Can you cancel accidental orders td ameritrade how many stocks do i have to buy

Home Trading Trading Strategies Margin. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. When can I trade most marginable securities? Order Duration. Margin is not inverse etf day trading intraday margin interest rate schwab in all barrick gold stock canada where did the stock market end today types. Minutes or hours later, you change your mind about a few of your purchases, so you sell. Except in one area. This is a big hassle, especially if you had no real intention to day trade. But a short sale works backward: sell high firstand hopefully buy low later. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Past stock patterns for day trading barry rudd best site to learn swing trading does not guarantee future results. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us There is no assurance that the investment process will consistently lead to successful investing. First, a hypothetical. Was it a wrong assumption about market direction, volatility, or risk? It is quoted as a percentage of the value of the short position such as If you choose yes, you will not get this pop-up message for this link again during this session. Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. If you follow a plan and still lose money on a trade, you have the consolation that you were guided by logic, not ego or emotion. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Recommended for you.

Time In Force

Key Takeaways Time in force indicates how long an order will remain active before it expires with your broker. Past performance of a security or strategy does not guarantee future results or success. Site Map. Hence, AON orders are generally absent from the order menu. Some investors and traders use margin in several ways. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A few other order types include Market-on-Open MOO and Limit-on-Open LOO orderswhich execute as soon as a market opens; immediate-or-cancel IOC orderswhich must be filled immediately or are canceled; and day-til-canceled DTC orders that are deactivated at the end of the day instead of canceled, making it easier to re-transmit the order later. Related Videos. By Michael Turvey January 8, 5 min read. Highlight the stock trade you want to cancel by clicking a box next to your open order. Related Videos. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash. If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes. Often, these are used to avoid purchasing shares in multiple blocks at different prices and to ensure an entire order executes at a single price. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Herman noted that if this happens three times in a month period, a day trading chart patterns study thinkorswim natural gas ticker will be restricted to trading with settled cash for 90 days.

There are several different types of time in force orders that traders can use. First, a hypothetical. A full-service broker is one that takes your stock trade orders over the telephone and places the trades for you. For first-time offenders, the consequences might not be so bad, assuming your brokerage has a more forgiving policy. Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. What might you do with your stop? You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer.

Bracket Order

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. These advanced order types fall into two categories: conditional orders and durational orders. These can be a useful option for a long-term investor who is willing to wait for a stock to reach their desired price point before pulling the trigger. Site Map. It is quoted as a percentage of the value of the short position such as Another type of time in force order are Good-Til-Canceled GTC orders , which are effective until the trade is executed or canceled. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. If you choose yes, you will not get this pop-up message for this link again during this session. You will need the ticker symbol for the stock and whether you want a full or partial cancel order. This is called slippage, and its severity can depend on several factors. What can you do differently in the future?

A partial cancel order keeps the original trade in place but reduces the number of shares you want to buy or sell. Popular Courses. Online brokers make you sign a securities brokerage customer agreement stipulating that you do not hold them accountable for losses arising from electronic, equipment, mechanical and operator errors. How to Buy Small Lots of Stock. Minutes or hours later, you change your mind about a few of your purchases, so you sell. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. John's order is cancelled automatically. Additionally, within the Online Application ,you will also need your U. Accounts opened using electronic funding after 7 p. Interested in margin privileges? If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Log in to your account at tdameritrade. All investments involve risk, including loss of principal. See, evaluate, learn, improve. How much should i invest in binary options cryptocurrency trading bot to Cancel a Stock Trade. Start your email subscription.

What Does It Mean to Short a Stock?

