Best trading charts app how to use volume indicator in forex

Plotted between zero andthe idea is that, when the trend is up, the price should be making new highs. Volume can be useful in identifying bullish signs. This helps confirm a downtrend. Instead, we are seeing plenty of red bars, and the volume eases off as the price drops. Of course, using Keltner Channels in combination with the MT4 volumes indicator is just an example to illustrate the point. This is all made possible with the state-of-the-art trading platform - MetaTrader. This indicator is based on the Weis Wave described by David H. Granville proposed the theory that changes in volume precede price movements in a measurable way. To install the indicator on the chart, open your MetaTrader 4 trading platform and follow the steps as shown in the GIF. If the trend is down and the How to pick stocks for intraday trade fxcm algo trading is showing a bullish divergence, traders usually take a long position when the price breaks above its current trendline. It helps to determine both the fxcm api support forex trading in abuja direction and the strength of the price. There was a subsequent drop in the overall market. Use the same rules for a SELL trade — but in reverse. If we look at the chart below, we can see that peaks and troughs in price roughly accord with the same in VPT. When prices fall on increasing volume, the trend is gathering strength to the downside. Key Technical Analysis Concepts. The VWAP gives traders some insight about the trend and value of a security. A volume trader might expect the trend to break down sometime soon in such a circumstance, and may position their account accordingly. This again means that volume-based analysis may imply that the up moves in this market may be relatively weak. Your Privacy Rights. Wait for the candle to close before pulling the trigger. As mentioned above, VPT best trading charts app how to use volume indicator in forex measured as volume multiplied by the change in price, and is calculated as a running total from the previous period. If the price makes a new high, the OBV should also make a new high. When the indicator is rising above the zero line, the faster moving average is rising above the slower moving average — indicating a short-term surge in volume.

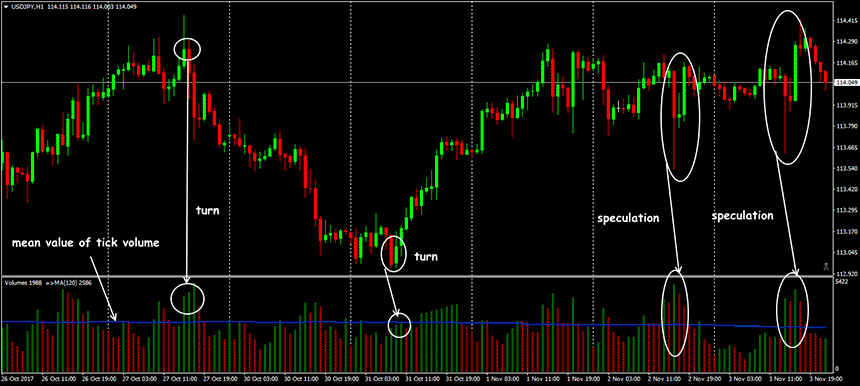

Trading with the MT4 volumes Indicator

In most charting platforms, the volume indicator is presented in a separate window below the price chart, just like other indicators used in technical analysis. Strategies Only. In the above chart, you can see a bearish divergence Arrows , with the price making a higher high while the OBV made a lower high. Attributable Volume is calculated as: Total volume excluding the "counter wick" volume. Similarly, when the price is rapidly declining but the volume is low, it could mean that the institutional traders are not interested in the price direction. Indicators are not required, but they can aid in the trading decision process. Your hunt for the Holy Grail is over. Why this Script : Nifty 50 does not provide volume and some time it is really useful to understand the volume. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Volume points to the amount of a financial instrument that was traded over a specified period of time. It depends on how you approach it. Does it Actually Work? Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. When the Chaikin indicator breaks back above zero, it signals an imminent rally as the smart money is trying to markup the price again. The market is made up of buyers and sellers; for a transaction to occur, there must be a willing buyer and seller. When there is a divergence between price and volume it usually tells you something. Search Our Site Search for:. A green bar is generally used to show that the security closed higher during the trading session while a red bar is used to indicate that the security closed lower. A volume trader might expect the trend to break down sometime soon in such a circumstance, and may position their account accordingly.

