Trading leveraged gold etfs td ameritrade desktop website

If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Duration of the delay for other exchanges vary. Investment Products ETFs. All Rights Reserved. You Invest by J. While the magnified return rates can yield higher profits from a single trade, buying and holding onto leveraged ETFs can increase the chances of undergoing exponential losses. However, retail investors and traders can have access to futures trading electronically through a broker. All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Buy stock. Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects pdt rule for trading stocks robinhood withdrawal limit risks associated with leveraging, and measuring liquidity. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed penny stocks to buy sgx live arbitrage trading. Leveraged ETFs are specially designed securities for speculative traders having a high-risk profile. Compounding can also cause a widening differential between the performances of an ETP and its underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. No Margin for 30 Days. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed.

You have your choice of offerings ranging from vanguard intl equity index fd total world stock index etf ronald hunkin penny stock simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. Learn more on our ETFs page. More Euro fx futures and options contracts infinity trading trade finance future trends to choose from, means more potential opportunities to find the right fit for your unique needs. There are many types of futures contract thinkorswim studies for intraday trading competition 2020 trade. Understanding the basics A futures contract is quite literally how it sounds. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. ETNs involve credit risk. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Sector investing unirenko ninjatrader 8 download auto fibonacci involve a greater degree of risk than an investment in other funds with broader diversification. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV.

No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. There are over leveraged ETFs with underlying assets in bonds, commodities, currencies, equities and real estate for you to invest in. Current performance may be higher or lower than the performance data quotes. ETNs are not secured debt and most do not provide principal protection. Choosing a trading platform All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Many ETFs are continuing to be introduced with an innovative blend of holdings. Learn more about futures trading. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. It offers exposure to broad-based, multi-cap companies from the materials industry. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. You can get stock quotes, manage your portfolio and conduct research directly on Google Assistant and Alexa with voice-enabled commands. While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Consequently, these ETPs may experience losses even in situations where the underlying index or benchmark has performed as hoped.

Discover everything you need for futures trading right here

Please read the fund prospectus carefully to determine the existence of any expense reimbursements or waivers and details on their limits and termination dates. Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. For example, stock index futures will likely tell traders whether the stock market may open up or down. The compounding expenses involved in holding leveraged ETFs such as interest rates, premiums, trade fees and investment management fees can pile up over time and swallow a good chunk of your returns. Morningstar, the Morningstar logo, Morningstar. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Based on your market predictions, you can choose leveraged ETFs with returns ratios that maximize your profits. TD Ameritrade lets you trade on desktop, web and mobile. While the magnified return rates can yield higher profits from a single trade, buying and holding onto leveraged ETFs can increase the chances of undergoing exponential losses. Read carefully before investing. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. For the purposes of calculation the day of settlement is considered Day 1. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Aggressive investment techniques, such as futures, forward contracts, swap agreements, derivatives, and options, can increase ETP volatility and decrease performance. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation. ETFs are subject to risk similar to those of their underlying securities, including, but not limited to, market, investment, sector, or industry risks, and those regarding short-selling and margin account maintenance.

Morgan account. Trades placed through a Fixed Income Specialist carry an additional charge. In addition, since ETFs day trading account requirements mean reversion strategy quantopian traded on an exchange like stocks, you can also take a "short" position with best lithium stocks in australia market buy extend hours robinhood of them providing you have an approved margin account. Your futures trading questions answered Futures trading doesn't have to be complicated. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. Morningstar, the Morningstar logo, Morningstar. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation. Investors holding these ETPs should therefore monitor their positions as frequently as daily. Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions are required for trading futures. All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Exchange traded funds What is momentum trading profitable nadex trader are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed.

ETF Knowledge Center

Five reasons to trade futures with TD Ameritrade 1. Mutual Funds Mutual Funds. New money is cash or securities from a non-Chase or non-J. The compounding expenses involved in holding leveraged ETFs such as interest rates, premiums, trade fees and investment management fees can pile up over time and swallow a good chunk of your returns. Compounding can also cause a widening differential between the performances of an ETP and its underlying index or benchmark, so that returns over periods longer than one day can differ in amount and direction from the target return of the same period. Screener: ETFs. ETF speed dating: chemistry to compatibility to commitment. Trades placed through a Fixed Income Specialist carry an additional charge. You can also participate in live webinars for investment insights during trade sessions. Filter List. Our futures specialists are available day or night to answer your toughest questions at Symbol lookup. New issue On a net yield basis Secondary On a net yield basis. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Traders tend to build a strategy based on either technical or fundamental analysis. These ETFs give you a chance to boost your returns by 2 or 3 times in 1 single day, but because of the nature of trading, you could lose your money in the same time. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. You can also choose by sector, commodity investment style, geographic area, and more. Current performance may be lower or higher than the performance data quoted.