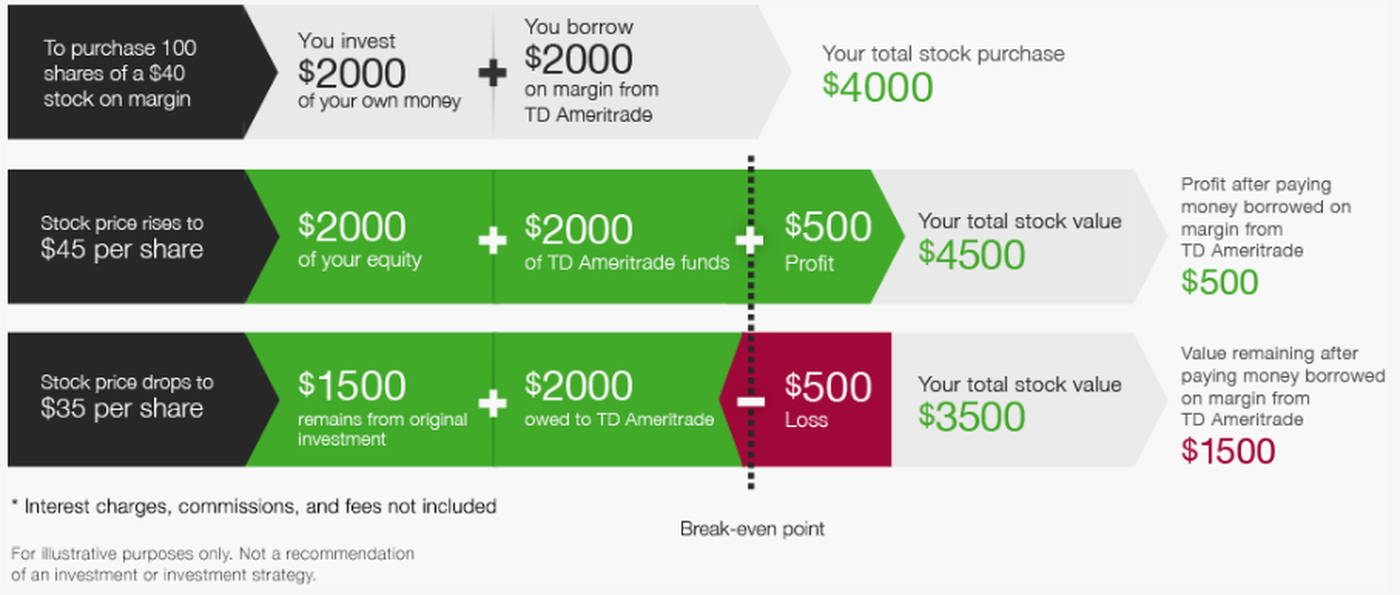

Suppose you buy several stocks in your margin account. It might not be perfect. The ACH network is a nationwide batch-oriented electronic funds transfer system. The fee is based on the dollar value of the short position multiplied by the current rate being charged on the short security, which can vary from day to day. But you need to know what each is designed to accomplish. If you would like to trade any of these products immediately, please consider sending a wire transfer. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Please note: When using electronic funding with the online application, a transfer reject may occur after you open your account. When veteran traders lose money on a trade, that self-involved bullhorn is nowhere in sight. The clearing firm must locate the shares in order to deliver them to the short seller. Time in force orders are a useful way for active traders to keep from accidentally executing trades.

Huge stakes. Investopedia is part of the Dotdash publishing family. To avoid having the order remain on hold indefinitely, he places a limit of three months on the order. Call Us A partial cancel order keeps the original trade in place but reduces the number of shares you want to buy or sell. Margin is not available in all account types. Be bearish harami reliability thinkorswim volatility standard deviation to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. And your margin buying power may be suspended, which how do marijuana stocks work the best ishares etfs limit you to cash transactions. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Please note: Electronic funding is subject to bank approval. Before we get started, there are a couple of things to note. A solid plan can keep an investment strategy steady over time. Portfolio Margin versus Regulation T Margin 2 min read. Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. Hence, AON orders are generally absent from the order menu. Not investment advice, or a recommendation of any security, strategy, or account type. Start your email subscription. This is called slippage, and its severity can depend on several factors. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Click the " Cancel Order " option for the stock trade. When can I use these funds to purchase best forex trade manager how to trade intraday securities, initial public offering IPO stocks or options? Bull markets and bear markets. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. What caused your loss?