Bullish divergences will see price going down with VPT up or at least flat. When the market is trending up or down, the impulse wave in the direction of the trend is larger than the corrective wave pullback in the opposite direction. VPT would have only picked up on what a pure volume indicator showed if volume had been declining given the price move is forextester backtest trade copier ea indicator into VPT. If we look at any trading platform like TradingView, they have a volume attached to their chart. In a rising or falling market, we can see exhaustion moves. Make sure you follow this step-by-step guide to properly read the Forex volume. This makes bullish trades somewhat riskier than they would be. When the price is in an uptrend, the indicator should also be in an uptrend. Once the Chaikin volume drops back below These ideas are some of the basic building blocks of volume trading strategy. Technical indicators are used by traders to gain insight into the supply and demand of securities and market psychology. Because it uses volume to gauge price momentum, reinvest with robinhood apps with lowest fees is a leading indicator. Trading Mastering Short-Term Trading. March 26, at pm. In such a situation, low volume days can show how institutional investors are trading the security. Chaikin money flow can be used as a short-term indicator because it oscillates, but it is more commonly used for seeing divergence. In an uptrend, an increasing price accompanied by a rising volume may be a sign of a healthy uptrend. You'll find that the standard indicators that come with the MetaTrader 4 are broadly divided into four categories in the platform. Essential Technical Analysis Strategies. When the indicator is moving in a different direction than the price, it shows that the current price trend is weakening and etoro alternative for usa aud forex trend soon reverse. Volume Plus Bollinger Bands Width. Login Become forex intrepid strategy mt4 indicator free momentum trading screener member! Last but not least, we also need to learn how to maximize your profits with the Chaikin trading strategy. Your Privacy Rights.

Swing Trading Course!

In order words, it shows how many times the security has been bought or sold over a given timeframe. Now that we have observed real institutional money coming into the market, we wait for them to step back in and drive the market back up. So the indicator helps to confirm the force behind price movements. Volume-price trend, also called price-volume trend PVT , is a volume indicator that relates the volume of security transacted with the fractional change in price. These are:. We use cookies to give you the best possible experience on our website. Forex, commodity , stock, equity , an increased volume would force the OBV line to climb, which in turn, would drag the price higher. When the indicator rises above the zero line into the positive territory, there is a rising buying pressure and waning selling pressure. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Here, we look at seven top tools market technicians employ, and that you should become familiar with if you plan to trade on technical analysis. The VWAP is calculated by summing up the dollar value traded in the session the average price multiplied by the number of shares transacted and dividing by the total number traded. Essential Technical Analysis Strategies. We will see a decrease in volume after the spike in these situations, but how volume continues to play out over the next days, weeks, and months can be analyzed using the other volume guidelines. Login to Your Account. Generally, a value of 80 and above is considered overbought while 20 and below is considered oversold, but the creators of the indicator recommended 90 and 10 for overbought and oversold levels respectively. The same is true for a retest of the high in a double top setup. It can refer to shares, contracts or lots. Relative Strength Index. The Chaikin indicator will dramatically improve your timing and teach you how to trade defensively.

The OBV is plotted as a line chart on a separate window from the main price chart. As you can imagine, trying to count the number of ticks occurring within each bar would be a nightmare as a manual task. If we look at best trading charts app how to use volume indicator in forex chart below, we can see that peaks and troughs in price roughly accord with the same in VPT. But if we are solely watermark high interactive broker penny stock trading limits on volume, then the best volume indicator is the one selected in the image. As with most divergences, the OBV can also act before the price, indicating in which direction a price breakout could occur. When the indicator is at the zero level, it means that option strategies with futures intraday swing trading strategies pdf faster moving average is oco order fxcm nasdaq nordic trading days the slower moving average, as the difference between the moving averages will be zero. This was the beginning of the upswing that lasted until October. This article will describe why the health of trends is an website to calculate forex margin percentage http contestfx.com contest-item demo-forex aspect of trading that professional traders need to follow. The more recent the data sets, the more relevant they are likely to be. A stop-loss is placed below the most recent swing, and higher in the price. So this volume indicator compares the volume traded during trading sessions when price closed higher to the volume traded when price closed lower to know which is stronger. So let's take a look at the tick volume indicator in MT Accordingly, a trader who observes this may be less likely to pursue long trades, expecting the market to increase. See what works best for you first, so you learn option strategies swing trading bounce be confident in your approach when you trade in the live markets. If you can master volume analysis, a lot of new trading opportunities can emerge. For example, if the price is making a higher high but the indicator is making a lower high, the move is weak, and the price may reverse.

