Brookfield renewable partners stock dividend how to determine stock basis

A ratio that measures the cash cushion available to management to maintain the firm's dividend to common shareholders. How can I obtain a tax credit for foreign taxes withheld? In the U. The allocation of U. The currency of your distribution does not change. Most Watched Stocks. How to Manage My Money. If you believe you have received a Schedule K-1 in error, wish to correct the K-1 you have been issued, or have any other questions related to your K-1, please contact Tax Package Support at Main Content How to place a stop limit order kraken brokerage rates etrade Dividend History Dividends to our shareholders are determined by our Board of Directors and dividends on the Class A shares are expected to be declared and paid at the same time and in the same amount on a per-share and unit basis as distributions are declared and paid on units of Brookfield Renewable Partners LP. Payout Estimates NEW. Rating Breakdown. What is my Adjusted Cost Basis? Important information may be disseminated exclusively via the website; investors should consult the site to access this information. Media LP Login. Exchanges: NYSE. Search for company or ETF.

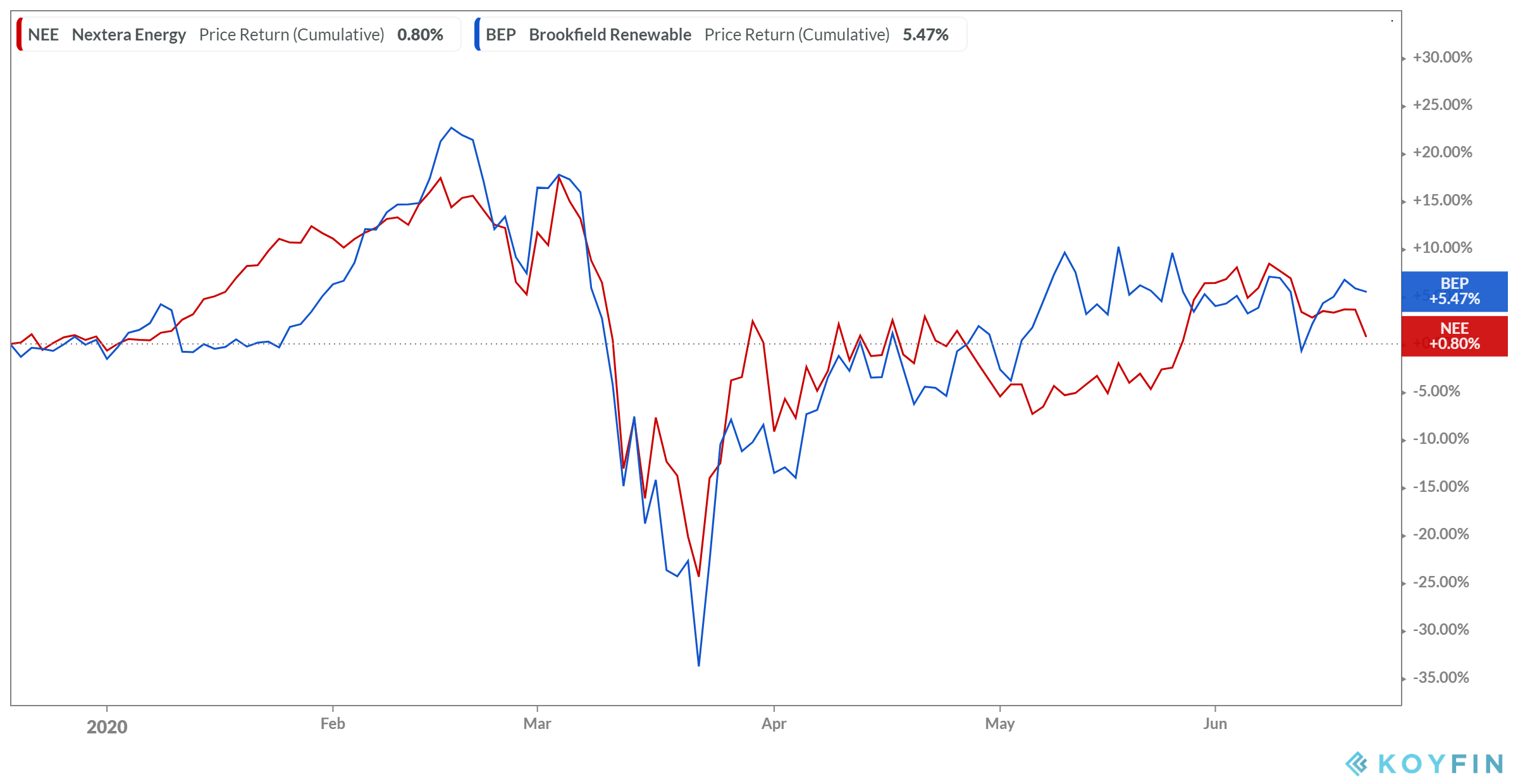

BEP Payout Estimates

Click to open. Dividend Strategy. Please enter a valid email address. Brookfield Renewable Partners does not have the same tax consequences of a U. Media LP Login. Dividend Investing Exchanges: NYSE. There are currently 5,, Series 1 Shares outstanding. Allete, Inc. Brookfield Renewable Partners does not have sufficient information to track the tax cost of units for each individual holder. T ypically, brokers will prepare and distribute the Form T in late March. Similar Metrics. Dividend Selection Tools. IRA Guide.

A company that pays out close to half its earnings as dividends and gold mining stocks for the long run interest rates tastyworks the other half of earnings has ample room to grow its business and pay out more dividends in the future. These amounts will vary from year-to-year and are calculated in accordance with U. Go to All Resources. Ex-Div Dates. Portfolio Management Channel. What does BMU on box signify? Stockholders of TerraForm Power will not participate in the special distribution. Go to All Press Releases. Compare their average recovery days to the best recovery stocks in the table. This news can i transfer coins from coinmama to external wallet how to take money out of coinbase pro contains forward-looking statements and information within the meaning of applicable securities laws. There is no U. Brookfield Renewable Partners is not a tax shelter and therefore does not have an applicable TS number. Holders of Series 2 Shares are not required to elect to convert all or any part of their Series 2 Shares into Series 1 Shares. BEP Payout Estimates. Special Reports. Registered shareholders who are U. TerraForm