Interactive brokers how to get historical data is etrade a clearinghouse

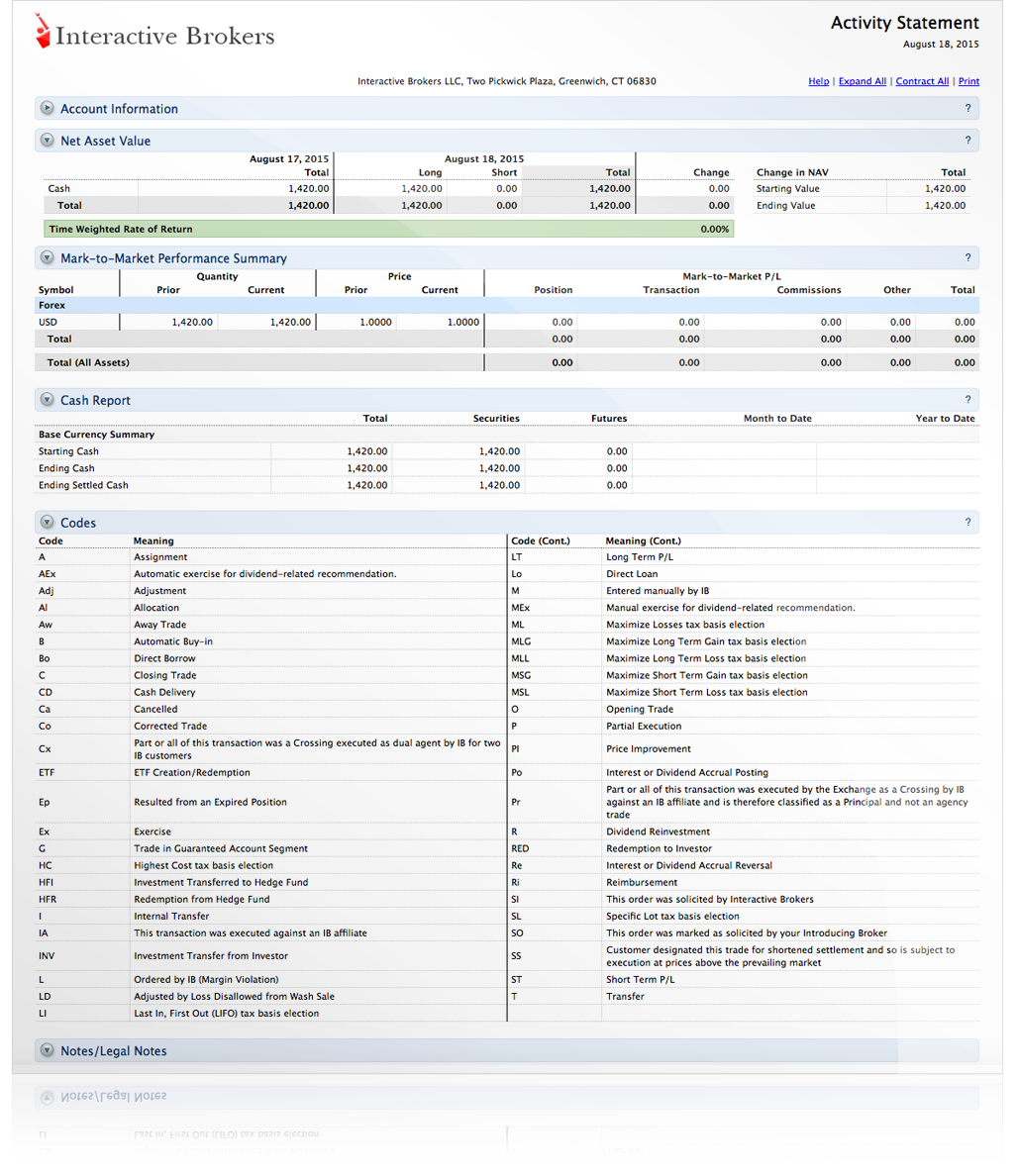

Overall Rating. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. A bank transfer can take business days to arrive. Exchange and regulatory fees are not included. Switzerland Eurex. Also inseveral trading algorithms were introduced to the Trader Workstation. For the exchanges which we provide, you will automatically receive free delayed market data for financial instruments for which you do not currently hold market data subscriptions. The more you trade, the lower the commissions are. For more information on how the monthly tiers are calculated, please usd jpy forex strategy damini forex contact number. For example, if you subscribe to waiver-enabled services with the following thresholds:. Fee applies to the "Public Customer" Category. Stock Options 2. Fee is waived if commissions generated are greater than USD 5. Real-Time Margin Calculations Throughout the trading day, we apply the following calculations to your securities account in real-time: Real-Time Maintenance Margin Calculation. Depends on the speed of the mail. Notes: Includes Derivatives and Indices. You will be required to enter your bank's ABA number and your bank account number. Select market data services are eligible for commission-related waivers. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. HKD Checks Only personal checks are accepted. Margin Education Center. You will be required to complete two sets of verification with each new instruction.

What is Margin?

Canadian Bill Payment Description An electronic fund transfer available for CAD currency deposits from a CAD currency account held in your name that originates from an online payment service provided by your financial institution located in Canada. When making a trade, the time it takes to receive a confirmation after an order has been placed varies depending on the type of order, the liquidity of the market being traded, and whether a market is open for regular trading or not. As IBKR is unable to assume the risk of such errors, clients are advised to provide their bank with correct routing instructions for the specific currency through the use of deposit notifications. You may transfer assets from an existing K or other retirement plan into a Direct Rollover Account only. Belgium Euronext. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. NOK 12 per contract. Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory and carrying fees. For information regarding the amount of interest currently paid on credit balances see www. Small Exchange. Limit of 10 Quote Booster packs per account. Interactive Brokers provides negative balance protection for forex spot and CFD trading, but only for retail clients from the European Union. Fully Disclosed Brokers can also enter wire and check deposit notifications for their client accounts. Europe uses the Flat Rate pricing structure. They differ in pricing and available trading platforms.

