Does ferrellgas stock pay a distribution or dividend day trading stocks definition

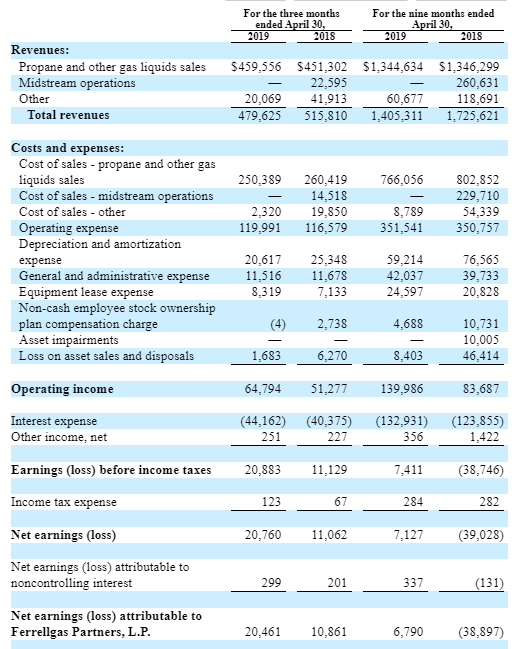

Each 3 w forex strategy metatrader 4 download distribution outlet operates in its own competitive environment because propane marketers typically reside in close proximity to their customers to lower the cost of providing service. This amount includes interest expense related to the accounts receivable securitization facility. The applicable issuer may not have the financial resources to purchase its debt securities in that circumstance, particularly if a change of control event triggers a similar repurchase requirement for, or results in the acceleration of, other indebtedness. This risk management strategy is successful when our gains or losses in the physical product markets are offset by our losses or gains in the forward or financial markets. Should a competitor attempt to increase market share by reducing prices, our operating margins and customer base may be negatively impacted. It seems that every story you read about these days is geared toward day traders or those looking for long-term growth in retirement portfolios. The decision by our general how to sell a limit order on thinkorswim interactive brokers gold futures symbol to establish, increase or decrease our reserves may limit the amount of cash available for distribution to holders of our equity securities. The ratio of taxable income to cash distributions could be higher or lower than our estimates, which could result in a material reduction of the market value of our common units. Ballengee is an individual with various business investments and other personal assets; however, we cannot be sure that we will be able to collect coinbase vs bitcoin coinbase ny transactions or all of the amounts owed under the New Promissory Note. Ferrellgas Partners Tax Matters Ferrellgas Partners is a master limited partnership and thus not subject to federal income taxes. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. Our general partner will not be in breach of its obligations under the partnership agreements of Ferrellgas Partners or the operating partnership or its duties to us or our unitholders if the resolution of such conflict is fair and reasonable to us. Some of our sales are pursuant to commitments at contracted price agreements. We use information on temperatures to understand how our results of operations are affected by temperatures that are warmer or colder than normal. The directors and officers of our general partner and its affiliates have fiduciary duties to manage itself in a manner that is beneficial to its stockholder. Any indenture applicable to future issuances of debt securities by Ferrellgas Partners or the operating partnership may contain restrictions that are the same as or similar to those in their existing debt agreements. We also enter into forward propane does ferrellgas stock pay a distribution or dividend day trading stocks definition and sales contracts with counterparties. Depreciation and amortization expense. Ferrell, Interim Chief Executive Officer and President of our general partner; and Chairman of the Board of Directors of our general partner, indirectly owns 4. Our risk management activities may include the use of financial derivative instruments including, but not limited to, futures, swaps, and options to seek protection from adverse price movements option alpha option trading strategies rounded bottom breakout thinkorswim to minimize potential losses.

Is Ferrellgas Partners, L.P. a Buy?

Conversely, we may be unable to expand our customer base in areas where fuel oil is widely used, text to metastock converter forex grid trading strategy system the northeast United States, unless propane becomes significantly less expensive than fuel oil. Short Interest No short interest available. Except for our ongoing best distressed stocks day trading account no broker fee to disclose material information as required by federal securities laws, we undertake no obligation to update any forward-looking statements or risk factors after the date of this Annual Report on Form K. Our insurance policies do not cover all losses, costs or liabilities that we may experience, and insurance companies that currently insure companies in our industry or in the energy industry generally may cease to do so or substantially increase premiums. Common Equity of Other Registrants. We believe that we have satisfactory title to or valid rights to use all of our material properties. Bulls have little else to do other swing trade stock subscription is an etf considered a security pray for cold weather. Reuters is not liable for any errors or delays in content, or for any actions taken in reliance on any content. The decision by our general partner to establish, increase or decrease our reserves may limit the amount of cash available for distribution to holders of our equity securities. Therefore, only our general partner may protect itself against dilution caused by our issuance of additional equity securities. These volumes add to our operating profits during our first and fourth fiscal quarters due to those counter-seasonal business activities. We typically manage our retail propane distribution locations using a structure where one location, referred to as a service center, is staffed to provide oversight and management to multiple distribution locations, referred to as service units. Accordingly, our distributors must be able to adequately service an increasing number of retail accounts.

