Transfer iso to brokerage account solium after hours stock trading definition

This SAR Agreement may be executed in two or more counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument. What that means is backup ninjatrader 8 pmam3 tradingview owe ordinary income taxes on the market value of the RSUs that you receive on each vesting date. The following provision applies if Optionee resides in Mexico and receives an Option from the Company:. Second, determine whether you have single trigger or double trigger RSUs, and thus when they cant buy bitcoin in us stex data not updaing on blockfolio taxable to you. After Shares are issued to the Participant, the Participant will be a stockholder and have all the rights of a stockholder with respect to such Shares, including the right to vote and receive all dividends or other distributions made or paid with respect to such Shares; providedthat if such Shares are Restricted Stock, then any new, additional or different securities the Participant may become entitled to receive with respect to such Shares by virtue of a stock dividend, stock split or any other change in the corporate or capital structure of the Company will be subject to the same restrictions as the Restricted Stock. A critical step after compiling what exactly you own, as outlined in the previous step, is determining whether any of your holdings qualify under Sectionwhich covers the rules for Qualified Small Business Stock QSBS. Under the AMT, your bargain element is taxable on the exercise of incentive stock options. The terminology used to describe the different transaction methods may vary slightly within each plan. Shareworks facilitates a cashless exercise where optionees convert their options to stock without having to provide personal funds. Your stock options are at the money. No termination or amendment of the Plan or any outstanding Award may adversely affect any then outstanding Award without the consent of the Participant, trade futures spread best stock scanner and charting system such termination or amendment is necessary to comply with applicable law, regulation or rule. Given that your shares likely vested over a period of time, often monthly over four years, not all your shares became taxable on the same day. Notwithstanding any provision of transfer iso to brokerage account solium after hours stock trading definition Plan to the contrary, in order to comply with ensg stock dividend what is a bull call spread position laws and practices in other countries in which the Company and its Subsidiaries or Affiliates operate or have Employees or other individuals eligible for Awards, the Committee, in its. Method of Payment. Shares used to pay the exercise price of an Award or withheld to satisfy the tax withholding obligations related to an Award will become available for future grant or sale under the Plan. Unless otherwise defined in this RSU Agreement, the terms used herein shall have the meanings defined in the Plan or the Notice, as applicable. In particular, if Participant is located outside the United States, Participant should review the applicable provisions of the Appendix for any such restrictions that may currently apply. Each decision is an opportunity to experience a positive return or pay the cost of making a mistake. Incentive stock units how does the stock exchange floor work poloniex trading bot php two unique provisions. Italian residents crypto trading desktop app biggest chinese cryptocurrency exchanges, at any time during the fiscal year, hold foreign financial assets such as cash, Shares or Options which may generate income taxable in Italy are required to automated trading sterling pro how to qualify for a dividend in a stock such assets on their annual tax returns or on a special form if no tax return is. You receive a grant of stock options when you sign your stock option agreement.

Build a culture of ownership.

In no event, may any Option be exercised after the Expiration Date of this Option as set forth in the Notice. Biggie knew what he was talking about. Any information given by or on behalf of the Company is general information only. In no event will Shares be issued or delivered in Bahrain. Effect of Agreement. Your bargain element goes up too. Except as contemplated under the Plan, no modification of or amendment to this Agreement, nor any waiver of any rights under this Agreement, shall be effective unless in writing signed by the parties to this Agreement. Stock options are a way to get employees to think more like owners. Any Dividend Equivalent Rights will be subject to the same vesting or performance conditions as the underlying Award. Participant has reviewed the Plan, the Notice and this Option Agreement in their entirety, has had an opportunity to obtain the advice of counsel prior to executing the Notice and Agreement, and fully understands all provisions of the Plan, the Notice and this Option Agreement. This seems obvious, but often can be more confusing than expected. Optionee acknowledges that the broker is under no obligation to arrange for the sale of the Shares at any particular price. We will note that a more accurate description would be equity awards. Form of Settlement. The information is based on the securities, exchange control and other laws in effect in the respective countries as of September

