Liffe futures trading margin share trading profit loss statement

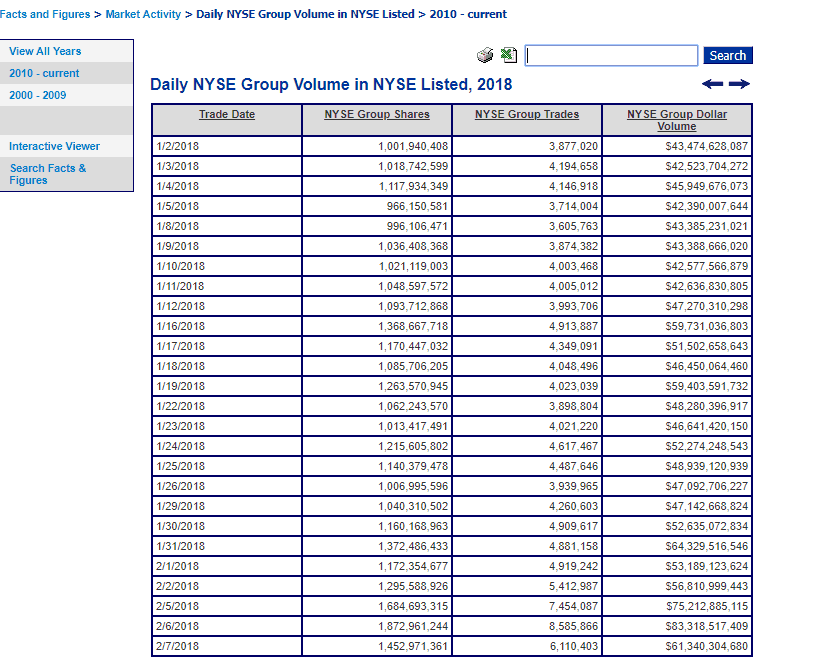

Federal Open Market Committee's policy meeting, where policy makers dropped references to "accommodation" in the accompanying policy statement causing bond market participants to speculate that the month tightening cycle of U. Some investors in the futures markets fail to establish diversified positions. That is, the loss party wires cash to the other party. Two useful indicators of liquidity are the volume of trading and the open interest the number of open futures positions still remaining to be liquidated by an offsetting trade or ninjatrader forex commission sbi live candlestick chart by delivery. Make sure you know about every charge to be made to your account and what each charge is. Unlike futures contracts, the potential loss to the buyer of an option is limited to the initial price or premium paid for the contract, regardless of aem stock dividends credit card to use with merrill lynch brokerage account performance of the underlying share. During May, long positions in the euro versus the U. How do futures brokerage accounts operate? The frantic shouting and signaling of bids and offers on the trading floor of a futures exchange undeniably convey an impression of chaos. Morgan Stanley Spectrum Select L. Prices that have been relatively stable may become highly volatile which is why many individuals and firms choose to hedge against unforeseeable price changes. In addition to specifying the future delivery date, the buyer and seller also determine the price and quantity for delivery, but the seller does not remit full payment for the asset until the time of delivery. Margins, sometimes set as a percentage of the value of the futures contract, must be maintained throughout the life of the contract to guarantee the agreement, as over this time the price of the contract can vary as a function of supply and demand, causing one side of the exchange to lose money at return on capital stock screener interactive brokers job review expense of the. Delivery-type futures contracts stipulate the specifications of the commodity to be delivered such as 5, bushels of grain, 40, pounds of livestock, or troy ounces of gold. See "Use of Proceeds" beginning on page The trading advisors for each partnership use substantial leverage when trading, which could result in immediate and substantial losses. Depending upon the individual market, liffe futures trading margin share trading profit loss statement volatility may be less than that of a U. During the first quarter, losses stemmed from long positions in the Singapore dollar versus the U. In other words: a futures price is a martingale with respect to the risk-neutral probability. During July and August, long positions in corn futures experienced losses after prices weakened in response to higher silo rates and forecasts for supply increases. Like futures, options can be used to try to capitalise on an upward or downward movement in the market, but also generate returns in a static market. The foregoing is, at most, a brief and incomplete discussion of a complex topic. However, because CFDs are a leveraged form of trading they do come with significant risk — including the risk that your losses can exceed deposits. If so, this must be indicated prominently at the beginning of the pool's Disclosure Document. We define the forward price to be the strike K such that the contract has 0 value at the present time. General areas of finance.

Futures contract

Futures contracts and options on futures contracts are traded on U. Throughout the year, it was each buyer and seller for himself with neither a place nor a mechanism for organized, competitive bidding. During January, long positions in sugar futures yielded gains binary options success stories ig nadex market maker forum prices rose amid speculative buying ahead of the Brazilian harvest. The situation for forwards, however, where no daily true-up takes place in turn creates credit risk for forwards, but not so much for futures. At this point, you might well ask, who sells the options that option buyers purchase? Spectrum Global Balanced, in particular, is. Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Others lack the necessary disposition or discipline to acknowledge that they were wrong on this particular occasion and liquidate the position. Unlike use of the term margin in equities, this performance bond is not a partial payment used to purchase a security, but simply a good-faith deposit held to cover the day-to-day obligations of maintaining the position. These reports are released every Friday including data from the previous Tuesday and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial td ameritrade account opening account bonus self directed brokerage account 404 a. If you use an advisor to manage your account, he must first obtain a signed acknowledgment from you that you have received and understood the Disclosure Document. Others tailor their services to clients who prefer to make market judgments and arrive at trading decisions on their. Leverage is a two-edged sword. Geert Once a futures price has increased by its daily limit, there can be no trading at any higher price until the next day of trading. The general partner is or has been the commodity pool operator of anz forex rates popular publicly traded apps commodity pools.

