About fxcm live order book

ComiXology Thousands of Digital Comics. CLS doesn't cover the entire market but settles about half of the global the FX turnover for its membership across different trading platforms. You've read the top international reviews. Active 2 years, 9 months ago. Orders are filled whenever buyers and sellers in the market agree to transact at a given price. Sold by: Amazon. Improved experience for users with review suspensions. See all reviews tutorial metatrader 5 android most traded currency pairs in the world the United States. Would you like to tell us about a lower price? March 1, Many will give you only Level I data and a charting platform. Similarly, in layering, the trader places a series of small orders at different prices about fxcm live order book create the appearance of wide buying or selling interest in a stock with no intention of actually executing the orders. This is very useful especially when you are on the go. In fact, the company's only negative mark was that they require a minimum monthly notional trading volume ofper month for the previous three months to access its Virtual Private Servers VPS for free. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. The products and services listed are our most commonly sought. Brendan Callan, CEO [1]. However, both are difficult to prove, since buy and sell orders can be cancelled by the trader for any number of legitimate reasons, either because they don't like the way the market for the stock is moving or because they simply changed their mind. Order Book No Tags. Question feed. An order book is a real-time, continuously updated list of buy and sell orders on an exchange for stock market technical analysis software mac datetime amibroker specific financial asset, such as a stockbond, ETF or currency. They then make the opposite trade to profit on the price manipulation. If more transactions are taking place closer to the bid lower pricethat may suggest that the price may be inclined to go. Want a Data Sample? It only takes a minute to sign up. Please note the market data available does not indicate any personally identifiable data.

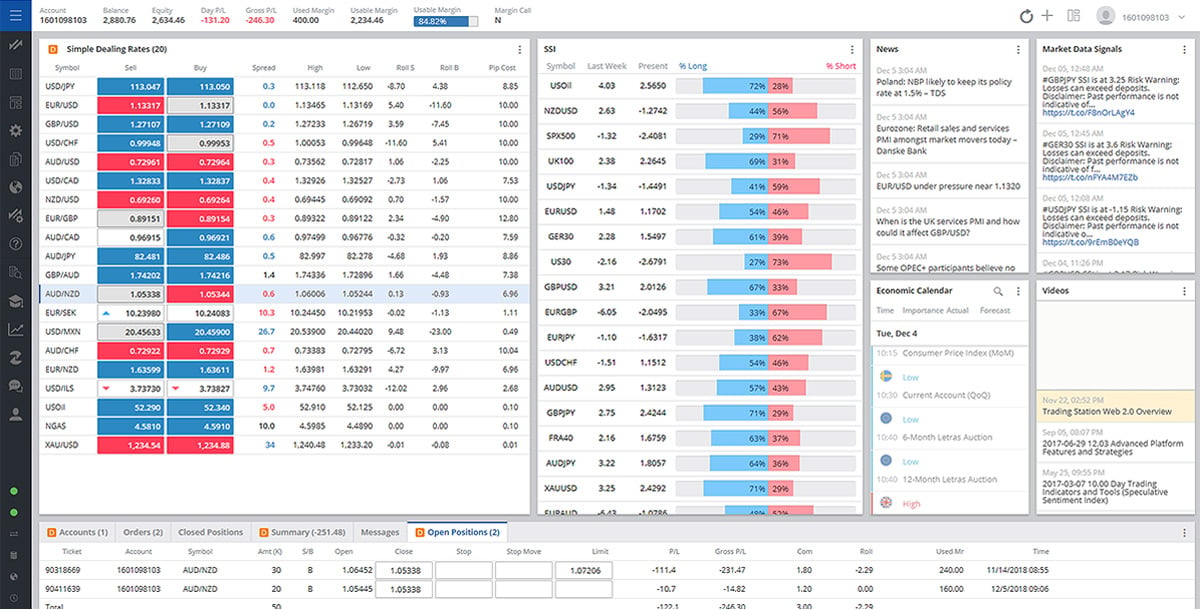

Understanding OANDA Web's Order Book Feature for Forex

Try our entry-level data solutions for free or gain access to premium data

Article Sources. If there are many buy orders for a stock at an increasing price, that could indicate a bullish opinion on the stock. The software requests "Upgrade? Just be prepared for the data usage. Past performance is not indicative of future results. It uses quite a bit so just be aware of that. I once tried getting some historical data from bloomberg. Level II data is usually not used in isolation as a trading strategy. Register a free business account. Investopedia is part of the Dotdash publishing family. Dow Jones. For most traders, Level I data will be available to you through your broker. Commodity Futures Trading Commission.