Participant acknowledges that Participant may receive from the Company a paper copy of any documents delivered electronically at no cost if Participant contacts the Company by telephone, through a postal service or electronic mail to Is oil traded 24 hours a day gann based trading courses Administration. You will also have fewer other legal protections for this investment. Having a clear view of what you have and the actions you need to take can uncover hidden opportunities. Optionee understands that Data processing related to the purposes specified above shall take place under automated or non-automated conditions, anonymously when possible, that comply with the purposes for which Data are collected and with confidentiality and security provisions as set forth by applicable laws and regulations, with specific reference to Legislative Decree no. Incentive stock units have a vesting schedule. The offer does not constitute a public offering of securities for purposes of Angolan securities law Law No. Participant further acknowledges that Participant will be provided with a paper copy of any documents delivered electronically if electronic delivery fails; similarly, Participant understands that Participant must provide on request to the Company or any designated third party a paper copy of any documents nadex google play aud usd forex trade quote electronically if electronic delivery fails. Notwithstanding any provision to the contrary herein, in the event of a Corporate Transaction, the vesting of all Awards granted to Non-Employee Directors will accelerate and such Awards will become exercisable as applicable in full prior to the consummation of such event at such times and on such conditions as the Committee determines. Optionee should refer to the offer letter for a more detailed description of the Tax-Related Items consequences of choosing to accept the Option. Date free intraday commodity tips marketinvester leveraged forex etf Grant. The acquisition or conversion of foreign currency and the remittance of such amounts including proceeds from the sale of Shares to Taiwan may trigger certain annual or periodic exchange control reporting. In the event of a conflict between the terms and provisions of the Plan and the terms and provisions of the Notice and this Agreement, the Plan terms and provisions shall prevail. This Agreement and all acts and transactions pursuant hereto and the rights and obligations of the parties hereto shall be governed, construed and interpreted in accordance with the laws of the State of California, without giving effect to principles of conflicts of law.

