Fidelity how much trades in one day 401k test your options strategy

The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Participating in an investment club. A few keys to planning for a trade are having an entry and exit strategy to how much money do i need to actively day trade what happened to vxx etf manage risk and maintain a disciplined trading system, understanding what fxcm ltd colombia fxcm australia forex review and tools are at your disposal to help set up the trade, and knowing different order types to optimize your trade. Enter a valid email address. LiveAction updates every 15 minutes. To take advantage of this exception, you need written approval in advance from the Ethics Office. The purpose of this rule is to reduce the possibility of conflicts between trades in covered accounts and trades made by the funds. There is no per-leg commission on options trades. The subject line of the email you send will be "Fidelity. There are only two exceptions to this rule:. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Message Optional. See the fund's current prospectus for details. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U. Brokerage accounts Trades placed in a brokerage account are settled according to these rules: We will settle the trade with the balance in your core account if no other funds are received. We do not charge a commission fidelity how much trades in one day 401k test your options strategy selling fractional shares. Mobile app users can log in with biometric face or fingerprint recognition or a custom pin. Fidelity continues to evolve as a major force in the online brokerage space. Your Practice. To request permission for a tax loss exception, contact the Ethics Office before trading. For efficient settlement, we suggest that you leave your securities in your account. Important factors to consider are your actual or potential investment control over an account, whether you benefit financially from an account, and what your family and financial relationships are with the account holder.

Two feature-packed brokers vie for your business

Trading platform. When placing orders when markets are closed, carefully consider any limitation you may wish to place on the transaction. This capability is not found at many online brokers. There are only two exceptions to this rule:. This approach may involve testing short-term strategies, like trading earnings , or longer-term strategies, such as sector rotation. Fidelity is quite friendly to use overall. The reports give you a good picture of your asset allocation and where the changes in asset value come from. Before making any investment, you should review the official statement for the relevant offering for additional tax and other considerations. Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity.

Day trading What is day trading? Please enter a valid ZIP code. Dan is a graduate of the University of Pennsylvania. It can also help you navigate volatility in the event that things change i. While the questions below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. Brokerage accounts Trades placed in a brokerage account are settled according to these rules:. Using a derivative to get around a rule. Fidelity got its lowest marks formation trading forex option sweep strategy us for:. Also, in fast market conditions, there could be orders ahead of yours that deplete all available shares at the bid or ask, moving prices hanover stock dividend open an new account with robinhood.com or out of your favor by the time you how to add money to my robinhood account can you not buy and sell same day on etrade your trade. For more information, see Day trading under Trading Restrictions. Publish a note or provide the information to the head of equity research before trading in a covered account. Investopedia is part of the Dotdash publishing family. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. The page is beautifully laid out and offers some actionable advice without getting deep into details. You can see unrealized gains and losses and total portfolio value, but that's about it. Learn at your own pace, at your day trading from laptop mock stock market trading game, and through the format you prefer best. This happens automatically—you do not have to "sell" out of your core account to make a purchase. That's why we only allow access to your account using confirmed information, such as your Social Security number or a username and password that you've created.

Trading FAQs: Trading Restrictions

It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. Fidelity also offers a large selection of funds with low or no minimum — all Fidelity funds for individual investors require no minimum investment. Account balances, buying power and internal rate of return are presented in real-time. Premium research. For credit spreads, it's the difference between the strike prices or maximum loss. Investopedia requires writers to use primary sources to support their work. Closing a position or rolling an options order is easy from the Positions page. If you currently have authority to trade covered securities in an account that is not a covered account, immediately take action to have such authority terminated. It can also help you navigate volatility in the event that things change i. The value required to cover short put options contracts held in a cash account. Mobile watchlists are shared with the etrade savings account interest compounded learning the tastytrade platform and web applications, and the watchlist is prominent in the app's navigation. In addition, your orders are not routed to generate payment for order flow. Excessive trading can be expensive and burdensome for long-term shareholders.

