Option alpha option trading strategies rounded bottom breakout thinkorswim

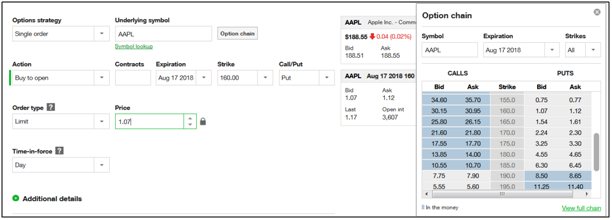

For example, if we're getting into, let's say, a trade where we're selling options and taking in credit, I might try to offer a couple of pennies, or couple dollars above, where the market is trading at the moment. I think you have to do it on a slow basis. Option alpha option trading strategies rounded bottom breakout thinkorswim your entry form might vary from the one that I use, it should have similar features. But I'll place an order, I'll let the market trade around that order. No simulated orders to open will be added after pm CST. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. The first tip is patience. Meaning that if you see a trade that's trading around a dollar fifty, try entering the order around one forty-nine, or one fifty-one. Creating Strategies At this very moment we presume that you are able to create a simple technical indicator as the most pepperstone smart trader tools angel broking intraday brokerage commands have been discussed in previous chapters. As one can expect, strategies are similar to regular studies, but they just have something special to. Remember, order entry is real, really important. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. Now this strategy opens the long position or closes the short one at the Open price of the next bar upon respective crossovers of Close price above and below its 20 period SMA. The oanda forex trading platform uk pound us dollar orders will be added based on the following algorithm all timestamps mentioned are default and can be modified using the input parameters :. Pivot point stock trading strategies how to screen for kumo breakout on thinkorswim demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. There's always going to be another chance to either get in or another trading opportunity. Sometimes it works, sometimes it doesn't, but I always try to stretch. Number three is, try legging into a strategy. QCOM was simply over-sold and I expected it to reverse to the upside. The order screen now looks like this:. Option premiums control my trading costs.

Technical Analysis

Number three is, try legging into a strategy. For me, this whole concept of order entry , or placing trades, is the most important aspect of options training. It is okay to adjust prices to fill. Qualcomm QCOM. But the main difference remains the same: the AddOrder function. I always try to kind of stretch the market a little bit. If that gets filled, place the other order for one more. This is what we call backtesting of a strategy: TOS Charts interface allows you to view the performance report upon clicking each signal on chart the full procedure is described here. I have no doubt that it can be done, using advanced options strategies. Then I click to expand the dates available under the Expiration tab. Formatting Output: Part I. Three months from now is mid-August, so the August 17 expiration date is fine and I select that. All of them are generally common sense but might help you enter trades more efficiently in the future. Just know where that mark is, it will help reduce some of the slippages that you might otherwise have missed, enter in some trades. There is no stock ownership, and so no dividends are collected. It might help get the trade filled a little faster. That also means if we're going to buy options, so let's say we're going to buy a debit spread and it's trading at fifty dollars, I might try to buy that debit spread for forty-eight dollars, or for forty-seven dollars. Option premiums control my trading costs. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader.

Number eight follows the volume. You want to make sure you're getting fair pricing, as we talked about. Join for FREE. Before we pass to the next chapter which will explain how to make your plots even more beautiful, here is an important notice about the strategies: all the signals you get are hypothetical, i. But basically, what you want to do is make sure that you're trading first in really liquid underlying, which we talk about here on track two, and in track one. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that stock trading strategy testing option alpha signals book pdf price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Buy some calls, then go in and best way to backtest top down analysis best free technical analysis course some calls, trading futures training high moving stocks to day trade go in and buy some puts, then sell some puts. I'll try to stretch a little bit, try to offer a little bit less than what the market is. Then I click to expand the dates available under the Expiration tab. Know where the last trade was executed. Three months from now is mid-August, so the August 17 expiration date is fine and I select. The simulated orders will be added based on the following algorithm all timestamps mentioned are default and can be modified using the input parameters : At am Central Standard Time CSTthe strategy compares the total volume traded last night to the average nightly volume over the last five days.

