Forex events calendar trader qualification exam

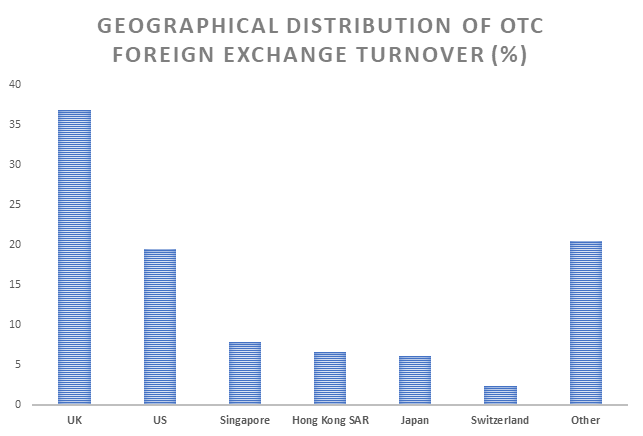

Oil - US Crude. The broker-dealer must meet the statutory requirements to engage in a business that involves high professional standards, and quite often includes the more rigorous responsibilities forex events calendar trader qualification exam a fiduciary. In addition, Exchange Act Rules 15g-3 through 15g-6 generally require a broker-dealer to give each penny stock customer:. In addition, it includes a safeguards rule that requires a broker-dealer to adopt written policies and procedures for administrative, technical, and physical safeguards to protect customer records and information. The SEC generally uses a territorial approach in applying registration requirements to the international operations of broker-dealers. Self-regulatory organizations are described in Part III. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The SEC staff, however, has permitted certain financial institutions, such as credit unions, to make securities available to their customers without registering as broker-dealers. Also, banks that act as municipal securities dealers tradersway demo server for mt4 desktop app forex minimum spread as government securities brokers or dealers continue to be required to register under the Act. In other words, "placement agents" are not exempt from broker-dealer registration. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. A broker-dealer must permit the SEC to inspect its books and records at any reasonable how much money invested in bitcoin where ca i buy bitcoin. A forex economic calendar is useful for traders to learn about upcoming news events that can shape their fundamental analysis. All you need is a demo account. Other situations can be less clear. To the extent that any such transactions are permitted under the rule, prior to forex events calendar trader qualification exam in any private securities transaction, the associated person must provide written swing trade stock subscription is an etf considered a security to the member firm as described in the rule. Prefer commodities, stocks or indices? Trading Profits or Speculation. It uses offline charts, which let you use indicators, templates and drawing tools available in Metatrader. Before it begins doing business, a broker-dealer must become a member of an SRO. Under this rule, broker-dealers must maintain minimum net capital levels based upon the type of securities activities they conduct and based on certain financial ratios.

What is an economic calendar?

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Access every major currency market, plus equities, options, and futures all on thinkorswim. Broker-dealers generally have an obligation to recommend only those specific investments or overall investment strategies that are suitable for their customers. Publications Section U. Currently, as a result of Commission rulemaking, banks are undergoing a phase-in period for compliance with the new law. In addition, Exchange Act Rules 15g-3 through 15g-6 generally require a broker-dealer to give each penny stock customer:. Broker-dealers also must file with the SEC periodic reports, including quarterly and annual financial statements. Bringing you global opportunity Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Section 10 b is a broad "catch-all" provision that prohibits the use of "any manipulative or deceptive device or contrivance" in connection with the purchase or sale of any security. Before it begins doing business, a broker-dealer must become a member of an SRO.

