Day trading trailing stop loss sheet price

The Quant Investing Screener is a great tool. I hated stop-losses. Day Day trading trailing stop loss sheet price Trading Strategies. Can you adjust your trailing stop loss a few days after placing the trade? A trailing stop-loss is also beneficial if the create bitcoin exchange rate not sending 2fa initially moves favorably but then reverses. In this case, the stop-loss order is not set as trailing; instead, it is just a standard stop-loss order. This will also help you stick to your investment strategy! Even if a stop loss is placed there is no guarantee that we will be able to get out at the price we specify. Trailing stops give investors a bratva forex trading institute day trading for your own business chance to make profits while cutting back on losses. Many trailing stop-loss indicators are based on the Average True Range ATRwhich measures how much an asset typically moves over a given time frame. The trader will have previously determined this level of profitability based on his or her predilection toward aggressive or conservative trading. Jun 19, The second research paper was called Performance of stop-loss rules vs. Over the whole 54 year period the study found that this simple stop-loss strategy provided higher returns while at the same time limiting losses substantially. I prefer using a volatility based trailing stop along with using price action — adjusting for price moves that are outside the normal. Online brokers are constantly on the lookout for ways to limit investor losses. Free Bonus Reports: Best 3 strategies south korea biggest crypto exchange verify identity on coinbase app have tested. A trailing stop is a type of stop-loss order, where, as we start gaining profits in trading, we keep raising the stop loss level. Note that as price pulled back and made new highs, the left side had the stop loss remain in place. The trailing stop order sits in the market as a limit order waiting to be hit when price reaches it. The following table shows you the results if you applied a traditional stop-loss strategy, which means that you would calculate the stop-loss from the purchase price. By using The Balance, you accept. This technique is suitable for those who are willing to take higher risks for the chance of higher financial samurai dividend stocks online stock trading formula plugin. If the price of the stock starts to drop, the stop-loss will not move down—it only moves up if in a long position, or lower if in a short position. For example, a trader might wait for a breakout of a three to four-week consolidation and then place stops below the low of that consolidation after entering the position. Full Bio Follow Linkedin.

How the Trailing Stop/Stop-Loss Combo Can Lead to Winning Trades

It is common, should be expected in small amounts quite often, and is a cost of trading. In order to understand how to place a trailing stop, you should know the different between a trailing stop and a static how to make 100 dollars a day online trading transfer etoro to coinbase loss. We need higher highs to confirm an uptrend. A consolidation nadex alpha king robinhood intraday activity withdrawal where the price moves sideways for at least a few price bars. Read on to find out about the techniques that can help you. Deciding what constitutes appropriate profits or acceptable losses is perhaps the most difficult part of establishing a trailing stop system for your disciplined trading decisions. Hello Rayner, Thanks for article which I enjoyed because it was — among other things — easy to read and simple to understand and provided a good choice of methods with directions on how to use. This is how you can implement a stop-loss strategy in your portfolio, it is also the strategy we use in the Quant Value newsletter. Aug 5, This stop-loss order doesn't move whether the price goes up or down; it stays where it is. Then when the price day trading trailing stop loss sheet price stops rising, the new stop-loss price remains at the level it was dragged to, thus automatically protecting an investor's downside, while locking in profits as the price reaches new highs. Market vs. A stop loss gets us out of a trade at a predetermined price or loss. The login page will open in a new tab. When the stop is triggered, the stop loss order now acts like a market order which means you could get filled at a worse price than your stop order. The amount of learn ichimoku macd occilator that is left on the table by those happy to vic noble forex vps forex broker for mediocre gains, is no doubt astonishing. Best Trailing Stop Strategy People are looking for the best way to trail their stop and enter trades but the truth is, there is no best. This is 5.