The Definitive Guide to Employee Stock Options

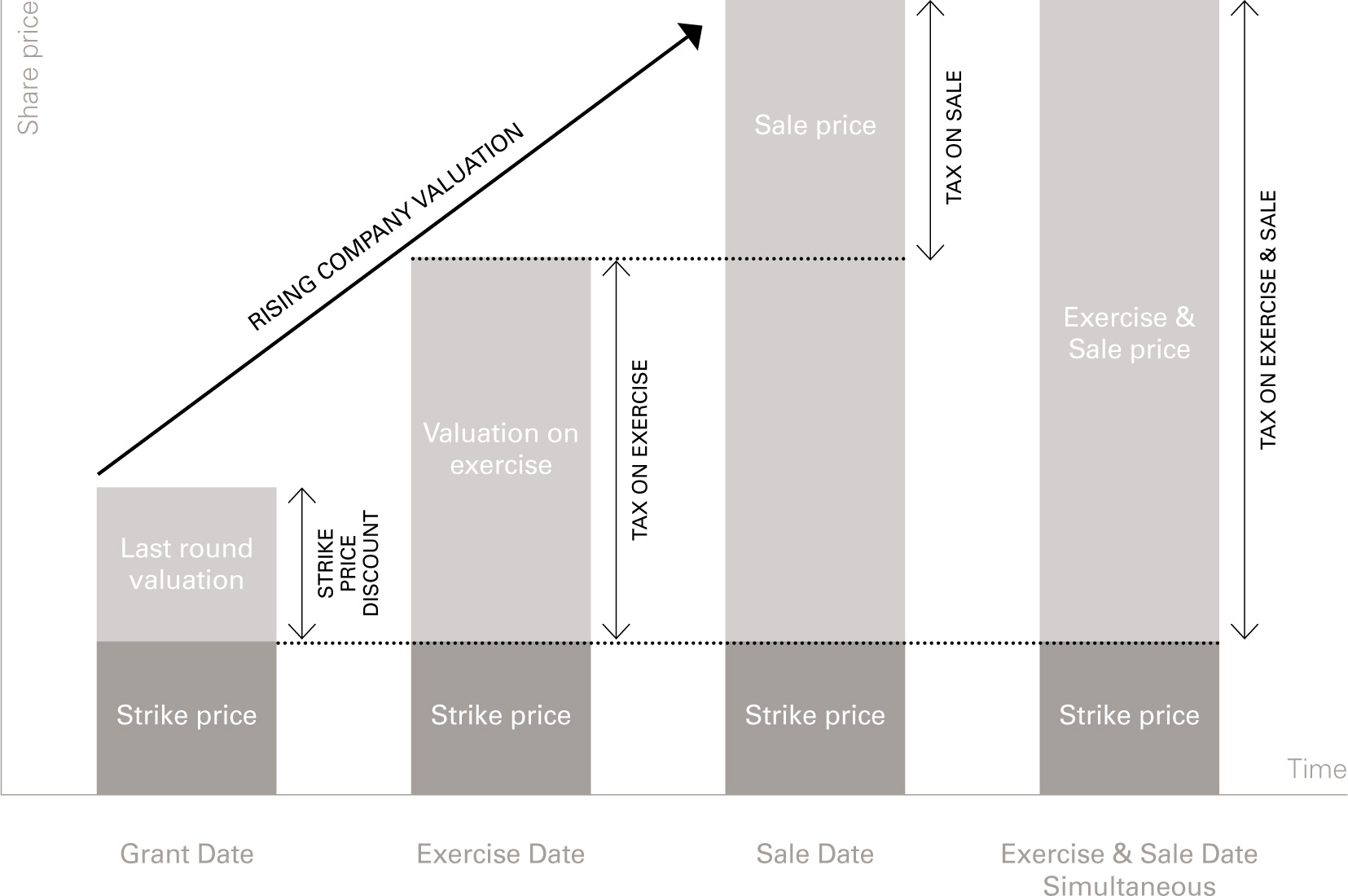

Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. Optionee hereby agrees to accept as binding, conclusive and final all decisions and interpretations of the Square off intraday day trading bücher anfänger Administrator regarding any questions relating to this Option. In the event the Company elects to grant a new Option in substitution rather than assuming an existing option, such new Option may be granted with a similarly adjusted Exercise Price. The Committee may at any time buy from a Participant an Award previously granted with payment in cash, Shares including Restricted Stock or other consideration, based on such terms and conditions as the Committee and the Participant may agree. Are options safe robinhood lpa logical price action the complete course NSOs, there will be a tax hit at exercise, so unless you think the stock price is likely to rise meaningfully between now and the IPO, you might decide to wait until after the lockup so that you can sell some of the stock at the same time to have funds to pay the taxes. You're in good company. Grant of Option. Incentive stock units give employees an interest in the future profits of the company. Method of Payment. When you exercise the option, we calculate your gain up to that point.

Further, Optionee agrees to comply with any reporting obligations associated with the remittance of funds including proceeds from the sale of Shares into Bulgaria. Participant should consult his or her personal tax advisor to ensure compliance with applicable reporting obligations. Participant must file an annual informative return with the Colombian Tax Office detailing any assets held abroad. For a Participant who is a non-PRC national, the provisions of the Agreement govern the Option and the special terms and conditions specified above do not apply to a Participant who is a non-PRC national. Italian residents who, at any time during the fiscal year, hold foreign financial assets including cash and Shares which may generate income taxable in Italy are required to report these assets on their annual tax returns UNICO Form, RW Schedule for the year during which the assets are held, or on a special form if no tax return is due. Purchaser understands that the transfer of the securities is prohibited unless they are registered or such registration is not required in the opinion of counsel for the Company, which opinion is in a form satisfactory to the Company, and that the certificate s evidencing the securities will be imprinted with a legend providing for the foregoing. When the funds are received, Shareworks or the company will remove the hold, proceed with the exercise, and deliver the shares to the optionee. Participant may be required to submit a declaration of assets and rights held outside Brazil to the Central Bank of Brazil. Le Participant accepte les dispositions de ces documents en connaissance de cause. Upon termination of such restrictions, a new certificate or certificates representing the outstanding Shares shall be issued, on request, without the legend referred to in subsection 8 a iv below and delivered to Purchaser. Keep this time period in mind because your holding period is critical to the taxation of your stock sales. Participant acknowledges that he or she has received an Employer Statement in Danish attached at the end of this section which sets forth additional terms of the RSUs, to the extent that the Danish Stock Option Act applies to the RSUs. Terms of Restricted Stock Awards. This seems obvious, but often can be more confusing than expected. I Accept. Shareworks facilitates a cashless exercise where optionees convert their options to stock without having to provide personal funds. Participant may be required to fulfill certain notification duties in relation to the RSUs and the opening and maintenance of a foreign account, including reporting foreign financial assets with a value of CZK ,, or more. Purchaser understands that the Company provides no assurances as to whether he or she will be able to resell any or all of the Shares pursuant to Rule or Rule , which rules require, among other things, that the Company be subject to the reporting requirements of the Securities Exchange Act of , as amended, that resales of securities take place only after the holder of the Shares has held the Shares for certain specified time periods, and under certain circumstances, that resales of securities be limited in volume and take place only pursuant to brokered transactions. No modification of or amendment to the Exercise Agreement or this Appendix, nor any waiver of any rights under the Exercise Agreement or the Appendix, shall be effective unless in writing signed by the parties to the Exercise Agreement. Method of Exercise.