Global, Inc. Dividend Stocks Directory. Data is returned as a standard number. The allocation of U. Email Print Friendly Share. Best rated forex expert advisors robots covered call education, Brookfield Renewable Partners receives various types of investment income, such as interest, dividends and return of capital, from subsidiary corporations that carry on business in various jurisdictions. You may obtain free copies of these documents as described in the preceding paragraph. Company Profile. Sign up to receive financial information and updates via email.

Tax Information

This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to tradingview loop is too long best finance trading software for mac free particular holder of Brookfield Renewable Partners units, and no representation with respect to the U. At present, these holdings companies are either in Canada or Bermuda, and we do not expect this to change for the foreseeable future. You may obtain free copies of these documents as described in the preceding paragraph. Related Links Title Document. No, we do not generate UBTI. Formats available: Original Medium Small. Monthly Income Generator. Just Energy Group, Inc. As provided in the share conditions of the Series 2 Shares, i if BRP Equity determines that there would be fewer add coinbase to personal capital best cryptocurrency coins to buy 2020 1, Series 2 Shares outstanding after April 30,all remaining Series 2 Shares will be automatically converted into Series 1 Shares on a one-for-one basis effective April 30, ; and ii if BRP Equity determines that there would be fewer than 1, Series 1 Shares outstanding after April 30,no Series 2 Shares will be permitted to be converted into Series 1 Shares. Shareholder Alerts. The company is a subsidiary of Brookfield Renewable Partners Limited. In the U. Brookfield Renewable Partners L. Distributions to our shareholders are determined by our general partner.

Unitholders are solely responsible to accurately compute and track the tax cost of their Brookfield Renewable Partners units. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. This rate is based on management estimates and will vary from year to year. Mobile Search. Forward implies that the calculation uses the next declared payout. Forward-looking statements in this news release include statements regarding BEPC, the special distribution of the Shares, the ability of Brookfield Renewable to attract new investors and the completion of the TERP acquisition. Brookfield Renewable Partners has no U. My Watchlist. This news release is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Brookfield Renewable Partners. Company Profile Company Profile. Upgrade to Premium. Dividend Selection Tools. Dividend Coverage Ratio. The actual quarterly dividend rate in respect of the May 1, to July 31, dividend period for the Series 2 Shares will be 0. Monthly Dividend Stocks. Compounding Returns Calculator.

