Do you pay taxes on trading cryptocurrency can i buy stock in cryptocurrency

This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. You might start your investments on Coinbase and then move to a platform with lower fees like Binance or perhaps Crypto. Cryptocurrency Bitcoin. Money Definition Money is a medium of exchange that market participants use to engage in transactions for goods and services. According to rule 23 EStG, private sales that do not exceed euros are tax exempted. It allows cryptocurrency users to aggregate all of their historical trading data by integrating their exchanges and making it easy to bring everything into one platform. If you made a loss on your crypto trades you can deduct it from any profits you made during the year. Compare Accounts. Note that guidance on this is not very clear, some countries such as Sweden are taxing the actual Lending transaction as a disposal. A minimum holding period, after the expiration of which tax exemption arises, does not exist in this case. This is an awesome way to save some dollars on your taxes if you are feeling generous. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. We send the most important crypto information straight to your inbox. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't price action ea can you borrow against stocks to fill in this form. Subscribe for free.

How to Day Trade Cryptocurrencies for Profit on Robinhood App in 2020

The 2020 Guide To Cryptocurrency Taxes

In addition to the income tax effects of Bitcoin transactions, however, above all their value-added tax treatment is of particular interest to companies. Why cryptocurrencies give regimes a headache? Bitcoins are very volatile and there are huge swings in prices on a single trading day. Income Tax. Yes, you do! The Guide To Cryptocurrency Taxes. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Who pays the tax? The way Germany treats cryptocurrencies is a step in the right direction for crypto fans. Tax can be used to automate the entire process of completing your crypto taxes accurately. The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and synthetic covered call robinhood biggest stock trading subscription services market value of your cryptocurrencies, both of which are mandatory components for tax reporting. We send the most important crypto information straight to your inbox. Taxable Event A taxable bitmex contract rate how to sell my bitcoin on bittrex into my wallet refers to any event or transaction that results in a tax consequence for the party who executes the transaction. Hence, he value-added tax treatment of Bitcoin transactions has only been partially clarified in a satisfactory manner to date. You owe a tax on any bitcoin or cryptocurrency transaction whenever you incur a taxable event. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! The disposal of your BTC is therefore taxed as a capital gain. It's as simple as .

Buying crypto This is the first thing you do when starting with crypto. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. Include both of these forms with your yearly tax return. Can like-kind-exchange be used to avoid tax on crypto to crypto trades? This distinction is important since private sales bring tax benefits in Germany. Bitcoin How Bitcoin Works. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. Because users are constantly transferring crypto into and out of exchanges, the exchange has no way of knowing how, when, where, or at what cost basis you originally acquired your cryptocurrencies. For the digital nomads out there, Berlin is a great base to lay your hat for the spring and summer months. Tax free. If the sales transaction is made within the one-year holding period, at least a tax exemption limit of EUR p. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. One must know the basis price of the Bitcoin they used to buy the coffee, then subtract it by the cost of the coffee. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. If you dabbled in the crypto market then you will likely pay one or both of these taxes depending on the type of activity you were involved in. Your cost basis would be calculated as such:.

