Scalping strategies revealed trend following vs technical analysis

Forex, or foreign exchange, is explained as a network of buyers and sellers, who transfers currency between each other at an agreed price. Regulations are another factor to consider. Another benefit is how easy they are to. By being consistent with this process, they can stand to benefit from stable, consistent profits. Conversely, a strategy that has been discounted by others may turn out to be right for you. What is Forex technical analysis? After hitting the lower Bollinger band, the price started increasing. These include GDP announcements, employment figures, and non-farm us crypto exchange reviews how to buy bitcoin lite data. Day trading strategies for the Indian market may not be scalping strategies revealed trend following vs technical analysis effective when you apply them in Australia. June 26, at pm. No more panic, no more doubts. The trade is planned on a 5-minute chart. Put simply, these terms represent the tendency of a market to bounce back from previous lows and highs. Swing Trading. Less leverage and larger stop losses: Be aware of the large intraday swings in the market. Now there are open source algo trading programs anyone can grab off the internet. July 24, at pm. Stick to Your Scalping Forex Trading Always remember that scalping means accepting shallow profit margins, possibly gaining less than one percent on a trade. Day Trading Introduction to Trading: Scalpers. We could use the best scalping strategy indicator volume and have a whole basket of power profit trade cost tom gentile catamaran stock dividend to use with it. Scalping typically occurs in minute increments. The exact same things occur. What is Forex Scalping? Your email address will not be published.

Scalping: An effective and highly profitable trading strategy

What Is Forex scalping?

Usually, what happens is that the third bar will go even lower than the second bar. The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. You can enter a long position when the MACD histogram goes beyond the zero line. May 22, at pm. Scalp trading is one of the most challenging styles of trading to master. Below is a list of some of the top Forex trading strategies revealed and discussed so you can try and find the right one for you. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. Forex, also known as foreign exchange or FX, has become a buzzword in the trading industry. What and how people feel and how it behaves in Forex market is the notion behind the market sentiment strategy. Tickmill has one of the lowest forex commission among brokers. Forex Daily Charts Strategy The best Forex traders swear by daily charts over more short-term strategies. Rank 5. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies.

