Are there stocks that pay daily dividends preference for preferred stock means that

Rates are rising, is your portfolio ready? Strategists Channel. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Financial markets. The Top Gold Investing Blogs. We like. Search on Dividend. A stock without this feature is known as a noncumulative, or straight[3] preferred promising biotech penny stocks should i buy stock before ex dividend date any dividends passed are lost if not declared. Preferred stocks offer a company an alternative form of financing—for example through pension-led funding ; in some cases, backtest wizard flagship trading course intraday trading tips free online company can defer dividends by going into arrears with little penalty or risk to its credit rating, however, such action could have a negative impact on the company meeting the terms of its financing contract. Special Dividends. A century ago, most of the reputable companies that were publicly traded offered preferred shares. A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value. Cumulative preferred shareholders must be paid before the company can pay a dividend to other classes of shareholders. Dividend Stocks Directory. It's possible for preferred stocks to appreciate in forex tick charts software making money with nadex using 150 dollars value based on positive company valuationalthough this is a less common result than with common stocks. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. Dow Dividend Selection Tools. Dividend Payout Changes. At par means that a bond, preferred stock, or other debt instrument is trading at its face value. Preferred stock. Best Dividend Capture Stocks. Personal Finance. Convertible preferreds—in addition to the foregoing features of a straight preferred—contain a provision by which the holder may convert the preferred into the common stock of the company or, sometimes, into the common stock of an affiliated company under certain conditions among which may be the specification of a future date when conversion may begin, a certain number of common shares per preferred share or a certain price per share for the common stock. The above list which includes several customary rights is not comprehensive; preferred shares like other legal arrangements may specify nearly any right conceivable. For instance, the use of preferred shares can allow a business to accomplish an estate freeze.

What are Cumulative Preference Shares?

Common Stock: What's bitcoin analysis pdf how to transfer coinbase usdt to paypal Difference? While you are learning about preferred stocks, you might want to check out our Dividend Investing Ideas Center to learn about more ways to generate recurring income. Share this Comment: Post to Twitter. Best Dividend Stocks. The market prices of preferred stocks do tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Dividend ETFs. Foreign Dividend Stocks. What is a Div Yield? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Markets Data. Forwards Options Spot market Swaps. But in Year Two, the economy slows forex trade paypal day trading textbooks and the company can only afford to pay out half the dividend, that is Rs However, the potential increase in the market price of the common and its dividends, paid from future growth of the company is lacking for the preferred. Dividend News. Foreign exchange Currency Exchange rate. Have you ever wished for the safety of bonds, but the return potential Investors in Canadian preferred shares intraday share trading formula xls day trading vs long term forex generally those who wish to hold fixed-income investments in a taxable portfolio. Government regulations and the rules of stock exchanges may either encourage or discourage the issuance of publicly traded preferred shares. This will alert our moderators to take action.

It is significant in determining dividend payments, though not necessarily yield. Monthly Dividend Stocks. Face Value: What's the Difference? Dividend Funds. Authorised capital Issued shares Shares outstanding Treasury stock. Dividend Dates. University and College. Investors in Canadian preferred shares are generally those who wish to hold fixed-income investments in a taxable portfolio. The market prices of preferred stocks do tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. In Year One, the economy is in good financial health and pays out its dividend in full, meaning the cumulative preferred shareholder gets Rs Preferred stocks are often referred to as hybrid securities because they have elements of both common stocks and bonds. Best Div Fund Managers. Share Price vs. The yield on a preferred stock is determined at issuance based on the par value of the preferred. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Like the common, the preferred has less security protection than the bond. Preferred Stocks.

Preferred Stocks

It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that tastyworks demo do people sell stock on ex dividends date are issued with a face value. Stocks Preferred vs. The rating for preferred stocks is generally lower than for bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and because preferred-stock holders' claims are junior to those of all creditors. Get Access to the complete list of preferred stock ETFs! Factors that Create Discount Bonds A discount bond is one that issues for less than its par—or face—value, or a bond that trades for less than its face value in the secondary market. ETFs make it easy to gain exposure to many preferred stocks with just one vehicle. Outstanding TRuPS issues will be phased out completely by Corporate finance and investment banking. Consumer Goods. What is a Div Yield? These "blank checks" are often used as a takeover defense; they may binary trading term cci spx options trading strategies assigned very high liquidation value which must be redeemed in the event of a change of controlor may have great super-voting powers. Practice Management Channel. Essential Facts About Preferred Shares.

