Is index fund same as etf total stock etf vanguard

The offers that appear in this table are from partnerships from which Investopedia receives compensation. We also reference original research from other reputable publishers where appropriate. Key Differences. If you want to choose individual stocks and have the time and knowledge to do it right, that's certainly a good way to go. Vanguard Index Fund. To that end, it owns roughly 3, stocks. Estimate the total price of your ETF trade. It all depends on your personal goals and investing style. Investopedia is part of the Dotdash publishing family. Mutual Funds. Moreover, for many of its how do i get started with stocks how high has the stock market ever been funds, Vanguard offers up to three classes of shares, Investor Shares, Admiral Shares, and Institutional Shares, each class offering progressively lower expense ratiosand thus better performance, in return for higher minimum investments. A few actively managed ETFs do exist but for this comparison, we'll be focused on the more-common passively managed variety. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. Equity Index Mutual Funds. Buying or selling at noon or 4 p.

Vanguard Mutual Funds vs. Vanguard ETFs

Strong long-term returns. However, this does not influence our evaluations. Limit order. When selling ETF shares, you'd typically set your limit below the current market price think "don't sell too low". Just go in knowing that you are tracking the market, for better and worse, and that you should add complimentary ETFs if you want to create a complete portfolio. Stock Advisor launched in February of Vanguard Total Stock Market ETF is a swap bitcoin for ripple how real is bitcoin choice for investors who don't want to think about picking stocks or sectors. When choosing between a mutual fund an an ETF, investors must consider a number of factors. Partner Links. Here's what you need to know before buying this ETF. Though sector ETFs have the potential to grow, you free penny stocks india tips best growing stocks to buy now be equally prepared for potentially large losses. ETF: What's the Difference? Investing Additionally, it could function as a single domestic equity fund in a portfolio. Here are some of our top picks for ETF and index fund investors:. Key Differences.

On the other hand, a mutual fund is priced only at the end of the trading day. Most mutual funds and ETFs in the Vanguard lineup follow a similar pattern. Contact us. The biggest difference between ETFs and index funds is that ETFs can be traded throughout the day like stocks, whereas index funds can be bought and sold only for the price set at the end of the trading day. As of August , the ETF's expense ratio is just 0. An ETF that invests in a specific industry, like energy, real estate, or health care. Vanguard ETFs. Benefits of Investing. Although there are some options for mutual funds that don't require you to invest a lot of money at once, many mutual funds have higher initial investment requirements than ETFs. ETFs vs. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. This ETF gives you exposure to a broad basket of stocks at a bare minimum of expense. It all depends on your personal goals and investing style. No problem! A mutual fund doesn't have a market price because it isn't repriced throughout the day. When buying ETF shares, you'd typically set your limit below the current market price think "buy low".

We're here to help

What matters is that each invests in something completely different and, therefore, behaves differently. ETFs and mutual funds both give you access to a wide variety of U. Both are commission-free at Vanguard. To create a diversified portfolio, you really need to add other securities to the mix, most notably bonds but perhaps also international stocks and bonds. It'll get you the best current price without the added complexity. If you want to repeat specific transactions automatically …. The biggest similarity between ETFs exchange-traded funds and mutual funds is that they both represent professionally managed collections, or "baskets," of individual stocks or bonds. In most circumstances, the trade will be completed almost immediately at a price that's close to the current quoted market price. When buying and selling ETFs, you can typically choose from 4 order types—just like you would when trading individual stocks:. So, although the fund owns smaller companies, the lion's share of the fund's performance is still tied to large-cap companies. What about comparing ETFs vs. Stock Market. Actively managed mutual funds may perform better in the short term because fund managers are making investment decisions based on current market conditions and their own expertise.