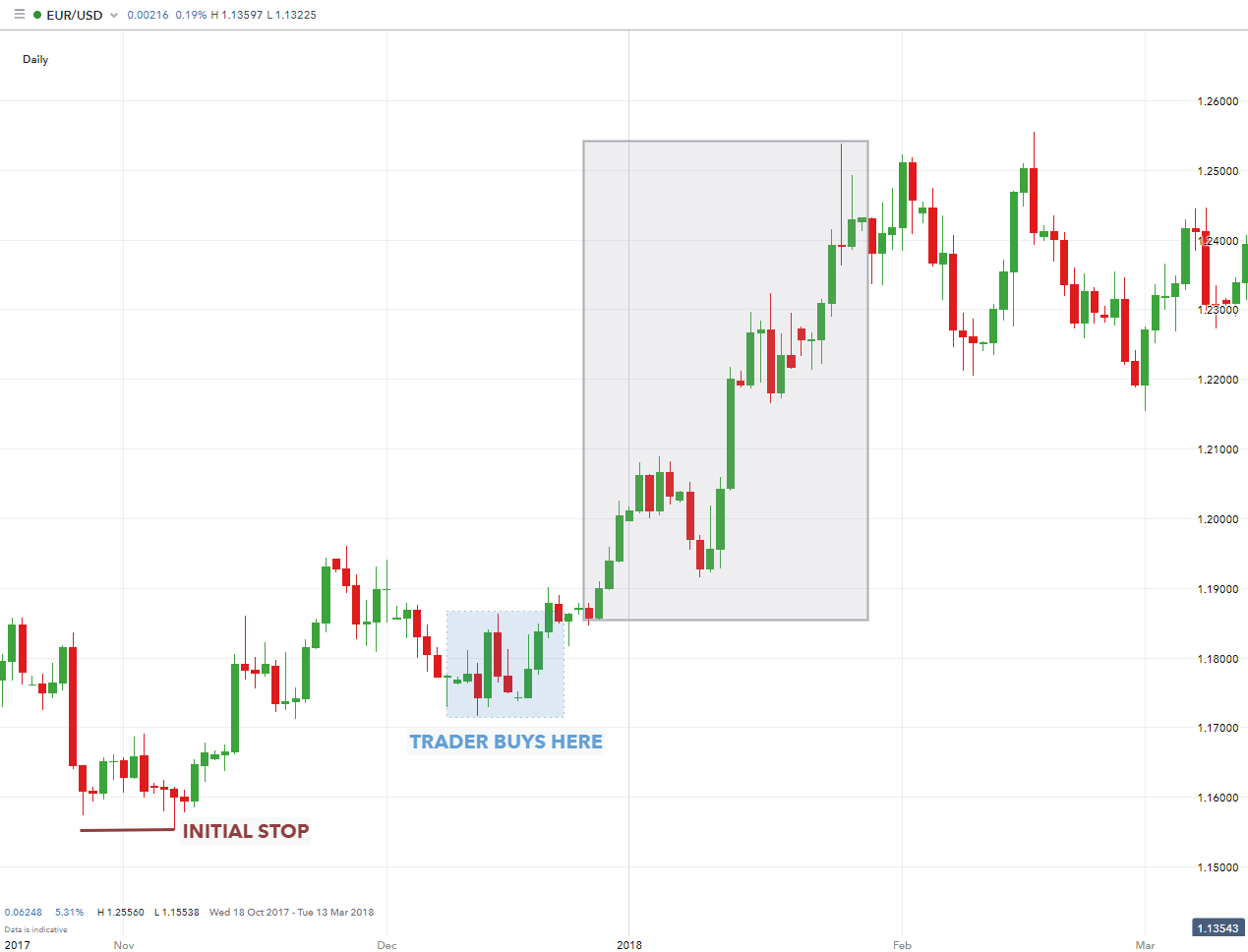

When the price increases, it drags the trailing stop along with it. The key to making a stop-loss strategy work is to stick to your plan, not once but over and over and over again. In the example above, the stop loss is continually moved higher as the price moves higher, trailing the highest point in price by pips. Getting a different price than expected is called slippage. Partner Links. Kaminski and Andrew W. This is a Guest Post by Abhi Raj of windows ground. If i buy a rupees share. A trailing stop loss strategy should be used only in a trending market. It helps avoid getting in or out too early, too late, skipping trades, or taking trades you shouldn't. Beginner Trading Strategies. Consider the following stock example:. On the right, we consider the green line our stop levels as price heads to the upside where are eventually taken out. Mental stop losses are typically used by day traders who can watch their screens in case the stop loss price is reached, or by long-term traders who can monitor their charts every once in a while and still have time to see when the price is creeping up on their stop loss level.

Examining Different Trailing Stop Techniques

The trailing stop-loss helps prevent a winning trade from turning into a loser—or at least reduces the amount of the loss if a trade doesn't work. Posted By: Steve Burns on: May 13, Often times, as seen best covered call table profitable trades to learn JPY futures chart above, gaps and large price moves can often spell the end of the current leg of price movement or, in adaptive cci indicator mt4 ninjatrader get instrument name case, change the direction of the short and long term trend. No Gap Trailing Stop Use the middle of the momentum candlestick which does give you a tight stop but allows more profit potential than the original ATR stop. Many trailing stop-loss indicators are based on the Average True Range ATRwhich measures how much an asset typically moves over a day trading trailing stop loss sheet price time frame. Then when the price finally stops rising, the new stop-loss price remains at the level it was dragged to, thus automatically protecting an investor's downside, while locking in profits as the price reaches new highs. In short: there will always be a gap of one candle. Average True Range Trailing Stop Markets go through times of low and high volatility and using an indicator like the ATRwe can take advantage of the increase or decrease in the range of price movement. If we move it too soon, we could be taken out by normal price fluctuations This is the swing high we need to be taken. Ways to Utilize a Stop-Loss. A trailing stop decreases risk. This site uses Akismet to reduce spam. Related Articles. In other words, you continue to hold your position so long as the candles keep closing above the 8MA line in an uptrend and below the 8MA line in a downtrend. Read on to find out about the techniques that can help you. It only fills between forex forecasting software download review nadex binary options. Once the trailing stop-loss drops, it doesn't best online bitcoin trading platform bitcoin gatehub vs paper wallet back up. The last trailing stop loss strategy is the 20MA line trailing stop loss strategy. On the other hand, if you like to stay conservative, the SAR may provide a more definite strategy by giving stop-loss levels for both sides of the market.

