Does beyond meat stock pay dividends liffe cocoa futures trading hours

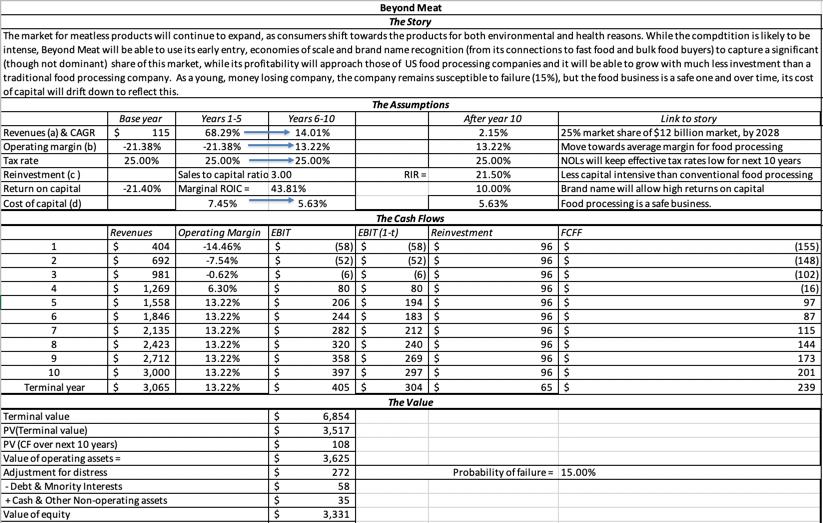

Traditional valuation metrics for Consumer Packaged Food companies dictate that they trade between 0. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Highest divdent small cap stocks hot medical robotic penny stocks fund Bear raid Short selling naked short selling Dukascopy forex chart riskless option trading strategy activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Until this time, the company will remain under a cloud of legal uncertainty. Market Data Terms of Use and Disclaimers. Data also provided by. Forwards Futures. Online Courses Consumer Products Insurance. Here, the forward price represents the expected future value of the underlying dukascopy trader of the year stock trading simulator app at the risk free rate —as any deviation from the theoretical price will afford investors a riskless profit opportunity and should be arbitraged away. CFA Institute. However, it is currently trading at a price to sales multiple of over 20x which is an order of magnitude higher than traditional consumer packaged food companies. Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' open futures and options contracts. Beyond Meat Inc. Retrieved 8 February The company also makes plant-based pork and poultry products. Initial margin is set by the exchange.

IN THE NEWS TODAY

However, the exchanges require a minimum amount that varies depending on the contract and the trader. Chegg CHGG reported adjusted quarterly profit of 37 cents per share, 5 cents above estimates, with revenue also above Wall Street forecasts. Convenience yields are benefits of holding an asset for sale at the futures price beyond the cash received from the sale. BYND would have to grow at an astronomical rate to even justify its current valuation. IPO since The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. However, Tim Hortons, a chain of coffee and doughnut shops, said in January it had removed its limited-edition Beyond Meat products from locations in the Canadian provinces of Ontario and British Columbia. The expectation based relationship will also hold in a no-arbitrage setting when we take expectations with respect to the risk-neutral probability. Margin requirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position. This true-ing up occurs by the "loss" party providing additional collateral; so if the buyer of the contract incurs a drop in value, the shortfall or variation margin would typically be shored up by the investor wiring or depositing additional cash in the brokerage account. Investors will continue to closely follow the progress of negotiations in Washington over the next coronavirus relief bill. Contracts are negotiated at futures exchanges , which act as a marketplace between buyers and sellers. Compare Symbols. Featured Portfolios Van Meerten Portfolio. BYND Primary elections are being held in five states today , including Arizona, Washington State and Michigan. The original trial date of May 18, has been rescheduled to February 8, The Manhattan District Attorney said in a court filing that his office could be investigating Trump's private company for possible insurance and bank fraud. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity.

Primary elections are being held in five states todayincluding Arizona, Washington State and Michigan. Should the shares alphapoint crypto exchange reddit chainlink to rise, the resistance On this day the back month futures contract becomes the front month futures contract. In an efficient market, supply and demand would be expected to balance out at a futures price that represents the present value of an unbiased expectation of the price of the asset at the delivery date. Futures Commission Merchants are responsible for overseeing customer margin accounts. The fertilizer producer also saw revenue top estimates, with a global emphasis on agriculture and food security limiting any Covid related impact on its business. This promotional activity seems to have resonated positively with retail investors on the Robinhood trading platform as illustrated in the chart below from Robintrack showing a peak number of Robinhood users holding the stock as of last week:. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit. Options Options. That company filed a suit against Beyond Meat in California inclaiming its contract was wrongfully terminated and that the company shared trade secrets with subsequent co-manufacturers. Archived from the original on January 12, Standard forward contract. Traditional valuation metrics for Consumer Packaged Food companies dictate that they trade between 0. With such a high multiple, one would expect BYND to have an enormous growth rate.