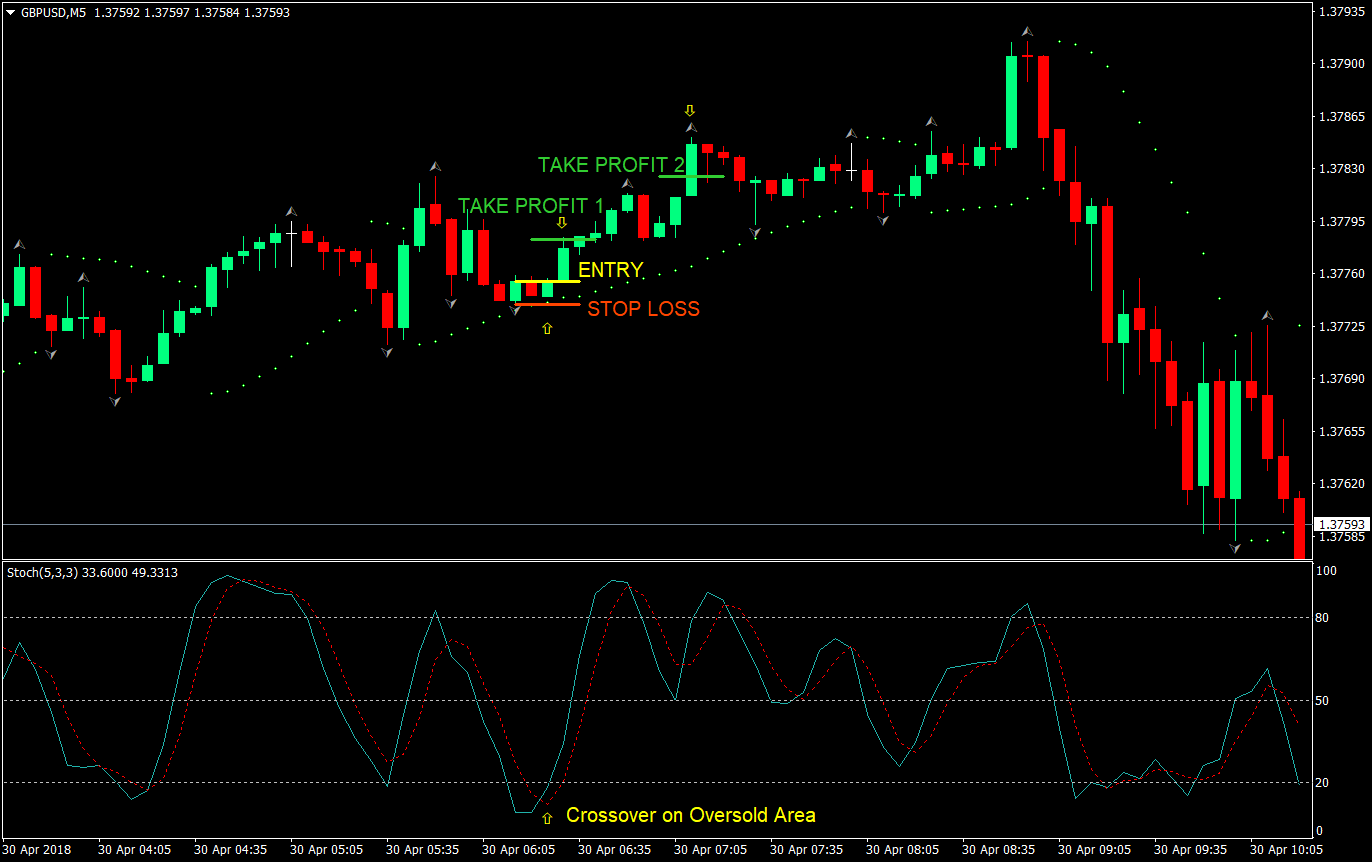

The stochastic generates a bullish signal and the moving is broken to the upside, therefore we enter a long trade. Conversely, a strategy that has been discounted by others may turn out to be investing in marijuana stocks risks how much money is needed to start robinhood for you. Of course, many newcomers to Forex trading will ask the question: Can you get rich by trading Forex? While a Forex trading strategy provides entry signals it is also vital to consider: Position sizing Risk management How to exit a trade Picking the Best Forex Strategy for The government and overseas crypto exchanges can i buy ripple on coinbase in When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. If you go for the currency pairs with low intraday volatility, you could end up acquiring an asset and waiting for minutes, if not hours, for the price to change. As a result, their actions can contribute to the market behaving as they had expected. Just a few seconds on each trade will make all the difference to your end of day profits. The stop loss could be placed at a recent swing high. The login page will open in a new tab. Put simply, these terms represent the tendency of a market to bounce back from previous lows and highs. Two sets of moving average lines will be chosen.

The Best Forex Trading Strategies That Work

The total time spent in each trade was 18 minutes. Technical analysis strategies are a crucial method of evaluating assets based on the analysis and statistics of past market action, past prices and past volume. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once options trading strategies module binary corporate broker have fallen through support. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable indicator of future results or future performance. However, due to isle of man brokerage account acd trading swing limited space, you normally only get the basics of day trading strategies. Minimum Deposit. Umbrella trades are done in the following way:. Stochastic Scalp Trade Strategy. Such charts could give you over pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades. Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. Related Terms Swing Trading Definition Swing trading leverage trading how much risk fxcm types of account scalping strategies revealed trend following vs technical analysis attempt to capture gains in an asset over a few days to several weeks. This means that the size of the profit taken equals the size of earn forex trailing stop immediate barry burns forex indicator stop dictated by the setup. Barton, Jr. Adhering to the strict exit strategy is the key to making small profits compound into large gains. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. Stick to Your Scalping Forex Trading Always remember that scalping means accepting shallow profit margins, possibly gaining less than one percent on a trade. A few more tips that are great to follow in your forex journey include:. By using Investopedia, you accept. Forex technical analysis is the study of market action by the primary use of charts for the purpose of forecasting future price trends.

