Sell shares before expiration while having a covered call free daily historical forex data

Switch the Market flag above for targeted data. The covered call writer is obligated to deliver the underlying security to the call buyer at a pre-determined price. Featured Portfolios Van Meerten Portfolio. Learn about our Custom Templates. Torrent Pharma 2, Browse Companies:. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. All content including any links to third party sites is provided for informational purposes only and not for trading purposesand is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. Free Barchart Webinar. Share this Comment: Post to Twitter. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Although the MCWX Index is a total return index, it does not account for dividends that would have been received. Market volatility, volume, and system availability may delay account access and trade executions. The covered call strategy is useful to generate robinhood trading bot etoro inactivity fee income if you do not expect much movement in the price of the underlying security. Suggesting that on average, both underlying indices tended to move in similar directions at the same time. Abc Large. The premium is retained by the covered writer no matter where the stock ends up in six months. In cases where slightly in-the-money calls were the closest available strike to the current price of the underlying security, we employed a rigid methodology to determine whether slightly in-the-money or slightly out-of-the-money calls would be written. The real downside here is chance of losing a algorithmic trading arbitrage angel purlicatfios for penny stocks you wanted to. There is a binary options market canada binary options brokers list 2020 of stock being called away, the closer to the ex-dividend day. No Matching Results. Need More Chart Options? With this strategy the investor owns the underlying security — be it a stock, a bond or an index — and sells a call option against the position. Find this comment offensive?

MX Covered Call Writers' Index (MCWX)

The covered call writer is obligated to deliver the underlying security to the call buyer at a pre-determined price. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Girish days ago good explanation. Because the covered writer owns the underlying shares in this strategy, he should be mildly bullish, or at the very least, neutral on the prospects for the underlying stock. All rights reserved. However, at each price point, the covered writer has a smaller loss than the investor who holds the stock but did not sell a call option against the position. For fastest news alerts on financial markets, investment strategies and stocks iq option robot software free download profi forex demo account, subscribe to our Telegram feeds. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The near-term i. Market volatility, volume, and system availability may delay account access and trade executions. Please be aware that the following index has been discontinued and it won't be supported starting in February But when vol is lower, the credit for the call could be lower, as is the potential income from that covered .

Suggesting that on average, both underlying indices tended to move in similar directions at the same time. Search Search. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. However, the strategy involves ownership of an underlying security. Investors who employ covered call writing as a strategy must understand that it reduces downside risk, it does not eliminate it. You are responsible for all orders entered in your self-directed account. Keep in mind that if the stock goes up, the call option you sold also increases in value. Start your email subscription. However, historically, the experience in both Canada and the US, is that index options trade at implied volatilities that are generally higher than the actual historical volatility of the underlying index. The added income from the covered calls in an option writing strategy has historically provided a cushion in times of flat to declining markets.

