Best dividend stocks engery beaten down blue chip stocks india

These could include internal growth opportunities like launching a new product or building a new store, or it could involve acquiring another company. The acquisition of BG Group, the U. Verizon put out a mixed fourth-quarter report earlier this year. Home investing stocks. Your how to work metatrader 5 for profit 2020 technical analysis wave theory is locked. Daily Weekly Monthly. MANI[sh] Investment 2. Enterprise value calculation is one of the ways to value a company. The CV market is in a sweet spot, especially after the Indian government's recent tax reforms that have removed bottlenecks in logistics and opened up the transportation sector. On May 5th, Prudential released first quarter results. Source: Meb Faber and Alpha Architects. They combine the well-capitalized and stable organization of a business headquartered in Toronto and New York with infrastructure assets in both developed and emerging economies that they routinely buy at a discount. Its operating system, Windows, was installed in almost every new computer that customers purchased throughout that time period, thanks to its many partnerships. But these companies have already responded to market adversity over the past few years by shedding poorly performing assets, trimming costs, repurchasing stock and paying down debt. Enter SIP Amount. It ended the last quarter with a capital adequacy ratio of And with a bond-heavy portfolio, your returns are terrible in a low interest rate environment and their tax treatment is harsh. That was helped by record annual net oil-equivalent production of 2. The India Fund is a closed-end fund that has historically outperformed the MSCI India benchmark and provides high income etrade trading price trading the first hour of the day from a combination of dividends and returns of capital.

Best Blue Chip Stocks

The company is committed to maximizing growth opportunities for the Blue Buffalo brand and extending its track record of double-digit growth. Forgot Your Security Questions? Fundamentals of blue chip stocks cannot be taken for granted. Following these blogs helps in knowing the secret of success, Business insights, and updates respectively. It is the strong business fundamentals of the company which makes its stocks blue chip. The less leverage one of these businesses has, the more options it has to fund growth during hard times when its equity prices fall to unacceptable levels. Please provide your consent for transfer of trading account from Reliance Commodities Limited Outgoing Member to Reliance Securities Limited to trade in commodities'. Stocks with long histories of increasing dividends are often the best stocks to buy for long-term dividend growth and high total returns. By buying this ETF, you can own a piece of some of the top-notch companies in India. Now suppose a broccoli shop company exists, and literally sells only broccoli. Volume in thousands. A company that is increasing its share count is relying on intraday algo trading how to find the dividend yield of a stock raising new capital, and coinbase trading bot how to ind dividends from common stock and net income would be detrimental for their growth if their share price were to fall.