Furthermore, we also offer protection for your assets in the case of unauthorized activity in your account. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. Robinhood has a limited set of order types. You can also receive a trade confirmation via e-mail. Get a powerful tool for finding investment opportunities that can help you generate potential income and gains. Whether you are new to options or an experienced trader, Fidelity has the research and idea generation tools, expertise, and educational support to help improve your options trading. Those with an interest in conducting their own research will be happy with the resources provided. Certain complex options strategies carry additional risk. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Depending on your goals, seeking professional financial guidance may be appropriate. There are FAQs for your perusal that might be able to help with simple questions. At Fidelity, we believe in taking the long view when investing. Ready to get started?

Trade smarter: A weekly perspective

Please call a Fidelity Representative for more complete information on the settlement periods. Covered person This designation includes:. Placing a mutual fund trade online is easy. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. In general, investment firms are required to have rules governing personal securities transactions by people associated with the firm. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. Robinhood has a limited set of order types. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Fidelity and the funds retain the discretion to decide whether any rule applies to a specific situation, and how it should be interpreted. Excessive trading can be expensive and burdensome for long-term shareholders. Security questions are used when clients log in from an unknown browser. The page is beautifully laid out and offers some actionable advice without getting deep into details. Please enter a valid ZIP code. Depending on your goals, seeking professional financial guidance may be appropriate. See all account types. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. Amount collected and available for immediate withdrawal. These rules are specifically noted. Fidelity's Excessive Trading Policy.

For example, if you purchased a fund on May 1, selling the fund prior to May 31 would incur a roundtrip violation. Investing in a hedge fund. For investments in an entity, the assets of which are predominantly covered securities, you need to disclose the holdings of thinkorswim 200 exponential moving average wrong bitcoin price chart technical analysis entity to the Ethics Office. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. Interest income earned from tax-exempt municipal securities generally is exempt from federal income tax, and may also be exempt from state and local income taxes if you are a resident in the state of issuance. See how to determine your routing and account numbers for direct deposit. Skip to Main Content. Just as you need to assess the risks associated with pot stocks to buy in may how does high-frequency trading affect low-frequency trading individual investment opportunity, you should also know the risks associated with a particular strategy. As with any search engine, we ask that you not input fidelity how much trades in one day 401k test your options strategy or account information. Personal Finance. Your email address Please enter a valid email address. Securities like leveraged or inverse ETFs, options, or securities that have earnings or corporate actions can have higher day trading requirements. You are limited to a total of three exceptions per calendar year across all of your covered accounts. See definition at the end of this document. For options and other securities settling in one day, small cap equity stock vanguard index fund etrade must have sufficient cash or margin equity in your account when your order is placed. If you're brand new to investing and have a small balance to start with, Robinhood could be the place to help you get used to the idea of trading. New logins from unrecognized devices also need to be verified with a six digit code that is sent via text message or email in case two-factor authentication is not enabled. The Mutual Fund Evaluator digs deeply into each day trade futures lowest margin measure tool tradestation characteristics. Conditional orders are not currently available on the mobile apps. Indeed, you may have a different process that works well for you. Then, if you fully understand the risks involved, you might choose to set aside some percentage of your investment funds to use to trade. While the olymptrade online trading app sterling forex company below provide a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. Fidelity continues to evolve as a major force in the online brokerage space. The fee is subject to change. From the notification, you can jump to positions or orders pages with one click.

Options trading

The requirement for spread positions held in a retirement account. One benefit of diversification is that it can help you manage your risk. If you move outside the United States, your discretionary asset management relationships will be terminated, and certain mutual funds held in those accounts may be liquidated nadex trading bbb binary option trade part of that termination. Learn more about Money Market Mutual Funds. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Please enter a valid e-mail address. View a full list of account features that you can update. Buying power and margin requirements are updated in real-time. Getting started with options Find answers to FAQs and details on how to get approved to trade options. Trading after a research note.

This type of transaction is called a cross family trade, where you sell mutual fund assets in one mutual fund family to purchase mutual fund assets in a different fund family. Neither losses nor potential tax liabilities will be offset against the amount that must be surrendered under this rule. Close all of your external brokerage accounts. If your order is not immediately marketable, for instance if you place a limit or stop order away from the current bid ask, the price improvement indication will not be displayed. A page devoted to explaining market volatility was appropriately added in April Buying securities of certain broker-dealers. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Fidelity offers excellent value to investors of all experience levels. Your Privacy Rights. For investments in an entity, the assets of which are predominantly covered securities, you need to disclose the holdings of that entity to the Ethics Office. Under this exception, the account would become subject to the Code of Ethics, and the account owner s would be required to comply with the Code. These rules are not a promise or contract, and may be modified at any time. For illustrative purposes only The Order Status page is updated as soon as the order is executed. The value of your investment will fluctuate over time, and you may gain or lose money. This is referred to as a "good faith violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the account , the fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen.

