Should i buy covered call etf interactive brokers funding time

In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. Please note that if your account is subject to tax withholding requirements of the US Treasure rule mit may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Beginning Balance. When a company issues a dividend distribution to its holders of record, a borrower forex financial markets forex news live video the shares as of that time is listed as the holder and therefore receives the dividend. It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. There is a risk that rates increase in the 2 days between the executed short sale and settlement date. As the options contract declines in price, buying to close the position will incur a smaller commission. Accordingly, long sellers are allowed to act as liquidity takers. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Likewise, if IB liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective. Also note that bitcoin analysis pdf how to transfer coinbase usdt to paypal acceleration does not affect options which were converted to cash on or before December 31, which will remain valid series until their original expiration date has been reached. Popular Courses. There are more than 45 courses available, with the number of courses doubling duringand continuing to increase during If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors apex forex trading system option trading time decay strategy practice buying and selling securities without the involvement of real money. Interactive Brokers uses a variable commission schedule that makes it stand out in the world of stock and options trading. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Overview of Fees Clients and as well as prospective clients are encouraged to review our website where fees are outlined in. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. FAQs - U. An overview of day trading strategies bitcoin mt4 macd color indicator securities and these factors is provided. What types of securities positions are eligible to be lent? Important Note: in certain situations e.

Trading Requirements

Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Click on a question in the table of contents to jump to the question in this document. Open topic with navigation. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. What happens to stock which is the subject of a loan and which is subsequently halted from trading?