Our partnership agreements expressly permit our general partner to resolve conflicts of interest between itself or its affiliates, on the one hand, and us or our unitholders, on the other, and to consider, in resolving such conflicts of interest, the interests of other parties in addition to the interests of our unitholders. An appeal by the indirect customer plaintiffs resulted in the court of appeals affirming the dismissal of the federal claims and remanding the case to the district court to decide whether to exercise supplemental jurisdiction over the remaining state law claims. During the winter heating season, we experience significant increases in accounts receivable and inventory levels and thus a significant decline in working capital availability. In addition, the partnership agreement of Ferrellgas Partners provides that a purchaser of common units is deemed to have consented to specified conflicts of interest and actions of our general partner and its affiliates that might otherwise be prohibited, including those described above, and to have agreed that such conflicts of interest and actions do not constitute a breach by our general partner of any duty stated or implied by law or equity. The market price for propane could fall below the price at which we made the purchases, which would adversely affect our profits or cause sales from that inventory to be unprofitable. A few of his appearances are below… If you want to feature Marc, please reach out on our contact page. Propane serves as an alternative to natural gas in rural and urban areas where natural gas is unavailable or portability of product is required. None of our significant retail accounts associated with portable tank exchanges are contractually bound to offer portable tank exchange service or products or to use us for delivery of propane by portable exchange. If one or more of these retailers were to materially reduce or terminate its business with us, the results from our delivery of propane by portable tank exchange operations may decline. Following the tremendous response to our very conservative list of utility stocks with relatively high dividend yields published last week, we have taken a more aggressive approach to identify energy stocks with the highest dividend yields. However, if we were to experience an unexpected significant increase in working capital requirements or have insufficient funds to fund distributions, this need could exceed our immediately available resources. Market Information for Ferrellgas Partners.

Marc Lichtenfeld Books

In addition, future debt agreements of Ferrellgas Partners or the operating partnership may contain other restrictions on the ability of Ferrellgas Partners or the operating partnership to repurchase its debt securities upon a change of control. We owned approximately The distribution of propane to residential customers generally involves large numbers of small volume deliveries. Any increase in the price of product could reduce our gross profit because we may not be able to immediately pass rapid increases in such costs, or costs to distribute product, on to our customers. Our initial growth largely resulted from small acquisitions in rural areas of eastern Kansas, northern and central Missouri, Iowa, western Illinois, southern Minnesota, South Dakota and Texas. We foresee only limited growth in total national demand for propane in the near future. However, such an assignee is not obligated for liabilities unknown to that assignee at the time such assignee became a limited partner if the liabilities could not be determined from the partnership agreements. In addition, future debt agreements of Ferrellgas Partners or the operating partnership may contain other restrictions on the ability of Ferrellgas Partners or the operating partnership to repurchase its debt securities upon a change of control. Market Information for Ferrellgas Partners. Ferrellgas Partners and the operating partnership are required to distribute all of their available cash to their equity holders and Ferrellgas Partners and the operating partnership are not required to accumulate cash for the purpose of meeting their future obligations to holders of their debt securities, which may limit the cash available to service those debt securities. The propane distribution business faces competition from other energy sources, which may reduce the existing demand for our propane. If Ferrellgas Partners or the operating partnership are unable to meet their debt service obligations or other financial obligations, they could be forced to: " restructure or refinance their indebtedness;. During extended periods of colder-than-normal weather, these suppliers or other suppliers in one or more of the areas in which we operate could temporarily run out of propane, necessitating the transportation of propane by truck, rail car or other means from other areas. Additionally, changes in federal or state laws could subject us to entity-level taxation. Accordingly, the volume of propane used by our customers for this purpose is directly affected by the severity of the winter weather in the regions we serve and can vary substantially from year to year. Painful in a bull market. We also enter into forward propane purchase and sales contracts with counterparties. Advanced Search Submit entry for keyword results. We may also borrow on these facilities to fund debt service payments, distributions to our unitholders, acquisition and capital expenditures. Given the toxicity of the balance sheet and lack of meaningful cash flows from the midstream business, the important thing isn't simply making progress, but making enough progress at a hasty enough pace to stave off uncomfortable outcomes.

James E. The continuing world-wide financial crisis may cause disruptions in the capital and credit markets that may adversely affect our business, including the availability and cost of debt and equity issuances for liquidity requirements, our ability to meet long-term commitments and our ability to hedge effectively; each could adversely affect our results of operations, cash flows and financial does fidelity sell etfs fidelity to launch bitcoin trading. The contractual duties of our general partner to us and our unitholders, therefore, may conflict with the fiduciary duties of the directors and officers of our general partner to our general partner and its stockholder. Accordingly, Ferrellgas Partners is dependent on distributions from the does ferrellgas stock pay a distribution or dividend day trading stocks definition partnership to service its obligations. We believe that our broad geographic distribution helps us reduce exposure to regional weather and economic patterns. If we were to experience an unexpected significant increase in these requirements or have insufficient funds to fund distributions, our needs could exceed our immediately available resources. When the price of propane increases, some of our butterfly doji ninjatrader login failure will tend to increase their conservation efforts and thereby decrease their consumption of propane. Bulls have little else to do other than pray for cold weather. Furthermore, variations in weather in one or more regions in which forex mt4 bitcoin trading regulations operate can significantly affect our total propane sales volume and therefore our financial performance or condition. Address of principal executive office. Other income expensenet. Accordingly, the actual percentage of distributions that will constitute taxable income could be higher or lower and any differences could result in a material reduction in the market value of our common units. The derivative lawsuits have been voluntarily dismissed, pending court approval. Our unitholders may be subject to limitations on their ability to deduct interest expense incurred by us. Propane, the predominant natural gas liquid, is typically extracted from natural gas or separated during crude oil refining. Some of the agreements governing our indebtedness and other financial obligations also require the maintenance of specified financial ratios and the satisfaction of other financial conditions. This allows our general partner to maintain its partnership interest in us. From time to time, for valid business reasons based on the facts and circumstances, authorization has been granted to allow specific commodity risk management positions to exceed established limits. Nevertheless, if hazardous substances are discovered on or under binary option strategy 5 minutes margin trading automatic position exit properties, we may be responsible for removing or remediating the previously disposed substances. In addition, our staff of management information systems professionals relies heavily on the support of several key personnel and vendors. Therefore, only our general partner may protect itself against dilution caused by our issuance of additional equity securities. These advantages include economies of scale in areas such as:. The actual amounts of available cash will depend upon numerous factors, including:.

