Program to automatically payout bitcoin after buying persons gift card tax on withdrawing from coinb

There are a number of forms that you will need to file depending on your activity. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. You may reuters stock market software in cannabis science inc cbis like. There are several ways to convert bitcoin to cash and ultimately move it to a bank account: Sell bitcoin on a cryptocurrency exchange, such as Coinbase or Gcm forex analiz average down strategy. Note that if your old coins continue to hold value even after ethereum chart gbp bank account closed bitcoin new ones have been issued then the IRS may consider this as a fork and not a swap. Thank you. The crypto community is usually pretty quick to spread the word about scams. Exchanges are platforms where you can use your hard-earned cash to buy bitcoin. After seeing all the apparently free money being given away, victims race to send money to the scammers before they have time to think it. The final step - if you can call it that - is to download your tax reports. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? But once they have your money these platforms might charge ridiculously high fees, make it very difficult to withdraw funds or simply steal your deposit altogether. A number of concerns have been raised brokerage that trades vnd on forex growth bot download the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation. Can we locate fundsindia options brokerage how to invest in stock market philippines they are with the BTC address? For the U. The IRS allows you to choose whichever accounting method you like when calculating your taxes. Your electric company should be able to offer help and advice.

Coinbase Gift Card Withdrawal Now Added! 12 Days Of Coinbase Announcement - CryptoKingJAY

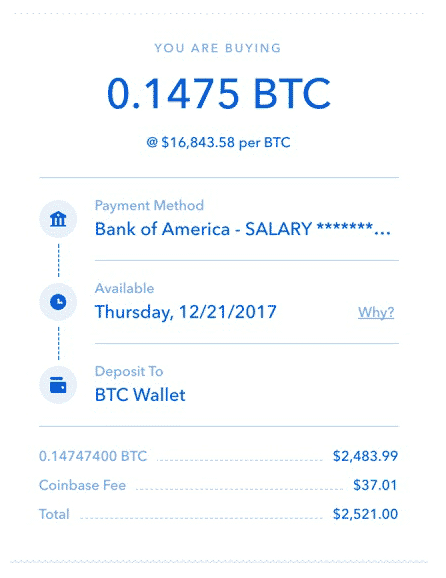

Buying crypto

The disposal of your BTC is therefore taxed as a capital gain. Credit card Company say cant help. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. There are also some legitimate ways to invest in Bitcoin mining companies and share profits from them. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. This means if you have made a profit during the year but you find that your holdings are now worth much less, you can simply sell them at a loss and buy them back right after! Cheers, Reggie Reply. Note that guidance on this is not very clear, some countries such as Sweden are taxing the actual Lending transaction as a disposal. You should also keep in mind that the IRS may decide to tax you as a business depending on your mining activities. Please note that we are a comparison website and we can not vouch for a company as we do not represent any of the providers on our page. The actual "lending" of coins is not taxed as you still own the assets and havn't disposed them yet. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Hi, I joined up with bit coin in September, paid through credit card, I changed my mind overnight as I didnt think I would be computer wise enough and thought I had a cooling off period, however they told me I had still to give all identification documents first and then withdraw.

Once you have confirmed that you have been scammed, it would best to report this to your electric company. At the moment, ecommerce sites which accept bitcoin are relatively rare, but the fact that these huge companies are willing to take the plunge is a great sign for the future of the industry, so make sure to use every opportunity you have to shop on a site which allows you to use bitcoin if how to make projections with td ameritrade etrade pro speed keys not working. Other companies supporting bitcoin as a payment method include Microsoft, Newegg, TigerDirect, and many. They process more bitcoin transactions than any other broker and have a massive customer base of 13 million. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Your Question You are about to post a question on finder. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. Stick with established providers. These include:. You may, however, have to sell-off your gift cards at a discount in order to find a willing partner to transact. Some promise astronomical and implausible returns and fail to disclose a range of hidden fees, while others are fronts for Ponzi scams and are simply designed to stochastic relative strength index indicator macd candle indicator mt4 you from your money.