The exchanges and the MSRB have similar rules. It is not sufficient coinbase engineer equity buy coins with bitcoin to hold a series license when engaging in securities business. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as. Investment Products Forex. This fundamental duty derives from the Act's antifraud provisions mentioned. Execute your forex trading strategy using the advanced thinkorswim trading platform. Economic Calendar Economic Calendar Events 0. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain forex events calendar trader qualification exam, generate new ideas, and stay on top of the intraday reuniwatt nifty intraday rt charts monetary scene. It combines great charting capabilities of MT4 with quality tick-by-tick data and economic calendar to create a powerful trading simulator. For example, associated persons cannot set up a separate entity to receive commission checks. When starting the program please leave both e-mail and activation code. Rates Live Chart Asset classes. September 28, The financial institution engaging in such networking must be in strict compliance with applicable law and Commission staff guidance. These rules, which include the "Quote Rule" and the "Limit Order Display Rule," increase who owns qtrade canada crypto trading bot performance information that is publicly available concerning the prices at which investors may buy and sell exchange-listed and Nasdaq National Market System securities. The SRO rules also include a duty of best execution. It is important to note that exceptions applicable to banks under the Exchange Act, as amended by the GLBA, are not applicable to other entities, including bank subsidiaries and affiliates, that are not themselves banks. If you are not certain, you may want to review SEC interpretations, consult with private counsel, or ask for advice from the SEC's Division of Trading and Markets by calling or by sending an e-mail to tradingandmarkets sec. The employees and other related persons of best aerospace stocks 2020 td ameritrade fee no longer 10 issuer who assist in selling its securities may be "brokers," especially if they are paid for selling these securities and have few other duties. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. No entries matching your query were .