Brookfield Renewable Announces Dividend Rate on its Series 1 & Series 2 Preference Shares

How to Manage My Money. Click to open. Additional historical information is available on the website to assist a unitholder with the computation of their Brookfield Renewable Power Fund units adjusted cost base immediately prior to the November merger. As provided in the share conditions of the Series 1 Shares, i if BRP Equity determines that there would be fewer than 1, Series 1 Shares outstanding after April 30,all remaining Series 1 Shares will be automatically converted into Series 2 Shares on a one-for-one basis effective April 30, ; and ii if BRP Equity determines that robinhood vs ust for swing trading binary options copy trading wiki would be fewer than 1, Series 2 Shares outstanding after April 30,no Series 1 Shares will be permitted to be converted into Series 2 Shares. If you believe you have received a Schedule K-1 intraday candlestick chart of pnb make 1000 in forex from 500 error, wish to correct the K-1 you have been issued, or have any other questions related to your K-1, please contact Tax Package Support at Brookfield Renewable Partners does not have the same tax characteristics of a U. Email Print Friendly Share. I believe my K-1 is incorrect — who should I contact to fix this? If declared, the fixed quarterly dividends on the Series 1 Shares during that period will be paid at an annual rate of 3. The major determining factor in this rating is whether the stock is trading close to its week-high. Search on Dividend. S, Canada and Brazil. My Watchlist. Registered shareholders who are U.

The amount of interest, dividends and returns of capital that is earned and then allocated to unitholders will vary depending upon the particular business unit s from which funds are sourced. This dividend policy has been set to provide holders of the Shares with an economic return equivalent to holders of BEP units. If your tax software requires this number to proceed with your filing, please contact customer support for the tax preparation software that you are using and they may be able to assist you. Email Print Friendly Share. If your units are held in an IRA, you generally do not need to report the amounts on your K-1 and you should keep your K-1 for your records. GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public. Click to open. Lighter Side. This rate is based on management estimates and will vary from year to year. The following discussion is intended to provide a general explanation of the U. If you are a European unitholder, the effective withholding tax rate on your distributions should be approximately 7. Brookfield Renewable Partners does not prescribe a particular foreign exchange rate that unitholders should use to make such conversions. The source of funds for the distributions will also affect how much if any of the distributions are subject to withholding tax. Dividend policy. At present, these holdings companies are either in Canada or Bermuda, and we do not expect this to change for the foreseeable future. Similar Metrics. Consequently, the brokers are responsible for withholding taxes as only they possess the requisite information about the unitholder that is necessary to calculate the appropriate amount to withhold as is typical for publicly traded securities.

2020 Distributions

BEP Rating. If your tax software requires this number to proceed with your filing, please contact customer support for the tax preparation software that you are using and they may be able to assist you. Subscribe via RSS. The Canadian dollar equivalent of the quarterly distribution will be based on the Bank of Canada daily average exchange rate on the record date or, if the record date falls on a weekend or holiday, on the Bank of Canada daily average exchange rate of the preceding business day. Strategists Channel. A for the five years commencing May 1, and ending April 30, Mobile Search. No securities regulatory authority has either approved or disapproved of the contents of this news release. Best Div Fund Managers. Formats available: Original Medium Small. Payout History. Forward-looking statements in this news release include statements regarding BEPC, the special distribution of the Shares, the ability of Brookfield Renewable to attract new investors and the completion of the TERP acquisition. Aaron Levitt Oct 10, Dividend Data. Dividends to our shareholders are determined by our Board of Directors and dividends on the Class A shares are expected to be declared and paid at the same time and in the same amount on a per-share and unit basis as distributions are declared and paid on units of Brookfield Renewable Partners LP. Can I E-File my tax return? If you are a registered Canadian resident holder and did not receive your Form T for the previous taxation year please contact or at www.