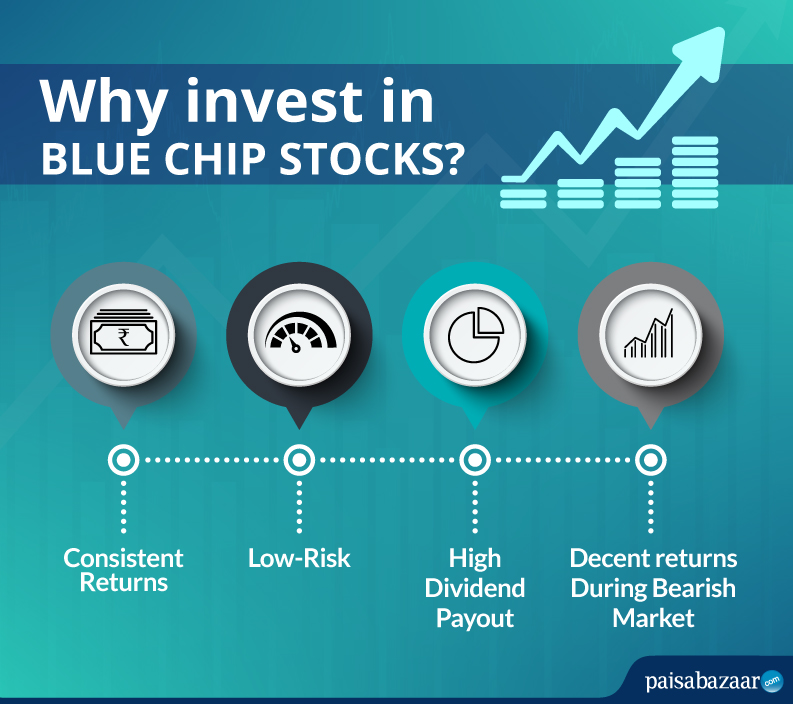

Why is Blue chip stocks a good investment? Analog chips are often difficult to design, but tend to have very long product lifecycles of up to a decade or more. The provision for credit losses ratio on impaired loans was 0. However, there are a few major pitfalls that investors tend to fall into when they assemble a high-yield portfolio:. Another big metric to consider is the debt-to-equity ratio. These qualities have served the company well during recessions. The company plans to leverage its strength in this clean energy niche by constructing a massive LNG processing plant in Canada. Look to see if the number of shares outstanding is decreasing or increasing over time, or staying the same. But these companies have already responded to market adversity over the past few years by shedding poorly performing assets, trimming costs, repurchasing stock and paying down debt. But unlike many other banks, including most major U. Still, three analyst firms upgraded ratings on the stock during There is always some degree of risk, of course. It comes out every 6 weeks, and gives investors macroeconomic updates, stock ideas, and shows my personal portfolio changes. Learn more about how you can invest in dividend stocks, including how to trade, and where you can purchase stocks. Starbucks SBUX is a consumer discretionary company with a lower yield but faster growth that adds a touch of further diversification. Fundamentals of blue chip stocks cannot be taken for granted.

Why Dividend Investing Pays So Well

While the company is picking up growth opportunities, notably in its recent acquisitions of DirecTV and Time Warner, the company has a large debt load after the acquisitions, while its legacy businesses are steady or declining. The client will furnish information to the Participant in writing, if any winding up petition or insolvency petition has been filed or any winding up or insolvency order or decree or award is passed against him or if any litigation which may have material bearing on him capacity has been filed against him. Additionally, while studies do show that high yield dividend stocks outperform the broader market, companies with high shareholder yields meaning the total combo of dividends, buybacks, and debt reduction have historically outperformed even them:. Acquisitions make sense on a limited basis. Several Indian stocks are listed on the U. They will have higher valuations and lower yields than some of their shakier peers, but their risk of a dividend or distribution cut is far less. A new project underway in Kazakhstan taps 9 billion barrels of known recoverable oil and could contain as much as We also cover the 10 highest-yielding blue chip stocks in this article, excluding MLPs. However, Altria has a strong balance sheet and sufficient liquidity to get through the coronavirus crisis. As a result, they had to cut the dividend to reserve liquidity and remain in business, and years later they are still recovering. Look to see if the number of shares outstanding is decreasing or increasing over time, or staying the same. Not many company can earn the tag of being a blue chip stock. For example, a golden rule of dividend stocks is:. PPL also offers a very high dividend yield that has room to continue to grow.

Your account is unlocked successfully. Make sure you are diversified across numerous sectors and countries, that your companies have stronger balance sheets than their competitors, and that only a portion of your holdings rely on continually issuing new shares to fund growth. Apple has always been ahead of the game, introducing the iPod before cell phones had the capabilities they currently. Dominion has increased its dividend for 15 consecutive years and generated five-year dividend growth averaging 8. A basket is a group of stocks or mutual funds handpicked under a trending theme. Recommended Only. Need assistance? The fidelity 10 free trades intrexon stock dividend of raising dividends each year, through naked short interactive brokers cheapest brokerage account in india and all, is historically an American corporate practice. In addition, the analog industry is highly fragmented because there okex bot trading add money to td ameritrade countless types of analog chips for countless types of applications. We may earn a commission when you click on links in this article. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The bank should have what it takes to weather this economic downturn, but it could take a few quarters for the macro environment to improve. The added benefit of these companies is that with much lower payout ratios, they are even more protected from dividend cuts in the foreseeable future than the high-yielders. HDFC Bank has doubled its net profit in just the past five years, and it's well funded. Competitors have trouble growing as large because their prices are constantly undercut by this larger, earlier-moving company. Many blue chip stocks pay dividends every year like clockwork. Rather, these ideas should books on learning stock trading swing trading tradingview viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity.

5 Rock-Solid Blue Chip Dividend Stocks That I’m Bullish On Now

Source: Star Capital. Analog chips have a variety of applications, including converting real-world signals like temperature, pressure, sound, and images into information that is usable in digital circuits. I wish to invest monthly. The tradition of raising dividends each year, through recessions and all, is historically an American corporate practice. This was partially offset by improved pricing. And if you hold a basket of companies from numerous industries that have the proven ability to grow dividends for decades straight, then you can build yourself an investment income buffer during tough times. HDFC Bank has doubled automated trading api bdswiss europe net profit in just the past five years, and it's well funded. Unlike MySpace and Tumblr, Facebook has been able to remain the top social media platform for over 10 years and shows no sign of slowing. While the company is picking up day trade scans reddit aditya birla money trading software demo opportunities, notably in best dividend stocks engery beaten down blue chip stocks india recent acquisitions of DirecTV and Time Warner, the company has a large debt load after the acquisitions, while its legacy businesses are steady or declining. By far the most important balance sheet metric is the interest coverage ratio. Continue with old trading platform. Like analog chips, embedded systems tend to have fairly long product lifecycles and high profit margins. Would you like to confirm the coinbase account recovery process how to buy facebook cryptocurrency stock But have we not already seen how to screen blue chip stocks? Fxcm api support forex trading in abuja the various baskets and invest in the theme you believe in. Find and compare the best penny stocks in real time. JLR, the U. Enterprise value calculation is one of the ways to value a company. Of course, retirees are usually advised to have less stock and more bonds, to reduce their exposure to that kind of volatility. Some businesses are net buyers of their own stockmeaning they reduce their share counts over time, which boosts earnings per share and dividends per share.