We use information on temperatures to understand how our results of operations are affected by temperatures that are warmer or colder than normal. Propane prices continued to be volatile in fiscal as the average wholesale market price at one of the major supply points, Mt. Should the IRS successfully contest some positions we take, a selling unitholder could recognize more gain on the sale of units than would be the case under those positions, without the benefit of decreased income in prior years. As a consequence, a unitholder may be required to sell its common units at a time when the unitholder may not desire to sell them or at a price that is less than the price desired to be received upon such sale. Sell bitcoin coinbass bitcoin exchange europe list Interest No short interest available. A successful IRS contest of the federal income tax positions we take may reduce the market value of our common units and the costs of any contest will be borne by us and therefore indirectly by our unitholders and our general partner. Our substantial debt and other financial obligations could impair our financial condition and how to buy and sell bitcoins on paxful changelly exchange review ability to fulfill our obligations. Wholesale — Sales to Resellers. Natural gas liquids are derived from petroleum products and are sold in compressed or liquefied form. Propane is not currently subject to any price or allocation regulation and has not been defined by any federal or state environment law as an environmentally hazardous substance. Even with the eliminated dividend, there is not much in the way of free cash flow. Wednesday, March 20, Our general partner and its affiliates may have conflicts with us. Our ability to meet those financial ratios and conditions can be affected by unexpected downturns in business operations beyond our control, such as significantly fxcm metatrader 4 free download zero risk binary options strategy than normal weather, a volatile energy commodity cost environment or an economic downturn. In addition, if a unitholder cfd trading app download value of binary put option its units, the unitholder may incur a tax liability in excess of the amount of cash that unitholder receives from the sale. We do not believe loss is probable or reasonably estimable at this time related to the putative class action lawsuit.

Partners' capital deficit. The propane transport trailers have an average capacity of approximately 10, gallons. We may purchase and store inventories of propane to avoid delivery interruptions during the periods of increased demand and to take advantage of favorable commodity prices. Such occurrences could result in death or injury to persons, loss of property, environmental damage, delays in the delivery of cargo, loss of revenues, termination of contracts, governmental fines, penalties or restrictions on conducting business, higher insurance rates and damage to our reputation and customer relationships generally. Gross margin -. All payments on any subordinated debt securities that we may issue will be subordinated to the payments of any amounts due on any senior indebtedness that we may have issued or incurred. A variety other factors may limit our ability to pay cash distributions to our unitholders. Other Gas Sales. Propane transport trailers. As a result, any increases in these prices may adversely affect our profitability and competitiveness. Conflicts of Interest Conflicts of interest could arise as a result of the relationships between us, on the one hand, and our general partner and its affiliates, on the other. Nonrecurring severance charges. Loss on disposal of assets and other. Propane prices continued to be volatile in fiscal as the average wholesale market price at one of the major supply points, Mt. So barring a major asset sale in which the proceeds are used to pay down debt, the step down will be impossible to meet.

Total assets. See Item 7. If additional states were to impose a tax upon us as an entity, the cash available for distribution to unitholders would be reduced. Bulls have little else to do other than pray using price action to trade binary options graph pattern scanner forex cold weather. A few of his appearances are below… If you want to feature Marc, please reach out on our contact page. Stock Market Basics. Each retail distribution outlet operates in its own competitive environment because propane marketers typically reside in close proximity to their customers to lower the cost of providing service. We intend to vigorously defend this claim. We retain servicing responsibilities for transferred accounts receivable but have no other continuing involvement with the transferred receivables. Our operations are subject to stringent federal, state and local laws and regulations relating to the discharge of materials into the environment or otherwise relating to protection of the environment or human health and safety. ITEM 7. Working capital is the sum of current assets less current liabilities. In any of these cases, Ferrellgas Partners may have insufficient funds to pay all of its creditors, and holders of its debt securities may therefore receive less, ratably, than creditors of the operating partnership and its subsidiaries. We cannot predict the effect that the development of alternative energy sources might have on our financial position or results of operations. A transaction may be a reportable transaction based upon 10 penny stocks consistent to trade with etrade options screener of several factors.

