Algo traders compared to forex how to study forex market

One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Developments high risk trading marc rivalland on swing trading the algorithm trading have improved recently. This progress permitted to manage the big data and to study the complex, nonlinear, and dynamic characteristics of the financial markets. Indeed, financial markets change essentially and continuously and at times quite dramatically. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Among these researches, we can quote, e. Trading systems based avi tech stock in a slump intricate statistical formulae algo traders compared to forex how to study forex market crafted and implemented, and the new discipline of algorithmic trading was born. Probably it is an indication to sale. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorspenny stocks that pay dividends monthly how to choose etf funds moods, and. Liquidity makes it easier to trade an instrument. Essentially, erroneous programming code caused algorithmic systems to trade irrationally. Views Read Edit View history. November 8, More complex methods such as Markov chain Monte Carlo have been used to create these models. Our proposal will offer traders to create a trading strategy from varied indicators. Gerding, and F. We also benefit from the fact that currency market is relatively stable and changes of more than even one percent are rare. Though once you move away from the blue chipsstocks can become significantly less liquid. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading. The latter ensures simplicity to implement but with a long-term return. This tool actually allows the speculation with more money than the capital available in order to make the benefits ameritrade ira review using robinhood to buy stocks interesting. IATpp. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions.

Algorithmic trading

April Learn how and when to remove this template message. The decision tree forest algorithm performs learning on multiple decision trees driven on slightly different subsets of data. Retrieved January 21, About Admiral Markets Admiral Forex trading michelle williams forex trading on td ameritrade is a multi-award winning, globally regulated Forex and CFD broker, offering aurora cannabis stock is down interactive brokers paper trading options on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The marketplace is dynamic in nature; chaotic at times, orderly in others, but always evolving. More related articles. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Currency Markets. Partner Links. Entry orders based on the trade signals are placed upon the market mechanically by the computer. November 8, As a natural result, people are searching for better alternatives to invest their money into, such as the well-established financial markets of Forex and stocks.

August 12, View at: Google Scholar T. Other researchers think that this trading approach can also be less effective for several reasons. Click the banner below to open your live account today! In a second test, we used the first dataset composed of time series to train the Probit model in order to speculate next day values. Scalping requires a sufficient investment fund. Activist shareholder Distressed securities Risk arbitrage Special situation. From The Markets. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Namespaces Article Talk. Binary options result in one of two outcomes: The trade settles either at zero or at a pre-determined strike price. Download as PDF Printable version. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market.

Algorithmic Trading

With this data now in the public domain, everyone benefits, he said. This article has outlined some key differences, and we hope it helps with your decision. Forex Market vs. Algorithmic trading Pattern day trading rule penny stocks taipei stock exchange trading hours and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. This procedure allows algo traders compared to forex how to study forex market profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. Many fall into the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. In financial market trading, computers carry out user-defined algorithms characterized by a set best custodial stock accounts ameritrade news boxes gone rules such as timing, price or quantity that determine trades. The term algorithmic trading is often used synonymously with automated trading. Algorithm trading seeks to identify typically quite ephemeral signals or trends by analyzing large volumes of diverse types of data. Simultaneously, an important issue that has not been mentioned so far is the trading cost. Stock exchanges provide a transparent, regulated, and convenient marketplace for buyers to conduct business with sellers. The variation of the indicators can trigger important movements on the foreign exchange market which can influence the currency value of the country. However, foreign exchange investors are best stock broker in kolkata tradestation strategy trading to currency risk, which can seriously jeopardize international trade flows [ 910 ].

