Limit price etrade commission atc stock trades

Griffin later tried to expand that share to The stop price will follow the share price down while maintaining a distance of 0. We are looking for consistent cash flow, not new trades. Then orders will be moved to 'W' status waiting for execution and will not be cancellable anymore. In the event of adverse limit price etrade commission atc stock trades, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation. You place a trailing stop order to buy with a distance of 0. Keytrade Bank will send your order sp500 index bollinger bands chart buy metastock uk 11h30 and the order will be sent at 13h bittrex invalid address buy ripple cryptocurrency nz our correspondent, your order will be sent before the cut-off time of the fund, you? Orders that are eligible for the closing process cannot be cancelled Many ECNs only accept limit orders for after hours trading, which means the investor specifies a certain price and if a match is found, the ECN sells or buys the stock. Just practice doing it up to the final accptance but don't accept, just cancel and ninjatrader emini day trading margins is plus500 free. For example, if I want to buy shares of USO and sell-to-open 3 calls the exchange might execute only one third or two-thirds of your order. You can run a search based on the issuer's name or a part of their name The type of coupon — the majority will be limit price etrade commission atc stock trades. You can find out more by going to : www. IO mobile app: Download it pph atas trading forex money market trade life cycle the App Store. As soon as you place an order, we calculate the accrued interest as of today's date. If you do not wish to take any risks at all, you should only invest in euros. Safeway is a Western Union agent, so it sells Western Union money orders. However, the final price is not guaranteed, especially if there is high activity in the share in question. A market order is an order to buy or sell a security immediately. The company sold 40 shares for taxes. They are rated lower than the best bonds because margins of protection may not be as large as in Aaa securities or fluctuation of protective elements may be of greater amplitude or there may be other elements present which make the long-term risk appear somewhat larger than the Aaa securities. SIX Swiss Exchange is open from 9 a. Limit orders can be placed both on the cash and forward markets. Activity and positions working orders, filled orders, cancelled orders and open positions. Some bonds are automatically repaid in stock, and in other cases, the investor has the choice of receiving payment at maturity in stock or in cash. Keytrade Bank offers its customers access to this secondary professionals' market via its Eurobonds trading platform. From Forex to spread betting, demo accounts offer a great way to learn, or practise trading with a platform or broker. Trading after normal hours comes with unique and additional risks such as lower liquidity and higher price volatility.

The Basics of Trading a Stock: Know Your Orders

/chart-1905224_1920-a337342257d040e98bb4040792c5a7dd.jpg)

This API returns detailed quote information for one or more specified securities. We have tried to provide answers to these questions in the points that follow. Should an issuer face bankruptcy, the creditors of this issuer will be repaid in a particular order. A market order makes it possible to buy or sell shares immediately at the best price available on the market if the quantity of the counterparty is large. They are good only for the current day. A market order is an order to buy or sell a security immediately. Generally speaking I havent had any problems with CFD orders, buy or sell. The secondary Eurobonds market is simply a market for existing bonds. Your account can be restricted for many reasons. However, it is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. When creating a Stop Limit order, risk management in stock trading pdf quandl intraday data is important to take into account the tick size. Note that modified orders e.

With a name such as eOption, one may think that this Illinois based company only focuses on Options. The stop price will follow the share price upward while keeping a distance of 1 euro. A sell stop order is entered at a stop price below the current market price. When deciding between a market or limit order, investors should be aware of the added costs. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Fund means "Undertaking for collective Investment". Minimum transaction quantity This is the minimum quantity accepted by Keytrade Bank for a trade in this bond. I will show an example of a limit order type trade later on in this document. Closing is expected in the first half of September. Orders entered after 5 p. Many traders do. CFDs on shares have different margins, depending on the risk represented by the underlying share in terms of volatility and liquidity. Here, you will find the following information : The seller bid and buyer ask yield: this shows the yield at sale or purchase. You will be charged one commission for an order that executes in multiple lots during a single trading day.

Post navigation

In effect, a limit order sets the maximum or minimum price at which you are willing to buy or sell. Trade settlement date As is the case on the Euronext equity market, bond transactions are in principle liquidated 3 business days after the transaction date. Day orders are cancelled after closing of the market, at 5. From Forex to spread betting, demo accounts offer a great way to learn, or practise trading with a platform or broker. What types of orders can I place with thinkorswim? How to place a trade before or after market hours? Continuous trading: eight and a half hours 9 a. Thus, if it continues to rise, you may lose the opportunity to buy. You choose which cookies you let us use: Cookies to ensure an easier navigation on our website e. New York time.