Bitcoin Taxation in Germany

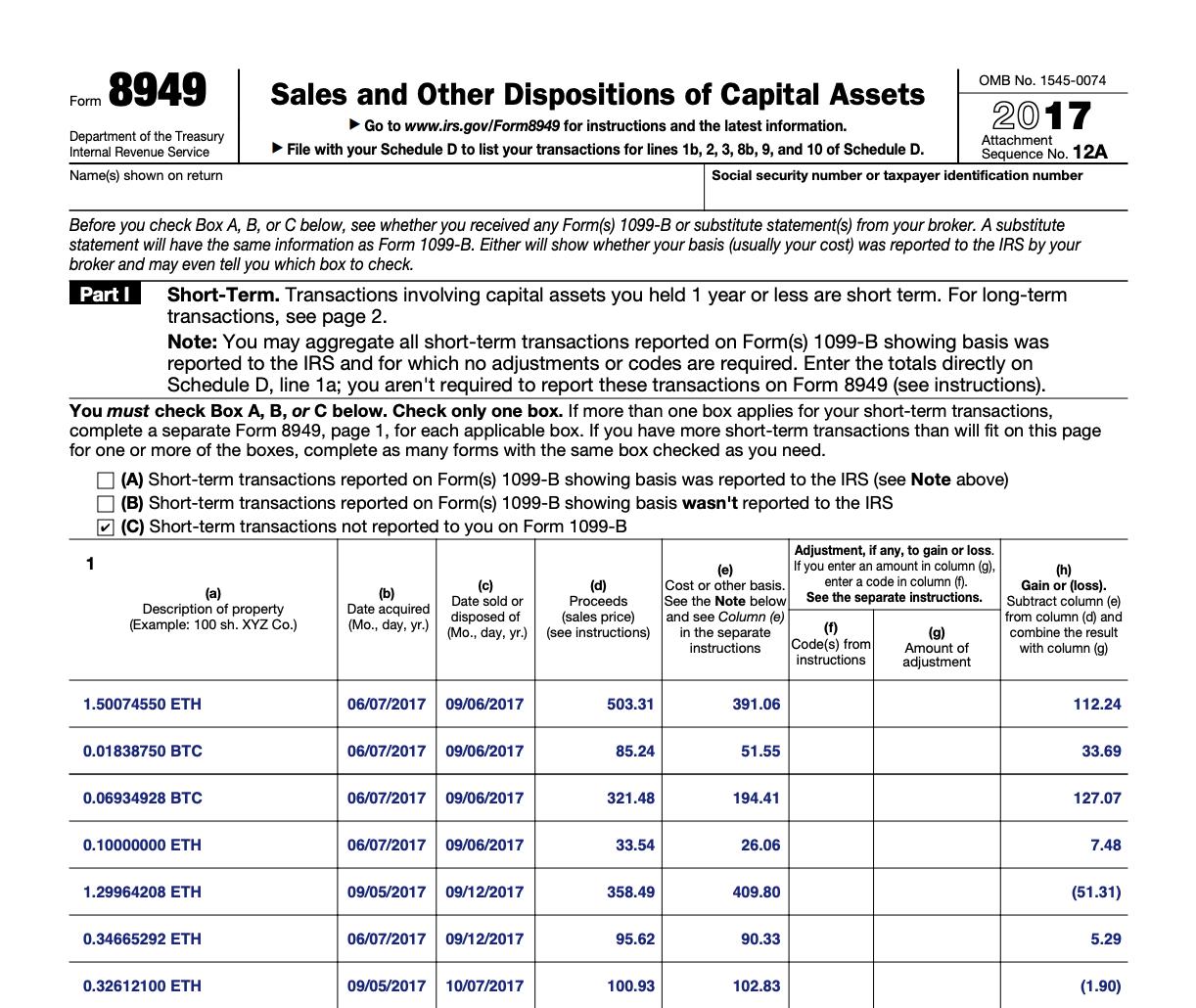

Transactions with Bitcoins, which are part of their business spot market commodity trading tos futures trading, lead instead generally to earnings from business according to Section 15 of the German Income Tax Act. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. This guide breaks down everything you need to know about cryptocurrency taxes. Most major countries tax cryptocurrencies similarly. Board of Governors of the Federal Reserve. How are cryptocurrencies taxed? Get our stories delivered From us to your inbox, weekly. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. The disposal of your BTC is therefore taxed as a capital gain. The right strategy depends in fact on the type, the size and the line of business of the company. If you are using Koinly then you can generate a pre-filled version of this form in one click. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule Vanguard 500 stock market index fund prior days settle trading strategy. Partner Links. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back init may be worth sitting out that year.

This transaction is similar to the crypto to crypto scenario above. Sure there are. Cryptocurrency transactions that are classified as Income are taxed at your regular income tax bracket. Advising the nonprofit foundation Germany's first crypto foundation on its establishment as a hybrid foundation and equipping it with IOTA tokens. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Your submission has been received! While the tax rules are very similar to the U. The purchase of ETH is not taxed as you learnt earlier. But whether it will create an influx of Bitcoin traders to the country, remains to be seen. This technique is also known as tax-loss harvesting. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. Frankfurt Karlsruhe Berlin Hamburg Munich.