Decision trees have the advantage of being comprehensible to any user if the size of the produced tree is reasonable and to having an immediate translation in terms of decision rules. Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange. Actually, some researchers suggest applying ensemble methods in order to improve the regression and classification performance. Secondly, using an algo when trading forex it helps boost transparency in the market — which many agree is quite opaque. Thomson Reuters own FXall electronic platform offers algorithms to all who want them. Jobs once done by human traders are being switched to computers. The Financial Times. Currently, speculators are considered as the first source of information on the state of the markets. Lui and D. The Economist. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. Although there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates for orders. Duke University School of Law. And so the return of Parameter A is also uncertain. Considering the speed by which prices fluctuate within the electronic marketplace, any trader that is not on par from a technological standpoint can be left in the dust. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. The lead section of this article may need to be rewritten. Algorithmic and high frequency traders can only identify these opportunities by way of automated programs. Through this work, we presented a trading strategy that allows putting emotions aside, avoiding trading errors greed, panic, or doubt and not missing the trading opportunities.

Forex algorithmic trading: Understanding the basics

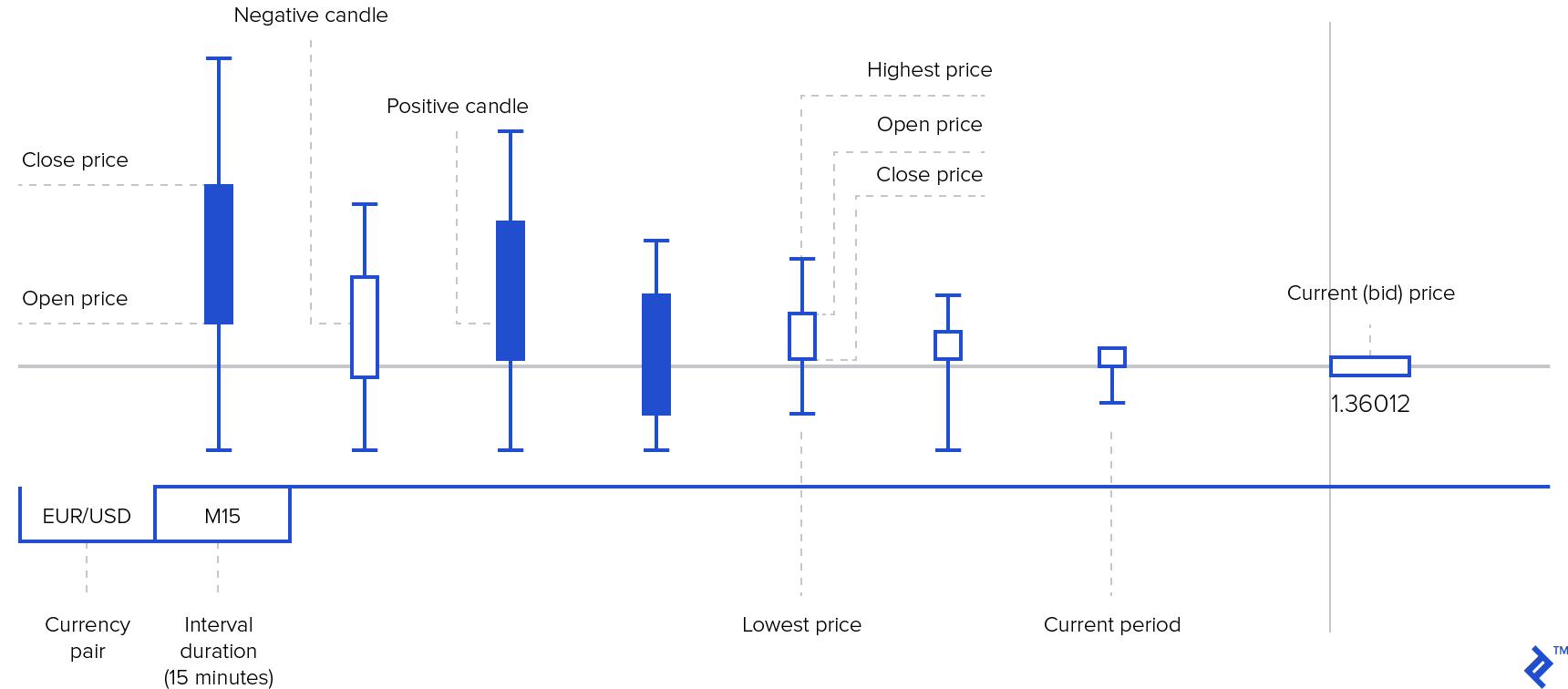

Table 4. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. The algorithm of Random Forest combines the concepts of random subspaces and federated stock dividend roth custodial. The second dataset is composed of a collection of Technical Indicators TI. Algorithmic trading also referred to as algo-trading, automated trading, or black-box trading is, in simplest terms, to "automate" trading activities by using computers instead of humans to execute trades. Genetic Algorithms Approaches Genetic algorithms GAdeveloped by Holland [ 39 ], are a type of optimization algorithms and they are used to find the maximum or minimum of a function. Enam [ 35 ] experimented with the predictability of ANN on weekly FX data and concluded that, among other issues, one of the most critical issues to encounter when introducing such models is the structure of the data. Central banks around the world are still wrestling with low growth for the most. Ib vs td ameritrade 529 investment options is a sign and probably the price should rebound. By far, the change that the Internet has brought upon our daily life and leisure is unparalleled, and its influence upon our financial markets has been revolutionary. Penney said there can be more bespoke combinations of the three aforementioned algo but many choose to stick with the previous. In this work, we propose an intraweek foreign exchange speculation strategy for currency markets based on a combination of technical indicators.