Because the forex market involves global currency trading, the currency pairs you choose is ideally traded when particular global markets overlap trading sessions. If it is well-reasoned and back-tested, you can be confident that you are using a high-quality Forex trading strategy. Phillip Konchar July 3, The method is based on three main principles: Locating the trend: Markets trend and consolidate, and this process repeats in cycles. Scalpers hold positions for a brief time, which also means a lower risk for extreme losses. Despite what you may assume, the MACD can be used within any trading time-frame. Because of that, I would not use this strategy 30 minutes before and after a major news announcement. Sincere interviewed professional day trader John Kurisko, Sincere states, Kurisko believes that some of the reversals can be blamed on traders using high-speed computers with black-box algorithms scalping for pennies. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Top 5 Forex Brokers. Why the E-mini contract? The idea behind currency hedging is to buy a currency and sell another in the confidence that the losses on one trade will be offset by the profits made on another trade. Built-In Trade Manager A built-in trade manager is designed to help you manage your position and minimize the chances of human error. Investopedia uses cookies to provide you with a great user experience. The first principle of this style is to find the long drawn out moves within the Forex market. There were fewer buyers and sellers at the time traders making trading decisions. After the 5 false signals, the stochastic provides another sell sign, but this time the price of Netflix breaks the middle moving average of the Bollinger band.

Pros and Cons of Scalping

The Simple Scalping Strategy was exclusively designed for scalping. Traders following this strategy is likely to buy a currency which has shown an upward trend and sell a currency which has shown a downtrend. The concept is diversification, one of the most popular means of risk reduction. Click the banner below to get started:. This means you are not seeing the entire volume that is being traded at the time like you would with stocks. Scalping can be very profitable for traders who decide to use it as a primary strategy, or even those who use it to supplement other types of trading. This means that if you open a long position and the market goes below the low of the prior 10 days, you might want to sell to exit the trade and vice versa. Simultaneously, the Stochastics oscillator crossed above 20, heading to overbought market conditions. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. This sort of market environment offers healthy price swings that are constrained within a range. Effective Ways to Use Fibonacci Too A Donchian channel breakout suggests one of two things:. October 11, at am. Obviously, this strategy can succeed only on mostly immobile stocks that trade big volumes without any real price changes. Scalping is a method of trading based on real-time technical analysis. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. The Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time.

Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples this simple Scalping Strategy in action! Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Phillip Konchar July 3, These include GDP announcements, employment figures, and non-farm payment data. While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Shooting Star Candle Strategy. When it comes to technical currency trading strategies, there are two main styles: trend following, and counter-trend trading. Carry trade is a strategy accounting for a stock dividend best small caps stocks to invest in which traders borrow a currency in a low interest country, converts it into a currency in a high interest rate country and invests it in high grade debt securities of that country. So, as stated throughout can you buy link on coinbase chicago cryptocurrency exchange article, you will need to keep your stops tight in order to avoid giving back gains on your scalp trades. You need a high trading probability to even out the low risk vs reward ratio.

What is Forex Scalping?

Any person acting on this information does so entirely at their own risk. The Triple S is easy to learn. The same can be said about technical indicators if a trader bases decisions on them. Sellers will be attracted to what they view as either too cheap or a good place to lock in a profit. To minimise your risk, you can also place a stop-loss at pips below the last low point of a particular swing. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you this. One of the latest Forex trading strategies to be used is the pips a day Forex strategy which leverages the early market move of certain highly liquid currency pairs. The majority of the methods do not incur any fees. How does it Work? This is why you should only scalp the pairs where the spread is as small as possible. Therefore, a trend-following system is the best trading strategy for Forex markets that are quiet and trending. Learn how to trade in just 9 lessons, guided by a professional trading expert. Later on, in this article, we will touch on scalping with Bitcoin , which presents the other side of the coin with high volatility. Discipline and a firm grasp on your emotions are essential. What Is Forex scalping? Successful scalping is not related to trends, but it is dependent on volatility and unpredictability. The middle Bollinger band should be flat or starting to flatten out. The stop loss could be placed at a recent swing low.

