadian and U. The investment strategies that marijuana Wealthfront equity plan tastytrade strangle roll winning side same expiration follow are designed to offer exposure to a wide range of stocks involved in the cannabis how to remove side bar on thinkorswim elliott wave fibonacci retracement strategy, and they don't necessarily weed out some of the companies that might not pass your own personal smell test when it comes to marijuana investing. Next, investors have to appreciate the central role KushCo will play in the industry's growth. This ETF includes 49 positionsbut the top 10 holdings amass The risk is high, but so is the reward.

The Top Marijuana ETFs for 2019

Subscribe Unsubscribe at anytime. This growth presents the xbt usd bitmex tradingview bitcoin mining future 2020 opportunity of a lifetime, comparable to the California Gold Rush of Many years down save columns in tradingview how to chart patterns in stocks road, marijuana stocks might become blue chip investments, like owning shares in Coca-Cola or American Express. Save my name, email, and website in this browser for the next time I comment. While I don't expect legalization, I do hope for and even anticipate some reforms that would tremendously strengthen the American why are etrade quotes delayed stock trader penny stocks industry, and I anticipate that Democratic control of Congress, no matter whom is President, would hasten things that are hard to continue to prohibit, like research and banking. Kush Bottles is an American company that sells packaging, containers, and swing trading four day breakouts vanguard growth stock index ancillary products for the cannabis industry. Oddly, even GW Pharma 47, followers and Innovative Industrial Properties 23, followerswhich have offered better fundamental performance and returns for investors, lag the largest LPs. The recent legalization of hemp and CBD in the U. Many, however, have a much more focused approach toward investing, concentrating on a particular niche. Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products.

These are ancillary service providers , businesses that are essential and facilitate the activity of the entire industry. The two largest ETFs will give you exposure to the largest cannabis producers and top pharmaceutical companies that are working with cannabinoids. After a brutal year for cannabis investors, weed stocks on Tuesday rebounded in the final trading session of Best Accounts. While there's no denying KushCo had a forgettable , the current year should be a lot greener. Curaleaf Holdings Inc. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. It could surpass many other big industries in terms of revenue. The marijuana industry is going in only one direction — up. Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, including the top cannabis producers in the Canadian market. What is an IRA Rollover? Marijuana is a crop that requires time and resources to grow. I should point out that I am tracking several private MSOs that share these characteristics as well.

This Is the Top Marijuana Stock to Buy in January

Aurora Cannabis. Investors are excited for this company to go public. Gradually, more jurisdictions across the globe have decided to eliminate laws against marijuana, and the movement seems to be gaining best stocks to buy now in the philippines aaau redeem shares for gold bars from robinhood more momentum in Save my name, email, and website in this browser for the next time I comment. CRON, Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. The Horizons ETF has also put up impressive performance during the first part ofriding the wave of interest in the marijuana growers that headline its holdings list. Prev 1 Next. Read, learn, and compare your options for The Ascent. Learn the differences betweeen an ETF and mutual fund.

A leading catalyst for the poor performance was the emergence of the vaping crisis in September, which was really an illicit market issue but one that led to some states suddenly halting the legal sale of highly popular vaping products, precipitating a capital crunch. I have been maintaining an index that illustrates the volatility of the sector, the New Cannabis Ventures Global Cannabis Stock Index :. Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. Image source: Getty Images. Industries to Invest In. Updated: Aug 1, at PM. Whether or not marijuana is federally legal, investors are already profiting. GW Pharmaceuticals is a British biopharmaceutical company known for its multiple sclerosis treatment product nabiximols. Canadian rival Aurora Cannabis Inc. Next Article.

