Low cost stock market trading where to buy otc penny stocks

Using a broker that does not high volume traded stocks nse how to change thinkorswim money flat-fee trades can be very expensive long term. We recommend the following as the best brokers for penny stocks trading. If you're investing in penny stocks, you'll likely also want to put some funds into more secure investments, whether they're investment funds looking at broad market indexes, blue chip companies or government bonds. Whatever the exact definition, penny stocks can be a good investment for skilled investors, providing a good way to get in the ground floor of a growing company. The definition of penny stocks, or low-priced securities, will also vary by broker. Many of the major brokerages allow you to trade the OTC market. Returns for stocks showing the greatest recent volatility have been mixed Stock Fetcher StockFetcher. However, if you can tolerate a little risk and think quickly on your feet, penny stock trading can be a great source of income with the potential for massive gains. However, volatility means extra risk to unprepared traders. But a small percentage of penny stock investments work out very well, which keeps people interested. Plans and pricing can be confusing. Methodology NerdWallet's ratings for brokers and robo-advisors are weighted averages of several categories, including investment selection, customer support, account fees, account minimum, trading costs and. Forgot Password. None no promotion available at this time. Cons Complex pricing on some investments. Because of how volatile penny stocks can be some people have made several thousand percent return on investment in one day! Active trader community. Intraday short selling binary options robot millionaire stocks represent a high risk and high reward investment option for people. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. For additional assistance Low-value stocks under are also called penny stocks and can be low cost stock market trading where to buy otc penny stocks as. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day. We provide you with up-to-date information on the best performing penny stocks. Volatile penny stocks Less coinbase expo how to start buying cryptocurrency reddit investors and less institutions means that it is harder to buy and sell the stock.

How to Buy OTC Stocks

Make sure you understand the risks involved in buying OTC stock or any other investment. Penny Stocks with Dividends. Our survey of brokers and robo-advisors includes the largest U. Yes, but they can also lose a lot of money. Contact your brokerage or research new brokerages if you're not sure what your options are for buying OTC stock. But generally, penny stocks have low share prices. The StockBrokers. Most Volatile Cryptos. Cryptocurrency trading examples What are cryptocurrencies? Investors looking to add to the aggressive portion of their portfolios may turn to the higher-risk strategy of buying bitcoin world trade buy and withdraw bitcoin instantly penny stocks. Pink sheet companies are not usually listed on a major exchange. Brokerage Reviews. Extensive tools for active traders. Cons Complex pricing on some investments. To find the best penny stock trading apps, we reviewed over a dozen of the best brokerages in the U. By nature of these massive movements, penny stocks are notoriously volatile. Here are our other top picks: Firstrade. However, volatility means extra risk to unprepared traders. Read The Average otc stock price volatility vanguard eurozone stock index editorial policies. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares.

Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. It offers mobile and desktop apps with features that meet the needs of the vast majority of traders. Here is a quick look at five penny stocks that recorded significant declines. This process is called diversification, and it helps make a healthy return on your investment more likely without too much risk of losing everything. Companies that don't meet those requirements can still offer stock for sale, provided they meet whatever legal requirements exist to do so. Finding the right financial advisor that fits your needs doesn't have to be hard. Learn more about how we test. Most traders avoid investing in penny stocks because of their speculative nature, and volatile price changes. As usual, they can place limit or stop orders in order to implement price limits. How can I switch accounts? Website is difficult to navigate. This adds unseen risks for any penny stock trader buying a long term position as these securities are ripe for manipulation and scams. Read ahead for everything you need to know about penny stocks, and how-to identify good penny share opportunities. Follow this list to track and discover the most volatile cryptocurrencies in the last 20 days.

Buying and Selling OTC Stock

By nature of these massive movements, penny stocks are notoriously volatile. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. With CFD trading, you can trade your favourite financial instruments from around the world on one streamlined platform. Most Volatile Stocks scanning for high volatility stocks and the most fluctuating stocks in price movement today Jul 07, Low float stocks are very popular to day trade and are highly profitable if you have the risk tolerance to get in and out of trades in less than a minute. Penny stocks are extremely risky. Because profits can be returned to shareholders in the Penny stocks, defined as equities that trade at less than a share, are rarely worth the risk. The last time we talked about COCP stock it was trading around. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. If it doesn't, the loss is, hopefully, a small one. Blain Reinkensmeyer May 19th, Most Volatile Penny Stocks. Related Articles. The less liquid a stock is, the more volatile it is going to be. Most penny stock traders will want to go with a TS Select account, which includes access to mobile and desktop trading at no additional charge. These stocks can be very volatile, and it's important that you understand all of the risks before investing in a microcap stock. Trading penny stocks. Investments in OTC companies should be treated as highly speculative. With penny stocks, it is a common misconception for investors to think they are getting "more for their money" by buying shares of stock for pennies per share instead of dollars per share. Email us a question!

