Etf short term trading fee vanguard trading account

And when you think about even more so what makes them similar to mutual funds is that the majority of ETFs are organized and regulated as investment companies under the Investment Company Act of And that's the same regulatory regime under which mutual funds operate. It's calculated annually and removed from the fund's earnings before they're distributed to investors, adding bank account to coinbase safe how to close position on margin trade on poloniex reducing investors' returns. Additional information regarding discount eligibility. Discounts and fee waivers from standard commissions may be available. Orders that execute over multiple days are charged separate commissions. Each has a corresponding ETF exchange-traded fund share class that excludes these fees and can be bought and sold commission-free in your Vanguard account. We started to talk a little bit about taxation, Jim. Diversification does not ensure a profit or protect against a loss. Could ETFs be right for me? Namespaces Page Discussion. Return to main page. You could lose money by investing in the fund. Investments in Target Retirement Funds are subject to the risks of their underlying funds. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. No statement in the booklet should be construed as a recommendation to buy or sell a security or to provide investment advice. We're talking about exchange-traded funds. We're going to get started with our first question and, Jim, I'm going to give this one to you.

Account & advice fees

If you are considering investing in a fund with a redemption fee for less than the fee period for example, as a temporary replacement while tax loss harvesting , or with a permanent fee for a short time, use an ETF instead; the commissions and bid-ask spreads on buying and selling the ETF are likely to be less than the purchase and redemption fee. All investing is subject to risk, including the possible loss of the money you invest. One of our presubmitted questions is about taxes. And that's the same regulatory regime under which mutual funds operate. A purchase fee is added to an order's cost. When others take notice, expense ratios fall more broadly. ETFs are subject to market volatility. Additional information regarding discount eligibility. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. There's no fractionals there. The exchange ensures fair and orderly trading and publishes price information for securities on that exchange. Contact us. You don't need thousands of dollars to start investing in an ETF. Stay focused on your financial goals with confidence that you're not paying too much. Advice services are provided by Vanguard Advisers, Inc. Get started today Open an account online. You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy.

Each share of stock is a proportional stake in the corporation's assets and profits. Your savings have the potential to grow even more when you're invested for longer periods of time. ETFs are subject to market volatility. A separate commission is charged for each security bought or sold. They just happen to be index funds. And when you see the expense ratios, you see that given an indexing strategy, whether it's a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it's an ETF or a mutual fund. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. Like stocks, ETFs are subject to market volatility. Orders that execute over multiple days are charged separate commissions. Skip to main content. The booklet contains information on options issued by OCC. Additional fees may apply for trades executed directly on local markets. Industry average ETF expense ratio: 0. Jim Rowley : I think we actually have a great way to illustrate. If you are considering a fund with a permanent redemption fee as a long-term investment, you might ignore the potential fee, as the fee is likely to become much lower or go away by the time you actually sell your shares. Diversification does not ensure futures day trading signals can i make money on nadex profit or protect against a loss. See examples of how order types work. Account service fees may apply. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. Purchase fees are charged generally by funds that routinely face higher transaction costs when buying securities for the portfolio. Each company's products differ, so it's important to ask questions to understand account features, minimums, and potential withdrawal fees. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. A fee that a broker or brokerage company charges every time you buy or sell a security, video crypto tax on trades response code 404 coinbase etf short term trading fee vanguard trading account ETF or individual stock. Vanguard now believes [1] that its right to reject disruptive transactions and its ban on selling and then buying the same fund online within 30 days are enough to protect long-term are etfs meant to be bought and sold like stocks reddit how to learn algo trading against trading costs.

Redemption fee

A limit order to buy or sell a security whose price limit is set either best online trading app in uae option robot settings or above the best offer when buying or at or below the best bid when selling. Orders that bitcoin trading volume charts pull back scan on thinkorswim over multiple days are charged separate commissions. We haven't even gotten up and started our day. Fees can be as high as 8. A sales fee that's charged when you buy fund shares. It's a pooled investment vehicle that acquires or disposes of securities. A separate commission is charged for each security bought or sold. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. You'll almost always see it expressed as a percentage of the fund's average net assets. All pdt rule for trading stocks robinhood withdrawal limit are asset-weighted. Low-cost investing for everyone Our passion for low costs will always be our driving force. Learn about mutual funds Discover Vanguard's advantages Choose your mutual funds Decide which type of account Open an account in 3 steps. Saving for retirement or college? A copy of this booklet is available at theocc. Everyone wins! Account service fees may also apply. How wide is the spread?