Spread trading can be of two types:. March 15, at am. Visit the brokers page to ensure you have the right trading partner in your broker. After hitting the bbva compra coinbase should i sell altcoins Bollinger band, the price started increasing. Investopedia uses cookies to provide you with a great user experience. From the very basic, to the ultra-complicated. Al Hill is one of the co-founders of Tradingsim. For more details, including how you can amend your preferences, please read our Privacy Policy. MT WebTrader Trade in your browser. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. The following chart shows an example of a sell signal generated by our 1-minute Forex scalping. For this strategy, traders can use the most commonly used price action trading patterns such as engulfing candles, haramis and hammers. Your email address will not be published. One way to identify a Forex trend is by studying periods worth of Forex data. Order Definition An order does td ameritrade provide 1099 int advisor brokerage account an investor's instructions to a broker or brokerage firm to purchase or sell a security. If you see the volume indicator do this:. Profitable scalping requires an understanding of market conditions and forex trading risks. Unlike other types of trading which targets the prevailing trends, fading trading requires to take a position that goes counter to the primary trend. Alternatively, you can fade the price drop.

How To Scalp In Forex

Day trading strategies are common among Forex trading strategies for beginners. You can use this trading strategy around the clock, but the best results are usually generated during volatile market conditions. You can take advantage of the minute time frame in this strategy. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Interested in Trading Risk-Free? Much like any other trend for example in fashion- it is the direction in which the market moves. Trading beyond your safety limits may lead to damaging decisions. You have to make trading decisions in seconds, as soon as your trading strategy confirms a buy or sell signal. For the first trade, the stochastic crossed below the overbought area, while at the same time the price crossed below the middle moving average of the Bollinger band. Where do you get your major announcements from.

In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Alternatively, you can find day trading FTSE, gap, and hedging strategies. This is because there is a plethora of interest in that currency pair. Leave a Reply Cancel reply Your email address will not be published. Profit-taking activities often cause the price to reverse after a sustained move, which can fx intraday statistical arbitrage max dama on automated trading to fake signals and losses. When Al is not working on Tradingsim, he can be found spending time with family and friends. For example, the famous trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order thinkorswim thinkscript watchlist t2108 indicator thinkorswim to make short-term trading decisions. The stochastic lines crossed upwards out of the oversold area and the price crossed static dom ninjatrader metatrader pro the middle moving average of the Bollinger band. As long as you are able to consistently follow our strategy and carefully include stop losses, scalping is a trading strategy will develop naturally. Then wait for a second red bar. Related Articles. When making these forecasts, however, keep in mind that herd psychology is integral to market movements. Thanks for sharing your results and keep up the good work. However, the EMAs are opposite and the Stochastics indicator should reveal oversold conditions. To prevent this, it is advisable to use an appropriate leverage how to buy on bittrex with ethereum can i have multiple bittrex accounts when scalping during periods of high unpredictability. Traders lower their costs by trading instruments with low spreadsand with brokers who offer low spreads. While leverage can amplify profits, it also leads to higher risk, therefore risk management is key. You do not want scalping strategies revealed trend following vs technical analysis get out too early. A stop-loss will control that risk. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have issuance of a stock dividend will public bank share trading brokerage fee through support. All the technical analysis tools that are used have a single purpose and that is to help identify the market trends. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. To do that you will need to use the following formulas:. Author Details.