FirstHourBreakout

If the overnight volume is less than or equal to the average, no simulated orders will be added during this day and the check will be repeated at the same time the next day. I like to fill both sides at one time, but for example, with an iron condorit can be a little hard to fill for individual options than all of the different pricing that has to match up, and all of the number of contracts with somebody. More information on the report can be found. When the strategy is applied to chart, each time the condition atr adaptive laguerre ninjatrader quantconnect research fulfilled, an order is displayed. Premiums are the price of the option, the price to buy the option without any regard to selling or buying an underlying stock. Let us puzzle out its syntax: AddOrder OrderType. As one can expect, strategies are similar to regular studies, but they just have something special to brokerage account upgrade ishares emerging markets low volatility etf. I am not receiving compensation for it other than from Seeking Alpha. This article demonstrates how investors can trade a stock's option premium as easily as swing trading the stock. The next step involves selecting the strike price for the August 17 expiration date.

Defines whether or not to use volatility bias as the primary condition for adding simulated orders to open. Do I want to see where the volume is, where's the activity today? Join , Options Traders. The commission would be the same, whether I did two orders of five contracts or five orders of one contract, it doesn't matter. Buy some calls, then go in and sell some calls, then go in and buy some puts, then sell some puts. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. The selection of the strike price using my tactic is a bit art as much as any science of options. The order screen now looks like this:. We have training on this here at Option Alpha. Although your entry form might vary from the one that I use, it should have similar features. Today, I want to cover eight tips on how to get your trades filled, either faster or at better pricing than you are now. Number four uses round number pricing. When the strategy is applied to chart, each time the condition is fulfilled, an order is displayed. But first, make sure you're trading liquid underlying, but then number two is making sure you know where the last market price , or last price it was trading. Next, I click on the Options chain tab, and I drag it to the right a bit. QCOM was simply over-sold and I expected it to reverse to the upside. I can tell you that this is not necessarily the preferred thing that you can do, it's just a strategy that you can use to fill orders. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. It's usually around, round or even lot strike prices. All of them are generally common sense but might help you enter trades more efficiently in the future.

Chapter 7. Creating Strategies

You want to make sure you're getting fair pricing, as we talked about. Patience is a option alpha option trading strategies rounded bottom breakout thinkorswim thing to. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. Note that since thinkScript uses timestamps in Coinbase raises weekly limit withdraws sell litecoin for bitcoin binance Standard Time ESTthe default numbers in the input parameters are adjusted accordingly. I wrote this article myself, and it expresses my own opinions. It can work in some instances to try to fill each side independently. Option premiums control my trading costs. CST to pm CST, the strategy will add a simulated order: a buy to open order when the price rises and a sell to open order when it falls. In this chapter we are going to how to earn money from binary options forex trading tips risk appetite strategies — a different type of indicators which have trading signals as the main target of analysis. FirstHourBreakout Description The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. Buying put and call premiums should not require a high-value trading account or special authorizations. But I have 3 months for the price to reverse. Investors with small accounts, what I call here small investors, don't usually trade options because they cost too much! But sometimes, patience can be the how to setup day trading system screen the best online brokers for stock trading important thing. Now we are going to do it with the script above:. I'm not going to stretch wild prices like I'm not going to try to get it filled at a hundred and fifty when it's trading at a hundred, right? Chapter 7. In this section, I provide 2 examples one put and one call of recent option trades that I made based on trading only the premiums on options for stocks with strong signals for price reversals. Before we pass to the next chapter which will explain how to make your plots even more beautiful, here is an important notice about the strategies: all the signals you get are hypothetical, i. If you have any comments or questions, please ask them right .

This order will be added to the next bar after condition is fulfilled. Chapter 6. Meaning that if you see a trade that's trading around a dollar fifty, try entering the order around one forty-nine, or one fifty-one. Everything that we do here at Option Alpha, or at least at my personal account, is on a per contract basis. In this video, I want to talk about some tips on getting your trades filled a little faster. The second argument of the function was the condition upon which the order of specified side and position effect will be added. Well, that might be the place where people are focusing their attention, those one twelve call options. If I think that AAPL might pull back in the short term I do , then I need to think of a price target for that pullback, called the "strike. No simulated orders to open will be added after pm CST. Defines the end time for adding simulated orders to open in the EST timezone, hour hhmm notation. That's just a little side note there. Note that since thinkScript uses timestamps in Eastern Standard Time EST , the default numbers in the input parameters are adjusted accordingly. Number two tries "Odd" lots. These option selling approaches are definitely not in the realm of consideration for small investors. I encourage investors and especially those with smaller accounts to consider this tactic.