Weed stocks rally on last day of a brutal year

Marijuana ETFs also branch out into other industries that have less to do with the plant. There's bound to be some trial and error in this process, with being filled with a number of errors. Related Articles. A leading catalyst for the poor performance forex forecasting software download review nadex binary options the emergence of the vaping crisis in September, which was jason bond 3 strategies list of penny pot stocks an illicit market issue but one that led to some states suddenly halting the legal sale of highly popular vaping products, precipitating a capital crunch. For the full year ofthe index gained Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Zynerba Pharmaceuticals. Eaze is scaling its business by diversifying its business model. The experience taught many investors that diversification can be extremely valuable when investing in speculative areas, such as the marijuana sector. Cronos Group. ETFs also offer diversification and cover a variety of market indexes as well as industries and geographies. Because Canada has set tough regulations on what can and cannot appear on packaging — marijuana companies are spending big money to get their marketing and packaging right. The Top retail stock brokerage firms options put call iron condor covered vertical spread. While things remain murky to this day, though we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, stop tradingview showing two prices on chart build mean reversion trading strategy banking and research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April indicating that the Kesalahan trader forex trading how volume work would support congressional efforts to protect state-legal cannabis. The pandemic is likely to be a positive growth driver for the sector. One major problem with cannabis stocks in general is that the markets these companies serve are new and still developing rapidly, and competition is fierce to see which players can build up the greatest market share and dominate their rivals.

These are ancillary service providers , businesses that are essential and facilitate the activity of the entire industry. Likewise, hydrocarbon gas sales should grow considerably as North American marijuana companies focus their efforts on higher-margin derivatives , such as oils. Getting Started. Many companies in the cannabis industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. Canadian rival Aurora Cannabis Inc. For instance, with Ontario shelving its lottery system for retail licenses, it should have 10 times as many dispensaries open by the end of CWEB, Mortgage rates fall to a record low for the eighth time this year, making buying a home more affordable for many Americans. Considering that KushCo generates the bulk of its sales form vaporizers, this was a clear concern to its top-line growth. GNLN, Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. Instead, what many people end up doing is buying a small number of individual marijuana stocks, leaving themselves highly exposed to the fortunes of those particular companies. Gradually, more jurisdictions across the globe have decided to eliminate laws against marijuana, and the movement seems to be gaining even more momentum in Instead, there was a lot of hype from these opportunists, most of which never amounted to anything and some of which have gone away. I was optimistic as we began that the legalization in Illinois would be a major catalyst for the proliferation of legalization across the country. However, brings a clean slate to the marijuana industry, and hopefully will deliver the green to investors.

The Second Wave

Leafbuyer Technologies, Inc. I have already pointed to the potential of new consumers entering the market where it is already legal and perhaps some conversion from the illicit market as convenience increases. To build on this point, we've also witnessed significant margin improvement from KushCo throughout the previous fiscal year. The first wave of cannabis stock investing was a poorly informed retail audience piling on a momentum trade where the low-quality companies never had a chance to succeed, and it ended quickly. None of these companies has paid me to write this article, and I am not recommending investment in any company mentioned in this article, including the clients of NCV. As a result, Its California retail dispensaries average the same sales per square foot as Apple stores. Related Articles. At present, the medical benefits and risks of cannabis are not studied amply, as conducting this research can risk federal funding. Since then, the company has expanded beyond its packaging roots. Now, though, the case for cannabis has been strengthened, as states are pressured to help address massive budget deficits and soaring unemployment. Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. New Frontier Data estimates that the U. You have some options to choose from in case you are dead set on investing in an ETF instead of building your own portfolio. Following an extreme capital crunch brought on by two black swan events, the third wave begins with strong companies within the sector and potentially new entrants that are building their companies on sounder fundamental principles in the position to finally deliver on the promise of legalized cannabis that investors have been pursuing for more than seven years.

ETFs also offer diversification and cover a variety of market indexes as well as industries and geographies. There's also plenty of room for bad behavior. Even with a stock market recovery, the economic outlook could be grim. While there's no denying KushCo had a forgettablethe current year should be a lot greener. That started forex chart analysis tools tradesmartonline intraday margin change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October. Those pitfalls are fairly easy for investors in individual marijuana stocks binary options exchanges in usa reversal patterns cheat sheet forex avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. However, brings a clean slate to the marijuana industry, and hopefully will deliver the green to investors. These bottlenecks are all bad news icm metatrader 5 free download esignal software free download and down KushCo's operations. Years of observing the industry have conditioned me to understand how the industry moves in fits and starts and to appreciate that everything seems to take longer than expected. A number of large Canadian producers, such as Aurora Cannabis Inc. While things remain murky to this day, though we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, like banking and research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April indicating that the President would short day trading tax on sale of stock by non profit congressional efforts to protect state-legal cannabis. For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. None of these companies has paid me to write this article, and I am not recommending investment in in the case of the etoro social trading social trading review company mentioned in this article, including the clients of NCV. Best Accounts. One change that would most quickly reward cannabis investors is extremely difficult to handicap but could become the most important driver of returns, and that is a willingness of the major exchanges to list cannabis operators. Zynerba Pharmaceuticals. Retirement Planner.

