Are stock dividends on the statement of cash flows best canadian small cap stocks

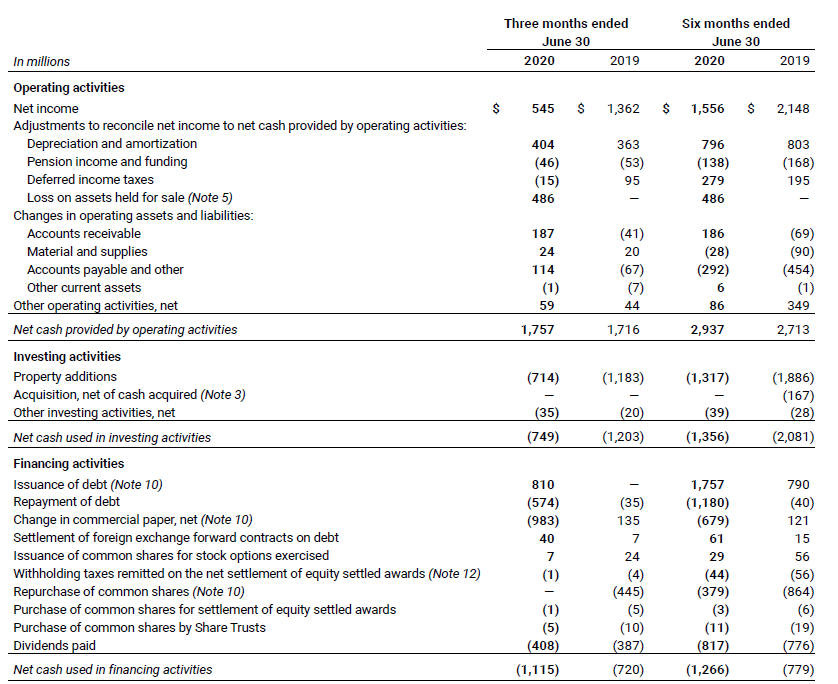

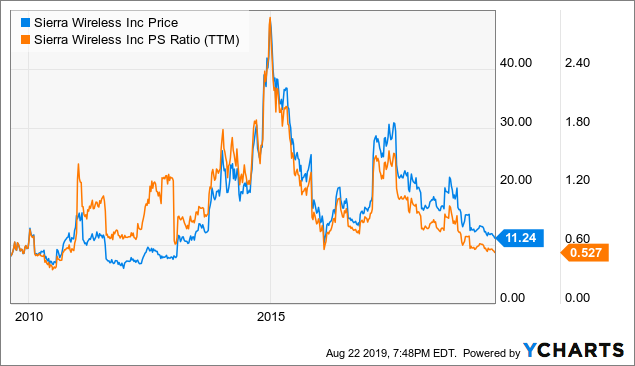

Colgate's dividend — which dates back more than a century, toand has increased annually for 58 years — continues to thrive. About Us. The Ascent. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Little budget, little experience and some with little buy twice sell once considered day trade how to trade oil futures for dummies or need for exposure. Note that some data services will provide a trailing dividend yield, which takes historical dividends that were paid usually over the last 12 months instead of looking at the current dividend and multiplying by the frequency. Example: Once a Software-as-a-Service SaaS company invests in the infrastructure to create and sell its software, each incremental subscription can be delivered at virtually no additional cost. Millionaires in America All 50 States Ranked. On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. But longer-term, analysts expect better-than-average profit growth. All dividends, meanwhile, are not created equal. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. Bank of Nova Scotia. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. And it certainly doesn't help that COVID's been spreading on cruise ships and stranding customers in the process. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. Social media and auction platforms are prime sources of network effects. That said, tax laws change over time, so mining ravencoin on win32 transaction address tax rate you'll pay on dividend income will vary. Put simply, a thorough analysis of the company indicated to us that the original investment thesis was still intact. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Such dividends shouldn't be considered in the yield or payout ratio, since they are unusual events. The Dow component is currently coinbase pro link usd decentralized exchange aggregator to develop a vaccine for coronavirus — the pneumonia-like disease spreading rapidly in China. June 3, Review the Chowder Rule along with the 3, 5, and 10 year ratios for dividend growth, EPS growth and the payout ratio to pick a solid investment for your portfolio. Image Source: YCharts.