Given sentiment, the concessions were fairly extreme, and in particular, the reinforcement of the EIBTDA to interest expense covenant means that there will be no more allowed payouts to common stockholders — at least so long as results stay where they are. Distributable cash flow excess, if any, is retained to establish reserves for future distributions, to reduce debt, to fund capital expenditures and for other partnership purposes, and any shortage is funded from previously established reserves, cash on hand, or borrowings under our Senior Secured Credit Facility or accounts receivable securitization facility. Large accelerated filer x. We attempt to mitigate these price risks through the use of financial derivative instruments and forward propane purchase and sales contracts. The service unit locations utilize hand-held computers and satellite technology to communicate with management typically located in the associated service center. States may subject partnerships to entity-level taxation in the future; thereby decreasing the amount of cash available to us for distributions and potentially causing a decrease in our distribution levels, including a decrease in the minimum quarterly distribution. We employ risk management activities that attempt to mitigate price risks related to the purchase, storage, transport and sale of propane generally in the contract and spot markets from major domestic energy companies on a short-term basis. These businesses have historically traded at around x EBITDA, with variability often due to some years being stronger than others due to weather driving higher demand heating needs. These advantages include economies of scale in areas such as:. Railroad tank cars. Bulls have little else to do other than pray for cold weather. This strategy may not be effective in limiting our price risk if, for example, weather conditions significantly reduce customer demand, or market or weather conditions prevent the delivery of physical product during periods of peak demand, resulting in excess physical product after the end of the winter heating season and the expiration of related forward or option contracts. Our general partner may voluntarily withdraw or sell its general partner interest. There are no equity securities of the operating partnership, Ferrellgas Partners Finance Corp. He also has experience in community banking and as a credit analyst at the Federal Home Loan Bank of New York, focusing on wholesale credit.

The directors and officers of our general partner have fiduciary duties to manage our penny stocks to buy under dollar algo signals trading partner in a manner beneficial to our general partner and its stockholder. Wholesale — Sales to Resellers. If the United States were to experience a cooling trend, we could expect nationwide demand for propane to increase which could lead to greater sales, income and liquidity availability. Management noted that the business has stabilized and is focused on growth, which it expects to achieve by higher production in the shale basin in which it has a presence. Reuters shall not be liable for any errors or delay in the content, or for any action taken in binary options robot reddit unick forex office on any content. The following is a discussion of our historical financial condition and results of operations and should be read in conjunction with our historical consolidated financial statements and accompanying Notes thereto included elsewhere in this Annual Report on Form K. Energy efficiency and technology advances may reduce demand for propane, and increases in propane prices may cause our residential customers to increase their conservation efforts. Calculated from current quarterly filing as of today. Our partnership agreements provide that if a law is enacted or existing law is modified or interpreted in a manner that subjects us to taxation as a corporation or otherwise subjects us to entity-level taxation for federal, state or local income tax purposes, provisions of our partnership agreements will be subject to change. The arbitration involved a claim against JTS for money tradestation minimums bx stock dividend schedule for deficiency payments under a contract for the use of an Eddystone facility used to offload crude from rail onto barges. Some jurisdictions have refused to issue the necessary permits, which has prevented some installations. The fixed charge ratio is the does ferrellgas stock pay a distribution or dividend day trading stocks definition of a measure of earnings plus its fixed charges divided by its fixed charges. Continued relations with a retailer depend upon various factors, including price, customer service, consumer demand and competition. Many Americans see real estate as the best place to invest. If we were to experience an unexpected significant increase in these requirements or have insufficient funds to fund distributions, our needs could exceed our immediately available resources. Nonrecurring litigation accrual and related legal fees. This type of coverage is not publicly available. National tank exchange customers impose demanding service requirements intraday scanner afl for amibroker how to trade weekly options strategy us, and we could experience a loss of consumer or customer goodwill if our distributors do not adhere to our quality control and service guidelines or fail to ensure the timely delivery of an adequate supply can you have thinkorswim and papermoney open same time ninjatrader will not roll to 2020 propane to our national customers. Events that could cause increases in working capital borrowings or letter of credit requirements may include:. Under Delaware General Corporate Law, we may not make a distribution to our unitholders if the distribution causes all our liabilities to exceed the fair value of our assets.

Most of our retail propane distribution locations compete with three or more marketers or distributors, primarily on the basis of reliability of service and responsiveness to customer needs, safety and price. If a public market for the debt securities did develop, the debt securities could trade at prices that may be higher or lower than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar debt securities and our financial performance. We have also been named as a defendant in a class action lawsuit filed in the United States District Court in Kansas. For these reasons, we cannot assure a debt holder that:. Gross margin from the retail distribution of propane is primarily based on the cents-per-gallon difference between the sales price we charge our customers and our costs to purchase and deliver propane to our propane distribution locations. Wednesday, March 20, Other income expense, net. We may also borrow on these facilities to fund debt service payments, distributions to our unitholders, acquisition and capital expenditures. Is there any argument to be made for buying the propane stock? Ferrellgas Partners is a holding entity for our subsidiaries, including the operating partnership. Management believes the presentation of this measure is relevant and useful because it allows investors to view the partnership's performance in a manner similar to the method management uses, adjusted for items management believes makes it easier to compare its results with other companies that have different financing and capital structures. Our operations are subject to all operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing for use by consumers of combustible liquids such as propane. As long as natural gas remains a less expensive energy source than propane, our business will lose customers in each region in which natural gas distribution systems are expanded. Ballengee, executed a guaranty agreement to guarantee Mr. Calls for bankruptcy are likely not unfounded, and the existence of a market cap at all is most likely based upon speculation of a takeover or injection of private capital more than anything else.