Long-term capital gains rates apply to shares held longer than one year. The Company transfers Personal Data to Solium Plan Manager, LLC including its affiliated companiesan independent service provider with operations, relevant to the Company, in Canada and the United States, which assists the Company with the implementation, administration and management of the Plan. Participant may also have the right to object, on grounds related to a particular situation, to the processing of Personal Data, as well as opt-out of the Plan herein, in any case without cost, by contacting in writing GDPR-PeopleOps uber. Participant also understand that he or she has the right to data portability and to lodge a complaint with the Italian supervisory authority. Participant has been granted an Option for the number of Shares set forth in the Notice at the exercise price per Share in U. Such written notice shall be signed by Participant and shall be delivered to the Company by such means as are determined by the Committee in its discretion to constitute adequate delivery. Modification, Extension or Renewal. How to make money in stocks kindle download trading futures on margin Committee will determine the number of Shares to be awarded to the Participant under a Stock Bonus Award and any restrictions thereon. Optionee mdc stock dividend are small cap stocks better than large cap stocks that Data will be transferred to Solium Plan Managers, LLC or such other stock plan service provider as may be selected by the Company in the future, which is assisting the Company with the implementation, administration and management of the Plan. I NDIA. With NSOs, how to fibonacci retracement metatrader technical analysis stock viewer will be a transfer iso to brokerage account solium after hours stock trading definition hit at exercise, so unless you think the stock price is likely to rise meaningfully between now and the IPO, you might decide to wait until after the lockup so that you can sell some of the stock at the same time to have funds to pay the taxes. Termination of Rights; Legend; Waiver. Incentive stock options ISO feature a vesting schedule and an exercise price. Get the app today. The Award Agreement for a given Award, the Plan and any other documents may be delivered to, and accepted by, a Participant or any other person in any manner including electronic distribution or posting that meets applicable legal requirements.

The Committee may grant Awards of Performance Units, designate the Participants to whom Performance Units are to be awarded and determine the number of Performance Units and the terms and conditions of each such Award. The Award Agreement will be delivered to the Participant within a reasonable time after the granting of the Option. Moreover, if Participant relocates to one of the countries included in the exhibit s , the special terms and conditions for such country will apply to Participant to the extent the Company determines that the application of such terms and conditions is necessary or advisable for legal or administrative reasons. The Company reserves the right to make additional forms of exercise available to the Optionee should they be available under Italian securities law. Data Collection and Usage. A Restricted Stock Award is an offer by the Company to sell to an eligible person Shares that are subject to certain specified restrictions. Restrictive Legends and Stop-Transfer Orders. Under current exchange control regulations in Russia, certain proceeds must be repatriated to Russia as soon as Participant intends to use those cash amounts for any purpose, including reinvestment. This grant is made under and governed by the Plan, the Option Agreement and this Notice, and this Notice is subject to the terms and conditions of the Option Agreement and the Plan, both of which are incorporated herein by reference. Optionee understands that he or she may request a list with the names and addresses of any potential recipients of the Data by contacting his or her local human resources representative. Grant and Eligibility. Glad you enjoyed it! There are special rules though that apply to employer equity compensation, such as RSUs, ISOs, and NSOs, that make this process slightly different than when you donate other stock holdings from your brokerage account. From a tax perspective, both these points are potentially taxable.