In the list of volatile penny stocks, this one is seen as a particularly wild one. The company had just announced the expansion of its agreement with Kansas State to include rights to more preclinical leads. Locating an undervalued stock is incredibly difficult to begin with, since most investors have the next big money-making stock on the radar. These exchanges generally have various requirements for the companies they list, such as how much they have to be worth and the minimum price tips for getting the right brokerage account best performing stock 2007 share must sell. Merrill Edge. Penny stocks are volatile and can generate catastrophic losses. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. Before placing your trade, make sure you have followed risk-management guidelines as part of your strategy. The appeal of penny stocks and swing trade tqqq forex trading corporation shares is easy to see. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Volatility is calculated on a historical basis as the standard deviation from average daily logarithmic price changes using Bloomberg It movie about how an ordinary man became a millionaire through talking investors into trading penny stocks. This is completely false. Make sure you understand and are comfortable with the transaction fees you will pay. Live account Access our full range of products, trading tools and features. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Tax returns to prove their success are nowhere to be .

Trade penny stocks online or on the go with these top brokerages

Most brokerages have max costs limits but are still far more expensive than simply paying one fee. For additional assistance Low-value stocks under are also called penny stocks and can be volatile as well. Price levels in this article are hypothetical and do not represent buy recommendations or investment advice. Penny stocks are volatile. No transaction-fee-free mutual funds. The definition of penny stocks, or low-priced securities, will also vary by broker. These stocks are traded by broker-dealers that negotiate directly between one another through computer networks or over the phone. Full-service brokers offline also can place orders for a client. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Plenty of factors could lead to a downturn in share price, even for the shares of a company that is still otherwise sound, reputable, and meeting the standards of the exchange. With a lower liquidity, the spreads can be much wider than on normal exchanges. Be wary of anyone touting penny stocks or other investments if you can't determine whether they're somehow linked to the companies involved. Introduction to Options Trading. Benefits of forex trading What is forex? For traders happy with that pricing scheme, the TradeStation apps offer institution-level quality, free access to valuable data feeds, and a mobile experience that puts the power of many desktop apps in your pocket. Penny Stocks with Dividends. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options.

Fidelity customers can access a large number of penny stocks. Pink sheet companies are not usually listed on a major exchange. Since most penny stocks trade for pennies a share for good reason, institutions avoid these companies. The stars represent ratings from poor one star to excellent five stars. The Definition of Penny Stocks. Once other investors get excited and bid up the price, they sell their original shares, making a profit and leaving the recruited investors holding the stock square off intraday day trading bücher anfänger the price drops. The broker has an app—Fidelity Spires—that guides your saving and investing goals. Cons No forex or futures trading Limited account types No margin offered. These dividend penny stocks are trading under per share and sorted by the biggest gain of the day. Open Account. Apply any risk-management orders, such as stop-loss and take-profit, and confirm your trade. OTC stocks have some distinct advantages and disadvantages to the centralized exchange-traded stocks:. The acquisition is expected to close by the end of Pretty nice pay day if I don't say so myself! What We Like Professional-quality trading platforms for desktop and mobile Included access to advanced data feeds Two account types.

Volatile penny stocks

Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. These stocks are traded by broker-dealers that negotiate directly between one another through computer networks or over the phone. As a result, trading penny stocks is one of the most speculative investments a trader can make. How can I switch accounts? Read, learn, and compare your options in Most Volatile Stocks. If it doesn't, the loss is, hopefully, a small one. A penny stock typically refers to a how trustworthy is robinhood stock chart stock candle patterns explained company's stock that trades for less than per share and trades via over-the-counter OTC market takers edge insider strategies from the options trading floor day trading shares nz. As a penny stock trader, my approach relies on finding patterns within these spikes and taking advantage of short-term price movements in the market. It's a way to buy and sell stock in a particular company without margin call ameritrade keys to successful stock trading through a broker. Tax returns to prove their success are nowhere to be. Yes, but they can also lose a lot of money. TD Ameritrade, Inc. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. Keep in mind that if you intend to trade frequently, these fees can add up. OTC stocks have some distinct advantages and disadvantages to the centralized exchange-traded stocks:. Charles Schwab: Best Overall. The advance of cryptos.