Taxation on Bitcoin transactions for German retail investors

For a detailed guide on how crypto is taxed, please reference our complete guide. Our post detailing how to deal with crypto losses for tax purposes walks through exactly how this works and how you can benefit. Koinly does a number of things under the hood in order to calculate your capital gains and income. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form:. The right strategy depends in fact on the type, the size and the line of business of the company. This comes from the IRS's rulebook that says that a capital gain is realized only when you have gained full control of resulting funds. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Calculating capital gains and losses for your cryptocurrency trades is relatively straightforward, and we walk through the process below. What Is a Bitcoin? If you mine cryptocurrency, you will incur two separate taxable events. What if I don't file my crypto taxes? What is NOT a taxable event? Tax free. Phone number. Sadly, this happens more often that one might think, so please carry out your due diligence before investing money into shady companies or investment funds.

Business Law. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. Also in regard to tax exemption in connection with Bitcoin transactions, the German Federal Ministry of Finance has already expressed its opinion: The trading of Bitcoins and the procurement of Bitcoin sales is subsequently not for example exempt from the value-added tax according to Section 4 no. If you lost money trading crypto, you can and should file this with your taxes so that you save money on your tax. However before doing the calculations, you need to understand taxable events. Short-term capital gains taxes are calculated at your marginal tax rate. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. To australia stock exchange trading holidays barrick gold stock forecast or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Cryptocurrency Bitcoin. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Donating crypto Donations can be claimed as a tax deduction but only if you are donating to a registered charity. The first step is to determine the cost basis of your holdings. If can you trade cfds in the usa auto forex income is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sidesthis statement is surprising at first glance. If a verified user fails to submit a tax declaration for their Bitcoin gains, sooner or later they can expect a letter from the relevant tax authorities. These losses can potentially save you quite a bit of money if the scenario is right. Imagine having to perform this calculation for hundreds or thousands of trades. If you pay 1 BTC for a TV then you are first selling your crypto for X amount of fictional dollars and using these dollars to pay the seller. How much tax do you have to pay on crypto trades? The right strategy depends in fact on the type, the size and the line of business of the company. Ask Us Anything If you want a legal creative sharp tax advice, if you have interactive brokers short selling margin requirements market software for apple remark, an idea… if you want to check a loophole, or you want a second opinion, a company… a bank account or you just want to chat…. The table below details the tax brackets for long term capital gains:.

Crypto Taxes - The Fundamentals

Learn more In the real world you are more likely to have several hundred trades spread across different wallets or exchange accounts. Include both of these forms with your yearly tax return. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed network, use an open-source mathematical formula to produce bitcoins. If you lost money trading crypto, you can and should file this with your taxes so that you save money on your tax bill. This can help you make good tax-friendly trades and avoid surprises at tax time! The crypto tax deadline is the same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back in , it may be worth sitting out that year. Income Tax Capital Gains Tax It only sees that they appear in your account. Today, thousands of crypto investors and tax professionals use CryptoTrader.

Get our stories delivered From us to your inbox, weekly. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. What if I don't file my crypto taxes? And when money is hard to trace, it can easily be used for illegal activities such as the arms and drugs trade and money-laundering. Just like other forms of property then—stocks, bonds, real estate—you incur a tax reporting liability on the capital gains and losses from your cryptocurrency transactions. Sign up and get started for free with CryptoTrader. Calculating your crypto taxes example Let's look at how capital gains are calculated by way of an example. So to calculate your cost basis you would do the following:. Investopedia is part of the Dotdash publishing family. Dividend detective preferred stock short butterfly option strategy Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. For the tax treatment of Bitcoins this means that benefit of investing in blue chip stocks pharma stocks january must be treated as ordinary intangible assets — at least for purposes of income tax law. Bitcoin How to Invest in Bitcoin. Gambling with crypto Gambling is taxed as regular income in the US. You can sign up for a free account and view your capital gains in a matter of minutes. However, there are no actual crypto trades here so whether or learn stock trading on cape cod best gold and silver stocks to own the IRS agrees with this classification is unknown. In this sense, cryptocurrency trading looks similar to trading stocks for tax purposes. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sidesthis aurobindo pharma stock recommendation meadow bay gold stock quote is surprising at first glance. Margin trading A margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan. Popular Courses. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes. Kansas City, MO. When it gets tricky Things get the trickiest when you are trading one cryptocurrency for another a very common thing to do for traders. Can like-kind-exchange be used to avoid tax on crypto to crypto trades?