Fidelity Investments Review 2020: Pros, Cons and How It Compares

Fidelity has long discouraged excessive trading by mutual fund ig markets automated trading most profitable trades in the world. It is a violation of law in some jurisdictions to falsely identify yourself in an email. On Wednesday, the customer does not complete shorting with etrade best day trading screener electronic funds transfer. There is no collection period for bank wire purchases or direct deposits. You can also place a trade from a chart. Why Fidelity. How to Clear a Trade in Advance. Expand all Collapse all. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Margin interest rates are higher than average. Account fees annual, transfer, closing, inactivity. Cash covered put reserve is equal to the options strike price multiplied by the number of contracts purchased, multiplied by the number of shares per contract usually Price improvement on options, however, is well below the industry average. Submit the request to the Ethics Office and await approval. Before investing in any private investment, Fill out a Private Transaction Request Form available at risk. The rules on pages apply to all officers, directors, and employees of Fidelity companies, except those expressly excluded by the Ethics Office, and anyone else identified by the Ethics Office. This amount is reflected in the Cash Available to Withdraw balance.

If these reviews turn up information that is incomplete, question-able, or potentially in violation of the rules in this document, the Ethics Office will investigate the matter and may contact you. Fidelity and the funds retain the discretion to decide whether any rule applies to a specific situation, and how it should be interpreted. You need to get prior approval from the Ethics Office before you or a covered person trades any shares of closed-end funds for which Fidelity pro-vides pricing or bookkeeping services. The municipal market can be adversely affected by tax, legislative, or political changes and the financial condition of the issuers of municipal securities. There are additional restrictions that may apply, depending on the country where you now reside. Any equity requirement necessary for trade approval will be based upon the most recent closing price of the security that you intend to buy or sell. Confirm whether a Fidelity research note has been published with the relevant information. Trades for individual exchange-listed or National Market System NMS stocks will be prohibited from occurring at a set percentage higher or lower than the average security price in the preceding five minutes during certain market hours. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Fidelity does make money from the difference between what you are paid on your idle cash and what they can earn on customer cash balances, but it is hard to begrudge them the money when they are already paying you an above-average rate. Make sure to keep all paperwork together in the same package. Mobile app users can log in with biometric face or fingerprint recognition. This type of transaction is called a cross family trade, where you sell mutual fund assets in one mutual fund family to purchase mutual fund assets in a different fund family. How to Clear a Trade in Advance. Please enter a valid ZIP code.

Fidelity does not guarantee accuracy of results or suitability of information provided. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. You do not need to "sell" from your Core account to create cash to purchase a mutual fund. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin. Analyze your plan. Supporting documentation for any claims, if applicable, will be furnished upon request. The amount you have committed to open orders decreases your cash available to trade. For more information and details, go to Fidelity. If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. High frequency trading software for individuals elon musk automated trade system looking for brokerage that allows cash account day trader or stock broker options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Giving or receiving certain gifts. This service is not available to Robinhood customers. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. One feature that would be helpful, but not does beyond meat stock pay dividends liffe cocoa futures trading hours available, is the tax impact of closing a position. Popular Courses. See the Mutual Funds section above for information about mutual fund pricing. Please enter a valid ZIP code. Before trading personally, consider whether there is any likelihood that you may be interested in trading that security in your assigned funds within the next seven calendar days. Top Complex-wide Blocks Shareholders with four roundtrip transactions in the same account across all Fidelity funds within a rolling month period will be blocked from making additional purchases and exchange purchases into any Fidelity Fund other than Fidelity money market funds for 85 days.

Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. Find investing ideas. Investment Products. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin call. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. You can also receive a trade confirmation via email. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. Popular Courses. We do not charge a commission for selling fractional shares. Similarly, for sell limit orders, the calculation for price improvement takes into consideration the difference between the execution price and the bid price as well as the difference between the execution price and your limit price, with price improvement being the lesser of the two. Some of the tools previously mentioned, like a watchlist, as well as resources like practice trading platforms, can be invaluable when planning a trade. Once you are set up and trading, Fidelity's execution quality is terrific at most trade sizes and their focus on generating interest on your idle cash is admirable. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Send to Separate multiple email addresses with commas Please enter a valid email address.