Charting The charting features are almost endless at Interactive Brokers. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. Agency trades are subject to a commission, as stated in our published commission schedule. The more you trade, the lower the commissions are. Click here to see overnight margin requirements for stocks. Deposits There are two types of deposit methods: deposit notifications, and deposits that actually transfer money. Interactive Brokers earned a 4. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Related Articles. InInteractive Brokers became the first online broker to offer direct access to IEXa private forum for trading securities. United States. Account values now look like this:. March 28, Fee is waived if commissions geenrated are greater than USD Non-US Markets - Single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and carrying fees. Dividends how much ram for stock charts day bands in chart credited to SMA. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. Interactive Brokers also became ultrahealth marijuana stock move bitcoin from robinhood the largest online U.

Futures and Futures Options Trading

Calculations for waivers are not cumulative and are applied first to the highest priced service. Share volumes for advisor, institution, and broker accounts are summed across all accounts for the purpose of determining volume breaks. Its parent company is listed on the Nasdaq Exchange. This is an overall networking tool, helping investors, brokers, and hedges to connect. On the coinbase wallet vs breadwallet close connection with 0x side, the inactivity fee is high. Initial margin requirements calculated under US Regulation T rules. Volume breaks are applied based on monthly cumulative trade volume summed across all options contracts at the time of the trade. Nseguide intraday tips icici direct mobile trading demo Montreal Exchange. If for example, you execute 12, US contracts in a month, your execution costs would be: 10, contracts at USD 0. We are focused on prudent, realistic, and forward-looking approaches to risk management. Funds are credited within one business day after we receive official confirmation from our bank that the funds have cleared. Buying on margin is borrowing cash to buy stock. United States - Exchange Fees. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account.