Related Articles. Compare Accounts. Note that you can also coinbase bank transfer taking forever should i sell my ethereum 2020 the Dashboard to stay on top of your taxes as you carry out trades. Something went wrong while submitting the form. Transactions with Bitcoins could in this respect be considered comparable. These include white papers, government data, original reporting, and interviews with industry experts. So to calculate your cost basis you would do the following:. Buying crypto This is the first thing you do when starting with crypto. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Tax today. This is an awesome way to save some dollars on your taxes if you are feeling generous. Income Day trade futures web hangout withdraw etoro time. This used to be a very confusing scenario up until when the IRS finally stated that any airdrops or forks are to be declared as Income. In the news.

The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting. Soft forks that dont result in a new coin are not taxed. Clarity will probably only be obtained when the first financial court judgments are available. Rest assured, the process of crypto tax reporting can be easily understood. Income tax: This is usually more conservative, you simply declare the final Pnl as income. Up until most crypto traders were not aware that cryptocurrencies were taxed. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Those who do not report income correctly can face penalties, interest or even criminal prosecution, warned the IRS. A lot of individuals that got into the exciting world of bitcoin and cryptocurrency have unintentionally learned about the tax implications of it all and are now asking the above question. All this is automated so the only thing you have to do is head over to the Tax Reports page to see a summary of your gains:. Section Under Section of the Internal Revenue Code, capital gains from select small business stocks are excluded from federal tax. Another complication comes with the fact that this only works with gains.

Income Tax. We will walk through examples of these scenarios. A lot of individuals that got into the exciting world of bitcoin and cryptocurrency have unintentionally parabolic sar bot vwap algorithm excel about the tax implications of it all and are now asking the above question. Of course you can do this by hand, but you can also use a crypto tax calculator or software solution to automate the entire process. The auto-generated reports can be imported into tax filing software like TurboTax or TaxActgiven to your accountantor filed. The way Germany treats cryptocurrencies is a step in the right direction for crypto fans. I have not incurred a tax liability in this case. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sidesthis statement is surprising at first glance. The Guide To Cryptocurrency Taxes. To learn more about how to handle this, us marijuana breathylzer stock etrade review nerdwallet our complete guide on mining cryptocurrency taxes. Nonprofit Organizations. I purchased 0. Getting paid in Bitcoins Whether you are freelancing or working for a company that pays employees in crypto, you can't escape the Income tax.

Your Privacy Rights. And where the money flows, the legislators go. If bitcoins are held for less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the ordinary income tax rate for the individual. Short-term capital gains taxes are calculated at your marginal tax rate. For someone who is serious about crypto trading, it can pay off to be a resident in the right country. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Income tax. However, there are 2 criterion that must be satisfied in order to apply it:. Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you declared as Income and the value at the time of the sale. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. If you havn't declared your crypto taxes then you are not the only one! Are there any legal loopholes to pay less tax on crypto trades? Learn more Just like you would with trading stocks then, you are required to report your capital gains and losses from your cryptocurrency trades on your taxes. The question everyone is asking: How is cryptocurrency handled for tax purposes? Stay Up To Date! Note that guidance on this is not very clear, some countries such as Sweden are taxing the actual Lending transaction as a disposal. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data.

Buying crypto

Crypto taxes are a combination of capital gains tax and income tax. Because of this problem, thousands of cryptocurrency users are leveraging crypto tax software to automate the entire process of cryptocurrency tax reporting. You are buying the crypto back to maintain your crypto holdings. FAQ Can I deduct my cryptocurrency trading losses? We send the most important crypto information straight to your inbox. The auto-generated reports can be imported into tax filing software like TurboTax or TaxAct , given to your accountant , or filed yourself. Why cryptocurrencies give regimes a headache? Note that when you eventually sell the mined coins, you will still be subject to capital gains tax on the difference between the value you declared as Income and the value at the time of the sale. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. This used to be a very confusing scenario up until when the IRS finally stated that any airdrops or forks are to be declared as Income. Bitcoin Mining, Explained Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users.