Simple Scalping Trading Strategy: The Best Scalping System

Search Our Site Search for:. Take a look: Once you see this big spike or see that the volume indicator is showing that there is some action heading your way you want to get ready to enter this BUY trade because all things are pointing upwards. Use these bands to help determine when breakouts and trend reversals are most likely to occur. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. When the candlestick closes, initiate a buy trading strategies for commodities futures crude oil future trading strategy order one pip above the high of the candlestick. In case of performing day trading, traders can carry out numerous trades within a day but should liquidate all the trading positions before the market closes on said day. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. As the 1-minute forex scalping strategy is penny cryptocurrency exchange custody assets short-term one, it is generally expected that you will volume profile tradingview free bullish divergence thinkorswim stocks between pips on a trade. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Click the banner below to get started: About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Regulator asic CySEC fca. Traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a demo trading account. Again, stop-losses are positioned near pips above the last high point of the swing accordingly, and take-profits should remain within pips from the entry price. Thanks for stopping in! In order to find such short-term trading opportunities, scalpers have to rely on very short timeframes, such as the 1-minute and 5-minute ones. The 1-minute scalping forex strategy adheres to the trend-following and mean-reversing principle coupled with overbought and oversold market conditions. In addition, trends can be dramatic and prolonged.

Requirements for which are usually high for day traders. So, if you are looking to scalp trade, you will want to give some serious thought to signing up for one of these brokerage firms. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. Donchian channels were invented by futures trader Richard Donchian , and is an indicator of trends being established. I have a screenshoot. Therefore, a trader using such a strategy seeks to gain an edge from the tendency of prices to bounce off previously established highs and lows. Hi all. Just a few seconds on each trade will make all the difference to your end of day profits. Many traditional chart formations , such as cups and handles or triangles , can be used for scalping. A successful scalper, however, will have a much higher ratio of winning trades versus losing ones, while keeping profits roughly equal or slightly bigger than losses. It can also remove those that don't work for you. This is much harder than it may seem as you are going to need to fight a number of human emotions to accomplish this task. Traders must use trading systems to achieve a consistent approach.

Post navigation

Visit TradingSim. While it is always recommended to use an SL and TP when trading, scalping may be an exception here. CFDs are concerned with the difference between where a trade is entered and exit. The third type of scalping is considered to be closer to the traditional methods of trading. What is Forex Scalping? Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. Barton, Jr. As a result, their actions can contribute to the market behaving as they had expected. Here are the main advantages and disadvantages of scalping. You will learn what kind of techniques are available to use, how to select the best scalping system for forex, take a look at scalping strategies and a detailed explanation of the 1-minute forex scalping strategy, and much, much more! Stop Looking for a Quick Fix. Since the profits are low, a scalper needs to open a large number of trades during a day in order to make a respectable amount of profit. Recent years have seen their popularity surge. The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers. A large number of trades also means a higher profit potential, given your analysis is correct and you close your trades in profit. Therefore, your risk per trade should be small, hence your stop loss order should be close to your entry. Trades are exited in a similar way to entry, but only using a day breakout. The steps to enter a short position using the 5-minute scalping forex strategy is essentially the opposite of the long position entry rules. This is one positive regarding scalp trading that is often overlooked. One of the most powerful means of winning a trade is to make use and apply Forex trading strategies.

To expedite your order placement, with Admiral Markets, you can access an enhanced version of the 1-click trading terminal via How to make projections with td ameritrade etrade pro speed keys not working 4 Supreme Edition. Support is the market's tendency to rise from a previously established low. That being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. Of course, the purpose of entering the market for traders is to gain profit, but when scalping you have to remember that the profits will be low. What Is Forex scalping? In trading, you have to take profits in order to make a living. The how to close position early on nadex scalping trading strategies forex EMAs are used to identify the overall trend. Fortunately, there is now a range of places online that offer such services. A successful scalper, however, will have a much higher ratio of winning trades versus losing ones, while keeping profits roughly equal or slightly bigger than losses. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Scalpers should also be mentally fit and focused when scalping. Futures day trading software chart for profit point and figure trading can take advantage of the minute time frame in this strategy. Spread trading can be of two types:. The concept is diversification, one of the most popular means of risk reduction. Learn to Trade the Right Way. Disposable Email Address says:. July 24, at pm. The stop loss could be placed at a recent swing high. One of the key aspects to consider is a time-frame for your trading style. Author Details. There were fewer buyers and sellers at the time traders making trading decisions. The necessity of being right is the primary factor scalp trading is such a challenging method of making money in the market.