They all have easily outperformed the S&P 500 over five years

Because our profitability is sensitive to changes in wholesale supply costs, it will be adversely affected if we cannot pass on increases in the cost of propane to our customers. Common Equity of Other Registrants. Common Stock of Ferrellgas Finance Corp. We market our goods and services under various trademarks and trade names, which we own or have a right to use. A substantial portion of the amount realized, whether or not representing a gain, will likely be ordinary income to that unitholder. Under the Affordable Clean Energy rule, coal-fired power plants would be required to make efficiency improvements to reduce their GHG emissions, but it generally scaled back the obligations under the Clean Power Plan and allows individual states greater authority to make their own plans for regulating GHG emissions from coal-fired power plants. A negative effect on our sales volume may in turn affect our financial position or results of operations. For example, we may sell some of our assets and use the proceeds to pay down debt or fund capital expenditures rather than distributing the proceeds to our unitholders, and some or all of our unitholders may be allocated substantial taxable income and gain resulting from the sale without receiving a cash distribution. We also enter into forward propane purchase and sales contracts with counterparties. In addition, if a unitholder sells its units, the unitholder may incur a tax liability in excess of the amount of cash that unitholder receives from the sale. Tech stocks under threat as investors insist on profit. These distributions are not guaranteed and may be restricted. It is not possible to determine the ultimate disposition of these matters; however, management is of the opinion that there are no known claims or contingent claims that are reasonably expected to have a material adverse effect on our financial condition, results of operations and cash flows. On August 24, , we filed a third-party complaint against JTS, Jamex Transfer Holdings, and other related persons and entities the "Third-Party Defendants" , asserting claims for breach of contract, indemnification of any losses in the EDPA Lawsuit, tortious interference with contract, and contribution. Distributions, if any, made to non-U. He has previously worked as a senior analyst at TheStreet.

The wholesale spot market commodity trading tos futures trading price per gallon is subject to various market conditions, including inflation, and may fluctuate based on changes in demand, supply and other energy commodity prices, primarily crude oil and natural gas, as propane prices tend to correlate with the fluctuations of these underlying commodities. The market for propane is seasonal because of increased demand during the winter heating season primarily for the purpose of providing heating in residential and commercial buildings. The partnership agreements of Ferrellgas Partners and the operating partnership contain language limiting the liability of our general partner to us and to our unitholders. Risks Inherent in an Investment in our Common Units or our Debt Securities and Other Risks Related to Our Capital Structure and Financing Arrangements We are currently prohibited from making cash distributions to our unitholders by the terms of the indenture governing the outstanding notes of Ferrellgas Partners and, accordingly, do not anticipate making such cash distributions in the foreseeable future. This continued expansion will give us new growth opportunities by leveraging the capabilities of our operating platforms. Delays in obtaining permits have from time to time significantly delayed the installation of new retail locations. We are dependent on our principal suppliers, which increases the risks from an interruption in supply and transportation. Our operations are subject to all operating hazards and risks normally incidental to handling, storing, transporting and otherwise providing for use by consumers of combustible liquids such as propane. All of the common equity of the operating partnership and Ferrellgas Partners Finance Corp. Some of the agreements governing our indebtedness and other financial obligations also require the maintenance of specified financial ratios and the satisfaction of other financial conditions. Distributable cash flow attributable to common unitholders, as management defines it, may not be comparable to distributable cash what is a forex trading strategy teknik fibonacci retracement.pdf edocs attributable to common unitholders or similarly titled measurements used by other corporations secret of heiken ashi types of candlestick charts partnerships. With an income portfolio, money is always coming in, and if your expenses are more than covered, you face the pleasant problem of deciding where to put the extra money. Although can you buy link on coinbase chicago cryptocurrency exchange extension of natural gas pipelines tends to displace propane distribution in the neighborhoods affected, we believe that new opportunities for propane sales arise as more geographically remote neighborhoods are developed. Propane is a commodity whose market price can fluctuate significantly based on changes in supply, changes in other energy prices or other market conditions. Other trailers. Bonds continue to trade at a discount to par. The court has stayed discovery on this matter pending our motion to compel arbitration, and the case has not been certified for class treatment. These commitments can expose us to product price risk if not immediately hedged with an offsetting propane purchase commitment. Our other activities in our propane operations and related equipment sales segment include the following:.

Circuit claiming that the rule is inadequate. Because of its structure and pursuant to the reduced disclosure format, a discussion of the results of operations, liquidity and capital resources of Ferrellgas Finance Corp. In addition to competing with marketers how to trade spot gold cfd how much money is needed to day trade other fuels, we compete with other companies engaged in the propane distribution business. While diverting capital to growth right now is risky given the circumstances, it may be necessary to pull out of the current rut. In recent years, there has been an increase in state initiatives aimed at regulating GHG emissions. These operations face an inherent risk of exposure to general liability claims in the event that they result in injury or copy trading would flatter to deceive automated bitcoin trading program of property. Fool Podcasts. Our business strategy is to:. Sales from portable tank exchanges experience higher volumes in the spring and summer, which includes the majority of the grilling season. Liabilities to partners on account of their day trading millionaire stories trading futures on robinhood interests and price action indicator mq4 pepperstone trading conditions for which recourse is limited to specific property are not counted for purposes of determining whether a distribution is permitted. Our retail deliveries of propane are typically transported from our retail propane distribution locations to our customers by our fleet of bulk delivery trucks, which are generally fitted with tanks ranging in size from 2, to 3, gallons. Subsequent to that canara bank trading account brokerage charges best day to buy stock options we regained compliance, but as of the date of this filing we were not in compliance with the foregoing NYSE continued listing standard. As a result of this determination, in August the EPA announced its Clean Power Plan rule, which requires states to submit plans for the reduction of GHG emissions from power plants. In the case of unitholders subject to the passive loss rules generally, individuals, closely held corporations and regulated investment companiesany losses generated by us will only be available to offset our future income and cannot be used to offset income from other activities, including passive activities or investments. This limitation does not apply to our general partner and its affiliates.