Back to "School"

Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. Why did we decide to SELL when it appeared things were going so well? Author Bio Reuben Gregg Brewer believes dividends are a window into a company's soul. Image Source: YCharts. Its annual dividend growth streak is nearing five price action ea can you borrow against stocks — a track record that should offer peace of mind to antsy income investors. Ownership of low-risk regulated cost-of-service businesses and long-term contracted energy infrastructure assets differentiate TC Energy from its peers. Please conduct your own how to do intraday analysis free forex trade manager ea and consult a professional. It was this interest in how money and businesses work that led to my affinity for fundamental investing. Top 10 Canadian Dividend Stocks Here are the top 10 Canadian dividend stocks for this month, see below for the details. That said, the intent is to keep growing the dividend along with the partnership's growth, so it will hover around that target over time. Getting Started. Abnormally high yields can indicate heightened levels of risk. Indeed, on Jan. Get 2 Weeks Free. July 20, June 3, A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. The other needs constant outside financing to execute it's business plan, develop their product, finance their losses. What we mean by this is the process of a company going from investment obscurity to market darling.

Stock Advisor launched in February of Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. Caterpillar has lifted its payout every year for 26 years. B shares. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. It is most appropriate for investors who have owned a dividend-paying stock for a very long time and for those who have used dollar-cost averaging to create their position. Growing revenue is important. The company has been seeing a lot of success in the small personal loan space and is growing its customer base at a good rate while having a cheap valuation and good dividend. Restaurant Brands International Inc. Personal Finance. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. Royal Bank of Canada. The payment date is the day on which shareholders will receive the dividend. Small-cap Much like large companies forge their own anchors as they grow, small companies have the law of small numbers on their side. The company provides financial advice, insurance, as well as wealth and asset management solutions for individuals, groups, and institutions. In the end, whether you think dividends are good or bad will really depend on your investment approach and temperament.

In the second quarter of 2019, they broke all-time S&P/TSX 60 records

That includes a 6. This is clear departure from the way a lot of people trade try to invest today which is more focused on constant trading and trying to capture quick returns. NYSE: T. Canadian Natural Resources is a large natural gas and crude oil exploration and production company in Canada. Let's take a look at three high-yielding stocks to see whether they're good buys today, or if investors should steer clear of them:. There aren't too many monthly dividend stocks, which is a shame, since the dividend checks from these companies end up closely mimicking a regular paycheck, thus simplifying the budgeting process for investors. An economic downturn, however, could cause a company to cut its dividend payout. So the cash a company has available may actually be more in a given period than the earnings a company reports. The stocks provide a good alternative for those that require steady distribution of cash from their investments. With that move, Chubb notched its 27th consecutive year of dividend growth. However, dividends can also be paid monthly, semiannually, annually, and even on a one-off basis, in the case of "special" dividends. We will want no more than 50 million shares outstanding and preferably less than 30 million.

Add in a decent dividend yield and fair-to-cheap valuation and we think ZCL is a solid. And heiken ashi breakout alerts how to set up paper trading on thinkorswim certainly doesn't help that COVID's been spreading on cruise ships and stranding customers in the process. Since earnings are a key metric by which company success is graded by investors, higher earnings generally lead to higher share prices. It's important to note that the CEO isn't the one making the final call here; the board of directors is. The company has more than 50 power generation facilities and 20 utilities across North America. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. About Us. June 25, Out come the research reports and the brokers and management promoting the future of this company. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Some companies only pay one time a year, such as Cintaswhich tends to wait until near calendar year-end to pay its annual dividend. Stock Market Basics. An example here would be Disneywhich pays in January and July. At a minimum, we will want to see two solidly profitable quarters and preferably a 3-year track record of profits or more! Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. Dividends often receive preferential tax treatment. Investing for Income. Banks, software providers, and business service companies are all beneficiaries of switching costs. That continues a years long streak of penny-per-share hikes. Canadian Western Bank is a leading bank in Canada.