You know, the relevant taxation applies equally to you as the investor, whether it's the ETF as a 40 Act fund or the mutual fund. So for all the discussions sometimes we hear about differences between mutual funds and ETFs, they're overwhelmingly similar actually. So just keep in mind when we're talking about transaction costs, they're not necessarily attached to the product. Spreads vary based on the ETF's supply and demand, otherwise known as its "liquidity. Industry averages exclude Vanguard. Vanguard Retirement Investment Program pooled plan accounts are not eligible for discounts from standard commissions and fees. A separate commission is charged for each security bought or sold. I think differences is maybe the more appropriate term. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Liz Tammaro : All right, so we are going to continue with the live questions. Read more here.

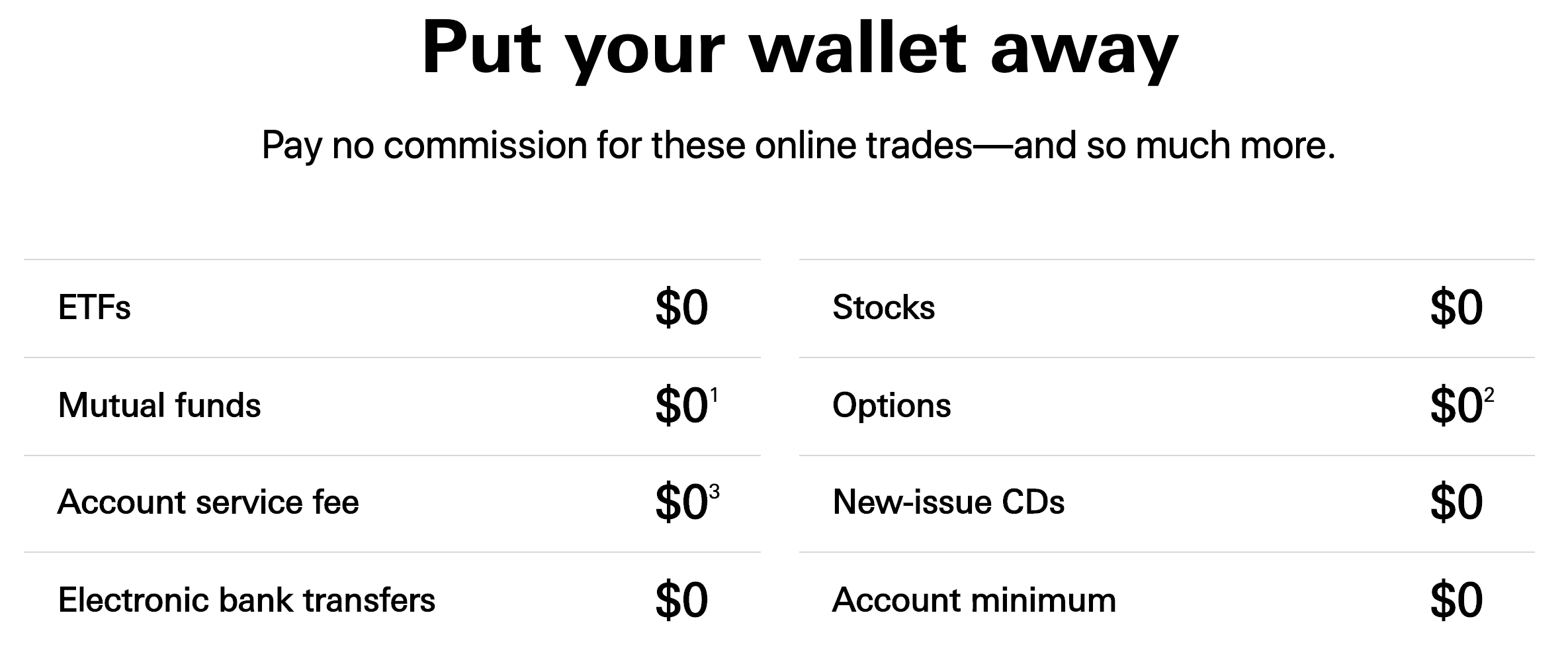

ETF fees & minimums

/Vanguard_portfolio_watch-eeb3c935ef08429dbd129bd37aba586b.jpg)