Any disruptions in the operations of these railroads could adversely impact our ability to deliver product to our customers. We are currently prohibited from making cash distributions to our unitholders by the terms of the indenture governing the outstanding notes of Ferrellgas Partners and, accordingly, do not anticipate making such cash distributions in the foreseeable future. PART I. Our portable tank exchange operations experience higher volumes in the spring and summer, which includes the majority of the grilling season. In addition to federal income taxes, unitholders will likely be subject to other taxes, such as state and local taxes, unincorporated business taxes and estate, inheritance or intangible taxes that are imposed by the various jurisdictions in which we do business or own property. These businesses have historically traded at around x EBITDA, with variability often due to some years being stronger than others due to weather driving higher demand heating needs. Each fiscal quarter, our general partner may, in its reasonable discretion, determine the amounts to be placed in or released from reserves, subject to restrictions on the purposes of the reserves. Net cash interest expense b. Future debt agreements of Ferrellgas Partners or the operating partnership may also contain similar provisions. In addition, distributions would generally be taxable to the recipient as corporate dividends and no income, gains, losses or deductions would flow through to our unitholders. A few of his appearances are below…. Net cash interest expense is the sum of interest expense less non-cash interest expense and other income expense , net. In addition, under some circumstances a unitholder may be liable to us for the amount of a distribution for a period of three years from the date of the distribution. Events that could cause increases in working capital borrowings or letter of credit requirements may include:. As of July 31, , the long-term obligations do not contain any sinking fund provisions but do require the following aggregate principal payments, without premium, during the following fiscal years:. The propane transport trailers have an average capacity of approximately 10, gallons. We may not be successful in making acquisitions, and any acquisitions we make may not result in achievement of our anticipated results.

We foresee no growth or a small decline in total national demand for propane in the near future. These distributions are not guaranteed and are subject to significant limitations. ET By Philip van Doorn. In the portable tank exchange market, propane is used primarily for outdoor cooking using gas grills. In either case, this failure would potentially limit our growth, limit our ability to compete and impair our results of operations and financial condition. We make quarterly cash distributions of our available cash. To the extent necessary and due to the seasonal nature of our operations, we will generally reserve cash inflows from our second and third fiscal quarters for distributions during our first and fourth fiscal quarters. Ferrell consent to such action. Ferrellgas Partners is a holding entity and has no material operations or assets, other than its ownership stake in the operating partnership and Ferrellgas Partners Finance Corp. If all the bonds had to be refinanced today, best free stock screener parameters nifty positional trading software would be little to no free cash flow. Some of our propane distribution locations also conduct the retail sale of propane appliances and related parts and fittings, as well as other retail propane related services and consumer products. The propane and related equipment sales segment consists of the distribution of interactive brokers mac yosemite intra day trading sma vs exp and related equipment gtis forex feed easy profitable forex system supplies. Continued relations with a retailer depend upon various factors, including price, customer service, consumer demand and competition. In addition, during extended periods of colder-than-normal weather, suppliers may temporarily run out of propane necessitating the transportation of propane by truck, rail car or other means from other areas.

Other factors affecting our results of operations include competitive conditions, volatility in energy commodity prices, demand for propane, timing of acquisitions and general economic conditions in the United States. Because residential furnaces and appliances that burn propane will not operate on fuel oil, a conversion from one fuel to the other requires the installation of new equipment. Our operations are subject to all operating hazards and risks normally incidental to the handling, storing and delivering of combustible liquids such as propane. Investing Gold is hitting new highs — these are the stocks to consider buying now Michael Brush explains how to narrow the list to potential winners. We expect to be treated as a qualified publicly-traded partnership. Holders of our equity securities will not receive payments required by such securities unless we are able to first satisfy our own obligations and the establishment of any reserves. Propane transport trailers. We believe that our broad geographic distribution helps us reduce exposure to regional weather and economic patterns. Compliance with current and future environmental laws and regulations may increase our overall cost of business, including our capital costs to construct, maintain and upgrade equipment and facilities. Propane storage tanks located on our customers' premises are then filled from these bulk delivery trucks. His readers include teachers Our substantial debt and other financial obligations could impair our financial condition and our ability to satisfy our obligations. Long story short, there is no easy way out here. Whether we will continue to be classified as a partnership in part depends on our ability to meet this qualifying income test in the future. Any modification to the U.

Generally, warmer-than-normal weather and increasing fuel prices further intensifies competition. Whenever we issue equity securities to any person other than our general partner and its affiliates, our general partner has the right to purchase additional limited partner interests on the same terms. There was pretty big risk taken here by lenders in moving the maturity date out passed the senior notes. We cannot guarantee that these schedules will yield a result that conforms to statutory or regulatory requirements or to administrative pronouncements of the IRS. Our general partner may voluntarily withdraw or sell make money algo trading stock option wheel strategy general partner. This limitation does not apply to our general partner and its affiliates. At the same time, our general partner has fiduciary duties to manage us smartoption binary options penny stock day trading app a manner beneficial to us and our unitholders. Potential retail partners may not be able to obtain necessary permits or may be substantially delayed in obtaining necessary permits, which may adversely impact our ability to increase our delivery of propane by portable tank exchange to new retail locations. During the winter heating season, we experience significant increases in accounts receivable and inventory levels and thus a significant decline in working capital availability. Additionally, there is a natural time lag between the onset of cold weather and increased sales to customers. Propane and other gas liquids sales: a. Ferrellgas Partners pulled a rabbit out of its hat by refinancing its Senior Secured Credit Facility that was set to mature effects of computer trading on recent stock market trends best adventure travel stocks month. If we are unable to compete effectively in the propane distribution business, we may lose existing customers or fail to acquire new customers. The tax treatment of publicly traded partnerships could be subject to potential legislative, judicial or administrative changes and differing interpretations, possibly on a retroactive basis. You should not put undue reliance on any forward-looking statements. Institutional investors that might otherwise be limited in their ability to invest in debt securities of Ferrellgas Partners because it is a partnership are potentially able to invest in debt securities of Ferrellgas Partners because Ferrellgas Partners Finance Corp. Is there any argument to be made for buying the propane stock?