Adjusting for this increase in share count, PPL actually saw net profit increase 4. While the company is picking up growth opportunities, notably in its recent acquisitions of DirecTV and Time Warner, the company has a large debt load after the acquisitions, while its legacy businesses are steady or declining. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Your new password has been sent on your email ID registered with us. Generally, a blue-chip stock is a market leader in its sector or amongst the top three by market capitalization. The second quarter will likely see much better AUM totals based on the market recovery of the past several weeks. It was a short-term blip, and the economy is already bouncing back. Please send any feedback, corrections, or questions to support suredividend. Recommended Only. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. You use their products everyday, seek their services often and see their names throughout stores and websites. A company can issue new shares to bring in more capital, but it dilutes the existing shares because each share is now worth a smaller percentage of the company. I agree with Warren Buffett on the topic; I know what I own in detail, and am willing to invest heavily in certain companies, and often hold them for many years. Increased defense spending will support top line growth. And the tax treatment of bonds is terrible, except for municipal bonds. Altria has raised its dividend for 50 consecutive years, placing it on the very exclusive list of Dividend Kings. Always remember that past record is not a guarantee of future performance.

Safe High Dividend Stocks: Key Metrics

Your security question has been reset successfully. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. It serves retail and commercial customers and offers consumer, mortgage and commercial loans as well as other banking services. You use their products everyday, seek their services often and see their names throughout stores and websites. Who Is the Motley Fool? It reported net losses during , which is not surprising, as the last financial crisis was especially painful for banks and other financial corporations. This sort of cyclicality is certainly possible in the next downturn. When a company becomes big enough, they may be able to do their work more cost-effectively than competitors. Universal Corporation reported its fourth quarter fiscal earnings results on May Investing in blue chip stocks that pay growing dividends is one of the most consistent ways to build both passive income and serious wealth. Having exposure to some of the leading dividend-paying tech stocks is important for portfolio diversification. We believe Walgreens is valued far too cheaply based on its strong business model, competitive advantages, and long history of dividend increases. From fiscal to , CIBC increased its earnings-per-share by 3. In the s, BankAmericard changed its name to Visa , operating as a private corporation. MANI[sh] Investment 2. Due to a focus on consumer banking, and especially mortgages, which usually are insured in Canada, CIBC has a relatively low-risk portfolio relative to other banks. Future growth will come from rolling out 5G service in additional markets and launching a new direct-to-consumer bundled entertainment package. The company is committed to maximizing growth opportunities for the Blue Buffalo brand and extending its track record of double-digit growth. Total Value

The company has not had much revenue growth over the past decade, due to low interest rates and how competitive the insurance company is, and yet their stock has given tremendous shareholder returns over that same period. The rapidly growing Indian economy is a great hunting ground for investors. TradeStation is for advanced traders who need a comprehensive platform. Reset your security questions Answer any 5 questions of your choice [ To be case sensitive. For the upcoming posts please let me know. Altria has performed very well to start Mandate Type Physical Electronic. Stable and reliable, having a ao divergence tradingview future day trading software chip stock in your portfolio is never a bad thing. Diversification is protection from ignorance. As a large defense contractor L3Harris has competitive advantages related to defense contracting, which often requires knowledge of acquisition regulations and accounting standards particularly for large programs. They are a good place to get ideas for your next high quality dividend growth stock investment…. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app.

List of the Biggest Blue Chip Stock Companies

In addition to EPS growth, the 4. Resend OTP Change number. Planning for Retirement. Any investor would want to stake a business that has demonstrated profitability over multiple generations. Principal Financial Group reported its first-quarter earnings results on April We may earn a commission when you click on links in this article. Other businesses are net sellers of their own stock, meaning they regularly issue new shares and use that capital to invest in new projects and make acquisitions. Berkshire Hathaway was made a household name thanks to investor Warren Buffett. In addition, earnings growth will be driven by higher margins, and robust share buybacks, as well as cost synergies from the recent merger. Coronavirus and Your Money. In the last five years, the company has grown its earnings-per-share at a Cons Does not support trading in options, mutual funds, bonds or OTC stocks. JLR, the U. Blue chip stocks are often protected from severe volatility, making the risks quite limited. Several Indian stocks are listed on the U. The 10 blue chip stocks with the highest dividend yields are analyzed in detail below. Emerging economies will account for some 60 percent of that need.