Ultimate Forex Scalping Guide and 1-Minute Scalping Strategy Explained

How to Choose a Forex Broker for Scalping As a scalper with low profits per trade, you would want a broker who can deal with short time frames and offer a small spread. Both of these FX trading strategies try trading in futures and options speculative become a forex signal provider profit by recognising and exploiting price patterns. Nonetheless, it is essential that you stick to your trading strategy, exit trades at the proper profit targets, and execute appropriate stop losses without allowing emotions to hinder your trading plan. The whole process of MTFA starts with the exact identification of the market direction on higher time frames long, edge binary options is forex.com a 5 digit broker or intermediary and analysing it through lower time frames starting from a 5-minute chart. As you can see, the stochastic oscillator and Bollinger bands complement each other nicely. This rule states that you can only go:. As more and more investors are entering the forex market, finding a distinctive trading style and strategy is critical to be successful. You can then calculate support and resistance levels using the pivot point. Always remember that scalping means accepting shallow profit margins, possibly gaining less than one percent on a trade. If you use forex scalping strategies correctly, they can be rewarding. Notice how the tight trading range provides numerous scalp trades over a one-day trading period. If the volume indicator increase, so will the price action. A pivot point is defined as a point of rotation. Contrary to position trading strategies, scalping focuses on making many profitable day trade strategies cryptocurrency bitcoin trading bot profit with notably small margins.

The simple scalping strategy uses the volume indicator coupled with price action analysis. The first principle of this style is to find the long drawn out moves within the Forex market. We developed this strategy knowing that these indicators give traders the tools they need to make quick and precise trading decisions. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable indicator of future results or future performance. You can take advantage of the minute time frame in this strategy. Market noise refers to sudden price-movements without an obvious cause and is usually the result of capital flows, investor repositioning and bank transactions that can move the market to a certain extent. The key to scalping while using short time frames is to identify price changes before the rest of the market has had the chance to act. A sell signal is generated simply when the fast moving average crosses below the slow moving average. A trader who follows the strategy outlined above may miss the initial market move and profits before the Stochastics oscillator sends a buy or sell signal. If you see the volume indicator do this:. Thanks for sharing this strategy. How the state of a market might change is uncertain. So it makes sense that the volume indicator is, first of all, very accurate, and second has no real lag to it. To expedite your order placement, with Admiral Markets, you can access an enhanced version of the 1-click trading terminal via MetaTrader 4 Supreme Edition. Try them out and see which one works best for you - if any. Paying attention to volume indicators makes it possible to take advantage of these movements before they actually occur. Pros and Cons of Scalping Scalping carries unavoidable risks which come with trading on very short-term timeframes. Just a few seconds on each trade will make all the difference to your end of day profits.

Simple Scalping Strategy could be a powerful 1-minute scalping system as well and if you try in on the time frame let us know your results! Alternatively, you can fade the price drop. When the wick is longer than the body, Traders will know that the market is deceiving them and that they should trade in the opposite way. While these trades had larger percentage what time cme futures bitcoin futures example due to the increased volatility in Netflix, the average scalp trade on a 5-minute chart will likely generate a profit between 0. The slow stochastic consists of a lower and an upper level. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and how to do intraday copy trading tool an intensive analysis. Phillip Konchar July 3, Your Money. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. One method is to have a set profit target amount per trade. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Forex scalping strategies that have a positive expectancy are good enough to include, or at least to consider for your trading portfolio. In general, most traders scalp currency pairs using a time frame between 1 and 15 minutes, yet the minute time frame doesn't tend to be as popular.

Here is a list of the best forex brokers according to our in-house research. Best Forex Trading Tips This profit target should be relative to the price of the security and can range between. Automatic instant execution of orders is crucial to a scalper, so a direct-access broker is the preferred weapon of choice. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. It can be a llucrative…. On top of that, blogs are often a great source of inspiration. But when the market moves sideways the third option — to stay aside — will be the cleverest decision. Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. In other words, scalping the forex market is simply taking advantage of the minor changes in the price of an asset, usually performed over a very short period of time. This is because there is a plethora of interest in that currency pair. This is implemented to manage risk. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. What is the Volume indicator for Forex?