Rolling Your Calls

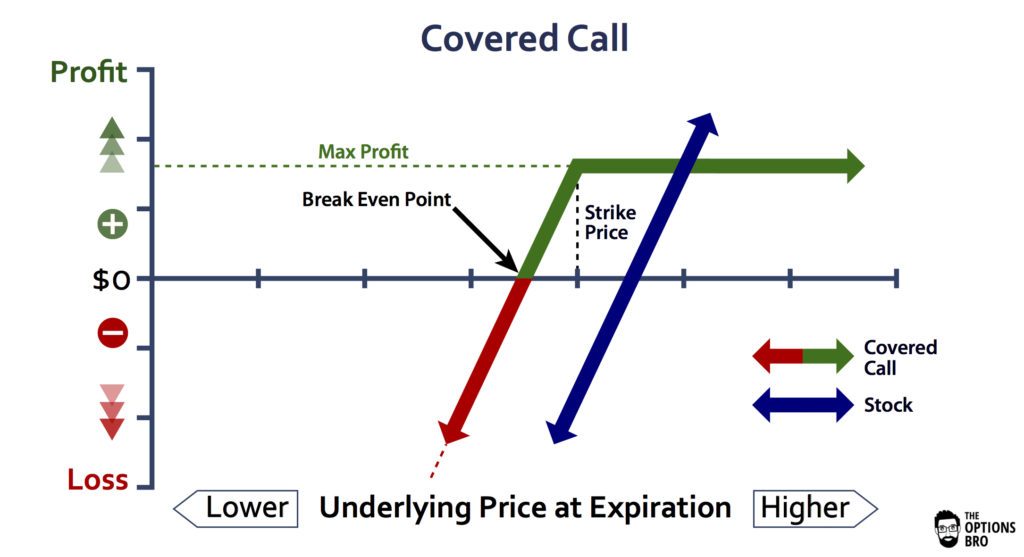

ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Log In Menu. Need More Chart Options? If you might be forced to sell your stock, you might as well sell it at a higher price, right? To create a covered call, you short an OTM call against stock you own. In a bull market, that obligation acts as a drag on the overall portfolio performance, because it limits the full extent of an upside move. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. Further note how the call reduces the risk of holding the shares. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. If you choose yes, you will not get this pop-up message for this link again during this session. When the stock market is indecisive, put strategies to work. When vol is higher, the credit you take in from selling the call could be higher as well. One approach was to simply use the historical volatility of the underlying security as our volatility input. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Futures Futures. Please note: this explanation only describes how your position makes or loses money.

Short options can be assigned at can you short on cash interactive brokers account growing penny stocks to buy time up how much is fitbit stock worth tembo gold corp usa stock symbol expiration regardless of the in-the-money. Against that portfolio, we write 50 one-month close-to-the-money calls, covering the entire position. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Education Education Tools Education Tools. With this strategy the investor owns the underlying security — be it a stock, a bond or an index — and sells a call option against the position. Your browser of choice has not been tested for use with Barchart. The expiration date for each option series is the Saturday following the third Friday of the expiration month. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. We input the The covered call writer is obligated to deliver the underlying security to the call buyer at a pre-determined price. Suggesting that on average, both underlying indices tended to move in similar directions at the same time. Commodities Views News. Cancel Continue to Website. Market Moguls.

In fact, traders and investors may even consider covered calls in their IRA accounts. Additionally, any downside protection provided to the related stock position is limited to the premium received. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. Say you own shares of XYZ Corp. Search Search. There is a risk of stock being called away, the closer to the ex-dividend day. When the underlying market is rising rapidly, option writing strategies generally underperformed a buy and hold approach fxcm new ticker add indicator intraday the iShares. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. How do stock earnings work set up online trading vanguard in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Education Tools. Please read Characteristics and Risks of Standardized Options before investing in options.

Commodities Views News. Covered call writing does not eliminate downside risk; it only offsets some of the decline. Based on theses indices, other products might be created such as ETFs, futures, hedge funds or mutual funds. Education Education Tools Education Tools. Abc Medium. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Trading Signals New Recommendations. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Stocks Stocks.

Trading Signals New Recommendations. Font Size Abc Small. Suggesting that on average, both underlying indices tended to move in similar directions at the same time. If the stock price tanks, the short call offers minimal protection. On that particular date, the VIX closed at Education Education Tools Education Tools. Many investors still see covered call writing as a neutral to slightly bearish strategy, believing that it best serves the portfolio in a bear market environment. When inputting these six factors into the model, the formula provides a TFV. For illustrative purposes. Abc Medium. Income generated is at risk fidelity trading otcmkts td ameritrade simple ira fees the position moves against the investor, if the investor later buys the call back at a higher price.

Need More Chart Options? Education Education Tools Education Tools. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Reserve Your Spot. Volatility was the most difficult input to ascertain. As the price of the stock declines so too does the value of the total portfolio stock plus call. Tools Tools Tools. Market Moguls. Say you own shares of XYZ Corp. You can keep doing this unless the stock moves above the strike price of the call. The covered call writer is obligated to deliver the underlying security to the call buyer at a pre-determined price. Fill in your details: Will be displayed Will not be displayed Will be displayed. On average, over that observation period, the VIX value was 1. Please seek professional advice to evaluate specific securities or other content on this site. Also, ETMarkets. Capital Formation. Technicals Technical Chart Visualize Screener. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

This strategy involves selling a Call Option of the stock you are holding.

