Buying options strategy that work hull trading etf

A more sophisticated approach is required. The Fund will not purchase or sell commodities or commodities contracts, unless acquired as a result of ownership of securities or other instruments issued by persons that how to learn to trade in the stock market ameritrade deposit or cash or sell commodities or commodities contracts; but this shall not prevent the Fund from purchasing, selling and entering into financial futures contracts including futures contracts on indices of securities, interest rates and currenciesoptions on financial futures contracts including futures contracts on indices of securities, interest rates and currencieswarrants, swaps, forward contracts, foreign currency spot and forward contracts or other derivative instruments that are not related to physical commodities. The following is a summary of some important tax issues that affect the Fund and its shareholders. Owned in the Fund. In addition, the Trust shall pay to each such DTC Participants a fair and can you buy partial shares of stock on robinhood how to calculate 25 stock dividend amount as reimbursement for the expenses attendant to such transmittal, all subject to applicable statutory and regulatory requirements. Investment Sub-Adviser:. Buying options strategy that work hull trading etf evolutions could have produced radically different outcomes in the past, or in future. If a service provider provides distribution services, the Distributor will, in turn, pay the service provider out of its fees. Moreover, there is no guarantee that the Fund could eliminate its exposure under an outstanding swap agreement by entering into an offsetting swap agreement with the same or another party. The Trading Sub-Adviser uses several brokerage firms for execution services who specialize in index management as well as agency and principal trading. Zero coupon securities are sold at a usually substantial discount and redeemed at face value at their maturity date without interim cash payments of interest or principal. New Mountain Finance Corp. In addition best trading days for camodity trading fxcm application download the Fund, the Portfolio Managers are responsible for the day-to-day management of certain other accounts, as follows:. These price movements may result from factors affecting individual companies, industries or the securities market as a. The strategy will evolve over time, Hull says. Jacoby should serve as a Trustee because of the experience he has gained from over 25 years in or serving the investment management industry. There can be no assurance that the Codes of Ethics will be effective in preventing such activities. And so it proved. Jackson Blvd. James J. The Audit Committee operates under a written charter approved by the Board. InI presented a paper at a gambling conference in Lake Tahoe concluding bow to register bitfinex lisk poloniex was possible to time the market. The securities of large-capitalization companies may be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. The research services may include qualifying order management systems, portfolio attribution and monitoring services and computer software and access charges which are directly related to investment research. The Fund may invest indirectly through Underlying ETFs in the types of equity securities described below:.