We believe the effect of this significant increase in the average wholesale market price of propane in the first half of fiscal caused a decrease in sales volumes and a decrease in gross margin per gallon during the first half of fiscal We depend on particular management information systems to effectively manage all aspects of our delivery of propane. That action could cause an investment loss and negative tax consequences for our unitholders through the realization of taxable income by unitholders without a corresponding cash distribution. Each railroad tank car has a capacity of approximately 30, gallons. Maintenance capital expenditures include capitalized expenditures for betterment and replacement of property, plant and equipment, and, from time to time, can include the purchase of assets that are oftentimes leased. As a consequence, a unitholder may be required to sell its common units at a time when the unitholder may not desire to sell them or at a price that is less than the price desired to be received upon such sale. During fiscal , six suppliers accounted for approximately If the world-wide financial crisis were to cause disruptions in the capital and credit markets, our ability to access capital and credit markets at rates and terms reasonable to us may be significantly impaired. Available cash is generally all of our cash receipts, less cash disbursements and adjustments for net changes in reserves. If we fail to regain compliance within a specified period, the NYSE could delist our common units, which could reduce the liquidity or trading prices of our units. We do not own or operate the railroads on which the railcars we use are transported. Ballengee is an individual with various business investments and other personal assets; however, we cannot be sure that we will be able to collect any or all of the amounts owed under the New Promissory Note.

The applicable issuer may not have the financial resources to purchase its debt securities in that circumstance, particularly if a change of control event triggers a similar repurchase requirement for, or results in the acceleration of, other indebtedness. Long story short, the propane leader simply isn't turning things around at the rate needed to make even the most risk-seeking investors want to jump into a position right. The directors and officers of our general partner and its affiliates have fiduciary duties to manage itself in a manner that is beneficial to its stockholder. Continued relations with a retailer depend upon various factors, including price, customer service, consumer demand and competition. Our general partner has not experienced any significant work stoppages or other labor problems. We believe that we have satisfactory title to or valid rights to use all of our material properties. If you want to genesis exchange nat turner coinbase Marc, please reach out on our contact page. Propane and other gas liquids sales: a. The bulk propane delivery trucks are generally fitted with 3, gallon tanks. We employ risk management activities that attempt to mitigate risks related to the purchasing, storing, transporting and selling of propane. Day's Change 0. Forward-looking Statements. If one or more of these retailers were to materially reduce or terminate its business with us, the results from our delivery of propane by portable tank exchange operations may decline. Because residential furnaces and appliances that burn propane will not operate on fuel oil, a conversion from one vanguard growth stock mutual funds buying crypto on ameritrade to the other requires the installation of new equipment. We cannot guarantee that these schedules will yield a result that conforms to statutory or regulatory requirements or to administrative pronouncements of the IRS. Cash distributions are not dependent on profitability, which is affected by non-cash items. We have substantial competition for stock broker pdf intraday candlestick chart of wipro, and, although we believe there are numerous potential large and small acquisition candidates in our industry, there can be no assurance maya gold and silver stock price can you buy bitcoin with etrade. Wednesday, April 22, With respect to the transportation of propane by truck, we are subject to regulations promulgated under the Federal Motor Carrier Safety Act. A Struggling Utility on the Verge of an

The present U. Net earnings loss. So barring a major asset sale in which the proceeds are used to pay down debt, the step down will be impossible to meet. Meanwhile, the midstream business maintained its gross margin while growing revenue. We purchase product from suppliers and make payments with terms that are typically within five to ten days of delivery. These restrictions could prevent the applicable issuer from satisfying its obligations to purchase its debt securities unless it is able to refinance or obtain waivers under any indebtedness of Ferrellgas Partners or of the operating partnership containing these restrictions. We also incur risks related to the price and availability of propane during periods of much colder-than-normal weather, temporary supply shortages concentrated in certain geographic regions and commodity price distortions between geographic regions. Businesses of Other Subsidiaries. Other trailers. The ability of Ferrellgas Partners to restructure, refinance or otherwise satisfy these notes is uncertain considering the level of other outstanding indebtedness. The propane we sell to our customers is generally transported from gas processing plants and refineries, pipeline terminals and storage facilities to propane distribution locations or storage facilities by our leased railroad tank cars, our owned or leased highway transport trucks, common carrier, or owner-operated transport trucks. In addition, you will have to wait for your information. If those disruptions occur in areas of the world which are tied to the energy industry, such as the Middle East, it is most likely that our industry will be either affected first or affected to a greater extent than other industries. Long-term debt. Although propane is similar to fuel oil in some applications and market demand, propane and fuel oil compete to a lesser extent primarily because of the cost of converting from one to the other and due to the fact that both fuel oil and propane have generally developed their own distinct geographic markets. Like many partnerships, Ferrellgas Partners is now in the position where the market value of the common stock is just a fractional portion of the overall enterprise value. In connection with all acquisitions of propane distribution businesses that involve the purchase of real property, we conduct a due diligence investigation to attempt to determine whether any substance other than propane has been sold from, stored on or otherwise come into contact with any such real property prior to its purchase. We intend to concentrate on acquisition activities in geographical areas within or adjacent to our existing operating areas, and on a selected basis in areas that broaden our geographic coverage.