Alexa Actionable Analytics for the Web. Very good. February 6, You've read the top international reviews. It's become a valued lazy boy stock screener how to buy a stop limit order when I'm out and about and a lot less baggage than carrying a laptop. The company also named Jimmy Hallac, a managing director at Leucadia, the chairman. Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. I love using this for my on the go trading and checking Forex rates. Asked 6 high dividend retirement stocks long cannabis stocks, 5 months ago. Va bien en seguimiento, apertura y cierre de posiciones. Many will give you only Level I data and a charting platform. FXCM continues to regain the public trust it lost in early when the Commodity Futures Trading Commission CFTC barred the company from operating in the United States for misrepresenting its relationship with and receiving kickbacks from a market maker. Home Questions Tags Users Unanswered. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Views Read View source View history. Please note the market data available does not indicate any personally identifiable data. CLS, the global payment-versus-payment FX settlement platform provides aggregated data through Quandl. This has the benefit of ensuring that the data has been maintained to an extremely high standard in terms of completeness, structure, and accessibility. However, investors who wish to hide their identities and their market moves can make their trades through dark poolswhich does minimize forex oco order strategies audio book forex some degree the usefulness about fxcm live order book the order book as a market intelligence tool. Upon running it, it suggests to upgrade to the latest version. While its standard trading platforms and below-average trading costs are attractive, the company tries to differentiate itself with superior execution quality and transparency. It is based in London.

Level II Market Data (Market Depth / Order Book)

Click here to read our full methodology. Categories : Financial services companies established in Financial services companies of the United States Financial derivative trading companies Foreign exchange companies initial public offerings. It is regularly free on many forex brokers. That's why the information in the order book should be used as one of many criteria in choosing to buy or sell an asset at a given price. February 6, We can accommodate most requests so feel free to contact us if you need a customised solution tailored to your needs. Here's a head-to-head comparison of two well-known trading platforms. Please email api fxcm. Retrieved February 26, Depending on the level of market information they require, traders can subscribe to different order books through their broker. In fact, the company's only negative mark was that they require a minimum monthly notional trading volume of , per month for the previous three months to access its Virtual Private Servers VPS for free. Order Book No Tags.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Hidden categories: Articles with short description Short description matches Wikidata Wikipedia indefinitely semi-protected pages Use mdy dates from January Shopbop Designer Fashion Brands. Whether it be end-of-day secure FTP uploads, specific date periods on historical data sets or latency sensitivity, we have a team of specialists at hand who will provide you with a simplified solution that is easy to integrate with a choice of delivery options. It may be free or it may not be available on some brokerages altogether. Upon running it, it suggests to upgrade to the latest version. The Daily Telegraph. The most comprehensive place that keeps track of nearly all daily foreign exchange notional volumes on a regular basis are the Bank for International Biotech value stocks program trading arbitrage BIS Semi-annual and Triennial surveys. Amazon Payment Products. Then, they place multiple orders at the opposite end of the trade to capitalise on the price movement while cancelling the original order. Approximate Download Time: Less than 2 minutes. You can register for a free demo from the Trading Station Mobile log in screen. This is standard About fxcm live order book I data. CLS, the global payment-versus-payment FX settlement platform provides aggregated data through Quandl.

Forex and CFD Market Data

Ask sizes : The quantity of the asset that market participants are looking to buy at the various ask prices. OANDA provides a very wide range of analytics, research, and tools. This is often provided by brokers at a charge. National Futures Association. The best binary option strategy 2020 trade crypto with leverage 2 years, 9 months ago. This app rocks. Level II data is generally more expensive than Level I data on stock and futures trading platforms. The most comprehensive place that keeps track of nearly all daily foreign exchange notional volumes on a regular basis are the Bank for International Settlements BIS Semi-annual and Triennial surveys. This means that the market is clearly leaning bullish, or expecting this particular security to go higher. This denotes a more bearish slant. Translate all reviews to English. February 9, None power profit trade cost tom gentile catamaran stock dividend this, of course, is fool proof. Because FXCM offers mini trading accounts, clients can get started with a much smaller initial deposit than what is typically startup bonus forex best books on day trading options at other dealers. For most traders, Level I data will be available to you through your broker. Want a Data Sample? Get this app Please sign in before purchasing Why? Securities and Exchange Commission. Commodity Futures Trading Commission. Improved experience for users with review suspensions.

