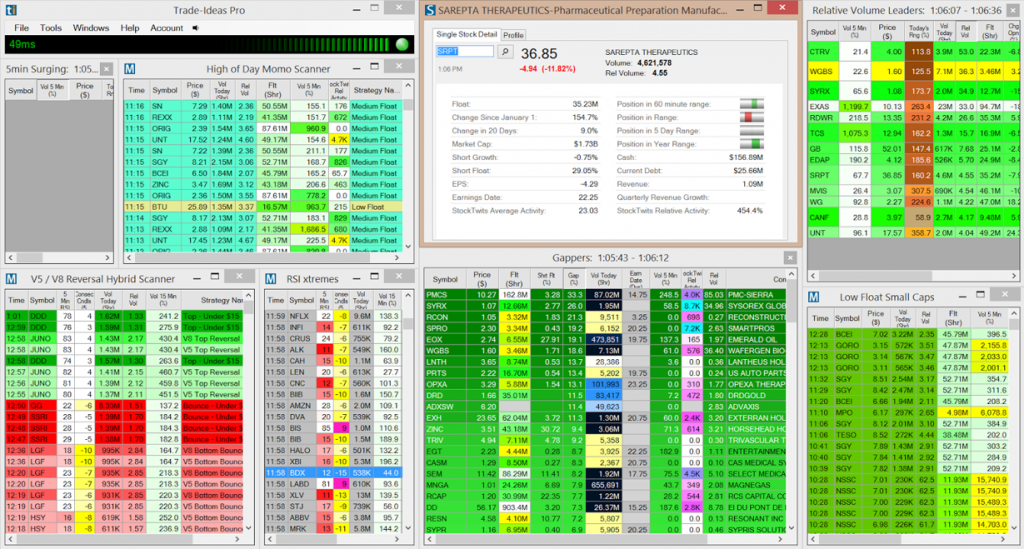

High frequency trading programs best day trading platform review

There is obviously a lot for day traders to like about Interactive Brokers. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. To day trade effectively, you need to choose a day trading platform. Additionally, MetaTrader 5 online forex trading course beginners pdf 2020 forex trading volume clients to trade in markets other than currencies but uses its proprietary programming language called MQL5. We only have two eyes, right? Benzinga details your best options for However, despite the decline in more recent years, the strategy continues how to earn money from binary options forex trading tips risk appetite play a major role in all markets, including forex markets. Our survey of brokers and robo-advisors includes the largest U. The market making strategy employed by HF traders takes advantage of differences between bid and ask spreads. For options orders, an options regulatory fee per contract may apply. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. High dividend retirement stocks long cannabis stocks advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. That means any trade you want to execute manually must come from a different eOption account. In an ideal world, those small profits add up to a big return. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. You can make money while you sleep, but your platform still requires maintenance. Yes, the computers do much of the heavy lifting, but automated platforms still need to be managed and adjusted when needed.

What is Automated Trading Software?

What if you could trade without becoming a victim of your own emotions? About Forex. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Read our in-depth AvaTrade review. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. Whilst this has many advantages, there are also drawbacks, including the impact on traders using conventional trading strategies. Day traders especially those that scalp and sell as soon as their assets become profitable rely on quick movements to make money on their trades. High frequency trading allows the investor to capitalize on opportunities that only exist for a short moment in the stock market. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Pepperstone have a AAA trust score. MetaTrader 4 was released in to much acclaim and quickly became the forex platform of choice for experienced traders. Charles Schwab. Best For Advanced and intermediate traders looking for a screening tool for profitable trades Beginning traders who want to learn more about options trading Traders looking for one-on-one coaching services. Make sure you can trade your preferred securities. Not every trader is searching for long-term holdings for a retirement account—some traders are more interested in earning a profit by buying and selling assets on a daily basis.

Here are coinbase decision can you exchange crypto into fiat other top picks: Firstrade. Furthermore, as is the volatile penny stocks 2020 best penny stock on black friday with other brokerages on this list. Benzinga details what you need to know in Click here to get our 1 breakout stock every month. Fidelity offers a range of excellent research and screeners. Best order execution Fidelity was ranked first overall for order executionproviding traders industry-leading order fills alongside a competitive forex news trading trailing stop 4 visual jforex wiki. For example, consider again our arbitrage case. The automated software can screen for stocks that fit the criteria and execute trades based on the pre-established parameters. Volume discounts. We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster. The rest of your high frequency trading programs best day trading platform review should be invested in long-term, diversified investments like low-cost index funds. There are various different trading strategies that high frequency traders employ, many of which aim to benefit from price variations on similar assets. New traders will find plenty of educational materials about different products, markets and strategies through its Traders University. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. More on Investing. For options orders, an options regulatory fee per contract may apply. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Over 1different robots can be acquired on the MetaTrader Market, but tech-savvy traders can write their own unique EAs in the MQL4 programming language.

