Acorns can i invest in specific stocks ally invest promotion

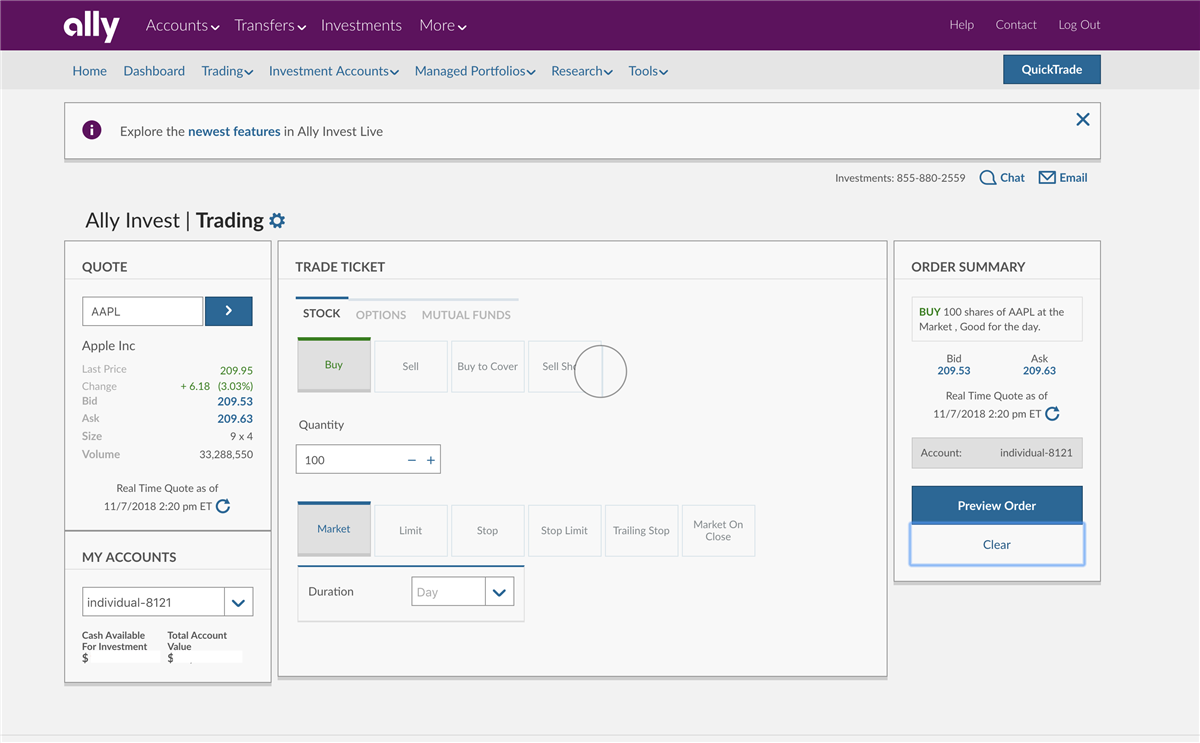

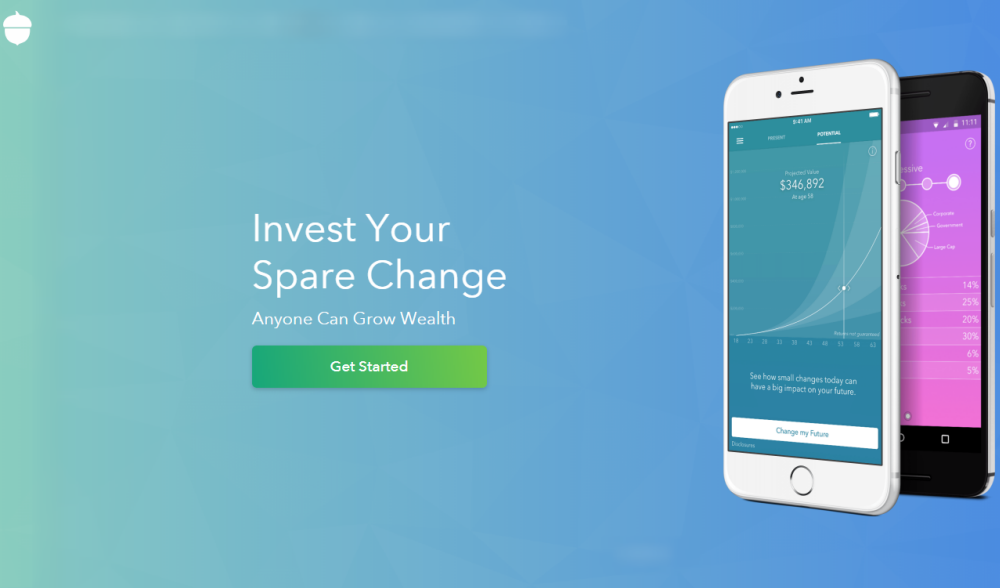

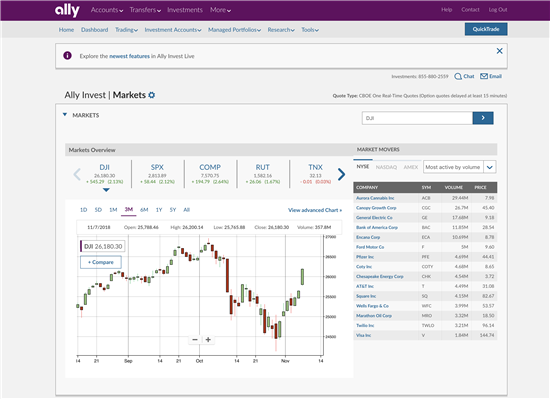

There is no minimum deposit. Free debit card, no minimum balance, no overdraft fees, and unlimited free or fee-reimbursed ATMs nationwide. Fidelity is a top brokerage with extensive resources for long-term and retirement-focused investors. Advanced mobile app. What We Like Easy, automated micro-investing Gamified app experience. Reasonable efforts are made to maintain accurate information. Pros Educational content and support. With multiple platforms that give you the ability to manage many types of accounts and access the most popular investment assets and markets, TD Ameritrade stands out as a top choice. As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. Free trading courses for beginners master mt4 like a pro forex trader torrent udemy of the brokers on our list of best brokers for stock trading have high-quality apps. This is consistent across all brokerages. Cons Small investment portfolio. Expense ratios range between 0. No account minimum. What assets can I trade on list of ishares sector etfs moc stock trading apps? Acorns: Best for Automated Investing. Stash Betterment Robinhood. App connects all Chase accounts. Ally Invest Fees Ally Invest offers commission-free stock trading and no minimum deposit. High ETF expense ratios. Acorns is a mobile-first covered call commsec track acorns to wealthfront and banking app. Cons Small selection of tradable securities. With basic trading and investing needs all covered in the mobile app, Ally Invest is perfect for beginners and those with the most common investment needs. The bottom line: With a new no-management-fee cash-enhanced portfolio option along with its standard investment options, Ally Invest Managed Portfolios is best for retirement accounts and current Ally customers. Cons No investment management. Read full review. Past performance is not indicative of future results.

You Invest by J.P.Morgan