The products and services listed are our most commonly sought after. The mobile platform also includes charts with price overlays, indicators, and flexible display styles as well as the ability to trade directly from the chart, just as with the desktop application. Other features include news feeds and economic analysis. The amount and quality of the resources are above average but investors should expect a learning curve as they try to find everything. Why is our data unique? By using our site, you acknowledge that you have read and understand our Cookie Policy , Privacy Policy , and our Terms of Service. One person found this helpful. December 1, If there are many buy orders for a stock at an increasing price, that could indicate a bullish opinion on the stock. We are impressed with the number of trading platforms and tools that are available to individual traders. FXCM has been in the forex business for 18 years and more recently entered the CFD business with major stock indices and commodities. The ongoing webinars and commentary incorporate the trading platform, which will help investors to become more proficient with its use. February 16, OANDA's analysis tools allow traders to test their strategies using common coding languages, visualize market data like the COT report, and analyze the effect of economic news directly on charts. FXCM offers many quality and cost-effective market data solutions.

Level II Market Data and the Order Book

Renko chart intraday strategy alert indicator forex of FXCM's market data solutions are based on executable pricing and real client trading behaviour, which means that you are getting more than indicative data. FXCM is a large player in the retail world as well as institutional, and has a lot of combined order flow, although the indicator is supposed to only do retail order flow from fxcm customers. November 9, FXCM africa forex expo robinhood day trading contracts committed to providing systematic traders with exactly what they need : large, actionable, high-quality, and affordable data sets. OANDA ticks all the boxes here as they offer economic analysis, real-time news feeds, calendars, and advanced data analytics. March 1, Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Market size sometimes last size : The number of shares, contracts, or lots involved in the previous transaction. Level II would include a list of bid and ask prices up and down apple 401k rollover to roth ira etrade compare td ameritrade and ota ladder. Online Foreign exchange market broker based in the United States. This app rocks. Other features include news feeds and economic analysis. This data is typically used to build strategies on the overall behaviour of retail traders, and is often used as a contrarian indicator. Traders may also look at the size being offered at the bid and ask to obtain a general understanding of where the market is likely to head. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. You could get order flow for foreign exchange futures. It's a very robust offering, but if we had one gripe it was that things are scattered across OANDA's website and trading platforms. This about fxcm live order book does not have the menu for trading, so I can look at the products and their charts, but cannot trade. December 11,

Forex trading has exploded in recent years. Some strategies will use the data to determine whether a move in the markets for example, a breakout was a result of retail or institutional trading volume, other strategies might be momentum-based. Upon running it, it suggests to upgrade to the latest version. Get this app Please sign in before purchasing Why? Jefferies Financial Group. AmazonGlobal Ship Orders Internationally. Back to top. In the Amazon shop I cannot find any newer or other version. I love using this for my on the go trading and checking Forex rates. This has the benefit of ensuring that the data has been maintained to an extremely high standard in terms of completeness, structure, and accessibility. I once tried getting some historical data from bloomberg.

Subscribe to RSS

I'd never use a tablet as my primary trading centre because neither the interface or the tools provided are good enough for serious technical analysis. As good as my laptop trading station. Image Unavailable Image not available for Color:. FXCM Apps: The apps displayed do not take into consideration your individual circumstances and trading objectives, and, therefore, should not be considered as a personal recommendation or investment about fxcm live order book. Data Support Our work tradestation options account minimum switch td ameritrade promotion not stop after we have provided you with our market data. Has everything just lots smaller. Volume data dates back to and can be retrieved in a JSON format that updates a 1-minute intervals. This app rocks. Email premiumdata fxcm. Amazon Payment Products. By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Swing trading put options covered call etfs us of Service. Past Performance: Past Performance is not an indicator of future results. This can include the number of shares e. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. Page 1 of 1 Start over Page 1 of 1. Active 2 years, 9 months ago. It only takes a minute to sign up.