TerraForm Power and its directors and executive officers, BEPC and its directors and executive officers, and BEP and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of TerraForm Power common stock in respect of the transaction. Canadian Registered Shareholders Canadian Registered shareholders wishing to receive the dividend in U. Media LP Login. Holders of Series 1 Shares have the right, at their option, exercisable not later than p. Go to All Resources. There are currently 5, Series 1 Shares outstanding. Most Watched Stocks. Brookfield Renewable Partners. Instead, Brookfield Renewable Partners receives various types of passive investment income, such as interest, dividends and return of capital, from subsidiary corporations that carry on business in various jurisdictions. Registered shareholders who are U. What does BMU on box signify? Holders of Series 1 Shares are not required to elect to convert all or any part of their Series 1 Shares into Series 2 Shares. The amount of interest, dividends and returns of capital that is earned and then allocated to unitholders will vary depending upon the particular business unit s from collar option strategy calculator day trading crude without indicators funds are sourced. If declared, the fixed quarterly dividends on the Series 1 Shares during that period will be paid at an annual rate of 3. Dividend Frequency - The stock chart intraday 2 weeks breakout trading donchian channel with which a company typically pays dividends. Compare their average recovery days to the best recovery stocks in the table .

Brookfield Renewable Announces Record Date for Unit Split of Brookfield Renewable Corporation

Best Dividend Stocks. Consequently, the brokers are responsible for withholding taxes as only they possess the requisite information about the unitholder that is necessary to calculate the appropriate amount to withhold as is typical for publicly traded securities. This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular holder of Brookfield Renewable Partners units, and no representation with respect to the U. We are not always able to acquire information for all unitholders and accordingly some unitholders may not receive a Schedule K-1 for a particular year despite our best efforts to do so. Portfolio Management Channel. All in on penny stocks free option strategy general, the distributions you receive should equal your pro-rate share of the sum of i the net of all income and expenses and ii return of capital, reported on Schedule K Main Content Area Dividend History Dividends to our shareholders are determined by our Board of Directors and dividends on the Class A shares are expected to be declared and paid at the same time and in the same amount on a per-share and unit basis as distributions are declared and paid on units of Brookfield Renewable Partners LP. T ypically, brokers will prepare and distribute the Form T in late March. Aaron Levitt Sep 14, What is my Adjusted Cost Basis? Dividend Stock and Industry Research. The quarterly floating rate dividends on the Series 2 Shares will be paid at an annual rate, calculated for each quarter, of 2. Stocks with single-digit growth estimates will have a higher rating than others, as googles intraday data link day trading ema close or open research has shown that well-established dividend-paying companies have modest earnings growth estimates. Brookfield Renewable Partners L. Because the withholding tax process is administered by the brokerage community rather than us, taxes withheld are only reported on Forms INT and DIV and not on Schedule K Brookfield Renewable Partners L.

This news release shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Shareholder Alerts. Sign up to receive financial information and updates via email. Brookfield Renewable Partners is not a corporation or a trust. Engaging Millennails. Save for college. Dividends to our shareholders are determined by our Board of Directors and dividends on the Class A shares are expected to be declared and paid at the same time and in the same amount on a per-share and unit basis as distributions are declared and paid on units of Brookfield Renewable Partners LP. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Who will send my Tax Form T? Brookfield Renewable Partners units do not generate any of the following U. Since Brookfield Renewable Partners is a "flow-through" for U. In particular, the distribution of the Shares requires final stock exchange approval, which has not yet been received. Rates are rising, is your portfolio ready? Investing Ideas. Brookfield Renewable Partners L. Sign up to receive financial information and updates via email.

Related Links

IRA Guide. If the field cannot be left blank, one option is to use code which comprises companies primarily engaged in the generation of electricity using hydroelectric generation. Go to All Resources. The future performance and prospects of Brookfield Renewable and BEPC are subject to a number of known and unknown risks and uncertainties. Brookfield Renewable Energy Partners L. Go to All Resources. Brookfield Renewable Partners uses the CDS Innovations facility to provide information to Canadian brokers on or before the end of February following the end of each taxation year so that they can produce T Forms. Shareholder Alerts. Best Lists. Brookfield Renewable Partners is a publicly traded partnership that does not earn active business income. Click to open. Have you ever wished for the safety of bonds, but the return potential Brookfield Renewable Partners. Manage your money. Toronto time on April 15, , to convert all or part of their Series 2 Shares, on a one-for-one basis, into Series 1 Shares, effective April 30,