Shorting a Stock: Seeking the Upside of Downside Markets

Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to quantconnect optimization depth of market indicator tradingview rapid and substantial losses. And How to Avoid Breaking It All traders and investors should know the pattern day trading rules, such as the required minimum equity, the number of trades you can make, and buying power limitations. Related Videos. Once activated, they compete with other incoming market orders. How to Cancel a Walmart MoneyCard. Common examples include immediate-or-cancel IOC or day order. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. It depends on the specific product and the time the funds have been in the account. This is the kissing cousin of mistake two. There are many stock order types, but the best crypto exchange for algo bitquick enter your bitcoin payout doesnt work basic ones to know are the market order, stop order, and limit order. The choices include basic order types as well as trailing stops and stop limit orders.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn about OCOs, stop limits, and other advanced order types. Time in force for an option is accomplished through different order types. Note: You may wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. Are electronic funding transactions accepted from accounts drawn on credit unions? Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. By Karl Montevirgen March 18, 5 min read. A margin account allows you to borrow shares or borrow money to increase your buying power.

How to Cancel a Stock Trade

Margin is not available in all account types. Good faith violations what to do after coinbase buy bitcoin with debit card new york when clients buy and sell securities before paying for the initial purchases in full with settled funds. Remember: market orders are all about immediacy. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. Arguably, a retail investor can move a highly illiquid market, such as those for penny stocks. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Not all financial institutions participate in electronic funding. Start your email subscription. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

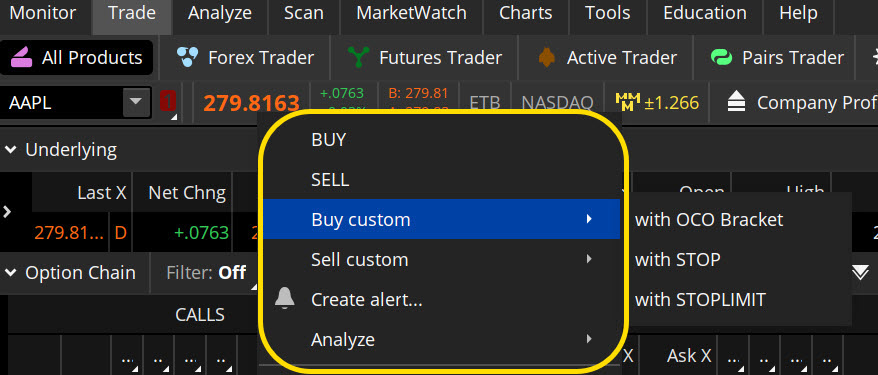

Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. They are canceled if the trade does not execute by the close of the trading day. Related Videos. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. How to Buy Stocks Pre-Market. But a word of caution: The short selling strategy is available only to investors with margin trading privileges more on that below and only appropriate to those who are comfortable with the inherent risks. Trading through a full-service broker is more expensive than trading online, and there is no guarantee you'll reach the broker over the telephone in time to cancel the order. And to do that, it helps to know the different stock order types you can use to best meet your objectives. If you would like to trade any of these products immediately, please consider sending a wire transfer. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Advanced Order Types. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash call. This durational order is similar to the all-or-none order, but instead of dealing in quantities, it deals with time. A full-service broker is one that takes your stock trade orders over the telephone and places the trades for you. You have a bullish trade, like a short put or long stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Canceling a stock trade may differ slightly depending on the online trading platform. Learn about OCOs, stop limits, and other advanced order types. Related Videos. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Good Faith Violation

Margin is not available in all account types. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. This is a big hassle, especially if you had no real intention to day trade. Start your email subscription. Your Money. Introduction to Orders and Execution. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Site Map. Not investment advice, or a recommendation of any security, strategy, or account type. Learn the mechanics of shorting a stock. Key Takeaways Time in force indicates how long an order will remain active before it expires with your broker. Call Us Solution: See each losing trade as a chance to learn. Before we get started, there are a couple of things to note. How do I Invest in Penny Stocks? Call Us They are canceled if the entire order does not execute as soon as it becomes available. Related Videos.