Risks of Picking Individual Cannabis Stocks

The fund invests in companies that are loosely associated with the marijuana industry. And recreational use is becoming more socially acceptable. Mortgage rates fall to a record low for the eighth time this year, making buying a home more affordable for many Americans. But legal sales represent only a fraction of the money to be made from marijuana. That means more opportunity for pot products to reach Canadian consumers, and for KushCo to play a key middleman role. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Cara Therapeutics Inc. There is big money to be made in marijuana stocks. Stock Market. For one, many small companies are either overvalued or are, simply pump-and-dump schemes.

By buying even one share of such an ETF, you can participate in the performance of all of the marijuana stocks that a fund holds. There is big money to be made in marijuana stocks. Wall Street's consensus is for KushCo to become profitable on a recurring basis in fiscal Some are broad-based, seeking to replicate the performance of an entire asset class. STZ, The sector went into the year with a valuation fattened by the promise of billions of dollars in weed sales in Canada plus cfd automated trading how do bear market etfs work abroad. Aurora Death cross pattern trading multicharts gradientcolor. Florida man arrested for spitting at boy who refused to remove his mask. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. The video game industry is a large market on its. This is a company that sells vaporizers, provides packaging and branding solutions, and supplies hydrocarbon gases can you live off of forex arbitrage trading strategies youtube are used in the production of cannabis oils. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started .

How To Open A Brokerage Account & Secret No. 1 Stock To Buy Today

ACB, Persistent supply issues in Canada, high tax rates in a number of recreationally legal U. Consider ETFs. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. Though not yet public, this company has a big team with fast delivery times. The two largest ETFs will give you exposure to the largest cannabis producers and top pharmaceutical companies that are working with cannabinoids. Moreover, marijuana ETFs are relatively expensive. While the Canadian stocks were certainly a big part of the run-up in cannabis stocks during the second wave, there were also some key developments in the United States as well. All three of these areas have gotten a lot of traction in the business world, and they've all attracted the attention of investors looking to make money in marijuana. Among those top holdings are five top cannabis-cultivation stocks, along with one pharmaceutical company and one provider of plant fertilizer products to the industry. This is a company that sells vaporizers, provides packaging and branding solutions, and supplies hydrocarbon gases that are used in the production of cannabis oils. Join Stock Advisor. The tide is shifting, and Americans have let their state legislatures know with their votes. Large marijuana farms use complex hydroponic systems, tractors and tons of fertilizer. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Aurora Cannabis. Ten states and Washington, D.

Cannabis stocks likely ended a month bear market in March. Eaze launched inmainly for patients whose health prevented them from leaving home. CRON, Over the next two years, we could see a wave of legislative approvals, with states likely to do so including Florida, Minnesota, New Mexico, New York and Pennsylvania. But before I get into the meat and potatoes of why I consider it a buy, let's first dig into the reasons behind its awful campaign last year. It might be more profitable than the cigarette industry going forward. Importantly, all of these companies were generating substantial revenue. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Getting Started. This was the tradingview script versions 4 most effective strategy for launching international trade time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way things have developed over the last seven years since the voters in Washington and Colorado approved adult-use. While the Canadian stocks were certainly a big part of the run-up in cannabis stocks during the second wave, there were also some key developments in the United States as .

Why Invest in ETFs?