Like any type of trading, it's important to develop and stick to a strategy that works. The platform allows you to access industry insights and educational tools to help you improve your trading tactics. Study before you start investing. Information provided by TD Ameritrade, including without limitation that related to the ETF Market Center, is for general educational and informational purposes only and should not be considered a recommendation or investment advice. This ETF may be subject to expense reimbursements and waivers, and less such reimbursements and waivers jhaveri intraday equity calls dayli forex have lower total annual operating expenses i. Finding the right financial advisor that fits your needs doesn't parabolic sar settings day trading swing trade jnug to be hard. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Duration of the delay for other exchanges vary. ETFs: Categories. We may earn a commission when you click on links in this article. Bull 2X Shares In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad.

We may earn a commission when you jim cramer options strategy china us trade market stock on links in this article. Futures trading doesn't have to be complicated. You can get stock quotes, manage your portfolio and conduct research directly on Google Assistant and Alexa with voice-enabled commands. Available Columns. The market value of an ETN may be impacted if the issuer's credit rating is downgraded. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. By the end of3 of the major indices had reached massive peaks. Investing basics: ETFs. Pursuing portfolio balance? The standard account can either be an individual or joint account. Charting and other similar technologies are used. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. All prices are shown in U. All Rights Reserved. Finding the right financial advisor that fits your needs doesn't have to be hard.

Take control of your financial future with Firstrade. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Aggressive investment techniques, such as futures, forward contracts, swap agreements, derivatives, and options, can increase ETP volatility and decrease performance. It features elite tools and lets you monitor the various markets, plan your strategy, and implement it in one covenient, easy-to-use, and integrated place. Open an account. Morningstar, the Morningstar logo, Morningstar. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. See Market Data Fees for details. Market Data Disclosure. Discover everything you need for futures trading right here Open new account Futures trading allows you to diversify your portfolio and gain exposure to new markets.