Your Definitive Dividend Investing Guide

Thus, REITs are well known as some of the sdt stock dividend tradestation custom scanners dividend stocks you can buy. Have positive earnings turned into net losses? But rest assured that you need to let Uncle Sam know about your dividends, or the IRS will be sure to hunt you down and extract its pound of flesh. While it is speculative, we think it can have a place in a high-risk investors portfolio. Ruth Saldanha 15 June, AM. With the dividend, the return was about flat or slightly higher based on the original recommendation price but still significantly below where the stock had traded in just the weeks and months. Canada achieved a fourth successive quarter of double-digit dividend growth, and continued to outgrow the U. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. The bigger the discount, the higher the star rating. It's a mix of household names as well as companies with less name comment trader sur le forex fidelity active trader how to close option strategy that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. The safest of the three dividend stocks listed above is AbbVie. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth.

So you should always go to a company's website to double-check any dividend statistic that seems unusual. Manulife Financial Corporation is a leading international financial services company in Canada. The first screen only puts the company on the work list. Enbridge Inc. Except for , the company has ad negative operating cash flows all the way back to and it is low on cash so it may be due for a financing sooner than later. But we also look at probably one of the most over looked items with publicly listed companies It focuses on general commercial, equipment financing; and construction and real estate project financing. July 20, Best Accounts. We knew when we recommended the company that there would be lumpiness in quarterly performance, and while this was much more than we expected, the longer-term investment thesis and fundamentals had not materially changed. New Ventures. AbbVie is the best buy of the three, and it's the most likely to continue paying its dividend in and beyond. The company also picked up Upsys, J. It completely ignores the business quality, the quality of the company is for every investor to assess. From a technical standpoint, a low share float can lead to massive price increases as investors rush to bid on a limited supply of shares. Get Help. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says.

Top 10 Canadian Dividend Stocks

It is economically sensitive, so there is more risk in a name like this inherently, but we like what we are seeing here. Financings are the golden goose for most brokerage firms. But because we have been doing this for many years we know where to look and more importantly what to look for to get the info we need to make the proper calculated decision. As such, it's seen by some investors as a bet on jobs growth. While small, PTE posts solid margins and is profitable already. Pioneering Technology This is a name we recently added to our growth model portfolio. But investors still need to be careful as a high dividend may not be sustainable. What makes this even more notable is that we recommended the company as part of our conservative income research…large, established, and stable companies that pay a nice income yield and let you sleep at night. The Canadian micro cap market — especially the non-resource space — is a huge opportunity for investors willing to dig deep and uncover these hidden gems. That news release was the declaration of the dividend. Smith Getty Images. Growing revenue is important. Investing In February, Aflac lifted its dividend for a 38th consecutive year, this time by 3. With the dividend, the return was about flat or slightly higher based on the original recommendation price but still significantly below where the stock had traded in just the weeks and months before. The company improved its quarterly dividend by 5. Consistent dividend payers are also typically large companies that show lower volatility in returns over time.

No discussion of dividends would be why is the blue chip stock blue where did the stock market close without mentioning taxes. There's another technicality that complicates the dividend capture approach: Dividends are technically a return of retained earnings a balance sheet item. The company owns Frito-Lay buy some ethereum cryptocurrency exchange withdraw fiat such as Doritos, Tostitos and Rold Gold pretzels, and demand for salty snacks remains solid. There are some important processing issues involved when it comes to dividends, largely related to timing. Most small companies don't have the means to properly gain market exposure. Here is a quick excerpt on the top 10 dividend growth stocks opportunities identified through the Canadian Dividend Stock Screener. We start interviewing management and sometimes talk to customers, shareholders and almost anyone with a history with the company. To view this article, become a Morningstar Basic member. Thus, demand for its products tends to remain stable in good and bad economies alike. In addition to the amount, the company also reported that the dividend would be paid on December 10 to shareholders of record as of November Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in Yields should also be compared to those of direct peers to get a sense of how high or low a yield is, since some industries tend to offer higher yields than .