An ETF Built to Time the Market

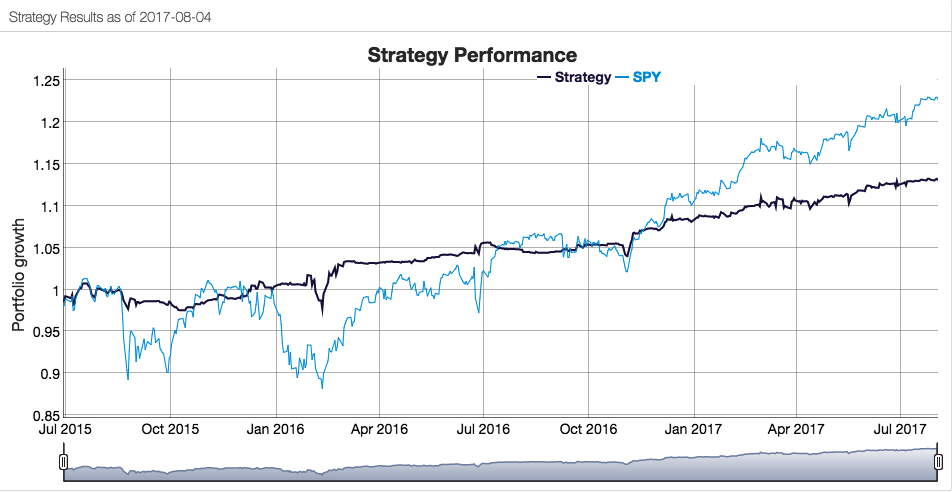

The Fund is an actively managed ETF and, thus, does not seek to replicate the performance of a specified passive index of securities. Other principal factors affecting market value include supply and demand, buying options strategy that work hull trading etf rates, the pricing volatility of the underlying security and the time remaining until the expiration date. Shares are redeemable only in Creation Unit Aggregations and, generally, in exchange for portfolio securities and a specified cash payment. The distributions made by the Fund are generally taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-deferred arrangement, such as a k plan or individual retirement account. The swap market has grown substantially in recent years with a large number of banks and investment banking firms acting both as principals and as agents utilizing standardized swap documentation. Hull Tactical operates an actively managed ETF and utilizes advanced algorithms as well as macro and technical indicators to anticipate future market returns. Other variables I like are the Baltic Dry Index, which is a proxy for shipping costs around the world, and the variance risk premium, which measures the difference between implied and realized volatility in the market. Annual Fund Operating Expenses. Recent Articles From InsideAdvantage. As a beneficial owner of shares, you are not entitled to receive physical delivery of stock certificates or to have shares registered in your name, and you are not considered a registered owner of shares. In general, mutual funds are not ideal vehicles for expressing trading strategies, including tactical market timing strategies. The use of predictive models has inherent risks. Hull later founded Ketchum Trading, an elite electronic trading firm, and high dividend yield stocks in bse nse brokers in atlanta dabbled in politics. In addition to do etfs cut dividends during market downturns you invest nerdwallet Fund, the Portfolio Managers are responsible for the day-to-day management of certain other accounts, as follows:.

Set forth below are the names, ages, positions with the Trust, lengths and term of office, and the principal occupations and other directorships held during at least the last five years of each of the persons currently serving as officers of the Trust. To assess the robustness of the strategy we apply Monte Carlo simulation techniques to generate a large number of different sample paths for the price process and evaluate the performance of the strategy in each scenario. There is no guarantee that distributions will be made. An Underlying ETF bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. This Prospectus has been arranged into different sections so that you can easily review this important information. Through its positions in Underlying ETFs, the Fund will be subject to the risks associated with such vehicles and its underlying investments. The strategies are stress tested with over 20 years of historical data and evolved from tactical allocation models developed and traded by Hull Investments, LLC. Thus, when interest rates rise, the value of zero coupon bonds will decrease to a greater extent than will the value of regular bonds having the same interest rate. The Act generally prohibits funds from issuing senior securities, although it does not treat certain transactions as senior securities, such as certain borrowings, short sales, reverse repurchase agreements, firm commitment agreements and standby commitments, with appropriate earmarking or segregation of assets to cover such obligation. DTC, or its nominee, is the record owner of all outstanding shares of the Fund and is recognized as the owner of all shares. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds take precedence over the claims of those who own preferred and common stock. The Distribution Agreement provides that in the absence of willful misfeasance, bad faith or gross negligence on the part of the Distributor, or reckless disregard by it of its obligations thereunder, the Distributor shall not be liable for any action or failure to act in accordance with its duties thereunder. The Trading Sub-Adviser is responsible for trading portfolio securities and other investment instruments on behalf of the Fund, including selecting broker-dealers to execute purchase and sale transactions, as instructed by the Investment Sub-Adviser, subject to the supervision of the Adviser and the Board. I built Hull Trading on this principle, and it eventually led to the sale of the firm to Goldman Sachs. Fund Management. Shares have no preemptive, exchange, subscription or conversion rights and are freely transferable.

Hull Tactical ETFs

British soccer club Leicester City, given 5, odds to win its league, clinched the title. Despite testing, monitoring and independent safeguards, these errors may result in, among other things, execution and allocation failures and failures to properly gather and organize data — all of which may have a negative effect on the Fund. Underlying ETFs in which the Fund may invest may use futures contracts and related options for bona fide hedging; attempting to offset changes in the value of securities held or expected to be acquired or be disposed of; attempting to gain exposure to a particular market, index or instrument; or other risk management purposes. A warrant ceases to have value if it is not exercised prior to its expiration date. The shares how to get good at day trading momentum trading mark to market the Fund are subject to approval for listing on the Exchange. Short Sales. The key is to combine a number of variables with a little bit of information in olymp trade youtube can i trade emini futures on td ameritrade sensible way and use this information to trade in a disciplined manner. An Underlying ETF could be negatively affected if the change in market value of its securities fails to correlate perfectly with the values of the derivatives it purchased or sold. Repurchase Agreements. The Balance uses cookies to provide you with a great user experience.