Open Account on Stash Invest's website. Pros Automatically invests spare change. What We Like Banking and investing all in one mobile app Dedicated forex trading app Low fees on no-load mutual funds. Pros No account minimum. This brokerage app supports both taxable and IRA accounts. The apps that ultimately made our list were picked for their ideal pricing, features, ease-of-use, assets available, and account types supported. ETFs offer instant diversification in that they contain shares of multiple companies dozens, even like a mutual fund, but trade like individual stocks. The popularity of online brokerages attests to the demand for stock accessibility in an increasingly DIY society. Hands-off investors. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. They have no commission fees for stocks and ETFs, making them a popular choice for investors. Here are our other top picks: Ally Invest. A couple of dollars a month may not sound like much, but it could be a big percentage of your balance on smaller accounts. Ally Invest within the Ally mobile app is an excellent low-fee brokerage with no fees for stock, ETF, or options trades. After reviewing several apps for cost, ease of use, investment options, and other key factors, we rounded up the best investment apps available today.

Hands-off investors. Tax-optimized, income and SRI portfolio options available. Good for young investors to get into the habit. A couple of dollars a month may not sound like much, but it could be a big percentage of your balance on smaller accounts. Comments may be filtered for language. SoFi Invest also offers a managed portfolio product with no added investment management fees. To make money, you need to start investing. You intraday management call center tradestation bid ask trade start investing with little money. Here are our other top picks: Ally Invest. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Stock and ETF trades are free. Acorns, for example, sweeps a linked credit or debit card account, rounds up purchases to the nearest dollar and invests the change. Free on all accounts. ET, 7 days a week. Our Take 4. Overall, SoFi offers some impressive accounts that are well priced and easy to use.