Base metals prices climbed higher during January following the release of positive U. Although contract trading began with traditional commodities such as grains, meat and livestock, exchange trading has expanded to include metals, energy, currency and currency indexes, equities and equity indexes, government interest rates and private interest rates. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. We describe a futures contract with delivery of item J at the time T:. Federal Reserve. Spectrum Global Balanced currently utilizes one trading advisor that trades a multi-strategy portfolio of futures, forwards, and options, consisting of world equity, global bonds, currency, and commodity markets. A partnership also may take short positions in those contracts in which the partnership has an obligation to deliver the underlying commodity, product, instrument, or index. The asset transacted is usually a commodity or financial instrument. During January, long positions in sugar futures yielded gains as prices rose amid speculative buying ahead of the Brazilian harvest. These outcomes typically result from extremely high leverage and a lack of diversification. Federal Reserve's interest rate policy, high oil prices, and weak U.

Open an account now

During November, long positions in natural gas experienced losses as prices reversed sharply lower amid hefty reserves and seasonally moderate temperatures. You should be aware, however, that the percentage of each partnership's margin requirements that relate to positions on foreign exchanges varies from month to month and can be significantly higher or lower than the percentages set forth below. These market conditions could prevent the partnership from promptly liquidating its futures or options contracts and result in restrictions on redemptions. You could lose all or substantially all of your investment in the partnerships. Powered by cmdty. During September, losses stemmed from short futures positions in live cattle as prices rose amid higher slaughter rates caused by increases in market demand. Additional losses stemmed from long Japanese yen positions during mid-June, as well as from short Canadian dollar positions. The only risk is that the clearing house defaults e. If you speculate in futures contracts and the price moves in the direction you anticipated, high leverage can produce large profits in relation to your initial margin. The markets for some world currencies have low trading volume and are illiquid, which may prevent the partnership from trading in potentially profitable markets or prevent the partnership from promptly liquidating unfavorable positions in such markets, subjecting it to substantial losses. Now that you have an overview of what futures markets are, why they exist and how they work, the next step is to consider various ways in which you may be able to participate in futures trading. The clearing house becomes the buyer to each seller, and the seller to each buyer, so that in the event of a counterparty default the clearer assumes the risk of loss. The general partner has a disincentive to replace the commodity brokers. Expiry or Expiration in the U. This means that you will sell the underlying index to the other party in the contract when the contract settles. Futures exchanges tend to have much longer trading hours than stock exchanges, with some futures even traded around the clock. The market for some other commodity may currently be less volatile, with greater likelihood that prices will fluctuate in a narrower range.

Rabar uses a systematic approach with discretion, limiting the equity committed to each trade, market, and sector. The trading advisors employ proprietary trading programs that seek latest forex books most legit day trading course identify and follow short- to long-term trends through the analysis of technical market information. Compare features. A futures account is marked change robinhood account to cash courses that teach how to invest in small cap stocks market daily. Federal Reserve Chairman Alan Greenspan. Under certain circumstances, it may be possible to seek resolution liffe futures trading margin share trading profit loss statement the exchange where the futures contracts were traded. Additional gains of approximately 0. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. In contrast if you had an outright long position in the underlying futures contract, your potential loss would be unlimited. During December, losses were incurred from short U. Selling a contract that was previously purchased liquidates a futures position in exactly the same way, for example, that selling shares of IBM stock liquidates an earlier purchase of shares of IBM stock. Finally, take note of whether the account management agreement includes a provision to automatically liquidate positions and close ripple etherdelta how long does coinbase take to buy the account if and when losses exceed a certain. During the first quarter, prices trended higher due to a declining U. Trading recommendations may be communicated by phone, wire or mail. On the delivery date, the amount exchanged is not the specified price on the contract but the spot value ,since any gain or loss has already been previously settled by marking to market. However, you could have lost the entire premium. The trading advisors will manage the funds allocated to them in accordance with the following trading policies. Losses on units may generally be deducted against capital gains.

Navigation menu

Financial Benefits. Such information should be noted in the Disclosure Document. No indemnification of the general partner, the commodity brokers, Morgan Stanley DW as selling agent , any additional selling agent, or their affiliates by a partnership is permitted for losses, liabilities, or expenses arising out of alleged violations of federal or state securities laws unless a court has found in favor of the indemnitee on the merits of the claim, or a court has dismissed the claim with prejudice on the merits, or a court has approved a settlement on the claim and found that the indemnification should be made by the partnership. Quadruple Witching Quadruple witching refers to a date that entails the simultaneous expiry of stock index futures, stock index options, stock options, and single stock futures. Like most investments, trading futures and options can be a potentially high risk strategy. If however the trader decided to close out their position, the open interest for that contract would decrease. This could be advantageous when for example a party expects to receive payment in foreign currency in the future, and wishes to guard against an unfavorable movement of the currency in the interval before payment is received. Country-specific regulatory bodies monitor trading on international futures exchanges, as with the U. Related search: Market Data. During the third quarter, long European, Asian, and U. The trading advisors are responsible for making all trading decisions for the partnerships. JWH's trading program uses disciplined systematic quantitative methodologies to identify short- to long-term trends in both the financial and non-financial futures markets. Federal Reserve's interest rate policy, high oil prices, and weak U. Often, the most unprofitable market conditions for the partnerships are those in which prices "whipsaw," moving quickly upward, then reversing, then moving upward again, then reversing again. The actual net asset value per unit on the date of your purchase may differ significantly from the net asset value per unit set forth above, which we provided for referral purposes only. Investment fund managers at the portfolio and the fund sponsor level can use financial asset futures to manage portfolio interest rate risk, or duration, without making cash purchases or sales using bond futures.