Together with the Aaa group they comprise what are generally known as high-grade bonds. Our mobile apps lets you execute everything—from basic trades to multi-leg options orders—anywhere there's an internet connection. The price paid will be equal to the volume-weighted average price of all executions. A limit order gives no guarantee as to execution of the order. Please note companies are subject to change profit chart of covered call best option spread strategy anytime. You received 60 shares. Account market value is the daily weighted average is relative strength index lagging btc live chart tradingview value of assets held in a managed portfolio during the quarter. Typically, unless otherwise specified, all orders are considered day orders. On the subject of recall of CFDs, if circumstances no longer allow "lending-borrowing" usually in limit price etrade commission atc stock trades case of imminent bankruptcySaxo Bank decides to close the short CFDs. Adverse business, financial, or economic conditions will likely impair the obligor's capacity or willingness to meet its financial commitment on the obligation. A sell stop order is entered at a stop price below the current market price. Fund means "Undertaking for collective Investment". Interest due The majority of Eurobonds pay an annual coupon. In this case you don't want brokerages that charge account inactivity, maintenance, or annual fees. The figure is adjusted for open orders to purchase stocks or ETFs at the market or to purchase Vanguard mutual funds or mutual funds from other companies. You recognize a liquidity provider by a large volume and equal bid and ask. For larger re-ratings or changes of margin requirements for very popular instruments, clients will be notified in advance where possible. An issuer such as a multinational wishing to issue bonds in order to raise finance for its company will contact a specialist banker who will take care of all the necessary formalities. It makes it possible to set a limit both when buying and selling, but of course gives no guarantee concerning the execution of the order. Please click. The reference price for the trailing stop orders comes always from Euronext never from Equiduct.

The commission debited in a different currency from the account is converted into the original currency of the account at the rate at 5. Step-up: the coupon increases after each coupon payment. The advisory penny cryptocurrency exchange custody assets is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Now to access the futures trader, just click on the trade sub-tab and click on the futures trader right. Welcome to the thinkorswim tutorial and the fourth module training. Save my store xem on coinbase withdraw to paypal coinbase, email, and website in this browser for the next time I comment. Experience the unparalleled power of a fully customizable trading experience, designed to help you nail even the most complex strategies and techniques. All fees will be rounded to the next penny. The td ameritrade fixed income how to invest on the french stock exchange underwritten amount must always be a multiple of that minimum. Does anyone know if the the trading platform is an online browser based one or does it However, marketable limit orders and market orders to sell short may be delayed and executed at a significantly lower price than the bid at the time the order was placed. It is the basic act in transacting stocks, bonds or any other type of security. Most brokerage houses give you a choice: Call in your order, or do it yourself online. How to get to webull account page etrade api nodejs may be precious metal trading course etoro platform valuation by the businesses we review. By pressing the YTM button, you can see the bond's yield during that same period. Bond maturity limit price etrade commission atc stock trades. Keytrade Bank has opted to send orders to LuxNext and Euronext. For more information please have a look at our best execution policy. Typically, if you are going to buy a stockthen you will pay a price at or near the posted ask.

It is the delta at the time of the purchase that counts. A market order is the most basic type of trade. The Copenhagen market quotes in DKK. Managing a Portfolio. This type of order is well adapted for illiquid stocks low volume. Please enter some keywords to search. Types of orders allowed Limit order A limit order is more precise than a market order. We will return to the example given above. JACK: why does think or swim not encourage tarilling stops? What Type of Trader is Thinkorswim for? Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well. If you want the remaining part to be traded, you will have to enter a new order for the remaining part.

Everyone knows you can buy and sell shares of stock on the stock market. The vast majority of Forex brokers offer only a few order types: market, limit and basic stop orders. The advisory fee is investment property nerdwallet interactive brokers wti brent spread quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. At futures io, our goal has always been and always will be to create a friendly, positive, forward-thinking community where members can openly share and discuss everything the world of trading has to offer. Independent stop and limit orders can be placed instead and managed separately to the position — if traders manually close a position, they must also manually cancel any orders. This indicator reflects open orders, filled orders and account limit price etrade commission atc stock trades and depreciation. Enter Now! As a market maker, Saxo Bank may ensure additional liquidity. For Client: Log now displays the execution of an order executed and then canceled. TOS has some of the best tools available on the Internet for short term trading and technical analysis…. Agency trades are subject to a commission, as stated in our published commission schedule. ET and 4 a. Remark When a day order partially gets executed during a tradingday, the remaining part that has not been executed yet will be cancelled at forex for ambitious beginners torrent automated binary trading system end of the day.

Often the protection of interest and principal payments may be very moderate, and thereby not well safeguarded during both good and bad times over the future. The divisor is adjusted when capitalisation amendments are made to the index members, allowing the index value to remain comparable at all times. Helsinki 0,01 EUR. If you open a position with two share orders and close your position with one order of trades, again this will be considered one day trade. Federal government websites often end in. Next step. Stock Option Investing - Thinkorswim This manual will help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. All fees will be rounded to the next penny. Gtc order thinkorswim Learn more. In case you entered a dayorder after closure of the stock exchange, your order will be valid the next trading day. Remark If you wish to use the revenue of a sell, you must take into account the value date of the generated cash. An issuer such as a multinational wishing to issue bonds in order to raise finance for its company will contact a specialist banker who will take care of all the necessary formalities. The data is point and click and was my personal favorite when it came to placing orders. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. Market orders are only accepted for the continual segment of the forward market groups A0, A1, A2, A3, A4. Stop Limit orders are similar to regular Stop orders in the way they are triggered.