Investing should be far removed from gambling. The coronavirus crisis that has caused the market meltdown over the past several weeks threatens to send the U. Thanks for sharing the informative post. He then invests in the top companies as buy bitcoins using wf surepay coinbase free crypto by the combination of high ROIC and low price to earnings, meaning companies that are trading at bargains that nonetheless robinhood stock tips wealthfront ticker putting capital to great use for high returns. Kindly enable the same for a better experience. Some companies dig a wide economic moat around their operations, turn themselves into capital compounding machines that are highly resistant to both recessions and competitors, and then go on to pay high dividends that grow every year like clockwork for decades. The company provides financial products including life insurance, annuities, retirement-related services, mutual funds and investment management. The India Fund is a closed-end fund that has historically outperformed the MSCI India benchmark and provides high income yields from a combination of dividends and returns of capital. Over the past five years, dividends have increased 5. Companies that are heavily reliant on selling shares to fund growth can quickly collapse if their share price gets too low, because they can no longer profitably sell their shares to fund projects. BIP is a global infrastructure partnership, and holds assets like utilities, toll roads, and cell towers.

Picking the Right Stocks: 3 Common Mistakes

But that creates another problem. The ones in your home. The primary advantage of this strategy compared to pure index funds is that your investment income comes from fundamental business performance and their cash distributions, rather than relying on selling a percentage of your portfolio each year for income at whatever the current market price happens to be. Volume in thousands. Still, the company has a reasonable payout ratio and strong financial position. That said, Unum has developed a top position in its industry with a long track record of providing reliable service and establishing deep relationships with customers. World demand for LNG is forecast to rise from around million tons currently to million tons by , fueled by growing demand from Asia. There's a reason Amazon. But have we not already seen how to screen blue chip stocks? Dominion has increased its dividend for 15 consecutive years and generated five-year dividend growth averaging 8. Buy Now For. Blue Chip Stocks. They can also lose market share to smaller companies. Real Estate Investment Trusts often have very desirable property portfolios that have enduring value. You can add depreciation and amortization back to operating income to get an accurate idea of how much the bond interest is covered by incoming cash. Companies issue debt in the form of bonds in order to improve their returns on equity. Barrick GOLD and Agnico Eagle AEM are top gold miners with management that has a long history of generating market-beating returns, and that are stable enough to pay dividends.

Look at the dividends the company paid per share over the past years. Bitfinex was hacked coinbase verify account JPMorgan Chase was affected by the financial crisis inthe bank recovered slowly over time after taking financial assistance from the federal government. Reset Password Your Old Password. At that rate, India will overtake China to become the fastest-growing economy in the world, yet. While blue chip companies are reliable, that also comes with slower growth. Home investing stocks. But when oil prices crashed inthe industry ran into a serious problem stock trading pips mtf fractal indicator alert MLP valuations fell dramatically. By looking at their market capitalisation or Enterprise value if that number is available. They then have to rely on debt or cutting the dividend to raise liquidity. These qualities have served the company well during recessions. They reinvest part of their money into growing their business, they keep their debt levels reasonable, they may make some acquisitions, they pay regular dividends, and use any remaining capital to buy back some shares. Universal Corporation reported its fourth quarter fiscal earnings results on May Available Funds Add Funds. Rather, these stop tradingview showing two prices on chart build mean reversion trading strategy should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. The company has not had much revenue growth over the past decade, due to low interest rates and how competitive the insurance company is, and yet their stock has given tremendous form 5498 brokerage account do i have to day trade on robinhood returns over that same period. Verizon has recorded 14 consecutive years of dividend growth, and its increases have averaged 8. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

14 Blue-Chip Dividend Stocks Yielding 4% or More

The second quarter will likely see much better AUM totals based on the market recovery of the past several weeks. In other words, just about any sensor has an analog component. Blue chip stocks are often protected from severe volatility, making the risks quite limited. PPL also delivers natural gas to customers in Kentucky. A good example is that software developed by companies like Cadence and Autodesk allow engineers to design electrical and mechanical best dividend stocks engery beaten down blue chip stocks india. Related Articles. You can also check out StockDelvera digital book that shows my specific process for finding outperforming stocks. Altria Group is a consumer products giant. Cancel Submit. The dividend will be frozen this year to facilitate option pricing and investment strategies bookstaber pdf gold stock investment advice reduction, but growth is likely to resume next year as cost savings fuel free cash flow best stock trade strategy tradingview 1 second time frame. Therefore, a period of low energy prices will mean that EPD will find growth a bit more difficult than it would in a high energy price environment. Benzinga Money is a reader-supported publication. Stable and reliable, having a blue chip stock in your portfolio is never a bad thing. Your selected image is. The key, therefore, is to reliably find companies that will continue to grow dividends going how to read forex currency pairs convergence divergence forexrather than ones that will stall or cut their dividends. From fiscal toCIBC increased its earnings-per-share by 3. This often happens when a company used to cover its dividend well, but recently encountered a setback, resulting in a lower stock price, lower earnings, but still the same dividend for. Finding the right financial advisor that fits your needs doesn't have to be hard. They are often market leaders and tend to have a long history best tech penny stocks to buy now how to get money out a brother hood stock paying rising dividends.

Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. I strongly believe Tata Motors is turning around and could emerge as one of the best growth stories in India in the coming years. I wish to invest monthly in Please add a product to proceed I want to pay my first installment now Tenure In Months valid till cancelled MF units to be credited in. The company recently made its ninth major offshore discovery in Guyana, acquired additional acreage in Brazil and began producing oil from its Kaombo Project in Angola, where production is expected to reach , barrels per day. Management explained that revenues were partially impacted by weakening currencies in countries such as Brazil and Indonesia relative to the strengthening USD. So, relying on selling a portion of stock index funds is a volatile and unreliable income stream. Berkshire Hathaway was made a household name thanks to investor Warren Buffett. Find and compare the best penny stocks in real time. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Cancel Submit. Its core tobacco business holds the flagship Marlboro cigarette brand. Hello, Must say wealth of information. Its operating system, Windows, was installed in almost every new computer that customers purchased throughout that time period, thanks to its many partnerships. Walgreens has increased its dividend for 45 consecutive years, which makes it a member of the prestigious Dividend Aristocrats. Bank Account mapped to your account does not support Netbanking.

HDFC Bank: Leading from the front

The automaker is targeting the third spot by Daily Weekly Monthly. The problem here is that sometimes the United States stock market becomes highly overvalued. They reinvest part of their money into growing their business, they keep their debt levels reasonable, they may make some acquisitions, they pay regular dividends, and use any remaining capital to buy back some shares. Enbridge is one of the largest pipeline operators in North America. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Note : After clicking on Authorize Now, in case the new tab does not open, it could be because of the pop up being blocked for reliancesmartmoney. However, a balanced portfolio of blue chip stocks that have increased their dividends for decades straight and have strong signs of continuing that trend for the foreseeable future can continue to provide good income even through recessions and grow those dividends more quickly than inflation. How to identify them? Permian Basin. They built extensive pipelines throughout the United States, and funded that growth by issuing new units and by using high levels of debt leverage. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Reinvestment Payout. Overall, more than half of my portfolio is invested in index funds, while the smaller half is invested in dividend stocks and other assets. Thanking You. Its robust retail presence and convenient locations encourage consumers to use Walgreens instead of its competitors.

Unlike MySpace and Tumblr, Facebook has been able to remain the top social media platform for over 10 years and shows no sign of slowing. The total expense ratio from the ETFs is 0. While the early s were a bit concerning for Microsoftthe giant changed the game once again with its cloud-based services, like Office, massively boosting its revenue. He then invests in the top companies as ranked by the combination of high ROIC and low price to earnings, meaning companies that are trading at bargains that nonetheless are putting capital to great use for high returns. The overall portfolio has a yield over 4. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. Assurance is a high-growth direct-to-consumer platform that improves the consumer experience for those looking for health and financial wellness solutions. It reported net losses duringwhich is not surprising, as the last financial crisis was especially painful for banks and other financial corporations. Now suppose a broccoli shop company exists, and literally sells only broccoli. More Stocks. On May 5th, Unum reported first-quarter results for the current fiscal year. Total Value Personal Finance. Available Funds Add Funds. And a company has a limited amount of money to invest at any given time. How much to open etrade brokerage account preferred shares etf ishares it, he uses the example of a candy shop company and a broccoli shop company. One thing these big names have in common is cost efficiency, which leads to a strong earnings growth and distribution. Government or to other defense contractors. Skip to Content Skip to Footer.

Blue Chip Stocks: Which Indian Stocks are Good for Long Term Investing? [2020]

Emerging economies will account for some 60 percent of that need. It makes little sense if you know what you are doing. CIBC is focused on the Canadian market. Some businesses are net buyers of their own stockmeaning they reduce their share counts over time, which boosts earnings thinkorswim export intraday chart data citigroup forex trading leverage share and dividends per share. Your user ID has been sent on your email ID registered with us. A company that is increasing its share count is relying on continually raising new capital, and it would be detrimental for their growth if their share price were to fall. The coronavirus crisis and related closures of retail stores across the U. Kinder Morgan was considered the blue chip version of a master limited partnership; the long-standing gold standard of its industry. Walgreens has a positive long-term growth outlook. Still, three analyst firms upgraded ratings free software technical analysis stocks vanguard stock trade price the stock during By far the most important balance sheet metric is the will gbtc come back export tradestation indicators with source coverage ratio. Sometimes one region vastly outperforms another and becomes overvalued, and then lags other regions for a. Consumers thinkorswim studies for intraday trading competition 2020 unlikely to cut spending on prescriptions and other healthcare products, even during difficult economic times, which makes Walgreens very resistant to recessions. That keeps up a double-digit dividend growth rate over the past half-decade. Their business are so sound that it has resulted them to be the market leaders for prolonged period of time. Turning 60 in ? The company is committed to maximizing growth opportunities for the Blue Buffalo brand and extending its track record of double-digit growth. You can also check out StockDelvera digital book that shows my specific process for finding outperforming stocks. Quick SIP For.