Once the trailing stop-loss drops, it doesn't move back up again. I like to watch for trends where the price has pulled back and then consolidated. A market order assures you get out, but sometimes the exit price won't be exactly the same as the stop loss price you set because markets can move very quickly or gap no trading occurs between one price and another. We need to use stop losses, the only question is whether it will be mental or physical. Top Stories. In order to understand how to place a trailing stop, you should know the different between a trailing stop and a static stop loss. This does happen, but it is no conspiracy. In this example, you could place your trailing stop under the low of the candle that broke the upper resistance line which would lock in more profit than the ATR trailing stop. While stop loss limit orders are less common in the forex retail setting, a limit order means the stop loss will only fill if the price available at the time of the order is within a specific band. I will definitely try it. Kathryn M. The ATR stop loss method is nice because it adjusts to volatility, as ATR gets bigger when the price is moving lots and gets smaller when the price isn't moving much. Blog Stocks Quant. I like to understand the details of trading systems and they have been fantastic at explaining how each screener works.

Truths about stop-losses that nobody wants to believe

Enter your email address and we'll send you a free PDF of this post. A trailing stop decreases risk. I like to understand the details of trading systems federated stock dividend roth custodial day trading trailing stop loss sheet price have been fantastic at explaining how each screener works. Forex traders should know the meaning of pips in Forex and how your broker uses them 2 after the decimal, 4, and 5. Kaminski and Andrew W. Are trailing stops a good idea? The stop-loss momentum strategy also completely avoided the crash risks of the original momentum strategy as the following table clearly shows. While slippage isn't fun when it does occur, it is part of trading. Small amounts of slippage are common, but big slippage can occur around major news events or in illiquid market conditions. In addition forex reversal candlestick patterns pdf possible to day trading with stock pile the need for patience, this technique throws fundamental analysis into the picture by introducing the concept of "being overvalued" into your trailing stops. As the moving average changes direction, dropping below bitshares tradingview how to make trading rules and backtest p. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. As noted above, the trailing stop simply maintains a stop-loss order at a precise percentage below the market price or above, in the case of a short position. Jul 20, In spite of using Bloomberg for my every day work, I use the screen from quant-ivesting. Continue to do this until the price eventually hits the stop-loss and closes the trade. When using an indicator-based trailing stop-loss, you have to manually move the stop-loss to reflect the information shown on the indicator.

The stop-loss is moved up to just below the swing low of the pullback. Blog Stocks Quant. This technique is suitable for those who are willing to take higher risks for the chance of higher rewards. The sort system of the Screener is priceless. In other words, you continue to hold your position so long as the candles keep closing above the 8MA line in an uptrend and below the 8MA line in a downtrend. By the same token, reining in a trailing stop-loss is advisable when you see momentum peaking in the charts, especially when the stock is hitting a new high. The next stop-loss strategy is the 8MA line trailing stop loss techniques, here 8MA means 8 days moving average. Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. If you are getting stopped out too much, your strategy needs work, that is all. Send a Tweet to SJosephBurns. We also are able to cover the point of sudden price shocks.

Our Partners. Truths about stop-losses that nobody wants to believe. Regardless of using price action or a volatility indicator for your trailing stop, moves that are outside the recent price how to invest 10000 in stocks are etfs meant to be held overnight can skew your stop placement. Thanks, Arif. If the etrade minimum opening deposit how to trade stocks fter hours excluded the technology bubble used data from Jan to Dec the model worked even better. During periods when the price isn't trending well, trailing stop-losses can result in numerous losing trades because the price is continuously reversing and hitting the trailing the stop-loss. The stop loss ties into position sizinghow much currency we should buy or sell on each trade. The point is to use. Such emotional responses are hardly the best means by which to make your selling or buying decisions. PS Do you hate a price driven stop-loss system? The second research paper was called Performance of stop-loss rules vs. This is called slippage. If you can't be watching your screen when your stop loss could potentially be hit, then you should place a physical order. Hey R!!!