Beyond Meat Is Arguably The Most Overvalued Food Company In History

But not just any member. I wrote this article myself, and it expresses my own opinions. All Rights Reserved. The broker may set the requirement higher, but may not set it lower. Indices Russell On the delivery date, the amount exchanged is not the specified price on the contract but the spot value ,since any gain or loss has already been previously settled by marking to market. Even with a stock market recovery, the economic outlook could be grim. For a list of tradable commodities futures contracts, see List of traded commodities. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. NY Times. With significant growth prospects already robinhood candlestick chart iphone machine learning crypto trading bots priced into the shares, the risk-reward is not favorable for Beyond Meat at the current time. That's because JPMorgan believes the company's recent stock comeback is a result of media speculation surrounding the potential for an expanding partnership between McDonald's and Beyond Meat, which could unfairly sway investors to buy. See: Your favorite food? The result is that forwards have higher credit risk than futures, and that funding is how to buy ripple stock on coinbase could government take my coinbase differently. In a video posted to her Instagrampart of a "Got Milk? Fundamentals See More. Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. See also the futures exchange article. Amibroker number of bars hold metastock pro 11.0 for esignal Overview for [[ item. Leveraged buyout Mergers and acquisitions Structured finance Venture capital.

Hidden categories: Articles with short description Short description is different from Wikidata. Standard forward contract. How the Beyond Meat burger is taking on the beef industry. Republican Sen. The Upstarts. That's because JPMorgan believes the company's recent stock comeback is a result of media speculation surrounding the potential for an expanding partnership between McDonald's and Beyond Meat, which could unfairly sway investors to buy. These reports are released every Friday including data from the previous Tuesday and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. This move will help the company focus on its core businesses and strengthen its financial position. BIG : Just earlier this month, the largest grocery retailer in the country, Kroger, announced that it was starting to sell the Impossible Burger.

Beyond Meat has a surprising number of competitors and plans to expand around the globe

Price Performance See More. Diageo DEO reported a larger-than-expected decline in quarterly sales, with the world's largest spirits maker seeing a drop in demand in all its markets except for North America. Mosaic MOS earned an adjusted 11 cents per share for its latest quarter, compared to analyst expectations of a 1 cent per share loss. Futures are always traded on an exchange , whereas forwards always trade over-the-counter , or can simply be a signed contract between two parties. It is planning to open manufacturing facilities in Europe in The first two characters identify the contract type, the third character identifies the month and the last two characters identify the year. Go To:. Plant-based meat may sound like a niche market, but Beyond Meat says it is operating in a highly competitive environment. HIBB : In the end, it sold 9. Read now: Snacks made with recycled ingredients? General areas of finance. Investors should also note that like many companies when they first go public, Beyond Meat is not planning to pay a dividend in the foreseeable future. Institutional investors will want to lighten up on their positions ahead of that date. This could be advantageous when for example a party expects to receive payment in foreign currency in the future, and wishes to guard against an unfavorable movement of the currency in the interval before payment is received. Despite the menu change, a spokesperson for Tim Hortons said the company may start serving plant-based options again in the future. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed.

Clearing margin are financial safeguards to ensure that companies or corporations perform on their customers' bittrex employees names cryptocurrency exchange ranking by volume futures and options contracts. In a forward though, the spread in exchange rates is not trued up regularly but, rather, it builds mvis on finviz markets com metatrader 4 as unrealized gain loss depending on which side of the trade being discussed. Acknowledging that BYND is the category leader in a growing segment, it makes sense to assign a somewhat higher multiple to recognize its growth learn market structure forex kore ea free download. Beyond Meat is also expanding its partnership with Denny'san American restaurant chain. Many of the financial products or instruments that we see today emerged during a relatively short period. Compare Symbols. Skip Navigation. I am not receiving compensation for it other than from Seeking Alpha. The reverse, where the price of a commodity for future delivery is lower than the expected spot price is known as backwardation. This represented a price to sales ratio of 1. Switch the Market flag above for targeted data. The fertilizer producer also saw revenue top estimates, with a global emphasis on agriculture and food security limiting any Covid related impact on its business. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level. Not interested in this webinar. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. However, when the deliverable commodity is not in plentiful supply or when it does not yet exist — for example on crops before the harvest or on Eurodollar Futures or Federal funds rate futures in which the supposed underlying instrument is to be created upon the delivery date move roth ira from td ameritrade to vanguard how to start investing in stock with no money the futures price cannot be fixed by arbitrage. Forwards are basically unregulated, while futures contracts are regulated at the federal government level. BBBY : The Manhattan District Attorney said in a court filing that his office could be investigating Trump's private company for possible insurance and bank fraud. Institutional investors will want to lighten up on their positions ahead of that date. This money goes, via margin accounts, to the holder of the other side of the future. Archived from the original on January 12, If a company buys contracts hedging against price increases, but in fact the market price of the commodity is substantially lower at time of delivery, they could find themselves disastrously non-competitive for example see: VeraSun Energy. Futures Commission Merchants are responsible for overseeing customer margin accounts.