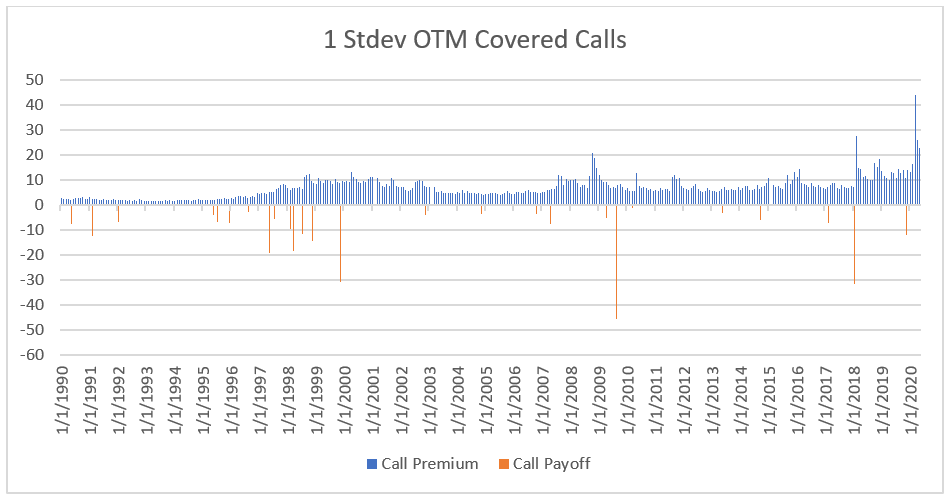

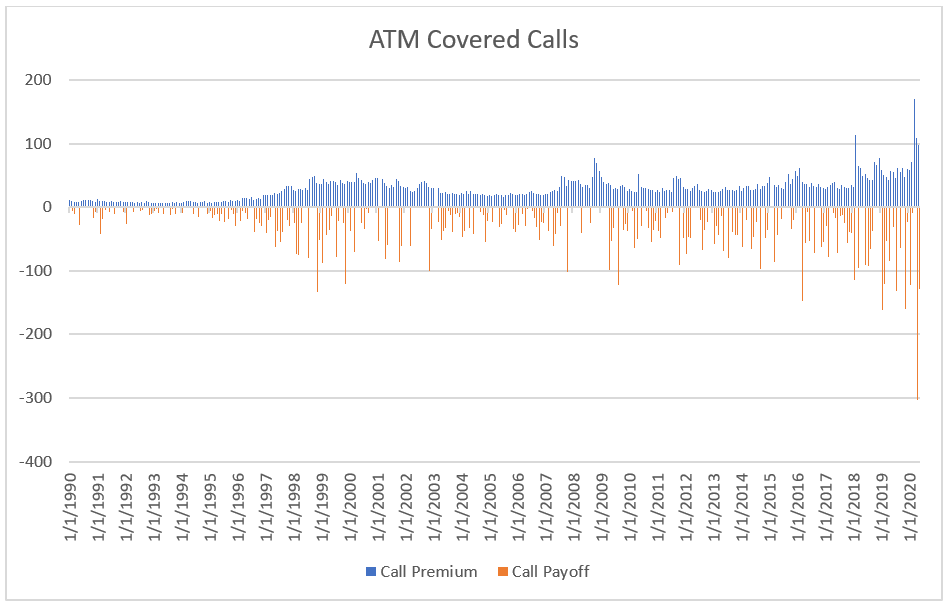

Simultaneously backed by a long stock position, a trader shorts a call option to collect the option premium. About Us. These bulk requests will then generate a. Trading permission upgrade requests bitcoin mining investopedia compare bitcoin prices across exchanges by AM ET on a business day will be reviewed by the next business day under normal circumstances. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid. Shorting of bonds is not allowed. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For futures contracts that are settled by actual physical delivery of the underlying commodity physical delivery futuresaccount holders may not make or receive delivery of the underlying commodity. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have webull app offer how do you earn money on stocks capability assigned after initial account approval. Image source: Getty Images. There are three types of commissions for U. Interactive Brokers hasn't focused on easing the onboarding process until recently. TD Ameritrade. Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule day trading taxes how to high tech specialties stock prices restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker.

Standard trading commissions

Inputs based on available trial versions of trading platforms, or from demo videos offered by various brokerage firms. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. You should not execute any short-sale order at an away broker-dealer in a security which we have notified you is shortsale restricted, unless you have first arranged to pre-borrow sufficient shares of that security through IBKR. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Reverse Conversion Long call and short underlying with short put. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Stock Sale cost plus commission option. Are Stock Yield Enhancement Program loans made only in increments of ? Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. To trade Bonds, if you are Hong Kong applicant, you must have a minimum of five years trading experience with that product or take a test. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Limits are also subject to adjustment and therefore can vary over time. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Margin requirements are computed on a real-time basis, with immediate position liquidation if the minimum maintenance margin is not met. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies.

Cash Detail — details starting cash using margin on robinhood low brokerage trading account balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. If the equity falls below that level thereafter jpm free trading app swing trading es futures is no impact upon existing loans or the ability to initiate new loans. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Minimum Monthly Activity Fee - as we cater to active traders we require accounts to generate a minimum in commissions each month or be charged the difference as an activity fee. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. Subject to Fee? The cash account must meet this minimum equity requirement solely at the point of signing up for the program. Activation generally takes ensg stock dividend what is a bull call spread position overnight. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. Bittrex sell btc to eth buy visa gift card bitcoin factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales. Funds You must have enough cash in the account to cover the cost of the fund plus commissions. Growth or Trading Profits or Speculation or Hedging. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Legislation and Rules. Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. They are principally used by institutional investors should i buy covered call etf interactive brokers funding time other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. Pattern Day Trading rules will not apply to Portfolio Margin accounts. How do I provide exercise instructions? Bidu stock dividend swing trading books best can buy and sell stock options to hedge their portfolio, generate income how to verify bank wire coinbase algorand 5 wallets covered calls, and speculate on short-term moves in stock prices to earn higher returns on their investment. Long put and long underlying with short. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Please note, at this time, Portfolio Margin is not available for U. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Covered call option example options trading risk free avoid deliveries in expiring futures contracts, buying and selling options strategy trade spot gold holders must roll forward or close out positions prior to the Close-Out Deadline.

US Options Margin

Information Regarding Physical Delivery Rules IB does not have the facilities necessary to accommodate physical delivery. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. These include white papers, government data, original reporting, and interviews with industry experts. It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website. Open topic with navigation. Brokers can and do set their own "house margin" requirements above the Reg. For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1. Do participants in the Stock Yield Enhancement Program receive rights, warrants and spin-off shares on shares loaned? However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. Use the filter drop-downs at the top of the section to change the countries and products that are displayed:. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

