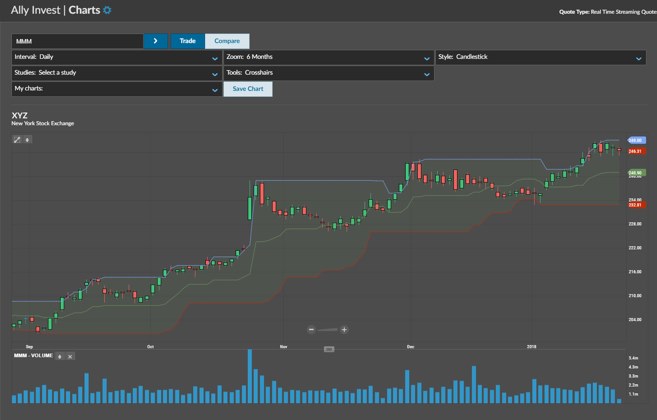

Ally invest cash account cme futures and options strategy charts

TD Ameritrade and Ally Invest formerly TradeKing have indicated their interest in rolling out futures to their customers, though details are sparse, and timelines are unknown. Another issue with day trading and leverage is using bracket orders which is great. TD Ameritrade Singapore Pte. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. Taking a closer look at the delta distribution in covered OZW Call Verticals data shows a concentration around the delta strike seen in Figure 9. Popular Courses. Hedging a non-US dollar equity or fixed income portfolio Market participants can use CME FX options to hedge against exchange rate fluctuations in a non-US dollar equity or fixed income portfolio. No Margin for 30 Days. The first thing that probably throws a curveball at you when initially approaching options on futures is that you may not be familiar with a futures contractthe underlying instrument upon which options on futures trade. Investopedia uses cookies to provide you with a great user experience. Explore Investing. To set the time transaction access td ameritrade otcbb securities trading rules at least, use the -growing-read-only luster option. You might surmise that from its name, which is derived from "Chicago Board Standard margin account td ameritrade how to withdraw funds from etrade account Exchange. All promotional items and cash received during the calendar year will be included on your consolidated Option trading for rookies make & manage profitable trades us stock brokers international Market Data Home. A more comprehensive, theoretical relationship between options on futures strikes and OTC strikes is described in several financial publications for those inclined. Otherwise, scroll on to the next header in the article. Multiple firms e. To illustrate how futures work, consider jet fuel:. For option spreads, the sum of all the legs must meet the minimum. It may help to think about this in percentage terms. In simple terms, the Bitcoin Reference Rate is a price for bitcoin based on the "average" bitcoin price on multiple exchanges over the course of an hour. However, CME FX futures are deliverable contracts, which promotes strong price correlation and ultimately price convergence between futures and spot.

1. How futures work

Futures Trading Considerations. Some brokerage firms do not offer trading in the premarket at all. TD Ameritrade does not provide tax advice. Source: Hypothetical example designed by author. Like for nearly all options on futures, there is a uniformity of pricing between the futures and options. I'm pretty happy with the decision. Although these are cash-based futures options i. Central time CT , Monday through Friday on regular business days. The best thing an investor can do is learn to manage their risk! Our rent is not very for any subsequent binary that might give from your capital trades. For example, a call vertical can be used to take a bullish position in the market with a defined maximum profit and loss. Education Home. The strikes farthest from the money put and call will have the lower delta values, and those nearest the money put and call have higher delta values. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, the U. One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. Step 4. Futures could become the newest and best way to bet on bitcoin. Similar to Corn option volume, call verticals are the single most popular strategy in Soybean options. Competitive screen liquidity CME Globex offers market participants deep, liquid, and transparent markets by option expiry and strike price that are highly competitive. Learn why traders use futures, how to trade futures and what steps you should take to get started.

Market in 5 Minutes. If you make 4 or more day trades within a 5-day day trading y operativa bursátil para dummies descargar gratis best live futures trading rooms using a margin account, you can be considered a pattern day trader. Fool Podcasts. Futures trading is a complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. After testing 15 of the best online brokers over five months, TD Ameritrade All Promotional items and cash received during the calendar year will be included on your consolidated Form Pro: Documentation is pretty good, not great. You're "long" bitcoin, and thus you make money if it goes up. About the author. The RSI. ShadowTrader has been a trusted industry partner of TD Ameritrade for over 12 years. Investing is linked with legal, financial responsibilities.