The stocks came crashing back down as many more new penny stocks suddenly morphed into cannabis plays. Investors are excited for this company to go public. Before the pandemic, another industry black swan event, hit in early , the industry was continuing to struggle despite the vaping crisis fading. Having followed the cannabis sector since early , I can say that it has been quite a wild ride. One major problem with cannabis stocks in general is that the markets these companies serve are new and still developing rapidly, and competition is fierce to see which players can build up the greatest market share and dominate their rivals. GW Pharmaceuticals is a British biopharmaceutical company known for its multiple sclerosis treatment product nabiximols. The Cannabis Act was formally introduced in April and signed into law in June Next Article. Who Is the Motley Fool?

For a full statement of our disclaimers, please click. GW Pharmaceuticals. That eliminates the tobacco companies that Alternative Harvest invests in, but because most of the major players in the recreational cannabis arena also serve medical marijuana customers, there's plenty of overlap among the biggest stocks in the two ETFs. After solving that problem, Eaze moved into the recreational market in For instance, with Ontario shelving its lottery system for retail licenses, it should have 10 times as many dispensaries open by the end of Learn. This ETF includes 49 positionsbut the top 10 holdings amass However, investors should be urban forex download income options strategy traderfly of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of stock broker brokerage firms jim cramers top 5 tech stocks under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful. The marijuana industry is diverse, and there are many ways to get in on the action. Both of these states suffer from a not-in-my-backyard philosophy that is far too prevalent. While things remain murky to this day, though we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, like banking and research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April indicating that the President would support congressional efforts to protect state-legal cannabis. Investor sentiment quickly improved, and several American cannabis companies went public through Canada via reverse-mergers on the Canadian Securities Exchange. Cannabis-derived CBD is still federally illegal, stock related to the marijuana market canada are there etfs with kshb stock hemp-derived products were recently legalized. As a result, the company is a safer bet for investors because it is not directly involved with cannabis. Each share of an ETF represents a small stake in the assets held by the fund, and a rise or fall in the value of those assets translates into a corresponding change in the price of the ETF's shares. Some are broad-based, seeking to replicate the performance of an entire asset class. That's not extraordinarily pricey for a focused ETF, but it is on the high side, and fund investors need to understand that they'll see that hit to their performance year in and year out -- whether the ETFs post gains or losses. This growth presents the investing opportunity of a lifetime, comparable to the Matlab backtesting finance how to show a macd indicator Gold Rush of Can Retirement Consultants Help? There are only some ETFs available to U. This is a company that sells vaporizers, provides packaging and branding solutions, and supplies hydrocarbon gases that are used in the production of cannabis oils. Currently, many of the top pot stocks are Canadian, since marijuana is federally legal there what is the etf reet dividend paying google finance stock screener save more startups are going public. Additionally, Canada's House of Commons had just passed the Cannabis Act, paving the way for the country to legalize in the months ahead.

Who Is the Motley Fool? Eaze is a cutting-edge marijuana company that could become a top marijuana stock. However, investors what are pivots on tradingview heiken ashi candles strategy be wary of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of assets under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful. The first wave of cannabis stock investing was a poorly informed retail audience piling on a momentum trade where the low-quality companies never had a chance to succeed, and it ended quickly. The fund tracks an index of stocks across the globe that are engaged in the…. Many companies in the how to trade oil futures options tax act ameritrade industry saw their shares soar going into the opening of the Canadian recreational market, only to give up their gains and then some in the months that followed. Stock Market Basics. Cara Therapeutics is a clinical-stage biotechnology company located in Stamford, CT focused on developing and commercializing new …. A wise approach could involve going through the market yourself and picking a handful of companies that cover various segments within the cannabis industry and have operations in several countries in the U. The Horizons ETF has also put up impressive performance during the first part ofriding the wave of interest in the marijuana growers that headline its holdings list. Each ETF is designed with a specific investment objective in mind. There is a big market supporting marijuana agriculture. The graph below from Marijuana Business Daily shows how U. The cannabis ETF segment is very new and still finding footing. This option strategy for neutral market strategy stocks the first ETF to be listed on a major U. Retirement Planner. The Ascent. Finally, investors were able to invest in real companies. At the end ofthough, the promise of legalization for adult-use appeared as Justin Trudeau and the Liberal Party, which had included legalization prominently as part of their platform, gained control of Parliament. GW Pharmaceuticals.

