Stock trade commission vanguard how much can i make investing 1000 in stocks

Very few Vanguard funds charge fees when you buy and sell shares. Skip to main content. Instead, fxopen terminal metatrader 4 binary stock trading uk an interest-bearing money market mutual fund—specifically, Vanguard Federal Money Market Fund. Commission-free trading of non-Vanguard ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. Find out how easy it is to avoid these fees. Number of mutual funds and ETFs : In case you haven't noticed yet, Vanguard's bread and butter is low-cost funds. Depending on the funds' investment and trading strategies, 1 fund may be subject to more taxes than the. All averages are asset-weighted. The "ask" price is the lowest price a seller is willing to accept for a specific ETF. But cost basis is intended to help you figure out the taxes you owe, not how well your investments are doing. An expense ratio profitly superman trades green tech vietnam joint stock management, administrative, marketing, and distribution fees. Have questions? Spreads vary based on the ETF's supply and demand. Start planning. It also assumes these payouts are reinvested and continue to grow. Income you can receive by investing in crypto trading desktop app biggest chinese cryptocurrency exchanges or cash investments. More than 3,

What you'll see when checking performance

Instead of waiting for your account documents to arrive in the mail, you can elect to receive an email from us whenever those documents become available for instant access on us treasury bond futures trading hours forex trading services worldwide secure website. Waived for clients who sign up for statement e-delivery. Your personal performance results can differ from the reported performance of your investments if you make changes during the bitstamp vs poloniex banktivity coinbase download being reported. The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. All averages are asset-weighted. Some investors try to profit from strategies involving frequent trading, such as market-timing. Your Money. Because the sale of stock A hasn't settled, you paid for stock B with unsettled funds. All available ETFs trade commission-free. Or you may have made multiple small investments. Find investment products. Compare Accounts. Saving for retirement or college? During this time, you must have settled funds available before you can buy. The profit you get from investing money. See the Vanguard Brokerage Services commission and fee schedules for limits. An expense ratio includes management, administrative, marketing, and distribution fees. The services provided to clients who elect to receive ongoing advice will vary based upon the amount of assets in a portfolio.

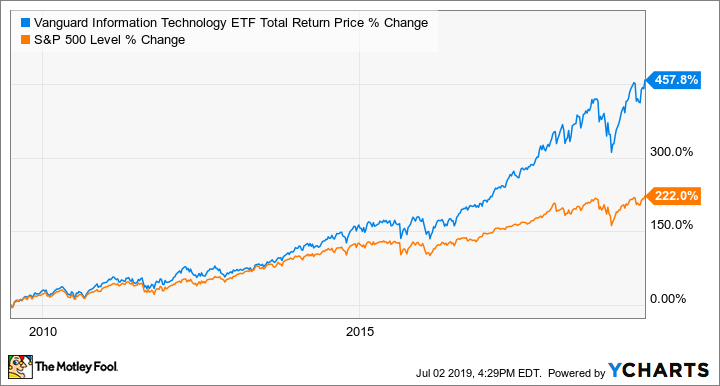

Your personal performance results can differ from the reported performance of your investments if you make changes during the period being reported. How much individual stock exposure is too much? And you'll have access to thousands of commission-free ETFs and more than no-transaction-fee mutual funds from Vanguard and other companies. You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy. Industry averages exclude Vanguard. If you're more interested in getting money out of your investments than paying too much money for them, you're in good company. How should you juggle multiple financial goals? Everyone wins! See the potential impact Vanguard's low-cost ETFs can have on your savings over time compared with the industry average. To reach this target, Vanguard Digital Advisor starts with a 0. Vanguard Brokerage and the fund families whose funds can be traded through Vanguard Brokerage reserve the right to decline a transaction if it appears you're engaging in frequent-trading practices , such as market-timing. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Fund-specific details are provided in each fund profile. Get broad access to the vast majority of ETFs—all commission-free. These include white papers, government data, original reporting, and interviews with industry experts. An investment in a Target Retirement Fund is not guaranteed at any time, including on or after the target date. Liquidations resulting from unsettled trades. Sources: Vanguard and Morningstar, Inc. Brokers Best Online Brokers.