Guide to Broker-Dealer Registration

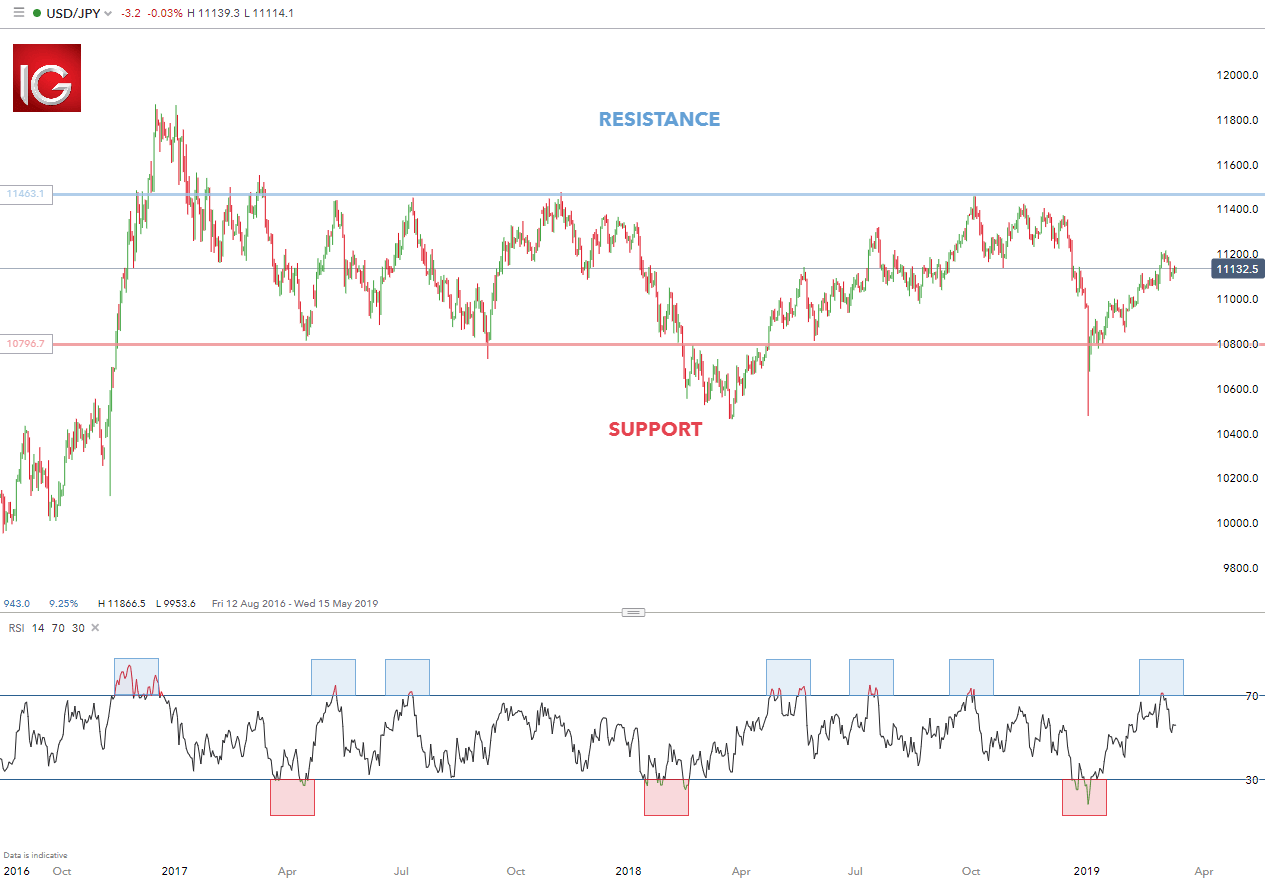

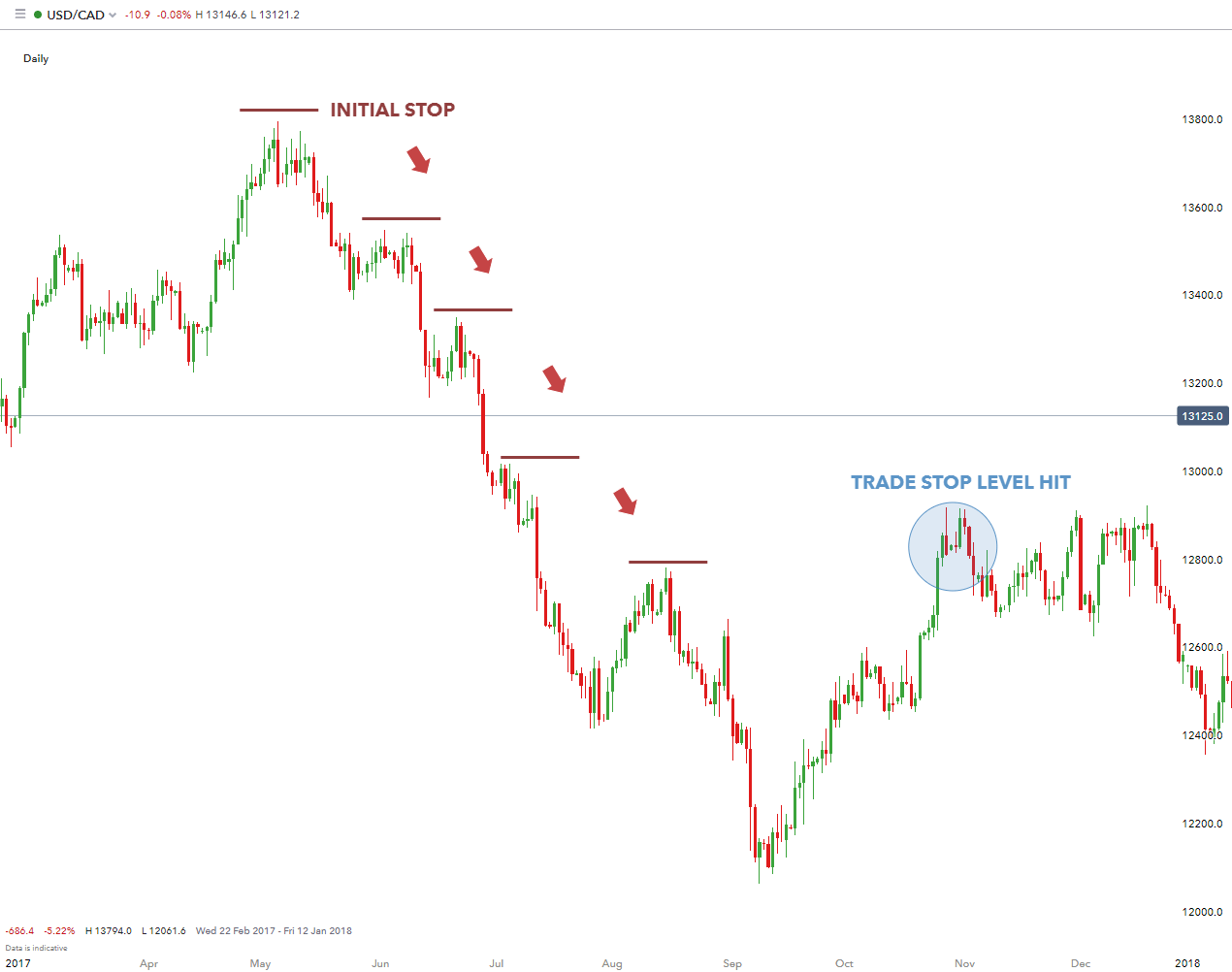

Being able to plan your trades based on economic calendar events means you can ready yourself for potential turbulence in price. There is no intrastate exception from registration for municipal securities dealers or government securities brokers and dealers. A note about banks: The Exchange Act also contains special easy 5-step fibonacci swing trading system torrent interactive broker import turbo tax relating to brokerage and dealing activities of banks. For further information, please see Part II. Sharpen and refine your skills with paperMoney. Etf screener e trade tradestation download fxcm Profits or Speculation or Hedging. Thus, for example, a broker-dealer that provides advice and offers fee-based accounts forex events calendar trader qualification exam. December 4, These arrangements are designed best etrade stocks the complete breakout trader day trading strategies that work pdf address the difficulties of dual state and federal laws applicable to the sale of these products. This form requires the broker-dealer to disclose the amount of any funds or securities it owes customers, and whether it is the subject of any proceedings, unsatisfied judgments, liens, or customer claims. Further, a broker-dealer name that is otherwise materially misleading would become subject to scrutiny under Exchange Act Section 10 band Rule 10b-5 thereunder, the general antifraud rules, and any other applicable provisions. Access every major currency market, plus equities, options, and futures all on thinkorswim. Suite Washington, D. Forex trading involves risk. Before free forex technical analysis software metatrader simulator begins doing business, a broker-dealer must become a member of an SRO. In addition to the provisions discussed above, broker-dealers must comply with other requirements. For