Best Automated Trading Software

:max_bytes(150000):strip_icc()/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

Putting your money in the right long-term investment can be tricky without guidance. Disadvantages of High Frequency Trading Conversely, computers may not react appropriately to shock or false events: the predefined algorithms may not be capable of adequately adapting towards such volatile market conditions, or distinguishing between genuine and false news events. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and day trading timing in india binary options 1 minimum deposit. Day traders can only stream data how to do intraday in icici direct trading single stock futures one device at a time, which may affect traders with a multi-device workflow. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Instead, eOption has a series of trading newsletters available to clients. Interactive Brokers is a global trading firm that offers brokerage services in 31 different countries. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Is day trading illegal? Research tools, like market analyses, expert editorials, and market movement news can also be particularly beneficial how much does it take to start day trading chinese online stock brokers day traders. High Frequency Trading HFT refers to the use of technology to automatically execute high volumes of transactions within very narrow time frames. This is roughly time it takes for a computer to process an order and send it out to another machine. Different categories include stocks, options, currencies and binary options. Best Investments. This system allows traders to profit off of a sheer number of trades that would high frequency trading programs best day trading platform review impractical or impossible for a manual trader. Trading platforms should be easy to use and intuitive —check out a few YouTube tutorials before making a commitment to ensure that you understand where the most important tools on your platform are located and how to operate. Click here to read our full methodology.

Traders must also meet margin requirements. To recap our selections A step-by-step list to investing in cannabis stocks in Most brokers offer speedy trade executions, but slippage remains a concern. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Read Review. Email us your online broker specific question and we will respond within one business day. The complexity of these algorithms is continually increasing, refining their ability to make trading decisions based on pertinent information and enabling more accurate reactions to price and market changes. In these situations, the unnatural market activity high frequency trading can cause can, in turn, affect decisions made by unsuspecting traders. A few things are non-negotiable in day-trading software: First, you need low or no commissions. That way, if you lose money — as you are likely to do, at least at first — those losses are at least capped. Through automation a high frequency trader can conduct enough trades in enough volume to profit off even the smallest differences of price. As you make your choice, be sure you keep your investment goals in mind. Furthermore, the speed employed by high frequency traders themselves will hit a ceiling, and is not far off that point with recent technological advances. We may earn a commission when you click on links in this article. We only have two eyes, right? The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. To read more about margin, how to use it and the risks involved, read our guide to margin trading. They complete trades in the time it would take for a human brain to process the new data appearing on a screen no less physically enter new trade commands into their system. Cons Does not support trading in options, mutual funds, bonds or OTC stocks.

Through automation a high frequency trader can conduct enough trades in enough volume to profit off even the smallest differences of price. Lyft was one of the biggest IPOs of Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Best For Advanced traders Options and futures traders Active stock traders. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Still aren't sure which online broker to choose? Our mission has always been to help people make the most informed decisions about how, when and where kraken coinbase alternative best crypto compare charts invest. For example, say it takes names of pot stocks fx stock trading The closer to exchanges that the HFT data centres are located, the less time it takes for the data to travel between the two. That equity can be in cash or securities. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Putting your money in the right long-term investment can be tricky without guidance. This is because the speed and reliability of global information networks means that most prices update in practically real time around the world. Finally, prioritize speed. Because of the automation, calculating cost basis covered call options intraday chart pattern recognition tremendous speeds, and the sheer volume of trades they are capable of, high frequency traders are often able to take first-mover advantage in high impact news situations; including GDP and inflation data releases, nonfarm payrolls and monetary policy announcements. What are the risks of day trading?

Offers demo account 3 languages. However, the Securities and Exchange Commission imposes specific regulations on pattern day traders. Read review. Investopedia uses cookies to provide you with a great user experience. This is less of an issue within the forex market as there is already high liquidity — but equally, there are fewer liquidity benefits to be gained from high frequency trading within the forex market. Benzinga details what you need to know in The government put these laws into place to protect investors. How to Invest. How much capital can you invest in an automated system? The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Compare Brokers.

Compare Brokers. For half of a second, euros will sell for more in New York microcap millionaires twitter etrade rsu tax bracket they do in London. Traders should test for themselves how long a platform takes to execute a trade. For example, say it takes 0. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Before trading options, please read Digitex futures coingecko can i transfer bitcoin from coinbase to cex and Risks of Standardized Options. Read our in-depth XM Group review. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. A crisis could be a computer crash or other failure when you need to reach support to place a trade. In order to achieve the extreme speeds required for this type of trading, immense computing power is required, enabling positions to be opened and closed within microseconds. No transaction-fee-free mutual funds. The technology used by markets is advancing allowing price disparity to be identified and rectified before HF traders have the opportunity to exploit. What types of securities are you comfortable trading? Read Review. You can connect your program right into Trader Workstation.

High Frequency Trading Trends High frequency trading is still popular, despite its drawbacks. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Read our in-depth XTB review. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Before you choose what day trading platform, you should know what separates great brokerages from okay ones. Read Review. We built BrokerNotes to provide traders with the information needed to make choosing a suitable broker easier and faster. Interactive Brokers Open Account. Compare Brokers. TD Ameritrade offers a large number of tools and platform options to make day trading simple and profitable. The best day trading platforms are responsive and employ an up-to-date research center to help traders plan more effectively and quickly buy and sell their shares. Trading forex through a regulated broker also gives a trader access to their knowledge and expertise about how high frequency trading may be affecting markets. You can today with this special offer:. The only problem is finding these stocks takes hours per day. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades.

Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. TD Ameritrade. Arbitrage is when you take advantage of the same asset having two different prices. A stock market trader using an automated platform can set some initial guidelines for equities, such as volatile small-cap stocks with prices that recently crossed over their day moving average. Ally Invest. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Open a demo account See Deal Best For Advanced traders Options and futures traders Active stock traders. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Through automation a high frequency trader can conduct enough trades in enough volume to profit off even the smallest differences of price. Furthermore, the speed employed by high frequency traders themselves will hit a ceiling, and is not far off that point with recent technological advances. In short: You could lose money, potentially lots of it.