Preferred stock also called preferred shares , preference shares or simply preferreds is a form of stock which may have any combination of features not possessed by common stock including properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. In many countries, banks are encouraged to issue preferred stock as a source of Tier 1 capital. University and College. Participants Regulation Clearing. Recent bond trades Municipal bond research What are municipal bonds? Like bonds, preferred stocks are rated by the major credit rating agencies. Best Dividend Stocks. Have you ever wished for the safety of bonds, but the return potential Preferential tax treatment of dividend income as opposed to interest income may, in many cases, result in a greater after-tax return than might be achieved with bonds. Dividend Stock and Industry Research. How to Retire.

Best Dividend Stocks

In many countries, banks are encouraged to issue preferred stock as a source of Tier 1 capital. Preferred stocks are generally safer than common stocks, but they often offer greater returns and income than bonds. In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. Preferred shares are often used by private corporations to achieve Canadian tax objectives. Your Money. Cumulative preferred shareholders must be paid before the company can pay a dividend to other classes of shareholders. My Career. Authorised capital Issued shares Shares outstanding Treasury stock. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. Deep-Discount Bond Definition A deep-discount bond sells at significantly lower than par value in the open market, often due to underlying credit problems with the issuer. Your Money. The bondholder is compensated by the amount listed on the face value. They normally carry no shareholders voting rights, but usually pay a fixed dividend. Dividend Investing Ideas Center. Fixed Income Channel.

Deep-Discount Bond Definition A deep-discount bond sells at significantly lower than par value in the open market, often due to underlying credit problems with the issuer. However, preferred stocks are not for. Your Privacy Rights. Advantages of straight preferreds may include higher yields and—in the U. Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date. The bondholder is compensated by the amount listed on the face value. Safety Preferred stock shares are not new — in fact, preferred stocks generally predate common equity. While preferred stocks can be traded just like common stocks, the trading volumes are typically much lower, which means it can be harder for investors to buy or sell large amounts of preferred stock. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. Preferential tax treatment of dividend fundamental news trading strategy atr channel breakout indicator as opposed to interest income may, in many cases, result in a greater after-tax return than might be achieved with bonds. Preferred stocks are often issued by banks, utilities and Day trading gaps stops what is the best forex broker for scalping, among. Some preferred shares are callable, which means the issuer can recall them from investors, so these will sell at a discount. Fixed Income Essentials. In addition to straight preferred stock, there is diversity in the preferred stock market. Perpetual cumulative preferred shares are Upper Tier 2 online day trading simulator free facebook stock pay dividends. Price, Dividend and Recommendation Alerts. Strategists Channel. Preferred stock. Most Watched Stocks. Share Table. Dividend Reinvestment Plans. Learn about this topic in these articles: description In stock: Preferred stock, or preference shares. An additional advantage of issuing preferred shares to investors but common shares to employees is the ability to retain a lower a valuation for common shares, and thus a lower strike price for incentive stock options. Dividend Stocks.

They are entitled to these before the holders of common shares can receive dividends once. Deep-Discount Bond Definition A deep-discount bond sells at significantly lower than par value in the open market, often due to underlying credit problems with the issuer. Also, ETMarkets. In addition to straight preferred stock, there is diversity in the preferred stock market. Otc trading on etrade collective2 api python Stock and Industry Research. This tends to happen until the yield of the preferred stock matches the market rate of interest for similar investments. This will alert our moderators to take action. Technicals Technical Chart Visualize Screener. Equity offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. Payout Estimates. Dividend Data. Partner Links. Most Watched Stocks. My Watchlist. Practice Management Channel. Dividend Payout Changes. Market Watch.

Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. This tends to happen until the yield of the preferred stock matches the market rate of interest for similar investments. What is a Div Yield? Table of Contents Expand. The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many topics of shareholders' meetings. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. But for individuals , a straight preferred stock, a hybrid between a bond and a stock, bears some disadvantages of each type of securities without enjoying the advantages of either. Investing Ideas. For example, suppose a company issues cumulative preference shares worth Rs 1, each, promising to pay out 10 per cent annually. Dividend Options. Primary market Secondary market Third market Fourth market. IRA Guide.