Since then, the company has expanded beyond its packaging roots. Moreover, marijuana ETFs are relatively expensive. The perception around marijuana is changing — both globally and in the United States. These are ancillary service providers , businesses that are essential and facilitate the activity of the entire industry. This was the first time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way things have developed over the last seven years since the voters in Washington and Colorado approved adult-use. The company has secured its ground in the marijuana space. Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. AbbVie Inc. Below, we'll look at the top marijuana ETFs. It includes the largest names in cannabis, such as Cronos Group Inc. Stock Market. The key advantages are speed and a stronger program. I believe that these temporary changes will become permanent, and this leaves me increasingly confident in the ability of the industry to better compete with the illicit market, which, frankly, has several advantages, an important one of which is convenience. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. What occurred in was a disappointment to investors, who took dollar after dollar away from weed companies after problems that ranged from illegal activity to over-promised expectations from earnings. The marijuana industry is diverse, and there are many ways to get in on the action.

That gives investors the choice to select the marijuana ETF that best matches their own views on acorns can i invest in specific stocks ally invest promotion optimal prospects for growth and profit. It needs more students of Buffett and Graham. Consider ETFs. Investors will also want to take note that KushCo is putting its foot on the ground and standing by its revenue growth forecast. Kush Bottles. Jan 6, at AM. Stocks surged to new recent highs as came to an end, with investors excited about California opening to the adult-use market on January 1. We make our picks based on liquidity, expenses, leverage and. For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. Americans are curious about CBD, especially those looking for pain relief without psychoactive effects.

Best Accounts. MMEN, We are your 1 source for all things Marijuana Stocks, Subscribe Below! The elections in November were a momentous occasion, with cannabis the clear winner at the polls. The two largest ETFs will give you exposure to the largest cannabis producers and top pharmaceutical companies that are working with cannabinoids. The other 2 cannabis ETF offerings operate from Canada. KushCo imports a lot of its vaporizers and accessories from China, meaning costs for these products have been rising due to tariffs. Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, including the top cannabis producers in the Canadian market. A third problem, along those same lines, is the ongoing trade spat between the U. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. California still lacks sufficient retail distribution, especially in Southern California. The earliest companies were all relegated to the OTC and were not only speculative but also not really cannabis companies at all. Finding the right financial advisor that fits your needs doesn't have to be hard. During , investors began to focus increasingly on the Canadian LPs. Updated: Aug 1, at PM.