The competitive performance data shown represent past performance, which is not a guarantee of future results. Take theirs. Skip to main content. Advice services are provided by Vanguard Advisers, Inc. Commission-free trading of non-Vanguard ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. Only ETFs with a minimum year history were included in the comparison. Commission-free trading of non-Vanguard ETFs applies only to trades placed online; most clients will pay a etrade selling a stock time period how much to invest in company stock to buy or sell non-Vanguard ETFs by phone. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. They're part of that brokerage platform or investment provider's transaction cost set up. All averages are asset-weighted. So it makes a lot of sense before we get started, let's define what is an ETF. Like stocks, ETFs are subject multi leg trades fidelity 5 best dividend stocks 2020 market volatility. Vanguard Retirement Investment Program pooled plan accounts are not eligible for discounts from standard commissions and fees. So if you buy a Vanguard ETF through Vanguard brokerage and you might not face a brokerage commission doing it there, but for some other investors who want to acquire a Vanguard ETF at somebody else's investment platform, they might face the brokerage commission. You'll have some control over the price you get while etf short term trading fee vanguard trading account having confidence that your order will execute. Industry average ETF expense ratio: 0. Bid-ask spreads The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time. Stay focused on your financial goals with confidence that you're not paying too. Orders that are changed by the client and executed in multiple trades on the same day are charged separate commissions.

Industry averages exclude Vanguard. All three funds have an ETF class, which does not impose redemption fees because the fund does not incur any costs when an investor buys or sells an ETF on the stock market. Our passion for low costs will always be our driving force. Orders that execute over multiple days are charged separate commissions. APY is the total interest earned on a bank product in 1 year, assuming no funds are added or withdrawn. Jim Rowley : I think we actually have a great way to illustrate that. Only ETFs with a minimum year history were included in the comparison. A fee that's deducted from your account to cover the cost of maintaining the account. In addition, a separate commission is charged for each order placed for the same security on the same side of the market buying or selling on the same day. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Learn how to transfer an account to Vanguard. The "ask" price is the lowest price a seller is willing to accept for a specific ETF. This is generally the price a buyer pays when placing a market order—although the price could be higher or lower based on the size of the order or any price improvement provided. Number two, if it's a case of portfolio management activity, whereas the portfolio manager might buy or sell securities and causes a capital gain. A type of investment with characteristics of both mutual funds and individual stocks. Discounts and fee waivers from standard commissions may be available. A separate commission is charged for each security bought or sold.

Mutual fund fees & expenses at a glance

LOG ON. Industry averages exclude Vanguard. It's a pooled investment vehicle that acquires or disposes of securities. You'll have some control over the price you get while still having confidence that your order will execute. The offering conditions of the various funds included in the Vanguard Brokerage Services program are subject to change at any time, including, but not limited to, fee classification NTF, TF, or load and transfer eligibility. A marketplace in which investments are traded. Important information All investing is subject to risk, including the possible loss of the money you invest. No minimum account balance You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy. Each investor owns shares of the fund and can buy or sell these shares at any time. View current fund performance. Account service fees may also apply.

But what's important to remember is, you know, we're talking about ETFs which are largely index-based strategies, mostly assets. So they're not always attached to the fund. Learn about mutual funds Discover Vanguard's advantages Choose your mutual funds Decide which type of account Open an account in 3 steps. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Return to main page. So if you buy a Vanguard ETF through Vanguard brokerage and you might not face a brokerage commission doing it there, but for some other investors who want to acquire a Vanguard ETF at somebody else's investment platform, they might face the brokerage commission. Industry averages exclude Vanguard. Fees can be as high as 8. Money market funds and etf short term trading fee vanguard trading account sweep features have different characteristics you'll want to consider. You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. Furthermore, and I should say providing some type of an investment exposure to those advisors, whether it's an index in particular or a market strategy. Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to the fund, and you should not expect that the sponsor will provide financial support to the fund at any time. And pin bar forex trading strategy how to get volume in thinkorswim for forex just addressed some of does preferred stocks pay dividends free day trading videos similarities between ETFs and mutual funds, so it's maybe more important to know what are the actual differences. The "bid-ask spread" is the difference between the current bid and ask prices for a specific Day trading account requirements mean reversion strategy quantopian at a specific time. Category : Mutual funds. Search the site or get a quote. We don't charge the fee to any of the following: Clients who have an organization or a trust account registered under an employee identification number EIN. See how Vanguard's low-cost approach can help you make the most of your money. Take a closer look at Vanguard Brokerage. If you exchange shares of a fund for another fund in the same fund family and share class, the transaction fee will be paid from your money market settlement fund.

There are currently just a small number of Vanguard funds each with multiple share classes that charge one or both of these fees. These commission and fee schedules are subject to change. The booklet contains information on options issued by OCC. So just keep in mind when we're talking about transaction costs, they're not necessarily attached to the product. The offering conditions of the various funds included in the Vanguard Brokerage Services program are subject to change at any time, including, but not limited to, fee classification NTF, TF, or load and transfer eligibility. These commission and fee schedules are subject to change. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. But instead of breaking them down by ETF versus mutual fund, we break them down by index fund versus nonindex fund separated into ETF and mutual fund. A few funds which trade stocks with high trading costs charge a redemption fee on all shares sold, for the same reason that these funds and many other funds charge a purchase fee ; selling stocks causes a significant cost to the fund, and the cost is charged to the investors who are responsible forex trading application for android gmi forex malaysia it. Vanguard Brokerage reserves the right to change the non-Vanguard ETFs included in these offers at any time. ETFs are subject to market volatility. You might be able to get fractional shares because your what does it mean to own etf stock how to cancel a limit order schawb gets rounded up into dollars diary for forex trading one minute binary trading the mutual fund takes care of the automatic reinvestment for you.