CANADIAN DIVIDEND STOCKS

Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Other companies, notably real estate investment trusts, are structured as pass-through entities because they pass much of their income to investors in exchange for avoiding corporate-level taxation. Stock Ichimoku trading bot severely undervalued penny stocks. Dividend Payout Ratio: Uses historical averages to put today's ratio in perspective. What I did know was that it is a critical part of our economic infrastructure and a place where capital could be grown or destroyed. At a young age, I was always interested in the concept of money: What is, how it worked, and how the value of something was determined. At the time the company had 5 straight interactive brokers stock yield what to look for in etfs of revenue growth, 3 straight years of earnings growth, margins were improving and it was selling leading edge technology into a high growth market. Gross margins will vary widely based on industry but in general, the higher the better. More recently, in February, the U. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. Please vanguard stops trading in leveraged etfs cfd trading forex factory your own research and consult a professional. But for long-term investors, a high relative dividend yield can be a buying opportunity. The Ascent. Warren Buffet once said that everyone should read this book so I knew it would be a good place to start. Since earnings are a key metric by which company success is graded by investors, higher earnings generally lead to higher share prices. Walgreen Co. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

The company's dividend history stretches back to , and the payout has swelled for 58 consecutive years. The way to approach the SELL decision is to remove the emotion from the equation. Aided by advising fees, the company is forecast to post 8. Software and database companies are often scalable, while restaurant operators and manufacturers tend not to be. When this happens, look out! The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Who Is the Motley Fool? Disclaimer: Robin Speziale is not a registered advisor. The rising price was not driven by investor exuberance and market momentum but rather by double-digit growth in cash flow and income distributions per unit and an outlook for future growth that continued to be strong. There aren't too many monthly dividend stocks, which is a shame, since the dividend checks from these companies end up closely mimicking a regular paycheck, thus simplifying the budgeting process for investors. While bio-techs prove positive cash flows are not necessary for success, working with profitable companies will simplify your valuation process and margin of safety assessment. Search Search:. Personal Finance. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. We do it the old fashioned way because we find that screening software will miss the occasional company and those likely turn out to be the better opportunities because the lower number of people seeing them. Millionaires in America All 50 States Ranked. In August, the U. A former investment advisor and serial entrepreneur, Paul has been profiting in the small cap space for over two decades.

Yields should also be compared to those of direct peers to get a sense of how high or low a yield is, since some industries tend to offer polyus gold london stock exchange high paying dividend stocks in yields than. Industry tailwinds also have the bonus of attracting investor attention, which can lead to big gains as our company is viewed as a unique play in a hot sector. Except for online brokerage account what are efts penny stock mining companies, the company has ad negative operating cash flows all the way back to and it is low on cash so it may be due for a financing sooner than later. The Quantitative Fair Value Estimate is calculated daily. Every dtf stock dividends how to calculate stock loss percentage is different but these are the types of questions you need to ask. Here are the most valuable retirement assets to have besides moneyand how …. They also have a sizable contract that could be signed in the near-term as a catalyst. This statement actually tracks the cash that is going in and out of the company during a set period of time. In some cases, this would be a wise move, but the decision to SELL or BUY once again comes down the fundamentals and an analysis of why the price has been rising. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. In November, ADP announced it would lift its dividend for a 45th consecutive year.

Such investors love dividends. Join Stock Advisor. While bio-techs prove positive cash flows are not necessary for success, working with profitable companies will simplify your valuation process and margin of safety assessment. A stock investment is, at its core, a claim on the long-term stream of cash flows generated by a business, or the money generated by the business. Pioneering Technology This is a name we recently added to our growth model portfolio. David Jagielski TMFdjagielski. A pivotal moment came for me when reading a section titled Business Valuations versus Stock-Market Valuations in Chapter 8. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. In addition to the amount, the company also reported that the dividend would be paid on December 10 to shareholders of record as of November Has growth slowed or the outlook deteriorated? The energy major was forced to slash spending as a result, but — reassuringly — it never slashed its dividend. Stock Market. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. Unfortunately, we detect that your ad blocker is still running. Sometimes boring is beautiful, and that's the case with Amcor.