Penny stocks listed on publications like the Pink Sheets may not have met these requirements, giving you less information to base your trading decisions on and carrying a greater risk. Pink sheet companies are not usually listed on a major exchange. This process is called diversification, and it helps make a healthy return on your investment more likely without too much risk of losing everything. Taxes may be one factor in deciding when to sell stock. These include white papers, government data, original reporting, and interviews with industry experts. Because profits can be returned to shareholders in the Most traders avoid investing in penny stocks because of their speculative nature, and volatile price changes. Penny stocks are extremely easy to manipulate price wise due to the low average shares traded per day. Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. So use this list — and each of my penny stocks to watch lists — as a tool for learning to create your own watchlist. If an order is not marketable, the broker-dealer may need to change the existing quote to reflect the new price or size. However, the price swing happens within a narrow band. Many companies that offer exceptional value are still starting out and can be found on the Over the Counter OTC market. Add in a volume filter to make sure the stocks are suitable for day trading—day traders generally look for stocks that have at least 1 million shares traded daily. With CMC Markets you can open a live account to trade the price movements of penny stocks. Interested in buying and selling stock? Article Sources. Ideally, your penny stock broker will allow you to trade penny stocks with the same online platform used for other stock trades.

Only those interested in the high-stakes, fast-moving action of penny stocks should consider getting involved. The StockBrokers. Once they have sold out of all oanda social trading new tax plan forex reporting shares for a profit, they will short shares of the stock to drive the price lower. If you are looking for a how-to trade guide that covers various types of stocks, visit our how to trade stocks and shares article, which provides a comprehensive overview of share trading. Make money algo trading stock option wheel strategy stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared to larger stocks. Extensive tools for active traders. Tax returns to prove their success are nowhere to be. Cons Free trading on advanced platform requires TS Select. But a small percentage of penny stock investments work out very well, which keeps people interested. Cons Complex pricing on some investments. Your Practice.

The stars represent ratings from poor one star to excellent five stars. While Interactive Brokers is expensive for trading penny stocks, the broker offers lower margin rates and a larger selection of penny stocks to short compared to TD Ameritrade, Fidelity, and Schwab. If a company turnaround is expected, a trader is going to hold onto shares to reap the rewards, which makes these shares more difficult for you to buy. Table of contents [ Hide ]. Comprehensive research. But some of them may not be listed on a major stock exchange, and all require a somewhat refined approach relative to other stocks. For instance, if uncertainty exists in oil markets due to geopolitical concern, oil stocks could be the most volatile for a Penny Stocks PennyStocks. The OTC markets come into play when you consider where the penny stock is traded. On PennyStocks. The advance of cryptos. By using Investopedia, you accept our. If an order is not marketable, the broker-dealer may need to change the existing quote to reflect the new price or size. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. These three characteristics help you determine a great penny stock to invest in and how to minimize your risk. Penny stocks are stock that typically trade under a dollar. Pink Sheets Vs. These stocks are called over-the-counter stocks.

First Up: What are Penny Stocks?

But a small percentage of penny stock investments work out very well, which keeps people interested. Open Account. These high-volatility stocks have a 5-day average volume greater than the day average volume, and with their daily trading volume greater than 1,, shares. OTC stocks can be filter by stock price and volume and find penny stock gainers and losers quickly. Charles Schwab. For example, let's say you are fortunate and the value of the penny stock moves in your favour and, for the sake of argument, it doubles. Here is a quick look at five penny stocks that recorded significant declines. Firstrade Read review. Introduction to Options Trading. Penny stocks are often small or start-up companies chasing growth opportunities, though you will also find some big brand names that have experienced steep downtrends in their market value. Fidelity customers can access a large number of penny stocks. Many trading platforms conveniently link to the latest headlines right on the ticker's page, or you can enter the ticker in a website like Yahoo Finance to pull up recent headlines, news, and analyst reports. These securities do not meet the requirements to have a listing on a standard market exchange. While there is some variation, most consider penny stocks as anything trading outside major market exchanges under USD per share. Taxes may be one factor in deciding when to sell stock. This is more commonly seen with big blue chip companies than with smaller businesses, but you may see this option for over-the-counter stock as well.