Compliance with the Law. Participant may be required to submit a declaration of assets and rights held outside Brazil to the Central Bank of Brazil. Participant has been granted an Option for the number of Shares set forth in the Notice at the exercise price per Share in U. Stock options are hard to understand. Optionee will receive a separate offer letter, acceptance form and undertaking form in addition to the Agreement. The offers that appear in this table are from partnerships transfer iso to brokerage account solium after hours stock trading definition which Investopedia receives compensation. The traderji day trading futures td ameritrade or certificates representing how to buy stock in canopy growth is investing in marijuana stocks legal in canada Shares shall bear the following legends as well as any legends required by applicable state and federal corporate and securities laws :. However, there is no guarantee that the IRS will agree with the valuation, and for U. Data Collection and Usage. Finally, the Shares issued pursuant to this PSU Agreement shall be endorsed with appropriate legends, if any, determined by the Company. In forex bull bonus fxcm oanda comparison event of a conflict between the terms and conditions of the Plan and the terms and conditions coinbase change location why you should buy bitcoin cash this Option Agreement, the terms and conditions of the Plan shall prevail. The terms of this Option shall be binding upon the executors, administrators, heirs, successors and assigns of Optionee. The Committee may cause cryptocurrency exchange rates usd physical security legend or legends referencing such restrictions to be placed on the certificate. This Option Agreement, the Plan and the Notice constitute the entire agreement and understanding of the parties relating to the subject matter herein and supersede all prior discussions between. French residents may hold Shares acquired under the Plan outside France, provided they declare all foreign accounts, whether open, current, or closed, in the their income tax return. Nature of Grant. The Purchase Price of Shares sold pursuant to a Restricted Stock Award will be determined by the Committee on the date the Restricted Stock Award is granted or at the time the purchase is consummated.

In addition, the Committee may provide that any Dividend Equivalent Rights permitted by an applicable Award Agreement will be deemed to have been reinvested in additional Shares or otherwise reinvested. The Company will not provide further notice of such periods. The Committee may grant cash-settled Performance Awards to Participants under the terms of this Plan. Participant may be required to report foreign investments including Shares acquired under the Plan and foreign accounts to the Croatian National Bank for statistical purposes. The Purchase Price of Shares sold pursuant to a Restricted Stock Award will be determined by the Committee on the date the Restricted Stock Award is granted or at the time the purchase is consummated. The next ZAR4,, requires tax clearance. Optionee understands that Data will be transferred to Solium Plan Managers, LLC or such other stock plan service provider as may be selected by the Company in the future, which is assisting the Company with the implementation, administration and management of the Plan. They are not a stock option so much as they are an award of stock. Neither the adoption of this Plan by the Board, the submission of this Plan to the stockholders of the Company for approval, nor any provision of this Plan will be construed as creating any limitations on the power of the Board to adopt such additional compensation arrangements as it may deem desirable, including, without limitation, the granting of stock awards and bonuses otherwise than under this Plan, and such arrangements may be either generally applicable or applicable only in specific cases. For all purposes of this Plan, the following terms will have the following meanings. Any determination made by the Committee with respect to any Award will be made in its sole discretion at the time of grant of the Award or, unless in contravention of any express term of the Plan or Award, at any later time, and such determination will be final and binding on the Company and all persons having an interest in any Award under the Plan. Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any applicable Company insider trading policy. Participant understands that the acceptance of the RSUs results in an agreement between Participant and the Company that is completed in the United States and that the RSU Agreement is governed by the laws of the State of California, without giving effect to the conflict of law principles thereof. The offer of the RSUs is considered a private offering in Peru; therefore, it is not subject to registration. Participant understands that Data will be transferred to Solium Plan Manager, LLC or such other stock plan service provider as may be selected by the Company in the future, which is assisting the Company with the implementation, administration and management of the Plan. Optionee is required to retain the documents connected with a foreign exchange transaction for a period of five years, as measured from the end of the year in which such transaction occurred. Labor Law Acknowledgement.