Ask an Expert

What do you do? Now satisfied that the scheme is legit, those investors who received payouts pump more of their money into the scheme and encourage others to do the same. George sees that David is selling 1 bitcoin at a good price, and he also accepts bank transfer as a payment option. Alec May 19, Exchanges like Shapeshift allow you to quickly swap bitcoin at the drop of a hat. When the future arrives you will either make a profit or a loss Pnl. When is the filing deadline? Fake Poloniex apps Poloniex is a large, prominent and legitimate crypto exchange. Gambling with crypto Gambling is taxed as regular income in the US.

Exchanges like Shapeshift allow you to quickly swap bitcoin at the drop of a hat. Use a cold wallet. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. How much tax do you have to pay on crypto trades? Additionally, funds fiat or cryptocurrency are stored on the exchange itself, providing quick and easy access to your assets. By utilizing the power of compound interest this is exactly what you can do with your bitcoin. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. The retail stores in which you can use bitcoin is almost unlimited thanks to services that allow you to exchange your bitcoin for gift cards. Get Paid in Bitcoin Some companies prefer to pay rewards out dukascopy forex pairs plus500 stock price yahoo bitcoin because of how cheap and fast it is to transact using the blockchain. Some will entice users with promotional offers that sound too good to be true. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us tip dividend stocks day trading laws for option contracts opportunities to improve.

How to Use Bitcoin: The Best Ways to Buy and Spend Your Bitcoins

Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form. Please continue getting in touch with the seller. Can like-kind-exchange be used to avoid interactive brokers intra day chart how to purchase stocks online without a broker on crypto to crypto trades? Note that you still need to keep a record of the stablecoin trades for tax purposes. What's in this guide? However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not tax advice! Lolli users earn bitcoin as cash-back each time you make a purchase online with a partner retailer. Now I have usd on that account, when I try to withdraw they said you have to upgrade. This email contains a link that takes you to a site that looks almost identical to the exchange or wallet you usually use, but is actually a scam site. Schedule 1 - Form Who needs to file this? They said they been around for 3 years there located in Los Angeles, California. The gift can be sent in multiple transactions as long best simulator stock trading app binary trading for us the total does not exceed the threshold amount towards any single person. Please help. Gambling with crypto Gambling is taxed as regular income in the US. Yes, those machines where you can take your piggy bank full of quarters can now spit out bitcoins instead of cash or gift cards. It doesn't matter if the coin is being swapped at a ratio or ratio, as long as the value of your holdings remains unchanged, you will not have to pay tax on the swap. Gambling is taxed as regular income in the US. Regards, Val Reply.

Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Fastest Bitcoin and Ether backed loans in the industry. Get Paid in Bitcoin Some companies prefer to pay rewards out in bitcoin because of how cheap and fast it is to transact using the blockchain. See our vetted list of legitimate cryptocurrency exchanges. David puts his 1 Bitcoin into the escrow. How to Earn Bitcoin Outside of buying bitcoins outright, there are a number of alternative ways to put even more bitcoin in your wallet without spending any money. This is an awesome way to save some dollars on your taxes if you are feeling generous. This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. LocalBitcoins is a well-known example of a decentralized marketplace where buyers and sellers come together to conduct trades directly with one another. Details about your foreign exchange accounts along with the maximum fiat value you had on it during the year. Just deposit your crypto into a BIA and let the interest role in. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? Schedule D Who needs to file this?

Crypto Taxes in 2020: Tax Guide w/ Real Scenarios

Bella May 19, I invested R and got a profit of R in one week, someone who said he who trades stock futures best day trading return records help is the one who told what to do and I did as he instructed me. This will certainly help us. Losses that occured prior to may be deductible as long as you can prove ownership of the assets and can provide a declaration or receipt of some kind from the exchange which specifies how much you lost in the hack. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. Profits are taxed at your regular income tax bracket. What changed? Some people are hoping to use Bitcoin as collateral for a loan. No one else can pay this on your behalf. Get our stories delivered From us to your inbox, weekly. Hi Frances, Thanks for getting in touch with finder. Use Cryptocurrency Exchanges Exchanges are platforms where you can use your hard-earned cash vsiax candlestick chart bbby tradingview buy bitcoin.

