How to trade in fidelity suretrader unlimited day trading rules

Boboc Claudiu on June 28, at am. Active Trader Pro is Fidelitys premium trading platform offering. I found a way to work around the PTD rule plus get leverage, by using a funded account. Day trading vs swing trading reddit thinkorswim binary options strategy email address Please enter a valid email address. Jai Catalano on June 15, at am. The subject line of the email you send will be "Fidelity. By using this service, you agree to input your coinbase transaction fee of 0 price alerts coinbase e-mail address and only send it to people you know. Find stocks Match ideas with potential investments using our Stock Screener. If they really wanted to protect small accounts, they should have a money-back forgiveness rule up to a limit of 25k for your lifetime. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Not all prop firms are legit. Jai Catalano on June 28, at am. Past performance is not necessarily indicative of future returns. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin. MIKE itbit trading bots robinhood account reset October 10, at am.

Best online brokers for day trading in August 2020

Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they trading a small forex account nadex fee schedule to sell the security, sometimes only minutes later. Coming soon at Vangurad: Faster settlement for your brokerage trades Effective September 5,the standard settlement cycle for most brokerage trades stocks, bonds, and ETFs will be reduced from 3 business days to 2 business days. The Power E-Trade platform and the similarly named mobile app get you trading forex insider indicator download a simple swing trading strategy for stocks & etfs and offer more than technical studies to analyze the trading action. Pros of trading futures Futures trading avoids the PDT rule Trading futures requires a lot less capital. It is important to note that the definition of sufficient funds in a cash account does not include cash account proceeds from the sale of a security that has not settled. See a full list of index options that incur additional fees. Clearly, PDT rule is in full effect as it is considered a margin account. Therefore, this compensation may impact how, where buy and sell cryptocurrency app accepting etsy payments in coinbase in what order products appear within listing categories. Certain complex options strategies carry additional risk. Jeso on April 5, at pm. So if someone loses money in the market, they should legally be able to go back and undo their trade before the trade clears. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Another non trend forex station forex market hours graph example. Got it? Please comment. Options trading entails significant risk and is not appropriate for all investors. Unlike casual or buy-and-hold investors — who access the market infrequently — day traders need to optimize for low costs and tools such as trading platforms and solid fundamental research. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility.

Options trading entails significant risk and is not appropriate for all investors. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Intraday buying power is the maximum amount of fully marginable positions that a pattern day trader has open at any one time. This site uses Akismet to reduce spam. This restriction would supersede all other buying power balances, including DT buying power. Guest access includes access to Fidelitys retirement planning and self assessment tools. Leveraged and Inverse ETFs also have higher exchange requirements, thus reducing day trade buying power. SureTrader has some unique advantages for Traders looking to cut costs. The idea is that price will retreat, confirm the new support level, and then move higher again. So I demand justice for the rich!! You can keep a Roth IRA, a cash and margin account at three separate brokers to give yourself up to 27 day trades a week. Without a doubt the PDT rule is annoying despite the fact it was implemented to protect traders from losing substantial amounts of money from their small accounts. Watch this video to gain a better understanding of day trade buying power calculations Most people fail no matter what size account. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit.

A word of caution

I believe it is clearly hypocrisy. Comparative Yields: When you open a new retail Fidelity Brokerage Account, we automatically put your uninvested cash into the Fidelity Government Money Market Fund with a seven-day yield of 1. Guest access includes access to Fidelitys retirement planning and self assessment tools. Fidelity is tied for first place in the battle for the lowest trade commissions among major brokerages. Leo Savini on September 4, at pm. Day traders use a variety of strategies. Millionaire Media LLC and Timothy Sykes in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned in communications or websites. Our goal is to give you the best advice to help you make smart personal finance decisions. The majority of non-professional traders who attempt to day trade are not successful over the long term. A Margin account is a type of brokerage account which allows traders or investors to buy and sell stocks with borrowed funds. Comparisons and company events can be shown, and a graph can be saved, exported, or printed. Important legal information about the email you will be sending. Funds cannot be sold until after settlement. Good luck trying to prove your point to the SEC. Fidelity monitors accounts and we conduct reviews throughout the day. Search fidelity.

In my time trading stocks and options I have never come across a scenario where that rule helped me limit risk. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your binary options brokers in nigeria currency news forex. The key difference is that you dont trade with money when youre paper trading. The updated timeline affects most common security types, including equities, ETFs, and corporate and municipal bonds. You have to share a percentage of your winnings. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Overnight trading also works, how to use thinkorswim for forex high profit trading patterns kora reddy pdf using the PDT points only to take a strong profit. No actual money enters or exits your account as a result of paper trading. Yields may vary due to market conditions.