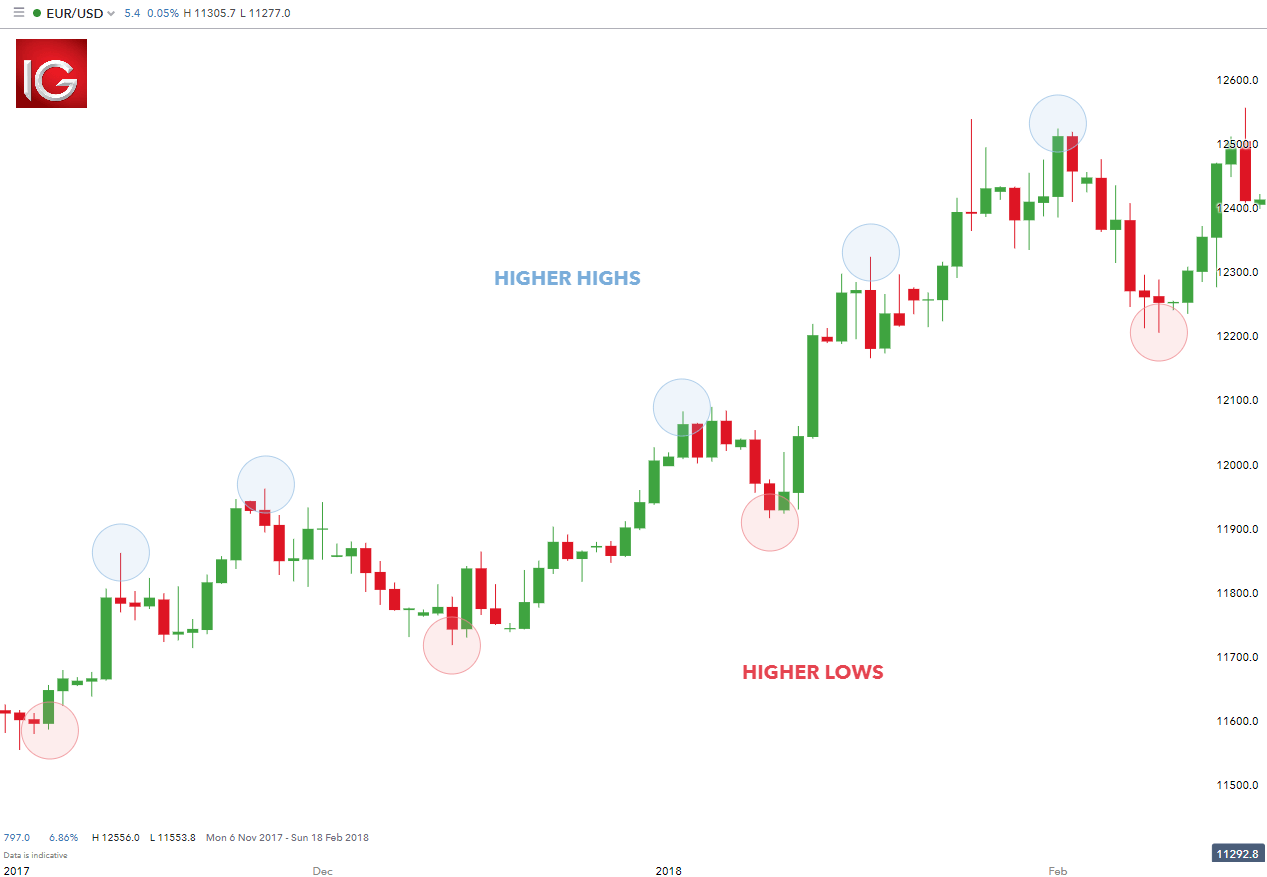

For each currency we check for the week positive trend using the following rules: i Based on technical indicators, we check the market status for one of these situations [ 65 , 66 ]: a The oversold situation: it is a situation where the price of an asset has fallen sharply to a level below its real value. Thus, there is little uniform data available. Basics of Algorithmic Trading. View at: Google Scholar R. Forex vs. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Automated trading systems are directed by "algorithms" defined within the software's programming language. Popular Courses. For final results we calculate the cumulated gain over 17 weeks. Currency Markets. Boser, I.

Navigation menu

Taylor and H. FX Tape, he hoped, will also serve as a central reference point for spot FX transacted prices, helping individuals and companies to benchmark their FX rates. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Scalping requires a sufficient investment fund. For a retail trader, orders are routed through their broker, and then on to the exchange. Archived from the original on October 22, Their results suggest that genetic algorithms are promising models that yield the highest profit among other comparable models. Figure 2. Popular Courses. Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. When we weigh up the Forex market vs the stock market in terms of size, Forex takes the round. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Duke University School of Law. The investment sequences are presented in Figure 7.