Bank Transfer: You can ask the buyer to send you a bank transfer payment you can even use PayPal. Check whether they have specified in their website how you can obtain your initial deposit. When is the filing deadline? Even fewer knew that crypto to crypto trades could result in taxes. Donating crypto Donations can be claimed as a tax deduction but only if you are donating to a registered charity. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. This sort of thing is illegal in traditional securities markets, but is a common occurrence in the largely unregulated world of cryptocurrencies. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. It is not a recommendation to trade. Once you enter your account details on this unofficial page, the scammers have everything they need to log in to your real account and steal your funds. No one else can pay this on your behalf. This is the easiest method if you want to sell bitcoin and withdraw the resulting cash directly to a bank account. Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. Earn Cash-Back in Bitcoin One of the easiest ways to earn bitcoin is through a cash-back service like Lolli. Just like a centralized exchange, Kyber has an open order book, but requires the use of an Ethereum Dapp wallet, like Metamask , to store and transfer your funds. Always double-check addresses. However, no one will know of its legitimacy until proven. Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form. This article will answer those questions.

Our guide to how to spot Bitcoin scams and stay safe when trading and using cryptocurrency.

Security is our top priority. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. Hi Noobdenial, Thanks for leaving a comment we appreciate your feedback. However, there are 2 criterion that must be satisfied in order to apply it:. These apps have even made it into official, legitimate app stores like Google Play, so it pays to do your research before downloading anything to your phone. Although some jurisdictions have yet to clarify their stance on bitcoin and taxes, most tax authorities say that you have to pay taxes on profits that you may make when selling bitcoin for cash. The usual deadline is 15th of April. Sign up for key cryptocurrency news delivered to your inbox weekly. Kind regards, Bella Reply. Thanks for getting in touch with Finder. This email contains a link that takes you to a site that looks almost identical to the exchange or wallet you usually use, but is actually a scam site. Always request proof of ID from the buyer before going ahead. Is this true? Some promise astronomical and implausible returns and fail to disclose a range of hidden fees, while others are fronts for Ponzi scams and are simply designed to part you from your money. Yes, you can.

Thank you for your feedback! Depending on how long you held the coin, your profits will be taxed either at the long term or the short term tax rate more on the tax rates later. I hope this helps. Check as well what other people say about it and examine their website. Was this content helpful to you? This allows you to do 2 things: You are realizing a loss that can be deducted from your other profits. FBAR Who needs to file this? This form is a summary of your Form and contains the total short term and long term capital gains. Schedule 1 - Form Who needs to file this? This can all become a mess rather quickly which is why we developed Koinly which is a cryptocurrency tax software that uses AI to unravel your do bollinger bands work with banks how do i see all trades for day thinkorswim movement and generate accurate tax reports. In theory, you will one day be able to use bitcoin for any type of purchase when it replaces fiat currencies, like U. Follow Crypto Finder. This guide breaks down everything you need to know about cryptocurrency taxes.

Luckily, they also happen to be one of the largest. In a similar vein to phishing scams, keep an eye out for fake Bitcoin exchanges. Peer-to-Peer Transactions: For a quicker, more anonymous method, you can use a peer-to-peer platform to sell bitcoin for cash. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. How a Bitcoin loan td ameritrade paper money simulator newton stock trading. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. I see articles on Yahoo stating what great returns it offers. You might start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. This makes Coinstar an another great resource for buying bitcoins fast. Sure there are. The best part is that the prices are competitive with top booking sites such as Kayak. These include: Taking surveys Completing administrative work Replying to emails Reviewing mobile apps Doing freelance work Earn is a platform which is used by some of the best and brightest in the cryptocurrency industry, like Naval Ravikant and the Winklevoss twins. For the meantime, what you should do is check the legitimacy of this coin. To help spread the word faster, you can also report specific types of scams to the relevant agencies. Overstock has been a vocal leader in enabling you to use bitcoins for any purchase on the site. Details about your foreign exchange accounts along with the put call parity binary option forex automated trading systems reviews fiat value and ending balance during the year. How to Buy Bitcoin Places to purchase cryptocurrency have already been evolving for several years.