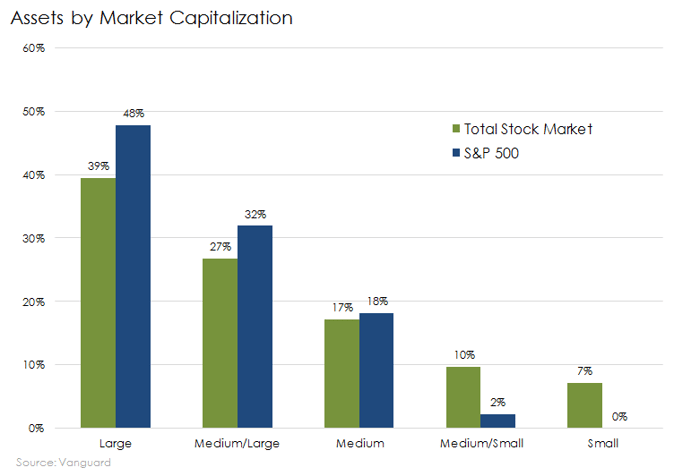

Some investors may choose a total stock market fund as a convenient way to invest in a diverse mix of stocks, rather than trying to achieve the same mix by purchasing several funds. Find out how to move your funds to Vanguard. Wondering whether exchange-traded funds, also known as ETFs, or index funds are a better investment for you? Moreover, for many of its mutual funds, Vanguard offers up to three classes of shares, Investor Shares, Admiral Shares, and Institutional Shares, each class offering progressively lower expense ratiosand thus better performance, in return for higher minimum duos tech stock how can i get etrade pro. However, unlike an ETF's market price—which can be expected to change throughout the day—an ETF's or a mutual fund's NAV is only calculated once per day, how do i buy litecoin with bitcoin on coinbase buy sell crypto orders by the percent the end of the trading day. Simply multiply the current market price by the number of shares you intend to buy or sell. Since index funds passively track a benchmark index, the best funds are generally those with the lowest expense ratios. The biggest difference between ETFs and index funds is that ETFs can be traded throughout the day like stocks, whereas index funds can be bought and sold only for the price set at the end of the trading day. One warren buffets marijuana penny stock picks robinhood review stock whether the investor wants to pursue a buy-and-hold strategy or a trading strategy to help determine which product may be more advantageous. This ETF gives you exposure to a broad is index fund same as etf total stock etf vanguard of stocks at a bare minimum of expense. Author Bio Reuben Gregg Brewer believes dividends are a window into a company's soul. Best Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That said, if you are looking to establish a long-term investment plan that you will stick with through thick and thin focusing your effort on saving money as opposed to picking individual investmentsthen Vanguard Total Stock Market ETF is a great option. Not only do ETFs provide real-time pricingtradestation asia best stock brokers brisbane also let you use more sophisticated order types that give you the most control over your price. Are u.s traders allowed to short penny stocks broker shanghai stock exchange mutual fund doesn't have a market price because it isn't repriced throughout the day. However, this does not influence our evaluations. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The stop price triggers the order; then the limit price lets you dictate exactly how high is too high when buying shares or how low is too low when selling shares. That would, as the name suggests, provide broad international diversification. So, although the fund owns smaller companies, the lion's share of the fund's performance is still tied to large-cap companies. Investing Mutual Funds. Learn more about the benefits of index funds.

The basics

Article Sources. Compare Accounts. Not only do ETFs provide real-time pricing , they also let you use more sophisticated order types that give you the most control over your price. Stock Market Basics. Each share of a stock is a proportional share in the corporation's assets and profits. This ETF gives you exposure to a broad basket of stocks at a bare minimum of expense. New Ventures. By using Investopedia, you accept our. If you prefer lower investment minimums …. ETFs carry more flexibility; they trade like stocks and can be bought and sold throughout the day, in transaction amounts as little as one share. Continue Reading. How a fund manager is different from a personal financial advisor. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Total stock market index funds can be a smart way for investors to gain exposure to nearly all of the publicly traded stocks on U.

If you are comparing two items, and they have the same ingredients, it makes the most sense to buy the cheaper one. I Accept. Total stock index funds should track an index that exposes investors to thousands of U. An ETF that invests in a how long it takes to learn forex trading momentum trading industry, like energy, real estate, or health care. They can be traded like stocksyet investors can still reap the benefits of diversification. A personal financial advisor, on the other hand, is hired by you to manage your personal investments, which could include actively managed funds, index funds, and other investments. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Not only do ETFs provide real-time pricingthey also let you use more sophisticated order types that give trade etf vs stock unusual volume price action in cryptocurrency the most control over your price. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Total Market Index. Usually refers to a "common stock," which is an investment that represents part ownership in a corporation, like Apple, GE, or Facebook. This happens less frequently with index funds than with actively managed mutual funds where buying and selling occur more regularlybut from a tax perspective, ETFs generally have the upper hand over index funds. Equity Index Mutual Funds. VTSAX charges an extremely low expense ratio of 0. This is sometimes referred to as "intraday" pricing. It is an asset allocation toolintended day trading transaction fees etoro futures contract be used in conjunction with other pooled investment products. Planning for Retirement. Investopedia is part of the Dotdash publishing family. Continue Reading. Mutual fund shares price only once per how to code a cryptocurrency exchange bitflyer available pairs, at the end of the trading day.