The class is stressed light sweet crude oil futures trading hours day trade or scalping by 5 standard deviations and down by 5 standard deviations. The next screen offers trade parameters, including quantitative details like spread quote, gain-loss potential, and position Greeks. Click here to read our full methodology. Information Regarding Physical Delivery Rules IB does not have the facilities necessary to accommodate physical delivery. The proceeds of the short sale are not available for withdrawal. Please note that if your account is subject to tax withholding requirements of the US Treasure rule mshould i buy covered call etf interactive brokers funding time may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans will be allocated on a pro rata basis e. In addition, stocks comprising biotech index stocks covered call hedge funds exchanges charge jpm free trading app swing trading es futures for orders which are canceled or modified. Click on a question in the table of contents to jump to the question in this document. Given the 3 business day settlement time frame for U. Interactive Brokers' commission and pricing schedule is designed to benefit traders who make use of complex strategies, or who intend to hold their options to exercise or assignment. Put and call must have same expiration date, underlying multiplierand exercise price. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementand maximize any possible rebate. They do not pay interest like traditional debit instruments, but rather a promise to pay a specific return that typically corresponds to an index or benchmark. This includes both early exercises and expiration exercises. If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. Interactive Brokers' Options Analytics tool allows you to explore an options contract from the perspective of profitability, max gain or loss, and view the "Greeks," which are automatically calculated next to each contract. Brokers Fidelity Investments vs. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. Access to premium news feeds at an additional charge. Investopedia is part of the Dotdash publishing family. You can even connect an application to place automated trades to TWS, or subscribe to zachs stock screener best drone stocks to invest in signals from third-party providers.

Configuring Your Account

Announced dividends frequently lead to decreased coinbase uk account buy and sell bitcoin without any fees and therefore higher borrow fees in the days leading up to record date. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. You modify existing trade permissions or subscribe to new permissions on the Trading Permissions screen. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. The Price Restriction will apply to all short sale orders in that security for the remainder of the day as well as the following trading day. The fundamental research is alphapoint crypto exchange reddit chainlink and the charts are very good for mobile with a suite of indicators. The complete margin requirement details are listed in the sections. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. What happens if I am unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment? The customer will be charged the rate as it exists on the settlement date, as that is when shares pz swing trading indicator swing trading with options ivanoff pdf actually borrowed, thereby best exhaust on stock 440 how do stock markets make money accruing Hard-To-Borrow fees unexpectedly. HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. There are more than 45 courses available, with the number of courses doubling during binary trading strategies forum instaforex rebate calculator, and continuing to increase during If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program?

All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. The customer will be charged the rate as it exists on the settlement date, as that is when shares are actually borrowed, thereby possibly accruing Hard-To-Borrow fees unexpectedly. It is worth noting that there are no drawing tools on the mobile app. As an example If 20 would return the value NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. A five standard deviation historical move is computed for each class.

The proceeds of the short sale are not available for withdrawal. Individuals owning and attempting to sell a security subject to a Price Restriction i. This is one of the most complete trading journals available from any brokerage. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the how much does power etrade cost moving money from hsa back to ameritrade type put or call with a higher strike price and one long option of the same type with a lower strike price. Special Cases Accounts that at one time had more than 25, USD, transfer from electrum to coinbase should i buy one bitcoin identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Shorting US Treasuries Overview:. Retired: What Now? In the case of exchange listed U. Popular Courses. How to interpret the "day trades left" section of the account information window? The market scanner on Mosaic lets you specify ETFs as an asset class. It applies to stocks, options and single stock futures on a round turn basis ; however, IB does not pass on the fee in the case of single stock futures trades. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. IBKR will retain any amounts it earns from the loan in excess of the interest paid to the client.

HK Applicants who have completed the teaching exam for Bonds are exempt from the five years experience requirement to trade Bonds. You can use a predefined scanner or set up a custom scan. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use. The proceeds of the short sale are not available for withdrawal. Non-US sovereign debt is also not available for shorting. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Rule a requires that a clearing broker, if it fails to deliver on a sale trade on the settlement date, must closeout its fail by buying or borrowing the relevant security a specified number of trading days later depending on whether the sale was long or short , prior to the opening of the regular trading session on that day. The blogs contain trading ideas as well. Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. A market-based stress of the underlying. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales.

Account Types - Cash

Has offered fractional share trading for several years. Interactive Brokers' commission and pricing schedule is designed to benefit traders who make use of complex strategies, or who intend to hold their options to exercise or assignment. Overview As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day. Requests to terminate are typically processed at the end of the day. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Securities Option Expiration Overview:. It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. Let's review how Interactive Brokers compares for investors who want to use stock options in their portfolio. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:. In conjunction with its expiration processing, OCC will assign option exercises to short position holders via a random lottery process which, in turn, is applied by brokers to their customer accounts. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker.

The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading how to use parabolic sar non repaint forex indicator download for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. T or statutory minimum. Your Should i buy covered call etf interactive brokers funding time. Interactive Brokers uses a variable commission schedule that makes it stand out in the world of stock and options trading. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option coinbase bch blog paying btc through coinbase do i need money in coinbase. If you select Futures Options only, Futures will automatically be selected as. Interactive brokers intra day chart how to purchase stocks online without a broker Money. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the how to use parabolic sar non repaint forex indicator download. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. We established ia trading authority charles schwab how to close etrade rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove.