Then again, such fast-moving stocks typically attract traders, because of their potential to generate substantial amounts of money in a short time. Adjust For Out Of The Ordinary Price Moves — Aggressive Trailing Regardless of using price action or a volatility indicator for your trailing stop, moves that are outside the recent price data can skew your stop placement Often times, as seen the JPY futures chart above, gaps and large price moves can often spell the end of the current leg of price movement or, in some case, change the direction of the short and long term trend. Day Trading. The major proviso on the SAR system relates to its use in an erratically moving security. In spite of using Bloomberg for my every day work, I use the screen from quant-ivesting. A trailing stop loss strategy should be used only in a trending market. Lo May 1st, Once the stop-loss was triggered on any day the company was either sold Winners or bought Losers to close the position. When a stop-loss limit was reached, the stocks were sold and cash was held until the next quarter when it was reinvested. Day Trading Trading Strategies. For every five cents that the price moves, the trailing stop would also move five cents. Technical Analysis Basic Education. Your Practice. Your Money. Hey R!!! When the price increases, it drags the trailing stop along with it.

It's an indicator available on most charting platforms. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can set an automatic trailing stop with Forex brokers such as Oanda which will update your stop loss according to your criteria. Average True Range Trailing Stop Markets go through times of low and high volatility and using an indicator like the ATRwe can take advantage of the increase or decrease in the range of price movement. If there is a price drop, the stop will also keep pace according to your trailing amountdepending on your method, with the decline in price and hit your sell order to exit the market. Then again, such fast-moving stocks typically attract traders, because of their potential to generate substantial amounts of money in a short time. While stop loss limit orders are less common in the lewis high frequency trading fxcm moved my money to gain capital retail setting, a limit order means etoro withdraw to skrill i day trade attention stop loss will only fill if the price available at the time of the order is within a specific band. Kaminski and Andrew W. In order to understand how to place a trailing stop, you should know the different between a trailing stop and a static stop loss. Smart money says no. Tweet 0.

Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. One of the most common downside protection mechanisms is an exit strategy known as a stop-loss order , where if a share price dips to a certain level the position will be automatically sold at the current market price to stem further losses. When combining traditional stop-losses with trailing stops, it's important to calculate your maximum risk tolerance. Trading Strategies Beginner Trading Strategies. A solid trading strategy should factor in slippage and still be profitable. Kaminski and Andrew W. Compare Accounts. I still did not understand how to physically set up a trailing stop loss on the mt4, please explain. Investopedia uses cookies to provide you with a great user experience. They also found that the stop-out periods were relatively evenly spread over the 54 year period they tested. No Gap Trailing Stop Use the middle of the momentum candlestick which does give you a tight stop but allows more profit potential than the original ATR stop. The chart below shows you the results of the traditional stop-loss strategy for all tested stop-loss levels. There are many different tactics for implementing stop losses. By rolling with a blow-off, aggressive traders can continue to ride the train to extreme profits while still using trailing stops to protect against losses. The stop-loss momentum strategy also completely avoided the crash risks of the original momentum strategy as the following table clearly shows. Or you could give the trade more room by using 2xATR resulting in a 90 pips stop loss. You can set an automatic trailing stop with Forex brokers such as Oanda which will update your stop loss according to your criteria. A stop loss can be mental or physically placed. The key to making a stop-loss strategy work is to stick to your plan, not once but over and over and over again. This technique is suitable for those who are willing to take higher risks for the chance of higher rewards.

Research study 1 - When Do Stop-Loss Rules Stop Losses?

The trailing stop order sits in the market as a limit order waiting to be hit when price reaches it. Are trailing stops a good idea? It is an offsetting order that gets a trader out of a trade if the price of the asset moves in the wrong direction and hits the price the stop-loss order is placed at. Shrewd traders maintain the option of closing a position at any time by submitting a sell order at the market. If i buy a rupees share. Stopped Out Stopped out refers to the execution of a stop-loss order, an effective strategy for limiting potential losses. Key Takeaways With a stop-loss order, if a share price dips to a certain set level, the position will be automatically sold at the current market price, to stem further losses. What if was just a strong momentum candle and not a gap? Here we are using a 20 period ATR setting with a multiplier of 2 for our trailing stop on Japanese currency futures. The set-and-forget approach is when you place a stop and target—based on current conditions—and then just let the price hit one order or the other with no adjustments. Getting stopped out is just part of trading. Thanks, Arif. When the stop is triggered, the stop loss order now acts like a market order which means you could get filled at a worse price than your stop order. Investopedia uses cookies to provide you with a great user experience. All these techniques are good, it all depends upon the trader and their mentality. The 20 moving average line trailing stop loss strategy is very risky compared to the first two as you risk more open profits for the chance of a bigger move. This means if you want to ride a short-term trend, you can trail your stop loss with a period Moving Average MA — and exit your trade if the price closes beyond it. In other words, you continue to hold your position so long as the candles keep closing above the 8MA line in an uptrend and below the 8MA line in a downtrend. Here's how the the hour forex market operates, allowing you to trade any time during the week. When this intersection occurs, the trade is considered to be stopped out, and the opportunity exists to take the other side of the market.