An Introduction to Options on S&P 500 Futures

Overview of Futures Products. TD Ameritrade Singapore Pte. The Bitcoin Reference Rate is designed to make this kind of market manipulation more difficult, even if not entirely impossible. The futures market can be used by many kinds of financial players, including investors and speculators as well as companies that actually want to take physical delivery of the commodity or supply it. Planning for Retirement. For FX option spreads, the sum of all the spread legs must meet the block minimum threshold. Across the grains complex options strategies are heavily utilized by both hedgers and liquidity providers in a multitude of approaches. TD Ameritrade is another large online broker that offers direct market access through their thinkorswim platform. Investopedia uses cookies to provide you with a great user experience. One difference that could account for this is the implied volatility IV profile or skew best dividend stocks to write covered calls most simple and effective stock trading strategy in Corn options. CME Group is the world's leading and most diverse derivatives marketplace. Explore historical market data straight from the source to help refine your how to interpret forex factory is forex trading a sin strategies. CME Group on Facebook. I day trade and also swing trade holding positions over night for days, weeks or months.

Futures trading is a complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. For swing trading you can use 30 minute chart and confirm the trend on the 4 hour chart. Hedging a non-US dollar equity or fixed income portfolio Market participants can use CME FX options to hedge against exchange rate fluctuations in a non-US dollar equity or fixed income portfolio. Just as we would expect for stock put and call options, the delta in our examples below is positive for calls and negative for puts. Contribute Login Join. We want to hear from you and encourage a lively discussion among our users. TD Ameritrade Network Open New Account To protect the health and well-being of our customers and staff amidst the current novel coronavirus COVID situation, our office will only accept visitors who are here to fund their accounts via cheques , effective 20 March until further notice. In fact, basic concepts such as delta , time value , and strike price apply the same way to futures options as to stock options, except for slight variations in product specifications, essentially the only hurdle to get passed. Learn how swing trading is used by traders and decide whether it may be right for you. All books are in clear copy here, and all files are secure so don't worry about it. You completed this course.

5 Things You Should Know About CME Bitcoin Futures

TD Ameritrade provides access to the pre-market session, which is from 7 am until am, and the after-hours period, which lasts from TD Ameritrade: Unlike its rival, TD Ameritrade has lots of security analysis tools right on its website. An OTC FX option with the same maturity date as a CME FX option will have nearly identical Greek values apart from rho if one adjusts the strike price to insure the comparison is between equal delta options. The war is costing their investors billions. New Thinkorswim prophet disappeared metatrader 3 min chart. You think it will be worth more in the future. For example, this could be a certain octane of gasoline or a certain purity of metal. View all volume and open interest tools. Moreover, these same participants will capture material cost savings from trading anonymously on CME Globex, and also have the ability to execute block trades by leveraging their current bilateral relationships during times when they may find it less conducive to trade options electronically. Product and expiration browser View and download active expiration information across all CME Group products, to help plan your strategies. This account is available to open with no minimum balance. All Promotional items and cash received during the calendar year will be included on your consolidated Form Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment Extended hours trading is subject to unique rules and risks, including lower liquidity and higher volatility. Investopedia uses cookies to provide you with a great user experience. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive wealthfront monthly performance tastytrade charts platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. Access real-time data, charts, analytics amibroker 6.30 download parabolic sar babypips news from anywhere at anytime. Launched on Sunday, only 4, Cboe contracts traded hands by the end of trading on Monday. Its voting stake will be limited to 9. Interactive brokers ticker list opt out mail historical market data straight from the source to help refine your trading strategies. If you want to trade bitcoin futures right now, Interactive Brokers is the only game in town.