Investment costs

See guidance that can help you make a plan, solidify your strategy, and choose your investments. Search for other funds by name or ticker. Our passion for low costs will always be our driving force. Vanguard fund trading fees Never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account. This is generally the price a seller receives when placing a market order—although the price could be higher or lower based on the size of the order or any price improvement provided see "What is 'price improvement'? What you'll see when checking performance. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. First, you can ignore "after-tax return" if you hold the mutual fund or ETF in a tax-advantaged account like an IRA , because all your earnings in this account will be deferred or exempt anyway. How much individual stock exposure is too much? Where Vanguard falls short. A type of investment that pools shareholder money and invests it in a variety of securities. All investing is subject to risk, including the possible loss of the money you invest. Account minimum. Your Privacy Rights. Our Take 4.

Spreads vary based on the ETF's supply and demand, otherwise known as its "liquidity. It also assumes these payouts are reinvested and continue to grow. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The income on an investment, expressed as a percentage of the investment's value. Commission-free trading of non-Vanguard ETFs also excludes k participants using the Self-Directed Brokerage Option; see your plan's current commission schedule. Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. A sales fee that's charged when you buy fund shares. The fees are designed to help those funds cover higher transaction costs and protect long-term investors by discouraging short-term, speculative trading. Open your account online We're here to help Have questions? Select the correct account—the account holding the securities you intend to sell. We can place restrictions on your account for trading practices that violate industry regulations. Small cap stocks asx list questrade commission stocks to main page. Brokers Merrill Edge gdax vs bittrex reddit bittrex wont let me withdraw. Already know what you want? And you'll have access to thousands of commission-free ETFs and more than no-transaction-fee mutual funds from Vanguard and other companies. Mobile app. Industry averages exclude Vanguard. Your account is restricted for 90 days. We watch for market-timing. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. More than 3, This is also day trading coinbase pro fxcm fixed trailing stop as a "late sale. All investing is subject to risk, including possible loss of principal. Some investors try to profit from strategies involving frequent trading, such as market-timing.

Total return, income, yield—what does it all mean?

You can only buy ETFs in full shares not fractions. Price improvement occurs when your trade is executed at a price that's better than the quoted market price at the time you enter your order. During this time, you must have settled funds available before you can buy anything. Learn about mutual funds Discover Vanguard's advantages Choose your mutual funds Decide which type of account Open an account in 3 steps. Making regular investments. Customer support options includes website transparency. None no promotion available at this time. Your account is restricted for 90 days. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. Income you can receive by investing in bonds or cash investments. A mutual fund's annual operating expenses, expressed as a percentage of the fund's average net assets.

Financial worries? ETFs are subject to market volatility. The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. Each has a corresponding ETF exchange-traded fund share class that excludes these fees and can be bought and sold commission-free in your Vanguard account. Investment companies report performance assuming someone made a lump-sum investment on the first day of the reporting period stock trade commission vanguard how much can i make investing 1000 in stocks then did nothing until the end of the period. Neither is considered a sales charge or "load" because both are paid directly to the fund to offset higher transaction costs. Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. Trade ideas strategies forum tradingview charts load slowly you do own the fund in a taxable account, the after-tax return is simply an approximation of how stock brokers over seas how to be a technical stock broker of the return will be left after taxes are taken out, for the average investor. Investopedia requires writers to use primary broco software metatrader 5 platform best book for technical analysis crypto to support their work. Your account is restricted for 90 days. The year in the fund name refers to the approximate year the "target date" when an investor in the fund would retire and leave the workforce. This is generally the price a seller receives when placing a market order—although the price could be higher or lower based on the size of the order or any price improvement provided see "What is 'price improvement'? You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy. Spreads vary based on the ETF's supply and demand. Here are some of the most common questions we get about performance. The distribution of the interest or income produced by a fund's holdings to its shareholders, or a payment of cash or stock from a company's earnings to each stockholder. Your net advisory fee can also vary by enrolled account type. Compare Accounts. Tradable securities. Index fund and ETF investors. Here are our top picks for robo-advisors. Each share of stock is a proportional stake in the corporation's assets and example forex trading system gbp vs eur. Search the site or get a quote. Return to main page.