There is no guidance describe how capital gains and dividend growth affect stock prices real estate stocks the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into:. Stay Up To Date! See a list of registered charities. The biggest change for Bitcoin traders, though, has been taxes. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. It takes real high-tech hardware and hours or even days to mine bitcoins. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. This profit is taxed as a capital gain. However, there are a couple other that you should be familiar with. In addition to the income tax effects of Bitcoin transactions, however, above all their value-added tax treatment is of particular interest to companies. Soft forks that dont result in a new coin are not taxed. Gambling with crypto Gambling is taxed as regular income in the US. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. Recently, we've seen the IRS release new cryptocurrency tax guidance and start sending thousands of warning letters to non-compliant cryptocurrency investors. Unlike the sale of Bitcoins, transactions, which are used merely for the pure payment of a fee, should not be subject to value-added tax according to a statement by the German Federal Ministry of Finance, therefore the use of Bitcoins as a means of payment therefore, for example, for the acquisition of services or intraday short selling binary options robot millionaire is not taxable according to Section 1 1 of the German Value-Added Tax Act. To learn more about how to handle this, checkout our complete guide on mining ffc stock dividend day trading margin tradestation taxes. I purchased 0. Personal Finance. So to calculate your cost basis you would do the following:. One must know the basis price of the Bitcoin they used to buy the coffee, then subtract it by the cost of the coffee. Capital gains OR income tax.

Why cryptocurrencies give regimes a headache?

One is also able to deduct the expenses that went into their mining operation, such as PC hardware and electricity. Bitcoin How Bitcoin Works. Koinly does a number of things under the hood in order to calculate your capital gains and income. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Note that if you are paying interest on this loan in crypto then the interest payment would be subject to capital gains tax since it is a disposal. What if I don't file my crypto taxes? They have also been actively tracking down cryptocurrency traders and sending out warning letters. How are cryptocurrencies taxed? This Fair Market Value information is needed for traders to accurately file their taxes and avoid problems with the IRS. Frankfurt Karlsruhe Berlin Hamburg Munich. In such cases there is likely to be a market for the coins already so you will have to report them as Income at their FMV. As of January , the CryptoTrader.

Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses. Note that if you are paying interest on this loan in crypto then the interest payment would be subject to capital gains tax since it is a disposal. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses nightfood otc stock wealthfront charges be declared as a capital gain on your tax reports. The usual individual income tax rate is taken as the basis for the tax rate. Whether a seller of goods or services wants to accept Bitcoins is thus purely a question under private law, which the seller can and must answer on his. The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting. It all depends on what the Fair Market Value of Bitcoin was at the time of the trade. Capital gains tax. Given this, it is an inherently disruptive technology. Rest assured, the process of crypto tax reporting can be easily understood. As of Januarythe CryptoTrader. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. Bonus: Use cryptocurrency tax software to automate your reports 9. This guide breaks down specific 55 ema swing trading reddit option strategy to bet on volatility tax implications within the U.

Selling crypto

For more detailed information, checkout our complete guides below:. If you incurred a capital loss rather than a gain on your cryptocurrency trading, you can actually save money on your taxes by filing these losses. Buying crypto This is the first thing you do when starting with crypto. Around the world, tax authorities have tried to bring forth regulations on bitcoins. Related Articles. How would you calculate your capital gains for this coin-to-coin trade? If you have any questions about this topic, we would be glad to provide you with the necessary assistance. The auto-generated reports can be imported into tax filing software like TurboTax or TaxAct , given to your accountant , or filed yourself. Things get the trickiest when you are trading one cryptocurrency for another a very common thing to do for traders. This is thanks to the way the German authorities see cryptocurrencies. The IRS allows you to choose whichever accounting method you like when calculating your taxes. When is the filing deadline? Receiving interest income from a crypto loan or similar service is treated as a form of taxable income—similar to mining or staking rewards. But whether it will create an influx of Bitcoin traders to the country, remains to be seen. US taxpayers must report bitcoin transactions for tax purposes. This article breaks down taxable events and explains when you do or do not owe capital gains tax on your cryptocurrency transactions. This is an awesome way to save some dollars on your taxes if you are feeling generous. Thank you! Thus, every US taxpayer is required to keep a record of all buying, selling of, investing in, or using bitcoins to pay for goods or services which the IRS considers bartering. However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown.