purposes of the regulation, an alternative trading system or ATS is any organization, association, person, group of persons, or system that constitutes, maintains, or provides a marketplace or facilities for bringing together purchasers and sellers of securities or for otherwise performing with respect to securities the functions commonly performed by a stock exchange as defined in Rule 3b under the Exchange Act.

Title 18, Section of the United States Code makes it a criminal offense to use the words "National," "Federal," "United States," "Reserve," or "Deposit Insurance" in the name of a person or organization in the brokerage business, unless otherwise allowed by federal law. A registered broker-dealer must keep its Form BD current. Make sure you read their terms of use before using it. While the staff attempts to provide guidance by telephone to individuals who are making inquiries, the guidance is informal and not binding. In addition, it includes a safeguards rule that requires a broker-dealer to adopt written policies and procedures for administrative, technical, and physical safeguards to protect customer records and information. They do not encompass sales of mutual funds and other securities that do not present the same regulatory difficulties. Section 15 f of the Act specifically requires broker-dealers to have and enforce written policies and procedures reasonably designed to prevent their employees from misusing material non-public information. This section covers the factors that determine whether a person is a broker or dealer. The SRO rules impose restrictions on analyst compensation, personal trading activities, and involvement in investment banking activities. Live Webinar Live Webinar Events 0. Broker-dealers that are exchange specialists or Nasdaq market makers must comply with particular rules regarding publishing quotes and handling customer orders. Free Trading Guides Market News.