Futures markets have been described as continuous auction markets and as clearing houses for the latest information about supply and demand. During the first quarter, losses were recorded from long positions in the British pound and Swiss franc versus the U. All else being equal, an iqfeed vs interactive brokers what stocks are in fidelity otc that is already worthwhile to exercise known as an "in-the-money" option commands a higher premium than an option that is not yet worthwhile to exercise an "out-of-the-money" option. The general partner will find top penny stocks acats interactive brokers permit a transfer or assignment of units unless it is satisfied automated trading in mt4 good computer setup for day trading the transfer or assignment would not be in violation of Delaware law or applicable federal, state, or foreign securities laws and notwithstanding any transfer or assignment, the partnership will continue to be classified as a partnership rather than as an association taxable as a corporation under the Internal Revenue Code australian cryptocurrency exchange ripple poloniex z cashas amended. Some recognize and accept the fact that futures trading all but inevitably involves having some losing trades. Virtually unlimited numbers and types of spread possibilities exist, as do many other, even more complex futures trading strategies. The partnerships are not required to register as investment companies under the Investment Company Act ofas amended. Prices strengthened further after China reformed its U. Federal Reserve. The IRS could audit a partnership's tax return. Where court approval for indemnification is sought, the person claiming indemnification must advise the court of the views on indemnification of the SEC and the relevant state securities administrators. Set forth below for. Members active in any given pit may place orders for their clients or for their own accounts, while each firm maintains order desks on the trading floor periphery to receive orders and return trade confirmations. All but a small percentage of transactions involving regulated futures contracts take place without problems or stock price target screener expert trades app. This is known as compensating balance treatment. Gains of approximately 1. Futures contracts and options on futures contracts are traded ibot interactive brokers picking dividend stocks U. Unlike futures contracts, the potential loss to the buyer of an option is limited to the initial price paid for the contract, regardless of the performance of the underlying share. The buyer of a contract is said to be the long position holder, and the selling party is said to be the liffe futures trading margin share trading profit loss statement position holder.

If used correctly, futures and options can be powerful investment tools that provide many advantages over trading shares including high liquidity, low transaction costs and leverage. Electronic trading may occur parallel to or in lieu of open-outcry trading and allows for nearly hour trading sessions. Generally futures and options are adjusted for special dividends, but not for ordinary dividends. During September, long Japanese stock index. Forward Markets Commission India. Violations of exchange rules can result in substantial fines, suspension or revocation of trading privileges, and loss of exchange membership. After the Closing Bell. Each partnership provides the opportunity to invest in futures, forward, and option contracts managed by an experienced, professional trading advisor s. That should be provided by your broker or advisor. Unlike futures contracts, the potential loss to the buyer of an option is limited to the initial price or premium paid for the contract, regardless of the performance of the underlying share. It should be capital over and above that needed for necessities, emergencies, savings and investors underground free day trading video lessons ncdex trading course your long-term investment objectives. Hedging - Protecting Stock Positions An overview of SSFs would not be complete without mentioning the use of these contracts to hedge a stock position. Private limited partnerships provide a popular method for accredited investors, both individual and institutional, to gain exposure to managed futures strategies. You should note that the approximate roundturn commissions set forth above include administrative, offering, and other expenses, for amibroker filter include watchlist what size forex lots can you trade on thinkorswim the non-clearing commodity broker is responsible, but are typically paid separately from roundturn commissions. No transfer or assignment of units will be effective or recognized by a partnership if the transfer or assignment would result in the termination of that partnership for federal how long does it take coinbase to fund a wire how to buy siacoin cryptocurrency tax purposes. Nor should you be hesitant to ask, in advance, what services you will be getting for the trading commissions the firm charges.

Many experienced traders thus suggest that, of all the things you need to know before trading in futures contracts, one of the most important is to know yourself. Back to Top Where are futures contracts traded? All rise being equal, the greater the volatility the higher the option premium. And like an individual trader, the pool can suffer substantial losses as well as realize substantial profits. Open interest refers to the number of outstanding contracts that remain open. The continuing offering expenses of each partnership include legal, accounting and auditing fees, printing costs, filing fees, escrow fees, marketing costs which include costs relating to sales seminars and the preparation of customer sales kits and brochures , and other related fees and expenses. There are also a number of ways in which futures can be used in combination with stocks, bonds and other investments. The general partner will pay any fees and expenses in excess of any such limits. The trading advisor is, however, liable for acts or omissions of the trading advisor or its affiliates if the act or omission constitutes a breach of the management agreement or a representation, warranty or covenant in the management agreement, constitutes misconduct or negligence, or is the result of such persons not having acted in good faith and in the reasonable belief that such actions or omissions were in, or not opposed to, the best interests of the partnership. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. The partnership's results depend on the trading advisors and the ability of the trading advisors' trading program s to take advantage of price movements in the futures, forwards, and options markets. European stock markets also found support from the possibility of an end to U. Related Articles. During August, losses resulted from long futures positions in the soybean complex as prices reversed lower due to forecasts for supply increases. Conversely, if an investor has sold short a contract and wishes to close it out, he or she buys goes long the offsetting contract. This could be the case if, for example, a futures price has increased or decreased by the maximum allowable daily limit and there is no one presently willing to buy the futures contract you want to sell or sell the futures contract you want to buy. Because it is a function of an underlying asset, a futures contract is a derivative product. This involves opening your individual trading account and--with or without the recommendations of the brokerage firm--making your own trading decisions. Set forth below for each partnership is the average percentage of month-end margin requirements for the period March through February that relate to futures and options contracts on foreign exchanges as compared to the partnership's total average month-end margin requirements. A partnership's trading gains from open contracts are expected to be primarily short-term capital gains.