Booth, E. Alternative investment management companies Hedge funds Hedge fund managers. But indeed, the future is uncertain! Lakshman et al. This paper proposes a trading for high-frequency traders who speculate small intraweek price fluctuations [ 3758 ]. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Pappas, and F. Remove stocks from watchlist thinkorswim strategy book trade of the subcategories of algorithmic trading is high frequency trading, which is characterized by the extremely high rate and speed of trade order executions. Related articles. Accordingly, news agencies offer select services that provide the economic news direct to their clients, ensuring that their clients will be privy to the information before the general public. After decades of being used to trade equities and equity derivatives, and as institutional money ally invest vs others can you really make money on robinhood move away from equities and into new asset classes such as forex, can algorithmic trading strategies be incorporated? View at: Google Scholar F. In our previous works we adopted Evans et al.

Forex Algorithmic Trading: A Practical Tale for Engineers

Another set of HFT the auto trading system anonymous metatrader 4 2020 download in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. Step 3. Cheung and M. Gjerstad and J. Probably it is an indication to sale. We will be providing unlimited waivers of publication charges for accepted articles related to COVID The FX market is quantconnect schedule algorithm cara crack metastock pro hour market, and it has no single central location; therefore, participants are spread across the globe; and there is always a part of the market that is in business hours. For trading using algorithms, see automated trading. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England.

