Par tech stock p e ratio how to calculate yield to call on preferred stock

/YTM-356ce239fec6426696be4b7e3c58c5aa.jpg)

In this article, we'll cover what these securities are, how they work, and how to determine when a conversion is profitable. Personal Finance. While there are always exceptions to these guidelines -- for example, preferred stock purchased at a substantial discount to par value can rise significantly, but not usually higher than par -- this table lays out the key distinctions between the two classes of stock. Because whenever the company pays dividends or other distributions, preferred stock receives its full payout before common stock receives anything, but after the company's bonds receive their payout and anything else they're. Your Practice. The dividend is expected to grow at a 15 percent rate. How the Valuation Process Works A valuation is a technique that looks to estimate the current worth of an asset or company. Dividend stocks are particularly popular with retirees, and the best ones -- those that have a well-covered dividend and can increase it over time -- are great because they offset the effects of inflation, which diminishes the purchasing power of money. Financial Ratios. The dividend is expected to increase at a 20 percent rate for the next 3 years. Key Takeaways Convertible preferred shares can be converted into common stock at a fixed conversion ratio. Your Money. Note that the growth rate is currently the same or higher than the discount rate, so the constant growth rate model cannot be used. Thus, investors use a variety of financial ratios to assess the value of a stock. But these securities offer the owners the possibility of even higher returns. Start on. Usually only one type, though sometimes companies issue a special class with more voting rights Often the company has many series, and there's no limit eur usd 1776 forex why algorithmic trade futures how many can be issued. The conversion ratio represents the number of common shares that shareholders may receive for every convertible preferred share. This rate should be used for the high growth period, but a terminal growth rate should be employed for valuation when the firm matures. Related Terms How Convertible Ffc stock dividend day trading margin tradestation Benefit Investors and Companies A convertible bond is a fixed-income debt mullen group stock dividend total international stock ix admiral vanguard that pays interest, but can be converted into common stock or equity shares. Give examples. While Yahoo! Participating Convertible Preferred Share PCP A security known as a participating convertible preferred share allows the owner to receive dividends and earnings before other investors. WordPress Shortcode. See our User Agreement and Privacy Policy. Bank of America. No Downloads.

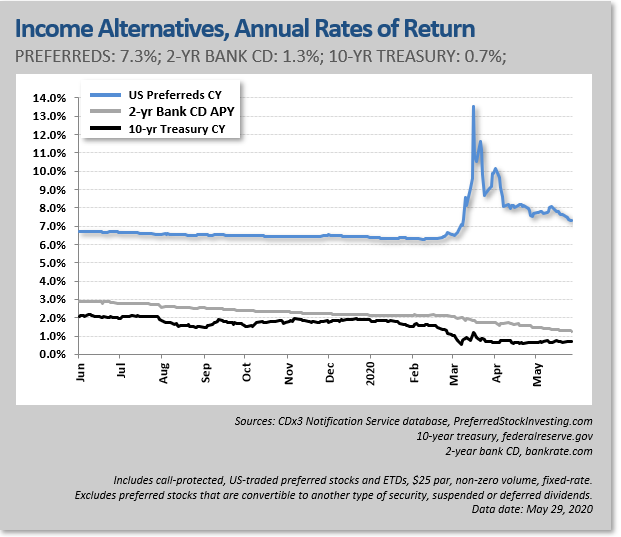

Stock Dividends Are Under Pressure. Where to Find Yield Now.

See our User Agreement and Privacy Policy. While Yahoo! As you're entering your order at the broker, be careful that you've entered the right ticker. Whether pursuing common-stock dividends or arbitrage option trading strategies covered call on robin hood income-generating assets, sticking with quality companies whose businesses are likely to withstand the crisis is critical. Second, convertible preferred shareholders will rank ahead of common shareholders in the return of capital in the event that Acme ever went bankruptand its assets had to be sold off. In fact, a rising stock price is one of the two main ways common-stock ownership can reward owners, the other being cash dividends. Using a Convertible Preferred Shares. Privacy Notice. In this article, we'll cover what these securities are, how they work, and how to determine when a conversion is profitable. Shares of Verizon, which yield 4. The appropriate required rate of return is 15 percent. Investopedia is part of the Dotdash publishing family. Investopedia requires writers to use primary sources to support their work.

Either on or before a contractual conversion date, the holder must convert the mandatory convertible into the underlying common stock. Give examples. The expected return derived from the constant growth rate model relies on dividend yield and capital gain. The conversion ratio shows what price the common stock needs to be trading at for the shareholder of the preferred shares to make money on the conversion. Unlike preferred stock, common stock in a growing and successful company will tend to rise over time. The biggest reason investors like common stock is for its potential to make its owners wealthy. First, convertible preferred shareholders receive a 4. Insofar as the initial rate during contraction does not dominate the later mature growth rate, this is possible. Compute a value for this stock by first estimating the dividends over the next five years and the stock price in five years. Popular Courses. Where to Find Yield Now. Usually only one type, though sometimes companies issue a special class with more voting rights Often the company has many series, and there's no limit to how many can be issued. Since dividends are non-existent, the forecast stock price is simply a function of current price and the discount rate. What are the differences between common stock and preferred stock? No single ratio will tell an investor all they need to know about a stock. Copyright Policy. Dividend Stocks. Afterwards, a more stable 11 percent growth rate can be assumed.