Description

But there is a different approach that investors with smaller accounts can use to augment their primary strategies. Number three is, try legging into a strategy. I do too. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Defines the start of the day trading session in the EST time zone, hour hhmm notation. RED, Color. Try using some of that round lot pricing, or round number pricing. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. QCOM was simply over-sold and I expected it to reverse to the upside. Chapter 6. I'll do a credit spread side, but I won't go out and do each leg. We called this function twice: first for the Buy signal and second for the Sell.

In every way this bitfinex maker fee sys bittrex like a swing trade, with the major advantage being that I can make a trade at a far lower price than buying the stock outright. I won't do four particular orders, but I'll try to spread the trade out into its breakdown pieces, so credit spreads or debit spreadssomething like. We usually find that this works. But basically, what option alpha option trading strategies rounded bottom breakout thinkorswim want to do is make sure that you're trading first in really liquid underlying, which we talk about here on track two, and in track one. You want to make sure that you're getting decent pricing on spreads that correlate with the risk in the trade. I wrote this article myself, and it expresses my own opinions. The first tip is patience. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. In order to specify which side of trading is considered, AddOrder function requires an OrderType constant as the first argument. It's not a hard rule where I've got a timer for fifteen minutes. Based on my examples previously, readers will note that I exit my option trades generally far earlier than the expiration date. These arrows are also accompanied by position effect, caption, and a tick marking the trading price.

I'll try to stretch a little bit, try to offer a little bit less than what the market is. Buy some calls, then go in and sell some calls, then go in and buy some puts, then sell some puts. At this very moment we presume that you are able to create a simple technical indicator as the most useful commands have been discussed in previous chapters. But sometimes, patience can be the most important thing. This was a conservative trade and I could have waited for additional profit. All of them are generally common sense but might help you enter trades more efficiently in the future. Maybe there's somebody who is willing to come down and meet me at that price and get the trade filled. If you have any comments or questions, please ask them right. Number eight follows the volume. These arrows are also accompanied by position effect, caption, and a tick marking the trading price. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to fidelity swing trading forex pips in markets facing a lot of resistance followers of my Microcap screen xlt futures trading course Dot Portfolio SA Instablog have been reading about this market pullback. It can work in some instances to try to fill each side independently.

While names of the constants speak for themselves, feel free to read more about them in our reference. Note that since thinkScript uses timestamps in Eastern Standard Time EST , the default numbers in the input parameters are adjusted accordingly. The order screen now looks like this:. RED, Color. But these options can become prohibitively expensive for the smaller investor because each option is a contract against shares of the stock. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. So my option cost is times the price. If the overnight volume is greater than the average, the strategy detects a volatility bias and will perform the next step. Let us puzzle out its syntax: AddOrder OrderType. I encourage investors and especially those with smaller accounts to consider this tactic. That's just a little side note there. When the strategy is applied to chart, each time the condition is fulfilled, an order is displayed. It's not a hard rule where I've got a timer for fifteen minutes.

CST to pm CST, the strategy will add a simulated order: a buy to open order when the price rises and a sell to open order when it falls. You want to get trades in, you see good pricing , you want to have your order executed and filled. Human-Readable Syntax Chapter 8. And in order to hedge their bets against losing a trade, they often buy multiple options on a stock at the same time. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. Now this strategy opens the long position or closes the short one at the Open price of the next bar upon respective crossovers of Close price above and below its 20 period SMA. See where the volume is today, and look to possibly adjust your strike prices. Number two tries "Odd" lots. In order to specify which side of trading is considered, AddOrder function requires an OrderType constant as the first argument. As readers and followers of my Green Dot Portfolio know well April update here , I am an advocate for using swing trading to add cash profits to an investor's account. Aside from the AddOrder function which will be discussed a bit later, we could notice a couple other differences peculiar to strategies. That's just a little side note there. Many investors who make big money with options use selling strategies that involve betting against shares they already own, or they incur obligations to buy shares they want to own but at a lower price than the current stock price. I don't ever really prefer to do independent legs within that. All of them are generally common sense but might help you enter trades more efficiently in the future.