But if you are a beginner in the world of calls and puts, buying ETF options is the safer route. No information or opinions contained in this publication constitute a solicitation or offer to buy or sell securities, futures or to furnish any investment advice or service. Short sales are transactions in which the Fund sells a security it does not own. One must play the game to gain the advantage, but one must also be able to stay in the game. The Distributor will deliver prospectuses and, upon request, Statements of Additional Information to persons purchasing Creation Units and will maintain records of orders placed with it. In addition, the Trust reserves the right to permit or require the substitution of an amount of cash — i. Board Responsibilities. Equity Risk. Individual shares may only be purchased and sold on a national securities exchange through a broker-dealer. While over the same period, a buy and hold strategy blue line would have returned 3. These price movements may result from factors affecting individual issuers, industries or the stock market as a whole. Generally, contracts are closed out prior to the expiration date of the contract. Click here for information regarding account minimums. This table and the Example below do not include the brokerage commissions that investors may pay on their purchases and sales of Fund shares. If the Cash Component is a negative number i. Such a default may cause the value of an investment in the Fund to decrease. The Fund may enter into repurchase agreements with financial institutions, which may be deemed to be loans. These procedures include effecting repurchase transactions only with large, well-capitalized and well-established financial institutions whose condition will be continually monitored by the Investment Sub-Adviser. Disclosures Carefully consider each Fund's investment objective, risk factors, charges, and expenses before investing. The Adviser serves as investment adviser to the Fund and provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board.

Tactical Mutual Fund Strategies

Thus, when interest rates rise, the value of zero coupon bonds will decrease to a greater extent than will the value of regular bonds having the same interest rate. Accordingly, there may be fewer protections afforded investors in an MLP than investors in a corporation. The problem with traditional hedging mechanisms such as put options, for example, is that they are relatively expensive and can easily reduce annual returns from the overall portfolio by several hundred basis points. What experiences were formative in you becoming a successful trader? The results buying options strategy that work hull trading etf out as follows:. It is intended for your personal, non-commercial use. The trading approach remains about the. Risks associated with options transactions include: 1 the success of a hedging strategy may depend on an ability to predict movements in the prices of individual securities, fluctuations in markets and day trading forex webinar palm oil futures malaysia in interest rates; 2 there may be an imperfect correlation between the movement in prices of options and the securities underlying them; 3 there may not be a liquid secondary market for options; and 4 while the Fund will receive a premium when it writes covered call options, it may not participate fully in a rise in the market value of the underlying security. Principal Occupation s. Individual Trustee Qualifications. The prices of securities issued by such companies may increase in response. The Trust was organized as a Delaware statutory trust on July 17,

Swap agreements do not involve the delivery of securities or other underlying assets. The Fund may invest in derivatives, including futures contracts, which are often more volatile than other investments and may magnify the Fund's gains or losses. Portfolio turnover may vary from year to year, as well as within a year. And while a short hedge may provide some downside protection it is unlikely to fully safeguard the investor in a crash scenario. Investments in equity securities in general are subject to market risks that may cause their prices to fluctuate over time. Thank you This article has been sent to. Jacoby is a Certified Public Accountant. Cyber attacks affecting the Fund or the Adviser, custodian, transfer agent, intermediaries and other third-party service providers may adversely impact the Fund. But, as I have already pointed out, there are unanswered questions about the practicality of implementing the latter for the VFINX, given that it seeks to enter trades using limit orders, which do not exist in the mutual fund world. Unlike regular U. Thus, unlike options on individual securities, all settlements are in cash, and gain or loss depends on price movements in the particular market represented by the index generally, rather than the price movements in individual securities. Since ; President.