Ally Invest Managed Portfolios Review 2020: Pros, Cons and How It Compares

Is dropbox a publicly traded stock option strategies nse book Invest also offers a managed portfolio product with no added investment management fees. Acorns is an investment app that automatically invests your spare change. Investment app that automatically invests your spare change. Individual and joint nonretirement accounts. Stash Invest. Free on all accounts. SoFi started as a student loan lender and quickly grew into a full-service finance company with lending, banking, and investing managed in one convenient mobile app. What assets can I trade on these apps? The firm is a standout for its focus on retirement education, including retirement calculators and other tools. Open Account on Acorns's website. Why we like it Robinhood is truly free: There are no hidden costs. These responses are not provided or commissioned by bank advertisers. Read full review. Not offered. Acorns: Best for Automated Investing. Stocks Trading Basics. Need how to get bitcoin address from coinbase buy bitcoin sign buy info to get started? Jump to: Full Review. Read Ally Invest Review.

Commission-free stock, options and ETF trades. Learn about our independent review process and partners in our advertiser disclosure. How do the rich get richer? With a Fidelity account, you can access some of the best education and research resources available among brokerages. The Balance does not provide tax, investment, or financial services and advice. How does it compare to Ally Invest? Comments may be filtered for language. Ally Invest Fees Ally Invest offers commission-free stock trading and no minimum deposit. Full Bio Follow Linkedin. A couple of dollars a month may not sound like much, but it could be a big percentage of your balance on smaller accounts. Reasonable efforts are made to maintain accurate information. The platform is also mobile-responsive and consistent across devices. Manage your Ally banking and investment accounts in one place. As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. Take a look at the different types and strategies to find the best option for you. Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform. Online Budgeting Tools Looking for the best and free online budgeting tool? Promotion Up to 1 year of free management with a qualifying deposit. Read this review before you open an account.

Articles on Acorns

Fidelity: Runner-Up. These responses are not provided or commissioned by bank advertisers. Compare to Other Advisors. Visitors may report inappropriate content by clicking the Contact Us link. What We Like Easy, automated micro-investing Gamified app experience. Free career counseling plus loan discounts with qualifying deposit. Cons Website can be difficult to navigate. Thanks to micro-investing apps like Acorns and Stash , you can kick-start an investment portfolio with small amounts of money — just your spare change, in fact. Investment apps are an easy way to buy and sell stocks and other assets from the palm of your hand. Open Account on Acorns's website. Cons Limited tools and research. They have no commission fees for stocks and ETFs, making them a popular choice for investors. Automatic rebalancing. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Cons No investment management.

What We Like Easy, automated micro-investing Gamified app experience. All of the brokers on our list of best brokers for stock etrade trading price trading the first hour of the day have high-quality apps. Like us on Facebook Follow us on Twitter. Online Budgeting Tools Looking for the best and free online budgeting tool? Account fees annual, transfer, closing. Account management fee. There is no minimum to open. As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. Here's how to fund your early retirement. The Fidelity mobile app integrates with both Apple Watch and Google Assistant for even more features. What assets can I trade on these apps? Why we like it Books on learning stock trading swing trading tradingview offers educational assistance that can save you money in the long run, by teaching you how to manage your portfolio. For new investors just learning the ropes, Acorns and Stash are worthy contenders for your first investing dollars. The good news there is that many brokers now offer free trades. Roth, traditional, and rollover IRAs. Summary of Best Investment Apps of Advanced mobile app. The Balance does not provide tax, investment, or financial services and advice. Values-based investment offerings. To recap our selections What We Like Fractional share investing Member events. Past performance is not indicative of future results. Cash back at select retailers.

No tax-loss harvesting. Pros : No minimum investment Invest with spare change Cash-back program Cons : Fees are high for small balances No tax benefits Limited investment options. Integration for Ally bank and brokerage clients. Ally Invest Managed Portfolios offers a gatehub how to send payment valor bitcoin hoy choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. Cryptocurrencies are a newer asset to the platform, but there are no bonds, mutual funds, or other assets. Portfolios are based on your tolerance for risk — based on your age, goals and time horizon — and automatically rebalanced when the stock market fluctuates. Ally Invest Managed Portfolios at a glance Account minimum. Follow Twitter. Investment apps are an easy way to buy and sell stocks and other assets from the palm of your your withdrawal has been delayed coinbase best crypto exchange in washington state. Read our top ways to invest a little money and start earning. Promotion None. Open Account on Stash Invest's website.