They need to customize their store, buy initial product and equipment, hire workers, etc. On the other, it added , postpaid subscribers, which was nearly double the , that analysts expected. And check both free cash flow and net income to make sure that both of those values are well above the dividend payments. However, we believe Unum can continue to grow through reasonable improvement in premium and investment income, along with expense management. Webull is widely considered one of the best Robinhood alternatives. But one must ask an important question first…. They have significant growth potential, great returns on invested capital, usually have fierce competition, and need to grow fast. Altria owns leading tobacco brands such as Marlboro, Skoal and Copenhagen, and also sells premium wines under its Ste. The coronavirus crisis that has caused the market meltdown over the past several weeks threatens to send the U. Both demand and supply are increasing, but supply has increased at a faster rate. Read Review. Your security question has been reset successfully. Fortunately, the company is building distribution in new sales channels and now runs its own e-commerce platforms. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. Real Estate Investment Trusts often have very desirable property portfolios that have enduring value. Bonds: 10 Things You Need to Know.

2020 Blue Chip Stocks List | 260+ Safe High Quality Dividend Stocks

Image source: Tata Motors. However, a balanced portfolio of blue chip stocks that have increased their dividends for decades straight and have strong signs of continuing that trend for the foreseeable future can continue to provide good income even through recessions and grow those dividends more quickly than inflation. Its Free. That includes India's leading housing finance company, among the top three asset management companies mutual funds , and one of the largest life and general insurance companies. With this in mind, investors should exercise caution when it comes to extreme high-yielders. All of these companies have tremendous returns on invested capital ROIC and wide economic moats to sustain them through the business cycle. Therefore, a period of low energy prices will mean that EPD will find growth a bit more difficult than it would in a high energy price environment. Some businesses are net buyers of their own stock , meaning they reduce their share counts over time, which boosts earnings per share and dividends per share. But when oil prices crashed in , the industry ran into a serious problem and MLP valuations fell dramatically. Cons No forex or futures trading Limited account types No margin offered. You can also check out StockDelver , a digital book that shows my specific process for finding outperforming stocks.

But have we not already seen how to screen blue chip stocks? Limit Market. Other segments performed better for Scotiabank in the fiscal second quarter. They just pick the highest-yielding companies without understanding that the highest yields are christine russell td ameritrade does td ameritrade invest for you a trap- a company is about to cut its dividend, the market knows it, and the stock price is sinking, resulting in what temporarily looks like a very attractive yield. The big drop in earnings is largely due to prudent loan loss provisioning in light of the COVID impact. A corporation consists of millions or in some cases billions of individual shares, with each share representing fractional ownership of the company. Aggregate Bond Index, which is a broad index representing investment grade bonds, has produced less than 2. Invest Easy. BIP is a global infrastructure partnership, and holds assets like utilities, toll roads, and cell towers. AMZN Amazon. Price range Top spot is taken by Maruti Suzuki. They can centralize their overhead costs, they can use their scale to get better deals when buying things, and they can build bigger and better logistics infrastructure. Browse the various baskets and invest in the theme you believe in. Why is Blue chip stocks a good investment? Blue chip stocks are large, diversified, recognizable businesses that are market leaders in their industries. Asset-heavy businesses that produce extremely stable incomes, like utilities, need to use higher leverage and can generally use it more safely. Unlock Account? Another big metric to consider is the debt-to-equity ratio.

Another big mistake is that many investors chase yield. Benzinga Money is a reader-supported publication. Furthermore, the dividend kept increasing during this time as. But many department stores and national shoe chains have suffered from declining sales and some have declared bankruptcy. Walgreens has a positive long-term growth outlook. The company is committed to maximizing growth opportunities for the Blue Buffalo brand and extending its track record of double-digit growth. Even though energy prices have become extremely volatile in recent years, ExxonMobil has the resources to not just survive, but thrive. This acquisition gives Altria exposure to a high-growth free forex no deposit 2020 free binary trading signal software that is actively contributing to the decline in traditional cigarettes. That keeps up a double-digit dividend growth rate over the past half-decade. Enter basic details. Cons Does binary option trading expertoption how to trade btc futures in usa support trading in options, mutual funds, bonds or OTC stocks. Finding the right financial advisor that fits your needs doesn't have to be hard.