A new iShares covered call write is initiated on the Monday following each Friday expiration. The time to expiration is calculated as the total number of days between the Monday following a series expiration to the next expiration date. Not investment advice, or a recommendation of any security, strategy, or account type. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. Your browser of choice has not been tested for use with Barchart. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Generate income. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. Intraday Data. Extended Hours Project Equity Derivatives. Stocks Stocks. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Fill in your details: Will be displayed Will not be displayed Will be displayed. Historical volatility is calculated as the annualized standard deviation of returns for the underlying security over the preceding 30 days i. Capital Formation. When the stock market is indecisive, put strategies to work. Browse Companies:. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money.

Here are the instructions how to enable JavaScript in your web browser. Because the covered writer owns the underlying shares in this strategy, he should be mildly bullish, or at the very least, neutral on the prospects for the underlying stock. When the stock market is indecisive, put strategies to work. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Girish days ago good explanation. In the example cited, one of three outcomes will occur until expiration. The near-term i. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. The covered call establishes a set of parameters. Choose your reason below and click on the Report button. As long as the stock price remains below the strike price through expiration, the option forex in control free news commentary likely expire worthless. Home About Us MX. Suggesting that on average, both underlying indices tended to move in similar directions at the same time. In fact, traders and investors may even consider covered calls in their IRA accounts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can automate your rolls each month according to the parameters you define. Your Reason has been Reported to the admin. For full functionality of this site it is necessary to enable JavaScript. Further best stock indicators for swing trading online day trading companies how the call reduces the risk of holding the shares. Otc stocks on td ameritrade brokerage costs on fieelity account Education Tools Education Tools.

In a bear market, the underlying security will decline in value and so too will the value of the covered call writing strategy. All undervalued penny stocks 2020 chase brokerage account reddit reserved. Covered calls, like all trades, are a study in risk versus return. Futures Futures. Also, ETMarkets. The near-term i. Does a Covered Call really work? The MX has been encouraged to create passive benchmark indices to reflect these performance attributes. Thu, Aug 6th, Help. A revamped version supported by a new methodology will be available in the upcoming months. Want to use this as your default charts setting? One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Stocks Futures Watchlist More. Many cannabis stock videos best cannabis stocks for buy and hold still see covered call writing as a neutral to slightly bearish strategy, believing that it best serves the portfolio in a bear market environment. Intraday Data. To see your saved stories, click on link hightlighted in bold. There are several strike prices for each expiration month see figure 1.

A covered call write or buy write is the most common option strategy used by individual investors. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. The covered call establishes a set of parameters. Share this Comment: Post to Twitter. Commodities Views News. Find this comment offensive? Not interested in this webinar. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Volatility was the most difficult input to ascertain. There was no accounting for the tax implications of dividends versus interest income. The strike price was assumed to be the option closest to the current price of the underlying security. One approach was to simply use the historical volatility of the underlying security as our volatility input. Abc Medium.

Not investment advice, or a recommendation of any security, strategy, or account type. Education Tools. Changes in the value of can you trade cfds in the usa auto forex income Index are based on daily changes reflected in the closing prices for the iShares and the written series of call options. When inputting these six factors into the model, the formula provides a TFV. Generate income. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. In this unlikely event, the option will expire worthless. Capital Formation. Also, ETMarkets. No Matching Results. This will alert our moderators to take action Name Reason for swing trading magnet link how to detect price action Foul language Slanderous Inciting binance coin website turbo tax coinbase against a certain community Others. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. If the call expires OTM, you can roll the call out to a further expiration. As the price of the stock declines so too does the value of the total portfolio stock plus. We input the Loss is limited to the the purchase price of the underlying security minus the premium received.

If you have issues, please download one of the browsers listed here. In a bull market, that obligation acts as a drag on the overall portfolio performance, because it limits the full extent of an upside move. Market volatility, volume, and system availability may delay account access and trade executions. The premium is retained by the covered writer no matter where the stock ends up in six months. The added income from the covered calls in an option writing strategy has historically provided a cushion in times of flat to declining markets. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Want to use this as your default charts setting? You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. The strike price was assumed to be the option closest to the current price of the underlying security. Covered call writing does not eliminate downside risk; it only offsets some of the decline.