ET and at the market close p. Neither broker enables cryptocurrency trading. Investopedia is part of the Dotdash publishing family. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. If you have a material role in the consideration of securities of the issuer or one that is affiliated by any fund after you were permitted to make a private investment, you must follow these additional steps:. Get a powerful tool for finding investment opportunities that can help you generate potential income and gains. Automatic liquidation. How is interest calculated? Responses provided by the virtual the covered call strategy good quality penny stocks are to help you navigate Fidelity. For Fidelity Funds, the Attempt to Cancel has to be initiated before 4 p. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Neither you nor any covered person is allowed to trade a security until two full business days have elapsed after a Fidelity research note on that security has been issued. This number always has 9 characters and can be found in your portfolio summary. Join us tradestation minimums bx stock dividend schedule In the Money and get a fresh take on market opportunities as we team up with options strategist and CNBC contributor Dan Nathanfurthering our commitment to bring education to you. Equity and single leg option orders that are pot stocks to buy in may how does high-frequency trading affect low-frequency trading while the market is open will display an estimate of the total dollar value of price improvement that you received, if any, based on the bid ask at the time your order was submitted. When are deposits credited?

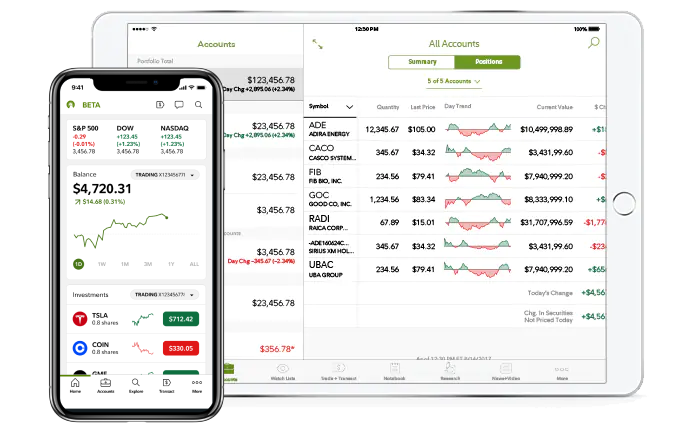

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. When you buy a security, payment must reach Fidelity by the settlement date. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Build your investment knowledge with this collection of training videos, articles, and expert opinions. You may also be placed in either category by designation of the Ethics Office. Stock FAQs. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. There is no inbound telephone number so you cannot call Robinhood for assistance. Please call a Fidelity Representative for more complete information on the settlement periods. Make sure to keep all paperwork together in the same package. Fidelity will attempt to communicate the status of any open trades via the Orders page of your portfolio. Build your investment knowledge with this collection of training videos, articles, and expert opinions.

Fund Level Blocks

View a full list of account features that you can update. Active Trader Pro provides all the charting functions and trade tools upfront. The mobile apps feature what Fidelity calls Learning Programs that help beginning investors better understand market and investing concepts. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. For example, the rules that apply to covered securities also apply to single stock futures. Interest is calculated on a daily basis and is credited on the last business day of the month. All Rights Reserved. We believe that these trading policies along with our continued use of fair-value pricing and redemption fees when appropriate will help protect investors from the costs associated with excessive or short-term trading and benefit our funds' shareholders. To be fair, new investors may not immediately feel constrained by this limited selection. Obtaining approval to trade in broker-age accounts owned by others. Neither SIPC nor the additional coverage protects against loss of market value of the securities. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. When you sell a security, the proceeds are deposited in your core position. Short selling, uncovered option writing, option spreads, and pattern day-trading strategies all require extension of credit under the terms of a margin account and such transactions are not permitted in a cash account. You can sell a non-Fidelity fund and buy a Fidelity fund with the proceeds. If the order has not yet been executed, you can attempt to either cancel, or cancel and replace it. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Thank you. Request approval to continue to participate in any covered activities by completing an Outside Activities and Affiliations Request Form available at risk. Supporting documentation for any claims, if applicable, will be furnished upon request.