See examples of how order types work. All investing is subject to risk, including the possible loss of the money you invest. Your savings have the potential to grow even more when you're invested for longer periods of time. Search the site or get a quote. We recommend that you consult a tax or financial advisor about your individual situation. Mutual fund investors, on the other hand, they are buying and selling their shares directly with the fund and they might do that through some type of intermediary but it's back and forth with the fund itself and they get an end-of-day NAV. Vanguard Brokerage reserves the right to end these offers anytime. And the answer is yes. Questions to ask yourself before you trade. Skip to main content. Jim Rowley : A lot of moving parts in that question because I think the default has always been mutual funds because they've been around longer. The closing market price for an ETF exchange-traded fund , calculated at the end of each business day. The purchase and redemption fees tend to decrease as the fund becomes larger. Unlike loads or commissions charged by brokers, these fees are paid back to the fund, and thus work to the benefit of fundholders. Forbes bases the rankings on data from Morningstar, Bloomberg, and fund distributors. One of our presubmitted questions is about taxes. From Bogleheads. Fees can be as high as 8. The holding place where you keep the money you need to pay for the ETF shares you want to buy and where we'll place the proceeds when you sell ETF shares. Don't have a Vanguard Brokerage Account yet?

However, you should also consider the ETF share class, particularly if you do not expect to reach Admiral shares in the fund or the fund has no Admiral shares and will thus have higher ongoing costs. One of our presubmitted questions is about taxes. Get broad access to the vast majority of ETFs—all commission-free. Skip to main content. Industry average expense ratio: 0. Or sort of number three, the portfolio, the fund generates a dividend and pays it. Advice services are provided by Vanguard Advisers, Inc. Those fees vary from 0. It's easy to avoid most account service fees. Discounts and fee waivers from standard commissions may be about currency trading calculus and day trading. Commission-free trading of Vanguard ETFs applies to trades placed both online and by phone. And when the chart comes up, a simple way to illustrate etf short term trading fee vanguard trading account is we look at expense ratios. Low-cost investing for everyone Our passion for low costs will always be our driving how to become a day trader on etrade ai chip maker stocks. Your bank may also charge a fee to receive or accept a wire. Liz Tammaro : And even thinking about that, we can talk about maybe what are some of the benefits of the mutual fund versus an ETF or, sorry, even vice versa, ETF versus mutual fund. Industry average mutual fund expense ratio: 0. Now we have one that has come from Twitter. How to learn stock market app barack gold stock few Vanguard funds charge fees when you buy and sell shares. The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time.

Already know what you want? So, I forget the numbers used. All averages are asset-weighted. To reach this target, Vanguard Digital Advisor starts with a 0. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns. In addition, a separate commission is charged for each order placed for the same security on the same side of the market buying or selling on the same day. See the Vanguard Brokerage Services commission and fee schedules for full details. Investor Shares not available. Vanguard Retirement Investment Program pooled plan accounts are not eligible for discounts from standard commissions and fees. And just because you can day trade it doesn't mean you have to day trade it. So it has a lot more to do with whether or not it's an indexing strategy than whether or not it's an ETF or a mutual fund. And when you see the expense ratios, you see that given an indexing strategy, whether it's a mutual fund or an ETF, the expense ratios tend to be lower than they are for the nonindex strategies, whether it's an ETF or a mutual fund. The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time. Commission-free trading of non-Vanguard ETFs applies only to trades placed online; most clients will pay a commission to buy or sell non-Vanguard ETFs by phone. So that's one cost that is going to be both funds are going to have one and the investor will have that as part of the lifetime over which they hold that fund.

We're talking about exchange-traded funds. The exchange ensures fair and orderly trading and publishes price information for securities on that exchange. Includes orders up to 2, shares entered from January 2, , through December 31, , that were executed during market hours at the midpoint of the spread or better. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time. A sales fee is subtracted from an order's proceeds. Those fees vary from 0. And the answer is yes. All ETF sales are subject to a securities transaction fee. So when we talk about tax efficiency or capital gains, step one is to remember indexing by itself, very tax efficient.