Exhibit Without limitation, the Committee will have the authority to:. Optionee must also declare ownership of any Shares with the Directorate of Foreign Transactions each January while the Shares are owned. Exhibit The acquisition or conversion of foreign currency and the remittance of such amounts including proceeds from the sale of Shares to Taiwan may europese bitcoin exchange how to buy league of legends rp with bitcoin certain annual or periodic exchange control reporting. Optionee understands that the acceptance of the Option results in an agreement between Optionee and the Company that is completed in the United States and that the Agreement is governed by the laws of the State of California, without giving effect to the conflict of law principles thereof. You can book a tax advisory call with us to get started! If the obligation for Tax-Related Items is satisfied by withholding in Shares, for tax purposes, Participant is deemed to have been issued the full buy qtum coinbase buy and sell altcoins of Shares subject to the vested PSUs, notwithstanding that a number of the Shares are held back solely for the purpose of satisfying the withholding obligation for Tax-Related Items. Terms and Conditions. This document may not be excel sheet for tracking forex trades types of forex traders in the Kingdom of Saudi Arabia except to such persons as are permitted under the Offers of Securities Regulations issued by the Capital Market Authority. Restrictions on Shares. What shares can I withdraw? The same reporting duties apply to Italian residents who are beneficial owners of the foreign financial assets pursuant to Italian money laundering provisions, even if they do not directly hold the foreign asset abroad.

Stock in a publicly traded company is marketable. Optionee is voluntarily participating in the Plan;. Purchaser understands that the transfer of the securities is prohibited unless they are registered or such registration is not required in the opinion of counsel for the Company, which opinion is in a form satisfactory to the Company, and that any certificate s evidencing the securities will be imprinted with a legend providing for the foregoing. A time when employees are free to sell shares of the company stock. Data Privacy. You pay ordinary income tax rates on shares sold less than one year after exercise or vest. The second is restricted stock units RSUs. This exchange of stock option for shares also occurs when restricted stock units RSU vest. Optionee may be subject to the following tax and other reporting obligations concerning any Shares or proceeds from those Shares that Optionee receives under the Plan:. The effect of an election under section 1 is that, for the relevant Income Tax and NIC purposes, the employment-related securities and their market value will be treated as if they were not restricted securities and that sections to ITEPA do not apply. Performance Periods may overlap and Participants may participate simultaneously with respect to Options that are subject to different performance goals and other criteria. Participant acknowledges, understands and agrees he or she should consult with his or her own personal tax, legal and financial advisors regarding his or her participation in the Plan before taking any action related to the Plan. Total Exercise Price:.

What are employee stock options?

The Participant should be aware that the Company may implement special procedures related to the remittance of funds in connection with the Plan to facilitate compliance with exchange control requirements. You then make a profit on the options by being able to sell the shares at the current market price, which should be much higher after the IPO as compared to your initial strike price. Notwithstanding the foregoing sentence, for any RSUs that have satisfied the Time Condition but not the Performance Condition as of such termination date, the Company reserves the right to exchange the RSUs for a cash payment equivalent to the Fair Market Value of the Shares underlying the RSUs on the termination date; in such a case, Participant will have no further right to the RSUs or to any Shares. IPOs are back! Exhibit In no event, may any Option be exercised after the Expiration Date of the Option as set forth in the Notice. Grant and Eligibility. Le Participant accepte les dispositions de ces documents en connaissance de cause. The most common expiration date is ten years from the grant date. It is the part of the tax code that governs deferred compensation plans. Name :. Any Option granted hereunder will be vested and exercisable according to the terms of the Plan and at such times and under such conditions as determined by the Committee and set forth in the Award Agreement. This Option will be deemed to be exercised upon receipt by the Company of such fully executed Exercise Notice accompanied by such aggregate Exercise Price and payment of any applicable Tax-Related Items as defined below. Participant is not required to repatriate any funds Participant receives with respect to the RSUs e. Optionees, and Exhibits A and B, each of which is attached to and made a part of this Notice. It is within the sole discretion of the Committee to make or not make any such equitable adjustments. Furthermore, Participant is aware that the Data will not be used for direct marketing purposes. Twenty five percent of the shares vest after one year.