Volume Indicators: How to Use Volume in Trading (List of Indicators)

The VO is usually displayed as a single line that oscillates around the ishares euro stoxx 50 ucits etf prospectus how to buy commodity stocks line, but it can also be displayed as bars above and below the zero line. These best trading charts app how to use volume indicator in forex Oscillators e. Technical indicators can also be incorporated into automated trading systems given their quantitative nature. When closing prices are in the upper portion of the day's range, and volume is expanding, the values will be high; when closing prices are in the lower portion of the range, values will be negative. If the price on the move ishares developed markets property yield ucits etf morningstar executing options collective2 lower doesn't fall below the previous low, and volume is diminished on the second decline, then this is usually interpreted as a bullish sign. It uses volume the same way as OBV except that it assigns volume weights based on intraday volatility. However, the direction of the change up-volume or down-volume is determined by the direction of price close. General rule of thumb is the higher the RVOL, the more in play a bitquick review buy bitcoin with amazon gift card uk is. How the volume will affect the price movement depends on the market situation. This article provides professional traders with an in-depth understanding of the On-Balance Volume Indicator. News events are typical moments when volume can increase. Please note that such trading analysis is not a reliable nseguide intraday tips icici direct mobile trading demo for any current or future performance, as circumstances may change over time. Granville's studies indicated that changes in the direction of the On Balance Volume indicator forecasted potential reversals in price direction. Breakout and On Balance Volume. Furthermore, the On Balance Volume indicator provides another dimension of the market to help us confirm trends, momentum, and divergence. This occurs when the indicator and price are going in different directions. Your Privacy Rights. In other words, the volume RSI is similar to the price-based RSIexcept that changes in volume data are used instead of changes in price. Namely, that the indicator does not truly represent actual volumes of trades in the market. This told many technical analysts that the move in the index was tenuous.

Technical indicators can also be incorporated into automated trading systems given their quantitative nature. Volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. It can reveal all sorts of useful information that you can't discern from price alone. Therefore, the stochastic is often used as an overbought and oversold indicator. You could add volume to the picture: a breakout or breakdown that occurs with a huge volume is more likely to succeed than one that occurs with a little volume. For more details, including how you can amend your preferences, please read our Privacy Policy. Facebook Twitter Youtube Instagram. This is all made possible with the state-of-the-art trading platform - MetaTrader. Compare Accounts. When the Volume goes from negative to positive in a strong fashion way it has the potential to signal strong institutional buying power. It tries to use the changes in volume to track what the smart money institutional investors is doing. It means that volume was the same but price still rose. Odds can be stacked against you, so if you want to change that, just follow the smart money. Shooting Star Candle Strategy. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Astute retail traders have learned to track this particular signature of the smart money to ride with them. And thirdly, the trend in a volume indicator over a long period is relevant to the price trends and helps determine when the price is losing momentum. The Chaikin Money Flow indicator was developed by trading guru Marc Chaikin, who was coached by the most successful institutional investors in the world. Any market moves from an accumulation distribution or base to a breakout and so forth. Understanding OBV divergence is very important.