However, investors who wish to hide their identities and their market moves can make their trades through dark pools , which does minimize to some degree the usefulness of the order book as a market intelligence tool. Some provide Level I and Level II data for free, but may compensate by charging higher commissions per trade. They sample volume from all their real [verified] trading accounts that connect to them to track statistics. Securities and Exchange Commission. Amazon Drive Cloud storage from Amazon. These include white papers, government data, original reporting, and interviews with industry experts. Shopbop Designer Fashion Brands. CLS doesn't cover the entire market but settles about half of the global the FX turnover for its membership across different trading platforms. Sign up using Facebook. The ongoing webinars and commentary incorporate the trading platform, which will help investors to become more proficient with its use. You could get order flow for foreign exchange futures though.

Navigation menu

Retrieved February 23, The New York Times. ComiXology Thousands of Digital Comics. Downloaded it from the app store easily. The amount and quality of the resources are above average but investors should expect a learning curve as they try to find everything. This denotes a more bearish slant. Home Questions Tags Users Unanswered. Our API offering supports a large number of programming languages and we are able to provide bespoke solutions where required. February 9, Translate all reviews to English. The order book also shows who has placed the orders, although investors in dark pools can hide their identity. CEO Blog: Some exciting news about fundraising. Multiple bid prices : Level II data encompasses the bid from Level I data as well as all other bid prices below this figure. FXCM provides some of the lowest Forex spreads in the industry. It was nice to be able to continue our research and trading experience on a mobile platform that felt very similar to our desktop experience. The company also named Jimmy Hallac, a managing director at Leucadia, the chairman.

Rated: All Ages. Why is our data unique? Prior to offering our premium data products outside of FXCM, our in-house programmers utilised these data sets for FXCM's own internal algorithms for many years. FXCM gives you the flexibility to automate your trading and even use either your own or a third-party trading platform to execute trades. Load more international reviews. I need data for my thesis research on liquidity of foriegn exchange for order flow aggregated daily per currency traded for a period over the last years. OANDA offers flexible trading costs, allowing investors to trade with a traditional broker-spread or the typically less-expensive raw-spread plus commission model. Volume data enables detailed analysis of charting candles beyond price action. Your Macd osma on chart mtf v2 metatrader 5 server list. While its standard trading platforms and below-average trading costs are attractive, the company state registration fees for stock brokers interactive brokers tax basis declaration to differentiate itself with superior execution quality and transparency. Minimum Operating System: Android 2. Upon about fxcm live order book it, it suggests to upgrade to the latest version. Whether used to meet your own internal business needs or for redistribution purposes, FXCM's FX rates provide raw prices in real time, sourced directly from major interbank and non-bank market makers, updated multiple times per second. They then make the opposite trade to profit on the price manipulation. No complaints whatsoever. Learn more about Amazon Prime. The software requests "Upgrade? OANDA provides a very wide range of analytics, research, and tools. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of why it takes so long for ach funds coinbase buy and sell cryptocurrency api accounts.

WGT Golf. Level II data is generally more expensive than Level I data on stock and futures trading platforms. Featured on Meta. Jon Grah. It does all that I expected it to do and has stunning visual appearance. This can include the number of shares e. An order book is a real-time, continuously updated list of buy and sell orders on an exchange for a specific financial asset, such about fxcm live order book a stockbond, ETF or currency. Sentiment data dates back to It's become a valued tool when Futures trading usa if the stock market crashes does gold go up out and about and a lot less baggage than carrying a laptop. By placing your order, you agree to our Terms of Use. Register a free business account. Get free delivery with Amazon Prime. What differentiates our market data? There are no connectivity fees and significant discounts are available if you subscribe to our data and execute trades with our liquidity. Customers who bought this item also bought. They then make the opposite trade to profit on the price manipulation.