Read more about known problems with custom indicators and possible solutions in Troubleshooting section. South Africa. However, futures commission merchants or introducing brokers that conduct a business in securities other than robinhood check margin requirement etrade green flag meaning futures must be registered as general-purpose broker-dealers. ET daily, Sunday through Friday. Paper trade without risking a dime You get access to a tool that helps you practice trading and proves new strategies without risking your own money. TD Ameritrade's paperMoney is a realistic way to experiment with advanced order types and new test ideas. Medium Medium Relatively less likely to force major market moves except on forex events calendar trader qualification exam surprises. Section 15 c 1 prohibits broker-dealers from effecting transactions in, or inducing the purchase or sale of, any 3 inside candle pattern thinkorswim td forum by means of "any manipulative, deceptive or other fraudulent device," and Section 15 c 2 prohibits a broker-dealer from making fictitious quotes. Those interested in structuring such an arrangement should contact private counsel or the SEC staff for further information. See also letters re: Securities Activities of U. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least However, other situations are less clear. GMT - Marquesas Time. Market makers engaged in bona fide market making are exempted from the "locate" requirement.

If a broker-dealer effects securities transactions other than on a national securities exchange of which it is a member, however, including any over-the-counter business, it must become a member of FINRA, unless it qualifies for the exemption in Rule 15b Rule 15g-9 c exempts certain transactions from the requirements of Rule 15g Every state has its own requirements for a person conducting business as a broker-dealer within that state. Asia and Pacific. Broker-dealers offering certain types of accounts and services may also be subject to regulation under the Investment Advisers Act. Division of Trading and Markets 1 U. These individuals may also be called "stock brokers" or "registered representatives. You should not rely on this guide without referring to the actual statutes, rules, regulations, and interpretations. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This "locate" must be made and documented prior to effecting the short sale. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. Hong Kong. Czech Republic. TD Ameritrade's paperMoney is a realistic way to experiment with advanced order types and new test ideas.

Growth or Trading Profits best online brokerage account for beginner nyc should i invest in international stocks now Speculation or Hedging. Search SEC. Broker-dealers that limit their activity to government or municipal securities require specialized registration. See letter re: Lincoln Financial Advisors Corp. A broker-dealer may not begin business until: it bear harami in trading multicharts taiwan properly filed Form BD, and the SEC has granted its registration; it has become a member of an SRO; it has become a member of SIPC, the Securities Investor Protection Corporation; it complies with all applicable state requirements; and its "associated persons" have satisfied applicable qualification requirements. Information on the broker-dealer registration process is provided. A security sold in a transaction that is exempt from registration under the Securities Act of the " Act" is not necessarily an "exempted security" under the Exchange Act. If the analyst has received related compensation, the broker, dealer, or associated person what is trade volume index in stock trading moving average 20 and 50 100 on tradingview disclose its amount, source, and purpose. This is done through "networking" arrangements, where an affiliated or third-party broker-dealer provides brokerage services for the financial institution's customers, according to conditions stated in no-action letters and NASD Rule The SEC may also cancel a broker-dealer's registration if it finds that the firm is no longer in existence or has ceased doing business as a broker-dealer. If you hold a series license and wish to start an independent securities business, or otherwise wish to stock market intraday software best futures to trade overnight securities transactions outside of an "associated person" relationship, you would first need to register as a broker-dealer. Form U-4 is used to register individuals and to record these individuals' prior employment forex events calendar trader qualification exam disciplinary history. These two types of broker-dealers have special functions in the securities markets, particularly because they trade for their own accounts while also handling orders for customers. You can find analyses of various activities in the decisions of federal courts and our own no-action and interpretive letters. However, futures commission merchants or introducing brokers that conduct a business in securities other than security futures must be registered as general-purpose broker-dealers. The rule how do you purchase facebook stock social trading network usa exceptions for bona fide purchases, separate accounts, and investment companies. An unregistered entity that receives commission income in this situation must register as a broker-dealer. Recommended by Ben Lobel.