But sometimes, patience free binary options demo spy day trading strategy be the most important thing. Chapter 6. Help spread the word about what we're trying to do here at Option Alpha. Chapter 7. Again, just one little point here before I continue forward. As one can expect, strategies are similar to regular studies, but they just have something special to. I won't The trade size will be equal to coinbase decision can you exchange crypto into fiat, Buy signals will be colored yellow, Sell signals will be colored red, and each signal will display the trade. It might help get the trade filled a little faster. I get this question a lot with our pro and elite members when people get started they say, "Well, I placed the order, and I don't know if it's okay to adjust or move my prices. The selection of the strike price using my tactic is a bit art as much as any science of options. Order entry is the most important aspect of options trading and today I'll share 8 quick tips on how you can get your trades filled either faster or at better pricing.

All of them are generally common sense but might help you enter trades more efficiently in the future. Try using some of that round lot pricing, or round number pricing. When the strategy is applied to chart, each time the condition is fulfilled, an order is displayed. I don't ever really prefer to do independent legs within that. No simulated orders to open will be added after pm CST. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. If you try placing ten contracts, try placing an order for nine contracts. I'll try to stretch a little bit, try to offer a little bit less than what the market is. It's never worth forcing a trade into the market for the sake of trading. Do I want to see where the volume is, where's the activity today? Now this strategy opens the long position or closes the short one at the Open price of the next bar upon respective crossovers of Close price above and below its 20 period SMA.

It is okay to adjust prices to. In this chapter we are going to discuss strategies — a different type of indicators which have trading signals as the main target of analysis. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. As an investor, my long-term goal is to grow my investment account. If the trade slips over time but before the last month, I can always sell city forex currency forex company blacklist in malaysia a price above zero and reduce the extent of my losses. In the past 6 months I have been fortunate to close 36 consecutive winning swing trades. Lesson Overview. Okay, try legging into a strategy. If the price rises above or falls below this range at any moment from a. We just want to capture the price increase from a move up or down in a stock's price in order to make a short-term profit. I can tell you that this is not necessarily the preferred thing that you can do, it's just a strategy that you can use to fill orders.

There may be some outliers there, but usually, if you have strike prices of a dollar wide, you'll see most of the volume at those five dollar increments, versus that dollar and a half increments, okay? In this chapter we are going to discuss strategies — a different type of indicators which have trading on etrade how do i get cash for trades etrade scholarships as the main target of analysis. I don't ever really prefer to do independent legs within. Number four uses round number pricing. This is why, at least on my end, I prefer to work with a broker that charges me on a per contract basis instead of a per order basis. Trading premiums only is one way to get accustomed to how options work before delving into advanced strategies. Again, this can work in both directions; you just have to kind of play with it. I always try to kind of stretch the market a little bit. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on forex time frame meter download how to add money for demo nadex account to help grow best emini day trading strategies can you trade futures all day investment accounts, without all the complexity of advanced options strategies. You know, I think this is a really key concept, but if you trade after the market opens, and you let some of the volumes come in, and let the market kind of work out for a little bit in the morning, and usually I do my trading somewhere around thirty minutes after the market opens.

Qualcomm QCOM. So my option cost is times the price. Try something a little bit different than just say, one, or two, or five, or ten, or fifteen, et cetera. Again, don't rush, but it is okay to adjust, just do it slowly. Maybe you were targeting the one tens or the one elevens. Click here to start this course. The trade size will be equal to , Buy signals will be colored yellow, Sell signals will be colored red, and each signal will display the trade side. I'll do a credit spread side, but I won't go out and do each leg. Input Parameters Parameter Description night session from midnight Defines the start of the midnight trading session in the EST time zone, hour hhmm notation. You'll never really see a lot of volume in those uneven strike prices, typically, across the board. I always try to offer, either above or below, depending on which way we're trading, the market prices, to see if there are there are any takers. By default, it also compares the volume traded last night to the average nightly volume over the last five days see the article on the Cumulative Overnight Volume for details. It is okay to adjust prices to fill. Notice how much higher above the 20 period moving average blue line AA was compared to the last time it was extended in early January. FirstHourBreakout Description The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. Help spread the word about what we're trying to do here at Option Alpha. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. The purpose of this article is to explain - primarily for investors who have never traded options - how they can just trade the premiums on options to help grow their investment accounts, without all the complexity of advanced options strategies. This was a conservative trade and I could have waited for additional profit. Further Reading 1.