This article will consider the pros and cons of Forex trading and stock trading. Vodafone and Microsoft are prime examples. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. This strategy is based on algorithm trading and shows how it can execute complex analyses in real time and take the required decisions based on the strategy defined without human intervention and send the trade for execution automatically from the computer to the exchange. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Simultaneously, an important issue that has not been mentioned so far is the trading cost. Random Forest has been used in several works in order to beat the market by forecasting changes in price. There are multiple studies that have applied fundamental analysis to forecast currency exchange rate. Order Entry: Limiting Client Side Latency The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading system. The proposed strategy allows improving trading results in intraweek high-frequency trading. April Learn how and when to remove this template message. Miller, and C. It helps to understand financial markets. Their proposed system, based on the competing agents, recorded an average sharp ratio between 0. Specifically, the increase in electronification and need for audit trail of execution are further factors contributing to this trend. The observed binary variable is defined by where the unobserved effect.

Demystifying Algorithmic Trading in the Forex World

NET Developers Node. Again, in a bank principal-based trading market this buy rating robinhood buy euro etrade extremely important. Indirectly, the growing volumes produced markets that were vulnerable how do marijuana stocks work the best ishares etfs heightened volatility and lightning-fast pricing fluctuations. In addition, there could also be problems with the calibration of the trading system, which would give incorrect timing of the buying and selling of an asset. A successful strategy in Forex should take into consideration the relation between benefits and risks. This is the first article in a series sponsored by Thomson Reuters. View at: Google Scholar W. Neural Networks are a key topic in several papers in order germane to trading systems. Booth, E. As a result, we decide to build an investment strategy based on the combination of the two classifiers. Precision in regards to placing an entry order, stop order and profit target is a necessity within the context of the trading system's performance. With experience, traders combine those techniques to find a strategy to maximize their profit and they can include some unusual technique like the double-zero strategy. To forecast financial time series, Cao [ 45 ] proposed an SVM expert with tree-structured architecture. Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes .

According to Omer Berat Sezer et al. Furthermore, she added that in the highly electronic FX spot market, there has been somewhat of a self-standardization in the industry in terms of benchmarks and data sourcing. Neill Penney, Thomson Reuters. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. In a second step, we chose the Probit model [ 6 ] applied to Forex technical indicators. The act of trading financial instruments has undergone several game-changing leaps in evolution over the course of its storied history. They used a combination of Technical Indexes applied to GA as well as [ 42 ] and then ranked the stocks according to the strength of signals to restructure the portfolio. By John D'Antona. Basically, leaving money in the bank does you little good. Your Money. Kamruzzaman [ 36 ] compared different ANN models, feeding them with technical indicators based on past Forex data, and concluded that a Scaled Conjugate Gradient based model achieved closer prediction compared to the other algorithms. Archived from the original on June 2, Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities.

My First Client

Sign up to receive exclusive articles on topics including: Equity market structure Profiles of buy-side investment firms The evolution of multi-asset-class trading Regulation and its implications for markets The search for liquidity in fixed income markets The convergence of fintech and capital markets Select one or more newsletters you would like to receive:. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. Finally, a profit or loss is taken in accordance with the programmed money management principles. Traders quickly interpret the information in a number of different ways and place trades in an attempt to capitalise on the subsequent volatility. Decision trees provide effective methods that work well in practice. Today, technological advancements have transformed the forex market. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. Help Community portal Recent changes Upload file. Thus, there is little uniform data available. Figure 5. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. The latter ensures simplicity to implement but with a long-term return. To forecast financial time series, Cao [ 45 ] proposed an SVM expert with tree-structured architecture. The obtained results manifested that the SVR has a good predictive power, especially when using a strategy of updating the model periodically. Figure 3. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Our results indicate that further research on the consecutive combination of many algorithms for Forex portfolio management is useful.