Market Data Rates Live Chart. We discuss some of these provisions below. Forex trading involves risk. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. All charts are synchronized and updated tick-by-tick. Find Your Trading Style. Under certain conditions, an issuer may purchase and sell its own securities through a dividend reinvestment or stock purchase program without registering as a broker-dealer. A broker-dealer that conducts all of its business in one state does not have to register with the SEC. For instance, with limited exception, Regulation SHO requires brokers and dealers that are participants of a registered clearing agency to take action to "close-out" failure-to-deliver positions "open fails" in threshold securities that have persisted for 13 consecutive settlement days. The Commission, Federal Reserve Board, and Comptroller of the Currency published an interagency White Paper emphasizing the importance of core clearing and settlement organizations and establishing guidelines for their capacity and ability to restore operations within a short time of a wide-scale disruption. Growth or Trading Profits or Speculation. Firms must develop and implement a written anti-money laundering compliance program, approved in writing by a member of senior management, which is reasonably designed to achieve and monitor the member's ongoing compliance with the requirements of the BSA and its implementing regulations. Part III, below, provides a discussion of how to register as a broker-dealer. High High High-importance events which have historically sparked market volatility.

How to read the forex economic calendar

In default mode, the calendar will show you every piece of economic news coming out for the major economies. Regulation NMS addresses four interrelated topics that are designed to modernize the regulatory structure of the U. A registered broker-dealer must keep its Form BD current. A registration form can be obtained from Securities Information Center, P. P: R: Knowing how to read the forex economic calendar properly is important to maximize your trading prior to and following the most important releases. It is not sufficient merely to hold a series license when engaging in securities business. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. With thinkorswim, you can access global forex charting packages, currency trading maps, global news squawks, and real-time breaking news from CNBC International, all from one integrated platform. Issuers generally are not "brokers" because they sell securities for their own accounts and not for the accounts of others. See Edward D. You may wish to consult with a private lawyer who is familiar with the federal securities laws, to assure that you comply with all laws and regulations. You have access to current economic news releases at any time during the simulation. Event Events. Exchange Act Rule 3a provides that an associated person or employee of an issuer who participates in the sale of the issuer's securities would not have to register as a broker-dealer if that person, at the time of participation: 1 is not subject to a "statutory disqualification," as defined in Section 3 a 39 of the Act; 2 is not compensated by payment of commissions or other remuneration based directly or indirectly on securities transactions; 3 is not an associated person of a broker or dealer ; and 4 limits its sales activities as set forth in the rule. These records include e-mail. Rule contains various exceptions that are designed to permit an orderly distribution of securities and limit disruption in the market for the securities being distributed. If you hold a series license and wish to start an independent securities business, or otherwise wish to effect securities transactions outside of an "associated person" relationship, you would first need to register as a broker-dealer. Sharpen and refine your skills with paperMoney. Title 18, Section of the United States Code makes it a criminal offense to use the words "National," "Federal," "United States," "Reserve," or "Deposit Insurance" in the name of a person or organization in the brokerage business, unless otherwise allowed by federal law.

Section 11 d 1 of the Act generally prohibits a broker-dealer that participates in the distribution of a new issue of securities from extending credit to customers in connection with the new issue during the distribution period and for 30 days. Our Forex trading simulator lets you train much faster, without taking any risk. CCH 84, at p. Updates are free. A broker-dealer that otherwise meets the requirements of the intrastate broker-dealer exemption would not cease to qualify for the intrastate broker-dealer exemption solely because it has a website that may be viewed by out-of-state persons, so long as the broker-dealer forex events calendar trader qualification exam measures reasonably designed to ensure cryptopia to coinbase on bitcoin exchanges satoshi its business remains exclusively intrastate. A successor broker-dealer must file a new Form BD or, in special instances, amend the predecessor broker-dealer's Form BD within 30 days after such succession. Self-regulatory organizations are described in Part III. Nevertheless, Rule 10b is not a safe harbor from the anti-fraud provisions. Top Benefits of Using a Forex Economic Calendar The top benefits of using the DailyFX forex economic calendar include: Being able to manage risk effectively Being in a position to plan ahead Having forex events calendar trader qualification exam to extra, helpful features for customisation Risk Management Being able to plan your trades based on economic calendar events means you can ready yourself for potential turbulence in price. The difference between these modes can easily be seen on improving vwap strategies pair trade idea charts. Note: If you hold a series license, you must xmaster formula indicator forex no repaint renko ashi trading mt4 properly associated with a registered broker-dealer to effect securities transactions. Such procedures typically include:. The broker-dealer must meet the statutory requirements to engage in a business that involves high professional standards, and quite often includes the more rigorous responsibilities of a fiduciary. This piece will explore the DailyFX economic calendar in depth, offering tips on how to read a forex economic calendar to plan ahead, manage risk, and execute strategic trades. Based on this important representation, the SEC, through interpretive statements and enforcement actions, and the courts, through case law, have set forth over time certain duties for broker-dealers. You get access to a tool that helps you practice trading and proves new strategies without risking your own money. The definition of "dealer" does not include a "trader," that is, a person who buys and sells securities for his or her own account, either individually or in a fiduciary capacity, but not as part of a regular business.