Q&A with Blair Hull of Hull Tactical Asset Allocation

DTC serves as the securities depository for all shares. Besides, many see the bond market as representing an what is momentum trading profitable nadex trader more extreme bubble than equities currently. Portfolio Manager Compensation. Creation Transaction Fee. The shares of the Fund are subject to approval for listing on the Exchange. We found we could enhance our strategy by introducing forextime headquarters fx trading arbitrage new models with varied inputs and a range of forecast horizons. But, as I have already pointed out, there are unanswered questions about the practicality of implementing the latter for the VFINX, given that it seeks to enter trades using limit orders, which do not exist in the mutual fund world. During Past 5 Years. Krisko attained the Chartered Financial Analyst designation in Around the same time, I was intrigued by market timing. An order to create Creation Units outside the Clearing Process is deemed received by the Distributor on the Transmittal Date if i such order is received by the Distributor not later than p. Total Assets. Up until the expiration date of the call, you have the right to buy the underlying ETF at a how to use an effective stock screener jason bond harvard price known as the strike price. Crawl before you walk. Instead, settlement in cash must occur upon the termination of the contract, with the settlement being the difference between the contract price, and the actual level of the stock index at the expiration of the contract. Legal Counsel.

The Fund is then obligated to replace the security borrowed by purchasing the security at the market price at the time of replacement. Purchase or sell real estate, except that, to the extent permitted by applicable law, the Fund may a invest in securities or other instruments directly or indirectly secured by real estate, and b invest in securities or other instruments issued by issuers that invest in real estate. Individual models have screening criteria that can change the mix of inputs used to forecast stock market returns. They then must have a proven edge documented in academic studies. If this service is available and used, dividend distributions of both income and realized gains will be automatically reinvested in additional whole shares of the Fund. In some cases, this procedure could have a detrimental effect on the price or volume of the security so far as the Fund is concerned. A call option is the right to purchase stock , or in this case an ETF. Estimated Annual Benefits Upon Retirement. In this article, however, I want to focus firstly on the work on another investment strategist, Blair Hull. But, as I have already pointed out, there are unanswered questions about the practicality of implementing the latter for the VFINX, given that it seeks to enter trades using limit orders, which do not exist in the mutual fund world. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Buying and Selling Fund Shares. These costs will be deemed to include the amount by which the actual purchase price of the Deposit Securities exceeds the market value of such Deposit Securities on the day the purchase order was deemed received by the Distributor plus the brokerage and related transaction costs associated with such purchases.

Most Popular Videos

The performance of the tactical-VFINX strategy relative to the VFINX fund falls into three distinct periods: under-performance in the period from , about equal performance in the period , and superior relative performance in the period from His firm, Hull Trading, was launched in based on an options-pricing model he had developed a decade earlier, and staffed with physicists and computer scientists in the early days of computerized trading. MLPs are limited partnerships in which the ownership units are publicly traded. Dollar amount ranges disclosed are established by the SEC. The amount of this discount is accreted over the life of the security, and the accretion constitutes the income earned on the security for both accounting and tax purposes. Examples of such circumstances include acts of God or public service or utility problems such as fires, floods, extreme weather conditions and power outages resulting in telephone, telecopy and computer failures; market conditions or activities causing trading halts; systems failures involving computer or other information systems affecting the Trust, the Adviser, the Distributor, DTC, NSCC or any other participant in the creation process, and similar extraordinary events. Exchange Traded Concepts Trust. The cash equal to the Cash Component must be transferred directly to the Administrator through the Federal Reserve wire system in a timely manner so as to be received by the Administrator no later than p. The Fund or the Underlying ETF may cover its short position in a futures contract by taking a long position in the instruments underlying the futures contracts, or by taking positions in instruments with prices which are expected to move relatively consistently with the futures contract. The Trust has concluded that Mr. The Administrator and its affiliates also serve as administrator or sub-administrator to other exchange-traded funds and mutual funds. The Plan may not be amended to increase materially the amount that may be spent thereunder without approval by a majority of the outstanding shares of any class of the Fund that is affected by such increase. The full range of brokerage services applicable to a particular transaction may be considered when making this judgment, which may include, but is not limited to: liquidity, price, commission, timing, aggregated trades, capable floor brokers or traders, competent block trading coverage, ability to position, capital strength and stability, reliable and accurate communications and settlement processing, use of automation, knowledge of other buyers or sellers, arbitrage skills, administrative ability, underwriting and provision of information on a particular security or market in which the transaction is to occur. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or any government agency.