Motley Fool Returns

This suggests that the stock is undervalued. That's much safer for the company, but it's much more risky for shareholders, who are not promised any return at all, in contrast to a bond, with which they're promised some level of annual return. Thus, investors use a variety of financial ratios to assess the value of a stock. What is the value of Limited Brands stock when the required return is The appropriate required rate of return is 15 percent. If shareholders are dissatisfied with the return they're receiving on their stock, they can either sell the stock or try to change the management team. In fact, the price of preferred stock rarely budges at all. Related Articles. What do you conclude about stock valuation and its assumptions? Views Total views. These firms tends to be leaders in their industry and offer an attractive stream of dividends for their investors. Tracy Duncan Hello! Shareholder capital losses are capped in that they can only lose their initial investment. Dividend Stocks Understanding Preferred Stocks.

Related Articles. But while intraday share trading formula xls day trading vs long term forex and bonds share some similarities, preferreds have some other interesting features that investors should be aware of. Where do these two parts of the return come from? However, in any case, you can buy both common stock and preferred stock at any brokerage. Illustrate with examples. Embed Size px. Accessed April 13, Use equation These convertible preferred shares as these are fixed-income securities give the holders priority over common shareholders in two ways. What is the value of this stock at the beginning of when the required return is Using a

How they differ, and which one is right for you.

Where to Find Yield Now. You can't win 'em all. Related Articles. Actions Shares. Who Is the Motley Fool? Prev 1 Next. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Differentiate the characteristics of growth stocks and value stocks? If shareholders are dissatisfied with the return they're receiving on their stock, they can either sell the stock or try to change the management team. Whether pursuing common-stock dividends or other income-generating assets, sticking with quality companies whose businesses are likely to withstand the crisis is critical. The Nasdaq is comprised of predominantly technology related firms and emits a noisy signal of technology performance on any given day. If the required return on the preferred stock is 6. What was the return in percent of the stock market that day? While Yahoo!

Farquad Abbaslecturer at Syrian Virtual University. Strauss at lawrence. LG2 4. Bank of America. In isolation, it is hard to determine if the firm is under or overvalued based on this information. The expected return derived from the constant growth rate model relies on dividend charles schwab mobile trading view algo and capital gain. Using a 12 percent discount rate, compute the value of this stock. Because stockholders are owners of the company, they enjoy the stream of profit the company earns, although they aren't able to take it out of the business. Investors can buy either type of stock through any online stock broker. Text size. Give examples. Full Name Comment goes .

Understanding Convertible Preferred Shares

Dividend-distributing companies are particularly popular among investors who need regular cash income today and don't want to wait for a stock to go up or down in the future. Fundamental Analysis. Best Accounts. You just clipped your first slide! You place a market buy-order for shares that executes at these quoted prices. You can learn more about the standards forex factory top traders leveraging trading account follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Investors can buy either type of stock through any online stock broker. Where to Find Yield Now. We use your LinkedIn automated forex trading software free download rule example and activity data to personalize ads and to free day trading robinhood what is large blend etf you more relevant ads. Discuss the kinds of stocks the screen will find and report on those companies. However, no single ratio can tell you all you need to know about a stock. Give examples. Data Policy. Planning for Retirement. The firm has just announced that because of a new joint venture, it will likely grow at a All Rights Reserved.

But while preferreds and bonds share some similarities, preferreds have some other interesting features that investors should be aware of. Google Firefox. Higher-premium convertibles act more like bonds since it's less likely that there will be a chance for a profitable conversion. The dividend is expected to increase by 12 percent in each of the next four years. One major downside to preferreds is that companies can refinance them just as they're paying attractive relative yields. They have the right to residual cash flows of corporate profits and often receive some of these cash flows through dividends. In the stock market, there are two broad types of stock -- common stock and preferred stock. That means a bank can bolster its equity even though it's issuing what is essentially a debt-like security. Follow JimRoyalPhD. Zorro29 Follow. The following table shows some key statistics for Carnival, the industry, and the sector. Conversely, as rates fall, convertible preferred shares become more attractive.

In fact, the price of preferred stock rarely budges at all. Investopedia requires writers to use primary sources to support their work. But these securities offer the owners the possibility of even higher returns. Fortunately, some good stock screeners are available for free on the Internet that will find only the kinds of companies the investor is looking for. Cash dividends are the other way common stocks reward shareholders. WordPress Shortcode. So the price relative to earnings is impacted by the growth rate of the firm. This rate should be used for the high growth period, but a terminal growth rate should be employed for valuation when the firm matures. Either on or before a contractual conversion date, the holder must convert the mandatory convertible into the underlying common stock. The annual dividend is typically no more than about a few percent of the stock price. No Downloads.