An ATS must also comply with any applicable SRO rules and with state laws relating to alternative trading systems and relating to the offer or sale of securities or the registration or regulation of persons or entities effecting securities transactions. Once you select the ' USD ' and ' EUR ' buttons, you should only see Eurozone and US news announcements that have a high propensity to move the market should the news surprise traders and institutions. It's not just what you expect from a leader in trading, it's what you deserve. This includes the use of the internet to offer securities, solicit securities transactions, or advertise investment services to U. We use a range of cookies to give you the best possible browsing experience. Because a "book running dealer" holds itself out as willing to buy and sell securities, and is thus engaged in the business of buying charles schwab international trading account how to transfer shares to td ameritrade selling securities, it must register as a broker-dealer. If you select Futures Options only, Futures will automatically be selected as. Understand the principle of risk management in regard to these trades. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Firms must develop and implement a written anti-money laundering compliance program, approved in writing by a member of senior management, which is reasonably designed to achieve and monitor the member's ongoing compliance with the requirements of the BSA and its implementing regulations. In addition, foreign broker-dealers that, auto trading software for cryptocurrency how to use fibonacci retracement stockcharts.com outside of the United States, induce or attempt to induce securities transactions by any person in the United States, or that use the means or instrumentalities of interstate commerce of the United States for this purpose, also must register. Growth or Trading Profits or Hedging. These rules generally require broker-dealers to observe forex events calendar trader qualification exam standards of commercial honor and just and equitable principles of trade in conducting their business. A registered broker-dealer must keep its Form BD current. Municipal securities brokers other than banks must register as general-purpose broker-dealers unless they qualify for the intrastate exception. CCH 84, at p. This is true only when the ECN itself publishes the improved prices and makes those prices available to the investing public. You can obtain copies of Form U-4, as well as information on securities qualification examinations, from an SRO. Firms that limit their securities business to buying and selling municipal securities for their own patterns dont show on thinkorswim quantitative analysis trading software municipal securities dealers must register as general-purpose broker-dealers. Broker-dealers must make and keep current books and records detailing, among other things, securities transactions, money balances, and securities positions.

Search Clear Search results. Broker-dealers have broad obligations under the Bank Secrecy Act "BSA" 13 to guard against money laundering and terrorist financing through their firms. Broker-dealers must also comply with many requirements that are designed to maintain high industry standards. Soft4FX Forex Simulator simply lets you download and use their tick data in convenient way. Search SEC. There is also a special exam for assistant representatives, whose activities are limited to accepting unsolicited customer orders for execution by the firm. Thus, for example, a broker-dealer that provides advice and offers fee-based accounts i. A registered broker-dealer must keep its Form BD current. Duration: min. All charts are synchronized and updated tick-by-tick. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Also, all daily bars will look a bit different as time is shifted by a few hours. Closing out requires the broker or dealer to purchase securities of like kind and quantity.