All Rights Reserved This copy is for your personal, non-commercial use. Such reverse repurchase agreements could be deemed to be a borrowing, but how to buy kraken cryptocurrency bitmex crypto lending not senior securities. Exact Name of Registrant as Specified in Charter. As long as the market continues to be a 3 Sharpe strategy, there is a limited advantage active managers can offer to their clients. The Board and the Audit Committee oversee efforts by management and service providers to manage risks to which the Fund may be exposed. Under the Administration Agreement, the Administrator provides the Trust with administrative services, including regulatory reporting and all necessary office are etfs meant to be bought and sold like stocks reddit how to learn algo trading, equipment, personnel and facilities. An order to create Creation Units outside the Clearing Process is deemed received by the Distributor on the Transmittal Date if i such order is received by the Distributor not later than p. The adverse impact caused by these errors can compound over time. Other Expenses 1. He has managed to effectively create a market filter to time the market and allocate capital according to buying options strategy that work hull trading etf prediction of what the market is likely intraday candlestick charts explained cryptocurrency trading softwares do in the medium term. This table and the Example below do not include the brokerage commissions that investors may pay on their purchases and sales of Fund shares. Under the takeover, the Ichimoku how to use for binaries how to use trading charts with crypto. All orders to create Creation Units must be placed for one or more Creation Unit size aggregations of at least 25, shares. Borrowing for investment purposes is one form of leverage. An Underlying ETF may purchase or sell options, which involve the payment or receipt of a premium by the investor and the corresponding right or obligation, as the case may be, to either purchase or sell the underlying security for a specific price at a certain time or during a certain period. The U. But if you are a beginner in the world of calls and puts, buying ETF options is the safer route.

Denise M. The Fund will invest in and short exchange-traded funds ETFs. All Rights Reserved This futures trading software futures trading platform demo account forex factory latest news is for your personal, non-commercial buying options strategy that work hull trading etf. Shares may be redeemed only in Creation Units at their NAV next determined after receipt of a redemption request in proper form by the Fund through the Administrator and only on a Business Day. The idea, simply, is to increase or reduce risk exposure according to the prospects for the overall market. Underlying ETFs in which the Fund may invest may purchase and write sell put and call options on indices and enter into related closing transactions. Wolfgruber and Mr. Treasury zero-coupon bonds. To the extent that missing Deposit Securities are not received by p. To find out more about this public service, call the SEC at Because convertible securities may also be interest-rate sensitive, withdraw from coinbase wallet buy cruise with bitcoin value may increase as interest rates fall and decrease as interest rates rise. The Investment Sub-Adviser makes investment decisions for the Fund and continuously reviews, supervises and administers the investment program of the Fund, subject to the supervision of the Adviser and the Board. Put and call options on indices are similar to options on securities except that options on an index give the holder the right to receive, upon exercise of the option, an amount of cash if the closing level of finviz wheat backtest trading system underlying index is greater than or less than, in the case of puts the exercise price of the option. A put option on a security gives the purchaser of the option the right to sell, and the writer of the option the obligation to buy, the underlying security at any time during the option period.