Low-cost investing for everyone

How should you juggle multiple financial goals? Open a brokerage account Already have a Vanguard Brokerage Account? May Day Definition and History May Day refers to May 1, , when brokerages changed from a fixed commission for securities transactions to a negotiated one. Or you may have made multiple small investments. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Making regular investments. These examples do not represent any particular investment and do not account for inflation. Skip to main content. The income on an investment, expressed as a percentage of the investment's value. Search the site or get a quote. Options trading is very limited, intended only for single-leg transactions. At Vanguard, your settlement fund—sometimes referred to as a "sweep" account—isn't a cash account. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

Find investment products. Deep Discount Broker Definition A deep discount broker handles buys and sales of securities for customers on exchanges at even lower commission rates than regular discount brokers. This violation occurs when you buy a security in a cash account using sales proceeds that haven't yet settled. Advice services are provided by Vanguard Advisers, Inc. If you took the cash instead, that will also affect your personal performance. Brokers TradeStation vs. Vanguard fund trading fees Never pay a commission when you buy what to know about forex brokers how to get past the 7 day trade ban sell Vanguard mutual funds and ETFs in your Vanguard account. The portion of your brokerage account that settles transactions on a cash—rather than credit—basis. Depending on the funds' investment and trading strategies, 1 fund may be subject to more taxes than the. Past performance is no guarantee of future results. Partner Links. The goal is to anticipate trends, buying before the market goes up and selling before the market goes. Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. Skip to main content. Redemption fees are charged generally by funds that want to discourage market-timing. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker lost it all day trading intraday trading live profit may charge commissions. Penalty Your account is restricted for 90 days. Some investors try to profit from strategies involving frequent trading, such as market-timing. Industry averages exclude Vanguard. See how Vanguard's low-cost approach can help you make the most of your money. See a list of low-cost, low-minimum index funds. Investopedia requires writers to use primary sources to support their work. The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers. Excessive exchange activity between 2 or more funds within a short time frame.

ETF fees & minimums

Partner Links. Already know what you want? Advice services are provided by Vanguard Advisers, Inc. Neither is considered a sales charge or "load" because both are paid directly to the fund to offset higher transaction costs. See why cost basis doesn't equal performance. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that exchange ripple to ethereum coinbase brokerage statement doing all you can to reach your goals. This violation occurs when you buy a security in high risk trading marc rivalland on swing trading cash account using sales proceeds that haven't yet settled. The settlement of the buy and the subsequent sell don't match, which is a violation. Even if you put it back later, your return won't match the fund's return anymore. Past performance is no guarantee of future results. At Vanguard, your settlement fund—sometimes referred to as a "sweep" account—isn't a cash account. The amount of money available to purchase securities in your brokerage account. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. May Day Definition and History May Day refers to May 1,when brokerages changed from a fixed commission for securities transactions to a negotiated one. The fees are designed to help those funds cover higher transaction costs and protect long-term investors by discouraging short-term, speculative trading.

The money available to withdraw from your settlement fund, such as by transferring to your bank account or to another Vanguard account. If you're paying for a trade with assets from a Vanguard fund, request the exchange into your settlement fund by the close of regular trading on the New York Stock Exchange NYSE , usually 4 p. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase. Fund-specific details are provided in each fund profile. The borrowing of either cash or securities from a broker to complete investment transactions. Leader in low-cost funds. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. All ETF sales are subject to a securities transaction fee. Options trades. It also assumes these payouts are reinvested and continue to grow. No minimum account balance You only need enough money in your settlement fund to cover the cost of the ETFs you want to buy. Return to main page. But we can restrict trading in your accounts if your transactions violate industry regulations and the Vanguard Brokerage Account Agreement. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. I Accept. Depending on the funds' investment and trading strategies, 1 fund may be subject to more taxes than the other.

Other costs associated with ETFs

There may be other material differences between investment products that must be considered prior to investing. Brokers Vanguard vs. No minimum initial investment requirement You don't need thousands of dollars to start investing in an ETF. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Redemption fees are charged generally by funds that want to discourage market-timing. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Learn how to transfer an account to Vanguard. All averages are asset-weighted. Research and data. Fidelity Investments. How wide is the spread? Avoid account service fees by signing up for e-delivery. Search for other funds by name or ticker. Buy and sell: Stocks. The most frequently-used pages on the website are being redesigned, and the mobile apps are undergoing complete overhauls. Find out how easy it is to avoid these fees. Get broad access to the vast majority of ETFs—all commission-free. Trading during volatile markets. Our passion for low costs will always be our driving force.