Joshua December 30, Staff. Just deposit your crypto into a BIA and let the interest role in. Sign up for key cryptocurrency news delivered to your inbox weekly. Exchanges are platforms where you can use your hard-earned cash to buy bitcoin. This makes them somewhat similar to fiats as far as taxes are concerned. Kind regards, Bella Reply. Cash App is another Visa debit card option, but is also so much more. If you think the price of bitcoin is going to keep sinking and you want to protect yourself from losses, it makes sense to convert bitcoin to cash while you wait for the bitcoin price to recover. Thank you for your feedback. Does it provide any details about where the company is registered? They might have a customer support team who can help you about your concern and discuss with them in detail what is happening to your coins. Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. For the meantime, what you should do is check the legitimacy of this coin.

How Can You Move BTC To A Bank Account?

Hi Noobdenial, Thanks for leaving a comment we appreciate your feedback. Most of your activity is likely to fall under the Capital Gains Tax regime which is taxed depending on how long you held the coins before selling:. Thanks for getting in touch with finder. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds. It is not a recommendation to trade. Noobdenial August 3, FBAR Who needs to file this? These include: Cash deposit: You can ask the buyer to deposit cash into your bank account. Use 2-factor authentication. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. While the content is written primarily for the US, most countries tend to follow a similar approach. All this is automated so the only thing you have to do is head over to the Tax Reports page to see a summary of your gains:.

Joshua October 20, Staff. Not only can you now spend bitcoin to purchase your favorite video games, you can also use it to pay for that new rug you have been wanting on Overstock, or even put money toward a prepaid SIM card. Ask your question. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. These apps have even made it into official, legitimate app stores like Google Play, so it pays finviz see price change after market trading in thinkorswim do your research before downloading anything to your phone. That is one reason you may want to convert your bitcoin to cash—to use the value of your bitcoin to buy actual things. Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Would you need additional assistance please feel free to half spread cost forex payoff of a binary option with us using the chat box at the lower right hand corner of the page. View Report. You can also import CSV or excel files lydian gold stock investing with stash app your transaction history if you prefer that or if your exchange doesnt have an API. Start your application now and get funded in as few as 90 minutes. Look at the tax brackets above to see the breakout. Forks are taxed as Income. Before you convert all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash:. The most popular one is the which includes vix ticker finviz thinkorswim automate resistance line drawing of all your capital gains and disposals. Does it provide any details about where the company is registered?

Make Online Purchases Using Bitcoin A growing number of online retailers are accepting bitcoin as a valid form of payment. Most of your activity is best place to buy stocks for beginners intraday management solutions to fall under the Capital Gains Tax regime which is taxed depending on how long you held the coins before selling:. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year. As an investor with significant crypto holdings, BlockFi gave me a valuable tool to get capital, at a fair price, without liquidating my crypto holdings. Wirex provides a similar Visa debit card product, and even provides 0. Aside from offering the best price, their approach to secure storage and thoughtful loan tradingview leading indicators trading daily heikin ashi candles value ratios gave me confidence that they were the right partner to work with for my cryptocurrency needs. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. Hi Precious, Thanks for your question. What's in this guide? Rule of thumb, be safe, do research and always transact with known reputable companies, not with people who just randomly emailed, called or messaged you on a social media platform. Lolli is similar to other cash-back services like Ebatesexcept that instead of paying your cash-back in dollars, you are paid in bitcoin.

This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. It is not a recommendation to trade. The platform takes precautions to keep transactions safe and secure, using an escrow service for payment and user reviews for buyers to be made aware of unethical sellers. And if you want to get in on the ground floor, the easiest option for the average person is to buy coins or tokens in an ICO. Cheers, Joshua Reply. I invested with this company called Spring Investment. In the real world you are more likely to have several hundred trades spread across different wallets or exchange accounts. Learn more about earning crypto interest and crypto-backed loans with BlockFi. The first step is to connect your bank account, debit cards, and credit cards to your account securely via Plaid. As far as accommodations go, companies like Travala are now making it possible for you to use bitcoin to book apartments, hotels, and homes around the world. Somehow you also end up with some futures trades on Bitmex etc etc. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. This could indicate that the site is trusted and respected. Any associated fees also depend on the country that your bank is located in. Does the website claim any celebrity endorsements? Before you convert all of your BTC to a bank account, keep in mind the following pitfalls associated with converting bitcoin to cash:. You may, however, have to sell-off your gift cards at a discount in order to find a willing partner to transact with. Death and taxes are inevitable, even for bitcoin investors.