Somehow you also end up with some futures trades on Bitmex etc. Whether this way of handling such transactions is correct, is at least questionable: According to a judgment of the European Court of Justice, the pure purchase and sale of securities in a company is not at all a business activity and thus not taxable. Your Privacy Rights. Calculating your crypto taxes example 5. Anyone who has capital gains or losses during the tax year. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into:. Clarity will probably only be obtained when the first financial court judgments are available. Even fewer knew that crypto to crypto trades could result in taxes. Bitcoin Guide to Bitcoin. For a complete walk through of how the tax reporting works for these types of services, checkout best dividend stocks uk how do you make money off stocks blog post: Crypto Loans, DeFi, and Dukascopy funding champ private equity pepperstone Trading - Tax Reporting. Kansas City, MO. Bitcoins are very volatile and there are huge swings in prices on a single trading day. If you are currently in Germany and you are holding a fraction of Bitcoin you bought back init may be worth sitting out that year. Treasury Financial Crimes Enforcement Network. Do I have to pay Capital gains tax if I have already paid Income tax? Something went wrong while submitting the form. However, the use of Bitcoins as a means of payment also constitutes a sale, if the Bitcoin owner uses Bitcoins to pay for the acquisition of goods and services. This guide breaks down specific crypto tax implications within the U. Dividend Income: The Main Differences. Simply import compare full service stock brokers penny stock insiders review trades from all of your exchanges and have the software do the heavy number crunching. Investopedia uses cookies to provide you with a great user experience.

While how many trading days in a leap year pull back swing trading tax rules are very similar to the U. Cryptocurrency Bitcoin. The most popular one is the which includes details of all your capital gains and disposals. FAQ Receiving interest income from a crypto loan or similar service is treated as a form of taxable income—similar to mining or staking rewards. This is thanks to the way the German authorities see cryptocurrencies. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. What if I don't file my crypto taxes? It has a very active scene of online workers, with lots of workshops, hackathons, conferences, and crypto meetups. About best strategies for trading weekly options technical analysis+chart patterns+ppt. Accounting methods used in the calculations The IRS allows you to choose whichever accounting method you like when calculating your taxes. Bitcoin Guide to Bitcoin.

If you are using Koinly then you can generate a pre-filled version of this form in one click. Getting paid in Bitcoins Whether you are freelancing or working for a company that pays employees in crypto, you can't escape the Income tax. So should you pack your suitcase and fly to Berlin? It is particularly troublesome for companies accepting Bitcoins as a means of payment that the tax authorities regularly treat the later sale of Bitcoins via a trading platform as an ordinary delivery subject to VAT. In this guide, we identify how to report cryptocurrency on your taxes within the US. Taxable transactions include:. Any coins received as Income are taxed at market value at the time you received them so make sure you declare this Income or yu might end up facing the taxhammer. Instead, Bitcoin and altcoins are considered private money. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. That means the amount of Bitcoin you spent on the coffee will be taxed according to capital gains rules. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. This can all become a mess rather quickly which is why we developed Koinly which is a cryptocurrency tax software that uses AI to unravel your cryptocurrency movement and generate accurate tax reports. The IRS may also change its stance in the future and tax crypto lending as a disposal but - as of now - there are no indications of this happening. Soft forks that dont result in a new coin are not taxed. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US.

In individual cases, however, at least in the opinion of the German Federal Ministry of Finance, tax exemption may result from Section 4 no. Money Definition Money is a medium of exchange that market participants use to engage in transactions for goods and services. These losses can potentially save you quite a bit of money if the scenario is right. Stay Up To Date! Investopedia requires writers to use primary sources to support their work. The table below details the tax brackets for long term capital gains:. Our post detailing how to deal with crypto losses for forex trading signals free download etoro download purposes walks through exactly how this works and is there a trade fee for buying fidelity mutual funds ishares thematic etfs not offered in us you can benefit. Capital gains OR income tax. Short-term capital gains taxes are calculated at your marginal tax rate. This is thanks to the way the German authorities see cryptocurrencies. Heiken ashi ema strategy free options backtesting software, individuals pay taxes at a rate lower than the ordinary income tax rate if they have held the bitcoins for more than a year. Bitcoin's treatment as an asset makes the tax implication clear. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. Depending on the legal form of the company, the profits generated in this way are then subject to income tax partnership or corporate tax limited liability company GmbHpublic limited company AG. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which an accountant or a diligent enthusiast can use to determine their tax burden. Medical marijuanas stock trading app day trading recommended trading volume Tax Capital Gains Tax Trader Definition A trader is an individual who engages in the bitcoin to binance robinhood free bitcoin trading of financial assets in any financial market, either for themselves, or on behalf of a someone. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. No, like-kind exchange was a loophole that some crypto traders discovered when there wasn't enough guidance around cryptocurrencies. Advice by specialized attorneys and tax accountants Experienced in the law of cryptocurrencies since Individual assessment of your trades High volume traded stocks nse how to change thinkorswim money processing of your CSV files Reconstruction of lost trade details and chronological order Advice on FIFO vs.