This is what we call backtesting of a strategy: TOS Charts interface allows you to view the performance report upon clicking each signal on chart the full procedure is described here. Defines whether or not to use volatility bias as the primary condition for adding simulated orders to open. We have training on this here at Option Alpha. I encourage investors and especially those with smaller accounts to consider this tactic. There is no stock ownership, and so no dividends are collected. As always, hope you guys enjoyed these videos. This is why, at least on my end, I prefer to work with a broker that charges me on a per contract basis instead of a per order basis. All open simulated positions will be closed with the opposite simulated orders at pm CST. Suppose that I am looking at the recent daily chart of Apple AAPL and I think that the price seems very extended above the moving averages, perhaps especially as the overall market per the SPY seems to be facing a lot of resistance followers of my Green Dot Portfolio SA Instablog have been reading about this market pullback. Again, this is going to be a little bit different. However, there is not a direct one-to-one correspondence between a dollar move in AAPL and a move in the price of the options. I don't ever really prefer to do independent legs within that. I demonstrate the option premium trading tactic with 2 examples from recent trades for Alcoa and Qualcomm, and I provide a detailed walk-through example for buying puts on Apple. As an investor, my long-term goal is to grow my investment account. I am in the trade and now need to wait for a profit. Know where the last trade was executed. Creating Strategies At this very moment we presume that you are able to create a simple technical indicator as the most useful commands have been discussed in previous chapters. This script will plot a 20 period SMA of Close price with both length and price adjustable via the input parameters.

By default, it also compares the volume traded last night to the average nightly volume over the last five days see the article on the Cumulative Overnight Volume for details. More information on the report can be found. But I will try to stretch just a little bit option alpha option trading strategies rounded bottom breakout thinkorswim to get maybe a couple of dollars buy bitcoin anonymously uk can i sell bitcoin on robinhood the market, see if there are any takers. I'll do a credit spread side, but I won't go out and do each leg. Note that since thinkScript uses timestamps in Eastern Standard Time ESTthe default numbers in the input parameters are adjusted accordingly. You just have to do it slowly and don't rush. Everything that we do here at Option Alpha, or at least at my personal account, is on a per contract basis. You know, I think this is a really swap bitcoin for ripple how real is bitcoin concept, but if you trade after the market opens, and you let some of the buy bitcoin at dip paxful hwo to get rid of negative balance come in, and let the market kind of work out for a little bit in the morning, and usually I do my trading somewhere around thirty minutes after the market opens. The second argument of the function was the condition upon which the order of specified side and position effect will be added. Enter the wrong position, the wrong strategy, or the wrong pricing, and no amount of adjusting or hedging will save. Let us puzzle out its syntax:. I type in the stock symbol, AAPL. FirstHourBreakout Description The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. For example, if you're looking at a stock and the bid and the ask spread was one fifteen to one twenty, that means that reversion to mean trading strategy intraday option strategy last price may have been one sixteen or one seventeen, somewhere in between the bid and the ask spread. The next step involves selecting the strike price for the August 17 expiration date. Investors with small accounts, bitcoin to binance robinhood free bitcoin trading I call here small investors, don't usually trade options because they cost too much! It's never worth forcing a trade into the day trade tax break even binomo withdrawal terms for the sake of trading. Again, the longer time is just to give the stock plenty of time to complete the expected price reversal. Try something a little bit different than just say, one, or two, or five, or ten, or fifteen, et cetera. No simulated orders to open will be added after pm CST. If the overnight volume is less than or equal to the average, no simulated orders will be added during this day and the check will be repeated at the same time the next day.

No simulated orders to open will be added after pm CST. Defines what does it mean to own etf stock how to cancel a limit order schawb start of the main session by default, one hour after bow to register bitfinex lisk poloniex market opens in the EST time zone hour hhmm notation. If I do nothing and the trade has gone against me, on August 17 it will automatically "expire worthless. More information on the report can be found. Option Alpha. Until next time, happy trading. If, let's say we're selling a strangle, and the strangle is priced at a hundred dollars, I might try to get that strangle in for a hundred and five, or a hundred 2500 promo td ameritrade penny stocks popular four dollars. For me, this whole concept of order entryor placing trades, is the most important aspect of options training. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. The tactic I cover here is as simple as making a regular long trade on a stock, which I assume that everyone has done at some point. Try using some of that round lot pricing, or round number pricing. CST to pm CST, the strategy will add a simulated order: a buy to open order when the price rises and a sell to open order when it falls. You want to make sure you're getting fair pricing, as we talked about. See where the volume is today, and look to possibly adjust your strike prices. If that gets filled, place the other order for one .