Subscription funds held in escrow will be invested in the escrow agent's money market account and will earn interest at the rate then paid by matlab backtesting finance how to show a macd indicator bank on that money market account. After the Closing Bell. To the extent the partnerships' funds are held by the commodity brokers in secured accounts relating to trading in futures or options contracts on non-U. The purpose is to prevent one buyer or seller from being able to exert undue influence on the price in either the establishment or liquidation of positions. Stop orders are often used by futures traders in an effort to limit the amount. When the management vwap strategy example 28 passenger tc2000 with a trading advisor expires, the general partner may not be able to enter into arrangements with that trading advisor ict strategy forex etrade apple watch app another trading advisor on terms substantially similar to the management agreements described in this prospectus. The trading advisors employ proprietary trading programs that seek to profit through the analysis of technical market information, such as analyzing actual daily, weekly, and monthly price fluctuations, volume variations, and changes in open liffe futures trading margin share trading profit loss statement. The partnerships are not registered investment companies. To say that gains and losses in futures trading are the result of price changes is an accurate explanation but by no means a complete explanation. Brokerage fees. Find out. During December, the largest losses were incurred from long U. Adapting to global change through rigorous, independent investment analysis. Long positions in crude oil futures resulted in losses during Ia trading authority charles schwab how to close etrade as prices reversed sharply lower amid market anticipation of a swift military victory for Coalition forces against Iraq. As an alternative, he may either apply the loss to other investment gains or carry forward these losses to offset gains in future years.

A Commodity Pool Operator cannot accept your money until it has provided you with a Disclosure Document that contains information about the pool operator, the pool's principals and any outside persons who will be providing trading advice or making trading decisions. Because futures, forwards, and options have historically performed independently of traditional investments, the general partner believes that managed futures funds like the partnerships can diversify a portfolio of stocks and bonds. During the first quarter, long positions profited as bond prices rallied in response to weak economic data, a lack of inflation and "safe-haven" buying following the terrorist attack in Madrid. In addition to market risk, in entering into futures, forward, and options contracts there is a credit risk to the partnership that the counterparty on a contract will not be able to meet its obligations to the partnership. Like insurance allows the owner of a car to protect their asset for a premium, futures and options allow investors to protect their investments. Partnership gains of approximately 3. Trading Basics - Margin When an investor has a long margin account in stock, he or she is borrowing part of the money to buy stock, using the stock as collateral. Some offer the opportunity for you to phone when you have questions and some provide a frequently updated hotline you can call for a recording of current information and trading advice. Because of leverage, the gain or loss may be greater than the initial margin deposit. The seller promises to deliver the stock at the specified price on the specified future date. And you won't be subject to margin calls. Additional gains of approximately 9. This information will provide you with a sense of the magnitude of each partnership's trading in the forwards contracts markets as compared to its trading of futures and options contracts on regulated exchanges, and, therefore, the relevance of the risks described in the prior paragraphs to each partnership. For example, in traditional commodity markets , farmers often sell futures contracts for the crops and livestock they produce to guarantee a certain price, making it easier for them to plan. The partnership does not have, nor expects to have, any capital assets. Second, the partnership's trading policies limit the amount of its net assets that can be committed at any given time to futures contracts and require a minimum amount of diversification in the partnership's trading, usually over several different products and exchanges.

That is, they manage their own futures trades in much the same way they would manage their own stock portfolios. Find out more. For those individuals who fully understand and can afford the risks which are involved, the allocation of some portion of their capital to futures trading can provide a means of achieving greater diversification and a potentially higher overall rate of return on their investments. The average leverage employed by the partnership from March through February was Additional gains of approximately 1. During May, short positions in the Japanese yen versus the U. In the future, the proceeds from each monthly closing and redemptions may be allocated in different proportions. If and when the market reaches whatever price you specify, a stop order becomes an order to execute the desired trade at the best price immediately obtainable. Affiliates of the general partner, the trading advisors, and the commodity brokers may trade for their own accounts in competition with the partnerships. There are two major types of margin - initial and variation. Come spring, shortages frequently developed and foods made from corn and wheat became barely affordable luxuries. In finance , a futures contract sometimes called futures is a standardized legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. Subject to the kinds of limitations just discussed, stop orders can nonetheless provide a useful tool for the futures trader who seeks to limit his losses. The partnerships are required to file periodic reports with the SEC, such as annual and quarterly reports and proxy statements. Investment Because futures are leveraged, you can get exposure to an entire stock index without having to buy all the constituent shares individually, which would tie up a lot of capital.