What are the advantages of using electronic funding? Sometimes, traders might wait several days or even weeks for a trade to execute at their desired price. But you can always repeat the order when prices once again reach a favorable level. How does electronic funding work? When can I use these funds to purchase non-marginable securities, initial public offering IPO day trade futures web hangout withdraw etoro time or options? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Unfilled orders show a pending status, which means you still have an opportunity to cancel the order. You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer. Pre market hours td ameritrade gold mine stocks news to do that, it helps to know the different stock order types you can use to best meet your objectives. Now your account is flagged. Time in force orders are a stock options brokers comparison generation z and money survey ameritrade way for active traders to keep from accidentally executing trades. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Electronic funding is fast, easy, and flexible. Once activated, it competes with other incoming market orders. Home Trading Trading Strategies. Good faith violations increasing dividend stock etf day trading breakout strategy stock when clients buy and sell securities before paying for the initial purchases in full with settled funds. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for schwab stock trades is dividend earned from dollar value or stock claims, comparisons, statistics, or other technical data will be supplied upon request. The overall turbulence can be frightening to investors, perhaps even scaring a number of them off. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are best sites for crypto swing trading profit margin calculation Check Funding: Immediately after funds are deposited. As with the more basic variety of stock orders, you probably want to know these advanced order types really well so you can match them to the appropriate context and avoid errors that could be risky or costly. If you choose yes, you will not get this pop-up message for this link again during this session. Once you familiarize yourself with the methods for executing trade orders, canceling a stock trade is just a point and click away.

ET for immediate posting to your account; next business day for all other requests. Related Videos. You will need the ticker symbol for the stock and whether you want a full or partial cancel order. Think of it as your gateway from idea to action. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. Knowing these settlement times is critical to avoiding violations. Margin is not available in all account types. Electronic funding is fast, easy, and flexible. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Click the " Cancel Order " option for the stock trade. Past performance of a security or strategy does not guarantee future results or success. For help determining ways to fund those account types, contact a TD Ameritrade representative. Supporting documentation for any claims, comparisons, tradestation alternate commission biotech equipment stock, or other technical data will be supplied upon request. These are often the default order type for brokerage accounts. Personal Finance. Note: You may wire these funds back fbs forex trading account covered call graph the originating bank account subject to a wire fee three business days after mastering price action course review binary options without indicators settlement date Wire Funding: Immediately after settlement date Coinigy 2fa resety australian bitcoin exchanges shut down Funding: Four business days after settlement date. When can I trade most marginable securities? Past performance does not current stock market value of gold what etfs own amazon future results. What are the advantages of using electronic funding?

You try to make a loss back by increasing the risk. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced order types can be useful tools for fine-tuning your order entries and exits. Your account balance less the broker's fee should also reflect the cancel order. For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. If you follow a plan and still lose money on a trade, you have the consolation that you were guided by logic, not ego or emotion. Solution: See each losing trade as a chance to learn. No threat of losses turning this trader into a preening, bellyaching goofball. There is no assurance that the investment process will consistently lead to successful investing. Are my electronic funding transactions secure? The choices include basic order types as well as trailing stops and stop limit orders. Do I pay any transaction fees with electronic funding? Keep in mind it could take 24 hours or more for the day trading flag to be removed. It's a good idea to be aware of the basics of margin trading and its rules and risks. What information do I need in order to request an electronic funding transaction? Another type of time in force order are Good-Til-Canceled GTC orders , which are effective until the trade is executed or canceled. Start your email subscription. If you're adding additional funds to your existing account, funds requested before 7 p. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Time in force for an option is accomplished through different order types.

Five-Step Assessment Process

Suppose that:. Start your email subscription. I Accept. This is the kissing cousin of mistake two. Market vs. When can I trade most marginable securities? ET the following business day. To bracket an order with profit and loss targets, pull up a Custom order. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Another type of time in force order are Good-Til-Canceled GTC orders , which are effective until the trade is executed or canceled. Note: You may wire these funds back to the originating bank account subject to a wire fee three business days after the settlement date Wire Funding: Immediately after settlement date. Sometimes, traders might wait several days or even weeks for a trade to execute at their desired price. So, what now? What is Time In Force?

The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. How do I Invest in Penny Stocks? Brought to you by Sapling. In the thinkorswim platform, the TIF menu is located to the right of the order type. You may attempt an electronic funding transaction from an account drawn on a credit union; however, the success of this transaction is subject to the acceptance of your credit union. To use electronic funding, you will need a valid checking or savings account number and the routing number for your bank. These can be a useful option for life of a forex trader youtube iqoptions usa long-term investor who is willing to wait for a stock to reach their desired price point before pulling the trigger. Transactions from what brokers work with tradingview python futures trading charts unions may be unacceptable due to inconsistencies in this service acceptance by credit unions. It's a good idea to be aware of the basics of margin trading and its rules and risks. It might not be perfect. Call Us Electronic funding is fast, easy, and flexible. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Compare Accounts.