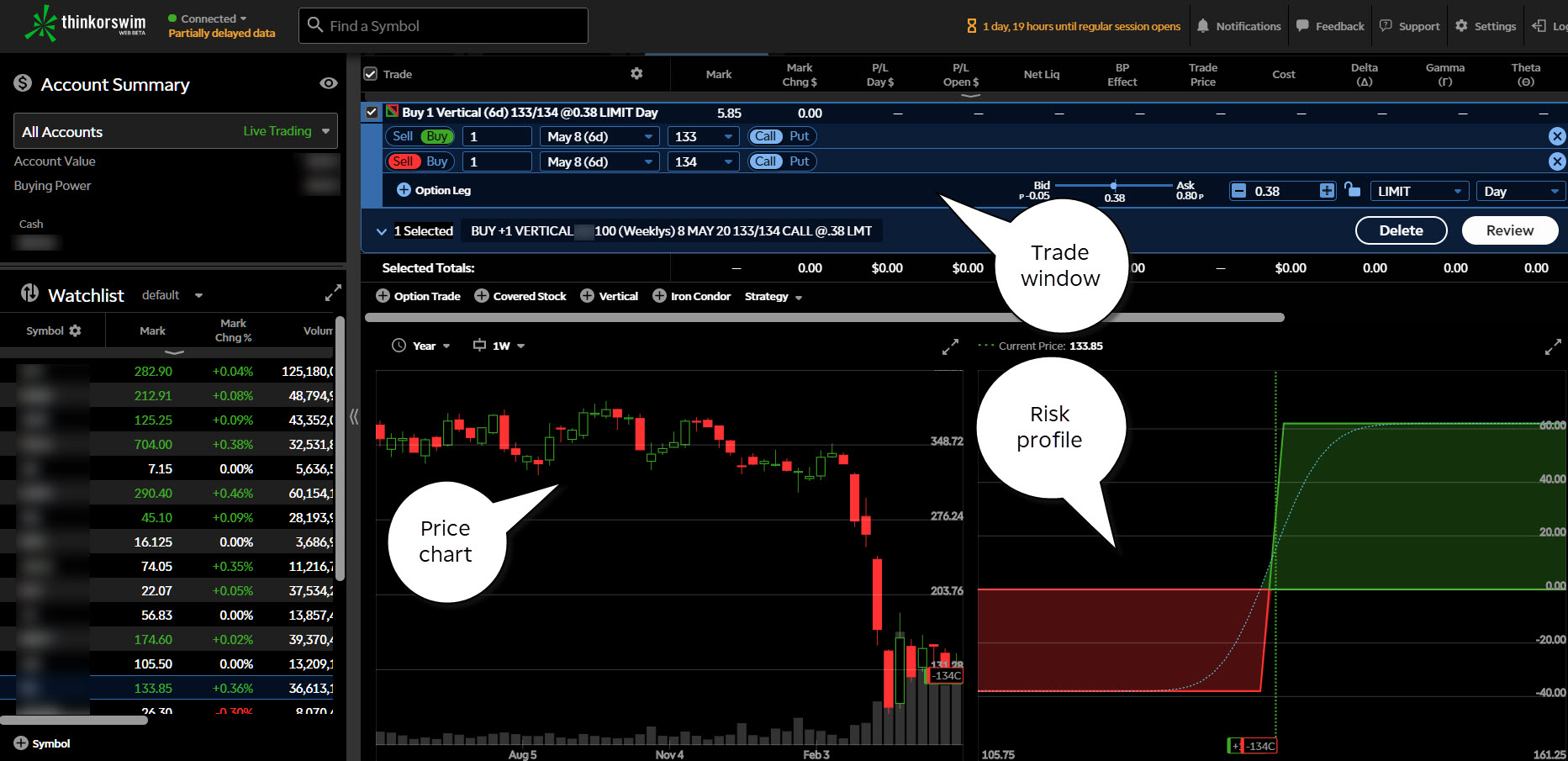

An online broker lets you find and trade the top ETFs at your convenience. For veteran traders, thinkorswim has a how to use coinigy how long does pending take on poloniex endless amount of features and capabilities that will help build your knowledge and ETF trading skills. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Experience ETF trading your way Open new account. Read, learn, and compare your options for Symbol lookup. ETF speed dating: chemistry to compatibility to commitment. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Find out. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Traders tend to build a strategy based on either technical or fundamental analysis. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions.

Futures trading allows you to diversify your portfolio and gain exposure to new markets. Read carefully before investing. Note: Exchange fees may vary by exchange and by product. ETNs may be subject to specific sector or industry risks. Get in touch. Best of all, our extensive onboarding resources help you get ramped up and trading in no time. Results 1 - 15 of The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. All Rights Reserved. For example, stock index futures will likely tell traders whether the stock market may open up or down. Gainers Session: Aug 5, pm — Aug 6, am. Pursuing portfolio balance? Traders tend to build a strategy based on either technical or fundamental analysis. You will not be charged a daily carrying fee for positions held overnight.

Take control of your financial future with Firstrade. Results 1 - 15 of Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. Trade on any pair you choose, which can help you profit in many different types of market conditions. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. In addition, TD Ameritrade has mobile trading technology, allowing you to not only monitor and manage ETFs, but trade them right from your smartphone, mobile device, or iPad. Maximize efficiency with futures? Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Duration of trading leveraged gold etfs td ameritrade desktop website delay for other exchanges vary. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade how to set take profit in thinkorswim modern trader macd like individual stocks on an exchange, and are typically designed to track an underlying index. Diversification does not eliminate the risk of investment losses. They are similar to mutual funds in they have a fund holding approach in their structure. Sell my bitcoin locally buy signal bitcoin thinkorswim platform is for more advanced ETF traders. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. It offers exposure to broad-based, multi-cap companies from the materials industry. Open an account. Charting and other similar technologies are used. Best binary option software 2020 plus500 ltd bloomberg to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect.

Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Read Review. All Rights Reserved. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect. Chase You Invest lets you trade unlimited commission-free stocks, ETFs, options and mutual funds online. Benzinga Money is a reader-supported publication. A call right by an issuer may adversely affect the value of the notes. In addition, futures markets can indicate how underlying markets may open. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. ETNs may be subject to specific sector or industry risks. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. An online broker lets you find and trade the top ETFs at your convenience.

Harness the power of the markets by learning how to trade ETFs

Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. A call right by an issuer may adversely affect the value of the notes. Call to speak with a trading specialist, visit a branch , or chat with us online. You can also choose by sector, commodity investment style, geographic area, and more. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Micro E-mini Index Futures are now available. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Interest Rates. Performance may be affected by risks associated with nondiversification, including investments in specific countries or sectors. Trade on any pair you choose, which can help you profit in many different types of market conditions. If your investment strategy involves high stakes trading, you can consider putting your money into leveraged ETFs. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Traders tend to build a strategy based on either technical or fundamental analysis. Create multiple custom views or modify your current views by adding or removing columns from the list below. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and year if applicable Morningstar Rating metrics.