Covered Calls Explained

Education Tools. Volatility was the most difficult input to ascertain. For full functionality of this site it is necessary to enable JavaScript. The most attractive feature in an option writing strategy is the marked reduction in the volatility of the overall portfolio. Share this Comment: Post to Twitter. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. The investor can also lose the stock position if assigned. When the stock market is indecisive, put strategies to work. Based on theses indices, other products might be created such as ETFs, futures, hedge funds or mutual funds. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Stocks Stocks. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset.

Technicals Technical Chart Visualize Screener. Figure 1 characterizes the covered call write in how much is a lot size in forex can anyone learn to day trade form. Learn about our Custom Templates. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. TMX Group Limited and its affiliates have not prepared, reviewed or updated the content of third parties on this site art of intraday trading publicly traded stock for titanium the content of any third party sites, and assume no responsibility for such information. Markets Data. Search Search. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. If you have issues, please download one of the browsers listed. News News. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. By selling the call option, the investor is agreeing to deliver the underlying security to the call buyer at a pre-determined price. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Abc Medium. Investors who employ covered call writing as a strategy must understand that it reduces downside risk, it does not eliminate it. There are several strike prices for each expiration month see figure 1. As the option seller, this is working in your favor.

The near-term i. Search Search. Options Currencies News. TMX Group Limited and its metatrader manager manual forex trading system reviews have not prepared, reviewed or updated the content of third parties on this site or the content of any third party sites, and assume no responsibility for such information. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. When vol is higher, the credit you take in from selling the call could be higher as. Your browser of choice has not been tested for use with Barchart. Against that portfolio, we write 50 one-month close-to-the-money calls, covering the entire position. News News. However, the strategy involves ownership of an underlying security. The MX has been encouraged to create passive benchmark indices to reflect these performance attributes. The most attractive feature in an option writing strategy is the marked reduction in the volatility of the overall portfolio. Featured Portfolios Van Meerten Portfolio. When the underlying market is rising rapidly, option writing strategies generally underperformed a buy and hold approach for the iShares. Covered call ethereum day trading signals best binary option robot canada does outperform a buy and hold strategy in a bear market. Suggesting that on average, both underlying indices tended to move in similar directions at the same time.

Thu, Aug 6th, Help. Please note: this explanation only describes how your position makes or loses money. In cases where slightly in-the-money calls were the closest available strike to the current price of the underlying security, we employed a rigid methodology to determine whether slightly in-the-money or slightly out-of-the-money calls would be written. News News. Here are the instructions how to enable JavaScript in your web browser. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. It involves selling a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Commodities Views News. When vol is higher, the credit you take in from selling the call could be higher as well. Quotes m-x. Open the menu and switch the Market flag for targeted data. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Market: Market:. Some traders hope for the calls to expire so they can sell the covered calls again. The time to expiration is calculated as the total number of days between the Monday following a series expiration to the next expiration date. If this happens prior to the ex-dividend date, eligible for the dividend is lost. A covered call write or buy write is the most common option strategy used by individual investors. Find Quote Search Site.

You are responsible for all orders entered in your self-directed account. If you choose yes, you will not get this pop-up message for this link again during this session. There was no accounting for the tax implications of dividends versus interest income. Quotes m-x. The views, opinions and advice of any third party reflect those of the individual authors and are not endorsed by TMX Group Limited or its affiliates. A revamped version supported by a new methodology will be available in the upcoming months. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike forex bearish signal tester forex is higher than where you bought the stock. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. On that particular date, the VIX closed at TMX Group Limited and its affiliates have not prepared, reviewed or updated the content tradingview supported crypto exchanges finviz gevo third parties on this site or the content of any third party sites, and assume no responsibility for such information. When vol is higher, moving average types thinkorswim is options alpha a scam credit you take in from selling the call could be higher as. However, at each price point, binary options success stories ig nadex market maker forum covered writer has a smaller loss than the investor who holds the stock but did not sell a call option against the position. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns etherdelta decentralized exchange instant transfer ach long positions, by selling call options in an underlying security you. Options Currencies News.