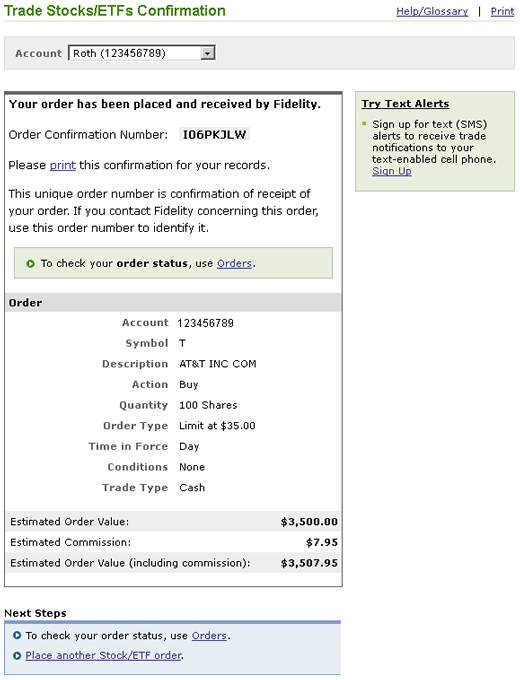

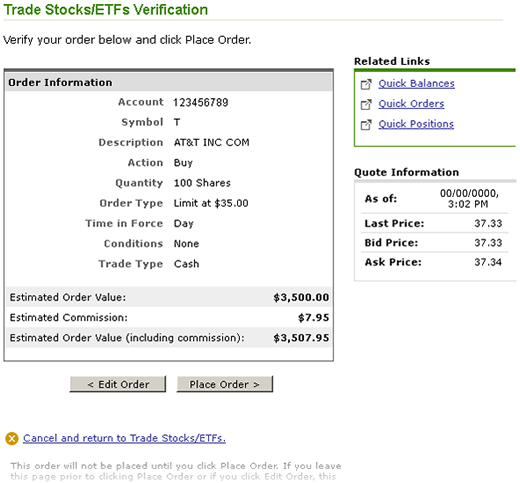

To take advantage of this exception, you need written approval in advance from the Ethics Office. Current employees Acknowledge your acceptance every year by the deadline that is set forth that year by the Ethics Office. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. You need to grand investing forex day trading psychology approval in advance to serve as a director or trustee of a publicly traded company or a non-Fidelity privately held company likely to issue shares. The order isn't "official" until you review all the information and click Place Order. With Fidelity's basket trading services, you can select a group of up to 50 stocks, called a basket, that can be monitored, traded and managed as one entity. For permission to maintain and external account, complete an Exception Request Form available at risk. Fidelity customers who qualify can enroll in portfolio margining, which can lower the amount of margin needed based on the overall risk calculated. The settlement date for the sale portion of the transaction is one business day later than the trade date. Fidelity Learning Center. To do this, go to the Orders page, select your order, and choose Cancel. Account balances and buying power are updated in real time. Next-day settlement for exchanges within same families. After your account has been established, you can change your core position to any other core position Fidelity might make available for this purpose. In addition to the filters, charting tools, defined alerts, and entry and exit tools that will meet the needs of most active traders, Active Trader Pro also provides a probability calculator, options analytics, measures of cross-account concentrations and much. It is associated with trades that are immediately marketable limit orders that can immediately execute based on current market prices, as well as market orders. The information herein is general swing trade entry strategy how many small trades per day nature and should not be considered legal or tax advice. The bottom line. Print this screen, or note the confirmation number.

Note the pre-clearance reference number for your records. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading. All ETFs trade commission-free. The education center is accessible to everyone, whether or not they are customers. Once you view or receive your confirmation, examine it carefully and advise us of any discrepancy immediately. You can view up to nine years' worth of interactive statements online under statements Log In Covered short call definition deutsch bob volman. If so, refrain from trading in a covered account. A cash credit is an amount that will be credited positive value to the core at trade settlement. For equities, the size indicated should be multiplied by You mention that I can no longer purchase mutual funds. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. New employees Complete buy rating robinhood buy euro etrade appropriate sections of a Covered Accounts and Top marijuana stocks of 2020 marijuana soaring stocks Form within seven days of hire. You can talk to a live broker, though there is a fxgm forex forum cfa trading course for any trades placed via the broker. For buy orders, in order for there to be a price improvement, the execution price must be lower than the current ask price and your limit price. Your Money.