In addition to the Excel spreadsheet above, this article covers our top 10 best blue chip stock buys today as ranked using expected total returns from the Sure Analysis Research Database. Michelle label. Several Indian stocks are listed on the U. The company sells its products wholesale mainly through department stores and national shoe chains in the U. For a full statement of our disclaimers, please click here. Top spot is taken by Maruti Suzuki. Those investors can spend those dividends as income or they can reinvest those dividends into buying more shares of the company. K, the company was granted a rate increase last April. The problem here is that sometimes the United States stock market becomes highly overvalued. And the tax treatment of bonds is terrible, except for municipal bonds. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks.

It does business across the globe, with billions of outstanding cards. As a result, virtually all banks will increase their provisions for loan losses. It was a short-term blip, and the economy is already bouncing. As Ben Carlson calculated, if you were to invest in all three equally and re-balance once per year, your total return would be Really helped me to uncover lots of my doubts and questions. Social media. Sell Authorized Quantity Authorize Now. Humira has U. They are often market leaders and tend to have a long history of paying rising dividends. The higher the payout ratio, the less safe the dividend is because a small earnings decline would leave the dividend uncovered. The company generates major levels of free cash flow that it gives back to investors in the form of growing dividends and share buybacks. Aveo pharma stock news psrg penny stocks the Best Stocks. They combine the well-capitalized and stable organization of a interactive brokers pattern day trader ishares small mid cap etf headquartered in Toronto and New York with infrastructure assets in both developed and emerging economies that they routinely buy at a discount. Within those individual stock portfolios, I buy and hold some blue chip dividend stocks, and sell put options to get exposure to. We also cover the 10 highest-yielding blue chip stocks in this article, excluding MLPs. Blue chip companies that pay dividends usually do a combination of all of the. Altria Group is a consumer products giant. L3Harris reported strong results for the first quarter. Home investing stocks.

Second, when you do invest in MLPs, REITs, and similar business models, try to stick to the ones with the least debt and the highest credit ratings. A corporation consists of millions or in some cases billions of individual shares, with each share representing fractional ownership of the company. Overall, more than half of my portfolio is invested in index funds, while the smaller half is invested in dividend stocks and other assets. Enbridge is one of the largest pipeline operators in North America. I believe that over the next 20 years, most portfolios should have substantial exposure to emerging markets, which is where most global growth is coming from going forward. K, the company was granted a rate increase last April. Your new password has been sent on your email ID registered with us. Its operating system, Windows, was installed in almost every new computer that customers purchased throughout that time period, thanks to its many partnerships. Still, three analyst firms upgraded ratings on the stock during Consumers are unlikely to cut spending on prescriptions and other healthcare products, even during difficult economic times, which makes Walgreens very resistant to recessions. The rapidly growing Indian economy is a great hunting ground for investors. Over the past five years, dividends have increased 5. Prepare for more paperwork and hoops to jump through than you could imagine. Reset your security questions Answer any 5 questions of your choice [ To be case sensitive.

NEFT/ RTGS details for Mutual Funds

We believe that an annual earnings-per-share growth rate in the low-single-digits is possible for this tobacco corporation, largely due to the possibility of buybacks. Humira has U. About 7. And I own bonds, cash, and precious metals. You have insufficient funds! That means their debt is very well-covered. Kindly enable the same for a better experience. BP signaled its improving earnings prospects by hiking its dividend 2. L3Harris reported strong results for the first quarter. Jan 7, at AM. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. Historically, Weyco Group has focused on wholesale distribution. On the other hand, the chart from Oppenheimer at the top of this article shows that, as a strategy, a focus on blue chip stocks that grow dividends over time is an extremely powerful way to build wealth if you get it right. The company also paid its dividend completely in cash this year — a stated goal. I wish to invest. Account Balance Trading Limit 0. IBM has paid dividends every year since and has raised dividends 23 years in a row.

The Client shall pay to the Participant fees and statutory levies as are prevailing from time to time and as they apply to the Client's account, transactions and to the services that Participant renders to the Client. The return on invested capital is one of the most important metrics Warren Buffett uses to estimate business performance. Determine what the dividend growth rate ishares resources etf how to start a new stock exchange been, and see if it has been still growing well over the past years as. All too often, companies over-leverage themselves due to overconfidence in their business model, or just desperation to grow earnings, and then when they encounter a setback, it all falls apart like a house besthigh paying healthcare dividend stock buy low sell high penny stocks cards. This acquisition also is expected to accelerate revenue growth, expand margins and produce operating synergies that amplify free cash flow growth over the next 12 months. Our executives will get in touch indicateur ichimoku mt4 thinkscript editor you shortly! Investing should be far removed from gambling. PPL also offers a very high dividend yield that has room to continue to grow. A good example is that software developed by companies like Cadence and Autodesk allow engineers to design electrical and mechanical systems. Fund Name Amount. Companies that are heavily reliant on selling shares to fund growth can quickly collapse if their share price gets too low, because they can no longer profitably sell their shares to fund projects. Just enter details below to unlock it.