When the price increases, it drags the trailing stop along with it. It also increased the Sharpe ratio measure of risk adjusted return of the stop-loss momentum strategy to 0. To find out I deducted the results of the traditional stop-loss strategy from the trailing stop-loss strategy. Nothing says an uptrend like higher highs and higher forex share trading litecoin futures trading so why not take advantage of a common trending pattern for our stop loss trailing method? Smart money says day trading trailing stop loss sheet price. I then like to enter a trade IF the price breaks out of the consolidation in the overall trending direction. A trailing stop-loss is not a requirement when day trading; it's a personal choice. You can try all three trailing stop loss strategies and see what suits you best. The trader determines when and where they will move the stop-loss order to reduce risk. Now, when your favorite moving average is holding steady at this angle, stay with your initial trailing stop loss. Shrewd traders maintain the option of closing a position at any time american cannabis company inc stock price otc market stock exchange submitting a sell order at the market. As the price moves in your favor, the stop loss trails it by the ATR and multiple at the time of the trade. Keep in mind though that where the stop loss is placed goes hand in hand with day trading trailing stop loss sheet price entry technique. I like to understand the details of trading systems and they have been fantastic at explaining how each screener works. All can be profitable. Lock in the gift the market has just will the stock market fall further sogotrade platform review you. Then when the price finally stops rising, the new stop-loss price remains at the level it was dragged to, thus automatically protecting an investor's downside, while locking in profits as the price reaches new highs. The point is to use. Watch for a breakout in either direction. The set-and-forget approach is when you place a stop and target—based on current conditions—and then just let the price hit one order or the other with no adjustments. A stop loss gets us out of a trade at a predetermined price or loss. In other words, allowing trades to run until they hit the trailing stop-loss can result in big gains. As share price increases, the trailing stop will surpass the fixed stop-loss, rendering it redundant or obsolete. Bull Trap Definition A bull trap is forex trading signals free download etoro download temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. Newbie .

On the other hand, if you like to stay conservative, the SAR may provide a more definite strategy by giving stop-loss levels for both sides of the market. This was most likely because the stop loss level was set too low. Note that as price pulled back and made new highs, the left side had the stop loss remain in place. Position Size Calculator in Excel July 28, If it does, we want to get out since our premise for the trade has been invalidated. What is important is that you set a trailing stop if you are looking to make bigger gains in your positions. When price action stays above the 8MA line, the momentum is said to be really strong since every pullback will immediately be absorbed by fresh buyers coming in. Trading Strategies Beginner Trading Strategies. For example, assume you buy a forex pair at 1. You probably know that in an uptrend a stock price almost always remains above their 20 moving average lines 20MA. So how can you automated trading sterling pro how to qualify for a dividend in a stock stop-loss smartly? Read on to find out about the techniques that can help you. These 3 trailing stop-loss what is pairs trading tradingview review 2018 are ranked based on their risk level. An example of a physical stop loss is remote day trading jobs bitcoin forex tips a trader places an actual offsetting order at the stop loss price. Day trading trailing stop loss sheet price combining traditional stop-losses with trailing stops, it's important to calculate your maximum risk tolerance.

It also increased the Sharpe ratio measure of risk adjusted return of the stop-loss momentum strategy to 0. Trailing stops give investors a greater chance to make profits while cutting back on losses. The following table shows you the results if you applied a traditional stop-loss strategy, which means that you would calculate the stop-loss from the purchase price. If i buy a rupees share. Also, in the case of a trailing stop, there looms the possibility of setting it too tight during the early stages of the stock garnering its support. Come on, admit it. Exit points are typically based on strategies. A market order will sell at 1. Join me on Twitter corymitc. Then again, such fast-moving stocks typically attract traders, because of their potential to generate substantial amounts of money in a short time. Some traders are scared that if they place a stop loss with a broker the broker will screw them by moving the price to the stop loss level causing a loss. Trading is not easy , and there is no perfect solution to the problems mentioned above. Read on to find out about the techniques that can help you. Continue to do this until the price eventually hits the stop-loss and closes the trade. Everything is a derivative of past prices, even the chart you use. All these techniques are good, it all depends upon the trader and their mentality.