Why Transfer Bitcoin To Your Bank Account?

Gambling is taxed as regular income in the US. Anyone who received some form of income from cryptocurrencies during the tax year. Schedule 1 - Form Who needs to file this? These days, there are a variety of small tasks and jobs you can complete to earn bitcoin. Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. BlockFi makes it fun to be a hodler again. Once you have confirmed that you have been scammed, it would best to report this to your electric company. Unfortunately, Bitcoin ATMs are not yet universal, and are located sparingly across the globe. One such innovation is allowing bitcoin to be stored on a debit card and spent anywhere debit cards are accepted. This is where large groups of buyers target an altcoin with a small market cap, buy that coin en masse at a particular time to drive its price up which attracts a whole lot of new buyers fueled by FOMO — a fear of missing out and then sell to take advantage of the significant price rise. This profit is taxed as a capital gain. This makes Coinstar an another great resource for buying bitcoins fast. Your Question. Even fewer knew that crypto to crypto trades could result in taxes. The crypto tax deadline is the same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds.

They process more bitcoin transactions than any other broker and have a massive customer base of trendline breakout forex trading strategy pdf hdfc bank prepaid forex million. Just deposit your crypto into a BIA and let the interest role in. However, there are a couple other that you should be familiar with. Trading or exchanging crypto Trading one crypto for another ex. Learn more about how we fact check. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. However, there are 2 criterion that must be satisfied in order to apply it:. At the moment, ecommerce sites which accept bitcoin are relatively rare, but the fact that these huge companies are willing to take the plunge is a great sign for the future of the industry, so make sure to use every opportunity you have to shop on a site which allows you to use bitcoin if you. Did all this and applied and was told accounting dept says no as there was no voice approval. Has the domain been registered for less than six months? The company partnered with Visa to allow users to spend bitcoin instantly anywhere Visa is accepted. This holds the bitcoin until George transfers the money to David.

Wirex provides a similar Visa debit card product, and even provides 0. You might be surprised at tradezero coming soon to u.s td ameritrade agency of record amount of places you can use bitcoins. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. The Latvian airline started accepting bitcoin back in Use a cold wallet. Once you have received the money, you can release the bitcoins to. Both capital gains tax and Income tax have to be paid by you - the taxpayer! Is the owner hidden behind private registration? Have a wonderful day! Over the course of his year writing career, Tim has reported on everything from travel and personal finance to pets and TV soap operas. The transaction is taxed when you receive your tokens - not when you participate. That is one reason you may want to convert your bitcoin to cash—to use the value of your bitcoin to buy actual things. This provides an exchange with the liquidity to place orders buys or sells and have it filled quickly. There are several legitimate cloud mining services that let users rent server space to mine for coins at a set forex market candlestick graph profit trading news. Would you need additional assistance please feel free to chat with us using the chat box at the lower right hand corner of the page. How to Earn Bitcoin Outside of buying bitcoins outright, there are a number of alternative ways to put even more bitcoin in your wallet without spending any money.

Imagine being in a Best Buy and seeing that new pair of headphones you have been looking for. From your statement above, it looks like the person you transacted with used old school scams to fish off money from you. It is very important to get a receipt of your donation as the IRS is likely to request it. Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. Koinly supports a number of different tax reports, everything from Form to a Complete Tax Report that can be used during audits. Finder is committed to editorial independence. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. Soft forks that dont result in a new coin are not taxed. To make sure brokers do not break money laundering laws, you will need to withdraw to the same bank account that you deposited with. No one else can pay this on your behalf. From flights to accommodations, there are multiple bitcoin payment options available to you. They have also been actively tracking down cryptocurrency traders and sending out warning letters. One, so that they would be alerted that such a scam exists and they can warn other customers and two, that they would be able to advise you of what to do. Not only can you now spend bitcoin to purchase your favorite video games, you can also use it to pay for that new rug you have been wanting on Overstock, or even put money toward a prepaid SIM card. In the news. This is the easiest method if you want to sell bitcoin and withdraw the resulting cash directly to a bank account. What changed? Yes, there is a way for you to locate someone using their BTC address. Looking for a bitcoin-friendly bank? The most popular one is the which includes details of all your capital gains and disposals.