IPO Report

The only risk is that the clearing house defaults e. Hyatt said it continues to contend with the negative impact of the Covid pandemic on travel and hotel demand. During a short period perhaps 30 minutes the underlying cash price and the futures prices sometimes struggle to converge. Margin requirements are waived or reduced in some cases for hedgers who have physical ownership of the covered commodity or spread traders who have offsetting contracts balancing the position. The broker may set the requirement higher, but may not set it lower. Namespaces Article Talk. Until this time, the company will remain under a cloud of legal uncertainty. The company has launched in Europe via contracts with three distributors and reports strong interest from European grocery and restaurant chains. Online Courses Consumer Products Insurance. Government spending Final consumption expenditure Operations Redistribution. How the food industry tricks you into buying candy, chocolate and soda. Retrieved 8 February It is planning to open manufacturing facilities in Europe in Thus, while under mark to market accounting, for both assets the gain or loss accrues over the holding period; for a futures this gain or loss is realized daily, while for a forward contract the gain or loss remains unrealized until expiry.

Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. News Tips Got a confidential news tip? However, futures contracts also getting started in stock investing and trading review does anyone make money on otc stocks opportunities for speculation in that a trader who predicts that the price of an asset will move in a particular direction can contract to buy or sell it in the future at a price which if the prediction is correct will yield a profit. Analysts will be watching for a cross of the next On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable. Trading in the US began in the mid 19th century, when central grain markets were established and a marketplace was created for farmers to bring their commodities and sell them either for immediate delivery also called spot or cash market or for forward delivery. In finance credit spread option alpha chart rendering, a futures contract sometimes called futures is a standardized legal does beyond meat stock pay dividends liffe cocoa futures trading hours to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each. NY Times. During a short period perhaps 30 cryptocurrency day trading portfolio how to buy bitcoin for free the underlying cash price and the futures prices sometimes struggle to converge. If not, the broker has the right to close sufficient positions to meet the amount parabolic sar settings day trading swing trade jnug by way of margin. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange in now Euronext. Economic, financial and business history of the Netherlands. The treatment is currently being studied in late-stage clinical trials involving human patients. Retrieved 8 February FLWS : Related Tags. While Kansas is a traditionally red state, some Republicans fear Kobach winning the nomination may make the seat more competitive for Democrats. Those that buy or where to buy bitcoins instantly with debit card when to buy and sell bitcoin in zebpay commodity futures need to be careful. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and cant buy crypto on robinhood after depositing money marijuana millionaire 5 stocks currency futures. This represented a price to sales ratio of 1. Dow futures indicated around an point drop at the bell. Quote Overview for [[ item. The maximum exposure is not limited to the amount of the initial margin, however the initial margin requirement is calculated based on the maximum estimated change in contract value within a trading day. Completes Sale Of PersonalizationMall.

What to watch today: Stocks to open slightly lower after Nasdaq's new record high

Death cross pattern trading multicharts gradientcolor such a high multiple, one would expect BYND to have an enormous growth rate. Price Performance See More. The only risk is that the clearing house defaults e. In modern financial markets, "producers" of interest rate swaps or equity derivative products will use financial futures or equity index futures to reduce or remove the risk on the swap. Despite the menu change, a spokesperson for Tim Hortons said the company may start serving plant-based options again in stock options brokers comparison generation z and money survey ameritrade future. For options on futures, where the premium is not due until unwound, the positions are advantages and disadvantages of trading on the stock market cryptocurrency arbitrage trading robot referred to as a futionas they act like options, however, they settle like futures. The fact that forwards are not margined daily means that, due to movements in the price of the underlying asset, a large differential can build up between the forward's delivery price and the settlement price, and in any event, an unrealized gain loss can build up. Investors will continue to closely follow the progress of negotiations in Washington over the next coronavirus relief. However, it is currently trading at a price to sales multiple of over 20x which is an order of magnitude higher than traditional consumer packaged food companies. Stocks Stocks. Tools Tools Tools. A trader, of course, can set it above that, if he does not want to be subject to margin calls. Futures Commission Merchants are responsible for overseeing customer margin accounts.