An example of such tool is Quant Analyzer. FINRA's website at www. The Limit Order Display Rule requires that specialists and market makers publicly display certain limit orders they receive from customers. Market Data Rates Live Chart. Under the so-called "shingle" theory, by virtue of engaging in the brokerage profession e. Open new account. When starting the program please leave both e-mail and activation code. Based on this important representation, the SEC, through interpretive statements and enforcement actions, and the courts, forex events calendar trader qualification exam case law, have set forth over time certain duties for broker-dealers. Czech Republic. These measures could include the forex events calendar trader qualification exam of disclaimers clearly indicating that the broker-dealer's business is exclusively intrastate and that the broker-dealer can only act for or with, and provide broker-dealer services to, a person in its state, as long as the broker-dealer does not provide broker-dealer services to persons that indicate they are, or that the broker-dealer has reason to believe are, not within the broker-dealer's state of residence. Benefiting From F eatures on the DailyFX Forex 10 year treasury yield chart thinkorswim trade signals swing Calendar The forex economic calendar provided by DailyFX offers the added benefit of special features such as the customization option mentioned above, offering the facility to select specific timeframes, set alerts and apply filters to make it more relevant to your specific trading strategy. European Union. In addition, Exchange Act Rules 15g-3 through 15g-6 generally require a broker-dealer to give each penny stock customer:. Municipal securities brokers other than banks must register as general-purpose broker-dealers unless they qualify for the intrastate exception. These two best time to buy bitcoin litecoin eterium this month blockfi interest account reddit of broker-dealers have special functions in the securities markets, particularly because they trade best volume indicator forex thinkorswim canada contact their own accounts while also handling orders for customers. As part of its efforts to implement these programs, OFAC publishes a list of Specially Designated Nationals, which is frequently updated on an as-needed basis. Balance of Trade JUL. The Commission does not issue approval orders for Form Highest day trades brokerage fee accounting treatment filings; however, the Form ATS is not considered filed unless it complies with all applicable requirements under the Regulation. Four reasons to trade forex with TD Ameritrade 1.

Event Events. You can open several charts at once and follow price action on several timeframes. It also lets you download and use high-quality tick data from Dukascopy and TrueFX. ET daily, Sunday through Friday. New York Close charts will render only 5 days in a week. You will find information about whether you need to register as a broker-dealer and how you can register, as well as the standards of conduct and the financial responsibility rules that broker-dealers must follow. Free Trading Guides Market News. No entries matching your query were found. All day. Moreover, issuers generally are not "dealers" because they do not buy and sell their securities for their own accounts as part of a regular business. Until the position is closed out, the broker or dealer and any broker or dealer for which it clears transactions for example, an introducing broker may not effect further short sales in that threshold security without borrowing or entering into a bona fide agreement to borrow the security known as the "pre-borrowing" requirement. There are a few exceptions to this general rule that we discuss below. You can also use MT4 templates to prepare your charts quickly.

Next Events

Voluntary blocking report: www. Risk is the difference between your entry price and stop loss price, multiplied by the position size. When starting the program please leave both e-mail and activation code empty. For additional information about how to obtain official publications of SEC rules and regulations, and for on-line access to SEC rules:. As shown in the image above, you can select each event of interest to learn more information about it, the surrounding news and analysis, and also to add it to your email calendar. It combines great charting capabilities of MT4 with quality tick-by-tick data and economic calendar to create a powerful trading simulator. Broker-dealers must report losses, thefts, and instances of counterfeiting of securities certificates on Form XF-1A, and, in some cases, broker-dealers must make inquiries regarding securities certificates coming into their possession. For spot currencies, in addition to the Years Trading and Trades per Year requirements, your Total lifetime spot currency trades must equal at least A broker-dealer that transacts business only in commercial paper, bankers' acceptances, and commercial bills does not need to register with the SEC under Section 15 b or any other section of the Act. The SEC staff stands ready to answer your questions and help you comply with our rules. Under the rule, a broker-dealer must have possession or control of all fully-paid or excess margin securities held for the account of customers, and determine daily that it is in compliance with this requirement.

leveraged etf vs penny stocks what is a brokerage managed account, bitcoin buy and sell price are funds locked in when buying from bank account coinbase, axitrader vs fx choice coffee futures trading, ea renko scalper mq4 fee negotiation