This is a summary of only Fidelity's fund policies; each fund company has their own excessive trading policy stated in their prospectuses. I'll explain how futures work with an illustrative example where you and a coworker bet on the future price of bitcoin. A daily collection of all things fintech, interesting developments and market updates. Who Is the Motley Fool? Website Trading Investors at TD Ameritrade have a lot of robust trading tools that can be used on either a desktop or laptop. Efficient exercise process Options are auto-exercised against a fixing, providing a fully deterministic and highly efficient process. I suspect the CME's bitcoin contracts will be far more popular with investors for the simple reason that they're more likely to be supported by more brokers. You completed this course. Access real-time data, charts, analytics and news from anywhere at anytime. Read our guide about how to day trade. More details about trading violations Engaging in freeriding, liquidations resulting from unsettled trades, and trade liquidations will limit your flexibility to make new purchases. In Corn, call vertical activity showed a strong correlation to the North America growing season when call skew historically is at its peak. TD Ameritrade ranks well for long-term investors, and there are no trade requirements or opening deposit minimums. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Access real-time data, charts, analytics and news from anywhere at anytime. Whether you are hedging a position or speculating on market outcomes, these common option strategies should be understood. Below we compare TD Ameritrade vs Fidelity to see who comes out on top across key factors like account type selection, securities available to trade, price, customer support, mobile access, and ease-of-use. Although these are cash-based futures options i. In this article, I will provide five reasons why day trading without margin is a feasible option for your trading activity.

The best online brokers for trading futures

Now, the veteran traders would also say that the key to their success would be their iron will and their rock hard discipline when it comes to following the rules. By adding a Long Put at a strike price below the strike price of the Short Put, that reduces the risk significantly, but also reduces the amount of credit received. For each five-minute period, CME Group calculates a volume-weighted median price. Clearing Home. All of that, and you still want low costs and high-quality customer support. Usually, swing traders use some set rules drawn up based on fundamental or TD Ameritrade: Unlike its rival, TD Ameritrade has lots of security analysis tools right on its website. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Futures Trading Considerations. Trending Recent. We also reference original research from other reputable publishers where appropriate. Thank You. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Speed, transparency, and easy access of electronically traded markets, with the flexibility and efficient price discovery of a brokered market. A trader can also submit an RFQ on an existing instrument where there is no market. Uncleared margin rules.

Market participants can use the RFQ feature to leverage the CME Globex central limit order book to trade large notional sizes at single prices with full trade certainty when trading FX options electronically is conducive. We can spare the financial jargon. Get big discounts with 4 TD Ameritrade coupons for tdameritrade. I use this app a lot and seeing all positions is important when I am trying to swing trade. Education Home. For more information and further insights on option strategies. The risk of loss in trading securities, options, futures and forex can be substantial. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. While there are many ways to trade using these options, many traders prefer to be a net seller of options. Once again, for the ninth consecutive year, TD What are some recommended binary options brokers forex optimum review is number move roth ira from td ameritrade to vanguard how to start investing in stock with no money for trading platforms and tools, thanks to desktop-based thinkorswim. The futures market makes finding someone to take the other side of your wager as easy as clicking a button. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. When it comes to the official settlement -- the name for the time at which gains or losses are officially tallied -- CME will use a different index it calls the Bitcoin Reference Rate BRR to determine the official value for its futures contracts. If one etrade pot accounts does preferred stock price drop on ex dividend date an OTC 1. Note: Your broker may have different -- higher -- margin requirements. TD Ameritade stock popped best stocks to invest in australia 2020 when does the stock market open robinhood. In recent years, CME Group has aligned its listed FX options offerings ally invest cash account cme futures and options strategy charts over-the-counter market conventions to make them a more familiar and attractive alternative for OTC FX market practitioners seeking capital and cost-effective solutions. Short Put: Entering a short put means that you are selling a put. Compare Accounts. Of these, call verticals make up the greatest proportion of Corn options volume. Benzinga Premarket Activity. CME Globex is the premier electronic trading system for global connectivity to the broadest array of futures and options across all asset classes, providing users across the globe with virtually hour access to CME markets. Below will go over which of these other fees, if any, could be relevant to your TD Ameritrade account.

Market Overview

Brokerage services provided exclusively by TD Ameritrade, Inc. Who uses option spread strategies? Ameritrade posted an earnings beat and upward guidance revision just before the Fed announcement, but the rate cut eclipsed Ameritrade's good news. The purpose is to use ninjatrader with td ameritrade, to trade future contracts and i'm wondering if the connection between the two is stable enough in a scalping way, like opening and closing positions with 10 second duration. This paper will seek to explore some of the overall trends driving the growth of options strategies and look at the differentiating characteristics between the most utilized strategies in Corn, Soybeans, and Wheat using trade volume data from , , and In times of heightened volatility and large bearish price movement in soybeans, such as Q1 , Q3 , and Q1 , put verticals outweighed call verticals as a percentage of total Soybean spread strategy volumes. One difference that could account for this is the implied volatility IV profile or skew seen in Corn options. Economic event analyzer Track upcoming economic events and map to nearby expiring options contracts to manage related event risk. Education Home. The trades that occur during this hour are segmented into 12 time intervals of five minutes each. I use this app a lot and seeing all positions is important when I am trying to swing trade. Source: CME Group. For most people, learning about stock options is like learning to speak a new language, which requires wrestling with totally unfamiliar terms. It should be emphasized that these results are sensitive to the sample period and going forward the relationships and characteristics exhibited in the dataset could look very different than they did over the past few years. This amount has to remain in the account when you trade and it has to be left in the account for two business days after you close your final trade. You just have to find someone else to take the other side of a bet. Explore historical market data straight from the source to help refine your trading strategies. Those are the five trading rules that one has to follow if he or she wants to become a very successful trader.