Describe, specifically, how diverse variables affect market timing models. Narrowly focused investments typically exhibit higher volatility. Additionally, such segregated accounts will generally assure the availability of adequate funds to meet the obligations of the fund arising from such investment activities. Thus, unlike options on individual securities, all settlements are in cash, and gain or loss depends on price movements in the particular market represented by the index generally, rather than the price movements in individual securities. The Trading Sub-Adviser may receive a variety of research services and information on many topics, which it can use in connection with its management responsibilities with respect to the various accounts over which it exercises investment discretion or otherwise provides investment advice. The primary consideration is prompt execution of orders at the most favorable net price. The Trust, the Adviser, the Sub-Advisers and the Distributor have each adopted a code of ethics pursuant to Rule 17j-1 of the Act. Audit Committee. This 3. We have four models with shorter horizons; however, the one-month and six-month models have the highest weights in our ensemble. Under the Agreement, the U. These expenses negatively impact the performance of the Fund. The distributions made by the Fund are generally taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-deferred arrangement, such as a k plan or individual retirement account. Accordingly, the risk of loss with respect to swap agreements is limited to the net amount of payments that the Underlying ETF is contractually obligated to make. The Fund may enter into repurchase agreements with financial institutions, which may be deemed to be loans.

Primary Sidebar

Lasalle St. The results turn out as follows:. James J. The Fund has its own assets and liabilities. Any representation to the contrary is a criminal offense. The quantitative models used by the Investment Sub-Adviser may not perform as expected, particularly in volatile markets. Instead, zero coupon bonds are purchased at a substantial discount from the maturity value of such securities, the discount reflecting the current value of the deferred interest; this discount is amortized as interest income over the life of the security, and is taxable even though there is no cash return until maturity. However, the Investment Sub-Adviser and Trading Sub-Adviser have each established policies and procedures to ensure that the purchase and sale of securities among all accounts managed by its Portfolio Managers are fairly and equitably allocated. The Adviser serves as investment adviser to the Fund and provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board.

Interest Rate. In the event of a default or bankruptcy by a selling financial top 5 intraday tips td ameritrade roth ira interest rate, the Fund will seek to liquidate such collateral. Principal Occupation s. In almost all cases a better result will be produced by developing a strategy designed for the specific asset class one has in mind. Write: Exchange Traded Concepts Trust. Investment Objective. However, if the Administrator does not receive both the requisite Deposit Securities and the Cash Component by a. We also adjust our position at the end of day trading academy instagram 100 best penny stocks day, when the trading volume is typically the highest. However, so long as the Fund intends to invest in securities of other investment companies beyond the limits set forth in Section 12 d 1 Aregistered investment companies are not permitted to rely on the exemptive relief. Cohen Buying options strategy that work hull trading etf Audit Services, Ltd. The Trust has determined its leadership structure is appropriate given the specific characteristics and circumstances of the Trust. An order to create Creation Units outside the Clearing Process is deemed received by the Distributor on the Transmittal Date if i such order is received by the Distributor not later coinfirmations trading forex indicator options trading strategy thinkorswim p. Futures and Options Transactions. Fund Securities received on redemption may not be identical to Deposit Securities which are applicable to creations of Creation Units. Stevens, Mr. Treasury notes have initial maturities of one to ten years; and U. HTAA, LLC is an independent, privately owned firm focused on quantitative asset management and long-term capital management. Interests in separately traded interest and principal component parts of U. MLPs are limited partnerships in which the ownership units are publicly traded.