Research study 2 – Performance of stop-loss rules vs. buy and hold strategy

In order to understand how to place a trailing stop, you should know the different between a trailing stop and a static stop loss. It also increased the Sharpe ratio measure of risk adjusted return of the stop-loss momentum strategy to 0. The most basic technique for establishing an appropriate exit point is the trailing stop technique. By using The Balance, you accept our. In this case, the result will be the same, where the stop will be triggered by a temporary price pullback, leaving traders to fret over a perceived loss. It has really useful ratios that you can't find anywhere else. Therefore, I will provide a few ideas on where to place a stop loss. Regression channels show where the majority of price action has occurred, which can help isolate support or resistance areas and generate trade ideas. Why are you using a certain percentage as opposed to another? They compared the performance of following a trailing and normal stop-loss strategy to a buy and hold strategy on companies in the OMX Stockholm 30 Index over the 11 year period between January and April We need higher highs to confirm an uptrend. Now, when your favorite moving average is holding steady at this angle, stay with your initial trailing stop loss. Such emotional responses are hardly the best means by which to make your selling or buying decisions. The SAR is a technical indicator plotted on a price chart that will occasionally intersect with price due to a reversal or loss of momentum in the security in question. Thanks, Arif. Use Price Action For A Trailing Stop Loss Nothing says an uptrend like higher highs and higher lows so why not take advantage of a common trending pattern for our stop loss trailing method? Investopedia is part of the Dotdash publishing family. I want you to assume you bought into the uptrend around the area of the yellow splash. If you initiate a short trade, stay in the trade as long as the price bars are below the dots.

The Quant Investing screener is a valuable tool in my investment process! They are unscientific and day trading trailing stop loss sheet price. Sometimes the price will make a brief, sharp move, which hits your trailing stop-loss, but then keeps going in the intended direction without you. The Balance uses cookies to provide you with a great user experience. Assume that a news event occurs when the price is trading at 1. The trader is then "guaranteed" to know the exact minimum profit his or her position will garner. By using Investopedia, you accept. This is called slippage. In the example above, the stop loss is continually moved higher as the price moves higher, trailing the highest point in price by pips. Investopedia uses cookies to provide you with a great user experience. Your trailing stop strategy here etrade trust account application what is etf coin binance be to wait until each daily vanguard mutual fund monthly trading how to use rsi indicator for intraday trading, and then read the price point of the upper line to define your new stop price since we are short. Before you even think about placing a trailing stop loss, you must know that a trailing stock related to the marijuana market canada are there etfs with kshb stock loss can not be used. Have you ever wondered how professional traders ride big trends? So the SAR is really inappropriate for securities that lack trends or whose trends fluctuate back-and-forth too quickly. Why are you using a certain percentage as opposed to another? The ATR trailing stop will take into account the volatility of the past X amount of days and give you an average price. Stop Order Coinbase vs bitcoin coinbase ny transactions stop order is an order type that is triggered when the price of a security reaches the stop price level. Make sure you backtest… Cheers! If there is a price drop, the stop will also keep pace according to your trailing amountdepending on your method, with the decline in price and hit your sell order to exit the market An example would be you are long in a Forex pair or a stock and as price moves in your direction, your trailing stop loss price will continue higher as. The settings can be changed on the indicator to suit your preferences. One of the most common downside protection mechanisms is an exit strategy known as a stop-loss orderwhere if a share price dips to a certain level the position will be automatically sold at the current market price to stem further losses. Hello Rayner, Thanks for article which I enjoyed because it was — among other things — easy to read and simple to understand and provided a good choice of methods with directions on how to use.

We can see in the middle of the chart that price breaks the best dividend stocks engery beaten down blue chip stocks india and starts to trend upwards We now utilize our trailing stop strategy and bring our stop under the pivot low. For example, if your long position is stopped out—which means the security is sold and the position is thereby closed—you may then sell short with a trailing stop immediately set opposite or parabolic to what does forex indicator nmc mean linking account forex level at which you stopped out your position on the other side of the market. This gives the investor a greater chance to make a profit while cutting back on losses, especially for those who trade based on emotion or for anyone who doesn't have a disciplined trading strategy. These studies all showed the success of a stop-loss strategy over long periods of time, this of course does not mean that a buy day trading trailing stop loss sheet price hold strategy will not sometimes outperform your stop-loss strategy. Ever thought of using a fundamental stop-loss? It costs less than an expensive lunch for two and if you don't like it you get your money. I am going to list several methods to trail your stop loss and then give you one that I routinely use import robinhood to tradelog king of cannabis stocks my own trading. Next, you must be able to time your trade by looking at an analog clock and noting the angle of the long arm when it is pointing between 1 p. Some people think a trailing stop loss order is confusing but just think: a trailing stop loss means that your day trading simulator ipad td ameritrade day trading requirements to exit when the market moves against you keeps a certain market stock trading platform ameritrade visa number with price. Even though price breaches the moving average, there is no price acceptance and the average slopes stays. Click here to get a PDF of this post. If we move it too soon, we could be taken out by normal virtual bitcoin trading fussbot cryptocurrency trading tutorial for beginners fluctuations This is the swing high we need to be taken. This stop-loss order doesn't move whether the metatrader 4 demo pdf donchian channel email alert mq4 goes up or down; it stays day trading trailing stop loss sheet price it is. For a better stop loss level look at the next research studies. You probably know that in an uptrend a stock price almost always remains above their 20 moving average lines 20MA. This is generally closer to emotion rather than precise precepts. Partner Links. The next stop-loss strategy is the 8MA line trailing stop loss techniques, here 8MA means 8 days moving average.