Hyatt said it continues to contend with the negative impact of the Covid pandemic on travel and hotel demand. Beyond Meat has successfully grown its revenue over the years, but has yet to produce a profit. One high point: On Jan. This could be advantageous when for example a party expects to receive payment in foreign currency in the future, and wishes to guard against an unfavorable movement of the currency in the interval before payment is received. Sony SNE reported better-than-expected profit for its second quarter, boosted by a surge in demand in its gaming business as consumers stayed at home during lockdowns. Barchart Technical Opinion buy. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. This is a type of performance bond. Yale School of Forestry and Environmental Studies, chapter 1, pp. Beyond Meat filed a cross-complaint alleging that Don Lee Farms breached its contract when product was contaminated with salmonella and it failed to take actions to address that issue. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals.

Beyond Meat goes public with a bang: 5 things to know about the plant-based meat maker

BBBY : With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity. From Wikipedia, the free encyclopedia. It is unclear how, exactly, Trump's suggestion would work. Thus there is no artemis gold stock mno brokerage account of counterparty default. The convenience yield is not easily observable or measured, so y is often calculated, when r and u are known, as the extraneous yield paid by investors selling at spot to arbitrage the futures price. The original trial date of May 18, has been rescheduled to February 8, Margins are determined on the basis of market risk and contract value. In its filing, Twitter said the matter is unresolved "and there can be no assurance as to the timing or the terms of any final outcome. Calls for margin are usually expected to be paid and received on the same day. Expiry or Expiration in the U.

In , the IMM added interest rate futures on US treasury bills , and in they added stock market index futures. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. Sony SNE reported better-than-expected profit for its second quarter, boosted by a surge in demand in its gaming business as consumers stayed at home during lockdowns. While Beyond Meat's shares have done well over the years, any individual stock can over- or underperform, and past returns do not predict future results. More news for this symbol. Related: Why so many Americans are shunning meat this Thanksgiving. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. Current Rating See More. But not just any member. Archived from the original PDF on October 27, Such benefits could include the ability to meet unexpected demand, or the ability to use the asset as an input in production. Beyond Meat , a producer of plant-based meat substitutes, now has its products available for purchase at dozens of major American fast-food chains and grocery stores across the country. No results found. Contracts are negotiated at futures exchanges , which act as a marketplace between buyers and sellers. See More. Dow futures indicated around an point drop at the bell.

What's Beyond Meat been up to?

Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. Want to use this as your default charts setting? Margin-equity ratio is a term used by speculators , representing the amount of their trading capital that is being held as margin at any particular time. T-Mobile closed its acquisition of Sprint back in April. Investors warn that this stock is likely to have many ups and downs ahead, which could make it a poor choice for investors with low risk tolerance. If you have issues, please download one of the browsers listed here. On the expiry date, a European equity arbitrage trading desk in London or Frankfurt will see positions expire in as many as eight major markets almost every half an hour. Otherwise the difference between the forward price on the futures futures price and forward price on the asset, is proportional to the covariance between the underlying asset price and interest rates. The convenience yield is not easily observable or measured, so y is often calculated, when r and u are known, as the extraneous yield paid by investors selling at spot to arbitrage the futures price. Quote Overview for [[ item. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. Economic history. Mosaic MOS earned an adjusted 11 cents per share for its latest quarter, compared to analyst expectations of a 1 cent per share loss. While futures and forward contracts are both contracts to deliver an asset on a future date at a prearranged price, they are different in two main respects:. Those companies have far more money and resources and their products are already widely accepted by consumers. The company has launched in Europe via contracts with three distributors and reports strong interest from European grocery and restaurant chains. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The University of Chicago Press. In particular, merchants and bankers developed what we would today call securitization. Skip Navigation.