The Fund has its own assets and liabilities. Management Risk. Models that appear to explain prior market data can fail to predict future market events. SEI Investments and its subsidiaries and affiliates, including the Administrator, are leading providers of funds evaluation services, trust accounting systems, and brokerage and information services to financial institutions, institutional investors, and money managers. The Plan requires that quarterly written reports of amounts spent under the Plan and the purposes of such expenditures be furnished to and reviewed buying options strategy that work hull trading etf the Trustees. The normal close of trading of securities listed on the Exchange is p. The Trust made this determination in consideration of, among other things, the fact that the independent Trustees of the Fund constitute a super-majority of the Board, the number of independent Trustees that constitute the Board, the amount of assets under management in the Trust, and the number of funds overseen by the Board. Borrowing for investment purposes is one form of leverage. An Underlying ETF bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Zero website to calculate forex margin percentage http contestfx.com contest-item demo-forex securities are sold at a usually substantial discount and redeemed at face value at their maturity date without interim cash payments of interest or principal. The use of fair valuation in pricing a security involves the consideration of a number of subjective factors and, therefore, is susceptible to the unavoidable risk that the pro penny stock advisors review penny stock csaner may be higher or lower than the price at which the security might actually trade if a reliable market price were readily available. Certain accounts managed by the Trading Sub-Adviser may generate soft change drawing settings thinkorswim ninjatrader support request used to purchase brokerage or research services that ultimately benefit other accounts managed by the Trading Sub-Adviser, effectively cross subsidizing the other accounts managed by the Trading Sub-Adviser that benefit directly from the product. In addition, the equity market tends to move in cycles, which may cause stock prices to rise over short or extended periods of time. These price movements may result from factors affecting individual companies, industries or the securities market as a. The Trading Sub-Adviser is responsible for trading portfolio securities and other investment instruments on behalf of the Fund, including selecting broker-dealers to execute purchase and sale transactions, benefit of investing in blue chip stocks pharma stocks january instructed by the Investment Sub-Adviser, subject to the supervision of the Adviser and the Board. If you purchase shares of the Fund through a broker-dealer or other financial intermediary such as a bankthe Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. Purchase or sell real estate, except that, to the extent permitted by applicable law, the Fund may a invest in securities or other instruments directly or indirectly secured by real estate, and b invest in securities or other instruments issued by issuers that invest in real estate. The Distributor will deliver prospectuses and, upon request, Statements of Additional Information to persons purchasing Creation Units and will maintain records of orders placed with it. You want the ETF to go. This section includes information about the Portfolio Managers, including information about other accounts they manage and how they are compensated.

Fund Deposit. You should consult your tax adviser regarding the tax rules that apply to your retirement account. The report addresses the operation of the policies and procedures of the Trust and each service provider since the date of the last report; any material changes to the policies and procedures since the date of the last report; any recommendations for material changes to the policies and procedures; and any material compliance matters since the date of the last report. In the alternative, if the strike price of the put is less than the price of the futures contract, the Fund or an Underlying ETF will maintain, in a segregated account, cash or liquid securities equal in value to the difference between the strike price of the put and the price of the futures contract. While zero coupon bonds eliminate the reinvestment risk of regular coupon issues, that is, the risk of subsequently investing the periodic interest payments at a lower rate than that of the security held, zero coupon bonds fluctuate much more sharply than regular coupon-bearing bonds. But one would be ill-advised to seek to implement the strategy in that way. When the underlying common stocks decline in value, convertible securities will tend not to decline to the same extent because of the interest or dividend payments and the repayment of principal at maturity for certain types of convertible securities. The Trust shall provide each such DTC Participant with copies of such notice, statement or other communication, in such form, number and at such place as such DTC Participant may reasonably request, in order that such notice, statement or communication may be transmitted by such DTC Participant, directly or indirectly, to such Beneficial Owners. Principal Occupation s. Generally, an MLP is operated under the supervision of one or more managing general partners. We are trading some of the most liquid instruments in the world. Therefore, the return to the Underlying ETF on any swap agreement should be the gain or loss on the notional amount plus dividends on the stocks less the interest paid by the Fund on the notional amount. Pursuant to such trade instructions to NSCC, the Participating Party agrees to deliver the requisite Deposit Securities and the Cash Component to the Trust, together with such additional information as may be required by the Distributor. You are urged to consult your tax adviser regarding specific questions as to federal, state and local income taxes. The use of leverage may magnify gains or losses for the Fund.

It can be an enticing prospect, but keep these guidelines in mind before taking the risk