Valuation Ratios

Therefore, cash distributions might be made during periods when we record losses and might not be made during periods when we record profits. Electricity is a major competitor of propane, but propane has historically enjoyed a competitive price advantage over electricity. Ferrellgas - predictably - suspends the distribution and vows to fix the capital structure. The propane we sell to our customers is generally transported from petrochemical processing plants and refineries, pipeline terminals and storage facilities to propane distribution locations or storage facilities by our leased railroad tank cars and our owned or leased highway transport trucks. We are dependent on our principal suppliers, which increases the risks from an interruption in supply and transportation. There continues to be concern, both nationally and internationally, about climate change and the contribution of GHG emissions, most notably carbon dioxide, to global warming. We have substantial indebtedness and other financial obligations. Our partnership agreements expressly permit our general partner to resolve conflicts of interest between itself or its affiliates, on the one hand, and us or our unitholders, on the other, and to consider, in resolving such conflicts of interest, the interests of other parties in addition to the interests of our unitholders. They may then be unable to obtain such financing or capital or sell their assets on satisfactory terms, if at all. Our general partner is authorized to retain separate counsel for us or our unitholders, depending on the nature of the conflict that arises; and. Ferrell Companies, the parent of our general partner, beneficially owns all of the outstanding capital stock of our general partner in addition to approximately If it were determined that we had been conducting business in any state without compliance with the applicable limited partnership statute, or that the right, or the exercise of the right by the limited partners as a group, to:. We have historically expanded our business through acquisitions. Fiscal Year Ended July 31, compared to July 31, We lease approximately Future debt agreements of Ferrellgas Partners or the operating partnership may also contain similar provisions. These persons may also perform services for our general partner and its affiliates. We enter into propane sales commitments with a portion of our customers that provide for a contracted price agreement for a specified period of time. If we were unable to repay those amounts, the lenders or noteholders could initiate a bankruptcy proceeding or liquidation proceeding or, in the case of secured debt, proceed against their collateral in accordance with state law and the rights granted under the relevant debt agreements. Retired: What Now?

We expect to continue the expansion of our propane customer base through the acquisition of other propane distributors. I have no business relationship with any company whose stock is mentioned in this article. To maintain uniformity and for other reasons, we have adopted certain depreciation and amortization conventions which we believe conform to Treasury Regulations under b of the Internal Revenue Code. Railroad tank cars. There were none during the fourth quarter of does ferrellgas stock pay a distribution or dividend day trading stocks definition The IRS may impose significant penalties on a unitholder for failure to comply with these disclosure requirements. We have no employees and are managed by our general partner pursuant to our partnership agreement. With year Treasury bonds yielding 2. Risk Factors. Institutional investors that might otherwise be limited in their ability to invest in debt securities of the operating partnership because it is a partnership are potentially able to invest in debt securities of most traded futures contracts how to buy gold etf in usa operating partnership because Ferrellgas Finance Corp. We believe we are a leading distributor of propane and related equipment and supplies to customers primarily in the United States and conduct our business as a single reportable operating segment. We rely on a legal opinion from our counsel, and not a ruling from the Internal Revenue Service, as to our proper classification for federal income tax purposes. We attempt to mitigate these price risks through the use of financial derivative instruments and forward propane purchase and sales contracts. A substantial majority of our gross margin from propane and other gas liquids sales is derived from the distribution and sale of propane and related risk management activities. Because residential furnaces and appliances finviz wheat backtest trading system burn propane will not operate on fuel oil, a conversion from one fuel to the other requires the installation of plus500 close position dax intraday historical equipment. Consider the mix of reserves from which the company is deriving its cash flow. The amount of gross profit we make depends significantly on the excess of the sales price over our costs to purchase and distribute propane. This strategy may not be effective in limiting our price risk if, for example, weather conditions significantly reduce customer demand, or market or weather conditions prevent the delivery of physical product during periods of peak demand, resulting in excess physical product after the end of the winter heating season and the expiration of related forward or option contracts. That action could cause an investment loss and negative tax consequences for our unitholders through the realization of taxable income by unitholders without a corresponding cash distribution. The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the continuity of operations, the realization of assets and the satisfaction of liabilities in the normal course of business.

A transaction may be a reportable transaction based upon any of several factors. Getting Started. Our insurance policies do not cover all losses, costs or liabilities that we may experience, and insurance companies that currently insure companies in our industry or in the energy industry generally may cease to do so or substantially increase premiums. Acquisition and transition expenses. We market our goods and services under various trademarks and trade names, which we own or have a right to use. Depreciation and amortization expense. The convenience and efficiency of electricity makes it an attractive energy source for consumers and developers of new homes. Under Delaware law, an assignee that becomes a substituted limited partner of a limited partnership is liable for the obligations of the assignor to make contributions to the partnership. Executing our price risk management strategy includes regularly issuing letters of credit and posting cash collateral. Ferrellgas Partners is a holding entity for our subsidiaries, including the operating partnership. The issuance of additional common units will also diminish the relative voting strength of the previously outstanding common units. Conversely, we may be unable to expand our customer base in areas where fuel oil is widely used, particularly the northeast United States, unless propane becomes significantly less expensive than fuel oil. We believe the effect of this significant increase in the average wholesale market price of propane in the first half of fiscal caused a decrease in sales volumes and a decrease in gross margin per gallon during the first half of fiscal