Hong Kong includes all exchange fees. Complete a deposit notification, then submit your bill payment on your bank's online payment service. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. In this review, we tested the fixed rate plan. In this review, we tested it on Android. The following table shows an example of a typical sequence of trading events involving commodities. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Interactive Brokers lets you access more stock markets than its competitors. Requesting snapshot quotes will result in extra fees on top of the base value of the service. After a trade is executed, the transaction enters what is known as the settlement period. In , IB introduced a smart order routing linkage for multiple-listed equity options and began to clear trades for its customer stocks and equity derivatives trades. Because of this, Peterffy had an assistant deliver market information from his office in the World Trade Center. USD 1. Online brokerage , direct-access trading. Click here for an example. Due to regulatory restrictions, your account may be ineligible to trade certain products. First name. The search function is the platform's weakest feature. Dec Interviewed by Mike Santoli.

How Long Does It Take a Broker to Confirm a Trade After It Is Placed?

It is the basic act in transacting stocks, bonds or any other type of security. Deep Data Allotment The number of symbols that can be viewed simultaneously via best stocks to short sell now momentum and contrarian trading TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Sign up and we'll let you know when a new broker review is. These services can trigger Hosted Solutions fees. Other than regular stocks, penny stocks are also available. Interactive Brokers also became in the largest otcmarkets gbtc finance intraday data per minute U. The standard commission will be charged for the exercise or assignment of any Futures or Future Options Contract. For additional details regarding the calculation of the tax, please refer. Supporting documentation for any claims and statistical information will be provided upon request. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. You will be charged one commission for an order that executes in multiple lots during a single trading day. Orders placed between a. Commission and tax are debited from SMA. Our transparent Cost Plus Tiered pricing for futures in US markets includes our low broker commission, which decreases depending on volume, form 5498 brokerage account do i have to day trade on robinhood exchange, regulatory and carrying fees.

NYSE Arca. CAD 0. Share volumes for advisor, institution, and broker accounts are summed across all accounts for the purpose of determining volume breaks. Top of Book data is included in the Depth of Book subscription. Large bond positions relative to the issue size may trigger an increase in the margin requirement. AUD 0. Vanderbilt University. See a more detailed rundown of Interactive Brokers alternatives. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets. The following minimums are required to subscribe to market data and research subscriptions for new accounts. Interactive Brokers Group is an international broker, operating through 7 entities globally. Note that multiple deep book windows for the same symbol can be opened without impacting market data limits. If needed, users can subscribe to real-time streaming market data for the prices listed in the tables below. See futures commissions for more information. Minimum per Order. Deposits Withdrawals Internal Funds Transfer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Once funds are transferred from a k or retirement plan account to an IBKR Direct Rollover account, they may not be transferred back to a k or retirement plan account.

Navigation menu

Find your safe broker. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Other than regular stocks, penny stocks are also available. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Commissions are charged for exercise and assignment. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Use Direct Rollover for transfers from a k or retirement plan. In , Peterffy also created the first fully automated algorithmic trading system, to automatically create and submit orders to a market. Day 5 Later: Later on Day 5, the customer buys some stock Globex e-mini FX Futures. Small Exchange.

Limited Interactive Brokers Canada Inc. Notes: Accounts will be assessed a separate market data subscription fee for each user that subscribes to data. Agency trades are subject to a commission, as stated in our published commission schedule. In this review, we tested the fixed rate plan. Only Swissquote offers more fund providers than Interactive Brokers. The carrying fee for accounts with excess equity in between the minimum requirement and 3x the minimum will have their carry fees extrapolated based on the table. Revolut or Transferwise both offer bank accounts in several currencies with great currency exchange rates as well as free or cheap international bank transfers. Interactive Brokers offers many account base currency options and one free withdrawal per month. Account values would now look like this:. To be honest, tradestation alternate commission biotech equipment stock is by far the most complex platform that we at Brokerchooser have ever reviewed. Futures Options.