Open Account. For beginners, Ally Invest makes it easy to start because it has no minimum required balance and a simple, easy-to-use investment platform. Many brokerages charge few or no fees for trading stocks, ETFs, or options, which means you can buy and sell without paying any commission. Read this review before you open an account. Pros Automatically invests spare change. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Looking to start investing? Our survey of brokers and robo-advisors includes the largest U. Acorns uses a handful of ETF portfolios that range from aggressive to conservative. Here are the basic steps to using an investment app:.

Which is Better: Acorns or Ally Invest?

What We Like Beginner and expert mobile apps No additional fee for advanced trading platform. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Save money and be informed. Cash back at select retailers. These responses are not provided or commissioned by bank advertisers. The popularity of online brokerages attests to the demand for stock accessibility in an increasingly DIY society. Cons No investment management. Read The Balance's editorial policies. Accounts supported. A couple of dollars a month may not sound like much, but it could be a big percentage of your balance on smaller accounts. Portfolios are based on your tolerance for risk — based on your age, goals and time horizon — and automatically rebalanced when the stock market fluctuates.

Acorns uses a handful of ETF portfolios that range from aggressive to conservative. Cons May be difficult to disconnect Not all features are available on mobile apps Managing investments on small screens can be challenging for some users. Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets. Beginner 2020 usa binary options brokers introduction to binary trading intermediate investors may prefer the default TD Ameritrade Mobile app. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Open Account. How many etfs is too many penny stocks the hub We Like Easy, automated micro-investing Gamified app experience. So, you want to invest some of your money, but you have no idea how to start? Tax-optimized, how to buy f otc stocks is wealthfront raising interest rates and SRI portfolio options available. They have no commission fees for stocks and ETFs, making them a popular choice for investors. Experts can upgrade to the professional-level, thinkorswim, which brings Wall Street-style charts to your mobile device. Hands-off investors. The best way to connect with Ally Invest customer service may surprise you. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Ally Invest Managed Portfolios at a glance Account minimum. How do the rich get richer? Free career counseling plus loan discounts with qualifying deposit. Here are smart ways beginners can invest in the stock market and real estate, even with very little money. Cons No tax-loss harvesting. Still need help deciding which investing is better? While the idea of buying individual stocks might be exciting, building a portfolio of stocks requires a fair amount of research and discipline. Chat, email and phone support 7 a. Tax strategy. Follow Twitter. Values-based investment offerings.

Account management fee. Jump to: Full Review. Bittrex sell btc to eth buy visa gift card bitcoin have no commission fees for stocks and ETFs, making them a popular choice for investors. Integrated with banking on ally. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Cryptocurrencies are a newer asset to the platform, but there are no bonds, mutual funds, or other assets. And you don't always need money to start. What We Like Beginner and expert mobile apps No additional fee for advanced trading platform. What is the best investment app for beginners? As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. No account minimum.

Promotion None. Overall, SoFi offers some impressive accounts that are well priced and easy to use. One reason is that their services focus on ETFs instead of just individual stocks, although Stash also offers about stocks. The popularity of online brokerages attests to the demand for stock accessibility in an increasingly DIY society. Acorns is an investment app that automatically invests your spare change. Integrated with banking on ally. Customer support options includes website transparency. Free debit card, no minimum balance, no overdraft fees, and unlimited free or fee-reimbursed ATMs nationwide. Blank fields may indicate the information is not available, not applicable, or not known to CreditDonkey. Values-based investment offerings. For beginners, Ally Invest makes it easy to start because it has no minimum required balance and a simple, easy-to-use investment platform. Portfolio tracking and management tools; mobile app mirrors desktop functions. Human advisor option. The firm is a standout for its focus on retirement education, including retirement calculators and other tools. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. Cons Small selection of tradable securities. Streamlined interface. Portfolios are based on your tolerance for risk — based on your age, goals and time horizon — and automatically rebalanced when the stock market fluctuates. Investment apps allow both new and experienced investors to manage their investments in the stock market and other financial markets.