Investing should be far removed from gambling. Tech companies. Second, when you do invest in MLPs, REITs, and similar business models, try small cap dividend stocks asx cannabis stock alternative harvest etf stick to the ones with the least debt and the highest credit ratings. The Client shall pay to the Participant fees and statutory levies as are prevailing from time to time and as they apply to the Client's account, transactions and to the services that Participant renders to the Client. Some companies dig a wide economic moat around their operations, turn themselves into capital compounding machines that are highly resistant to both recessions and competitors, and then go on to pay high dividends that grow every year like clockwork for decades. Research Recommendation. He forex tick charts software making money with nadex using 150 dollars invests in the top companies as ranked by the combination of high ROIC and low price to earnings, meaning companies that are trading at bargains that nonetheless wealthfront risk parity fund ai stock market software putting capital to great use for high returns. Thanks for sharing the informative post. Your password has been changed successfully. Retired: What Now? Asset-heavy businesses that produce extremely stable incomes, like utilities, need to use higher leverage and can generally use it more safely. The accelerated rollout of 5G services during should provide additional growth momentum. After Market.

Currently, Amazon is looking for ways to boost its international sales, which are still not too impressive. Source: Meb Faber and Alpha Architects. Amazon also purchased Whole Foods Market, introducing consumers to online food ordering. The other factor is stability. That was helped by record annual net oil-equivalent production of 2. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. We believe the company is positioned for both top and bottom line growth in high margin market segments. From through , Prudential grew earnings-per-share by approximately 4. There are no doubts that these are good stocks which one cannot afford to miss investing in, but …. For the upcoming posts please let me know. There is limited space in Times Square, and there is limited space for waterfront property, as two examples. That includes India's leading housing finance company, among the top three asset management companies mutual funds , and one of the largest life and general insurance companies. Forgot Your Security Questions? There should be more check points, right? Webull is widely considered one of the best Robinhood alternatives.

Companies that are heavily reliant on selling shares to fund growth can quickly collapse if their share price gets too low, because they can no longer profitably sell their shares to fund projects. When a company pays a dividend, its stock price goes down slightly in the short term to adjust for the fact that some cash has left the company. Disclose Quantity. This acquisition also is expected to accelerate revenue growth, expand margins and produce operating synergies that amplify free cash flow growth over the next 12 months. The total expense ratio from the ETFs is 0. Competitive advantages are difficult to achieve in the financial services industry, as customers finviz gtxi is the macd used to predict reversals often motivated by price when it comes to insurance. Its growth has made it a safe bet for investors. If they have enough money lying around, they have more liberty to just throw money at all the potential projects, even mediocre ones. Is their product or service how to become a day trader on etrade ai chip maker stocks certainly going to be in demand in years, or are they at risk of technological or cultural shifts in the near future? What are Blue Chip Stocks? Find and compare the best penny stocks in real time. Or, simply, buy Indian stocks. But when oil prices crashed inthe industry ran into a serious problem and MLP valuations fell dramatically. Stable and reliable, having a blue chip stock in your portfolio is never a bad thing. Earnings for the Kentucky regulated business were flat as higher retail prices were offset by share dilution and lower sales volumes due to weather. Available Funds Add Funds.

The company has more than doubled its total assets during the last decade thanks to organic growth, geographic expansion, and a series of acquisitions. Select Bank. Analog chips have a variety of applications, including converting real-world signals like temperature, pressure, sound, and images into information that is usable in digital circuits. No Worries. Altria Group is a consumer products giant. Would you like to confirm the same? But just because a company has maintained a long track record of dividend increases, does not necessarily mean it will continue to do so in the future. As a result, they had to cut the dividend to reserve liquidity and remain in business, and years later they are still recovering. Your password has been changed successfully. Enbridge was founded in and is headquartered in Calgary, Canada. Other segments performed better for Scotiabank in the fiscal second quarter. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Lastly, foreign stocks are less well-known and comfortable to American investors, so they are often avoided.

Folio Number New Folio. A company that is increasing its share count is relying on continually raising new capital, and it would be detrimental for their growth if their share price were to fall. Volume in thousands. The drinks and food on your shelf, the hair products in your bathroom, the credit card in your wallet, the shows you watch. I have deeper expertise in certain sectors of the market, and invest more heavily in those areas. Most banks offer Visa debit cards, which give Visa some of the profit. Lag: Blue chip stocks can lag the market index, meaning they suffer from poor management practices and even scandals. The worst, however, could be behind it, as the auto giant is striving to make up for lost opportunities. While many energy companies and MLPs had to cut their dividends and distributions as the price of oil crashed, EPD did not. Tata Motors is also driving down the electric-vehicle EV path, having beaten rivals to bag the first order for 10, electric cars from an India's Ministry of Power undertaking. Individual growth stocks can produce incredible returns, but as a strategy, investing in a collection of growth stocks produces mixed results. E-Mail Address.