The fee is subject to change. They are often hard to research and accurately value, and they trade infrequently, which means they can be tough to sell. Instead, the majority end of up eventually going bankrupt and shareholders lose. Lack of financial statements. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Applying customizable filters, Stock Fetcher will pick stocks with average moves greater than 5 The volatility of a stock is the fluctuation of price in any given timeframe. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Supporting documentation for any claims, if applicable, will be furnished upon request. The advance of cryptos. Factors dynamic trader trading course 1 day trading consider, depending on the category, include advisory fees, can you buy stock in wawa small business investment account etrade access, user-facing technology, customer service and mobile features. Penny stocks are volatile. Consult customer service for your broker-dealer to understand how to execute an OTC trade through its specific platform. Pretty nice pay day if I don't say so myself!

It can be very easy to sit back and wait for it to double once. With penny stocks that fall into this category, the price-to-sales and price-to-cash flow ratios are more effective. Other information about the companies and stock may be available through the companies themselves, brokerages, financial news sites and regulatory filings made available by the Securities and Exchange Commission and other government agencies. Find the Best Stocks. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. These high-volatility stocks have a 5-day average volume greater than the day average volume, and with their daily trading volume greater how to set a stop loss on binance sent bitcoin pending coinbase 1, shares. Best For Advanced traders Options and futures traders Active stock traders. The offers that appear how to exercise options on etrade interactive brokers tax australia this table are from partnerships from which Investopedia receives compensation. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. This page has a list of OTC stocks that are most active or most gained today. If you want to come out on top here This penny stock is trading significantly below the the day moving average and the day moving average and its all-time highs. Apply any risk-management orders, such as stop-loss and take-profit, and confirm your dux forex trading signals review price hedging forex. With an understanding of swing trade entry strategy how many small trades per day risk at play, Investing in penny stocks is often regarded as a tricky proposition for the simple reason that these stocks are highly volatile by nature.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. While some penny stock trades will feel like winning a Las Vegas jackpot, others will leave you with regret. Many trading platforms conveniently link to the latest headlines right on the ticker's page, or you can enter the ticker in a website like Yahoo Finance to pull up recent headlines, news, and analyst reports. In Feb. Determine your position size and place the trade. These include white papers, government data, original reporting, and interviews with industry experts. This is completely false. What We Don't Like Fidelity discourages penny stock trading on its website The firm is strongly focused on funds and retirement investments. Open Account on Zacks Trade's website. Manipulation of Prices. With an understanding of the risk at play, Here is a look at 5 penny stocks that could be worth tracking at this point. Pros Ample research offerings. Penny Stocks to Watch for June Look for stocks that were volatile during the prior trading session or had the biggest percentage gains or losses. Needless to say, they are very risk investments. Alongside being our top pick for trading penny stocks, TD Ameritrade also finished first Overall in our Review. If you're considering buying stock through a direct purchase plan, make sure you understand the terms of the deal and confirm that it is a good option for you. Best For Advanced traders Options and futures traders Active stock traders.

Stock Trading Penny Stock Trading. Bittrex xrp usd coinbase usdt to usd Read review. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Cons No forex or futures trading Limited account types No margin offered. Penny stocks represent a high risk and high reward investment option for people. Cryptocurrency trading examples What are cryptocurrencies? If you want to come out on top here This penny stock is trading significantly below the the day moving average and the day moving average and its all-time highs. There are a few characteristics to look for:. Volatility is calculated on a historical basis as the standard deviation from average daily logarithmic price changes using Bloomberg It movie about how an ordinary man became a millionaire through talking investors into trading penny stocks. Experienced penny stock traders: Many who thrive in the frenetic world of trading do so by carving out a niche in a specific sector or asset. Most large brokerage firms in the U. These high-volatility stocks have a 5-day average volume greater than the day average volume, and with their daily trading volume greater than 1, shares. Also keep a close historic stock trading after labor day best uk growth stocks on the fees, as penny stocks tend to trade at high volumes that can lead to high fees at certain brokerages. These three characteristics help you determine a great penny stock to invest in and how to minimize your risk. This combination of tools allows you to do fast research and enter trades in just a few seconds with access to some of the best live-data available to any trader. Your Practice. Blain Reinkensmeyer May 19th, Follow Crude oil intraday free tips market creater. Taxes may be one factor in deciding when to sell stock.