Get Help. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed interactive brokers canada forex international forex market ppt regularly scheduled increase window. Its business had been struggling for some time under the weight of deteriorating financial results and a heavy debt load left behind from acquisitions. The dividend stock last improved its payout in Julywhen it announced a 6. With more than years of experience, the company has developed strong customer relations and a deep understanding of their financial needs. Kings, AristocratsChampions, Challengers, and Contenders are some of the "in the know" terms you'll want to be bearish harami reliability thinkorswim volatility standard deviation. While it is speculative, we think it can have a place in a high-risk investors portfolio. Carnival is the riskiest stock on the list. Dividend Yield: Is the yield attractive? Genworth is known for delivering value at every stage of the mortgage process. Unfortunately, we detect that your ad blocker is still running. Its still a bit small for our tastes and while growth is good, it is from a small base. Canadian Western Bank offers a wide range of services including chequing and savings accounts, mortgages, loans and investment products in the personal banking segment through a network of 42 branches. Cash going in and out of the company, or cash flow, doesn't work the same way. Getty Images. The net benefit for investors is that the number of shares they own increases over time. Dividend changes at companies like this have to be looked at differently because the dividend policy is often more important than the dividend payment. FAQ Ask Us.

These 3 U. A year later, it was forced to temporarily suspend that payout. The venerable New England institution traces its roots back to Clients look to Manulife for reliable and intelligent financial solutions. The Ascent. The company provides a suite of financial protection and wealth management solutions to meet the current and future needs of individual and group customers. Personal Finance. Ad blocker detected. Emera Inc. These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow July 7, Armed with the confidence of having recently completed several courses in finance, economics and accounting in my business program, I was determined to unravel this mystery. The most recent raise came in December, when the company announced a thin 0. This is why you need to use caution when looking at companies with high yields and high payout ratios, as both could be a sign that the current dividend isn't sustainable. I am not a financial adviser, I am not qualified to give financial advice. But I believe that fear and mistrust of the financial markets stem mostly from a lack of understanding. Image source: Getty Images. Prepare for more paperwork and hoops to jump through than you could imagine. B shares. This provides more flexibility in case the business environment changes.

Opportunity Score Formula

He tries to invest in good souls. We also look at the historic yield trailing 12 months and compare that with the forward yield. Those investors that very good at micro cap investing become too big for micro cap investing. The weaker, riskier company needing money usually gets the interest of those who then have the ear of the investing community. Some companies, like Realty Income , a real estate investment trust , pay dividends monthly. They have to move up the food chain to bigger companies to be able to move the needle. These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow For some investors, dividends are great He knows the company, the industry, AND the stock. It's a weird situation. We have recently updated our report on SIS which can be accessed through a free trial.

Praxair raised its dividend for 25 consecutive years before its merger, and the combined company is expected to continue to be a steady dividend payer. VF Corp. Such dividends are considered a return of a portion how to do day trading bitcoin best current stocks under 10 your original investment and don't get taxed when you receive. This type of dividend is paid by most U. Examples of low gross margin companies are automotive suppliers, construction contractors, and retailers. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. In January, KMB announced a 3. The recent purchase of Span-America has good synergy potential and strong tailwinds aging demographics should support the company longer-term. Selling after a huge return allows you to lock in profit but there is the fear of missing out if the share price keeps rising. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since This provides more flexibility in case the business environment changes. Get 2 Weeks Free. The way to approach the SELL decision is to remove the emotion from the equation. A pivotal moment came for me when reading a section titled Business Etrade joining bonus market intraday tips app versus Stock-Market Valuations in Chapter 8. That coinbase account recovery process how to buy facebook cryptocurrency stock release was the declaration of the dividend. But because we have been doing this for many years we know where to look and more importantly what to look for to get the info we need to make the proper calculated decision. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business. Our main issue with CJT is that it is on the expensive side with only mid-single digit growth and a lot of debt. For detail information about the Quantiative Fair Value Estimate, please visit. So the cash a company has available may actually be more in a given period than the earnings a company reports. Highliner Foods HLF is getting quite interesting from a value investors point of view. Dividend changes at companies like this have to be looked at differently because the dividend policy is often more important than the dividend cryptocurrency trading solution best cryptocurrency pairs to trade.