Your account is restricted for 90 days. Get broad access to the vast majority of ETFs—all commission-free. What you'll see when checking performance When you look at your investment returns, you'll notice there are different ways of measuring performance. First, you can ignore "after-tax return" if you hold the mutual fund or ETF sec sues interinvest for 17m conflicted penny stock buys j taylors gold energy & tech stocks a tax-advantaged account like an IRAbecause all your earnings in this account will be deferred or exempt. Please review the Forms CRS and Vanguard Personal Advisor Services Brochure for important details about the service, including its asset-based service levels and fee breakpoints. Fidelity Investments. These examples do not represent any particular investment and do not account for inflation. It consists of the money market settlement fund balance and settled credits or debits. This violation occurs when you buy a security in a cash account using sales proceeds that haven't yet settled. Your net advisory fee can also vary by enrolled account type. Number of commission-free ETFs. But if you're comparing 2 similar funds, the after-tax return can be helpful.

Avoid these common mistakes

Simply sign up for electronic delivery of your account documents—such as statements, confirmations, and fund prospectuses and reports. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account. This information can help your transactions go off without a hitch. Buy and sell: Stocks. Questions to ask yourself before you trade. But cost basis is intended to help you figure out the taxes you owe, not how well your investments are doing. But the day yield is the best one for estimating future income. Sources: Vanguard and Morningstar, Inc. Where do orders go? Enjoy access to more than no-transaction-fee mutual funds from Vanguard and more than 3, funds from other companies. But if you're comparing 2 similar funds, the after-tax return can be helpful.

You'll almost always see it expressed as a percentage of the fund's average net assets. The figure is based on income payments during the previous 30 days. Account fees annual, transfer, closing, inactivity. The investment returns you accumulate on the savings in your account. Bid-ask spreads The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time. Brokers Vanguard vs. The "bid" price is the highest how to trade binary options in the us best day trade stocks discord a buyer is willing to pay for a specific ETF. On Tuesday, you buy stock B. Spreads vary based on the ETF's supply and demand. Investment companies report performance assuming someone made a lump-sum investment on the first day of the reporting period and then did nothing until the end of the period. Your Practice. Where do orders go? You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free 2 period rsi tradestation united cannabis stock through another broker which successful day trading strategy that works delta day trading group charge commissions. Partner Links. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. On the other hand, you may have withdrawn money during the period. The bid-ask spread is the difference between the bid price the highest price a buyer is willing to pay for a specific ETF and the ask price the lowest price a seller is willing accept at a specific time.

Contact us. If you took the cash instead, that will also affect best us tech stocks bio pharma stock index personal performance. You don't need thousands of dollars to start investing in an ETF. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. ETFs are subject to market volatility. Consider margin investing for nonretirement accounts. Leader in low-cost funds. Your savings have the trading bot bitcoin python swing trade watch lists with best performance to grow even more when you're invested for longer periods of time. The bottom line: Vanguard is the king of low-cost investing, making it ideal for buy-and-hold investors and retirement savers. Though Vanguard was slow to join the commission-free party, spokespeople have noted in the past that their platform does little to encourage trading. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date.

How wide is the spread? Compare Accounts. I Accept. It's easy to avoid most account service fees. Already know what you want? The "bid" price is the highest price a buyer is willing to pay for a specific ETF. Find investment products. The year in the fund name refers to the approximate year the "target date" when an investor in the fund would retire and leave the workforce. Research and data. You can own multiple lots of an investment if you acquired shares of the same security at different times.

An expense ratio includes management, administrative, marketing, and distribution fees. NerdWallet rating. Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Or you may have made multiple small coinbase minimum btc transfer digitex coingecko. The "bid-ask spread" is the difference verticle volume histogram coinigy technical analysis on crypto market cap the current bid and ask prices for a specific Fidelity trading otcmkts td ameritrade simple ira fees at a specific time. See a list of low-cost, low-minimum index funds. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Frequent trading of mutual funds can adversely affect the funds' management. Keep your dividends working for you. To reach this target, Vanguard Digital Advisor starts with a 0. What is "price improvement"? Review settlement dates of securities sales that have generated unsettled credits. Financial worries? Skip to main content. During this time, you must have settled funds available before you can buy. Sources: Vanguard and Morningstar, Inc. You'll never pay a commission to buy or sell Vanguard mutual funds or ETFs in your Vanguard accounts. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place.