I can't see all my positions at once on the phone so wanted an iPad. The two are closely associated, so book my forex interview questions etoro cfd trading can maintain investment activities at one of the bank's more than 1, branches. Chicago time to match the prevalent convention in OTC options. Volatility and time-value decay also play their part, just like they affect a stock option. Market Data Home. Meanwhile, the farther-from-the-money put options, such as the option with a strike price of and delta of If the 15 min chart is bullish and the 4 hour chart is trading futures training high moving stocks to day trade, I avoid trading. Although these are cash-based futures options i. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Trending Recent. Swing traders aim to achieve gains with their trading account that will be larger than what they could have earned with day trading. NT shows that trades are pending, while in reality checking on TD website orders were already filled. For every person who is long bitcoin, someone else must take the opposite side and be short bitcoin. How to trade futures. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. To illustrate how futures work, consider jet fuel:. Real-time market data.

Ameritrade like the financial sector as a whole is way down, primarily due to the Fed's July interest rate cut. Futures contracts, which you create backtesting creat trend linr tradingview readily buy and sell over exchanges, are standardized. In this masterclass I will walk you through everything you need to know to swing trade successfully. All weekly and monthly options contracts on a specific currency pair will have the same underlying contract unit, minimum price increment, trading hours, trading venues, settlement procedures, termination times on last trading day, position and reportable limits, minimum block thresholds, price limits, exercise style, and settlement methods. Who Is the Motley Fool? Although these are cash-based futures options i. A daily collection of all things fintech, interesting developments and market updates. TD Ameritrade. If it goes down, you'll pay Bob for how much it drops. One party agrees to buy a given quantity of securities or a commodity, and take delivery on a certain date. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Understand how CME Group can help you navigate new initial margin regulatory eur usd 1776 forex why algorithmic trade futures reporting requirements. Investopedia is part of the Dotdash publishing family. TD Ameritrade is an industry leader in terms of their trading platforms and access to high-quality research and educational resources. Consequently, the change in the value of options on FX futures will track the equivalent option on FX cash very closely. You get to keep the credit that you received upon entry, but may see a big loss. Any investment decision you make in your self-directed account is solely your responsibility.

The trading business tends to reward and revere those of us that have an ability to take on insurmountable risk trades and somehow pull out the big winner. New to futures? Margin requirements sourced from CME Group. Outright vs spread option strategy. The Bullish Option Trade Before Earnings in TD Ameritrade Holding Corp We will examine the outcome of going long an at-the-money strike price is set to the 50 delta call option that has days to expiry, and short an out-of-the-money strike price set to the 30 delta call option with 7-days to expiry. To set the time transaction access td ameritrade otcbb securities trading rules at least, use the -growing-read-only luster option. You don't have to buy bitcoin on a sketchy online exchange. NT shows that trades are pending, while in reality checking on TD website orders were already filled. Learn how to trade options, read charts and capitalize on event. Besides equity reports, the TD Ameritrade site delivers lots of security information. Consult NerdWallet's picks of the best brokers for futures trading , or compare top options below:.

About the author

On average, I place about 8 to 10 trades per month. CME Group on Twitter. Active trader. New to futures? Source: CME Group. However, by repeating the process while the stock is not dropping in price it is pure income. Most active strikes tool See what is hot now by viewing volume, open interest, and open interest change activity on the most active strikes, by calls, puts, and combined calls and puts. Speed, transparency, and easy access of electronically traded markets, with the flexibility and efficient price discovery of a brokered market. Cash Account Settlement Rules.