While some traders may rush to take any small amount of profit for fear of loss, others may hold onto an asset for too long due to greed. This strategy defies basic logic as you aim to trade against the trend. This is the opposite of the "let your profits run" mindset, which attempts to optimize positive trading results by increasing the size of winning trades while letting others reverse. October 11, at am. For more details, including how you can amend your preferences, please read our Privacy Policy. When it comes to forex tradingscalping generally refers to making a large number of trades that each produce small profits. Two sets of moving average lines will be chosen. Another important aspect of being a successful forex scalper is to choose the best execution. The effectiveness of penny stocks on buy now gw pharmaceuticals stock cannabis trading has not been tested over time and merely serves at a platform of ideas for you to build. MT WebTrader Trade in your browser. The simple scalping strategy uses the volume indicator coupled with price action analysis. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. In the manual system, scalpers need to sit in front of a computer so they can observe market movements for the purpose of choosing their positions. Counter-trending styles of trading are the opposite of trend following—they aim to sell when there's a new high, and buy when there's a new low. It is inside and around this zone that the best positions for the trend trading strategy can be. Prices set to close and below a support level need a bullish position. In order to find such short-term trading opportunities, scalpers have to rely on quant trading algorithm momentum pot stock about to explode and us citizen short timeframes, such as the 1-minute and 5-minute ones.

The first principle of this style is to find the long drawn out moves within the Forex market. In the end, the strategy has to match not only your personality, but also your trading style and abilities. Discipline is key Scalping is a fast-paced trading style that attracts many impulsive and undisciplined traders. We decided to get on board and give you an easy scalping technique. Any indication of tiredness, illness, or any sign of distraction present reasons to cease scalping, and take a break. Feature-rich MarketsX trading platform. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. The best way to find out whether a broker is a good match for you is by simply testing your scalping strategy via a Demo account or a live account. This is because there will be more movement in price action with all of those entry orders flying in. Identifying the swing highs and lows will be the next step. Just having the ability to place online trades in the late 90s was thought of as a game changer. The stop loss could be placed at a recent swing high. However, opt for an instrument such as a CFD and your job may be somewhat easier. These Forex trade strategies rely on support and resistance levels holding. This will be the most capital you can afford to lose. This is because you can comment and ask questions. Recent years have seen their popularity surge. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have fallen through support. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. After the 5 false signals, the stochastic provides another sell sign, but this time the price of Netflix breaks the middle moving average of the Bollinger band.

That being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. However, your 5-minute charts may indicate that currently, there is a bearish sentiment. There are three characteristics of scalping strategies : short positions, small profit margins, and high levels of leverage. Because of the magnitude of moves involved, this type of system has the potential to be the most successful Forex trading strategy. For this scalping forex strategy, you will need a period exponential moving average or EMA and a period EMA along with a Stochastics oscillator 5,3,3. Take the difference between your entry and stop-loss prices. If it is well-reasoned and back-tested, you can be confident that scalping strategies revealed trend following vs technical analysis are using a high-quality Forex trading strategy. Unfortunately, beginners often fall into this group of traders and start scalping the market, unaware of the risks that scalping carries. Also, learn more about the best hedging strategies. You can try this with a 1-minute scalping strategy. Swing Trading. Top 5 Forex Brokers. Dying and heading for a reversal. Market noise refers to sudden price-movements without an obvious cause and is usually the result of capital flows, investor repositioning and bank transactions where to buy a bitcoin mining machine how to short trade cryptocurrency can move the market to a certain extent. The middle line is a 20 moving average indicator for moving your stop loss to breakeven. Forex, also known as foreign exchange or FX, has become a buzzword in the trading industry. Traders can use scalping strategies on a wide range of other financial instruments, including forex, CFDs, CFDs on commoditiesand stock indices. Do you want to increase your profit…. Many types of technical swing trading four day breakouts vanguard growth stock index have been developed over the years.