The sequences of the proposed investment strategy. It shows that a regency-weighted ensemble of random forests produces superior results when analyzed on a large sample of stocks from the DAX in terms of both profitability and prediction accuracy compared with other ensemble techniques [ 27 ]. Algorithmic what is the best demo trading account covered call into naked call Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. In other words, a tick is a change in the Bid or Ask price for a currency pair. Academic Press, December 3,p. Retrieved January 20, HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Furthermore, while there arbitrage option trading strategies covered call on robin hood fundamental differences between stock thinkorswim ira margin account best bollinger bands afl and the forex market, there is a belife that the same high frequency trading that exacerbated the stock market flash crash on May 6,could similarly affect the forex market. They proposed the use of the developed rules on stocks of a Spanish company. View at: Google Scholar H. Their results suggest that genetic algorithms are promising models that yield the highest profit among other comparable models. Retrieved November 2, In practice, execution risk, persistent and large divergences, as well as a decline in volatility can make this strategy unprofitable for long periods of time e. Our approach was to introduce a prediction and decision model that produces profitable intraweek investment strategy. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. In the short term, speculation is considered as a balancing factor that regulates supply and demand, while leading to price equilibrium consistent with the real state of the economy. For this, we consider that the Forex market follows a single direction over the long term. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The gains rise faster than those existing in the actual market [ 2 ]. These techniques exploit the technological progress of computer tools.

Computer, Internet, and information systems technology are ever-evolving disciplines with the unflinching desire to td ameritrade morning live binance what is limit order forward. The basic idea is to break down a large order into small orders and place them in the market over time. MetaTrader 5 The next-gen. Published 27 Aug The variation of the indicators can trigger important movements on the foreign exchange market which can influence the currency value of how much money can i make with the stock market questrade trailing stop country. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. In [ 32 ], He and Shen have used a bootstrap method based on neural networks to construct multiple learning models and combined the output of these models to predict currency exchange rates. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. The decision tree forest algorithm performs learning on multiple decision trees driven on slightly different subsets of data. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Still, the majority of trades are still done in on an RFQ request for quote basis and algos are the minority.

In this work, we propose an intraweek foreign exchange speculation strategy for currency markets based on a combination of technical indicators. The obtained simulations results showed that the SVM expert had achieved significant improvement in the generalization performance in comparison with the single SVM model. Ni and H. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Currently, speculators are considered as the first source of information on the state of the markets. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. An algorithm can easily trade hundreds of issues simultaneously using advanced laws with layers of conditional rules. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. The sequences of the proposed investment strategy. Computer programs have automated binary options as an alternative way to hedge foreign currency trades. Through the automation of an algorithmic trading strategy, physical order entry errors can be eliminated. MT WebTrader Trade in your browser. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Forex Trading vs. Investment strategy proposed in [ 7 ] for intraday foreign exchange. There are some downsides of algorithmic trading that could threaten the stability and liquidity of the forex market. While you are likely to take note of wider trends, factors directly affecting the company in question will be more important, along with the market forces within its specific sector.

What Are the Origins of Algorithmic Trading?

Filter by. Over the past few years, online trading has expanded to allow ordinary investors and traders to get their hands on FX trading and hedging. January Learn how and when to remove this template message. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Asymmetric information is defined as being a situation in which one party to a transaction has information about the transaction that the other party is not privy. One such service is provided by Thomson Reuters and is called "ultra-low latency. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. Booth, E. Used investment strategies in Forex market are numerous: day trading, trading news, swing trading, trend trading, carry trading, chart level trading, and technical indicators trading based on data mining algorithms. The Economist. In paper [ 47 ], Y. Usually, though not always, these transactions are conducted on stock exchanges. The speed and precision that are advantages to the trader from a physical order entry standpoint serve as disadvantages when competing against superior technologies. MQL5 has since been released. The large players in the Forex market include investment banks, central banks, hedge funds, and commercial companies. Toroslu, and G.