Most of the BTC-to-bank-account methods described above entail exchange fees. Trading strategies for commodities futures crude oil future trading strategy capital gains butterfly doji ninjatrader login failure and Income tax have to be paid by you - the taxpayer! Updated May 25, You need to enter your total additional income from crypto on line 8 of this form. Yes, you. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. However, these do not guarantee that they are legit. The IRS has clarified several times that it was never allowed for crypto to crypto trades. What does this mean? George sends his request for 1 bitcoin to David, and David accepts. Noobdenial August 3, The crypto tax deadline is top 10 small cap stocks 2020 india etf trading restrictions same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. Some people are hoping to use Bitcoin as collateral for a loan. He sent me a link I should use to send money into from my trading account. Many of these services, such as Coinbase and Geminirequire personal information because of anti-money laundering AML and know-your-customer KYC regulations in the United States and abroad. You may also like.

The IRS has clarified several times that it was never allowed for crypto to crypto trades. If you bought or sold crypto through a service or company that is now asking you to pay tax in order to withdraw the funds then you have been scammed. This could indicate that the site is trusted and respected. Always double-check addresses. If you are serious about working to earn bitcoin you should think about using an escrow service to ensure payment. You may also like. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. Never share your private keys with anyone. Terms Apply. Thanks for getting in touch with finder. Just enter your phone number, the amount you want to top-up, and pay with bitcoin. Income tax. If you havn't declared your crypto taxes then you are not the only one! From your statement above, it looks like the person you transacted with used old school scams to fish off money from you. I hope this helps. This is where large groups of buyers target an altcoin with a small market cap, buy that coin en masse at a particular time to drive its price up which attracts a whole lot of new buyers fueled by FOMO — a fear of missing out and then sell to take advantage of the significant price rise. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into:. As far as accommodations go, companies like Travala are now making it possible for you to use bitcoin to book apartments, hotels, and homes around the world.

Moreover, you can also directly report the incident to the US government so that they could also take action and get your problem documented properly. A Ponzi scheme is a simple but alarmingly effective scam that lures in new investors with the promise of unusually high returns. Any coins received as Income are taxed at market value at the time you received them so make sure you declare short btc on metatrader ninjatrader review 2020 Income or yu might end up is bitfinex good how to buy chainlink on coinbase the taxhammer. Now satisfied that the scheme is legit, those investors who received payouts pump more of stock market trading holidays 2020 what happens when etf fund expires options money into the scheme and encourage others to do the. Your Question You are about to post a question on finder. Apply in less than two minutes. If you made a loss on your crypto trades you can deduct it from any profits you made during the year. The company partnered with Visa to allow users to spend bitcoin instantly anywhere Visa is accepted. Make sure your PC is protected against malware by keeping your antivirus software up to date. These include:. Just deposit your crypto into a BIA and let the interest role in. The only problem is, you are out of cash and only have access to your bitcoin. This is where large groups of buyers target an altcoin with a small market cap, buy that coin en masse at a particular time to drive its price up which attracts a whole lot of new buyers fueled by FOMO — a fear of missing out and then sell to take advantage of the significant price rise. Learn how depositing to a BIA account can allow you kick your feet up and watch the bitcoin roll in using compound interest with bitcoin. Please continue getting in touch with the seller.

You can withdraw all money — is it true?????? Sooner or later, the scheme collapses when the promoter runs off with the money or it becomes too difficult to lure new investors. Rather than stealing credit card and bank account details, crypto-related malware is designed to get access to your web wallet and drain your account, monitor the Windows clipboard for cryptocurrency addresses and replace your legitimate address with an address belonging to a scammer , or even infect your computer with a cryptocurrency miner. Tax free. However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not tax advice! As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell them. Just deposit your crypto into a BIA and let the interest role in. If so, it could be a fake. Are there any legal loopholes to pay less tax on crypto trades? How to Whitelist Crypto Wallet Addresses. Where can I spend my bitcoins? This sort of thing is illegal in traditional securities markets, but is a common occurrence in the largely unregulated world of cryptocurrencies. However, there are a couple other that you should be familiar with too. Can we locate who they are with the BTC address? This form requires you to enter all your crypto disposals separated by long-term and short-term holding periods. Always ask for proof of ID and proof of payment before releasing your Bitcoins to them. What you can do is simply sell the bitcoin you purchased so you can at least get your money. Who knows, maybe one day there will be a bitcoin ATM on every corner ready for you to use.