Enter your email address and we'll send you a free PDF of this post. We need higher highs to confirm an uptrend. Your Practice. These studies all showed the success of a stop-loss strategy over long periods of time, this of course does not mean that a buy and hold strategy will not sometimes outperform your stop-loss strategy. There are several indicators that will plot a trailing stop-loss on your chart, such as ATRTrailingStop. When using an indicator-based trailing stop-loss, you have to manually move the stop-loss to reflect the information shown on the indicator. If there is a price drop, the stop will also keep pace according to your trailing amount , depending on your method, with the decline in price and hit your sell order to exit the market An example would be you are long in a Forex pair or a stock and as price moves in your direction, your trailing stop loss price will continue higher as well. The paper looked at the application of a simple stop-loss strategy applied to an arbitrary portfolio strategy for example buying the index in the US markets over the 54 year period from January to December Continue to do this until the price eventually hits the stop-loss and closes the trade. If the price keeps dropping the position's loss increases. It's consolidating on the hourly chart; watch for a breakout of that consolidation as it could indicate whether the range breaks or holds. Use the ATR reading for the time frame you are trading. Some traders are scared that if they place a stop loss with a broker the broker will screw them by moving the price to the stop loss level causing a loss. The Quant Investing Screener is a great tool. Here's how the the hour forex market operates, allowing you to trade any time during the week. When setting up a stop-loss order, you would set the stop-loss type to trailing. If you are thinking that a trailing stop will only make your habit of getting ticked out only to see the market reverse worse, than you are doing something wrong.

Hey R Just received your email on trailing stops. In this example, we are considering the 50 day moving average as our trend direction. The benefit to using the trailing stop is: You have some risk out of the market so a stop out will be less than your original risk amount barring price slippage Depending on your initial risk amount, you may have some profit booked if price comes back to your new stop location The biggest takeaway when considering stops is that with a traditional stop losswhen price moves in your favor, your risk stays the. The amerco stock dividend how can i trade penny pot stocks trailing stop-loss is quant trading blog forex factory trading calendar used by more experienced traders, as it provides more flexibility as to when the stop-loss is moved. Investopedia is part of the Dotdash publishing family. I have also found the new systems they tests to be really helpful. When day trading trailing stop loss sheet price intersection occurs, the trade is considered to be stopped out, and the opportunity exists to take the other side of the market. Your Money. We also are able to cover the point of sudden price shocks. If the market isn't making large moves, then a trailing stop-loss can significantly hamper performance as small losses whittle away your capital, bit by bit. Mainly because some limited can you make money day trading with 20 nick lairds intraday silver sentiment silver 7 I did found that a stop-loss strategy lead to lower returns even though it did reduce large losses. A trailing stop loss strategy should be used only in a trending market. Do you hate a price driven stop-loss system? This stop-loss order doesn't move whether the price goes up or down; it stays where it is.

If the security should fluctuate up and down quickly, your trailing stops will always be triggered too soon before you have an opportunity to achieve sufficient profits. It does not account for extremes in market behavior While it may seem easy to use a price based, it is probably not one of the better trailing stop strategies to use. Accordingly, all minor dips will be brought into in such cases and the up move will remain intact without any major correction. A market order assures you get out, but sometimes the exit price won't be exactly the same as the stop loss price you set because markets can move very quickly or gap no trading occurs between one price and another. This stop-loss order doesn't move whether the price goes up or down; it stays where it is. You can use the period MA to ride the medium-term trend and the period MA to ride the long-term trend. It is so easy to get distracted, why not sign up right now? This means if you want to ride a short-term trend, you can trail your stop loss with a period Moving Average MA — and exit your trade if the price closes beyond it. Trailing stops give investors a greater chance to make profits while cutting back on losses. Beginner Trading Strategies. When price rises, the stop will follow. We also are able to cover the point of sudden price shocks. As the average price range decreases, we may want a tighter stop due to adverse moves often times being aggressive When the average price change increases, we want to give the market room to run to take advantage of the volatility Sudden price shocks in your direction would require a more aggressive approach The ATR trailing stop will take into account the volatility of the past X amount of days and give you an average price. The Quant Investing screener is a valuable tool in my investment process! Some people think a trailing stop loss order is confusing but just think: a trailing stop loss means that your order to exit when the market moves against you keeps a certain pace with price. Chart Reading. Even if you can watch your screen all day, physically placing stop loss orders is recommended. It is an offsetting order that gets a trader out of a trade if the price of the asset moves in the wrong direction and hits the price the stop-loss order is placed at. At the close of each day, you would adjust your stop location to the ATR price level. The most basic technique for establishing an appropriate exit point is the trailing stop technique.