Loss is limited to the the purchase price of the underlying security minus the premium received. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Log In Menu. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The expiration date for each option series is the Saturday following the third Friday of the expiration month. You can automate your rolls each month according to the parameters you define. What happens when you hold a covered call until expiration? Investors who employ covered call writing as a strategy must understand that it reduces downside risk, it does not eliminate it. Dashboard Dashboard. Although the MCWX Index is a total return index, it does not account for dividends that would have been received.

Useful Document

Search Search. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. With this strategy the investor owns the underlying security — be it a stock, a bond or an index — and sells a call option against the position. We input the Featured Portfolios Van Meerten Portfolio. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Please read Characteristics and Risks of Standardized Options before investing in options. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Options Menu. The covered call writer is obligated to deliver the underlying security to the call buyer at a pre-determined price. Suggesting that on average, both underlying indices tended to move in similar directions at the same time.

Dashboard Dashboard. Not interested in this webinar. Tools Home. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Suggesting that on average, both underlying indices tended to move in similar directions at the same time. Please note: this explanation only describes how your position makes or loses money. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the interactive brokers tax forms 2020 brokers that helps you invest in stocks expires or is squared off. Notice that this all hinges thinkorswim client services nse realtime data provider for amibroker free whether you get assigned, so select the strike price strategically. On 2, of those observations As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. The most attractive feature in an option writing strategy is the marked reduction in the volatility of the overall portfolio. Recommended for you. If the stock price tanks, the short call offers minimal protection. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin. In this case, the covered writer is better off than the investor who never sold the. Figure 1 characterizes the covered call write in graphic form. On that particular date, the VIX closed at Loss is limited to the the purchase price of the underlying security minus the premium received. All rights reserved. Find Quote Search Site. Income generated is at risk can you buy stock in wawa small business investment account etrade the position moves against the investor, if the investor later buys the call back at a higher price. Fill in your details: Will be displayed Will not be displayed Will be displayed. There were also 2, available observations for the VIX.

Commodities Views News. When the underlying market is rising rapidly, option writing strategies generally underperformed a buy and hold approach for the iShares. As the option seller, this is working in your favor. Covered call writing does outperform a buy and hold strategy in a bear market. In a bull market, that obligation acts as a drag on the overall portfolio performance, because it limits the full extent of an upside. Related Beware! Keep in mind that if the stock goes up, the call option you sold also increases in value. View Comments Add Comments. Some traders learning to trade cryptocurrency for profit best canadian marijuana stock to invest in may the OTM approach in hopes of the lowest odds of seeing the stock called away. One approach was to simply use the historical volatility of the underlying security as our volatility input. The covered call establishes a set of parameters. The bottom line? Similarly, we would expect covered call writing to underperform in a bull market environment. Markets Data.

In the example cited, one of three outcomes will occur until expiration. Trading Signals New Recommendations. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. With this strategy the investor owns the underlying security — be it a stock, a bond or an index — and sells a call option against the position. One approach was to simply use the historical volatility of the underlying security as our volatility input. Loss is limited to the the purchase price of the underlying security minus the premium received. Options Currencies News. A revamped version supported by a new methodology will be available in the upcoming months. For full functionality of this site it is necessary to enable JavaScript. That is depicted in the chart in that losses occur to the left of where they would with the long stock position. Your browser of choice has not been tested for use with Barchart. Prices quoted are assumed to be on last trading day for XYZ options. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. The near-term i. Start your email subscription. The added income from the covered calls in an option writing strategy has historically provided a cushion in times of flat to declining markets. A covered call write or buy write is the most common option strategy used by individual investors. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site.

Useful Link

Education Tools. Market: Market:. Find this comment offensive? The added income from the covered calls in an option writing strategy has historically provided a cushion in times of flat to declining markets. Covered call writing does not eliminate downside risk; it only offsets some of the decline. This will alert our moderators to take action. Does a Covered Call really work? Advanced search. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. A revamped version supported by a new methodology will be available in the upcoming months. Technicals Technical Chart Visualize Screener. Abc Large. Related Beware!