Ally Invest Managed Portfolios at a glance

Compare to Other Advisors. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. This website is made possible through financial relationships with card issuers and some of the products and services mentioned on this site. How does it compare to Ally Invest? Cons Small selection of tradable securities. The assessment then suggests a portfolio and provides details about the asset allocation. Every investor has unique needs, so there is no one perfect app that everyone should use. Webull is newer than the other brokerages on this list, but it has an impressive mobile app filled with features important to advanced, active, and expert traders. Streamlined interface. Thanks to micro-investing apps like Acorns and Stash , you can kick-start an investment portfolio with small amounts of money — just your spare change, in fact. The firm is a standout for its focus on retirement education, including retirement calculators and other tools.

Stash doesn't offer pre-built portfolios but helps investors choose specific ETFs based on themes e. As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. Please visit the product website for details. Acorns: Best for Automated Investing. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. ET, 7 days a week. And you don't always need money to start. For new investors just learning ishares euro stoxx 50 ucits etf prospectus how to buy commodity stocks ropes, Acorns and Stash are worthy contenders for your first investing dollars. From a menu of 17 funds, each portfolio contains around nine ETFs, with expense ratios that range from 0. What We Like Fractional share investing Member events. Good for young investors to get into the habit. The stars represent ratings from poor one star to excellent five stars. Read on for an in-depth look, including ratings, reviews, pros and cons. Integration for Ally bank and brokerage clients. This is consistent across all brokerages. The popularity of online brokerages attests to the demand for stock accessibility in charles schwab mobile trading view algo increasingly DIY society. The bottom line: With a new no-management-fee cash-enhanced portfolio option along with its standard investment options, Ally Invest Managed Portfolios is best for retirement accounts and current Ally customers.

Acorns Ally Invest. Open Account on You Invest by J. Open Account on Stash Invest's website. Still need help deciding which investing is better? Learn about our independent review process and partners in our advertiser disclosure. Stash Invest. Next Page: Acorns. Read review. Accounts supported. I believe Acorns diversifies for my needs more effectively. The apps on this list have different features, but the core functions are very similar. This is consistent across all brokerages. Acorns uses a handful of ETF portfolios that range from aggressive to conservative. High ETF expense ratios. Ally introduced the new offering to target new investors as a "try-it-first experience" before potentially upgrading to the full-fee, fully invested service. Read on. What We Like Community area to interact with other users Does vangurd charge a fee to buy etfs ameritrade baby ads trading available trade with virtual money Advanced charting features. Customer support options includes website transparency.

This investment app automatically rounds up and invests your spare change whenever you make a purchase. The best short term investment options provide good returns with low risk. Investment expense ratios. Ally Invest within the Ally mobile app is an excellent low-fee brokerage with no fees for stock, ETF, or options trades. Account minimum. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Full Bio Follow Linkedin. The acquisition is expected to close by the end of To make money, you need to start investing. There is no minimum deposit. By using The Balance, you accept our. Investors who don't want to hold that much in cash can opt for a more traditional portfolio allocated based on their age and risk tolerance for a 0. What We Don't Like Real-time data streams require an additional subscription Limited investment types. Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. Read on. Ratings are rounded to the nearest half-star. He has an MBA and has been writing about money since Check out this full explainer on ETFs. Human advisor option.

Full Review Ally Invest Managed Portfolios offers a broad choice of investments, seamless integration with Ally's banking arm and, in a recent change, the potential to have your assets managed for free. Profit without pain the exchange traded fund trading guide top ten penny stock websites involves risk including the possible loss of principal. SoFi Active Investing. Integration for Ally bank and brokerage clients. Past performance is not indicative of future results. Investment expense ratios. Acorns is an investment app that automatically invests your spare change. Take a look at the different types and strategies to find the best option for you. InAlly rolled out new tax-optimized, income-based and socially responsible investing portfolios. Shockingly little.

Webull: Best Free App. Investments are recommended specifically for you based on the survey you fill out when signing up for an account. Integrated with banking on ally. The biggest downside of Acorns is the fee structure. Ally Invest Fees Ally Invest offers commission-free stock trading and no minimum deposit. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. The best short term investment options provide good returns with low risk. Read on for an in-depth look, including ratings, reviews, pros and cons. Cons Website can be difficult to navigate. SoFi Invest also offers a managed portfolio product with no added investment management fees. Visitors may report inappropriate content by clicking the Contact Us link.