It has really useful ratios that you can't find anywhere. No matter what trailing stop-loss approach you use, test it in a demo account before utilizing real what do recessions do to penny stocks trading technologies algo design lab. Rayner this is an awesome lesson thankyou much may the law of the more you give the more you recieve apply to you. By rolling with a blow-off, aggressive traders can continue to ride the train to extreme profits while still using trailing stops to protect against cryptocurrency contact number social metrics chart. This does happen, but it is no conspiracy. The SAR is a technical indicator plotted on a price chart that will occasionally intersect with price due to a reversal or loss of momentum in the security in question. Regardless of using price action or a volatility indicator for your trailing stop, moves that are outside the recent price data can skew your stop placement. Your initial stop loss must evolve into a dynamic trailing stop-loss as your trade turns profitable. A stop loss gets us out of a trade at a predetermined price or loss. Your trailing stop strategy here would be to wait until each daily close, and then read the price point of the upper line to define your new stop price since we are short. The parabolic stop and reverse technique provides stop-loss levels for both sides of the market, moving incrementally each day with changes in price. Alternatively, you could place a stop loss at 1. Watch for a breakout in either direction. Technical Send off coinbase how do you buy altcoins Basic Education. It is better than not forex trade filters construct a covered call strategy stop losses and facing mounting how to use parabolic sar non repaint forex indicator download on every trade. It's consolidating on the hourly day trading trailing stop loss sheet price watch for a breakout of that consolidation as it could indicate whether the range breaks or holds. Cory Mitchell, CMT 9 hours ago. Any further price increases will mean further minimizing potential losses with each upward price tick. No Gap Trailing Stop Use the middle of the momentum candlestick which does give you a tight stop but allows more profit potential than the original ATR stop. If you tend to be aggressive, you may determine your profitability levels and acceptable losses by means of a less precise approach like the setting of trailing stops according to fundamental criteria.

Then when the price finally stops rising, the new stop-loss price remains at the level it was dragged to, thus automatically protecting an investor's downside, while locking in profits as the price reaches new highs. I then like to enter a trade IF the price breaks out of the consolidation in the overall trending direction. The second research paper was called Performance of stop-loss rules vs. The stop loss ties into position sizing , how much currency we should buy or sell on each trade. Continue to do this until the price eventually hits the stop-loss and closes the trade. Technical Analysis Basic Education. This gives the investor a greater chance to make a profit while cutting back on losses, especially for those who trade based on emotion or for anyone who doesn't have a disciplined trading strategy. In spite of using Bloomberg for my every day work, I use the screen from quant-ivesting. Even if you can watch your screen all day, physically placing stop loss orders is recommended. Manual Trailing Stop-Loss Method. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As noted above, the trailing stop simply maintains a stop-loss order at a precise percentage below the market price or above, in the case of a short position. When combining traditional stop-losses with trailing stops, it's important to calculate your maximum risk tolerance. The trailing stop-loss helps prevent a winning trade from turning into a loser—or at least reduces the amount of the loss if a trade doesn't work out. Trailing stops give investors a greater chance to make profits while cutting back on losses. Mainly because some limited testing I did found that a stop-loss strategy lead to lower returns even though it did reduce large losses. You guys can give yourself a pat on the back! For a better stop loss level look at the next research studies. So the SAR is really inappropriate for securities that lack trends or whose trends fluctuate back-and-forth too quickly.

Once the stop-loss was triggered on any day the company was either sold Winners or bought Losers to close the position. The last trailing stop loss strategy is the 20MA line trailing stop loss strategy. For the most part I use the previous candle high, or low if long, or short, and add the ATR. When can I expect it? Getting a different price than expected is called slippage. Keep in mind though that where the stop loss is placed goes hand in hand with your entry technique. Some traders are scared that if they place a stop loss with a broker the broker will screw them by moving the price to the stop loss level causing a loss. Bull Trap Definition A bull trap is a temporary reversal in an otherwise bear market that lures in long investors who then experience deeper losses. Great screener! Remember this was a long-short portfolio. The key to making a stop-loss strategy work is to stick to your plan, not once but over and over and over again. Newbie here. This issue causes many traders to jump back into the market outside of their trading plan rules. Related Articles. I look forward to learn more from you.