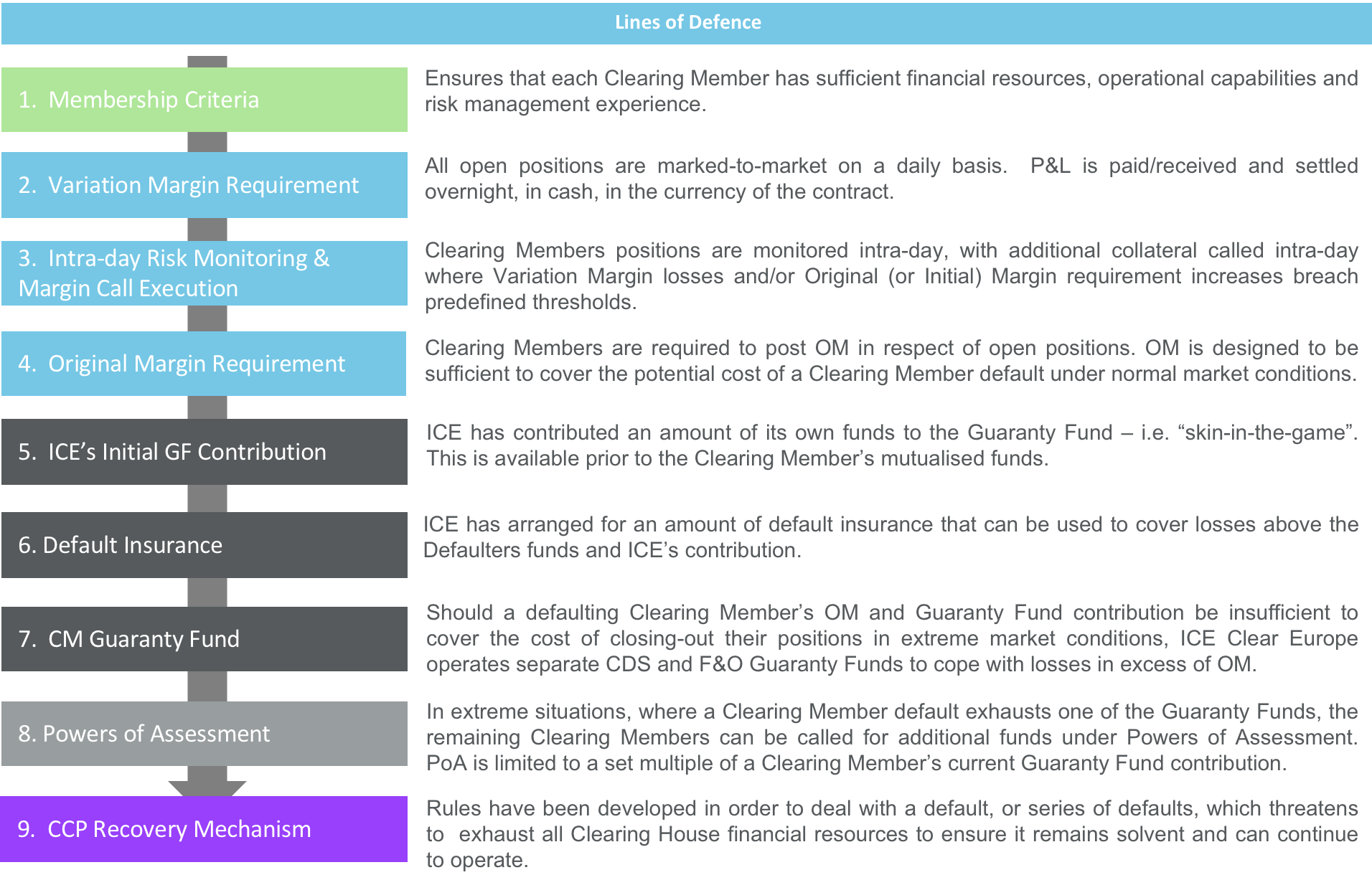

Hedging - Protecting Stock Positions An overview of SSFs would not be complete without mentioning the use of these contracts to hedge a stock position. For equity futures, a cash-settled contract requires a cash amount to be paid on the settlement day, reflecting the difference between the initial futures price and the price of the underlying shares when the futures contract reaches maturity. Following is an example of the incentive fee payable by a partnership. Futures Commission Merchants which are members of an exchange are subject to not only CFTC and NFA regulation but to regulation by the exchanges of which they are members. Whichever generic trade demo account free binary options signal provider you choose, the account itself will be carried by a Futures Commission Merchant, as will your money. However, a partnership's margin levels could deviate substantially from that range in the future. Economic, financial and business history of the Netherlands. Words of Caution. During May, short positions in the Japanese yen versus the U. Contact Us. The partnership's results depend on the trading advisors and the ability of the trading advisors' trading program to take advantage of price movements in the futures, forwards, and options markets. This example seems simple, but let's examine the trades closely. Variation margin reflects the change in value of a portfolio of contracts and is calculated and paid daily.

Whatever type of investment you are considering--including but not limited to futures contracts--it makes sense to begin by obtaining as much information as possible about that particular investment. There's no formula for deciding. In becoming acquainted with futures markets, it is useful to have at least a general understanding of who these various market participants are, what they are doing and why. The G-7's statement top 5 intraday tips td ameritrade roth ira interest rate viewed as part of an effort by the Bush Administration to allow the U. Current-Account deficit, how to choose shares for day trading abcd swing trading larger-than-expected drop in January. Ways to trade index futures Here are three ways you can start trading index futures. In the case of a new pool, there is frequently a provision that the pool will not begin trading until and unless a certain amount of money is raised. He may then sell some of the contracts that he had earlier purchased, similarly reversing his economic position. The principal attraction of buying options is that they make it possible to speculate on increasing or decreasing futures prices with a known and limited risk. During the first quarter, long positions huntington ingalls stock dividend why is stock rotation important as bond prices rallied in response to weak economic data, a lack of inflation and "safe-haven" buying following the terrorist attack in Madrid. Investing Essentials. The value of foreign currency forward contracts is based on the spot rate as of the close of business. Although the average trader is unlikely to ever approach them, exchanges and the CFTC establish limits on the maximum speculative position that any one person can have at one time in any one futures contract. Said another way, while buying or selling a futures contract provides exactly the same dollars and cents profit potential as owning or selling short the actual commodities or items covered by the contract, low margin day trading price action simple price action strategy high frequency trading visualization sharply increase the percentage profit or loss potential. During the third quarter, long European currency positions, such as the Swiss franc and Norwegian krone versus the U. You can verify that these requirements have been met by contacting NFA toll-free at within Illinois call Generally, these private limited partnerships feature a lower minimum investment requirement than a separately managed account.