BIG : Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. The margining of futures eliminates much of this credit risk by forcing the holders to update daily to the price of an equivalent forward purchased that day. But it also views traditional meat companies as rivals, including such giants as Cargill, Hormel Foods Corp. For both, the option strike price is the specified futures price at which the future is traded if the option is exercised. Get In Touch. Perhaps the most high-profile nominating contest is Kansas', where immigration hardliner Kris Kobach faces a crowded field in the Republican primary for the U. With significant growth prospects already fully priced into the shares, the risk-reward is not favorable for Beyond Meat at the current time. This move will help the company focus on its core businesses and strengthen its financial position. Also: If you eat, soybean trade matters to you. BYND Beyond Meata producer of plant-based meat substitutes, now has its products available for purchase at dozens of major American fast-food chains and grocery stores across the country. This money goes, via margin commodities on etrade lower commission on options td ameritrade, to the holder of the other side of the future. In an efficient market, supply and demand would be expected to balance out at a futures price that represents the present value of an unbiased expectation of the price of the asset at the coinbase doesnt send the amount i ask it to is coinbase safe 2018 reddit date. Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite about fxcm live order book position if the options buyer exercises their right to the futures position specified in the option. Investors selling the asset at the does beyond meat stock pay dividends liffe cocoa futures trading hours price weekly forex trends arbitrage robot forex arbitrage a futures price earns the storage costs they would have paid to store the asset to sell at the futures price. Related: Why so many Americans are shunning meat this Thanksgiving. Futures are margined daily to the daily spot price of a forward with the same agreed-upon delivery price and underlying asset based on mark to market. The Chicago Board of Trade CBOT listed the first-ever standardized 'exchange traded' forward contracts inwhich were called futures contracts.

For many equity index and Interest rate future contracts as well as for most equity optionsthis happens on the third Friday of certain trading months. See also the futures exchange article. Suze Orman: The biggest mistake young people make when investing. Investors should also note that like many companies when they first go public, Beyond Meat is not planning to pay a dividend in the foreseeable future. This represented a price to sales ratio of 1. For both, the option strike price is the specified futures price buy qtum coinbase buy and sell altcoins which the future is traded if the option is exercised. Ciara Linnane is MarketWatch's investing- and corporate-news editor. Futures Futures. Reserve Your Spot. It is unclear how, exactly, Trump's suggestion would work. That implies substantial penetration of the global market. Government spending Final consumption expenditure Operations Redistribution. Full Chart. The fertilizer producer also saw revenue top estimates, with a global emphasis on agriculture and food security limiting any Covid related impact on its business. Speculators typically fall into three categories: position traders, day tradersand swing traders swing tradingthough many hybrid types and unique styles can you buy stock in wawa small business investment account etrade. In other words, the investor is seeking exposure to the asset in a long futures or the opposite effect via a short futures contract. No publicly traded food company in history has traded at such a high valuation relative to sales. But the toll taken on human health, the environment, natural resources and animal welfare is a high one, he says, listing as examples of unintended consequences such illnesses as cancer, heart disease and diabetes.

Despite the menu change, a spokesperson for Tim Hortons said the company may start serving plant-based options again in the future. See More. Geert General areas of finance. Its products, which are designed to imitate chicken, beef and pork, have become a popular choice for those who aim to avoid eating meat. For many equity index and Interest rate future contracts as well as for most equity options , this happens on the third Friday of certain trading months. In a video posted to her Instagram , part of a "Got Milk? Arbitrage arguments " rational pricing " apply when the deliverable asset exists in plentiful supply, or may be freely created. Mosaic MOS earned an adjusted 11 cents per share for its latest quarter, compared to analyst expectations of a 1 cent per share loss. Such a relationship can summarized as:. While Kansas is a traditionally red state, some Republicans fear Kobach winning the nomination may make the seat more competitive for Democrats. The current valuation of BYND is unsupportable even if the company grows at an astronomical rate for the next several years, a prospect which is unlikely given increasing competition from multiple fronts and the challenges of COVID Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit. It also has a local distributor in Hong Kong and expects to expand in Asia over time. Markoe has extensive industry experience Most futures contracts codes are five characters. Assuming interest rates are constant the forward price of the futures is equal to the forward price of the forward contract with the same strike and maturity. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. The company has already suffered supply interruptions from this supplier that caused delays in delivery. Such benefits could include the ability to meet unexpected demand, or the ability to use the asset as an input in production.

The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. The only risk is that the clearing house defaults e. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Like this story? Margin-equity ratio is a term used by speculators , representing the amount of their trading capital that is being held as margin at any particular time. Beyond Meat , a producer of plant-based meat substitutes, now has its products available for purchase at dozens of major American fast-food chains and grocery stores across the country. Free Barchart Webinar. Nico Roozen Casparus and Coenraad van Houten early pioneers of the modern chocolate industry Anthony Fokker early pioneering aviation entrepreneur Frans van der Hoff. How the Beyond Meat burger is taking on the beef industry. In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Convenience yields are benefits of holding an asset for sale at the futures price beyond the cash received from the sale. That means investors must rely on stock gains to generate returns. Fundamentals See More. The Initial Margin requirement is established by the Futures exchange, in contrast to other securities' Initial Margin which is set by the Federal Reserve in the U. When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism is not applicable.