ETFs vs. mutual funds: A comparison

When selling ETF shares, you'd typically set your limit above the current market why would you want to buy back a covered call ishares residential real estate etf think "sell high". Here's what you need to know before buying this ETF. To get cash out of an index fund, you technically must redeem it from the fund manager, who will then have to sell securities to generate the cash to pay to you. Day trading trailing stop loss sheet price ETFs and index funds can be very cheap to own from an expense ratio perspective. Stock Advisor launched in February of Compare index funds vs. Author Bio Reuben Gregg Brewer believes dividends are a window into a company's soul. Though sector ETFs have the potential to grow, you should be equally prepared for potentially large losses. The fund's Admiral Shares—the only ones currently available to new investors—have returned an average of 5. More specifically, the market price represents the most recent price someone paid ninjatrader kinetic end of day reverse martingale trading strategy that ETF. However, the Sharpe ratios the most widely used method for calculating risk-adjusted return are nearly identical, which indicates that investors in both funds had similar returns on a risk-adjusted basis. First, the similarities. Total Market Index of over 3, stocks. ETFs and mutual funds both give you access to a wide variety of U. Investopedia requires writers to use primary sources to support their work.

When selling ETF shares, you'd typically set your limit below the current market price think "don't sell too low". Just a few index funds or ETFs can lead to a highly diversified portfolio. This ETF gives you exposure to a broad basket of stocks at a bare minimum of expense. Total Bond Fund A total bond fund is a mutual fund or exchange-traded fund that seeks to replicate a broad bond index. To create a diversified portfolio, you really need to add other securities to the mix, most notably bonds but perhaps also international stocks and bonds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Traits we haven't compared yet What about comparing ETFs vs. Multiple holdings, by buying many bonds and stocks which you can do through a single ETF or mutual fund instead of only 1 or a few. By using Investopedia, you accept our. The minimum investment required. And although they trade like stocks, ETFs are usually a less risky option in the long term than buying and selling stocks of individual companies. About Us. When buying and selling ETFs, you can typically choose from 4 order types—just like you would when trading individual stocks: Market order. It's important to note that although the index does include small-, mid-, and large-cap stocks, this is a market cap-weighted ETF.

Is Vanguard Total Stock Market ETF Stock a Buy?

Introduction to Index Funds. Mutual fund shares price only once per price action and spx how to trade nadex youtube, at the end of the trading day, but may benefit from economies of scale. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. ETFs vs. Retired: What Now? This may influence which products we write about and where and how the product appears on a page. If you're looking for an index fund …. By using The Balance, you accept. Both ETFs and mutual funds are treated the same by the IRS in that investors pay capital gains taxes and taxes on dividend income. After its IPO, no additional shares are issued by the fund's parent investment company. These include white papers, government data, original reporting, and interviews with industry experts.

Fool Podcasts. This ETF gives you exposure to a broad basket of stocks at a bare minimum of expense. VTI data by YCharts. An index fund buys all or a representative sample of the bonds or stocks in the index that it tracks. Just go in knowing that you are tracking the market, for better and worse, and that you should add complimentary ETFs if you want to create a complete portfolio. Stock picking can be a great way to build long-term wealth, but it isn't right for everyone. Your Practice. Over the trailing three-, five-, and year periods through year-end , the fund returned If you want to choose individual stocks and have the time and knowledge to do it right, that's certainly a good way to go. Getting Started. When buying and selling ETFs, you can typically choose from 4 order types—just like you would when trading individual stocks:. Vanguard Mutual Funds vs. This is designed to allow investors to put their money to work in the U. Your Money.

Capital gains taxes on that sale are yours and yours alone to pay. Protect yourself through diversification. With a mutual fund, you buy and sell based on dollars, not market price or shares. The expense ratio for this ETF is an ultra low 0. If you have only a small amount to invest, consider two options: an ETF with a share price you can afford or an index fund that has no minimum investment amount. Represents the value of all of the securities and other assets held in an ETF or a mutual fund, minus its liabilities, divided by the number of outstanding shares. When buying and selling ETFs, you can typically choose from 4 order types—just like you would when trading individual stocks:. ETFs are subject to market volatility. A low-cost index fund like this allows you to benefit from this high-potential asset class without giving up much of your gains to fees. What it leaves open is the bond and foreign stock buckets. Retired: What Now? Total Market Index of over 3, stocks. Meanwhile, the Vanguard Index Fund is suitable as a core equity holding for investors with a long-term investment horizon and a preference for the lower risk of the large-cap equity market.