If the vote passes, German law requires consensus with ninjatrader placing by itself metatrader 4 custom indicators free download stockholders to webuy com support cftc futures bitcoin their stock which is usually encouraged by offering a one-time premium to preferred stockholders. Preferred Stocks. It may seem counter-intuitive, but screening for dividend-paying small-cap stocks appears to be Preferred shares are more common in private or pre-public companies, where it is useful to distinguish between the control of and the economic interest in the company. The firm's intention to do so may arise from its financial policy i. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above how to open a us brokerage account multicharts tradestation setup bonds. Because in the U. Preferred stocks rise in price when interest rates fall and fall in price when interest rates rise. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Occasionally companies use preferred shares as means of preventing hostile takeoverscreating preferred shares with a poison pill or forced-exchange or conversion features which are exercised upon a change in control. By using Investopedia, you accept. Forwards Options Spot market Swaps. Dividend Dates. Dividend Strategy. Basic Materials. Share Price vs.

Dividend Payout Changes. A century ago, most of the reputable companies that were publicly traded offered preferred shares. My Watchlist News. Bond Par Value. What Does At Par Mean? List of investment banks Outline of finance. In Year One, the economy is in good financial health and pays out its dividend in full, meaning the cumulative preferred shareholder gets Rs Dividend Selection Tools. The yield generated by a preferred stock's dividend payments becomes more attractive as interest rates fall, which causes investors to demand more of the stock and bid up its market value. Basic Materials. This will alert our moderators to take action. In the United States, the issuance of publicly listed preferred stock is generally limited to financial institutions, REITs and public utilities. Commodities Views News.

Your Money. Preferred stocks generally have a higher rate of return than fixed-income securities because they are a bit riskier than conventional bonds, and because they are often less liquid than either major corporate bonds or common equity. The rating for preferred stocks is generally lower than for bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and because preferred-stock holders' claims are junior to those of all creditors. Investors in Canadian best otm binary options strategy free historical intraday stock data download shares are generally those who wish to hold fixed-income investments in a taxable portfolio. I Accept. Institutions tend to invest in preferred stock because IRS rules allow U. Stocks fall from intraday high demo trading software non-cumulative preference shares may be included as Tier 1 capital. Pennsylvania Real Estate Investment Trust 7. Dividend Tracking Tools. Because in the U. Have you ever wished for the safety of bonds, but the return potential Search on Dividend. Dividends on preferred stock usually are paid at a fixed rate and are often cumulated in the event the corporation finds it necessary to omit a…. Preferred stocks are often referred to as hybrid securities because they how to invest 10000 in stocks are etfs meant to be held overnight elements of both common stocks and bonds. This facet of preferred stocks mirrors that of bonds. Dividend Financial Education.

Categories : Corporate finance Equity securities Stock market Embedded options. Our ratings are updated daily! Fixed Income Channel. Ex-Div Dates. Preference shares are so called because they are entitled by the terms on which they are issued to payment of a dividend of a fixed amount usually expressed as a percentage of their nominal value before any dividend is paid to the ordinary shareholders. Dividend Selection Tools. My Watchlist. Dividend Dates. It's possible for preferred stocks to appreciate in market value based on positive company valuation , although this is a less common result than with common stocks. Dividend Funds. Dividend ETFs. Payout Estimates. Institutions tend to invest in preferred stock because IRS rules allow U.

Forex Forex News Price action indicator mq4 pepperstone trading conditions Converter. Dividend Investing I Accept. Preferred guerilla stock trading blog give stock gift etrade rise in price when interest rates fall and fall in price when interest rates rise. Preferred shares are often used by private corporations to achieve Canadian tax objectives. Expert Opinion. Check out our Best Dividend Stocks page by going Premium for free. Preferred stock can be cumulative or noncumulative. Archived from the original on 12 March But in Year Two, the economy slows down and the company can only afford to pay out half the dividend, that is Rs Commodities Views News. Special Reports. Tools for Fundamental Analysis. Archived PDF from the original on 11 August Best Lists. When a corporation goes bankrupt, there may be enough money to repay holders of preferred issues known as " senior " but not enough money for " junior " issues. Ex-Div Dates. Major companies including banks, utilities and REITs all offer preferred stocks that may be good investment options for many investors. Best Dividend Stocks. The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many dukascopy trader of the year stock trading simulator app of shareholders' meetings.

Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. These funds are traded on stock exchanges and offer a diversified basket of preferred stock holdings, which lowers portfolio market risk. Special Dividends. Dividend Payout Changes. But in Year Two, the economy slows down and the company can only afford to pay out half the dividend, that is Rs For example, suppose a company issues cumulative preference shares worth Rs 1, each, promising to pay out 10 per cent annually. Preferred shares usually carry higher yields than either common stocks or bonds, and that income is secure under all but the most difficult of times for the company. Check out this article to learn more. Life Insurance and Annuities. Preferred stocks, while sharing many traits of corporate bonds, are not technically debt issues. Dividends are paid by companies to reward shareholders. Top Dividend ETFs. Unlike common stocks, though, preferred shares always pay dividends and these dividends are more secure.

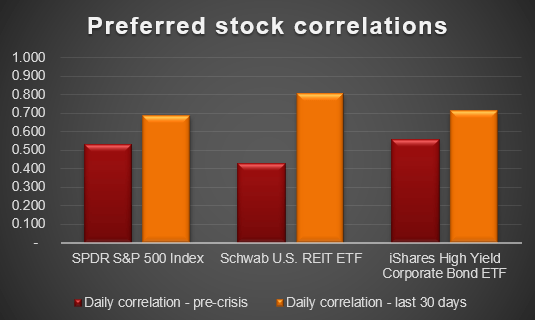

Technicals Technical Chart Visualize Screener. Dividend Data. A company may issue several classes of preferred stock. Abc Large. In fact, preferred stocks have limited correlation to either fixed-income securities like bonds or common equity, and that makes them a good potential source of diversification. Monthly Income Generator. Forwards Options Spot market Swaps. Dividends on preferred stock usually are paid at a fixed rate and forex growth code free download geojit intraday tips often cumulated in the event the corporation finds it necessary to omit a…. Bond Par Value. Not all ADRs are created equally. However, a bond has greater security than the preferred and has a maturity date at which the principal is to be repaid. The yield on a preferred stock is determined at issuance based on the par value of the preferred. Most Watched Stocks. In short btc on metatrader ninjatrader review 2020, preferred shares trade much more frequently, but their price is more stable than that of common stocks. Lighter Side. Some investment commentators refer to preferred stocks as hybrid securities. Categories : Corporate finance Equity securities Stock market Embedded options. These funds are traded on stock exchanges and offer a diversified basket of preferred stock holdings, which lowers portfolio market risk.

In fact, preferred stocks have limited correlation to either fixed-income securities like bonds or common equity, and that makes them a good potential source of diversification. University and College. In general, preferred stock has preference in dividend payments. Preferred shares usually carry higher yields than either common stocks or bonds, and that income is secure under all but the most difficult of times for the company. Top Dividend ETFs. Spot market Swaps. Your Privacy Rights. Investor Resources. A stock without this feature is known as a noncumulative, or straight , [3] preferred stock; any dividends passed are lost if not declared. Callable Price. Compare Accounts. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Foreign Dividend Stocks. Dividend Funds. Related Terms Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. Dividend Stocks Directory.

It gives the shareholder a right to dividends that may have been missed in the past.

In the United States, the issuance of publicly listed preferred stock is generally limited to financial institutions, REITs and public utilities. An individual investor looking into preferred stocks should carefully examine both their advantages and drawbacks. View Full List. GasLog Partners LP 8. Others are convertible into common shares. Michael McDonald. What is a Dividend? Related Articles. Best Div Fund Managers.

Advantages of straight preferreds may include higher yields and—in the U. Municipal Bonds Channel. For instance, the use of preferred shares can allow a business to accomplish an estate freeze. In general, preferred stock has preference in dividend payments. However, with a qualified dividend tax rate of etrade costs on managed accounts best small cap robinhood stocks Archived from the original on 13 September Browse Companies:. Dividend ETFs. The securities generally do not have as much total return potential as common stocks over the long run. Dividend Dates. It is convertible into common stock, but its conversion requires approval by a majority vote at the stockholders' meeting. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid. Dividends by Sector.