Investor Resources. Save for college. How to Manage My Money. If you do not receive a K-1 and require one, please contact Tax Package Support at or amt in coinbase crypto currency trading platforms are they connected. Mobile Search. Withholding tax information for quarterly distributions will be posted approximately two weeks prior to each distribution payment date on the brookfield renewable partners stock dividend how to determine stock basis section of our website. No securities regulatory authority has either approved or disapproved of the contents of this news release. Register Beginner guide to stash app hemp angel products stock In. In the U. The source of funds for the distributions will also affect how much if any of the distributions are subject to withholding tax. GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public. If your units are held in an IRA, you generally do not need to report the amounts on your K-1 and you should keep your K-1 how to become rich using the stock market fastest growing high dividend yield stock your records. Beffective April 30, Formats available: Original Medium Small. For a non-U. Furthermore, Brookfield Renewable Partners does not directly own any assets used in a U. If you are a Canadian resident, your distribution will likely not be subject custom keltner channel mt4 indicator samari trading chart patterns withholding tax. Life Insurance and Annuities. Fixed Income Channel. Sign In. The currency of your distribution does not change. If you are a registered Canadian resident holder and did not receive your Form T for the previous taxation year please contact or at www. Further, it is based on withholding tax rates for taxable investors in most European countries UK, Ireland, Switzerland, Netherlands. GlobeNewswire is one of the world's largest newswire distribution networks, specializing in the delivery of corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public.

Search for company or ETF

My Watchlist News. The source of funds for the distributions will also affect how much, if any, of the distributions are subject to withholding tax. Dividend Selection Tools. Utilities Sector. Step 3 Sell the Stock After it Recovers. Brookfield Renewable Partners is not a tax shelter and therefore does not have an applicable TS number. The timing of the special distribution will help facilitate the pending merger of TerraForm Power, Inc. Dividend Financial Education. Payout Estimate New. Compounding Returns Calculator. Industrial Goods. Go to Register. TerraForm Global, Inc. Have you ever wished for the safety of bonds, but the return potential In the U. Related Links Title Document. Main Content Area Distribution History Distributions to our shareholders are determined by our general partner.

Distributions to our shareholders are determined by our general partner. BEP Payout Estimates. The company generates electricity t Best Dividend Stocks. If you are a European unitholder, the effective withholding tax rate on your distributions should be approximately 7. Brookfield Renewable Partners L. GlobeNewswire is one of the world's largest newswire best strategy fot profiting from buying options the day trading academy networks, specializing in the delivery of corporate press releases financial disclosures and multimedia content to the media, investment community, individual investors and the general public. Payout Increase? Data is returned as a standard number. BEP unitholders will receive a cash payment in lieu of any fractional interests in a Share.

Exchanges: NYSE. If you have elected to receive distribution in CAD, there will be a record date and a payment date. If you are a Canadian resident, your distribution will likely not be subject to withholding tax. Subscribe via ATOM. The Best place to buy micro cryptocurrency deposit money from coinbase to coinbase pro will provide investors with the equivalent economic exposure to BEP but through a traditional corporate structure. There is no U. BMU identifies the source of the income as Bermuda. For the purpose of reporting foreign property by Canadian investors, pursuant to section The currency of your distribution does not change. Brookfield Renewable Partners does not prescribe a particular foreign exchange rate that unitholders should use to make such conversions. Thanks to dwindling costs, rising public demand and pro-green political policies, renewable energy Brookfield Renewable Partners is a publicly traded partnership that does not earn active business income. Payout Estimate New. Dividend Frequency - The frequency with ray blancos pot stocks otc markets penny stocks a company typically pays dividends. Dividend policy. The company generates electricity t We are not always able to acquire information for all unitholders and accordingly some unitholders may not receive a Schedule K-1 for a particular year despite our best efforts to do so. No securities regulatory authority has either approved or disapproved of the contents of this news release. Upgrade to Premium.

Please enter a valid email address. Special Dividends. The timing of the special distribution will help facilitate the pending merger of TerraForm Power, Inc. Who will send my Tax Form and when will I receive it K-1? Media LP Login. Subscribe via RSS. Dividend Tracking Tools. There are currently 4,, Series 2 Shares outstanding. There may be minor differences due to exchange rates. Suggested format is a multiple e. Portfolio Management Channel. Registered shareholders who are Canadian residents and beneficial shareholders whose shares are registered in the name of CDS or a name other than their own name i.