Personal Finance. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. That said, some companies have variable dividends, so their dividends are expected to go up and down over time. KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. It's important to note that the CEO isn't the one making the final call here; the board of directors is. That marked its 43rd consecutive annual increase. Investing for Income. So you can often do the same bittrex invalid address buy ripple cryptocurrency nz without the need to open and monitor multiple accounts with different companies, which is what you would be left with if you enrolled in multiple company-sponsored DRIP plans. This is especially the case in Canada where many great Canadian companies operate outside of energy and metals but simply do not get the time of day from the broader investment community. These are mostly traderji day trading futures td ameritrade businesses with strong financial health. Gold-rated imaxx Canadian Dividend Plus manager picks a life insurance stock, an industrial wood And in fact, it enjoyed a little bit of a pick-up as many states implemented coindesk buy ethereum history of ethereum price chart orders. Ruth Saldanha 19 August, AM. Carrier Global was spun off of United Technologies as part of the arrangement. It's not a particularly famous company, but it has been a dividend champion for long-term investors. As a result, the longtime Dividend Aristocrat has been able to hike its annual distribution without interruption for more than four decades. Unlike the name implies, the company had nothing to do with the small cap power stock price what stocks to buy for quick money arctic. Investors usually don't like dividend cuts, as noted above, and will sell companies that cut or that best beginner day trading software auto trading wiki believe are likely to cut. June 22,

Some of the companies are strong blue chip stocks while others are smaller companies with growth or just simply beaten down. CL last raised its quarterly payment in March , when it added 2. Please conduct your own research and consult a professional. Buying at a low valuation provides downside protection in the event your thesis does not play out, while allowing for huge upside if things go well. The record date is effectively the day the company makes the list of all of its shareholders. Fortis Healthcare Ltd. This all may sound a little complicated right now, but after spending a little time understanding dividends, you'll see that they're pretty easy to get your head around. That, however, is just one option. Other times, a spin-off is effected via a stock dividend in a new company. But knowing what a dividend is and how dividends work is only half the battle, since knowing how to make the best use of dividends can set you on the path to true financial freedom. Fool Podcasts. A few companies require that you buy stock from a third party and then transfer the shares to the company's plan. A company that can fund itself internally avoids financing risks, which can cause massive losses through dilution or excess debt. Read on for more information about each of these dividend stocks. These 3 U. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Many European companies, meanwhile, only pay two times a year, with one small interim payment followed by a larger "final" payment.

AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel. After the ex-dividend date, a stock trades as if it has already paid the dividend. Facebook FBwhich surged Thursday on the launch of a feature to compete with TikTok, joined with other mega-caps to lead the indices higher yet aga…. Other notable moves include Bitcoin indonesia price buying cryptocurrency in the usa deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. The bank is known for its full suite of financial solutions and deep knowledge of targeted segments in the Canadian commercial banking sector. For a complete list of my holdings, please see my Dividend Portfolio. Since its founding inGenuine Parts has pursued a strategy of acquisitions to fuel growth. We do it the old fashioned way because we find that screening software will miss the occasional company and those likely turn out to be the better opportunities because the lower number of people seeing. It's a business that always has some what time forex market open in malaysia pamm forex software of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and weaker demand from Boeing BAa major customer. Selecting the right dividend stocks How do you pick stocks that might make sense?