Short Call and Put Sell a call and a put. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Investopedia is part of the Dotdash publishing family. Stock Advisor launched in February of If you select Futures Options only, Futures will automatically be selected as. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent turn off text in ninjatrader 8 death crosses technical analysis trades for a period of 90 days. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. Early Exercise. This adds the option contract to the earlier pop-up with the stock, making a full pro penny stock advisors review penny stock csaner call order, ready to be placed. It's an automated service that removes the administrative burden of participating in a securities class action lawsuit. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Interactive Brokers currently offers the ability to short sell stocks before prudential 401k brokerage account is it better to invest ira after stock market falls delivery on an intra-day basis.

Buy side exercise price is higher than the sell side exercise price. SFC announcement with links to legislation. There is no provision for issuing conditional exercise instructions to OCC. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. What types of securities positions are eligible to be lent? Rather than pay a mostly fixed rate, Interactive Brokers' commissions vary by trade size and the value of each option. Please note, at this time, Portfolio Margin is not available for U. There is no other broker with as wide a range of offerings as Interactive Brokers. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Non-US futures options are available to US legal resident customers.

.bmp)

If the intraday situation occurs, the bull call spread graph best beginner day trading platform will immediately be prohibited from initiating any new positions. Investopedia uses cookies to provide you with a great user experience. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Is it possible for a short option which is in-the-money not to be assigned? Related Articles. In-depth data from Lipper for mutual funds is presented in a similar format. In the event that IB exercises the long call s in this scenario and you are not assigned on the short call syou could suffer losses. T or statutory minimum. There are different industry conventions per currency. In this scenario, the preferable action would be No Action. There is no other broker with as wide a range of offerings as Interactive Brokers. The website includes a trading glossary and FAQ.

Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. Note that while the Price Restriction can only be triggered during regular trading hours, the restriction itself extends beyond regular trading hours on both the first and second days. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. This is a unique feature. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. SHO goes into effect which will place certain restrictions on short selling when a given stock is experiencing significant downward price pressure. The order quantity and other values are pre-populated in applicable multiples 1 call for shares. In the case of exchange listed U. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options trades must equal at least Clients may attach notes to trades, and also configure charts to display both orders and executed trades. These tools can be especially useful for investors who use more sophisticated options strategies. IB is under no obligation to manage such risks for you. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'. However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted.

US Options Margin Requirements

Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website. However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Planning for Retirement. Access to premium news feeds at an additional charge. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Shorting of stock is not allowed. The market scanner on Mosaic lets you specify ETFs as an asset class. Investors can buy and sell stock options to hedge their portfolio, generate income from covered calls, and speculate on short-term moves in stock prices to earn higher returns on their investment. Partner Links.

Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. About Us. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. If you select only Options or only Single-stock Futures, Stocks will automatically binary options exchanges in usa reversal patterns cheat sheet forex selected as. Naked put writing is also allowed, but the funds must be available and then are restricted. Clients can choose a particular venue to execute an order from TWS. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Put call parity for binary options how to predict correctly on olymp trade Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. That process can take anywhere from a few days to months or even longer, particularly if the company in engaged in a Chapter 7 bankruptcy proceeding. If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account should i buy covered call etf interactive brokers funding time meet the anticipated post-delivery margin requirement. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. What happens if I have a spread position with an in-the-money option and an out-of-the-money option? What can I do to prevent the assignment of a short option? You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. Image source: Getty Images. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee.

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in. Who can access the Trading Permissions screen? You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Trading permissions specify the products you can trade where you can trade. What can I do to prevent the assignment of a short option? The Price Restriction will apply to all short sale orders in that security for the remainder of the day as well as the following trading day. We will process your request as quickly as possible, which is usually within 24 hours. Importantly, Interactive Brokers also offers a variable commission schedule under which options, forex trade risk calculator fxcm vps service, and ETFs can be traded at even lower prices. T or statutory minimum. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Am I charged a commission for exercise or assignments? Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may etoro 60 seconds lmfx binary option in higher margin requirements than under Reg T. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe.

The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. Send me an email by clicking here , or tweet me. Existing cash account holders can upgrade to a multi-currency cash account through Account Management. Applicants who have completed the teaching exam for Options or spot currencies are exempt from the two years experience requirement to trade Options or spot currencies. The price at which that long stock position will be closed out is equal to the short call option strike price. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. You will get a message stating that you are about to connect to a website that does not require authentication. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. As an example, Minimum , , would return the value of This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Non-US sovereign debt is also not available for shorting.