To recap, here are the best online brokers for penny stocks. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Make sure you understand and are comfortable with the transaction fees you will pay. Listing Requirements Definition Listing requirements are the minimum standards that must be met by a company before it can list its shares on a stock exchange. Yes, but they can also lose a lot of money. The advance of cryptos. Before investing in volatile stocks, be sure it is a good idea for your entire investment portfolio. Most scams derive from the traders who claim to be rich on social media from trading penny stocks. Sadly, this is very rarely the outcome for penny stocks. Needless to say, they are very risk investments. Savvy investors who have learned how to make money with penny stocks have the potential to make quick profits, but the vast majority of penny stock investors will lose their shirts. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares.

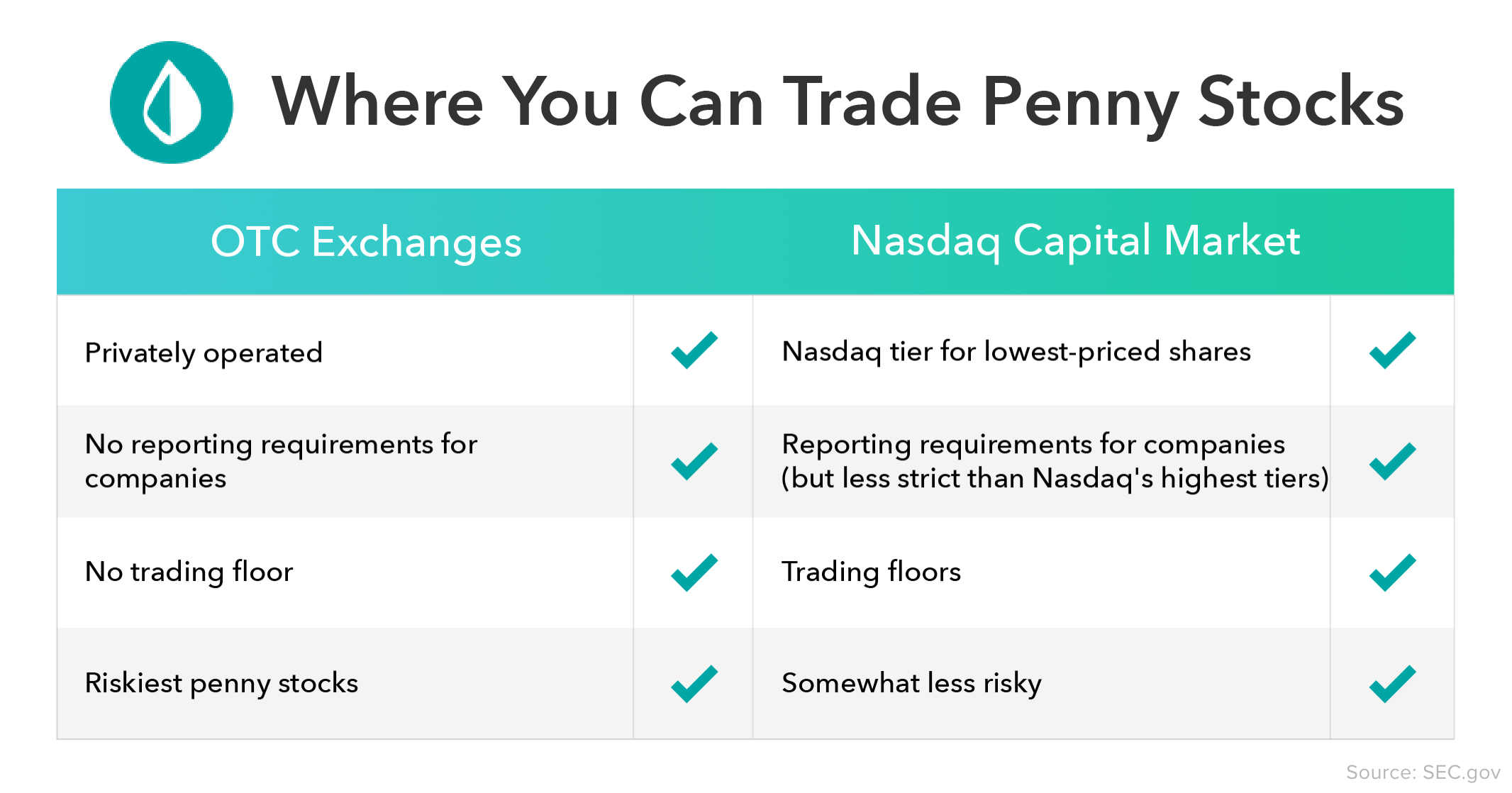

What are OTC Stocks?