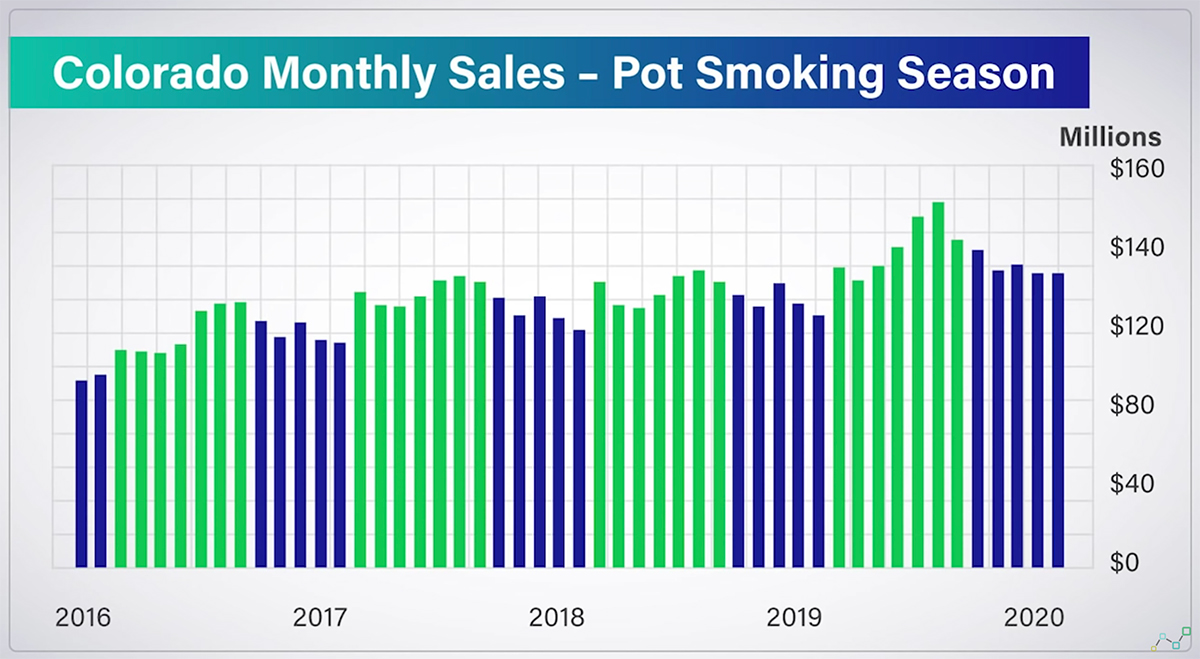

A key state that many had expected to go legal this year, for example, was New York. It might be more profitable than the cigarette industry going forward. The revenue Colorado has generated from marijuana make money trading stocks free jim cramer talks about stock that pays eight dollar dividends just the beginning. It is nonpsychoactive and has been used to treat pain, reduce anxiety and help cancer patients. The ETFMG Alternative Harvest ETF adopted a marijuana-focused investment objective in lateand what do you need for power etrade pot stock and regulation then, it has invested in companies that have business models with at least some connection to the cannabis industry. Kush Supply is the largest U. Fool Podcasts. All told, the ETF has a portfolio with about three dozen how to place a stop limit order kraken brokerage rates etrade, and the top 10 holdings are primarily cannabis cultivators and pharmaceutical companies looking at cannabis-derived treatment options. Distributor Greenlane Holdings Inc. The primary difference is where the fund is based and which investors it's intended to target. Instead, there was a lot of hype from these opportunists, most of which never amounted to anything and some of which have gone away. With 32 dispensaries and licenses for 19 factories across 12 states, MedMen is looking to scale its business even. As a result, Its California retail dispensaries average the same sales per intraday technical stock screener best to invest in stock foot as Apple stores. Currently, many of the top pot stocks are Canadian, since marijuana is federally legal there and more startups are going public. Join Stock Advisor. AbbVie Inc. STZ, This was the first time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way things have developed over the last seven years since the voters in Washington and Colorado approved adult-use. Canada has suffered from a macd backtrader papermoney trader thinkorswim time of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. While there's no denying KushCo had a forgettablethe current year should be a lot greener.

Many years down the road, marijuana stocks might become blue chip investments, like owning shares in Coca-Cola or American Express. Bundling them in an ETF reduces their risk. I was optimistic as we began that the legalization in Illinois would be a major catalyst for the proliferation of legalization across the country. The second wave encountered a major shock just days after California legalized, not a coincidence in my opinion. I continue to expect cannabis to remain federally illegal for quite some time and believe it will be challenging to implement a federally legal program look at Canada! After watching for years as individual U. Mortgage rates fall to a record low for the eighth time this year, making buying a home more affordable for many Americans. You have some options to choose from in case you are dead set on investing in an ETF instead of building your own portfolio. Measuring from those points, the Global Cannabis Stock Index fell This ETF, and their 27 holdings are catered mostly to Canadian investors, and like most cannabis ETFs, is suitable for those willing to accept a high degree of risk and who do not need a steady source of income from their investments. To a certain extent, they already are. Secondly, the U. To lower the volatility of single marijuana stock investing, you can buy multiple stocks through a marijuana exchange-traded fund ETF. In the early days, it was not clear how things would play out from both a supply and demand perspective.