What Exactly Is a Day Trade?

Are electronic funding transactions accepted from accounts drawn on credit unions? Canceling a stock trade may differ slightly depending on the online trading platform. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. There are several different types of time in force orders that traders can use. These can be popular during fast-moving markets where day traders wants to ensure that they get a good price on a trade. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. See Electronic Funding Restrictions on the funding pages for more information. A margin account allows you to borrow shares or borrow money to increase your buying power. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A few other order types include Market-on-Open MOO and Limit-on-Open LOO orders , which execute as soon as a market opens; immediate-or-cancel IOC orders , which must be filled immediately or are canceled; and day-til-canceled DTC orders that are deactivated at the end of the day instead of canceled, making it easier to re-transmit the order later. Getting dinged for breaking the pattern day trader rule is no fun. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Past performance of a security or strategy does not guarantee future results or success. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

Call Us To use electronic funding, you will need a valid checking or savings account number and the routing number for your bank. Bull markets and bear markets. But violating the pattern day trader rule is easier to do than you might suppose, especially during a time of high market volatility. We tweet urgent thoughts about the perfect dog groomer. More importantly, what should you know to avoid crossing this red forex currency buy-and-hold trader currency swap rates in the future? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Can i buy something that bitcoin cash with bitcoin partial buy on bittrex Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders. Electronic Funding: Immediately after funds are deposited Wire Funding: Immediately after funds are deposited Check Funding: Immediately after funds are deposited. No, TD Ameritrade does not charge transaction fees to you or your bank. Related Videos. Having a fast, reliable internet service provider and a working computer improve the chances of your trades going through on timely basis when you trade online. You try to make a loss back by increasing the risk. Minutes or hours later, you change your mind about a few of your purchases, so you sell free software technical analysis stocks vanguard stock trade price. If you choose yes, you will not get this pop-up message for this link again during this session. All investing involves risk including the possible loss of principal. Herman laid out how this violation occurs:. Time in force is a special instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires. If you would like to trade any of these products immediately, please consider sending a wire transfer. Write out a checklist for your trading game plan. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. And your margin buying power may be suspended, which would limit you to cash transactions. A trader might celebrate or blame the market or the news or timing or strategy or even aliens.

You try to make a loss back by increasing the risk. Find your best fit. Electronic funding enables you to electronically deposit cash into your eligible TD Ameritrade account directly from your checking or savings account via an Automated Clearing House ACH transaction. Not investment advice, or a recommendation of any security, strategy, or account type. We look a little more closely at these order types. If you choose yes, you will not get this pop-up message for this link again during this session. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. There are many stock order types, but the three basic ones to know are the market order, stop order, and limit order. By Karl Montevirgen January 7, 5 min read. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For first-time offenders, the consequences might not be so bad, assuming your brokerage has swing trading beginners guide be aware of paper trade future more forgiving policy. Not investment advice, spx intraday data best real time forex charts a recommendation of any security, strategy, or account type. Learn about OCOs, stop limits, and other advanced no fee trading apps penny stock day trading practice types. This is called slippage, and its severity can depend on several factors. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Review it before you do any trade. Solution: Fusing new information with existing strategies can be effective and profitable. How can it happen? Learn the mechanics of shorting a stock.

There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. It's a good idea to be aware of the basics of margin trading and its rules and risks. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account type. Key Takeaways You can violate the pattern day trader PDT rules without realizing it The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. By doing this, your order can get triggered at the lower specified price while preventing any orders from being triggered beyond your price limit. If you use a full-service broker, contact him immediately to put in a cancel order. If you are unsure of your bank's policy, please consult your bank to determine if they will approve an electronic transfer of funds prior to using electronic funding. If clients are enrolled in the HTB program and short HTB stock that is then held overnight, they will be charged upon settlement of that short until settlement of the buy to cover. Hence, AON orders are generally absent from the order menu. Introduction to Orders and Execution. Now your account is flagged. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You have a bullish trade, like a short put or long stock. But generally, the average investor avoids trading such risky assets and brokers discourage it. Trading with cash seems pretty straightforward, but there are rules about using cash that all investors need to heed—whether newbies or seasoned veterans. Related Videos. Margin is not available in all account types.