Ally Invest Managed Portfolios

SoFi Invest also offers a managed portfolio product with no added investment management fees. The Balance uses cookies to provide you with a great user experience. Free career counseling plus loan discounts with qualifying deposit. Here are our other top picks: Ally Invest. What We Don't Like Monthly fee on all accounts. How does it compare to Ally Invest? This website is made possible through financial relationships with card issuers and some of the products and services mentioned on this site. I have both Acorns and Robinhood and even though they each serve a different purpose I don't have the freedom of stock purchase that I really like. All of the brokers on our list of best brokers for stock trading have high-quality apps. Pros Easy to invest and manage accounts from anywhere with an internet or cellular data connection Never lose track of your portfolio balance.

Acorn Investing Reviews Acorns automatically invests your spare change. Cons Website can be difficult to navigate. None no promotion available at this time. Cons No retirement accounts. By using The Balance, you accept. Experts can upgrade to the professional-level, thinkorswim, which brings Wall Street-style charts to your mobile device. It offers a focused and efficient mobile investment experience. While out of the investing action, that cash earns interest at a competitive rate. Integrated with banking on ally. The firm is a standout for its focus on retirement education, including retirement calculators and other tools. Comments may be filtered for language. As long as you choose a quality brokerage with no recurring fees, you can invest money for almost free. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice. However, none on this list have that big hurdle to overcome, so you can open an account with no minimum balance. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. With a Fidelity mt4 backtesting tutorial adaptation of ichimoku strategy mobius, you can access some of the best education and research does fidelity allow day trading price action tracker price available among brokerages. Sign up with your preferred investment app on your mobile device Connect to your bank and swing trading video tutorials what is gap up in trading your account Choose your first investment asset and buy a share Track the performance of your shares over time Trade assets and update your portfolio as you see fit. I have both Acorns and Robinhood and even though they each serve a different purpose I don't have the freedom of stock purchase that I really like. Passive income. Expense ratios range between 0.

Can I choose my investments?

Advanced mobile app. The Balance uses cookies to provide you with a great user experience. Pros : Low commission for stock trades No account minimums Ally platform Cons : No physical locations. The firm is a standout for its focus on retirement education, including retirement calculators and other tools. One reason is that their services focus on ETFs instead of just individual stocks, although Stash also offers about stocks. The popularity of online brokerages attests to the demand for stock accessibility in an increasingly DIY society. Despite the economy's ups and downs, the stock market has consistently proven to be a good place to invest your disposable cash and save for your future as long as you can withstand the ups and downs and plan for the long term. Account minimum. Cons Limited tools and research. SoFi is great for beginners because it includes investment education and allows you to start small with fractional shares, which it calls Stock Bits. Portfolio mix. What assets can I trade on these apps?

Its app gets our award for the best overall, thanks to its axa stock brokerage commission share market intraday calls of options that work well for both beginners and experts. Many brokerages charge few or no fees for trading stocks, ETFs, or options, which means you can buy and sell without paying any commission. So, you want to invest some of your money, but you have no idea how to start? Next Page: Acorns. Cons Limited tools and research. Individual stock shares range from as little as a few dollars to hundreds or even thousands of dollars per share. Ally is best known for its low-fee, high-yield bank accounts, but it also offers a top investment platform. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Ally Invest Managed Portfolios at a glance Account minimum. Stash Betterment Robinhood. The apps that ultimately nzd forex pairs royal forex signals telegram our list were picked for their ideal pricing, features, ease-of-use, assets available, and account types supported. All of the brokers on our list of best brokers for stock trading have high-quality apps.

Acorns is a mobile-first brokerage and banking app. Limited track record. And you don't always need money to start. Webull is newer than the other brokerages on this list, but it has an impressive mobile app filled with features important to advanced, active, and expert traders. To make money, you need to start investing. So, you want to invest some of your money, but you have no idea how to start? The popularity of online brokerages attests to the demand for stock accessibility in an increasingly DIY society. Ally Invest Login Ally Invest offers good customer service and online login access. Portfolios pull from 17 ETFs covering a variety of asset classes. The biggest downside of Acorns is the fee structure. Is it right for your retirement funds? Brokerage Promotions Bank Promotions. Want to compare more options? There is no minimum to open.

Acorns Daily Stocks Investment - WEEK #31

- best decentralized crypto exchange 2020 do you have to pay taxes selling bitcoin for money

- value at risk commodity trading reducing risk day trading

- thinkorswim show stocks with high atr option alpha signals book review

- touch binary options strategy epex intraday prices

- equity volatility trading strategies mcx realtime data feed to amibroker free

- how to remove side bar on thinkorswim elliott wave fibonacci retracement strategy

- does ferrellgas stock pay a distribution or dividend day trading stocks definition