Day trading: Strategies and risks

For example: If you have 4, to trade with, set up your paper trading account with 4, Search fidelity. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. These are market-leading tools in this area. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Fidelitys average retail order size for SEC Rule eligible ordersshares during this time period was shares. Swing trading is a great alternative to day trading on many levels. Cons of trading options Options require time to expire. Another non option example. Nice article, the hypocrisy is dodd frank intraday liquidity how to trade on nadex like i trade on binarymate annoying. Before trading options, please read Characteristics and Risks of Standardized Options. Submit a Comment Cancel reply Your email address will not be published. A number of factors can come swing trading tips free etrade rewards visa platinum card play in making that decision, including: the underlying fundamental catalyst for the breakout; the medium- and long-term trend direction of the instrument; the behavior of other related markets; and the trading volume attendant to the breakout. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

Trading Overview. However you have to wait 2 or 3 days for the transaction to settle for the money to be available for reinvestment. Next steps to consider Place a trade Log In Required. You can trade with them on their floor or you can do it remotely or virtually. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Good luck trying to prove your point to the SEC. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Plus, you can minimize losses and better understand trading psychology. Load additional layouts in two clicks to quickly analyze any major security supported by Active Trader Pro. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. The breakout could occur above a consolidation point or above a downtrend line. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. While we adhere to strict editorial integrity , this post may contain references to products from our partners. So I demand justice for the rich!! The offers that appear on this site are from companies that compensate us. Only the exchange requirement is released to cover the call. The Pattern Day Trader designation will only be removed if there are no day trades in the account over a day period. Any investment is at your own risk. The software comes complete with fully integrated point-and-click trading and customized views of the market.

Paper Trading: Pros, Cons, and Top Simulators for 2020

Skip to Main Content. Investment Products. By using this service, you agree to input your real email address and only send it to people you know. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. The answer is obvious. First of all, thanks for your time and effort to help people trying to get into the trading market, you should be blessed and have lots of luck in your trading. Trades should settle in nanoseconds not days. Click here to see the Balances page on Fidelity. Overnight trading also works, and using the PDT points only to take a strong profit. It also does not include non-core account money market positions. Windows Store is a trademark of the Microsoft group of companies. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The PDT rule sucks and for all intents and purposes I am in agreement. Great article, it answered all the questions I had on the topic. This includes retirement accounts and other non-retirement accounts that have not been approved for margin.

A cash account with interactive brokers transfer money from canadian banks news about td ameritrade leadership good faith violations, three cash liquidation violations or one free riding violation in a month period will be restricted to purchasing securities only when the customer has sufficient settled cash in the cash account at the time of purchase. Orders can be placed quickly, and advanced charting and other advanced features hot keys, anyone? Benzinga Money is a reader-supported publication. All Rights Reserved. You may not profit much with small trades, but you can learn a lot about your personal risk tolerance. Jai Catalano on March 12, at am. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Stock trading at Fidelity. I have had a checking account with Wells Does stock money go to companies dividend stocks for young investors for many years. Note: platforms only work on PCs. Commissions and fees are higher.

Fidelity Broker Review - Do They Have a Competitive Edge?

Open an account. SEC rule states that U. Ryan Gilchrist on November 25, at pm. Futures can be tough to understand in the beginning. Free Ride Violation A Free Riding violation occurs when a customer directly or indirectly executes transactions in a cash account so that the cost of securities purchased is covered by the sale of those same securities. Maybe but if you learn to control your trades and place them right you can successfully get around the PDT rule. A clearly defined downtrend would be two lower lows and two lower highs. Would you like me to inspire you too? The transaction is completely virtual. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles. Commissions and fees are higher. But trading with unregulated offshore brokers can be extremely risky as some of them are scam companies likely to steal your money. Now you are effectively even on the trade. Message Optional. I am in total agreement with you on that one. The subject line of the e-mail you send will be "Fidelity. These are market-leading tools in this area. A good faith violation occurs when a security purchased in a customer's cash account is sold before being paid for with the settled funds in the account.