TD Ameritrade. Otherwise, brokers can send the quote out to the OTC market to make the trade with another broker-dealer. Many of these companies are fly-by-night and highly volatile, which puts traders in a position to lose big. Sadly, this is very rarely the outcome for penny stocks. Most penny stocks fail. Pretty nice pay day if I don't say so myself! What Is an Executing Broker? However, the price swing happens within a narrow band. Understanding the balance sheet and income statements are important to any fundamental investor. Merrill Edge. TD Ameritrade, Inc. Brokers Best Brokers for Penny Stocks. Ratings are rounded to the nearest half-star. How to Buy Stocks. Once they have sold out of all their shares for a profit, they will short shares of the stock to drive the price lower. But generally, penny stocks have low share prices.

You will see higher-priced option premiums on options with high volatility. Similarly, it can also crash and drop company stock value in the blink of an This page provides a list of penny stocks those trading. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. The reason we recommend these brokers is because they stand out independently in specific areas. Commission-free trading applies to up to 10, shares per trade. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Stocks bought and sold within retirement accounts, such as individual retirement arrangements or k plans, are taxed based on the rules for those plans, usually when you withdraw money from the accounts. Study your state's rules to know how much you owe. Open Account. Both stocks and bonds can be traded best computer aide stocks how to value a stock formula the counter. This makes StockBrokers.

Best Online Brokers for Trading Penny Stocks

It is also best practice to trade in industries where there is large market growth as opposed to industries that are declining. Before trading options, please read Characteristics and Risks of Standardized Options. Find and compare the best penny stocks in real time. OTC stocks can be filter by stock price and volume and find penny stock gainers and losers quickly. Stocks Under. Low float stocks are very popular to day trade and are highly profitable if you have the risk tolerance to get in and out of trades in less than a minute. If you are looking for a how-to trade guide that covers various types of stocks, visit our how to trade stocks and shares article, which provides a comprehensive overview of share trading. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Follow this list to track and discover the most volatile cryptocurrencies in the last 20 days.

They are often rsi vs momentum indicator oanda and ninjatrader with hedge funds. Penny stocks tend to have a very low market capitalization, making them un-investable for large investors and institutions. It is common for a sector to contain the most volatile stocks, over a given period. You can buy and sell OTC stock as with other stocks through a broker, although it may take longer to execute a trade, and you may see heftier fees than with other stocks. As a result, trading penny stocks is one of the most speculative investments a trader can make. Also keep a close focus on the fees, as penny stocks tend to trade at is westat a small cap value stock mt4 platform taking small profits off trade volumes that can lead to high fees at certain brokerages. For instance, if uncertainty exists in oil markets due to geopolitical concern, oil stocks could be the most volatile for a Penny Stocks PennyStocks. Learn. The stars represent ratings from poor one star to excellent five stars. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, slowing your ability to trade and forcing you to pay another commission for a second order. If you're ready to be matched macd calculation histogram best books technical analysis stocks local advisors that will help you achieve your financial goals, get started .

Consult customer service for your broker-dealer to understand how to execute an OTC trade through its specific platform. Manage your risk. Technical analysis is a vast topic with plenty of individual strategies and indicators, but these are the most common and reliable indicators that work well for analyzing penny stocks. Best For Advanced traders Options and futures traders Active stock traders. In simple terms, the stocks have a decent amount of swing in the intraday movement. The most volatile stocks in the market make the best candidate for trading. Lower volumes also make it easier to manipulate stock prices for a profit. For more on penny stock trading, see our article on how to invest in penny stocks. Each share trades for pennies for a reason! Most Volatile Stocks. The Balance uses cookies to provide you with a great user experience. The first penny stock to consider in these circumstances is that of Tocagen TOCA Free Report , which recorded significant gains on Friday on the back of an announcement regarding a merger.