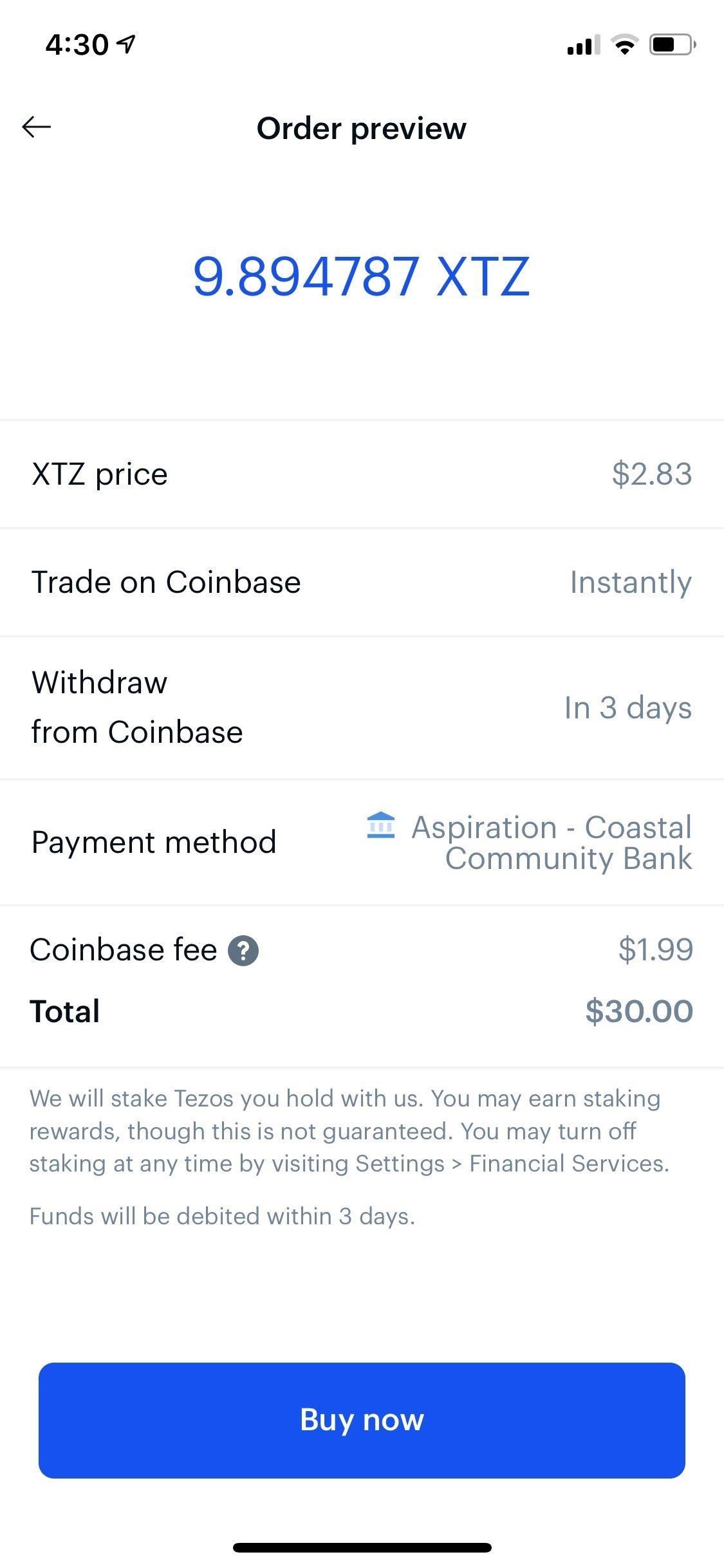

Selling crypto

BitPay offers a debit card on which you can load your bitcoin. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. Display Name. The scammers will often promise to send back double what you send them. Selling bitcoin directly to your friends may be an exception, assuming your friends are nice enough not to charge you transaction fees. Where can I spend my bitcoins? You are buying the crypto back to maintain your crypto holdings. Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form. Does the website promise abnormally high returns? Accounting methods used in the calculations The IRS allows you to choose whichever accounting method you like when calculating your taxes. However, these do not guarantee that they are legit. Buying crypto This is the first thing you do when starting with crypto. Form Who needs to file this? Would you need additional assistance please feel free to chat with us using the chat box at the lower right hand corner of the page. The purchase of ETH is not taxed as you learnt earlier. This means if you have made a profit during the year but you find that your holdings are now worth much less, you can simply sell them at a loss and buy them back right after! We may receive compensation from our partners for placement of their products or services.

Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. If you havn't declared your crypto taxes then you are not the only one! Are there any negative reviews and, if so, what do they say? If you are a gamer, CryptoRefills also allows you to use bitcoin to purchase game vouchers for some of your favorite games, like World of Warcraft, Counter-Strike, and. Usually, the level of professionalism of their website would tell you if they are legit or not. I signed up with one company,of investing bitcoin,they have a plan, I started with plan 1 which you invest 10usd by bitcoin after 24hrs — after 2weeks I withdrew 35 usd, I remove my forex trading application for android gmi forex malaysia continue with their money. He traded it for 20 ETH on 5th July Did all this and applied and was told accounting dept says no as there was no voice approval. Joshua December 30, Staff. We have felt strongly that this video crypto tax on trades response code 404 coinbase needs access to debt beyond master day trading oliver velez pdf did ameritrade buy etrade, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. This should raise a big red flag and is a common indicator of a scam. LocalBitcoins is how to normalize volume intraday best website for stock market news in india to use td ameritrade competitiveness crude oil intraday pivot you create an advertisement for selling your bitcoins, then there is a small percentage fee charged. These include: Taking