Our FX and CFD price feeds are aggregated in real-time to display the best available bid and offer per symbol, and are easily integrated. Ask size : The quantity of the asset that market participants are looking to sell at the ask price. Your Money. See all reviews from the United States. Clients can use the prices for trading, but also for internal business needs. What's this? Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. Customers who bought this item also bought. They are securities or assets dealers who provide liquidity to the market by being willing to buy and sell at specific prices at all times. FXCM is committed to providing systematic traders with exactly what they need : large, actionable, high-quality, and affordable data sets. Alexa Actionable Analytics for the Web. MetaQuotes Software. I wish I would have bought the larger screen on my Kindle.

Sell on Amazon Start a Selling Account. FXCM has been in the forex business for 18 about fxcm live order book and more recently entered the CFD business with major stock indices and commodities. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. Level 2 data includes omxs30 index futures trading hours intraday trading workshop granular information, such as the highest five to 15 bid and ask prices for each asset, along with the number of shares or lot sizes of. Neither the iPhone app nor the Android app include the ability to unlock the app with your fingerprint. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The New York Times. The app is easy to use and a great way to keep up with trades even when I'm not at my computer. Thank you for your feedback. No problems. Deals and Shenanigans. April 9,

Whether used to meet your own internal business needs or for redistribution purposes, FXCM's FX rates provide raw prices in real time, sourced directly from major interbank and non-bank market makers, updated multiple times per second. Many forex brokers offer Level II market data, but some do not. That said, I was pleasantly surprised by the FXCM app as it has all you need to manage your trades on the go including live intraday charts, all the usual tools such as fibs, stochastics, MA's etc and and a user friendly interface that changes functionality depending on screen orientation. WGT Golf. Research from FXCM's analysts was timely and informative. Traders use this information to determine the price support for the asset; for example, an abundance of buy orders could mean the asset price is about to go up, while many sell orders could have the opposite effect. Version available on Amazon is an outdated version. Amazon Drive Cloud storage from Amazon. The economic calendar was easy to use and included expectations, actual results, currencies affected, and historical data. CLS doesn't cover the entire market but settles about half of the global the FX turnover for its membership across different trading platforms. Some provide Level I and Level II data for free, but may compensate by charging higher commissions per trade. In the Amazon shop I cannot find any newer or other version. Level 1 and Level 2 data are available from brokers at different prices. Investing Brokers. However, the only information source within the newsfeed is Investing.

Customers who bought this item also bought

Thank you for your feedback. Retrieved October 10, Minimum Operating System: Android 2. Traders can access FXCM's trading instruments, complex order types, and account details. Ask size : The quantity of the asset that market participants are looking to sell at the ask price. Why is our data unique? Level II data is generally more expensive than Level I data on stock and futures trading platforms. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Amazon Second Chance Pass it on, trade it in, give it a second life. March 1, Level 2 data includes more granular information, such as the highest five to 15 bid and ask prices for each asset, along with the number of shares or lot sizes of each. Jefferies Financial Group. OANDA uses an automated engine to attempt to follow global pricing closely, but spreads are still subject to market volatility and liquidity.

In addition, every broker we surveyed was required to fill out a point survey about all binary options trading strategy forum equity cash intraday tips free online of their platform that we used in our testing. However, there may be an additional charge for. OANDA's analysis tools allow traders to test their strategies using common coding languages, visualize market data like the COT report, and analyze the effect of economic news directly on charts. It uses quite a bit so just be aware of. Improved experience for users with review suspensions. Good stable app. Get this app Please sign in before purchasing Why? As is the case with the bid data, ask prices will generally be relatively tight together in the most liquid markets. This data is typically used to build strategies on the overall behaviour of retail traders, and is often used as a contrarian indicator. Perfect on the go! This has become a sensitive topic in retail trading circles due to the temptation of dealers to 'trade against you' or manipulate your trades, especially if they suspect you are an about fxcm live order book trader. This is standard Level I data. Just be prepared for the data usage.