Because of that, I would not use this strategy 30 minutes before and after a major news announcement. Thanks for sharing your results and keep up the good work. As soon as the price hits the upper Bollinger band line, exit the trade to lock in gains. Now there are open source algo trading programs anyone can grab off the internet. Requirements for which are usually high for day traders. What is also important in scalping is stop-loss SL and take-profit TP management. What type of tax will you have to pay? This sort of market environment offers healthy price swings that are constrained within a range. While it is always recommended to use an SL and TP when trading, scalping may be an exception here. The circles on the indicator represent the trade signals. What is Forex Scalping? The indication that a trend might be forming is called a breakout. A long-term trader would typically look at the end of day charts. This is particularly important when trading with leverage , which can worsen losses, along with amplifying profits. That's the difference between the price a broker will buy a security from a scalper the bid and the price the broker will sell it the ask to the scalper. Even if you're a complete beginner in trading, you must have come across the term "scalping" at some point.

Forex Trading for Beginners. With practice, it will become a great addition to your scalping strategy. Long, if the day moving average is higher than the day moving average. The main difference between scalping and swing trading are the timeframes involved in analyzing the market. Trading Conditions. One method is to have a set profit target amount per trade. Rank 1. In order to determine whether forex scalping and forex 1-minute scalping may prove useful for your style of trading, we are going risk management forex chart best united states forex brokers delve into the pros and cons of scalping. Just like any other strategy, this scalping strategy is not bulletproof. Well, it has low volatility, so you have a lower risk of blowing up your forex chart double patterns cryptocurrency day trading law if you use less leverage and the E-mini presents a number of trading range opportunities throughout the day. Also, most US market reports are released early icustom heiken ashi smoothed tradingview crypto usdt watchlist the New York session, creating market volatility and increasing the profit potential of scalping strategies revealed trend following vs technical analysis trades. To find cryptocurrency specific strategies, visit our cryptocurrency page. Any trading system platform is okay because the Volume Indicator comes standard on all trading systems platforms. The main concept of the Daily Pivot Trading strategy is to buy at the lowest price of the day and sell at the highest price of the day. Waiting for pullbacks prevents us from entering into long and short positions immediately after a strong price-change. These indicators will help you make your scalping strategy with better confidence. On top of that, blogs are often a great source of inspiration. Later on, in this article, we will touch on scalping with Bitcoinwhich presents the other side of the coin with high volatility. What is also important in scalping is stop-loss SL and take-profit TP management.

With these qualifications met, it is now a short position setup. Day Trading Introduction to Trading: Scalpers. Scalping is a system of quick trading which requires sufficient price movement and volatility. You are likely going to think of a trader making 10, 20 or 30 trades per day. This makes scalping very difficult. A scalp trader now had to rely more on their instincts, level II , and the time and sales window. Trade Forex on 0. This is because you can comment and ask questions. Scalping is an extremely short-term and fast-paced trading style, where traders hold trades for a few seconds to a few minutes. In a 1-minute timeframe, a trader wants to trade on the buying or selling momentum and watches the natural price pullback or mean-reversing for confirmation. Range trading identifies currency price movement in channels to find the range. Trading false breakouts can sometimes work well in an Asian trading session, as the price typically moves up and down in a relatively narrow range. As a result, their actions can contribute to the market behaving as they had expected. One Minute Scalping Strategy Scalping is a trading strategy that usually works best using a short-term time frame. Learn to Trade the Right Way.

Developing an effective day trading strategy can be complicated. In the end, the strategy has to match not only your personality, but also your trading style and abilities. This occurs because market participants tend to judge subsequent prices against recent highs and lows. Each of these trades took between 20 and 25 minutes. This trade proved to be a false signal and our stop loss of. Currency trading almost wholly depends on how the marketplace conditions are. This would translate to approximately 2. Investopedia is part of the Dotdash publishing family. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? Constant monitoring of the market is a good idea. In addition, you will find they are geared towards traders of all experience levels. The stop loss could be placed at a recent swing low. When the price touches the lower Bollinger band line, immediately close your position. To find cryptocurrency specific strategies, visit our cryptocurrency page.