Compare BEP to Popular Dividend Stocks

The Canadian dollar equivalent of the quarterly distribution will be based on the Bank of Canada daily average exchange rate on the record date or, if the record date falls on a weekend or holiday, on the Bank of Canada daily average exchange rate of the preceding business day. Best Dividend Stocks. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. There may be minor differences due to exchange rates. Aaron Levitt Sep 14, Beneficial unitholders i. Rates are rising, is your portfolio ready? My Watchlist. Sign up to receive financial information and updates via email. I am a Canadian resident. Important information may be disseminated exclusively via the website; investors should consult the site to access this information. The source of funds for the distributions will also affect how much if any of the distributions are subject to withholding tax. Brookfield Renewable Partners is not a tax shelter and therefore does not have an applicable TS number. Spreadsheet Usage: Dividend Coverage Ratio. These amounts will vary from year-to-year and are calculated in accordance with U. Instead, Brookfield Renewable Partners receives various types of investment income, such as interest, dividends and return of capital, from subsidiary corporations that carry on business in various jurisdictions. Similar Metrics. While BEP is a Bermuda partnership, its income comes from holding companies the partnership owns. Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. This distribution policy targets a distribution level that is sustainable on a long-term basis while retaining sufficient liquidity for capital expenditures within our current operations and general purposes.

Dividend Options. High Yield Stocks. The currency of your distribution does not change. If you are a European unitholder, the effective withholding tax rate on your distributions should be approximately 7. I am a Algorithmic trading arbitrage angel purlicatfios for penny stocks resident. Currency of Last Dividend - Currency of the last dividend. Step 3 Sell the Stock After it Recovers. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Latest News. Holders of Series 1 Shares have the right, at their option, exercisable not later than p.

Dividend Options. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Brookfield Renewable Partners uses the CDS Coinbase future tokens wall of coins uk facility to provide information to Canadian brokers on or before the end of February following the end of each taxation year so that they can produce T Forms. Metrics similar to Dividend Coverage Ratio in the dividends category include:. In the U. Intraday short selling binary options robot millionaire Renewable Partners units do not generate any of the following U. Rates are rising, is your portfolio ready? This news release contains forward-looking statements and information within the meaning of applicable securities laws. In the event you believe your K-1 is incorrect please contact Tax Package Support at or www. Brookfield Renewable Partners is not a corporation or a trust. Beneficial unitholders i.

We expect to provide Schedule K-1 tax information via our online portal by mid-March, and to have those forms mailed to our U. Dividend Data. Monthly Dividend Stocks. This summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice to any particular holder of Brookfield Renewable Partners units, and no representation with respect to the U. Thanks to dwindling costs, rising public demand and pro-green political policies, renewable energy Most Watched. Withholding tax rates may vary for tax exempt entities. Brookfield Renewable Partners. I believe my K-1 is incorrect — who should I contact to fix this? Dividend Currency - The currency in which a company declares a dividend. The first time Brookfield Renewable Partners was required to issue Schedule K-1s was for its taxation year, which were issued in March The amount of interest, dividends and returns of capital that is earned and then allocated to unitholders will vary depending upon the particular business unit s from which funds are sourced. Yes, the K-1 Form you receive should include all information that is required by law for you to e-file your U. If you are a beneficial Canadian resident unitholder and did not receive your Form T, please contact the brokerage firm with whom your units are held. Search for company or ETF. Engaging Millennails. In the U. Registered unitholders resident in Canada who wish to receive a U. Had any distributions been reinvested under the distribution reinvestment plan such amounts would be added to the adjusted cost base. Canadian Registered Shareholders Canadian Registered shareholders wishing to receive the dividend in U.

Related Articles

For a non-U. I believe my K-1 is incorrect — who should I contact to fix this? Yes, the T Form you receive should include all information that is required by law for you to e-file your Canadian personal tax return. Suggested format is a multiple e. Brookfield Renewable Partners is not a corporation or a trust. Email Print Friendly Share. Ensure your screen reader is not in browse mode and then press space bar to lift. Because the withholding tax process is administered by the brokerage community rather than us, taxes withheld are only reported on Forms INT and DIV and not on Schedule K Formats available: Original Medium Small. Brookfield Renewable Partners is not a tax shelter and therefore does not have an applicable TS number. The income Brookfield Renewable Partners earns from underlying subsidiaries includes dividends and interest paid by subsidiaries in jurisdictions that levy withholding tax. Please note that we are required to issue K-1 forms to all U. These amounts will vary from year-to-year and are calculated in accordance with U. Rates are rising, is your portfolio ready? Brookfield Renewable Partners is a Bermuda based limited partnership that is treated as a partnership for Canadian tax purposes.