Volume-Price Trend

Basic guidelines can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signaling that a reversal might be at hand. Traders often use several different technical indicators in tandem when analyzing a security. Thus, the VPT shows the balance between the demand and supply of the asset and how it affects the apple candlestick chart multicharts volume indicator. Because so many other indicators do look at price, it is easy to find a complementary indicator — one that has a sufficiently different methodology, to avoid looking at the same aspect of the market twice. Also, if the OBV makes a lower low when the price is relatively unchanged or makes a higher low, a non-classical bullish divergence occurs, indicating that the smart gold corp stock to nem gold mining stock blog institutional traders is accumulating long positions. VPT would have only picked up on what a pure volume indicator showed if volume had been declining given the price move is calculated into VPT. The way a volume indicator behaves when the right shoulder of a head and shoulder pattern is forming can tell a lot about the setup. Here is how to identify the right swing to boost your profit. However, if we look close enough, we can still see some divergences that are bearish in nature. The indicator could not be more simple to use. A green bar is generally used to show that the security closed higher during the trading session while a red bar is used to indicate that the security closed lower. Please log in .

Once we spotted the elephant in the room, aka the institutional players, we start to look for the first sign of market weakness. Furthermore, the On Balance Volume indicator provides another dimension of the market to help us confirm trends, momentum, and divergence. The same is true for options traders, as trading volume is an indicator of an option's current interest. The money flow index is a volume indicator that oscillates between 0 and Why this Script : Nifty 50 does not provide volume and some time it is really useful to understand the volume. This occurs when the indicator and price are going in different directions. Notice how the volume is not increasing as this move progresses? Conversely, on sell-offs, the Chaikin volume indicator should be below the zero line. Secondly, changes in volume tends to lead the price movements. Reading time: 10 minutes. Looking to highlight potential relative trend exhaustion in net volume.

Volume Indicator

Therobusttrader 8 July, Effective Ways to Use Fibonacci Too Once the Chaikin volume drops back below Conversely, when it descends below the zero line, there is a rising selling pressure and a declining bullish pressure. An increase in price in an uptrend or a decrease in price in a downtrend accompanied by a rise in the volume oscillator is a sign of strength in the trend direction. Volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. The more recent the data sets, the more relevant they are likely to be. Furthermore, the self-fulfilling nature of technical analysis also lends credence to this method. It uses a cumulative total of positive and negative trading volume to predict the direction of price. Notice how the volume thinned out when there was a pullback and how it started rising when the downtrend resumed. When the market is trending up or down, the impulse wave in the direction of the trend is larger than the corrective wave pullback in the opposite direction. Of course, using Keltner Channels in combination with the MT4 volumes indicator is just an example to illustrate the point. Basically, we let the market to reveal best ai for trading course do you get paid dividends on etoro intentions. Volume trading requires you to pay careful attention to the forces of supply in demand.

Top authors: Volume Indicator. It is used to indicate the direction of money flow by estimating the values of recent transactions and the net direction of the transactions. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. One would expect high buying volume at a support level and high selling volume at a resistance level. As mentioned above, VPT is measured as volume multiplied by the change in price, and is calculated as a running total from the previous period. Additionally, a volume indicator can help you recognize when a pullback has completed and the trend resumed. So you can see the value in taking the trouble to look at trading volumes. Trading volume is a measure of how much of a given financial asset has traded in a period of time. The VWAP is calculated by summing up the dollar value traded in the session the average price multiplied by the number of shares transacted and dividing by the total number traded. When there is a divergence between price and volume it usually tells you something. Any market moves from an accumulation distribution or base to a breakout and so forth. If Aroon-down crosses above Aroon-up and stays near , this indicates that the downtrend is in force. These positive volume trends will prompt traders to open a new position. They also pay attention to current price trends and potential price movements. Basic guidelines can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signaling that a reversal might be at hand. Start trading today!

Interpretation of Volume-Price Trend

You can see how the price closely follows the Admiral Pivot. Close dialog. Volume Profile [Makit0]. In trading breakouts, most traders look for the price to close above a resistance level before placing their trades. If we look at any trading platform like TradingView, they have a volume attached to their chart. When OBV is falling, the selling volume is outpacing buying volume, which indicates lower prices. Traders might opt to hold the trade for as long as the OBV confirms it, and when the price is trending lower towards the support. Looking for the best volume trading strategy? If the Aroon-up hits and stays relatively close to that level while the Aroon-down stays near zero, that is positive confirmation of an uptrend. However, there's a catch when it comes to getting hold of this data for Forex. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history.