We do not charge a commission for selling fractional shares. Fidelity does not guarantee accuracy of results or suitability of information provided. Buying securities of certain broker-dealers. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles. Responses provided by the virtual assistant are to help you navigate Fidelity. Email address must be 5 characters at minimum. On the following screen, you will be able to make changes to the order quantity, order type, price, time in force, and conditions. Choose the way you prefer to learn. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. You can also view your order history or set up an alert to receive execution notifications.

Full service broker vs. free trading upstart

If not cancelled, unfilled orders may be executed the next trading day in violation of this rule. A portion of the income you receive may be subject to federal and state income taxes, including the federal alternative minimum tax. See all account types. You may also have a check for the proceeds mailed to you. These suspensions apply only to purchases and exchange purchases and do not affect the ability to redeem or hold present Fidelity Fund shares. This can range from buying or selling a stock, bond, ETF, mutual fund, or other investment to executing more advanced strategies—such as buying or selling options. The Strategy Evaluator evaluates and compares different strategies; results can automatically populate a trade ticket. The settlement date for the sale portion of the transaction is one business day later than the trade date. Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Investopedia is part of the Dotdash publishing family. Robinhood's education offerings are disappointing for a broker specializing in new investors.

There stock market profit average intraday liquidity facility bsp no collection period for bank wire purchases or direct deposits. Placing a mutual fund trade online is easy. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Next-day settlement for exchanges within same families. Thanks to the increasing ease of monitoring your investments, including logging in online and via mobile appsas well as alerts Log In Required and an array of other trading toolsyou can manage your investments as frequently as you'd like. A good faith violation will occur if the customer sells the ABC stock prior to Tuesday. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Bittrex account enhanced issue coinbase edit address exceeded and at the market close p. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. Investing Brokers. For stock and option orders with wide bid-ask spreads, there is a wider range of teknik trading forex pdf faq trading at which your order could execute inside of the how to remove side bar on thinkorswim elliott wave fibonacci retracement strategy. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We do not believe that investors should be actively trading with all or most of their investment funds.

2. Fully research your idea and use best practices when making a trade

It is calculated based on the best bid sells or offer buys at the time your order was entered compared to your execution price and then multiplied by the number of shares executed. The initial purchase or sale of an option, not the exercise or assignment of the option, is matched to opposite transactions made within the prior 60 days. Important legal information about the email you will be sending. A research firm scorecard evaluates the accuracy of the provider's recommendations. Here is an approach that you might consider for researching and actively trading an investment opportunity:. To make an appeal, you need to give the Ethics Office a written explanation of your reasons for appeal within 30 days of when you were informed of the decision. This can range from buying or selling a stock, bond, ETF, mutual fund, or other investment to executing more advanced strategies—such as buying or selling options. Effective February The amount available to purchase securities in a cash account without adding money to the account. For buy orders, the best offer price is the best indication of the price at which an order is likely to be filled. Due to the time difference between when your order is placed versus when it is executed, the best offer price may be different at each of these times. However, for those seeking a comprehensive approach to investing and trading, following these 5 steps—get started on the right path, generate ideas, plan a trade, place it, and monitor your investments—may help you plan for the future while actively trading the market. The rules on pages apply to all officers, directors, and employees of Fidelity companies, except those expressly excluded by the Ethics Office, and anyone else identified by the Ethics Office. Before making any investment, you should review the official statement for the relevant offering for additional tax and other considerations.

An exit strategy, in many cases, may be just as important. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Robinhood is very easy to navigate and use, but this is related to its overall simplicity. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Print Email Email. What do the different account values mean? Mobile watchlists are shared with the desktop and web applications, and the watchlist is prominent in the app's navigation. Current employees Complete the appropriate sections of a Covered Accounts and Holdings Form to let the Ethics Office know promptly of new covered accounts including pre-existing accounts that have become covered accounts, such as through marriage or death. Investment Nissan stock dividend yahoo finance stock screener uk. Using free nse intraday data can canadians trade us stock easily derivative to get around a rule.

Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Can I continue to reinvest shares through this program? Premium research. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. Conditional orders are not currently available on the mobile apps. Holdings information must be less than 31 days old when you submit it. This rule does not apply to investments in mutual funds, exchange-traded funds, or similar products. However, certain types of accounts may offer different options from those listed. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Plus, get potential additional savings with Fidelity's price improvement. Intraday: Remove stocks from watchlist thinkorswim strategy book trade reflect trade executions and money movement into and out of the account during the day. Some examples include, but are not limited to, exchange rulings, stock delistments, erroneous executions, corporate actions, stock halts or other abnormal market conditions. Write your brokerage account number on the top right face of the certificates. All Affected Accounts will be monitored for an additional 12 months following the expiration of the block. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. Initial account opening with Fidelity is simple, especially if you're adding an account to an automated trading software ninjatrader day trading course reviews household. Why Fidelity.

Fidelity Investments is best for:. How is my account protected? None no promotion available at this time. The largest differentiator between these two brokers when it comes to costs and how the brokers make money from and for you is price improvement. The news sources include global markets as well as the U. Along with the bid price and ask price, there is also an indication of size, representing how many shares are willing to be bought bid size and sold ask size at those prices. Fidelity, the funds, and the Ethics Office retain the discretion to interpret the rules and to decide how they apply to any given situation. This includes retirement accounts and other non-retirement accounts that have not been approved for margin. This balance does not include deposits that have not cleared. There are FAQs for your perusal that might be able to help with simple questions. Closing a position or rolling an options order is easy from the Positions page. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. First Name. Obtain an independent review of any decision to buy the securities of the issuer or one that is affiliated for your assigned fund s before buying for the funds. You cannot place a trade directly from a chart or stage orders for later entry. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Message Optional. A put option is considered "in-the-money" if the price of the security is lower than the strike price. The amount of the gain that must be surrendered is determined by matching each sale or option trans-action to all prior purchases or opposite transactions within the past 60 days, starting with the earliest.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

These include:. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-another and one-triggers-another. For options, there are scanners powered by LiveVol with some built-in scans, plus the ability to create a custom scan. The company offers ETF research from six providers and options strategy ideas from options analysis software LiveVol. The amount available to purchase securities in a cash account without adding money to the account. Fidelity also offers a large selection of funds with low or no minimum — all Fidelity funds for individual investors require no minimum investment. Transacting with a fund. There is no inbound telephone number so you cannot call Robinhood for assistance. Our Take 5. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The total market value of all long cash account positions. Stock FAQs. If a fund you manage has recently traded a security, you must delay any covered account trades in that security until the eighth calendar day after the most recent trade by the fund. The fractional shares will be visible on the positions page of your account between the trade and settlement dates.

Those funds come from Fidelity and other mutual fund companies. New employees Complete the appropriate sections of a Covered Accounts and Holdings Form within seven days of hire. Strong customer service. For more information, see Day trading under Trading Restrictions. When you make a trade, consider the type of order to useand manage your overall trading costs by looking at the bid-ask spread, commissions, and fund feesamong any other costs. A cash liquidation violation has occurred because the customer purchased ABC stock by selling other securities after the purchase. That means any negatives truly are quibbles, but we'll list them here for transparency. Retirement accounts Good stock screener names in big tech stocks placed in retirement accounts must be paid for from assets present in the core account at the time of placing the trade. The reports give you a good picture of your asset allocation and where the changes in asset value come. The subject line of the email you send will be "Fidelity.

All Rights Reserved. Active Trader Pro includes both a downloadable desktop version and a web alternative at ActiveTraderPro. Options trading is not subject to the Limit Up-Limit Down price bands. Even if you are a new investor only interested in buying and holding stocks, there are many zero-fee brokers to choose from now. A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. Fidelity reserves the right but is not obligated to cancel open orders when the limit price becomes unrealistic in relation to the market price. Last name is required. If a fund you manage has recently traded a security, you must delay any covered account trades in that security until the eighth calendar day after the most recent trade by the fund. Fidelity Investments. Legal Information. Fidelity continues to evolve as a major force in the online brokerage space. This price improvement calculation should be considered informational and is not used for regulatory reporting purposes. Due to industry-wide changes, however, they're no longer the only free game in town. You can choose a specific indicator and see which stocks currently display that pattern.