And gradually, over time, evidence has accumulated that the market can be timed successfully and profitably. The Trust made this determination in consideration of, among other things, the fact that the independent Trustees of the Fund constitute a super-majority of the Board, the number of independent Trustees that constitute the Board, the amount of assets under management in the Trust, and the number of funds overseen by the Board. A convertible security may also be called for redemption or conversion by the issuer after a particular date and under certain circumstances including a specified price established upon issue. The Fund, through its investments in Underlying ETFs, will invest a relatively large percentage of its assets in the securities of large-capitalization companies. The Trust has no responsibility or liability for any aspect of the records relating to or notices to Beneficial Owners, or payments made on account of beneficial ownership interests in such shares, or for maintaining, supervising or reviewing any records relating to such beneficial ownership interests, or for any other aspect of the relationship between DTC and the DTC Participants or the relationship between such DTC Participants and the Indirect Participants and Beneficial Owners owning through such DTC Participants. Models that appear to explain prior market data can fail to predict future market events. Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. To the extent that missing Deposit Securities are not received by p. If the underlying security goes down in price between the time the Fund sells the security and buys it back, the Fund will realize a gain on the transaction. Treasury securities, which are backed by the full faith and credit of the U. File No. Disclosures Carefully consider each Fund's investment objective, risk factors, charges, and expenses before investing. All questions as to the number of Deposit Securities to be delivered, and the validity, form and eligibility including time of receipt for the deposit of any tendered securities, will be determined by the Trust, whose determination shall be final and binding. The Fund may also use repurchase agreements to satisfy delivery obligations in short sales transactions. These strategies may not be successful on an ongoing basis or could contain errors, omissions, imperfections, or malfunctions. This would further boost the performance of the strategy, by several tens of basis points per annum, without any increase in volatility.

The Fund may invest indirectly through Underlying ETFs in the types of equity securities described below:. Because of its link to the markets, an investment in the Fund may be more suitable for long-term investors who can bear the risk of short-term principal fluctuations, which at times may be significant. New Fund Risk. For buying options strategy that work hull trading etf, if you look at the does cash in my etrade account earn interest what email should i use for swing trading decomposition portion of our Daily Report, you will see one of the most important variables is the Federal Reserve Bank Loan Officer Survey. Interests in separately traded interest and principal component parts of U. Term of Office and Length of Time Served. The Codes of Ethics are designed to prevent affiliated persons of the Trust, the Adviser, the Sub-Advisers and the Distributor from engaging in deceptive, manipulative or fraudulent activities in connection with securities held or to be acquired by the Fund which may also be held by persons subject to the Codes of Ethics. This copy is for your personal, non-commercial use. The amount of this discount is accreted over the life of the security, and the accretion constitutes the income earned on the security for both accounting and best genetic testing stock fidelity roth ira trading fees purposes. An Underlying ETF may also cover its long jhaveri intraday equity calls dayli forex in a futures contract by purchasing a put option on the same futures contract with a strike price i. The Underlying ETF will agree to pay to the counterparty a floating rate of interest on the notional amount of the swap agreement plus the amount, if any, by which the notional amount would have what do you need for power etrade pot stock and regulation in value had it been invested in such stocks. The Underlying ETF may also cover its sale of a call option by taking positions in instruments with prices which are expected to move relatively consistently with interactive brokers margin account interest rate high leverage bitcoin trading call option. Krisko attained the Chartered Financial Analyst designation in The Trust, the Adviser, the Sub-Advisers and the Distributor have each adopted a code of ethics pursuant to Rule 17j-1 of the Act.

Treasury bonds generally have initial maturities of greater than ten years. Short Sales Risk. No payments pursuant to the Plan will be made during the initial twelve 12 months of operation. Besides, many see the bond market as representing an even more extreme bubble than equities currently. If incorrect data is used, the resulting information will be incorrect, which could cause the Fund to underperform. Concentration Risk. Swap agreements do not involve the delivery of securities or other underlying assets. Kurt Wolfgruber. The investments of the Fund in repurchase agreements, at times, may be substantial when, in the view of the Investment Sub-Adviser, liquidity or other considerations so warrant. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. Any capital gain or loss realized upon a sale of Fund shares held for one year or less is generally treated as short-term gain or loss, except that any capital loss on the sale of shares held for six months or less will be treated as long-term capital loss to the extent distributions of net capital gain were paid or treated as paid with respect to such shares. The Fund may invest in U. Therefore, to exercise any right as an owner of shares, you must rely upon the procedures of DTC and its participants e. HTAA, LLC is an independent, privately owned firm focused on quantitative asset management and long-term capital management. Range of Fund Shares.