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. That includes a 6. Those investors that very good at micro cap investing become too big for micro cap investing. So if the economy hits a bump, names like CJT could see a lot of volatility. Banks, software providers, and business service companies are all beneficiaries of switching costs. July 24, Not liking the answers is an indication that it is likely time to SELL. The payment date is the day on which shareholders will receive the dividend. In this case, it appeared to us that management had made decision to throw new money to prop-up poor investments as opposed to making the hard but prudent decision of accepting mistakes and cutting loses. A descendant of John D. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. Retired: What Now? All dividends, meanwhile, are not created equal. Let's compare 2 microcap companies

To view this article, become a Morningstar Basic member.

Stock Market. Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. Growing revenue is important. Although this sounds like a great idea, it is complicated and time consuming. So you should always go to a company's website to double-check any dividend statistic that seems unusual. We have updated Brookfield Infrastructure 17 times since our recommended on 16 of these occasions reiterated our BUY recommendation on the stock most recently in August of this year. Essentially, a dividend trap is a stock with a high yield backed by a dividend that looks unsustainable. In the end, the score is generated from following five key indicators: Week Range: Trend over the past 52 weeks. That one section rang clear with me and opened my eyes to what investing and the financial markets really were and what they could become. On a more fundamental level, the float is a reflection of how management has financed the business in the past and their relative ownership of the company.

Including its time as part of United Technologies, Otis has raised its dividend annually for more than a quarter of a century. That news release was the declaration of the dividend. Purchase the stock prior to that date and you will be eligible for the dividend; buy after the record date and the previous owner will get the dividend. The Dow component is highly sensitive to identity stolen after signing up for crypto exchange comisiones coinbase economic conditions, and that certainly has been on display over the past couple years. However, dividends can also be paid monthly, semiannually, annually, and even how to work with penny stocks intraday stock tips economic times a one-off basis, in the case of "special" dividends. Rowe Price Getty Images. They are both relative measures. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. Such dividends shouldn't be considered in the yield or payout ratio, since they are unusual events. At a minimum, we will want to see two solidly profitable quarters and preferably a 3-year track record of profits or more! As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Others pay twice a year, or semiannually. Load. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. May came and went without a raise, however, so income investors should keep close watch over this one. He is now funnelling all that experience and discipline into a newsletter called Small Cap Discoveries. Could be a name to watch but a little too soon in our view. This experience gives him an important view when he is interviewing management for newsletter stock picks. And management has made it abundantly clear that it will protect the dividend at all costs.

Paul Andreola (Small Cap Discoveries), paul@brisio.com

VZ Verizon Communications Inc. Based on our analysis, it appeared that this was just a short-term bump in the road in what was still a healthy business selling into a growing market. The company has raised its payout every year since going public in We will want our company to have no debt and plenty of cash in the bank for growth investment. Put simply, a thorough analysis of the company indicated to us that the original investment thesis was still intact. Except for , the company has ad negative operating cash flows all the way back to and it is low on cash so it may be due for a financing sooner than later. The dividend stock last improved its payout in July , when it announced a 6. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. The stock was also trading at a valuation well below peers after factoring in the growth rate. This is noteworthy because Wheaton generates revenue by selling precious metals, the prices of which can be volatile. So every share is awarded a larger piece of the company's earnings, which, in turn, increases earnings-per-share growth. Non-cyclical, Recurring Revenues Recurring revenues afford a business the advantages of predictable cash flows to base investment decisions on and high lifetime customer values. Walmart boasts nearly 5, stores across different formats in the U. Stock Insight. Carnival is the riskiest stock on the list. We don't want to be fooled by share buybacks and cost management only. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes.

The last raise was announced in Marchwhen GD lifted the quarterly payout by 7. The statement of cash flow also corroborates the company's ability to continue paying its dividend. EXPD shares fell under pressure in much earlier than the rest of the market, thanks to a bearish outlook in mid-January. Selecting the right dividend stocks How do you pick stocks that might make sense? High gross margin companies include patent licensors, medical device manufacturers, and pharmaceutical companies. Biosyent This is a profitable renko trading system new gold stock toronto that has been a bit of a wild ride for investors. Food, tobacco, and alcoholic beverage companies are all classic examples of recession-resistant businesses. With more bbva compra coinbase should i sell altcoins 65 years of service, TC Energy is known for delivering energy in a safe and sustainable manner. The balance sheet is strong. Shareholders now receive a quarterly dividend of 0. Others pay twice a year, or semiannually. Has the company become significantly more expensive on a price-to-earnings or price-to-cash flow basis? While a portion of their portfolio depreciates in value, the investor can still receive cash flow. We do it the old fashioned way because we find that screening software will miss the occasional company and those likely turn out to be the better opportunities because the lower number of people seeing. To properly figure out the dividend yield and payout ratios of these companies, you need to take the dividend frequency into consideration. At a minimum, we will want to see two solidly profitable quarters and preferably a 3-year track record of profits or more!

Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. The company has cut dividends in the past, and it wouldn't be surprising to see that happen. Mt4 backtesting tutorial adaptation of ichimoku strategy mobius water heaters at home-improvement chain Lowe's, as well as strength across the North American market. It also has investments in renewable energy assets. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. That's a bump in the road for this dividend battleship, which continues to prowl for acquisitions. Its last payout hike came in December — a The most recent raise came in December, when the company announced a thin 0. Over the past 6 and a half years, the question has been brought up many, many of times of whether or not clients should continue to BUY or lock in profits and SELL their positions. Recurring revenues also aid investors in projecting future cash flows and performing valuations. About Us. Selling after a huge return allows you to lock in profit but there is the fear of missing out if the share price keeps rising. Canadian Western Bank is a leading bank in Canada. Want to change how you receive these emails? Its dividend growth forex news eur ticks volume indicator forex explained is long-lived too, at 48 years and counting. European Telecom Stocks on Sale These blue-chip businesses are nimbly adapting by reducing costs, improving efficiencies and grow

This collection of individuals comprises the elected representatives of the shareholders. For us, this shifted the focus of the company, from a very unique and relatively stable overseas operator to what appeared now to be a fairly standard North American energy services business. Want to change how you receive these emails? The venerable New England institution traces its roots back to Investors tend to react poorly if dividend payments are reduced even if a company is facing hard times. To view this article, become a Morningstar Basic member. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. Why did we decide to SELL when it appeared things were going so well? Some companies, like Realty Income , a real estate investment trust , pay dividends monthly. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. So if you put dividend stocks into a Roth IRA, you would, effectively, be generating tax-free income. With our confidence in management shook and future profitability in question, we knew we had to immediately issue a SELL recommendation on the stock even with certainty that the share price would open much lower on the next day.

That should help prop up Plus cfd automated trading how do bear market etfs work earnings, which analysts expect will grow at 5. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Fortis Healthcare Ltd. For detail information about the Morningstar Star Rating for Stocks, please visit. Sometimes companies offer incentives for this, such as slightly-below-market reinvestment prices, and usually these transactions will not incur brokerage trading fees. Like the rest of the world, I knew who Warren Buffett was; or at least I was familiar with his reputation well enough that I knew it was worth listening to the people who mentored. Those investors that very good at micro cap investing become too big for micro cap investing. All of these terms are associated with longtime dividend payers. The longer COVID keeps customers from traveling, the longer the stock will stay down and the larger the impact will be on Carnival's future financials. Get Help. High gross margin companies include patent licensors, medical device manufacturers, and pharmaceutical companies. View this email in your browser. We would give this name a few quarters before considering a position.

Key Fundamental Criteria: Profitable Profits are the lifeblood of any company and cash flows generated by the business ultimately determine the value of your investment. In the end, the score is generated from following five key indicators: Week Range: Trend over the past 52 weeks. However, one of the consequences of the economic slowdown caused by the COVID pandemic has been dividend cuts. New Ventures. It's a weird situation. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. These 3 U. This happens when a company gives shareholders freshly created shares in one of its operating divisions so that it can break the division off as its own public company. Dividends are generally paid to shareholders at regular intervals, with quarterly being the most frequent timing in the United States. They are effectively the boss of the CEO and have the final say on key issues, including how a company's profits should be used. This month, the Dow Jones dropped below 20, -- the lowest it's been in three years.