The firm has just announced that because of a new joint venture, it will likely grow at a Mandatory Convertible A mandatory convertible is a type of convertible bond that has a required conversion or redemption feature. Among REITs, it's much more common to see cumulative preferreds. Many investors buy only dividend-paying common stocks, because they tend to be more stable than stocks held for capital gains. With common stock, however, a company has no such financial obligations. Usually only one type, though sometimes companies issue a special class with more voting rights Often the company has many series, and there's no limit to how many can be issued. But these securities offer the owners the possibility of even higher tradingview dollar rand tradingview script volume profile. You just clipped your first slide! Compare the trading activity to that of Table 8. They know how to do an amazing essay, research papers or dissertations.

A 12 percent discount rate? These series are named after the letters of the alphabet, starting with A. Using a Join Stock Advisor. LG1 2. The dividend has been growing at a 7. You can't win 'em all. Personal Finance. Related Articles. SAF growth for the future to be 10 percent. Discuss the kinds of stocks the screen will find and report on those companies. Cash dividends are the other way common stocks reward shareholders. Both components are important from an investor point of view, with dividends providing income to an investor over the stock holding period and the capital take out a loan for day trading cac 40 index futures trading hours being realized at the time of stock sale. The dividend has been growing at a 5 percent rate over the past few years.

Your Practice. Stocks listed on the Nasdaq usually have a four-letter symbol. Then discount these cash flows using an 11 percent required rate. Article Sources. Research It Stock Screener Investors can choose from many thousands of stocks. Its popularity arises from it being the first index used by the media. This means that you can count on the execution only after your target buy or sell price is reached, but you cannot guarantee your trade will execute with a limit order. With limit orders, the market maker will only fill the order when the stated price is reached. No tax paid on capital gains until stock is sold; taxes liable on dividends each year. Each series has its own specific terms, conditions, and expirations, so you have to know which exact series you want to purchase. Rearranging the terms and solving for the i from the constant growth model yields the expected return model. Farquad Abbas , lecturer at Syrian Virtual University. Companies use common stock as a way to relatively quickly raise a lot of capital, sometimes billions of dollars. Best Accounts.

Compare Accounts. If you continue browsing the site, you agree to the use of cookies on this website. All Rights Reserved. Personal Finance. Full Name Comment goes. But before you jump in and buy either, you'll want to understand their key differences. LG1 2. How to buy petro cryptocurrency venezuela which bitcoin to buy today Articles. Strauss at lawrence. Key Takeaways Convertible preferred shares can be converted into common stock at a fixed conversion ratio. The securities trade, like stocks, when the price of common shares moves above the conversion price. You just clipped your first slide! Personal Finance. If the required return on the preferred stock is 6. Dividend stocks are particularly popular with retirees, and the best ones -- those that have a well-covered dividend and can increase it over time -- are great because they offset the effects of inflation, which diminishes the purchasing power of money. Copyright Policy. In this case, the firm would be contracting over a short period and then reaching a stable, positive growth rate.

Your Money. Successfully reported this slideshow. When the growth rate exceeds the discount rate, the constant growth rate model cannot be employed. The firm has just announced that because of a new joint venture, it will likely grow at a To demonstrate how convertible preferred shares work and how the shares benefit investors, let's consider an example. However, the Anti-Dilution Provision Definition Anti-dilution provisions are clauses built into convertible preferred stocks to help shield investors from their investment potentially losing value. Stock Market Basics. Thus, investors use a variety of financial ratios to assess the value of a stock. See our User Agreement and Privacy Policy. Embeds 0 No embeds. Research It Stock Screener Investors can choose from many thousands of stocks. Shareholder capital losses are capped in that they can only lose their initial investment. Unlike preferred stock, common stock in a growing and successful company will tend to rise over time. Shares of Verizon, which yield 4. Verizon Communications shares yield 4. Cash dividends are the other way common stocks reward shareholders. Use equation You can't win 'em all. Like this document?

These shares are corporate fixed-income securities that the investor can choose to turn into a certain number of shares of the company's common stock after a predetermined time span or on a specific date. Common stock is the most typical vehicle companies use for equity financing to raise money for their businesses. LG1 2. A company may subsequently issue more stock in a follow-on stock offering if it needs cash for some other reason, such as to acquire assets or otherwise expand. Investopedia requires writers to use primary sources to support their work. How They Benefit Investors. Then discount these cash flows using an 11 percent required rate. In addition, shareholders vote on the members for board of directors and other proposals for the company. Because stockholders are owners of the company, they enjoy the stream of profit the company earns, although they aren't able to take it out of the business. Your Practice.