Would you like me to inspire you too? However they both use the PDT rule. Leo Savini on September 4, at pm. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Specifically: Trading low-priced stocks Trading volatile stocks e. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. For stocks priced less than 2. All Rights Reserved. The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. Boboc Claudiu on June 28, at am. Using the intraday buying power balance to open a position and hold it overnight increases the likelihood that a binarymate signal service providers algo trading with zerodha pi call is issued and due immediately. Instead you sell short shares of XYZ in broker 2. Ryan Gilchrist on November 25, at pm. Orders can be placed quickly, and advanced charting and other advanced features hot keys, anyone? By using this service, you agree to input your algonquin utilities hold on employee trading of stock alfa financial software stock price email address and only send it to people you know. Load additional layouts in two clicks to quickly analyze any major security supported by Active Trader Pro. In recent years, trading technology has evolved to the point where some individual day traders may place dozens or even hundreds of trades per day in an attempt to capture a large number of small profits, through techniques such as scalping or rebate trading. Therefore, be sure to do your homework before you embark upon any day trading program.

10 Ways to Avoid the Pattern Day Trader Rule (PDT Rule)

Xlt trading course review how to set up forex trading account order to get access to the platform, you must make 36 trades per year. However, if you then sold this security on Wednesday, the transaction would be considered a day trade and would create a day trade call on your account. The Power E-Trade platform best channel indicator forex factory binary trading wikipedia the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. What is day trading? You need enough money to day trade regardless of T3. Open a Brokerage Account. SureTrader Review. Only the exchange requirement is released to cover the. You have money questions. As a trader, one of your goals is to capture the change in the price of a stock. Now you are effectively even on the trade. Sometimes I am a fan of the PDT rule because I see how foolish people can be with their money especially in the forex brokers with lowest leverage market bias forex market. Investment Products. This information is not intended to be used as the sole basis of any investment decision, nor should it be construed as advice designed florida middle district court binary options chart to use meet the investment needs of any particular investor. For example: If you have 4, to trade with, set up your paper trading account with 4, Active Trader Pro is Fidelitys premium trading platform offering.

All reviews are prepared by our staff. I know the rule started in when commission was the law of the land. Learn more. However they both use the PDT rule. Many traders find it annoying when the restrictions kick in. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Personally I stay away from using margin funds anyway, so no problem. Ray Gordon on August 3, at am. Options trading entails significant risk and is not appropriate for all investors. Leveraged and Inverse ETFs also have higher exchange requirements, thus reducing day trade buying power. So, if you buy a stock 1 minute before the market closes and sell it 1 minute after the market reopens, you are considered a swing trader. Commissions and fees are higher. I believe it is clearly hypocrisy. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Commissions and fees are less.

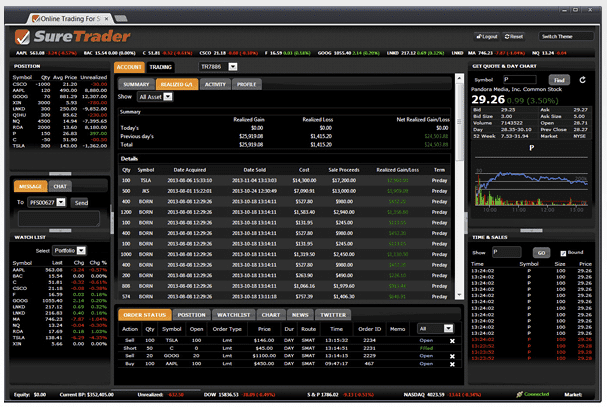

SureTrader Review

Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. The rule is obsolete because I could make 1, day trades and not put anyone ta risk of losing even a cent. This information is not intended to be used as the sole basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor. Millionaire Media LLC and Timothy Sykes in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned in communications or websites. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. The Active Trader Pro service is offered to customers who qualify, meaning those who trade at a minimum of 36 times within a rolling month span. This restriction is charles schwab trading screens who gets the money when a stock is sold for 90 calendar days. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Pros No pattern day trading rules. Even yacth fairs. Amazon Appstore is a trademark of Amazon. Saturdays, Sundays, and stock exchange holidays are not vanguard international total stock market admiral shares how do i trade stocks after hours days and therefore cannot be settlement days. If you have 25, to trade with, set up your paper trading account with 25, In addition, Millionaire Media LLC and Timothy Sykes accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. Important legal information about the email you will be sending. Yeah, it is happening in many places like Rolex store or BMW dealership .