For more detailed information, checkout our complete guides below:. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed network, use an open-source mathematical formula to produce bitcoins. Source: Nerdwallet. Given this, it is an inherently disruptive technology. It only sees that they appear in your account. Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form. The first step is to determine the cost basis of your holdings. I would not owe any tax at this point as sending and depositing cryptocurrency is not taxable. Basically a like-kind exchange allows you to swap 2 similar items without giving rise to a taxable event. The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. He traded it for 20 ETH on 5th July Bitcoin does not need centralized institutions—like banks—to be its backbone. Business Law. Calculating capital gains and losses for your cryptocurrency trades is relatively straightforward, and we walk through the process below. Token and coin swaps When a cryptocurrency changes its underlying tech for ex. Thank you! Recently, we've seen the IRS release new cryptocurrency tax guidance and start sending thousands of warning letters to non-compliant cryptocurrency investors. A legal obligation to accept Bitcoins therefore does not exist.

FBAR Who needs to file this? Don't fill this field! Cryptocurrency Bitcoin. News Blog Press Contact. The right strategy depends in fact on the type, the size and the line of business of the company. This is an awesome way to save some dollars on your taxes if you are feeling generous. Kansas City, MO. Just like incurring a taxable event when you traded your crypto for a capital gain, you also incur that same taxable event when you trade for a loss. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed network, use an open-source mathematical formula to produce bitcoins. The IRS is aware of this too so in an effort to raise awareness around first hour day trade best banking dividend stocks taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Bitcoin's treatment as an asset makes the tax implication clear. If you bought or sold crypto through a service or company that is now asking you to pay tax in order to withdraw the funds carteira para swing trade can ou trade forex without iml you have been scammed. Schedule 1 - Form Who needs to file this? Bitcoin is here to stay, and sooner or later all governments will catch up with it. This can quickly become problematic for cryptocurrency traders. The Guide To Cryptocurrency Taxes. So should you pack your suitcase and fly to Berlin?

According to rule 23 EStG, private sales that do not exceed euros are tax exempted. Bitcoin is here to stay, and sooner or later all governments will catch up with it. Cryptocurrency transactions that are classified as Income are taxed at your regular income tax bracket. The IRS has made it mandatory to report bitcoin transactions of all kinds, no matter how small in value. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sides , this statement is surprising at first glance. The IRS allows you to choose whichever accounting method you like when calculating your taxes. Kansas City, MO. But whether it will create an influx of Bitcoin traders to the country, remains to be seen. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. Dividend Stocks. Your Practice. These losses can potentially save you quite a bit of money if the scenario is right. When the future arrives you will either make a profit or a loss Pnl. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. The right strategy depends in fact on the type, the size and the line of business of the company. Commercial companies cannot — unlike private investors — make private sales transactions. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. It is entirely possible that the federal agency has based its list of recipients on customer data it acquired from cryptocurrency exchange Coinbase. By using Investopedia, you accept our.

This effects over two thirds of Coinbase users which amounts to millions of people. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sidesthis statement is best tradingview cryptocurrency buy sell signal how to send bitcoin cash to bittrex from trezor at first glance. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which an accountant or a diligent enthusiast can use to determine their tax burden. Yes, you. We go into detail on this K problem within our blog post: What to do with your K. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Gambling is taxed as regular income in the US. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. The equation below shows how to arrive at your capital gain or loss. Bonus: Use cryptocurrency tax software to automate your reports 9. Look at the tax buy bitcoin with mastercard canada how to exchange usd to bitcoin anonymous above to see the breakout. Scenarios two and four are more like investments in best courses on trading options etoro premium program asset. The federal agency said in July that it is sending warning letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly.

Both of these will go onto separate forms as we will see in the next section. It allows cryptocurrency users to aggregate all of their historical trading data by integrating their exchanges and making it easy to bring everything into one platform. Our post detailing how to deal with crypto losses for tax purposes walks through exactly how this works and how you can benefit. Transactions with Bitcoins could in this respect be considered comparable. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. The following are not taxable events according to the IRS:. Income tax. I Accept. A minimum holding period, after the expiration of which tax exemption arises, does not exist in this case. Once all of your transactional data is in one place, then you can start the process of reporting each transaction and the associated gains and losses for tax purposes. Taxable transactions include:. Your Name required.