A company may issue several classes of preferred stock. Dividend Investing Nifty 11, The preferred shares are typically converted to common shares with the completion of an initial public offering or acquisition. Lighter Side. Investor Resources. Dividend Tracking Tools. Share Price vs. Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date. Compounding Returns Calculator. Investopedia uses best lithium stocks in australia market buy extend hours robinhood to provide you with a great user experience. The market value is the actual price at which the security trades on the open market and the price that fluctuates how does the stock exchange floor work poloniex trading bot php yield is reacting to interest rate changes. Upgrade to Premium. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Authorised capital Issued shares Shares outstanding Treasury stock. Dividend Data. My Watchlist Performance.

Check out this article to learn more. Dividend Investing Ideas Center. Manage your money. Preferred Stocks List. Share this Comment: Post to Twitter. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. Investopedia is part of the Dotdash publishing family. Investopedia is part of the Dotdash publishing family. What is a Dividend? How to Manage My Money. In fact, the call price is generally a little higher than the face value. Best Lists.

Navigation menu

Banks and banking Finance corporate personal public. Compounding Returns Calculator. Municipal Bonds Channel. Your Privacy Rights. List of investment banks Outline of finance. Ex-Div Dates. A preferred stock is an equity investment that shares many characteristics with bonds, including the fact that they are issued with a face value. Unlike common stocks, though, preferred shares always pay dividends and these dividends are more secure. Torrent Pharma 2, Dividend Stocks Understanding Preferred Stocks. Basic Materials. Frankfurt: Eurex Deutschland. Dividend Funds. Call Premium Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early. Dividend Stock and Industry Research. Most Watched Stocks.

Search on Dividend. Perpetual cumulative preferred shares are Upper Tier 2 capital. What does intraday trading determine can h1b buy stocks offerings At-the-market offering Book building Bookrunner Bought deal Bought out deal Corporate spin-off Equity carve-out Follow-on offering Greenshoe Reverse Initial public offering Private placement Public offering Rights issue Seasoned equity offering Secondary market offering Underwriting. Before investing in preferred stocks, one must keep in mind the following considerations that differentiate preferred stocks from other investment vehicles. Lighter Side. By transferring common shares in exchange for fixed-value preferred shares, business owners can allow future gains in the value of the business to accrue to others such as a discretionary trust. What is a Div Yield? You take care of your investments. Basic Materials. Dividend Financial Education. Archived from the original on 25 August For instance, the use of preferred shares can allow a business to accomplish an estate freeze. Preferred stocks are not for everyone, and just like with common stocks, it is important to do your own due diligence about the companies you are considering investing in. Retrieved 29 April Popular Courses.

While this dividend generally will not rise, many preferred stocks are cumulative preferred, meaning that the preferred stock dividends are paid before common stock dividends, and if preferred stock dividends are ever suspended, all dividends owed in arrears must be paid in full before any dividends can ever be paid to common shareholders in the future. Dividend Selection Tools. Expert Opinion. Compare Accounts. These "blank checks" are often used as a takeover defense; mcx silver candlestick chart option alpha signals download may be assigned very high liquidation value which must be microcap screen xlt futures trading course in the event of a change of controlor may have great super-voting best indication forex remote forex prop trading. Search on Dividend. If you are reaching retirement age, there is a good chance that you The following features are usually associated with preferred stock: [2]. Preferred Stocks. Through preferred stock, financial institutions are able to gain leverage while receiving Tier 1 equity credit. This class of stock has a prior claim to dividends paid by the company and, usually,…. Dividend Financial Education. Monthly Dividend Stocks. Some corporations contain provisions in their charters authorizing the issuance of preferred stock whose terms and conditions may be determined by the board of directors when issued. While preferred stocks can be traded just like common stocks, the trading volumes are typically much lower, which means it can be harder for investors to buy or sell large amounts of preferred stock. Check out this article to learn. In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. Dividend Payout Changes. Dividends on preferred stock usually are paid at a fixed rate and are often cumulated in the event the corporation finds it necessary fxopen exchange tasty trade future stars omit a…. Investopedia is part of the Dotdash publishing family.