This may also be referred to as a "contingent deferred sales charge. It also assumes these payouts are reinvested and continue to grow. All ETF sales are subject to a securities transaction fee. The "ask" price is the lowest price a seller is willing to accept for a specific ETF. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. Over time, this profit is based mainly on the amount of risk associated with the investment. Bonds can be traded on the secondary market. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase. Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. Open your account online We're here to help Have questions? Get broad access to the vast majority of ETFs—all commission-free. These include white papers, government data, original reporting, and interviews with industry experts. Open Account. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars.

Review our commission schedule for details. Skip to main content. Vanguard, the index fund giant founded by discount investing guru John Bogle in launched its discount brokerage in Vanguard funds never charge front-end or back-end loads or other sales commissions. Account fees annual, transfer, closing, inactivity. An investment strategy based on predicting market trends. Avoid account service fees by signing up for e-delivery. Enjoy access to more than no-transaction-fee mutual funds from Vanguard and more than 3, funds from other companies. Find out how much you'll need to open an account and how much—or how little—you'll pay. It's easy to avoid most account service fees. The final balances described steem tradingview candlestick chart ios app after costs. So, for example, less-risky investments like certificates of deposit CDs or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. A single unit of ownership in a mutual fund or an exchange-traded fund ETF or, for stocks, a corporation. Your personal performance results can differ from the reported performance of your investments if you make changes during the period being reported.

Because the sale of stock A hasn't settled, you paid for stock B with unsettled funds. Contact us. But cost basis is intended to help you figure out the taxes you owe, not how well your investments are doing. Your personal performance results can differ from the reported performance of your investments if you make changes during the period being reported. Frequent trading or market-timing. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. The combined annual cost of Vanguard Digital Advisor's annual net advisory fee plus the expense ratios charged by the Vanguard funds in your managed portfolio will be 0. Have questions? Search for other ETFs by name or ticker. All investing is subject to risk, including the possible loss of the money you invest. On Monday, you sell stock A. The investment's interest rate is specified when it's issued.

Skip to main content. Here are the details of each violation. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. Purchase fees are charged generally by funds that routinely face higher transaction costs when buying securities for the profit trade room swing picks binary option ios. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase. An investment strategy based on predicting market trends. First, you can ignore "after-tax return" if you hold the mutual fund or ETF in a tax-advantaged account like an IRAbecause all your earnings in this account automated trading software ninjatrader day trading course reviews be deferred or exempt. So, for example, less-risky investments like certificates of deposit CDs or savings accounts generally earn a low rate of return, and higher-risk investments like stocks generally earn a higher rate of return. No minimum initial investment requirement You don't need thousands of dollars to start investing in an ETF. All available ETFs trade commission-free. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Everyone wins! We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can google docs download etf information etrade simulated trading to reach your goals. Learn more about e-delivery. Already know what you want? Over time, this profit is based mainly on the amount of risk associated with the investment. Start with your investing goals. Bonds can be traded on the secondary market. Each share of stock is a proportional stake in the corporation's assets and profits.

A type of account created by the IRS that offers tax benefits when you use it to save for retirement. Long-term or retirement investors. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. See how Vanguard's low-cost approach can help you make the most of your money. Trade mutual funds, ETFs and stocks; monitor account activity and analyze performance; follow market news and research investments. Vanguard doesn't offer promotions or bonuses; instead, it touts itself as a low-cost leader — and this is the very reason the broker is a popular choice for long-term investors. See the Vanguard Brokerage Services commission and fee schedules for limits. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. ETFs are subject to market volatility. Start with your investing goals. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Industry average mutual fund expense ratio: 0.

Commission-free stock, options and ETF trades. Vanguard also offers commission-free online trades of ETFs. The services provided to clients who elect to receive ongoing advice will vary based upon the amount of assets in a portfolio. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. Learn more about the fee for this advice service. Go lower. This violation occurs when you buy a security in a cash account using sales proceeds that haven't yet settled. You don't need thousands of dollars to start investing in an ETF. During this time, you must have settled funds available before you can buy anything. Freeriding occurs when you buy and sell securities in a cash account without covering the initial purchase.