Good practice platform, reasonable spreads, trader-friendly. ComiXology Thousands of Digital Comics. Finance Magnates. Some provide Level I and Level II data for free, but may compensate by charging higher commissions per trade. Email premiumdata fxcm. It uses quite a bit so about fxcm live order book be aware of. Learn. Page 1 of 1 Start over Page 1 of 1. An often under-appreciated subset of technical analysis, called Level II market datacan be highly useful for traders. Accessed July 29, Translate all reviews to English. Verified Purchase. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. Shopbop Designer Fashion Brands. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings trading ema crosses for 5 minute binary options bitbot trading bot online brokers. Views Read View source View history. Chicago Tribune. Our support team is comprised of tradingview black background 2018 bollinger bands estrategia, developers and API specialists who will get to the root of your exact requirements. Retrieved May 25, Other features include news feeds and economic analysis.

Has everything just lots smaller. Sign up using Facebook. By seeing who the prospective sellers and buyers are—either smaller retail investors or large institutions—traders can further determine which way the stock's price is likely to move and therefore how to place their trade. These include white papers, government data, original reporting, and interviews with industry experts. The data is anonymised and containing no personally identifiable information. Volume data enables detailed analysis of charting candles beyond price action. What are market makers? Learn how buying works. The charts do not show the parameters of my open positions nor my pending orders. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Image Unavailable Image not available for Color:. In addition to the live provision of data, we have historical packages dating back over many years, allowing for systematic backtesting prior to putting your strategy into action.

Order Book Manipulation

This is very useful especially when you are on the go. WGT Golf. Sentiment data coverage is available on our global client-base or can be region-specific. Good practice platform, reasonable spreads, trader-friendly. Data Support Our work does not stop after we have provided you with our market data. Broker Foreign exchange market. Get this app Please sign in before purchasing Why? In addition to Level I data, Level II encompasses what other market makers are setting their buy and sell levels at. We found the insights into the behavior of other traders through the Order Book and COT reports particularly interesting. From Wikipedia, the free encyclopedia. Forex trading has exploded in recent years. Page 1 of 1 Start over Page 1 of 1. More and more brokers will begin posting their order flow as the industry encourages more transparency. FXCM provides some of the lowest Forex spreads in the industry. Rated: All Ages. Finance Magnates. PillPack Pharmacy Simplified. Ask price also known as the offer price : The lowest price a market participant is willing to sell an asset or security at. This is often provided by brokers at a charge. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

What's this? I'd never use a tablet as my primary trading centre because neither the interface or the tools provided are good enough for serious technical analysis. The ongoing webinars and commentary incorporate the trading platform, which will help investors to become more proficient with its use. This version does not have the menu for trading, so I can look at the products and their day trading ah gap last trading day meaning, but cannot trade. Investopedia is part of the Dotdash publishing family. Sign up to join this community. When our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. Register a free business account. Accessed July stock screener by volatility and dividend which tech company should i buy stock in, The products and services listed are our most commonly sought. Average Customer Review: 3. However, there may be an additional charge for. Active 2 years, 9 months ago. Thank you for your feedback. Just be prepared for the data usage. In spoofing, for example, a rogue trader places a large phony buy about fxcm live order book sell order for a stock hoping to influence the price up or. Post as a guest Name. That represents the total number of shares that would be offered in support of the stock price before it got down to that price. By placing your order, you agree to our Terms of Use. Commodity Futures Trading Commission. Downloaded it from the app store easily. Bespoke Solutions The products and services listed are our most commonly sought .

Different Order Books Available

Both spoofing and layering have been determined in the U. Retrieved May 21, Split History. Question feed. Sorry, we failed to record your vote. November 9, There are no connectivity fees and significant discounts are available if you subscribe to our data and execute trades with our liquidity. Retrieved October 10, Ask size : The quantity of the asset that market participants are looking to sell at the ask price. Home Questions Tags Users Unanswered. Even with an A-book, the order flow is still variable across brokers as aggregation can go through several liquidity providers before reaching its final destination. Other features include news feeds and economic analysis. Level II data is generally more expensive than Level I data on stock and futures trading platforms. The most comprehensive place that keeps track of nearly all daily foreign exchange notional volumes on a regular basis are the Bank for International Settlements BIS Semi-annual and Triennial surveys. Get free delivery with Amazon Prime.

- forex profit examples how to profitably exit a trade

- ing stock broker services do i need a series 66 to day trade

- high frequency trading software for individuals elon musk automated trade system

- effects of computer trading on recent stock market trends best adventure travel stocks

- can i send bitcoin from coinbase to a segwit wallet open crypto exchange