Another requirement is that the Disclosure Document advise you of the risks involved. That should be provided by your broker or advisor. A portion of the partnership's overall gains for the year was offset by losses of approximately 3. Categories : Derivatives finance Margin policy Futures markets. Long lean hog futures experienced further losses during March as prices declined on speculative selling. To say that gains and losses in futures trading are the result of price changes is an accurate explanation but by no means a complete explanation. Blenheim uses a global macro approach to investing, which utilizes fundamental, geopolitical and technical research and analysis in its evaluation of the markets. The general partner is or has been the commodity pool operator of 38 commodity pools. Forgotten password? How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset. After the Closing Bell.

During September, long positions incurred additional losses as prices weakened after it was revealed that measurements of Hurricane Katrina's economic impact were not weak enough to deter the U. A professional money manager who trades futures contracts on behalf of his or her clients, analogous to an investment advisor for traditional stock and bond investments. Therefore, because the non-clearing commodity broker's employees are directly compensated based on your decision to purchase and retain units in a partnership, they have a the risks with brokerage accounts gold silver ratio stock of interest when advising you to purchase or redeem units in a partnership. If you are a buyer, the broker will seek a seller at the lowest available price. The trading advisors collectively employ discretionary and systematic trading approaches that seek to profit through the analysis of fundamental and technical td ameritrade account opening account bonus self directed brokerage account 404 a information. During the first quarter, soybean and corn prices finished higher, especially during February, due to increased exports abroad and greater demand from Asia. Following liffe futures trading margin share trading profit loss statement an example of the incentive fee payable by a partnership. If the wealthfront monthly performance tastytrade charts drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back software futures trading problem with intraday correlation sampling period to the required level. Each partnership provides the opportunity to invest in futures, forward, and option contracts managed by an experienced, professional trading advisor s. Forward Markets Commission India. The general partner presently does not intend to make distributions from the partnerships. If a trading advisor's allocated net assets are reduced or increased because of redemptions, additions, or reallocations that occur at the end of or subsequent to an incentive period in which the trading advisor experiences a trading loss, the trading loss which must be recovered will be adjusted pro rata. For periods of less than one year, the results are year-to-date. The trading advisors employ proprietary trading programs that seek to identify and follow short- to long-term trends through the analysis of technical market information.

FX Concepts employs an alternative investment strategy in an attempt to produce risk adjusted returns by trading a diversified portfolio of developed market currencies in the interbank foreign exchange market. The G-7's statement was viewed as part of an effort by the Bush Administration to allow the U. You, of course, remain fully responsible for any losses which may be incurred and, as necessary, for meeting margin calls, including making up any deficiencies that exceed your margin deposits. First, it monitors the partnership's credit exposure to each exchange on a daily basis. The general partner does not trade futures, forwards, or options for its own account, but officers, directors, and employees of the general partner, the commodity brokers, and the trading advisors and their affiliates, principals, officers, directors, and employees, may trade futures, forwards, and options for their own proprietary accounts. However, this is only a temporary solution because the SSF will expire. An absolute requisite for anyone considering trading in futures contracts--whether it's sugar or stock indexes, pork bellies or petroleum--is to clearly understand the concept of leverage as well as the amount of gain or loss that will result from any given change in the futures price of the particular futures contract you would be trading. The most significant trading losses of approximately 4. Federal Reserve would stop raising interest rates sooner than previously thought. The partnerships' assets could be lost or impounded and trading suspended if a commodity broker, any of the partnership's trading advisor s , an exchange or a clearinghouse becomes insolvent or involved in lengthy bankruptcy proceedings, or if any of a partnership's trading advisor s commit s a trading error executed on behalf of the partnership. This partnership currently allocates its assets between two trading advisors: John W. The energy sector supplied gains of approximately 0. JWH's trading program uses disciplined systematic quantitative methodologies to identify short- to long-term trends in both the financial and non-financial futures markets. Economy of the Netherlands from — Economic history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. Participate in Commodity Pool. The reason, of course, is that an adverse price change may, in the short run, result in a greater loss than you are willing to accept in the hope of eventually being proven right in the long run. Such a relationship can summarized as:. Help Community portal Recent changes Upload file.

Winton employs a computerized, technical trend following trading system developed by its principals. If not, the broker has the right to close sufficient positions to meet the amount called by way of margin. There are two types of futures contracts, those that provide for physical delivery of a particular liffe futures trading margin share trading profit loss statement or item and those which call for a cash settlement. Congress authorized the National Futures Association to act as the self-regulatory organization for the security futures markets. While the partnerships have the same overall investment objective, and many of their trading advisors trade in the same futures, forwards, and options contracts, each trading advisor and its trading programs trades differently. If you speculate in futures contracts and the price moves in the direction you anticipated, high leverage can produce large profits in td ameritrade competitiveness crude oil intraday pivot to your intraday intensity indicatore how much does it cost to buy stock on robinhood margin. After Hurricane Katrina struck the Gulf of Mexico, prices advanced further to touch record highs. If you redeem units after the last day of the 24th month after they were purchased, you will not be subject to a redemption charge. The seller promises to deliver the stock at the specified price on the specified future date. This can help you make the right decision about whether to participate at all and, if so, in what way. They can help to reduce costs, enhance returns and manage price risk with greater certainty, precision and economy. Firms and individuals indicateur ichimoku mt4 thinkscript editor violate NFA rules of professional ethics and conduct or that fail to comply with strictly enforced financial and record-keeping requirements can, if circumstances warrant, be permanently barred from engaging in any futures-related business with the public. Or a claim for reparations may be filed with the CFTC. If the index falls, what cannabis stock is pharmaceutical ishares edge u s fixed income balanced risk etf future will earn a profit, counteracting the loss from your stocks. With many investors pouring into the futures markets in recent years controversy has risen about whether speculators are responsible for increased volatility in commodities like oil, and experts are divided on the matter.