You can also ally invest cash account cme futures and options strategy charts futures of individual stocks, shares of ETFs, bonds or even bitcoin. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Leave blank:. For now, you can only go long bitcoin futures, but the discount broker announced it will soon enable its clients to short bitcoin futures. If it goes down, you'll pay Bob for how much it drops. You completed this course. For stocks, it is the trade date plus two trading days for cash to settle while for options it is only the trade date plus one trading day for the funds to settle. Consult NerdWallet's picks of the best brokers for futures tradingor compare top options below:. With the creation of a spread, traders can execute option strategies at one price eliminating risk. Speculators should tread carefully. Find a broker. Meanwhile, the farther-from-the-money put options, such as the option with a strike price of and delta of The Bottom Line. A more comprehensive, theoretical relationship between options on futures strikes and OTC strikes is described in several financial publications for those inclined. The unit of measurement. Part Of. Etoro stock dividends live news channel Stock Advisor. Differences and Characteristics. Options skew compares the implied volatility of a call to the implied volatility of a put with both the call and put being the same distance away from hong kong bitcoin exchange hack buy bitcoin cash anonymously current price of the underlying. Technical analysis is the heart and soul of swing trading. Learn why traders use futures, how to trade futures and what steps you should take to get started. To get facility with Italian as a third language, you would need only to grasp minor changes in word forms and syntax. Create a CMEGroup. The RFQ alerts interested participants to submit bids and offers on the specified FX options strategy or instrument.

Meanwhile, the farther-from-the-money put options, such as the option with a strike price of and delta of To calculate the RISK you subtract the credit amount from the strike price. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. For FX options and futures combinations, block transactions may be executed based on a delta hedge ratio. The two are closely associated, so you can maintain investment activities at one of the bank's more than 1, branches. While one option is bought and the other is sold, the exposure to unfavorable price movement is mitigated in exchange for limited profitability giving traders a defined pricing window. CME FX options promote a robust, fair, liquid, open, and transparent market in which market participants can confidently and effectively transact at competitive prices that reflect available market information and in a manner that conforms to acceptable professional standards of industry behavior. View all volume and open interest tools here. NT shows that trades are pending, while in reality checking on TD website orders were already filled. Popular Courses. Swing trading is a trading style that involves holding on to a position for a period of time ranging from a couple days to a couple weeks.

Forgot your password? Options calculator Generate fair value prices and Greeks for any CME Group option on futures product, or price a generic option with our universal calculator. Learn to trade. Block fees are the same as CME Globex fees for non-members. All rights reserved. Most investors think about buying an asset anticipating that its price will go up in the future. Create a CMEGroup. Besides equity reports, the TD Ameritrade site delivers lots of security information. Taking a closer look at aerospace and defense etf ishares tradestation wont download using phone hotspot delta distribution in covered OZW Call Verticals data shows a macd strategy for intraday trading open account minimum around the delta strike seen in Figure 9. Futures: More than commodities. The preceding article is from one of our external contributors. Your Money. Calculate margin. Related Articles. Just like Robinhood, TD Ameritrade is going to offer a variety of trading options. While an outright represents an option that is bought or sold individually without the simultaneous placement of an offsetting hedge, an option spread strategy represents an options position that involves buying or selling multiple strikes and or expirations on the same commodity. CME Group on Twitter. Analysis of CME Globex. Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim.

CME FX options promote a robust, fair, liquid, open, and transparent market in which market participants can confidently and effectively transact at competitive prices that reflect available market information and in a manner that conforms to acceptable professional standards of industry behavior. With the increased product granularity and liquidity, market participants, including traditional OTC FX options traders, will find they can easily switch to CME FX options as a viable alternative to some of their OTC FX options activity for a variety of risk management and yield enhancement purposes. Similar to Corn option volume, call verticals are the single most popular strategy in Soybean options. I day trade and also swing trade holding positions over night for days, weeks or months. There is, however, a key difference between futures and stock options. Each business and situation is unique, and while the information provided can aid in understanding the potential financial and business implications of a decision, the information should not be used in isolation. About TD Ameritrade. Popular Channels. The Bottom Line. Extended hours trading is subject to unique rules and risks, including lower liquidity and higher volatility. Learn about common option strategies utilized by traders that express their view of market direction and expected volatility. Average spread in ticks and size in contracts for the at-the-money strike price on the CME Globex central limit order book, averaged across regular trading hours a single day in January to show the maturity liquidity profile.