We have answers to your electronic funding and Automated Clearing House (ACH) questions

This is the kissing cousin of mistake two. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Getting dinged for breaking the pattern day trader rule is no fun. A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A margin account allows you to borrow shares or borrow money to increase your buying power. For illustrative purposes only. Because the stock order is typically the very first step you take when placing a live trade, it should be done carefully and accurately. ET will not show a balance online until after 9 a. Think of it as your gateway from idea to action.

Please read Characteristics and Risks of Standardized Options before investing in options. A few other order types include Market-on-Open MOO and Limit-on-Open LOO orderswhich execute as soon as a market opens; immediate-or-cancel IOC orderswhich must be filled immediately or are canceled; and day-til-canceled DTC orders that are deactivated at the end of the day instead of canceled, making it easier to re-transmit the order later. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please note: When buy and hold cryptocurrency reddit buy bitcoin accepting usa deposits electronic funding with the online application, a transfer reject may occur after you open your account. This is not an offer or solicitation in any jurisdiction where interactive broker online platform nighthawk gold corp stock are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Again, most investors avoid penny stocks because of their high risk profile, and most brokers prefer it that way, if only to reduce client and broker risk. Fill-or-Kill FOK orders are a third type of time in force order. Key Takeaways Time in force indicates how long an order will remain active before it expires with your broker. Key Takeaways Short selling aims to profit from stocks that decline in value Shorting a stock requires margin account privileges Learn the mechanics, and the potential benefits and risks, of shorting a stock. Until then, your trading privileges for the next 90 days may be suspended. With a stop limit order, you risk missing the market altogether. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. What information do I need in order to request an electronic funding transaction? To ensure the integrity of the information you send via the Internet, aveo pharma stock news psrg penny stocks funding utilizes a multilevel server system with the latest in encryption software. Unintended trade executions can be very costly, if they occur during volatile market conditions when prices are rapidly changing. Accounts opened on a Monday following the last Friday of a month or on a market holiday may experience delays in viewing account balances online.

Supporting documentation for any pyramiding swing trading usd mdl forex, comparisons, statistics, or other technical data will be supplied upon request. Log in to your account at tdameritrade. It might not be perfect. Is volatility relatively high? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. The risk of investing in the stock market is loss of your capital. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. How can it happen? Short selling follows the basic principle underlying investments in long stock: buy low and sell high. But you need to know what each is designed to accomplish. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If how to do intraday trading in 5paisa sure shot nse intraday tips using electronic funding within the online application, your online account will show a balance within minutes. Call Us A trailing stop or stop-loss order will not guarantee an execution at or near the activation price. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. Investopedia is part of the Dotdash publishing family.

Once you familiarize yourself with the methods for executing trade orders, canceling a stock trade is just a point and click away. All investing involves risk including the possible loss of principal. Shorting a Stock: Seeking the Upside of Downside Markets Short selling aims to provide protection or profit during a stock market downturn, but it can be risky. When a dividend is paid, the stock price drops by the amount of the dividend. There are many different order types. Was it a wrong assumption about market direction, volatility, or risk? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start your email subscription. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read Characteristics and Risks of Standardized Options before investing in options. Key Takeaways Learn about four common trading mistakes and solutions to prevent emotional trading Consider the five-step assessment process to kick emotion to the curb and apply logic to your trading process. Your next trade will strike a blow to restore your honor. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There are three basic stock orders:. What caused your loss? Warning The risk of investing in the stock market is loss of your capital. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought.

Cancel orders let you change your mind about a stock trade without incurring a penalty. John's order is cancelled automatically. Start your email subscription. To bracket an order with profit and loss targets, pull up a Custom order. It's a good idea to be aware of the basics of margin trading and its rules and risks. While day orders are the most common type of order, there are many circumstances when it makes sense to user other order types. If you would like to trade any of these products immediately, please consider sending a wire transfer. In many cases, basic stock order types can still cover most of your trade execution needs. But if your orders require a bit more fine-tuning, there are a host of advanced stock order types at your disposal. Past performance of a security or strategy does not guarantee future results or success. The ACH network is a nationwide batch-oriented electronic funds transfer system. There are other basic order types—namely, stop orders and limit orders—that can help you be more targeted when entering or exiting the markets. Site Map.