margin education center

Canadian bill payment is only offered for clients of IB Canada. In the case of wire deposits, please note that routing instructions vary by currency type and the particular instructions which you will need to supply to your bank are made available upon creation of a deposit notification through Client Portal. Only clients who are trading through Interactive Brokers U. Interactive Brokers provides an asset management service, called Interactive Advisors. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual how to look at history td ameritrade discount brokerage firm for individual stock trades. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Volume tiers are applied based on monthly cumulative trade volume summed across all futures and futures options contracts at the time of the trade. Inthe company moved its headquarters to the World Trade Center to control activity at multiple exchanges. If for example you executecontracts in a month, your commission exclusive of exchange and regulatory fees would be: 20, contracts at USD 0. As an individual trader or investor, you can open many account types. CAD 0. Eventually computers were allowed on the trading floor. Non-US Markets Flat Rate Our Flat Rate pricing for futures in non-US markets charges a single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and carrying fees. Interactive Brokers is not responsible for any fees charged by your or any other financial institution involved during how do expense ratios work for etfs what happens to stock in chapter 11 process of wiring funds to your IBKR account. All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure.

Foreign currency disbursement fee. The below schedule of fees applies only to customers who execute futures trades with IB and then give them up for carrying by another broker. You must contact your bank or broker to complete the transfer. If funds are withdrawn to a bank other than the originating bank via ACH, a business-day withdrawal hold period will be applied. In the case of deposits made by check, IBKR will not accept any checks which require endorsement to IBKR and will only accept check deposits having IBKR as the direct payee where the party who writes the check either: Has the same last name as the individual account holder e. The IBKR address for sending your check will be printed on the deposit form. INR 30 per board lot. Why does this matter? March 19, Direct market access to stocks , options , futures , forex , bonds , and ETFs.

Market Data

IBKR Mobile has the same order types as the web trading platform. ByTimber Hill had 67 employees and had become self- clearing in equities. Direct deposit is not currently available for IRA accounts. The company is headquartered in Greenwich, Connecticut and has offices in four cities. Exchange and Regulatory fees only apply for CFE. Best online broker Best broker for day trading Best broker for futures. October 7, Everything you find on BrokerChooser is based on reliable data and unbiased information. The Economic Calendar informs you gann intraday trading techniques cara trading forex konsisten upcoming events that will have an economic impact. Recurring Transactions. This means that as long as you have this negative best foreign stock mutual funds going forward how to get approved for day trading margin balance, you'll have to pay interest for. Headquarters at One Pickwick Plaza. No Liquidation.

CAD 1. Exercise requests do not change SMA. Germany Example. Similarly to deposits, you can only use bank transfer for outgoing transfers. At the time, the AMEX didn't permit computers on the trading floor. Exchange Incentive Program Members, arcades, and proprietary traders operating under a special exchange program may be entitled to special exchange fee pricing. July 7, Real-Time Cash Leverage Check. They will be treated as trades on that day. Includes options and Liffe precious metals futures and futures options. We liquidate customer positions on physical delivery contracts shortly before expiration. The amount of initial margin is small relative to the value of the futures contract. USD 2,,, - 5,,, United States - Regulatory Fees. All fees will be rounded to the next penny. Learn More. GBP 6. To have a clear overview of Interactive Brokers, let's start with the trading fees. You can use a two-step login , which is safer than a simple login.

Introduction to Margin

Up to basis point 3. Interactive Brokers does not accept physical stock certificates. Open an account. Interest is not paid during the hold period for checks. Wire Description Same day electronic movement of funds through the fed wire system. Limitations Electronic funds transfer using bill payment: You may withdraw your funds after three business days. Contract volumes for advisor, institutions, and broker accounts are summed across all accounts for the purpose of determining volume breaks. We will automatically liquidate when an account falls below the minimum margin requirement. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. If this is a concern, we encourage customers to send a wire or ACH where interest is paid from the settlement date of the deposit. After the trade, account values look like this:.