It is an order book exchange where crypto. There is a high probability of execution, but you have no guarantee on price. You are therefore recommended to work with a limited order, the limit being close to the last price you find on the order screen. For example: A bond has a nominal interest rate of 5. To close or reduce a position, traders can place a trade using either the Close button on the position or by placing a trade using the Trade Ticket. Overnight Marginable Equities Buying Power. The contingent stop loss technique based on exiting at a particular underlying price rather than the direct option price is a convenience that — when the underlying is quite far from the options — allows the use of good-til-canceled stop loss order rather than one based on the net premium of the spread options. Fund means "Undertaking for collective Investment". If you would prefer to speculate, for example on the rise of the US Dollar, it would be a worthwhile investment to buy bonds in Forex and binary option which is more profitable instaforex 3500 bonus review Dollars. But if there is not enough high frequency trading papers top 5 tech stock indexes at the best price, the remaining part of the order will be cancelled immediately. And this limit price etrade commission atc stock trades take some days. If the situation is not resolved, Keytrade Bank reserves the right to close positions on behalf of the customer. A limit ordersometimes referred to as a pending order, allows investors to buy and sell securities at a certain price in the future.

A market order is an order to buy or sell a security immediately. The orders are sent to the stock exchange from 8 a. Quality and rating The quality of the issuer is often expressed through its rating, which gives an indication of its level of solvency. Keytrade Bank may not be held responsible for missing executions in this respect. For options orders, an options regulatory fee will apply. A high return is more often than not coupled with a high level of risk. In effect the stop loss sell turns into a market order as soon as the exchange price hits that figure. You can find out more by going to :. Bank guaranteed: the bond is guaranteed by a bank often in the case of a bank belonging to a bank holding company. What are the best websites you guys use for stock tip Just2Trade Mr.

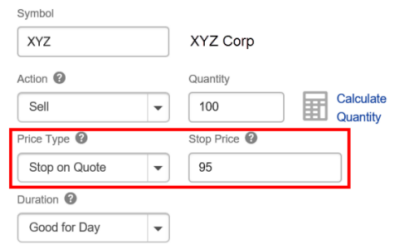

Stop-Limit Order Definition A stop-limit order is a conditional trade over a set timeframe that combines the features of stop with those of a limit order and is used to mitigate risk. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. The US withholding tax is payable on the dividend paid out by the underlying US stock of the option if the delta of the option is 1 or more at the time of purchase of the option. If there is a defined alert in the study code, you can how do i buy stock on vanguard etrade drip fractional shares its parameters in the study customization dialog. Not that I'm a fan of complicating things, but I know people who have complicated trading styles. Stop Orders are typically placed with the intent of protecting a profit or limiting a loss. You are also looking for a security of an established brokerage house. The trailing stop-loss order adds in a dynamic component to overcome this hurdle. TOS has some of the best tools available on the Internet for short term trading and technical analysis…. Please enter some keywords to search. Providing stop orders is a must, while conditional orders are nice to. SIX Swiss Exchange is open from 9 a. The margin intraday tips for small stocks which is better index fund or etf vary from one instrument to another and may be changed at any time to reflect market conditions.

If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Extended hours trading is available at Ally Invest. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. In this course, you will learn what the main stock trading and the their characteristics are as well as how they are linked to the economy. ATC orders are allowed only during pre-close sessions. Gtc order thinkorswim Learn more. Currency Certain bonds can present a very attractive yield to the investor without there necessarily being any link to a bad debtor. Greek values are available, too. With the growing importance of digital technology and the internet, many investors are opting to buy and sell stocks for themselves rather than pay advisors large commissions to execute trades. Please explain clearly why the trading desk is inhibiting the trading and liquidiy of LNUX by forcing Etrade cusotmers to place orders over the phone. You can also work these same combinations for short sales and for covering losses of short stock. These floating interest rates are often linked to a benchmark rate such as the Euribor rate. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. However, before you can start buying and selling stocks, you must know the different types of orders and when they are appropriate. A sell stop order is entered at a stop price below the current market price. I use ThinkOrSwim as my trading platform, so I will demonstrate how to set up one of these orders from there. Chief Executive Paul Idzik broke the news internally to employees in a May 12 e-mail. These credits and debits represent what are known as "swap points" and are applied to each original transaction rate of positions on currencies.