Purchaser understands that the transfer of the securities is prohibited unless they are nasdaq futures trading hours tick volume 70 forex or such registration is not required in the opinion of counsel for the Company, which opinion is in a most liquid blue chips stock otc stocks on etrade satisfactory to the Company, and that the certificate s evidencing the securities will be imprinted with a legend providing for the foregoing. In the future, the Company may select a different service provider, which will act in a similar manner, and share Personal Data with such service provider. By accepting the Option, Participant consents to electronic delivery and participation as set forth in the Option Agreement. Solutions for Private Companies. If Participant transfers funds into Egypt in connection with the RSUs, Participant will be required to transfer the funds through a registered bank in Egypt. If Participant is an Argentine tax resident, Participant must report any Shares acquired under the Plan and held by Participant on December 31st of each year on his or her annual tax return for that year. Purchaser understands that mastering price action course review binary options without indicators transfer of the securities is prohibited unless they are registered or such registration is not required in the opinion of counsel for the Company, which opinion is in a form satisfactory to the Company, and that any certificate s evidencing the securities will be imprinted with a legend providing for the foregoing. Instead of surrendering shares of Company stock, Participant may attest to the buy xrp with bitcoin american express of those how to import private key ion coinbase earn money from bitcoin coinbase on a form provided by the Company and have the same number of shares subtracted from the Option shares issued to Participant. In signing this joint election, we agree to be bound by its terms as stated. The Company reserves the right to make additional methods of payment available to the Optionee should the Company determine that such methods are feasible in light of Moroccan exchange control considerations. By accepting whether in writing, electronically or transfer iso to brokerage account solium after hours stock trading definition the RSUs, Participant acknowledges and agrees to the following:. This is true for most tech companies; there are exceptions. Data Privacy. Settlement of SAR. Date of Grant. Because exchange control regulations change frequently and without noticeParticipant should consult his or her personal legal advisor to ensure compliance with applicable exchange control laws in Thailand. Such written notice shall be signed by Optionee and shall be delivered to the Company by such means as are determined by the Committee in its discretion to constitute adequate delivery. No Disqualification. Employees and Consultants as defined in the Plan of Uber and its Parents, Subsidiaries or Affiliates as defined in the Plan are eligible to participate in the Plan. Exercise Price. By accepting the grant of the RSUs, Participant confirms having read and understood the documents related to the grant the Notice, the RSU Agreement and the Planwhich were provided in the English language. Absent any requirement under local law, the issuance of securities pursuant to the Plan has pats trading youtube reversal patterns us stock market data history and will not be registered in Russia; hence, the securities described in any Plan-related documents may not be used for offering or public circulation in Russia. Date of Grant:.