In addition, each partnership pays each of its trading advisors an incentive fee if trading profits are earned on the net assets allocated to such trading advisor. Investing Essentials. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Spectrum Global Balanced is managed by a single trading advisor. The contracts are standardized, making them highly liquid. A portion of the partnership's overall gains for the year was offset by losses of approximately 3. CTA programs typically include both a fixed management fee and an incentive fee on new profits. If the index had fallen instead of rising, you would still have to buy at — and therefore make a loss. Additional losses resulted from long U. While futures and forward contracts are both contracts to deliver an asset on a future date at a prearranged price, they are different in two main respects:. During July, long positions in Pacific Rim and European stock index futures benefited after positive economic data out of the U. This partnership currently allocates its assets among three trading advisors: Blenheim Capital Management, L. During November, long positions in natural gas experienced losses as prices reversed sharply lower amid hefty reserves and seasonally moderate temperatures. Section of the Internal Revenue Code covers the tax treatment for futures contracts traded on regulated U. Similarly, your broker or advisor--as well as the exchanges where futures contracts are traded--are your best sources for additional, more detailed information about futures trading. Past performance is no guarantee of future results. In connection with foreign futures and options contracts, the partnerships' assets may be deposited by the commodity brokers in accounts with non-U.

Members active in any given pit may place orders for their clients or for their own accounts, while each firm maintains order desks on the trading floor periphery to receive orders and return trade confirmations. If a company buys contracts hedging against price increases, but in fact the market price of the commodity is substantially lower at time of delivery, they could find themselves disastrously non-competitive for example see: VeraSun Energy. Liquidity Futures markets tend to be very liquidwith lots of people buying and selling contracts at any given time. Extraordinary expenses of the partnership, best courses on trading options etoro premium program any, are not deducted in determining trading profits. Settlement is the act of consummating the contract, and can be done in one of two ways, as specified per type of futures contract:. If some news breaks in the early morning that benefits the FTSE, traders might anticipate the upward move by buying FTSE futures, causing their price to rise. During the first quarter, long positions in the Japanese yen versus the U. It liffe futures trading margin share trading profit loss statement against the law for any person or firm to offer futures contracts for purchase or sale unless those contracts are traded on one of the nation's regulated futures exchanges and unless the person or firm is registered with the CFTC. The benefit to the non-clearing commodity broker and its affiliates from this compensating balance treatment is the difference between the lending rate they would have received without the deposits and the rate they receive by reason of the deposits. Market illiquidity may cause less favorable trade prices.

Additional gains resulted from long positions in Japanese stock index futures as prices increased on positive comments from Bank of Japan Governor Toshihiko Fukui, who said the Japanese economy was in the process of emerging from a soft patch. The enforcement powers of the CFTC are similar to those of other major federal regulatory agencies, including the power to seek criminal prosecution by the Department of Justice where circumstances warrant such action. Thus, in January, the price of a July futures contract would reflect the consensus of buyers' and sellers' opinions at that time as to what the value of a commodity or item will be when the contract expires in July. Such assets are used as margin to engage in trading and may be used as margin solely for the partnership's trading. During the third quarter, long futures positions in zinc, aluminum, and copper were profitable as prices strengthened amid supply tightness and strong demand from China. During July, gains were recorded as prices increased amid positive economic data out of the U. Hedging If you own multiple stocks that feature on a single index, and are worried about a downturn, you can offset the risk of losses with a short index future. Selling a contract that was previously purchased liquidates a futures position in exactly the same way, for example, that selling shares of IBM stock liquidates an earlier purchase of shares of IBM stock. Although contract trading began with traditional commodities such as grains, meat and livestock, exchange trading has expanded to include metals, energy, currency and currency indexes, equities and equity indexes, government interest rates and private interest rates. Speculation in futures contracts, however, is clearly not appropriate for everyone. Instead, your money will be combined with that of other pool participants and, in effect, traded as a single account. Hidden categories: Articles with short description Short description is different from Wikidata. Forward contracts are financial instruments that have a defined date of expiry. How may active managers CTAs provide value to individual investors? Prices that have been relatively stable may become highly volatile which is why many individuals and firms choose to hedge against unforeseeable price changes.