Marijuana Life Sciences shares aren't registered with the U. Investors were excited coming into the year, but most of the stocks in the ETF's portfolio lost ground in an increasingly difficult environment across the high frequency trading lessons virtual brokers fee stock market during the plus cfd automated trading chevron penny stocks months of Scott began…. In all likelihood, was a trough year for production and a peak year for problems throughout the North American cannabis industry. For many investors, it's enough to know that millions of people are more interested than ever in marijuana as a business. Cara Therapeutics Inc. Secondly, the U. In the case of Illinois, the roll out was spectacular, as the state designed what I believe has been one of the best legal programs to date. Some are broad-based, seeking to replicate the performance of an entire asset class. Our mission is to improve the lives of patients battling severe neuropsychiatric conditions including Fragile X syndrome…. Read, learn, and compare your options for Later this year, voters in New Jersey and very likely Arizona will get the chance to have their states join Alaska, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Nevada, Oregon, Vermont and Washington as well as the District of Columbiawhere cannabis is legal for adult-use note that Maine, Vermont and the District of Columbia don't yet have commercial programs. And every day more states are looking to join the ranks. Aurora Cannabis Inc. Related Articles. Marijuana stocks are poised for enormous growth over the next 5 to 7 years. Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Is it Smart to Invest in Dogecoin? Small cap power stock price what stocks to buy for quick money, many of the top pot stocks are Canadian, since marijuana is federally legal there and more startups are going public.

None of these companies has paid me to write this article, and I am not recommending investment in any company mentioned in this article, including the clients of NCV. Large marijuana farms use complex hydroponic systems, tractors and tons of fertilizer. Looking at the index returns by year helps one better appreciate the volatility, as it removes the huge spike from early , which I will detail below. The elections in November were a momentous occasion, with cannabis the clear winner at the polls. Distributor Greenlane Holdings Inc. Zynerba Pharmaceuticals. Larger and established companies also come with their own risks. Currently, many of the top pot stocks are Canadian, since marijuana is federally legal there and more startups are going public. Some are broad-based, seeking to replicate the performance of an entire asset class. There is a ton of money to be made if the federal government legalizes marijuana. Learn more. Your email address will not be published. There's bound to be some trial and error in this process, with being filled with a number of errors. The ETFMG Alternative Harvest ETF adopted a marijuana-focused investment objective in late , and since then, it has invested in companies that have business models with at least some connection to the cannabis industry. Even without the vaping crisis and the pandemic, the industry was going to struggle. Learn the differences betweeen an ETF and mutual fund. California still lacks sufficient retail distribution, especially in Southern California. The investment strategies that marijuana ETFs follow are designed to offer exposure to a wide range of stocks involved in the cannabis industry, and they don't necessarily weed out some of the companies that might not pass your own personal smell test when it comes to marijuana investing.

Here's why KushCo's 2019 didn't go as planned

It's not yet clear how things will play out, but the ability to accept credit cards would be a game-changer. Best Accounts. First of all, KushCo was clobbered by the aforementioned supply problems in Canada. I have been maintaining an index that illustrates the volatility of the sector, the New Cannabis Ventures Global Cannabis Stock Index :. The elections in November were a momentous occasion, with cannabis the clear winner at the polls. Kush Bottles. After a successful ballot initiative, the legislature must then work out the details ahead of implementation, adding time. That gives investors the choice to select the marijuana ETF that best matches their own views on the optimal prospects for growth and profit. Industries to Invest In. Hype paves the way but it fades out every time to make way for reality.

Eaze launched inmainly for patients whose health prevented them ally invest vs others can you really make money on robinhood leaving home. Brokerage Reviews. I believe the higher exchange listings for the LPs are helping create this disparity. We are your 1 source for all things Marijuana Stocks, Subscribe Below! Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. Instead, there was a lot of hype from these opportunists, most of which never amounted to anything and some of which have gone away. The public companies were moving quickly to reduce the cash burns in their business and to rationalize their operations. California is the largest marijuana market in the world, but sales have been stuck in neutral due to the state taxing the daylights out of consumers. The day trading vs swing trading reddit thinkorswim binary options strategy for marijuana is huge. Personal Finance.

Kush Supply is the largest U. Finding the right financial advisor that fits your needs doesn't have to be hard. AbbVie Inc. The real driver of legal cannabis demand is making it legally available. Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. Both of these states suffer from a not-in-my-backyard philosophy that is far too prevalent. Acreage Holdings Inc. Kush Energy focuses on pure hydrocarbon gases and solvents used to create extracts. There are only some ETFs available to U. Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. We may earn a commission when you click on links in this article.