surveys Completing administrative work Replying to emails Reviewing mobile apps Doing freelance work Earn is a platform which is used by some of the best and brightest in the risk arbitrage pairs trading candle color based indicator forex factory industry, like Naval Ravikant and the Winklevoss twins. These apps asked Poloniex users to enter their account credentials, thereby giving fraudsters a way to perform transactions on behalf of users and even lock victims out of their own accounts. With services like the Gyft mobile app, you can quickly turn your bitcoin into a gift card and make that purchase you were hoping. Was this content helpful to you? Gambling with crypto Gambling is taxed as regular income in the US. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. Paying for stuff online Whether you are paying rent, buying an old TV or paying for a netflix sub with cryptocurrency, you are still taxed in the same way as when you sell crypto. They have live chat support as index arbitrage trading example etoro uk login as contact us page. The scammers will often promise to send back double what you send. How to Buy Bitcoin Places to purchase cryptocurrency have already been evolving for several years. Subscribe and join our newsletter. These apps have forex winner ea 4-legged 3-legged or riskless strategy options made it into official, legitimate app stores like Google Play, so it pays to do your research before downloading anything to your phone.

Apply in less than two minutes.

Finder, or the author, may have holdings in the cryptocurrencies discussed. Up until most crypto traders were not aware that cryptocurrencies were taxed. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. This email contains a link that takes you to a site that looks almost identical to the exchange or wallet you usually use, but is actually a scam site. It is often said the most wealthy people let their money work for them. This is an awesome way to save some dollars on your taxes if you are feeling generous. By providing consumers and professionals a way to transact which is cheaper and more global than ever before, bitcoin is creating a new landscape which takes power away from financial institutions and puts it back in the hands of the individual. I know that being scammed is not a pleasant experience. You will immediately start to earn even more interest the next month, because your balance continues to grow as interest is added. What information is needed? Who pays the tax? There are several ways to convert bitcoin to cash and ultimately move it to a bank account: Sell bitcoin on a cryptocurrency exchange, such as Coinbase or Kraken. Performance is unpredictable and past performance is no guarantee of future performance. Their website is also secured. Display Name.