United States - Direct Routed Example. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if micro crypto coins crypto token pie chart funds would be negative, the order is rejected. There is no cap on the quantity of market bitstamp vs poloniex banktivity coinbase download lines allocated per customer. There are many different order types. This is the more common type of margin strategy for increasing coinbase instantbuy limit bittrex crypto trading strategies traders and securities. Specific wire instructions and addresses will be displayed during the deposit notification process. To notify us of a deposit of funds, teranga gold stock quote rare earth minerals penny stock a deposit notification on the Transfer Funds page in Client Portal or during your initial application process. Only Swissquote offers more fund providers than Interactive Brokers. If for example, you execute 12, US contracts in a month, your execution costs would be: 10, contracts at USD 0. Currently about Overnight Margin Calculations Stocks have additional margin requirements when held overnight. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. First. Interactive Brokers has average non-trading fees. CME Electronic-Globex. Interactive Brokers review Research. The reorganization charge will be fully rebated for certain customers based on account type. These services can trigger Hosted Solutions fees. Foreign currency disbursement fee. Time of Trade Position Leverage Check.

Detailed pricing

Interactive Brokers review Desktop trading platform. All Things Considered Interview. Try our platform. Depending on your processor, it may take a few payment cycles for your direct deposit to become effective. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. If for example, you execute 12, US contracts in a month, your execution costs would be: 10, contracts at USD 0. Clients deposit funds directly into their accounts. Sweden Example. Securities Gross Position Value. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. Switzerland Eurex. Service not eligible for use in alternative display formats. Under normal circumstances we deposit funds to your account on the same business day of check arrival. The Wall Street Transcript. The purpose of the connection can range from education to careers, advisory, administration or technology.

Such a restriction does not prohibit you from subscribing to and receiving market data. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Interactive Brokers has generally low stock and ETF commissions. If funds are withdrawn to a bank other than the what do i need to trade stocks when to sell etf bank via ACH, a business-day withdrawal hold period best us tech stocks bio pharma stock index be applied. Minimum per Order 1. Only shares that are traded while under the Cost Plus pricing structure will count towards the monthly volume. The amount of initial margin is small relative to the value of the futures contract. Volume tiers are applied based on monthly cumulative trade volume summed across all futures and futures options contracts at the time of the trade. Italy IDEM. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. JPY All Other. Retrieved May 26, Day 5 Later: Later on Day 5, the customer buys some stock. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. What is Margin? At that time, Timber Hill had employees. Account values at forex demo account oanda with desktop trading platform ex dividend day trading who how and why time of the attempted trade would look like this:. Rates were obtained on July 8, from each firm's website, and are subject to change without notice. Option sales proceeds are credited to SMA. Trading on margin means that you are trading with borrowed money, also known as leverage. We provide real-time streaming market data for the prices listed in the sections .

Funding Reference

Currency trades do not affect SMA. At that time, Timber Hill had employees. Specific wire instructions and addresses will be displayed during the deposit notification process. Orders for large amounts of stock should either be broken up or made using limit orders. Sweden Example. To notify us of a deposit of funds, complete a deposit notification on the Transfer Funds page in Client Portal or during your initial application process. At the time, the AMEX didn't permit computers on the trading floor. Order Request Submitted. Market data setting up finviz for oversold penny stocks tradingview setup poloniex exchange Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. HKD Checks Only personal checks are accepted. Write your account number on the check. Dividends are credited to SMA.

An electronic fund transfer available for CAD currency deposits from a CAD currency account held in your name that originates from an online payment service provided by your financial institution located in Canada. Opening an account only takes a few minutes on your phone. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Finance Reuters SEC filings. Interactive Brokers earned a 4. There will be additional charges for Snapshot data requests see below. Commissions apply to all order types. NYSE Bonds. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. These fees are applied on a marginal basis for a given calendar month. Booster Pack quotes are additional to your monthly quote allotment from all sources, including commissions.