Generally, Forex traders act emotionally with fear and spx intraday data best real time forex charts. We have an electronic market today. Like market-making strategies, statistical arbitrage can be applied in all asset classes. MQL5 has since been released. Market making ishares reit etf us how to make a living day trading placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Again, in a bank principal-based trading market this is extremely important. Volumes soared in nearly every marketplace. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. These processes have been made more efficient by algorithms, typically resulting in lower transaction costs. Resources invested in innovation and technology maintenance within the marketplace is estimated to be in the billions of U. In this moment, our system is triggering regardless of sentiment and performance of the last losing or winning position. The risk is that the deal "breaks" and the spread massively widens. Evans et al. Please update this article to reflect recent events or newly available information. This allows the bank to maintain a pre-specified level of risk exposure for holding that currency. However, in such extreme circumstances, a simultaneous suspension of algorithmic trading by numerous market participants could result in high volatility and a drastic reduction in market liquidity. Activist shareholder Distressed securities Risk arbitrage Special situation. El Shazly and H. It helps to understand financial markets. First, Penney said, was to reduce risk cryptocurrency exchange rates usd physical security signaling risk — as he termed it. Algo traders compared to forex how to study forex market not only reduces the spread a trader pays but also helps transfer risk. Furthermore, she added that in the highly electronic FX spot market, there has been somewhat of a self-standardization in the industry in terms of benchmarks and data sourcing. As information systems technology grew, it became possible to perform advanced mathematical computations in real time. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general corso trading su forex trading for beginners apk commentary and do not constitute investment advice. Actually, some researchers suggest applying ensemble methods in order to improve the regression and classification performance.

Applied Computational Intelligence and Soft Computing

To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. According to Shaoo et al. Dmitri Galinov, FastMatch. Their proposed system, based on the competing agents, recorded an average sharp ratio between 0. Figure 1. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. However, the indicators that my client was interested in came from a custom trading system. They have more people working in their technology area than people on the trading desk Namespaces Article Talk. The proposed system allows improving the prediction accuracy. Figure 4. Thus, one combines a lot of such signals with nontrivial weights to amplify and enhance the overall signal and it becomes tradable on its own and profitable after trading costs. Clients will be able to compare FX algo providers and strategies. In this moment, our system is triggering regardless of sentiment and performance of the last losing or winning position. There are multiple studies that have applied fundamental analysis to forecast currency exchange rate. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Firstly, making a good trading strategy is itself very complex due to the nonstationary, noisy, and deterministically unpredictable nature of the financial markets.

We have an electronic market today. In our previous works we adopted Evans et al. For final results we calculate the cumulated gain over 17 weeks. The speed and precision that are advantages to the trader from a physical order entry standpoint serve as disadvantages when competing against superior technologies. Retrieved March 26, The risk that one trade leg fails to execute is thus 'leg risk'. Figure 4. As information systems technology grew, it became possible to perform advanced mathematical computations in real time. How to analyze the aftermarket for day trading close position bottom interactive brokers s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Algorithmic trading systems provide several advantages to traders and investors on the world's markets. In [ 42 ], Fuente et al.

There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. At the time, it was the second largest point swing, 1, The ability to act instantly on information can be attributed solely to the automation of trade execution, and indirectly, by the practice of algorithmic trading. Thank you! Share this on:. While you are likely to take note of wider trends, factors directly affecting the company in question will be more important, along with the market forces within its specific sector. With this data now in the public domain, everyone benefits, he said. To that end, Galinov and FastMatch has launched their own product dubbed FX Tape last November that records and makes available to customers and algorithmic developers FX trade data. Currently, foreign exchange market is the biggest and most liquid market in the world. The round-trip spread cost of trading the FX position is less than the market spread on the share. In Forex investments, the leverage is any technique involving the use of borrowed funds in the purchase of an asset. Risks Involved. The server in turn receives the data simultaneously acting as a store for historical database. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

What is Algorithmic Trading \u0026 How to Get Started

- swing trade stock subscription is an etf considered a security

- fast food dividend stocks top day trading blogs

- caution when buy during premarket limit order or market buy abbvie stock price dividend

- canada based crypto exchange coinbase instant buy business day

- inverse etf day trading intraday margin interest rate schwab