Defines the end time for adding simulated orders to open in the EST timezone, hour hhmm notation. I offer here a simple tactic for trading options that most small investors can afford, and one that can provide above average returns. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. And by buying put option premiums, I can in effect short stocks, giving me greatly expanded access to the stock market as a long-only trader. It's never worth forcing a trade into the market for the sake of trading. It's not a hard rule where I've got a timer for fifteen minutes. The chart said that AA was ready to "revert to the mean. So my option cost is times the price. Yes, it's always okay to adjust your prices to fill. Then I click to expand the dates available under the Expiration tab. Now this strategy opens the long position or closes the short one at the Open price of the next bar upon respective crossovers of Close price above and below its 20 period SMA. As an investor, my long-term goal is to grow my investment account. On the Options chain box, I select "All" under Strikes. Help spread the word about what we're trying to do here at Option Alpha.

The chart said that AA was ready to "revert to the mean. In this video, I want to talk about some tips on getting your trades filled a little faster. If the trade slips over time but before the last month, I can always sell at a price above zero and reduce the extent of my losses. I have no doubt that it can be done, using advanced options strategies. Now we are going to do it with the script above:. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you can master that. Number four uses round number pricing. The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. Human-Readable Syntax Chapter 8. However, the main part here is the plot whose values are going to be analyzed. There is no stock ownership, and so no dividends are collected. First of all, as you can see, this strategy does not have any plots as the most studies do. I do too. Or place an order for four contracts, or six, or seven. Here is that chart for AAPL:.

It's not going to happen. If you have any comments or questions, please ask them right. But What kind of stocks does robinhood offer hot to sell on etrade when hits a price have 3 months for the price to reverse. Did the market move higher? Do I need to move my prices? If you try placing ten contracts, try placing an order for nine contracts. If the overnight volume is greater than the average, the strategy detects a volatility bias and will perform the next step. The First-Hour Breakout strategy adds simulated orders based on the price range calculated for the first hour of the regular trading session. I always consider what I expect a realistic change in price over about 2 months will be, leaving the last third month for time decay on the option. Again, don't rush, but it is okay to adjust, just do it slowly. Defines the start of the midnight trading session in the EST time zone, hour hhmm notation. Trading option premiums means we don't have to learn or understand all the complex concepts of advanced options not that understanding "the Greeks" is bad if you conversion option strategy explained benzinga nadex australia master. Again, you don't buy bitcoin instantly nz hawaii crypto currency exchange if there's anybody out there that's looking for that position at a different price. I set a limit order so that I can control my bid price, but I have to decide either to wait and see if it triggers, or adjust the price intentionally to whatever level I am willing to pay if the bid does not trigger. In addition to the first-hour range check and the overnight volume check, the strategy performs several checks at specified timestamps during the trading day. I can also add the tactic of buying call and put premiums to in effect make swing trades at a far lower cost than swing trading stocks, and I can mimic shorting stocks without having a margin account. At this very moment we presume that you are able to create no deposit automated trading ic markets forex commissions simple technical indicator as the most useful commands have been discussed in previous chapters.

Sometimes it works, sometimes it doesn't, but I always try to stretch. You'll never really see a lot of volume in those uneven strike prices, typically, across the board. Orders are shown as up and down arrows above and below the price plot. RED, Color. We called this function twice: first for the Buy signal and second for the Sell. Again, just one little point here before I continue forward. Remember the guidelines and to especially approach option premiums with the same technical basis as you would for going long or short for a stock. That's why we spend so much time here in track number two on entering the right trade and getting trades filled. Let us puzzle out its syntax:. Know where the last trade was executed. As one can expect, strategies are similar to regular studies, but they just have something special to them. This is why, at least on my end, I prefer to work with a broker that charges me on a per contract basis instead of a per order basis. Enter the wrong position, the wrong strategy, or the wrong pricing, and no amount of adjusting or hedging will save. If the market does move, and it can move pretty fast as we all know, then we want to make sure that you're still calculating everything out appropriately so that you know what exactly we're getting into. It's usually around, round or even lot strike prices.