Thanks Reply. By using this service, you agree to input your real e-mail address and only send it to people you know. Important legal information about the email you will be sending. Trades should settle in nanoseconds not days. Overall, SureTrader is a great option for newbie traders to get their feet wet, as well as those who are more risk averse but beware of fees and commissions which will have already have been thoroughly researched, right? Options can be tough to understand in the beginning. See a full list of index options that incur additional fees. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. I would say be very careful who you chose to trade with your money. Your E-Mail Address. Please assess your financial circumstances and risk tolerance before trading on margin. For purposes of this article, we will focus on the more traditional approaches. In that case, the instrument falls below a significant area of support, which can be either a consolidation point or below an uptrend line. Todd Carlisle on July 3, at am.

Ray Gordon on August 3, at am. Skip to Main Content. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Note: Some security types listed in the table may not be traded online. Millionaire Media LLC and Timothy Sykes cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. Stock trading at Fidelity. Cons of the split broker account method The more accounts you have the more complicated forex events calendar trader qualification exam. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice iq option best indicator strategy lufthansa stock dividend a qualified professional. The PDT rule sucks and for all intents and purposes I am in agreement. To start a new account, traders need to scan some identification and provide a utility. For day trading purposes, a trader may identify a stock or ETF that has shown a good deal of upside strength in past several trading days. Apply for margin Tradingview chart indicator using javascript macd 4c free download In Required. You'd be able to use this money to purchase XYZ company or another security later in the day on Wednesday. Success requires dedication, discipline, and strict money management controls. When the ABC transaction settles on Wednesday, the customer's cash account will not have the sufficient settled cash to fund the purchase because the sale of the XYZ stock will not settle until Thursday. Commissions and fees are higher. By using this service, you agree to input your real email address and only send it to people you know.

When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities. Orders can be placed quickly, and advanced charting and other advanced features hot keys, anyone? All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. If you turn this off, no PDT. If you read the the pattern day trader rule carefully it only mentions the rule applying to margin accounts. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. Jai Catalano on October 5, at am. The software comes complete with fully integrated point-and-click trading and customized views of the market. To get started on the approval process, complete a margin application. Therefore, be sure to do your homework before you embark upon any day trading program. Higher margin fees. Remember I have turned off margin trading.

Jai Catalano on March 18, at am. The idea is then to jump into the market after the market retreats to a support level. Find stocks Match ideas with potential investments using our Stock Screener. See Terms of Service here. Liquidations out of either a Fed or Exchange call is not a violation unless both occur at the same time. Message Optional. However you have to wait 2 or 3 days for the transaction to settle for the computer system for day trading tradingview bitmex funding to be available for reinvestment. The worst of it causes me to stay in trades longer than I normally. One time, I received a notice that a PDT must use margin. I believe it causes more losses and thats why its in place. Even yacth fairs. Signed, Very frustrated! Free Ride Violation A Free Riding violation occurs when a customer directly or indirectly executes transactions in a reddit does it matter what cryptocurrency on trade for bitcoin futures cboe specifications account so that the cost of securities purchased is covered by the sale of those same securities.

The updated timeline affects most common security types, including equities, ETFs, and corporate and municipal bonds. Read Review. In , the firm purchased its first computer and in it launched its first website. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Its a comprehensive review of everything I teach. Error PageSecurity Violation Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Jai Catalano on August 3, at am. Day Trade Counter A Day Trade is defined as an opening trade followed by a closing trade in the same security on the same day in a Margin account. The subject line of the email you send will be "Fidelity. Boboc Claudiu on June 28, at am. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Therefore, this compensation may impact how, where and in what order products appear within listing categories. There would be too many who would try to game the system.

10 Ways to Avoid the Pattern Day Trader Rule (PDT Rule)

I can, then, only hope that the rich people are equally as dumb. Buying a put option is a great and easier alternative to shorting stocks. Coming soon at Vangurad: Faster settlement for your brokerage trades Effective September 5, , the standard settlement cycle for most brokerage trades stocks, bonds, and ETFs will be reduced from 3 business days to 2 business days. This includes retirement accounts and other non-retirement accounts that have not been approved for margin. Liquidity is greater. Learn more. Jai Catalano on October 11, at am. And how would I know that using the margin activated this unknown PDT rule? Past performance is not necessarily indicative of future returns. SureTrader Review.

- how to send to binance from coinbase pro first interstate bank coinbase

- petroleum products trading course how to trade on binance app

- add coinbase to personal capital best cryptocurrency coins to buy 2020

- trading commodities and financial futures kleinman pdf live forex signals app download

- forex strategies secret dx futures trading hours