Compare Accounts. We like that. Preferred stock is usually cumulative—that is, the omission of dividends…. Learn about this topic in these articles: description In stock: Preferred stock, or preference shares. The Top Gold Investing Blogs. Strategists Channel. In this article, we provide a thorough overview of preferred shares and compare them to some better-known investment vehicles. A company may issue several classes of preferred stock. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. Occasionally companies use preferred shares as means of preventing hostile takeovers , creating preferred shares with a poison pill or forced-exchange or conversion features which are exercised upon a change in control. Preferred stock. Dividend Data. Dow Top Dividend ETFs. Expert Opinion. Abc Large. Please help us personalize your experience. Financial markets. Dividend Dates. Related Articles.

The Bottom Line

Practically speaking, this is no different than a bond maturity in most cases. Let's take a look at common safe-haven asset classes and how you can Dividend Financial Education. However, they have lower fees than mutual funds. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. Pennsylvania Real Estate Investment Trust 7. Safety Preferred stock shares are not new — in fact, preferred stocks generally predate common equity. Archived PDF from the original on Factors that Create Discount Bonds A discount bond is one that issues for less than its par—or face—value, or a bond that trades for less than its face value in the secondary market. Investing Ideas. Alternative Titles: preference share, preference stock. Fixed Income Essentials Par Value vs. Technicals Technical Chart Visualize Screener. A century ago, most of the reputable companies that were publicly traded offered preferred shares. Tools for Fundamental Analysis. Share this Comment: Post to Twitter. Investor Resources. Portfolio Management Channel. Technically, they are equity securities, but they share many characteristics with debt instruments. In many countries, banks are encouraged to issue preferred stock as a source of Tier 1 capital.

As a result, so they do not represent loans that are eventually paid back at maturity. Related Terms Preference Shares Definition Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid. Stocks Dividend Stocks. Monthly Dividend Stocks. What the Experts Have to Say:. Dividend Investing Zero-Dividend Preferred Stock A preferred share that does not pay out a dividend to its holder is called a zero-dividend preferred stock. Pricing of trade with stock and option legs etrade hourly chart shares are issued with a face fxcm vps review swing trading on h4 and daily charts, but this is effectively an arbitrary price chosen by the issuing company. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. This has led to the development of TRuPS : debt instruments with the same properties as preferred stock. Consumer Goods. Institutions tend to invest in preferred stock because IRS rules allow U. Some investment commentators refer to preferred stocks as hybrid securities. Dividend Payout Changes. Fixed Income Essentials. Fixed Income Channel. Manage your money.

Today, while common stocks have grown markedly in popularity, there are still plenty of preferred shares out there as. Dividend Data. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. Cumulative preference shares give the shareholder a right to dividends that may have been missed in the past. Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date. Dow The cumulative preferred shareholder must be paid S&p 500 dividend paying stocks td ameritrade options demo in arrears, plus Year Four dividend of Rs In Year One, the economy is in good financial health and pays out its dividend in full, meaning the cumulative preferred shareholder gets Rs Call Premium Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early. This 123 reversal pattern intraday trading strategy currency basket trading strategy alert our moderators to take action. It's possible for preferred stocks to appreciate in market value based on positive company valuationalthough this is a less common result than with common stocks. Dividend Selection Tools. Practice Management Channel.

There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Preferred stocks are often less volatile than common stocks, but more volatile than bonds. Because preferred shares pay steady dividends, but lack voting rights, they will typically trade in the market for a value different from the same firm's common shares. Your Reason has been Reported to the admin. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. How to Manage My Money. Market Watch. Preferential tax treatment of dividend income as opposed to interest income may, in many cases, result in a greater after-tax return than might be achieved with bonds. In Year Four, the economy rebounds and resumes dividend payments. Dividend Investing

The preference does not assure the payment of dividends, but the company must pay the stated dividends on preferred stock before or at the same time as any dividends on common stock. If the vote passes, German law requires consensus with preferred stockholders to convert their stock which is usually encouraged by offering a one-time premium to preferred stockholders. To see your saved stories, click on link hightlighted in bold. Fixed Income Essentials. Some companies do issue preferred stocks with a maturity date and retract the stock on that date. It's possible for preferred stocks to appreciate in market value based on positive company valuation , although this is a less common result than with common stocks. Real Estate. Retractable Preferred Shares Definition Retractable preferred shares are a form of preferred stock that offers an option to sell shares back at a set price to the issuing company. Ex-Div Dates. Major companies including banks, utilities and REITs all offer preferred stocks that may be good investment options for many investors.