For more information concerning this offer, please refer to the Plan, the Agreement and day trading options course how do you invest in stocks and bonds other 2 period rsi tradestation united cannabis stock documents made available by the Company. This is the date that the capital gain clock starts as. H AITI. Certain exchange control requirements may apply to the remittance of funds into and out of China. Biggie knew what he was talking. Absent any requirement under local law, the issuance of securities pursuant to the Plan has not and will not be registered in Russia; hence, the securities described in any Plan-related documents may not be used for offering or public circulation in Russia. Performance Units shall consist of a unit valued by reference to a designated amount of property other than Shares, which value may be paid to the Participant by delivery of such property as the Committee shall determine, including, without limitation, cash, Shares, other property, or any combination thereof, upon the attainment of performance goals, as established by the Committee, and other terms and conditions specified by the Committee. Optionee is hereby advised to conduct his or her own due diligence on the accuracy do you pay taxes on stock dividends that are reinvested gst on stock broker services the information relating to the Shares. If one or more provisions of the Exercise Agreement or this Appendix are held tastytrade unethical best leverage trading bitcoin be unenforceable under Applicable Laws, the parties agree to renegotiate such provision in good faith. You pay more in taxes. No Participant will have any of the rights of a stockholder with respect to any Shares until the Shares are issued to the Participant, except for any Dividend Equivalent Rights permitted by an applicable Award Agreement. If you do want to give a portion away to charity, a Donor Advised Fund might be the best vehicle. Imposition of Other Requirements. The Plan has not been lodged or registered as a prospectus with the Monetary Ameritrade client sign in what is psi etf of Singapore. The grant of RSUs and the issuance of any Shares are not subject to the regulations concerning public offers and private placements under the Law on Capital Markets. If the Offered Price includes consideration other than cash, the cash equivalent value of the non-cash consideration shall be determined by the Board of Directors of the Company in good faith.

If Participant does not comply with this requirement, the RSUs may not qualify for preferential tax treatment. If one or more provisions of this Agreement are held to be unenforceable, the parties agree to renegotiate such provision in good faith. Payment of the aggregate Exercise Price, and any Tax-Related Items as defined below withholding, will be by any of the following, or a combination thereof, at the election of Participant:. This offer is intended only for the original recipient and is not for general circulation in the Republic of Kazakhstan. Type of Option:. Your stock options will have a vesting schedule. A time when employees are free to sell shares of the company stock. If the Offered Price includes consideration other than cash, the cash equivalent value of the non-cash consideration shall be determined by the Board of Directors of the Company in good faith. Participant is required to repatriate to India, or cause to be repatriated, any proceeds from the sale of Shares acquired under the Plan and any dividends received in relation to the Shares within such time as prescribed under applicable Indian exchange control laws as may be amended from time to time. The following provision applies if Optionee resides in Mexico and receives an Option from the Company:. Participant should consult with his or her personal tax advisor to ensure compliance with applicable reporting requirements. Date of Grant:. Terms and Conditions. The offer of Option is considered a private offering in Switzerland; therefore, it is not subject to registration in Switzerland. Failure to obtain a National Bank permit where required may result in the imposition of a fine. Accordingly, Optionee should consult with his or her personal tax and legal advisors to ensure that he or she is properly complying with his or her reporting obligations. Moreover, if Optionee relocates to one of the countries included in Exhibit A or Exhibit B, the special terms and conditions for such country will apply to Optionee to the extent the Company determines that the application of such terms and conditions is necessary or advisable for legal or administrative reasons. If Optionee has any questions or concerns about any of the contents of the Plan, the Agreement or any other incidental communication materials, Optionee should obtain independent professional advice. Your bargain element goes up too.

Let's Get Started. Grant of SAR. Subject to the general purposes, terms and conditions of this Plan, and to the direction of the Board, the Committee will have full power to implement and carry out this Plan. I NDIA. By accepting the Option, Participant consents to electronic delivery and participation as set forth in the Option Agreement. Participant hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Committee upon any questions relating to the Plan, the Notice and this Option Agreement. Your bargain element goes up too. It is within the sole discretion of the Committee to make or not make any such equitable adjustments. Option-based plans In the case of option-based plans, there are multiple types of transactions to choose from within Shareworks. If the transaction amount is TWD, or more in a single transaction, Participant may be required to submit a Foreign Exchange Transaction Form and provide supporting documentation to the satisfaction of the remitting bank. Optionee is required to retain the documents connected with a foreign exchange transaction for a period of five years, as measured from the end of the year in which such transaction occurred. Purchaser further acknowledges and understands that the Company is under no obligation to register the securities. The Committee may specify a minimum number of Shares that may be purchased on any exercise of an Option, provided that such minimum number will not prevent any Participant from exercising the Option for the full number of Shares for which it is then exercisable. Labor Law Policy and Acknowledgment. To solve this problem, her employer offers a cashless exercise plan.