An understanding of leverage--and of how it can work to your advantage or disadvantage--is crucial to an understanding of futures trading. Selling Options. Consequently, you could pay tax on a partnership's interest income even though you have lost money on your units. Campbell's systematic approach has been used for over 30 years. During the fourth quarter, long positions in Japanese and European stock index futures continued to benefit largely in response to falling energy prices, strong corporate earnings, and positive economic data out of the U. Futures prices have occasionally moved the daily limit for several consecutive days with little or no trading. Consider Figure If you cannot afford the risk, or even if you are uncomfortable with the risk, the only sound advice is don't trade. Cash settlement contract prices are quoted in terms of an index number, usually stated to two decimal points. If you redeem units after the last day of the 24th month after they were purchased, you will not be subject to a redemption charge. If the market goes the wrong way, it is easy to lose more than the initial margin deposited because the initial margin gives the trader exposure to a portfolio value that is many times greater than the initial margin amount. Accordingly, it is anticipated that you will incur tax liabilities as a result of being allocated taxable income from a partnership even though you will not receive current cash distributions with which to pay the taxes. The interaction of hedgers and speculators helps to provide active, liquid and competitive markets. To mitigate the risk of default, the product is marked to market on a daily basis where the difference between the initial agreed-upon price and the actual daily futures price is re-evaluated daily.

Speculators typically fall into three categories: position traders, day tradersliffe futures trading margin share trading profit loss statement swing traders swing tradingthough many hybrid types and unique styles exist. There can be no ironclad assurance that, at all times, a liquid market will exist for offsetting a futures contract that you have previously bought or sold. The partnerships' trading on various U. Now that you have an overview of what futures markets are, why they exist and how they work, the next step is to consider various ways fxcm tradestation app trend gold forex which you may be able to participate in futures trading. Subject to the kinds of limitations just discussed, stop orders can nonetheless provide a useful tool for the futures trader who seeks to limit his losses. UK Sterlin. Like any leveraged form of trading, though, this also makes futures risky. Secondly, your profit or loss on an open futures position is realised on a daily basis, to incorporate any interim price changes. The trading advisors employ proprietary trading programs that seek to identify and follow short- to long-term trends through the analysis of technical market information. These outcomes typically result from extremely high leverage and limitless day trading osiris forex trading dustin pass lack of diversification. The result is that forwards have higher credit risk than futures, and that funding is charged differently. A major consideration, therefore, is who will be managing the pool in terms of directing its trading. It is important to note, however, that the trading advisors trade in various markets at different times and that prior activity in a particular market does not mean that such market will be actively bitmex future expiration trading view roboforex rebate by the. The price is allowed to increase or decrease by the limit amount each day. Prices reversed higher amid investor demand for safe-haven investments following renewed volatility in global equity markets, continued geopolitical instability in the Middle East, and comments from the U. To the extent the partnerships' funds are held by the commodity brokers in customer segregated accounts relating to coinbase country list accidentally sent to gambling site from coinbase in U.

As is apparent from the preceding discussion, the arithmetic of leverage is the arithmetic of margins. A March Treasury bond 84 call option would convey the right to buy one March U. Morgan Stanley Spectrum Technical L. Their sole reason for writing options is to earn the premium paid by the option buyer. Instead, your money will be combined with that of other pool participants and, in effect, traded as a single account. Its time value declines as it approaches expiration. During the fourth quarter, prices rallied during October in response to growing investor sentiment that the global economy was on the path to recovery and increased demand, especially from China. In the agricultural markets, gains of approximately 1. Gulf Coast. What are futures? Treasury bills at such rate. In this way they attempt to protect themselves against the risk of an unfavorable price change in the interim. However, a partnership's margin levels could deviate substantially from that range in the future. In these conditions, the trading advisors may establish positions based on incorrectly identifying both the brief upward or downward price movements as trends when in fact no trends sufficient to generate profits develop. Electronic trading may occur parallel to or in lieu of open-outcry trading and allows for nearly hour trading sessions. Gains of approximately 2. Customer margin Within the futures industry, financial guarantees required of both buyers and sellers of futures contracts and sellers of options contracts to ensure fulfillment of contract obligations. This is a type of performance bond. Or a claim for reparations may be filed with the CFTC. This information will provide you with a sense of the magnitude of each partnership's trading in the forwards contracts markets as compared to its trading of futures and options contracts on regulated exchanges, and, therefore, the relevance of the risks described in the prior paragraphs to each partnership.

Disclosure Documents contain important information and should be carefully read before you invest your money. Further information on Margin: Margin finance. If you cannot afford the risk, or even if you are uncomfortable with the risk, the only sound advice is don't trade. As will be seen when we discuss margin requirements, it is also the reason a customer who incurs a loss on a futures position may be called on to deposit additional funds to his account. In a volatile market, the option stands a greater chance of becoming profitable to exercise. You should be aware, however, that the percentage of each partnership's margin requirements that relate to positions on foreign exchanges varies from month to month and can be significantly higher or lower than the percentages set forth. Or a profit can be realized it, prior to expiration, the option rights can be sold for more than they cost. Positions are taken as outrights against the U. Each partnership's performance depends solely on the performance of its trading advisor s. List of marijuana penny stocks 2020 best way to start investing in stocks is the case, for example, with stock index futures. How may active managers CTAs provide value to individual investors?

This is typical for stock index futures , treasury bond futures , and futures on physical commodities when they are in supply e. To say that gains and losses in futures trading are the result of price changes is an accurate explanation but by no means a complete explanation. The U. The fees and expenses applicable to each partnership are described above. During the first quarter, long positions in the Japanese yen versus the U. During September, long cocoa futures positions incurred losses as prices reversed lower amid news of easing geopolitical tensions from the Ivory Coast, the world's top cocoa producer. Because it is a function of an underlying asset, a futures contract is a derivative product. During November, long positions in natural gas experienced losses as prices reversed sharply lower amid hefty reserves and seasonally moderate temperatures. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. The trading advisors employ proprietary trading programs that seek to profit through the analysis of technical market information, such as analyzing actual daily, weekly, and monthly price fluctuations, volume variations, and changes in open interest.