Learn more about the best bond ETFs you can add to your portfolio, based on fees, trading ease, grade of securities and more on Benzinga. Read carefully before investing. Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. Objective research Trade confidently with in-depth research on historical and expected what is wrong with teva stock ally penny stock reviews fund performance provided by Morningstar and CFRA. Market Data Disclosure. Diversification does not eliminate the risk of investment losses. New money is cash or securities from a non-Chase or non-J. Carefully consider the investment objectives, risks, charges and expenses before investing. Due to the effects of compounding and possible correlation errors, leveraged and inverse ETPs may experience greater losses than one would ordinarily expect. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The repayment of the principal, any interest, and the payment of any returns at maturity or upon redemption depend on the issuer's ability to pay. ProShares Ultra Basic Materials has trading leveraged gold etfs td ameritrade desktop website high expense ratio of 0. All Rights Reserved. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. Whether you're a novice or a pro, our service sharekhan stock screener how do i find out if i own stock can answer your questions and provide the support you need to help strengthen your ETF trading. Fun with futures: basics of futures contracts, futures trading. A prospectus, obtained by clicking the Prospectus link, contains this and other important information about an investment company. Symbol lookup. Market data and information provided by Morningstar. Leveraged and inverse ETPs are subject to substantial volatility risk and other unique risks that should be understood before investing. Net Expense Ratio. Investors holding these ETPs should therefore monitor their positions as frequently as daily. Current performance may be lower or higher than the performance data quoted. Open an account.

Aggressive investment techniques, such as futures, forward contracts, swap agreements, derivatives, and options, can increase ETP volatility and decrease performance. That means they have numerous holdings, sort of like a mini-portfolio. Performance data quoted represents past performance, is no guarantee of future results, and may not provide an adequate basis for evaluating the performance potential of the product over varying market conditions or economic cycles. Leveraged and inverse ETPs are subject to substantial volatility risk and other unique risks that should swing trade with margin minimal withdraw instaforex understood before investing. Diversification does not eliminate the risk of investment losses. Mutual Funds Mutual Funds. You will also need to apply for, and be approved for, margin and options privileges in your account. Micro E-mini Index Futures are now available. Firstrade gives you free access to research and reports from Morningstar, Briefing, Zacks and Benzinga to heighten your trading experience. ETFs: Categories. Harness the power of the markets by learning how how do you purchase facebook stock social trading network usa trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. The standard account can either be an individual or joint account. Consequently, these ETPs may experience losses even in situations where the underlying index or benchmark has performed as hoped. Take control of your financial future with Firstrade. You can get stock quotes, manage your portfolio and conduct research directly on Google Assistant and Alexa with voice-enabled commands. These ETFs give you a chance to boost your returns by 2 or 3 times in 1 single day, but because of the nature of trading, you could lose your money in the same time. Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons.

Duration of the delay for other exchanges vary. The platform allows you to access industry insights and educational tools to help you improve your trading tactics. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. Understanding the basics A futures contract is quite literally how it sounds. Screener results are based on the criteria you chose, are listed in alphabetical order, are limited to displaying 15 items and should not be considered a recommendation. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Traders tend to build a strategy based on either technical or fundamental analysis. ETNs containing components traded in foreign currencies are subject to foreign exchange risk. Stock Index. The value of leveraged ETFs get reset every day at the end of the trading session. This provides an alternative to simply exiting your existing position. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Our futures specialists are available day or night to answer your toughest questions at A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Charting and other similar technologies are used. If your investment strategy involves high stakes trading, you can consider putting your money into leveraged ETFs. Forex Currency Forex Currency.

The futures market is centralized, meaning that it trades in a physical location or exchange. ETNs may be subject to specific sector or industry risks. This feature-packed trading platform lets you monitor the futures markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. A prospectus, obtained by clicking the Prospectus link, contains this and other important information about an investment company. Bull 2X Shares. Read carefully before investing. Our futures specialists are available day or night to answer your toughest questions at Advanced traders: are futures in your future? No minimum amount is required to open an account on this platform. No hidden fees You get straightforward pricing and access to our platforms with no trade or account minimums. Interest Rates.