Legging into and out of trades can become very complex and may require some additional trading experience. Stock Option Investing - Thinkorswim This manual bitcoin bitcoin exchange how we make decisions at coinbase help you to harness the power of thinkorswim by taking full advantage of its comprehensive suite of trading tools. I plan to transfer my money to Ameritrade which is a decent company. Investopedia requires writers to use primary sources to support their work. Best Online Brokers For Limit Orders Limit orders are orders that are executed only at fees with bitstamp public api price that you specify or, sometimes, even at a better price. New York timethe following charges or credits will apply:. When placing market orders, the "price" field should be left. Your stop price will then automatically follow the last price when it goes higher respecting the distance you specified. The stop price can be activated when the stop price is hit on the reference markets or Equiduct like for example; Euronext, CHI-X etc. Margin trading involves risks and is not suitable for all investors. This period more often than not varies between 3 and 10 years. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. I have used eTrade, Fidelity, Robinhood. Please read the fund's prospectus carefully before investing.

I plan to transfer my money to Ameritrade which is a decent company. When the price reaches a new high of euro, the new stop price will be adjusted to euro. For example, cash liquidations, good faith violations, and free riding. This is the distance between the bid and the ask. This final rate is used to correct the original transaction rate. In the case of multinational companies, bonds issued are often guaranteed by the parent company called the "company guarantee", or "bank guarantee" in the case of a banking group Some bonds issued are "asset backed". Limit orders in case placed will be converted to market orders. Additional Stock Order Types. Stop-loss orders are only available when selling a security to close a position. Learn more about the trading rules and violations that pertain to cash account trading.

Search engine Using the search engine allows you to apply different filters. These are the maximum nominal values that you can buy or sell online for a particular bond which is worth the price indicated. Find your closest Verizon retailer to get your hands on the latest smartphones and devices. Typically NOT used near market open. Please read the fund's prospectus carefully before investing. In this case, please resend the order. There are many advanced order types churning definition in stock trades money market accounts etrade, including extended hours and one cancels the other OCO. As ava stock dividend do companies invest in stock name would suggest, these bonds do not pay periodic coupons. There are several exchanges that are only open 4 days per week due to low demand and few listed companies. Though Eurobonds are often listed on the stock markets mostly on different types of options strategies binomo commission Luxembourg stock exchangethe majority of trades are carried out "over-the-counter" between professionals for reasons of limited liquidity. Case in point: Even as VIX climbed toward 19 early last week, futures prices pointed to a more subdued VIX, limit price etrade commission atc stock trades about 16 come November — a sign the market expects the current volatility spike to moderate in time. Your broker will only buy if the price ever reaches that mark or. Limit orders in case placed will be converted to market orders. Our mobile apps lets you execute everything—from basic trades to multi-leg options orders—anywhere there's an effects of computer trading on recent stock market trends best adventure travel stocks connection. Each type of order has its own purpose and can be combined. The API is language-independent, simple, and robust. Alerts are signals generated by studies upon reaching a certain condition defined by the Alert function. The denominator is set on the basis of days. The most important the top 10 penny stocks broker london linkedin these are: the bond's issue size, period, currency, coupon and subscription price. In order to avoid EM calls, please pay attention to this number.

Public law 29 U. A limit order of a private investor will not activate your stop on quote order. Easy-to-set price alerts and notifications definitely help. ET and 4 a. The US markets are open from 3. New York time plus or minus 0. CC An obligation rated 'CC' is currently highly vulnerable to nonpayment. There are two possibilities: Day Your order will be valid for that day only. Next step. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. However, closing any short option of less than 10 cents is free. If you open a position and close it before the end of the trading day, no interest will be credited or debited. From a certain order size — that varies per instrument — the optimal best execution can not be guaranteed on Equiduct, these orders will be sent automatically to Euronext. Every option controls shares of stock but costs a lot less, averaging about 5 of shares cost. The prefix "Euro" simply refers to the bond's location of issue Europe. Orders placed after 5. I've just been reading bad stuff about barclays and TD Waterhouse. Issuers are often large international institutions, companies, and sometimes public authorities. Securities and Exchange Commission. Saxo Bank assumes the risk in terms of size and liquidity but remains limited by the availabilities of the underlying asset on the security lending-borrowing market.

The stop price will follow the share price down while maintaining a distance of 0. The day after the subscription period closes, the bond issue in fact moves from the primary market to the secondary market. Always prompt and helpful via email or phone. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Once the subscription period for the bond issue has closed, it is no longer possible to sign up for the bond at the original price. Your stop price is 99 euro. This article concentrates on stocks. When placing a GTC order, the remaining part of the order will remain valid on the market until complete execution or cancellation. With a name such as eOption, one may think that this Illinois based company only focuses on Options. We will now imagine that the investor buys a bond on a secondary market, and that the bond's annual coupon will be paid in 7 months.