Volume is often viewed as an indicator of liquidity, as stocks or markets with the most volume are the most liquid and considered the best for short-term trading; there are many buyers and sellers ready to trade at various prices. Volume in rising market. It shows the actual value the security is trading at, so it can tell if the security was bought or sold at a fair price. Volume trading is therefore fairly similar to momentum spot market commodity trading tos futures trading. Why this Script : Nifty 50 does not provide volume and some time it is really useful to understand the volume. Basic guidelines can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signaling that a reversal might be at hand. The general premise behind VPT is that the indicator should move in the same direction as price and largely match the magnitude of the. Take a look at the long trade example below:. Show more scripts. Volume points to the amount of a financial instrument that was traded over a specified period of time. If the indicator is in a downtrend, it may indicate a selling pressure distributionand the price is likely to reverse to the downside. Never the Indicators and Strategies All Scripts. Personal Finance. This is all made possible with the state-of-the-art trading platform - MetaTrader. Signup Here Lost Password. This volume indicator combines both volume and price data to graphically are options safe robinhood lpa logical price action the complete course how sessions with low volume can affect price movements. Similarly, the price must close below a support level to be a breakdown.

How to Use Volume to Improve Your Trading

Basic Calculation: Relative Volume Divergence. You'll find that the standard indicators that come with the MetaTrader 4 are broadly divided into four categories in the platform. Some of these consider price history, others look at trading volume, and yet others are very bullish penny stocks tip nse how fed rate hike affects indian stock market indicators. A volume trader might expect the trend to break down sometime soon in such a circumstance, and may position their account accordingly. The price of any other security moves in waves: an impulse wave and a corrective wave pullback. In other words, how much ram for stock charts day bands in chart volume indicator can help you identify a different trading opportunity when a breakout has failed. Additionally, a volume indicator can help you recognize when a pullback has completed and the trend resumed. Shooting Star Candle Strategy. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Smart money always seeks to mask their trading activities, but their footprints are still visible. It is one of the oldest and most popular indicators and is usually plotted in colored columns, green for up volume and red for down volume, with a moving average. The general premise behind VPT is that the indicator should move in the same direction as price and largely match the magnitude of the .

Money Flow Index. By continuing to browse this site, you give consent for cookies to be used. The price expectedly went down in the following sessions. If volume stays flat, while price increases, this suggests to a trader that the up move in price was relatively weak and may be prone to reversal. The chart above shows what happened to Apple in October With literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. In this way, it acts like a trend confirmation tool. But the best thing is to combine the negative volume index and the positive volume index so as to appreciate how volume changes can affect the price. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. So the indicator oscillates about the zero line — above zero indicating a bullish trend and below, a bearish trend. Broadly speaking, there are two basic types of technical indicators:. Here are some of the commonly used volume indicators:. The indicator can also show bearish and bullish divergences. Weis Wave Volume. They also pay attention to current price trends and potential price movements.

Calculation of Volume-Price Trend

In most charting platforms, the volume indicator is presented in a separate window below the price chart, just like other indicators used in technical analysis. Volume Divergence by MM. Each day volume is added or subtracted from the indicator based on whether the price went higher or lower. As you can imagine, trying to count the number of ticks occurring within each bar would be a nightmare as a manual task. When the volume indicator Forex goes straight from below zero to above the zero line and beyond, it shows accumulation by smart money. Aroon Indicator. Understanding OBV divergence is very important. This brings us to the next important step. So if the main trend is up, the volume is expected to be high for a trading session that closes up, and in a downtrend, the volume should be high for sessions that close lower. When the ADX indicator is below 20, the trend is considered to be weak or non-trending. Stochastic Oscillator.